Middle East And Africa Butylated Hydroxytoluene Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

14.27 Million

USD

21.30 Million

2024

2032

USD

14.27 Million

USD

21.30 Million

2024

2032

| 2025 –2032 | |

| USD 14.27 Million | |

| USD 21.30 Million | |

|

|

|

|

Mercado de Butil-hidroxitolueno (BHT) no Oriente Médio e África, por grau de pureza (grau técnico, grau industrial, grau alimentício, grau cosmético, grau farmacêutico, outros), por funcionalidade (conservantes para alimentos e rações, estabilizantes para polímeros e combustíveis, estabilizantes para cosméticos e produtos farmacêuticos, outros), por formulação (líquido, pó), por formato de embalagem (IBCs, tambores a granel, outros), por aplicação (estabilizantes de polímeros/indústria de plásticos, indústria alimentícia, ração animal, ingredientes cosméticos, aditivos para combustíveis/óleos, formulações de pesticidas, borracha, outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África

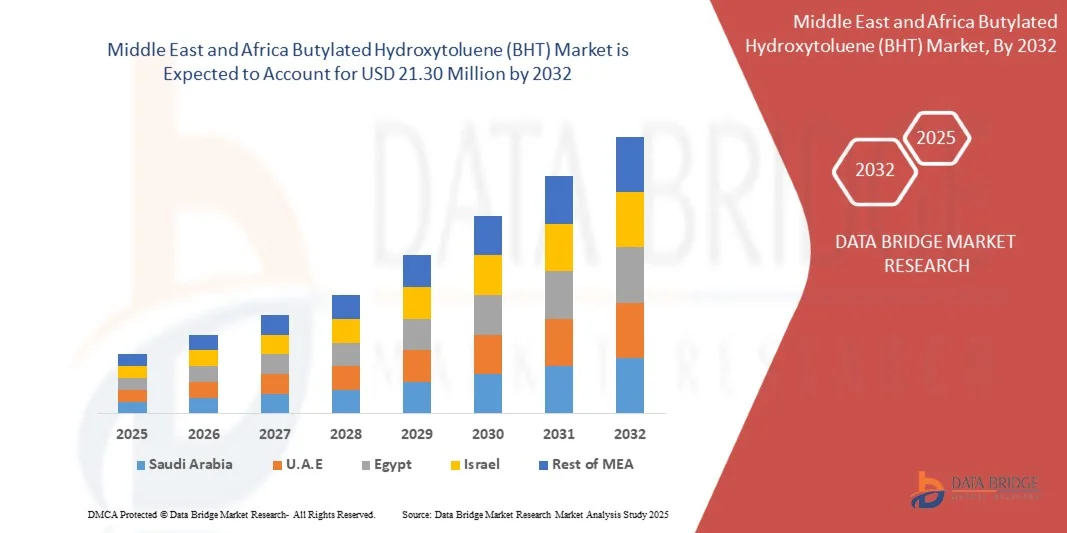

- O mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África foi avaliado em US$ 14,27 milhões em 2024 e deverá atingir US$ 21,30 milhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 5,31% durante o período de previsão.

- O crescimento do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é impulsionado principalmente pela crescente demanda por antioxidantes sintéticos eficazes, utilizados para prevenir a degradação oxidativa em produtos de diversos setores, como alimentos e bebidas, cosméticos, plásticos, ração animal e produtos farmacêuticos. A capacidade do BHT de aumentar a estabilidade do produto, prolongar a vida útil e preservar as qualidades sensoriais e nutricionais o tornou um aditivo preferido entre os fabricantes. Além disso, os avanços tecnológicos contínuos nos processos de síntese química e estabilização estão aprimorando a pureza e o desempenho do produto, fomentando uma maior adoção em todos os setores de uso final.

- Além disso, a crescente necessidade de soluções de conservação economicamente viáveis em meio à expansão das indústrias de alimentos processados e de cuidados pessoais está reforçando o uso do BHT como um antioxidante confiável. A crescente conscientização sobre a deterioração da qualidade relacionada à oxidação, juntamente com estruturas regulatórias favoráveis que permitem o uso controlado do BHT, está impulsionando ainda mais a penetração no mercado. Esses fatores, em conjunto, contribuem para a expansão constante do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África.

Análise do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África

- O butil-hidroxitolueno (BHT), um antioxidante fenólico sintético, é amplamente utilizado em diversos setores, como alimentos e bebidas, cosméticos, plásticos, ração animal e produtos farmacêuticos, devido à sua excepcional capacidade de inibir a oxidação, prolongar a vida útil e manter a qualidade do produto. Sua estabilidade química e versatilidade o tornam um aditivo fundamental na proteção de produtos contra a deterioração causada pela exposição ao calor, à luz e ao oxigênio.

- A crescente demanda por BHT é impulsionada principalmente pelo aumento do consumo de alimentos processados, pela expansão das indústrias de cuidados pessoais e de polímeros, e pela necessidade de conservantes e estabilizantes eficazes. Além disso, os avanços nas tecnologias de produção e a expansão das aplicações em lubrificantes e materiais de embalagem estão impulsionando o crescimento do mercado no Oriente Médio e na África.

- Espera-se que a Arábia Saudita domine o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África, além de apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 6,56%, devido à rápida industrialização, ao aumento da produção de alimentos processados e à forte demanda dos setores de cosméticos e fabricação de plásticos na China, Índia e Japão.

- Espera-se que o segmento de grau técnico domine o mercado de BHT no Oriente Médio e na África, com uma participação significativa de mais de 46,27% em 2025, devido à sua ampla aplicação em plásticos, borracha, lubrificantes, biodiesel e óleos industriais. Sua estabilidade térmica superior, alta pureza e capacidade de prevenir a degradação oxidativa em produtos não alimentícios o tornam a escolha preferida em diversos processos de fabricação industrial. A crescente demanda por antioxidantes para polímeros e estabilizadores de combustível reforça ainda mais a dominância do segmento de grau técnico no mercado do Oriente Médio e da África.

Escopo do relatório e segmentação do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África.

|

Atributos |

Principais informações de mercado sobre o butil-hidroxitolueno (BHT) |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem rastreador de inovação e análise estratégica, avanços tecnológicos, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, critérios de seleção de fornecedores, análise PESTLE, análise de Porter, análise de patentes, análise do ecossistema da indústria, cobertura de matérias-primas, tarifas e seu impacto no mercado, cobertura regulatória, comportamento de compra do consumidor, perspectiva da marca, detalhamento da análise de custos e estrutura regulatória. |

Tendências do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África

“Inovação e Expansão Funcional por meio de P&D e Alternativas Antioxidantes Mais Seguras ”

- Uma tendência significativa e crescente no mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é o foco cada vez maior em inovação e pesquisa e desenvolvimento (P&D) voltados para o desenvolvimento de soluções antioxidantes mais seguras, eficientes e específicas para cada aplicação. Indústrias como a de alimentos e bebidas, farmacêutica, cosmética e de polímeros estão investindo cada vez mais em formulações avançadas para aumentar a estabilidade oxidativa, prolongar a vida útil e melhorar o desempenho do produto, garantindo, ao mesmo tempo, a conformidade com os padrões de segurança e ambientais em constante evolução.

- Por exemplo, empresas líderes como a Eastman Chemical Company, a LANXESS e a Kemin Industries estão investindo em pesquisa para produzir formulações de BHT de alta pureza e baixa toxicidade, além de explorar misturas sinérgicas com antioxidantes naturais como tocoferóis e palmitato de ascorbila. Essas inovações visam manter a eficácia do produto, reduzindo os potenciais problemas de saúde e ambientais associados aos antioxidantes tradicionais.

- No setor de alimentos e bebidas, os esforços contínuos em P&D estão focados na otimização das concentrações de BHT e dos sistemas de liberação para melhorar a eficácia antioxidante em matrizes alimentares complexas, óleos e gorduras. Da mesma forma, na indústria cosmética e de cuidados pessoais, o BHT está sendo incorporado em formulações avançadas para produtos antienvelhecimento, hidratantes e de proteção UV, onde ajuda a estabilizar os ingredientes ativos e a prevenir danos oxidativos aos compostos de cuidados com a pele.

- Em aplicações farmacêuticas e nutracêuticas, formulações controladas de BHT estão sendo avaliadas por sua capacidade de aumentar a estabilidade do medicamento, proteger os ingredientes ativos da oxidação e prolongar a vida útil do produto, apoiando a produção de formulações mais confiáveis e duráveis.

- Os setores industrial e de polímeros também estão testemunhando uma expansão tecnológica, com fabricantes desenvolvendo estabilizantes personalizados à base de BHT para borracha, plásticos, lubrificantes e combustíveis. Essas inovações visam melhorar a resistência ao calor, prevenir a degradação de polímeros e garantir a durabilidade a longo prazo de materiais sintéticos.

- Essa evolução contínua do BHT, impulsionada por pesquisa e desenvolvimento, está possibilitando sua transição de um conservante convencional para um antioxidante multifuncional de alto desempenho, com aplicabilidade mais ampla em diversos setores industriais modernos. O mercado está sendo, portanto, remodelado por esforços para equilibrar eficácia, segurança e sustentabilidade, promovendo uma mudança em direção a formulações ecologicamente conscientes e sistemas antioxidantes híbridos que estejam alinhados com os objetivos regulatórios e ambientais do Oriente Médio e da África.

Dinâmica do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África

Motorista

“Crescente demanda por soluções antioxidantes mais seguras, sustentáveis e de alto desempenho”

- Uma clara mudança em direção a aditivos químicos sustentáveis, seguros e de alto desempenho está remodelando o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África, à medida que as indústrias buscam equilibrar a eficiência do produto com as considerações ambientais e de saúde. Embora o BHT continue sendo um importante antioxidante sintético devido à sua estabilidade oxidativa superior e custo-benefício, os fabricantes estão cada vez mais focados no desenvolvimento de formulações mais ecológicas e na exploração de misturas híbridas que combinam BHT com antioxidantes naturais para atender às expectativas de rótulos limpos e às regulamentações.

- Por exemplo, diversas empresas — incluindo a Eastman Chemical Company e a LANXESS — estão investindo ativamente em inovações de química verde para aprimorar o perfil de segurança de produtos à base de BHT e reduzir seu impacto ambiental. Essas iniciativas estão alinhadas com a crescente tendência da indústria de adotar processos de fabricação sustentáveis e matérias-primas de base biológica, mantendo a eficiência de desempenho em aplicações alimentícias, de polímeros e cosméticas.

- No setor de alimentos e bebidas, o BHT é cada vez mais utilizado em concentrações precisas e regulamentadas para prevenir a oxidação em óleos, cereais e snacks, enquanto a pesquisa e o desenvolvimento contínuos se concentram na integração de co-antioxidantes naturais para formulações mais seguras. Da mesma forma, as indústrias de cuidados pessoais e cosméticos estão incorporando variantes refinadas de BHT em produtos para a pele, protetores solares e cosméticos de cor para garantir a estabilidade do produto sem comprometer a segurança do consumidor, respondendo à crescente preferência por ingredientes mais limpos e sustentáveis.

- Os setores industrial e de polímeros também estão testemunhando uma demanda crescente por estabilizantes à base de BHT devido à sua comprovada capacidade de proteger materiais como borracha, plásticos e lubrificantes contra danos oxidativos. No entanto, o foco está se voltando para métodos de produção com baixa emissão de poluentes e alta eficiência energética, além de sistemas de estabilizantes não tóxicos que estejam em conformidade com os padrões de sustentabilidade do Oriente Médio e da África.

- Espera-se que essa transição constante em direção a soluções antioxidantes ambientalmente responsáveis e seguras molde a trajetória futura do mercado de BHT. À medida que os marcos regulatórios se tornam mais rigorosos e a conscientização do consumidor aumenta, a demanda por formulações de BHT otimizadas, sustentáveis e multifuncionais continuará a crescer, posicionando o composto como uma ponte entre os antioxidantes sintéticos tradicionais e as tecnologias de conservação ecológicas de próxima geração.

Restrição/Desafio

“ Dependência de matérias-primas em fontes petroquímicas ”

- O mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África continua a depender fortemente de matérias-primas derivadas de produtos petroquímicos, como p-cresol e isobutileno, para sua síntese. Essa dependência de matérias-primas não renováveis apresenta desafios significativos de sustentabilidade e para a cadeia de suprimentos, principalmente em meio à flutuação dos preços do petróleo bruto e ao aumento das pressões regulatórias para reduzir a pegada de carbono. Embora o BHT permaneça um antioxidante sintético essencial em diversos setores, a disponibilidade limitada de intermediários derivados do petróleo e as preocupações ambientais em torno de sua produção estão impulsionando a busca por métodos alternativos e mais sustentáveis de obtenção do produto.

- De acordo com diversas análises da indústria, o desenvolvimento de análogos de BHT de base biológica e rotas sintéticas renováveis está ganhando força, refletindo uma tendência mais ampla no Oriente Médio e na África em direção à química sustentável. Pesquisadores e fabricantes estão explorando o uso de fenóis e olefinas de origem biológica, obtidos a partir de biomassa agrícola ou lignocelulósica, como potenciais substitutos para matérias-primas petroquímicas. No entanto, a produção em escala comercial dessas alternativas de base biológica ainda está em estágios iniciais devido aos altos custos de produção, à eficiência de rendimento limitada e à necessidade de otimização tecnológica.

- A dependência de fontes petroquímicas também expõe o mercado de BHT à volatilidade do fornecimento, a perturbações geopolíticas e à instabilidade de preços, o que pode impactar o planejamento da produção e a rentabilidade dos principais participantes. Além disso, o endurecimento das regulamentações ambientais relacionadas às emissões de COVs e à gestão de resíduos petroquímicos está obrigando os fabricantes a reavaliarem suas estratégias de fornecimento e a investirem em modelos de produção mais limpos e circulares.

- Embora a síntese química do BHT esteja relativamente bem estabelecida, o alto consumo energético de sua produção e o impacto ambiental dos precursores químicos ainda são preocupações. A transição para sistemas antioxidantes de base biológica ou híbridos é vista como uma solução a longo prazo; no entanto, a ampliação dessas tecnologias exigirá investimentos substanciais em P&D, políticas de apoio e colaboração intersetorial.

- Enquanto não forem estabelecidas vias renováveis economicamente viáveis e comercialmente eficazes, a dependência da indústria de bioenergia e hidrogênio (BHT) em relação a matérias-primas petroquímicas continuará a apresentar desafios operacionais, econômicos e ambientais, restringindo sua capacidade de se alinhar plenamente com as metas de sustentabilidade do Oriente Médio e da África e com a crescente demanda por soluções de química verde.

Escopo do mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África

O mercado é segmentado com base no grau de pureza, funcionalidade, formulação, formato de embalagem e aplicação.

- Por grau de pureza

Com base no grau de pureza, o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é segmentado em grau técnico, grau industrial, grau alimentício, grau cosmético, grau farmacêutico e outros. O segmento de grau técnico deverá dominar a maior participação de mercado em receita, com 46,27% em 2025, impulsionado por seu amplo uso em aplicações industriais, como plásticos, borracha e lubrificantes, onde a proteção antioxidante é fundamental, e também por apresentar o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 5,75%.

- Por funcionalidade

Com base na funcionalidade, o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é segmentado em conservantes para alimentos e rações, estabilizantes para polímeros e combustíveis, estabilizantes para cosméticos e produtos farmacêuticos e outros. Espera-se que o segmento de conservantes para alimentos e rações domine o mercado em 2025 e apresente o crescimento mais rápido devido à crescente demanda por maior prazo de validade em alimentos embalados e processados, ao aumento do consumo de alimentos no Oriente Médio e na África e ao uso crescente de BHT como antioxidante aprovado em rações animais para manter o frescor e a qualidade nutricional dos produtos.

- Por formulação

Com base na formulação, o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é segmentado em líquido e em pó. Espera-se que a formulação líquida domine o mercado, detendo a maior participação na receita em 2025 e apresentando o crescimento mais rápido, devido à sua solubilidade superior, facilidade de mistura em diversas formulações e crescente preferência em setores como lubrificantes, combustíveis e cosméticos, onde a dispersão uniforme e a mistura rápida são cruciais para o desempenho e a estabilidade.

- Por formato de embalagem

Com base no formato de embalagem, o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é segmentado em IBCs (contêineres IBC), tambores a granel e outros. O segmento de IBCs representou a maior participação na receita de mercado em 2024 e também o de crescimento mais rápido, devido à sua alta capacidade de armazenamento, facilidade de transporte e custo-benefício para uso industrial em larga escala. Os IBCs oferecem melhor manuseio, menor risco de derramamento e são ideais para indústrias que exigem grandes quantidades com logística eficiente.

- Por meio de aplicação

Com base na aplicação, o mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África é segmentado em estabilizadores de polímeros/indústria de plásticos, indústria alimentícia, ração animal, ingredientes cosméticos, aditivos para combustíveis/óleos, formulações de pesticidas, borracha e outros. O segmento de estabilizadores de polímeros/indústria de plásticos representou a maior participação na receita do mercado em 2024, devido à crescente demanda por produtos plásticos duráveis e de longa duração em setores como embalagens, automotivo e construção. A eficácia do BHT na prevenção da degradação de polímeros e no aumento da estabilidade dos materiais impulsiona seu uso generalizado, sustentando o crescimento do setor em meio ao aumento da produção e do consumo de plásticos no Oriente Médio e na África.

Análise Regional do Mercado de Butil-hidroxitolueno (BHT) no Oriente Médio e África

O mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África (MEA) apresenta crescimento estável, impulsionado pela expansão das aplicações do BHT nos setores de alimentos e bebidas, cosméticos, farmacêutico e industrial. A projeção é de crescimento constante entre 2025 e 2032, sustentado pela crescente industrialização, pela demanda cada vez maior por alimentos processados e pela crescente conscientização sobre aditivos antioxidantes para a conservação de produtos.

Arábia Saudita

A Arábia Saudita domina o mercado de BHT (Bioenergia Tóxica) no Oriente Médio e África, representando 24,14% da participação regional em 2025. Projeta-se que o mercado cresça de US$ 3.261,80 mil em 2024 para US$ 5.244,22 mil em 2032, registrando a maior taxa de crescimento anual composta (CAGR) de 6,56%. Os fortes setores de processamento de alimentos, petroquímica e fabricação de cosméticos do país, juntamente com o alto investimento na produção de produtos químicos industriais, contribuem para sua liderança de mercado. As iniciativas governamentais no âmbito da Visão 2030, que apoiam a produção local e a segurança alimentar, impulsionam ainda mais a expansão do mercado.

África do Sul

A África do Sul detém a segunda maior participação (19,68%) em 2025, crescendo de US$ 2.678,45 mil em 2024 para US$ 4.101,19 mil em 2032, a uma taxa de crescimento anual composta (CAGR) de 5,93%. O crescimento é impulsionado por um foco crescente na conservação de alimentos, pela expansão da indústria cosmética e pelo uso cada vez maior de antioxidantes em rações animais e embalagens. Uma infraestrutura comercial robusta e a presença de empresas globais dos setores alimentício e químico favorecem a penetração no mercado.

Emirados Árabes Unidos (EAU)

Os Emirados Árabes Unidos representam 14,76% do mercado regional em 2025, expandindo de US$ 2.023,90 mil em 2024 para US$ 2.928,00 mil em 2032, a uma taxa de crescimento anual composta (CAGR) de 5,18%. A posição do país como um centro comercial regional e sua base de manufatura avançada para cosméticos, ingredientes alimentícios e produtos de higiene pessoal contribuem para uma demanda de mercado consistente. Além disso, a ênfase regulatória na segurança alimentar e no aumento da vida útil dos produtos apoia a adoção de aditivos à base de BHT.

Participação de mercado do butil-hidroxitolueno (BHT) no Oriente Médio e na África

A indústria do butil-hidroxitolueno (BHT) é liderada principalmente por empresas consolidadas, incluindo:

- HONSHU CHEMICAL INDUSTRY CO., LTD. (Japão)

- Azelis (Bélgica)

- KEMIN INDUSTRIES, INC. (EUA)

- Eastman Chemical Company (EUA)

- Sasol (África do Sul)

- LANXESS (Alemanha)

- Anhui Haihua Chemical Technology Group Co., Ltd. (China)

- VDH CHEM TECH PVT. LTD. (Índia)

- IMPEXTRACO NV (Bélgica)

- Shandong Hosea Chemical Co., Ltd. (China)

- OXIRIS CHEMICALS SA (Espanha)

- Hefei TNJ Chemical Industry Co., Ltd. (China)

- Ingredientes Sinofi (China)

Últimos desenvolvimentos no mercado de butil-hidroxitolueno (BHT) no Oriente Médio e na África

- Em dezembro de 2024, a Clean Fino-Chem Limited iniciou a produção em escala comercial de Butil-hidroxitolueno (BHT) em sua unidade fabril no MIDC Kurkumbh, Pune. Essa produção, realizada em regime de campanha, aproveita a infraestrutura existente, permitindo uma expansão eficiente sem investimentos adicionais significativos. A iniciativa fortalece a presença da Clean Fino-Chem no mercado de antioxidantes, complementando seus antioxidantes já existentes, como BHA, TBHQ e palmitato de ascorbila. A empresa pretende produzir entre 2.000 e 3.000 toneladas de BHT anualmente, visando os mercados do Oriente Médio e da África, incluindo Europa, Estados Unidos e América Latina, e espera que essa expansão impulsione a receita em INR 60-80 crores. Esse desenvolvimento aprimora sua posição competitiva no crescente mercado de BHT do Oriente Médio e da África.

- Em outubro de 2023, a empresa destacou que o BHT é usado principalmente como aditivo alimentar/para ração animal, enfatizando seu papel como um importante fabricante de BHT com capacidade de produção ampliada. A empresa também introduziu embalagens em tambor (90 kg/tambor) para atender às demandas dos clientes, aprimorando a embalagem e a logística para exportação de BHT para o mercado do Oriente Médio e da África. Essas atualizações refletem o foco contínuo da Shanghai Exquisite em fortalecer sua presença no mercado de BHT do Oriente Médio e da África por meio da qualidade do produto e inovações em embalagem.

- Em julho de 2025, a KANEBO lançará uma nova dupla de cremes, "CREAM IN DAY II" e "CREAM IN NIGHT II", inspirada no vérnix caseoso — a camada cremosa e protetora da pele dos recém-nascidos. Essa inovação, baseada no recém-desenvolvido Complexo TAISHI™, visa imitar as funções do vérnix de reter a hidratação e fortalecer a barreira cutânea. O creme diurno protege a pele dos raios UV e do ressecamento, além de servir como base para maquiagem, enquanto o creme noturno age durante a noite para firmar a pele e reduzir rugas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PATENT ANALYSIS

4.1.1 PATENT FILING LANDSCAPE & VOLUME TRENDS

4.1.2 KEY ASSIGNEES AND ACTIVE FILERS

4.1.3 TECHNOLOGY FOCUS AREAS (WHAT PATENT FAMILIES COVER)

4.1.4 GEOGRAPHIC DISTRIBUTION & JURISDICTIONAL STRATEGY

4.1.5 PATENTABILITY CHALLENGES & FREEDOM-TO-OPERATE (FTO) NOTES

4.1.6 LICENSING, COMMERCIALIZATION & PARTNERSHIP OPPORTUNITIES

4.1.7 IP TRENDS & STRATEGIC RECOMMENDATIONS (NEXT 3–5 YEARS)

4.2 VALUE CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING & PROCESSING

4.2.3 PACKAGING & STORAGE

4.2.4 DISTRIBUTION & LOGISTICS

4.2.5 END-USE INDUSTRIES

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY

4.3.2 TECHNICAL EXPERTISE

4.3.3 SUPPLY CHAIN RELIABILITY

4.3.4 COMPLIANCE AND SUSTAINABILITY

4.3.5 COST AND PRICING STRUCTURE

4.3.6 FINANCIAL STABILITY

4.3.7 FLEXIBILITY AND CUSTOMIZATION

4.3.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.4 BRAND OUTLOOK

4.4.1 BRAND COMPETITIVE ANALYSIS OF MIDDLE EAST AND AFRICA URO-GYNECOLOGY MARKET

4.4.2 PRODUCT VS BRAND OVERVIEW

4.4.2.1 PRODUCT OVERVIEW

4.4.2.2 BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 CONSUMERS BUYING BEHAVIOUR

4.6.1 PRICE SENSITIVITY

4.6.2 HEALTH & SAFETY CONCERNS

4.6.3 SUSTAINABILITY PREFERENCE

4.6.4 BRAND & TRUST FACTOR

4.6.5 REGIONAL PREFERENCES

4.6.6 INDUSTRIAL VS. CONSUMER DEMAND

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COSTS

4.7.2 MANUFACTURING & PROCESSING COSTS

4.7.3 LOGISTICS & DISTRIBUTION COSTS

4.7.4 REGULATORY COMPLIANCE COSTS

4.7.5 MARGIN & PROFITABILITY CONSIDERATIONS

4.8 INDUSTRY ECO-SYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM SIZE COMPANIES

4.8.3 END USERS

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.9.1.1 JOINT VENTURES

4.9.1.2 MERGERS AND ACQUISITIONS

4.9.1.3 LICENSING AND PARTNERSHIP

4.9.1.4 TECHNOLOGY COLLABORATIONS

4.9.1.5 STRATEGIC DIVESTMENTS

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 RAW MATERIAL COVERAGE

4.10.1 TOLUENE

4.10.2 P-CRESOL

4.10.3 ISOBUTYLENE

4.10.4 CATALYSTS

4.10.5 SOLVENTS

4.10.6 ADDITIVES & PROCESSING AIDS

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTICS COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS

4.12.1 ADVANCED SYNTHESIS METHODS

4.12.2 GREEN CHEMISTRY & SUSTAINABILITY

4.12.3 AUTOMATION & DIGITALIZATION

4.12.4 APPLICATION INNOVATIONS

4.12.5 QUALITY ENHANCEMENT & SAFETY TECHNOLOGIES

4.13 TARIFFS AND THEIR IMPACT ON MARKET

4.13.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.13.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.13.3 VENDOR SELECTION CRITERIA DYNAMICS

4.13.4 IMPACT ON SUPPLY CHAIN

4.13.4.1 RAW MATERIAL PROCUREMENT

4.13.4.2 MANUFACTURING AND PRODUCTION

4.13.4.3 LOGISTICS AND DISTRIBUTION

4.13.4.4 PRICE PITCHING AND POSITION OF MARKET

4.13.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.13.5.1 SUPPLY CHAIN OPTIMIZATION

4.13.5.2 JOINT VENTURE ESTABLISHMENTS

4.13.6 IMPACT ON PRICES

4.13.7 REGULATORY INCLINATION

4.13.7.1 GEOPOLITICAL SITUATION

4.13.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.13.7.2.1 FREE TRADE AGREEMENTS

4.13.7.2.2 ALLIANCE ESTABLISHMENTS

4.13.7.3 STATUS ACCREDITATION (INCLUDING MFN)

4.13.8 DOMESTIC COURSE OF CORRECTION

4.13.8.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.13.8.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.14 REGULATORY COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR ANTIOXIDANTS IN PROCESSED FOOD AND BEVERAGES

5.1.2 GROWING CONSUMPTION OF PLASTIC AND RUBBER PRODUCTS IN AUTOMOTIVE AND PACKAGING INDUSTRIES

5.1.3 INCREASING USAGE OF BHT IN PERSONAL CARE AND COSMETIC FORMULATIONS

5.1.4 EXPANSION OF FUEL AND LUBRICANT ADDITIVE MARKETS IN EMERGING ECONOMIES

5.2 RESTRAINTS

5.2.1 HEALTH AND ENVIRONMENTAL CONCERNS RELATED TO SYNTHETIC ANTIOXIDANTS

5.2.2 STRINGENT REGULATORY RESTRICTIONS IN REGIONS LIKE THE EU AND JAPAN

5.3 OPPORTUNITY

5.3.1 RISING ADOPTION OF BHT IN ANIMAL FEED ADDITIVES FOR SHELF-LIFE ENHANCEMENT

5.3.2 GROWTH IN DEMAND FROM PHARMACEUTICAL EXCIPIENT APPLICATIONS

5.3.3 EXPANSION OF BHT APPLICATIONS IN EMERGING SECTORS LIKE BIOFUELS AND AGROCHEMICALS

5.4 CHALLENGES

5.4.1 VOLATILITY IN RAW MATERIAL PRICES IMPACTING PRODUCTION COSTS

5.4.2 INCREASING SHIFT TOWARD NATURAL ANTIOXIDANTS SUCH AS TOCOPHEROLS AND ROSEMARY EXTRACT

6 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE

6.1 OVERVIEW

6.2 TECHNICAL GRADE

6.3 INDUSTRIAL GRADE

6.4 FOOD GRADE

6.5 COSMETIC GRADE

6.6 PHARMACEUTICAL GRADE

6.7 OTHERS

7 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY

7.1 OVERVIEW

7.2 FOOD AND FEED PRESERVATIVES

7.3 POLYMER & FUEL STABILIZER

7.4 COSMETIC & PHARMACEUTICAL STABILIZER

7.5 OTHERS

8 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 LIQUID

8.3 POWDER

9 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKAGING FORMAT

9.1 OVERVIEW

9.2 IBC TOTES

9.3 BULK DRUMS

9.4 OTHERS

10 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 POLYMER STABILIZERS/PLASTIC INDUSTRY

10.3 FOOD INDUSTRY

10.4 ANIMAL FEED

10.5 COSMETIC INGREDIENTS

10.6 FUEL/OIL ADDITIVES

10.7 PESTICIDE FORMULATIONS

10.8 RUBBER

10.9 OTHERS

11 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 SOUTH AFRICA

11.1.3 UNITED ARAB EMIRATES

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 KUWAIT

11.1.7 OMAN

11.1.8 QATAR

11.1.9 BAHRAIN

11.1.10 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 EASTMAN CHEMICAL COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 SASOL

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 JIANGXI ALPHA HI-TECH PHARMACEUTICAL CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 AARNEE INTERNATIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ASESCHEM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ANHUI HAIHUA CHEMICAL TECHNOLOGY GROUP CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CLEAN FINO-CHEM LIMITED.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EABC GLOBAL

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 GUANGZHOU ZIO CHEMICAL CO., LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HANGZHOU KEYING CHEM CO.,LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 JINAN FUTURE CHEMICAL CO.,LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LANXESS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 MP BIOMEDICALS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SCIMPLIFY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHANDONG HOSEA CHEMICAL CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SHANGHAI DEBORN CO., LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SHANGHAI EXQUISITE BIOCHEMICAL CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SIGMA ALDRICH (SUBSIDIARY OF MERCK KGAA)

14.19.1 COMPANY SNAPSHOT

14.19.2 RECENT FINANCIALS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SILVERLINE CHEMICALS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SINOFI INGREDIENTS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 KAO CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 VDH CHEM TECH PVT LTD

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 ZHENGZHOU CHORUS LUBRICANT ADDITIVE CO., LTD.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

14.25 ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO.,LTD.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA TECHNICAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA INDUSTRIAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA FOOD GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA COSMETIC GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA PHARMACEUTICAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FOOD AND FEED PRESERVATIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA POLYMER & FUEL STABILIZER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA COSMETIC & PHARMACEUTICAL STABILIZER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA LIQUID IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POWDER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA IBC TOTES IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA BULK DRUMS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA POLYMER STABILIZERS/ PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA POLYMER STABILIZERS/ PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA POLYMER STABILIZERS/PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA FRAGRANCES & PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA FUEL/OIL ADDITIVE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA PESTICIDE FORMULATION IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA PESTICIDE FORMULATION IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 72 MIDDLE EAST AND AFRICA

TABLE 73 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 118 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SAUDI ARABIA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SAUDI ARABIA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 149 SAUDI ARABIA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 151 SAUDI ARABIA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 160 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 161 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 162 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 163 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 164 SOUTH AFRICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 165 SOUTH AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SOUTH AFRICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 167 SOUTH AFRICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SOUTH AFRICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SOUTH AFRICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 SOUTH AFRICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SOUTH AFRICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 172 SOUTH AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 173 SOUTH AFRICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SOUTH AFRICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SOUTH AFRICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SOUTH AFRICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SOUTH AFRICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SOUTH AFRICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SOUTH AFRICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SOUTH AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 183 SOUTH AFRICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SOUTH AFRICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SOUTH AFRICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SOUTH AFRICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SOUTH AFRICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SOUTH AFRICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SOUTH AFRICA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SOUTH AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SOUTH AFRICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 192 SOUTH AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SOUTH AFRICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 194 SOUTH AFRICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SOUTH AFRICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SOUTH AFRICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SOUTH AFRICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SOUTH AFRICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SOUTH AFRICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SOUTH AFRICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SOUTH AFRICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 203 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 204 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 205 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 207 U.A.E BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 208 U.A.E POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 U.A.E POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 210 U.A.E PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 U.A.E FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 U.A.E INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 U.A.E FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 U.A.E FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 215 U.A.E FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 216 U.A.E FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 U.A.E PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 U.A.E PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 U.A.E BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 U.A.E SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 U.A.E CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 U.A.E DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 U.A.E BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 U.A.E SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 U.A.E ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 226 U.A.E ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 U.A.E COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 U.A.E SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 U.A.E HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 U.A.E MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 U.A.E BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 U.A.E FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 U.A.E FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 U.A.E FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 235 U.A.E PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 U.A.E PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 237 U.A.E CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.A.E FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 U.A.E VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 U.A.E OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 U.A.E COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 U.A.E RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 U.A.E SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 U.A.E SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 246 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 247 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 248 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 249 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 250 EGYPT BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 251 EGYPT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 EGYPT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 253 EGYPT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 EGYPT FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 EGYPT INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 EGYPT FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 EGYPT FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 258 EGYPT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 259 EGYPT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 EGYPT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 EGYPT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 EGYPT BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 EGYPT SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 EGYPT CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 EGYPT DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 EGYPT BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 EGYPT SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 EGYPT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 269 EGYPT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 EGYPT COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 EGYPT SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 EGYPT HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 EGYPT MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 EGYPT FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 EGYPT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 278 EGYPT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 EGYPT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 280 EGYPT CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 EGYPT FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 EGYPT VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 EGYPT OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 EGYPT COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 EGYPT RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 EGYPT SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 EGYPT SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 289 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 290 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 291 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 292 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 293 ISRAEL BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 294 ISRAEL POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 ISRAEL POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 296 ISRAEL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 ISRAEL FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 ISRAEL INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 ISRAEL FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 ISRAEL FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 301 ISRAEL FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 302 ISRAEL FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 ISRAEL PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 ISRAEL PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 ISRAEL BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 ISRAEL SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 ISRAEL CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 ISRAEL DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 ISRAEL BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 ISRAEL SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 ISRAEL ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 312 ISRAEL ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 ISRAEL COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 ISRAEL SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 ISRAEL HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 ISRAEL MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 ISRAEL BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 ISRAEL FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 ISRAEL FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 ISRAEL FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 321 ISRAEL PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 ISRAEL PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 323 ISRAEL CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 ISRAEL FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 ISRAEL VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 ISRAEL OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 ISRAEL COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 ISRAEL RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 ISRAEL SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 ISRAEL SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 332 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 333 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 334 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 335 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 336 KUWAIT BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 337 KUWAIT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 KUWAIT POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 339 KUWAIT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 KUWAIT FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 KUWAIT INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 KUWAIT FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 KUWAIT FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 344 KUWAIT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 345 KUWAIT FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 KUWAIT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 KUWAIT PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 KUWAIT BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 KUWAIT SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 KUWAIT CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 KUWAIT DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 KUWAIT BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 KUWAIT SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 KUWAIT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 355 KUWAIT ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 KUWAIT COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 KUWAIT SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 KUWAIT HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 KUWAIT MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 KUWAIT BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 KUWAIT FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 KUWAIT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 KUWAIT FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 364 KUWAIT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 KUWAIT PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 366 KUWAIT CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 KUWAIT FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 KUWAIT VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 KUWAIT OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 KUWAIT COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 KUWAIT RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 KUWAIT SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 KUWAIT SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 375 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 376 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 377 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 378 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 379 OMAN BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 380 OMAN POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 OMAN POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 382 OMAN PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 OMAN FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 OMAN INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 OMAN FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)