Middle East And Africa Cancer Photodynamic Therapy Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

160.69 Million

USD

287.92 Million

2024

2032

USD

160.69 Million

USD

287.92 Million

2024

2032

| 2025 –2032 | |

| USD 160.69 Million | |

| USD 287.92 Million | |

|

|

|

|

Segmentação do mercado de terapia fotodinâmica para câncer no Oriente Médio e África, por tipo de produto (medicamentos fotossensibilizadores, dispositivos de terapia fotodinâmica), por indicação de câncer (oncologia cutânea, cabeça e pescoço, esôfago, pulmão, bexiga, colo do útero, próstata), por modalidade de terapia (terapia isolada, terapia adjuvante, terapia paliativa, outras), por técnica de procedimento (feixe externo, administração intracavitária (endoscópica), administração intersticial (interna), outras), por estágio da doença (câncer em estágio inicial, câncer em estágio avançado), por perfil demográfico do paciente (geriátrico, adulto, pediátrico), por usuário final (hospitais, clínicas de dermatologia e câncer de pele, centros cirúrgicos ambulatoriais (CCAs), institutos acadêmicos e de pesquisa, outros), por canal de distribuição (licitações diretas, distribuidores terceirizados, online, outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de terapia fotodinâmica para câncer no Oriente Médio e na África

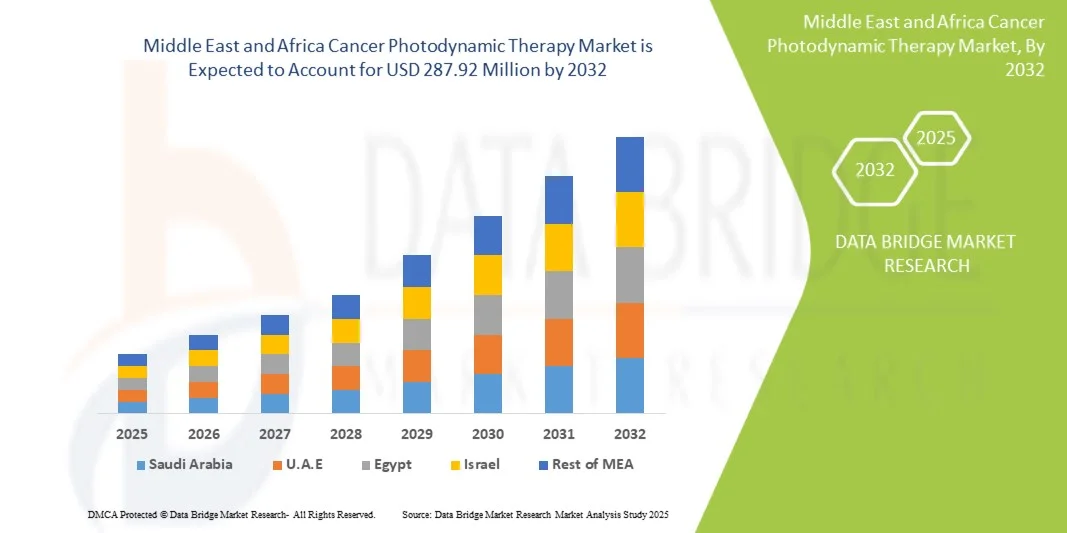

- O mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África foi avaliado em US$ 160,69 milhões em 2024 e deverá atingir US$ 287,92 milhões até 2032, com uma taxa de crescimento anual composta (CAGR) de 7,7% durante o período de previsão.

- O mercado é impulsionado principalmente pela crescente prevalência do câncer, pelo aumento dos gastos com saúde e pela maior conscientização sobre opções de tratamento avançadas. Melhorias rápidas na infraestrutura de saúde e a expansão de centros especializados em tratamento de câncer também contribuem para esse cenário.

- Esse crescimento é impulsionado por fatores como iniciativas governamentais que promovem o diagnóstico precoce e terapias inovadoras, o grande número de pacientes e o aumento dos investimentos de empresas internacionais e locais em tecnologias de terapia fotodinâmica.

Análise do mercado de terapia fotodinâmica para câncer no Oriente Médio e na África

- O mercado de terapia fotodinâmica (PDT) para o câncer está experimentando um crescimento constante, impulsionado pelo aumento da prevalência do câncer, pela crescente conscientização sobre tratamentos não invasivos e pelos avanços em medicamentos fotossensibilizadores e tecnologias a laser. A América do Norte domina o mercado devido à sua robusta infraestrutura de saúde e aos fortes investimentos em pesquisa e desenvolvimento.

- Os mercados emergentes da região Ásia-Pacífico estão testemunhando uma rápida adoção da Terapia Fotodinâmica (PDT), impulsionada por iniciativas governamentais, aumento dos gastos com saúde e crescimento da população idosa. No entanto, os altos custos do tratamento e o reembolso limitado continuam sendo os principais obstáculos, enquanto as inovações em terapias combinadas e fotossensibilizadores direcionados apresentam oportunidades significativas de crescimento.

- A África do Sul deverá dominar o mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África, com a maior participação de receita, de 26,09% em 2025. Esse crescimento é impulsionado por uma infraestrutura de saúde avançada, alta adoção de tratamentos inovadores, fortes investimentos em pesquisa e desenvolvimento, políticas de reembolso favoráveis e conscientização sobre terapias minimamente invasivas. Além disso, a presença de importantes players do mercado e estruturas regulatórias favoráveis aceleram o crescimento do mercado e as taxas de adoção na região.

- A África do Sul deverá ser a região de crescimento mais rápido no mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 8,5%, impulsionada pelo aumento da prevalência de câncer, pela expansão da infraestrutura de saúde, pela crescente conscientização sobre terapias avançadas e por iniciativas governamentais que promovem o diagnóstico precoce. Além disso, a crescente adoção de tecnologias inovadoras e o aumento da renda disponível impulsionam a demanda por terapia fotodinâmica na região.

- O segmento de medicamentos fotossensibilizadores deverá dominar o mercado de terapia fotodinâmica para câncer no Oriente Médio e na África, com uma participação de mercado de 78,27% em 2025. Esse crescimento é impulsionado por seu papel central no tratamento, alta especificidade no direcionamento às células cancerígenas, crescente aprovação de novos medicamentos, adoção cada vez maior em terapias combinadas e pesquisa e desenvolvimento contínuos que visam maior eficácia e redução dos efeitos colaterais.

Escopo do relatório e segmentação do mercado de terapia fotodinâmica para câncer no Oriente Médio e na África.

|

Atributos |

Principais informações sobre o mercado de seda no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África

“Integração com outras terapias oncológicas”

- A capacidade da terapia fotodinâmica (PDT) de produzir destruição localizada de células tumorais, ao mesmo tempo que estimula respostas imunes, a torna uma parceira atraente para o tratamento multimodal do câncer.

- Cada vez mais evidências mostram que a PDT pode aumentar a liberação de antígenos tumorais, modular o microambiente tumoral e aumentar a infiltração ou ativação de células imunes — mecanismos que podem apresentar sinergia com inibidores de checkpoint imunológico, vacinas terapêuticas contra o câncer, quimioterapia ou radioterapia.

- A combinação da PDT com terapias sistêmicas pode converter o controle local em respostas sistêmicas duradouras, permitir a redução da dose de agentes tóxicos e expandir as indicações (por exemplo, doença irressecável ou metastática).

- Com a multiplicação da pesquisa clínica e translacional, a integração com outras modalidades representa um caminho valioso para ampliar a relevância clínica e a adoção comercial da PDT.

Dinâmica do mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África

Motorista

“Prevalência crescente do câncer”

- O aumento da prevalência do câncer em todo o mundo é um dos principais fatores que impulsionam a demanda por terapias como a terapia fotodinâmica (PDT).

- Com o crescimento e envelhecimento da população, e com a melhoria das ferramentas de diagnóstico, o número de casos de câncer detectados a cada ano aumenta.

- Taxas mais elevadas de fatores de risco, como tabagismo, obesidade, sedentarismo, poluição do ar e infecções em países de baixa e média renda, também contribuem para o aumento da incidência.

- Com o aumento do número de pacientes que necessitam de modalidades de tratamento localizadas, eficazes, menos invasivas e com melhor custo-benefício, a PDT torna-se cada vez mais atrativa.

- O crescente número de casos de câncer sobrecarrega os sistemas de saúde, criando uma pressão urgente por terapias que possam melhorar os resultados, reduzir os efeitos colaterais e ser implementadas de forma mais ampla.

Restrição/Desafio

“Profundidade limitada de penetração da luz”

- Uma limitação significativa que dificulta a adoção e a eficácia mais amplas da terapia fotodinâmica é a penetração restrita da luz ativadora nos tecidos humanos.

- Como os fotossensibilizadores precisam ser ativados por luz de comprimentos de onda específicos, a absorção e dispersão da luz pelo tecido reduzem a profundidade que a iluminação pode atingir.

- Os fotossensibilizadores de luz visível geralmente funcionam apenas para tumores superficiais ou de fácil acesso; tumores mais profundos ou maiores continuam sendo um desafio.

- Essa limitação leva à destruição incompleta do tumor, exige o uso de métodos invasivos de iluminação (por exemplo, sondas de fibra óptica, endoscopia), aumenta a complexidade do procedimento e pode resultar em desfechos insatisfatórios ou recidiva.

- Até que avanços superem essa limitação, a Terapia Fotodinâmica (PDT) permanece restrita ao leque de tipos de câncer que pode tratar de forma não invasiva e eficaz.

Escopo do mercado de terapia fotodinâmica para câncer no Oriente Médio e na África

O mercado é segmentado com base no tipo de produto, indicação de câncer, modalidade de terapia, técnica de procedimento, estágio da doença, dados demográficos do paciente, usuário final e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado global de terapia fotodinâmica (PDT) para câncer no Oriente Médio e na África é segmentado em medicamentos fotossensibilizadores e dispositivos de PDT. Em 2025, espera-se que os medicamentos fotossensibilizadores dominem o mercado com uma participação de 78,27%, devido ao seu papel crucial na eficácia do tratamento, ampla aplicabilidade em diversos tipos de câncer e formulações versáteis (intravenosa, tópica, oral, intravesical e intraperitoneal). Os principais fatores que impulsionam essa dominância incluem a crescente prevalência de câncer, a adoção cada vez maior de terapias minimamente invasivas, as inovações farmacêuticas contínuas e as aprovações regulatórias, que, em conjunto, fazem dos fotossensibilizadores os principais contribuintes para a receita, superando os dispositivos de PDT.

Os medicamentos fotossensibilizadores são o segmento de crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 7,8% no mercado global de terapia fotodinâmica (PDT) para o câncer no Oriente Médio e na África, devido à crescente adoção de tratamentos oncológicos direcionados e minimamente invasivos. A crescente conscientização sobre a eficácia da PDT, os menores efeitos colaterais em comparação com as terapias convencionais e o desenvolvimento de fotossensibilizadores de última geração com seletividade tumoral aprimorada e penetração tecidual mais profunda estão impulsionando a demanda. Além disso, pesquisas clínicas promissoras e aprovações para novos agentes fotossensibilizantes também contribuem para a expansão do mercado.

- Por indicação de câncer

Com base na indicação do câncer, o mercado global de terapia fotodinâmica (PDT) para câncer no Oriente Médio e África é segmentado em Oncologia Cutânea, Cabeça e Pescoço, Esôfago, Pulmão, Bexiga, Colo do Útero e Próstata. Em 2025, espera-se que o segmento de Oncologia Cutânea domine o mercado com uma participação de 57,28%, devido à alta prevalência de câncer de pele, à ampla conscientização sobre a detecção precoce e à eficácia da PDT na obtenção de resultados estéticos superiores. O segmento se beneficia da ampla adoção de medicamentos fotossensibilizadores e dispositivos de PDT, especialmente para pacientes geriátricos e adultos, que representam a maior parcela da população. Além disso, a crescente demanda por terapias minimamente invasivas e direcionadas para queratoses actínicas, carcinoma basocelular e carcinoma espinocelular, juntamente com políticas de reembolso favoráveis em regiões-chave, reforça ainda mais sua liderança de mercado em relação a outras indicações de câncer.

O segmento de Oncologia Dermatológica é o que apresenta o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 8,1% no mercado global de terapia fotodinâmica para câncer no Oriente Médio e África, devido à crescente prevalência de câncer de pele, à maior conscientização sobre o diagnóstico precoce e à preferência por tratamentos minimamente invasivos com menos efeitos colaterais. A terapia fotodinâmica oferece ação direcionada, recuperação rápida e melhores resultados estéticos, tornando-a altamente favorável para a oncologia dermatológica. Além disso, os avanços tecnológicos em fotossensibilizadores e sistemas de distribuição de luz estão impulsionando a adoção nesse segmento.

- Por Modalidade de Terapia

Com base na modalidade terapêutica, o mercado global de terapia fotodinâmica (PDT) para câncer no Oriente Médio e África é segmentado em terapia isolada, terapia adjuvante, terapia paliativa e outras. Em 2025, espera-se que o segmento de terapia isolada domine o mercado com uma participação de 47,46%, devido à sua eficácia como tratamento primário para cânceres localizados, incluindo câncer de pele, esôfago e pulmão. Os principais fatores que impulsionam essa dominância incluem alta eficácia, mínima invasividade, resultados estéticos superiores e crescente preferência clínica por terapias direcionadas. Regionalmente, a América do Norte e a Europa lideram a adoção da PDT isolada devido à infraestrutura de saúde avançada, estruturas de reembolso estabelecidas e alta conscientização dos pacientes, enquanto os mercados emergentes na Ásia-Pacífico estão testemunhando uma crescente adoção impulsionada pela crescente prevalência de câncer, expansão das redes hospitalares e maior acesso a tratamentos oncológicos modernos. Essas dinâmicas regionais, combinadas com o aumento da educação e da conscientização sobre os benefícios da PDT, reforçam a dominância da terapia isolada globalmente.

A terapia isolada é o segmento de crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 8,0% no mercado global de terapia fotodinâmica para câncer no Oriente Médio e África, devido à sua simplicidade, custo-benefício e redução dos efeitos colaterais em comparação com as terapias combinadas. Ela permite o tratamento direcionado do tumor sem a necessidade de medicamentos ou intervenções adicionais, melhorando a adesão do paciente. A crescente adoção em ambientes ambulatoriais, a maior conscientização sobre tratamentos minimamente invasivos e os avanços em fotossensibilizadores e sistemas de distribuição de luz estão impulsionando ainda mais o rápido crescimento desse segmento.

- Por meio da técnica de procedimento

Com base na técnica de procedimento, o mercado global de terapia fotodinâmica para câncer no Oriente Médio e na África é segmentado em feixe externo, administração intracavitária (endoscópica), administração intersticial (interna) e outras. Em 2025, espera-se que o segmento de feixe externo domine o mercado com 72,28% de participação, devido à sua natureza não invasiva, facilidade de uso e eficácia para tumores superficiais. A forte adoção na América do Norte e na Europa, apoiada por infraestrutura de saúde avançada e políticas de reembolso, juntamente com a crescente demanda na região Ásia-Pacífico devido à crescente prevalência e conscientização do câncer, impulsiona sua liderança de mercado.

O segmento de administração intracavitária (endoscópica) é o que apresenta o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 8,2% no mercado global de terapia fotodinâmica para câncer no Oriente Médio e na África, pois permite a administração minimamente invasiva e direcionada de luz e fotossensibilizador a tumores em órgãos ocos, reduz a exposição sistêmica e os efeitos colaterais, possibilita tratamentos repetíveis, melhora o acesso ao tumor em cânceres de esôfago, brônquios e bexiga e reduz o tempo de recuperação.

- Por estágio da doença

Com base no estágio da doença, o mercado global de terapia fotodinâmica (PDT) para câncer no Oriente Médio e na África é segmentado em câncer em estágio inicial e câncer em estágio avançado. Em 2025, espera-se que o segmento de câncer em estágio inicial domine o mercado com uma participação de 83,47%, devido à eficácia da PDT em atingir tumores localizados, minimizar danos ao tecido saudável e oferecer melhores resultados estéticos. O segmento se beneficia da alta conscientização dos pacientes, da preferência por tratamentos minimamente invasivos e da ampla adoção na América do Norte e na Europa, enquanto as crescentes taxas de diagnóstico de câncer e a expansão da infraestrutura oncológica na região Ásia-Pacífico reforçam ainda mais sua liderança de mercado.

O câncer em estágio inicial é o segmento de crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 7,8% no mercado global de terapia fotodinâmica (PDT) para câncer no Oriente Médio e África, devido à crescente adoção de tratamentos minimamente invasivos, à maior conscientização sobre a detecção precoce e aos melhores resultados para os pacientes com a PDT. Os cânceres em estágio inicial respondem melhor às terapias direcionadas, resultando em maior eficácia e menos efeitos colaterais. Além disso, iniciativas governamentais de apoio e avanços em fotossensibilizadores e sistemas de distribuição de luz estão impulsionando uma penetração de mercado mais rápida nesse segmento.

- Por dados demográficos do paciente

Com base nos dados demográficos dos pacientes, o mercado global de terapia fotodinâmica para câncer no Oriente Médio e na África é segmentado em geriátrico, adulto e pediátrico. Em 2025, espera-se que o segmento geriátrico domine o mercado com uma participação de 71,17%, devido à maior prevalência de câncer entre os idosos, à maior suscetibilidade a cânceres de pele e cutâneos e à preferência por tratamentos minimamente invasivos e direcionados. A forte adoção na América do Norte e na Europa é impulsionada por uma infraestrutura de saúde avançada e pela conscientização da população, além do crescimento da população idosa.

O segmento geriátrico é o que apresenta o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 7,9% no mercado global de terapia fotodinâmica (PDT) para o câncer no Oriente Médio e na África, devido à maior prevalência de câncer entre os idosos. O envelhecimento enfraquece o sistema imunológico e aumenta a suscetibilidade a vários tipos de câncer, impulsionando a demanda por tratamentos eficazes e minimamente invasivos, como a PDT. Além disso, a PDT oferece menos efeitos colaterais e recuperação mais rápida, tornando-a adequada para pacientes idosos que podem não tolerar terapias agressivas, o que impulsiona o crescimento do mercado nessa faixa etária.

- Por usuário final

Com base no usuário final, o mercado global de terapia fotodinâmica (PDT) para câncer no Oriente Médio e na África é segmentado em hospitais, clínicas de dermatologia e câncer de pele, centros cirúrgicos ambulatoriais (CCAs), instituições acadêmicas e de pesquisa e outros. Em 2025, espera-se que o segmento de hospitais domine o mercado com uma participação de 47,56%, devido à sua infraestrutura abrangente, disponibilidade de departamentos de oncologia especializados e capacidade de oferecer tratamentos integrados de PDT. Hospitais públicos e privados, principalmente os de nível 1 e 2 na América do Norte e na Europa, lideram a adoção devido aos sistemas de saúde avançados e ao suporte de reembolso. O crescimento das redes hospitalares e a expansão dos serviços de oncologia na região Ásia-Pacífico reforçam ainda mais a dominância dos hospitais como os principais usuários finais da PDT para câncer em todo o mundo.

Os hospitais são o segmento de crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 8,2% no mercado global de terapia fotodinâmica (PDT) para o câncer no Oriente Médio e na África, devido à crescente adoção de tratamentos oncológicos avançados, ao maior fluxo de pacientes e à disponibilidade de departamentos de oncologia especializados. Os hospitais oferecem serviços abrangentes de PDT, incluindo diagnóstico, tratamento e cuidados pós-terapia, o que os torna preferíveis a clínicas independentes. Além disso, a crescente conscientização, as iniciativas governamentais e a cobertura de planos de saúde impulsionam ainda mais a adoção da PDT em hospitais.

- Por canal de distribuição

Com base no canal de distribuição, o mercado global de terapia fotodinâmica (PDT) para o câncer no Oriente Médio e na África é segmentado em Licitação Direta, Distribuidores Terceirizados, Online e Outros. Em 2025, espera-se que o segmento de Licitação Direta domine o mercado com uma participação de 56,02%, devido à aquisição em grande escala por hospitais, programas governamentais de saúde e grandes centros de oncologia, o que garante custo-benefício e fornecimento confiável de fotossensibilizadores e equipamentos de PDT. A forte adoção na América do Norte e na Europa é impulsionada por sistemas estruturados de aquisição hospitalar e licitações de saúde pública, juntamente com a crescente demanda institucional.

O segmento de Licitação Direta é o que apresenta o crescimento mais rápido, com uma taxa de crescimento anual composta (CAGR) de 7,9% no mercado global de Terapia Fotodinâmica (PDT) para o câncer no Oriente Médio e na África, devido ao aumento das aquisições de equipamentos avançados de PDT por governos e hospitais por meio de contratos diretos. Essa abordagem garante custo-benefício, aquisição mais rápida e fornecimento confiável para programas de tratamento de câncer em larga escala. Além disso, o aumento dos gastos públicos com saúde, as iniciativas governamentais para o tratamento do câncer e a preferência por compras centralizadas impulsionam a adoção da licitação direta em detrimento de distribuidores ou canais online.

Análise Regional do Mercado de Terapia Fotodinâmica para o Câncer no Oriente Médio e na África

- A África do Sul deverá dominar o mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África, com a maior participação de receita, de 26,09% em 2025. Esse crescimento é impulsionado por uma infraestrutura de saúde avançada, alta adoção de tratamentos inovadores, fortes investimentos em pesquisa e desenvolvimento, políticas de reembolso favoráveis e conscientização sobre terapias minimamente invasivas. Além disso, a presença de importantes players do mercado e estruturas regulatórias favoráveis aceleram o crescimento do mercado e as taxas de adoção na região.

- Prevê-se que a África do Sul seja a região de crescimento mais rápido no mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África durante o período de previsão, com uma taxa de crescimento anual composta (CAGR) de 8,5%, impulsionada pelo aumento da prevalência de câncer, pela expansão da infraestrutura de saúde, pela crescente conscientização sobre terapias avançadas e por iniciativas governamentais que promovem o diagnóstico precoce. Além disso, a crescente adoção de tecnologias inovadoras e o aumento da renda disponível impulsionam a demanda por terapia fotodinâmica na região.

- Além disso, a presença de importantes players de mercado e estruturas regulatórias favoráveis aceleram o crescimento do mercado e as taxas de adoção na região.

Análise do mercado de terapia fotodinâmica para o câncer na África do Sul, Oriente Médio e África.

O mercado de terapia fotodinâmica (PDT) para o câncer na África do Sul, Oriente Médio e África está em expansão gradual, impulsionado pelo aumento da prevalência da doença, uma infraestrutura de saúde altamente avançada e forte apoio governamental a tratamentos inovadores. A crescente conscientização entre pacientes e médicos, juntamente com a adoção de terapias minimamente invasivas, alimenta a demanda. Além disso, a pesquisa e o desenvolvimento (P&D) locais ativos, as colaborações com empresas globais de PDT e as políticas de reembolso favoráveis contribuem para o crescimento constante do mercado, posicionando o Japão como um dos principais adotantes na região.

Análise do mercado de terapia fotodinâmica para o câncer na Arábia Saudita, Oriente Médio e África

O mercado de terapia fotodinâmica (PDT) para câncer na Arábia Saudita, Oriente Médio e África representou a maior fatia do mercado global em 2024, devido ao seu grande número de pacientes, à crescente prevalência de câncer e ao aumento dos gastos com saúde. O forte apoio governamental a tratamentos avançados contra o câncer, a crescente adoção de terapias inovadoras e a presença de importantes fabricantes nacionais de dispositivos de PDT impulsionam ainda mais o crescimento do mercado. Além disso, a expansão da infraestrutura de saúde e o aumento da conscientização entre pacientes e médicos contribuem para a posição de liderança da China no mercado regional de PDT.

Os principais líderes de mercado que atuam no setor são:

- Novartis Pharma AG (Suíça)

- Galderma SA (Suíça)

- Bausch Health Companies Inc. (Canadá)

- Fotocura ASA (Noruega)

- ADVANZ PHARMA Corp. (Reino Unido)

- Sun Pharmaceutical Industries Ltd. (Índia)

- Biofrontera AG (Alemanha)

- LUMIBIRD SA (França)

- LUZITIN SA (Portugal)

- Lumeda Inc. (Suécia)

- ImPact Biotech (Israel)

- biolitec Holding GmbH & Co KG (Alemanha)

- Modulight Corporation (Finlândia)

- THERALASE TECHNOLOGIES INC.

Últimos desenvolvimentos no mercado de terapia fotodinâmica para o câncer no Oriente Médio e na África

- Em fevereiro de 2023, a colaboração entre a Galderma e a German Medical Engineering (GME) representa um desenvolvimento estratégico no mercado de dermatologia e terapia fotodinâmica (PDT). Ao combinar o Metvix da Galderma, um fotossensibilizador líder para lesões pré-cancerosas e cânceres de pele não melanoma, com o dispositivo MultiLite da GME, a parceria fortalece a oferta de tratamentos integrados da Galderma e expande sua capacidade de fornecer tanto a PDT convencional com luz vermelha (C-PDT) quanto a PDT com luz artificial diurna (ADL-PDT), mais confortável para o paciente.

- Em 2025, a McKesson concluiu a aquisição da Core Ventures (Community Oncology Revitalization Enterprise Ventures), adquirindo uma participação majoritária de aproximadamente 70% por cerca de US$ 2,49 bilhões, para fortalecer seu atendimento oncológico comunitário por meio do Florida Cancer Specialists & Research Institute.

- Em 2025, a Biofrontera AG transferiu todos os ativos nos EUA relacionados ao Ameluz e ao RhodoLED para a Biofrontera Inc., recebendo uma participação acionária de 10% e royalties de 12 a 15% sobre as vendas do Ameluz nos EUA.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.3.1 INTRODUCTION

4.3.2 PRODUCTION SIDE ANALYSIS

4.3.2.1 PHOTOSENSITIZER MANUFACTURING

4.3.2.2 DEVICE MANUFACTURING

4.3.2.3 RESEARCH AND INNOVATION

4.3.3 CONSUMPTION SIDE ANALYSIS

4.3.3.1 CLINICAL APPLICATION

4.3.3.2 TREATMENT VOLUMES AND TRENDS

4.3.3.3 DOSAGE AND PROTOCOLS

4.3.4 PRODUCTION–CONSUMPTION DYNAMICS

4.3.4.1 SUPPLY CONSTRAINTS

4.3.4.2 REGIONAL OVERVIEW

4.3.4.3 FUTURE OUTLOOK

4.3.5 CONCLUSION

4.4 COST ANALYSIS BREAKDOWN

4.4.1 INTRODUCTION

4.4.2 DIRECT MEDICAL COSTS

4.4.2.1 COST OF PHOTOSENSITIZERS

4.4.2.2 LIGHT DELIVERY SYSTEMS

4.4.2.3 HEALTHCARE FACILITY CHARGES

4.4.3 INDIRECT COSTS

4.4.3.1 PATIENT-RELATED EXPENSES

4.4.3.2 POST-TREATMENT MONITORING

4.4.4 COMPARATIVE COST-EFFECTIVENESS

4.4.5 REIMBURSEMENT AND INSURANCE IMPACT

4.4.6 REGIONAL COST VARIATIONS

4.4.7 FUTURE COST TRENDS AND REDUCTION STRATEGIES

4.4.7.1 TECHNOLOGICAL ADVANCEMENTS

4.4.7.2 HEALTHCARE EFFICIENCY INITIATIVES

4.4.8 CONCLUSION

4.5 TECHNOLOGICAL ADVANCEMENTS

4.5.1 INTRODUCTION

4.5.2 NEXT-GENERATION PHOTOSENSITIZERS

4.5.3 ADVANCEMENTS IN LIGHT DELIVERY SYSTEMS

4.5.4 NANOTECHNOLOGY-ENABLED DELIVERY

4.5.5 COMBINATION THERAPIES AND IMMUNOMODULATION

4.5.6 DIGITAL INTEGRATION AND TREATMENT PLANNING

4.5.7 RECENT TRENDS AND OUTLOOK

4.5.8 CONCLUSION

4.6 VALUE CHAIN ANALYSIS

4.6.1 INTRODUCTION

4.6.2 RESEARCH & DEVELOPMENT

4.6.2.1 DISCOVERY OF PHOTOSENSITIZERS

4.6.2.2 DEVELOPMENT OF LIGHT DELIVERY SYSTEMS

4.6.2.3 CLINICAL TRIALS AND REGULATORY APPROVALS

4.6.3 MANUFACTURING

4.6.3.1 PRODUCTION OF PHOTOSENSITIZERS

4.6.3.2 FABRICATION OF LIGHT DELIVERY DEVICES

4.6.4 DISTRIBUTION & LOGISTICS

4.6.4.1 SUPPLY CHAIN MANAGEMENT

4.6.4.2 INTERNATIONAL TRADE AND MARKET ACCESS

4.6.5 CLINICAL APPLICATION

4.6.5.1 INTEGRATION INTO TREATMENT PROTOCOLS

4.6.5.2 TRAINING AND EDUCATION

4.6.6 POST-TREATMENT MONITORING & SUPPORT

4.6.6.1 FOLLOW-UP CARE

4.6.6.2 PATIENT SUPPORT SERVICES

4.6.7 TECHNOLOGICAL ADVANCEMENTS INFLUENCING THE PDT VALUE CHAIN

4.6.7.1 NANOTECHNOLOGY IN PDT

4.6.7.2 ARTIFICIAL INTELLIGENCE AND IMAGING

4.6.7.3 PERSONALIZED MEDICINE

4.6.8 CONCLUSION

4.7 VENDOR SELECTION CRITERIA

4.7.1 INTRODUCTION

4.7.2 CORE SELECTION CRITERIA

4.7.2.1 REGULATORY COMPLIANCE

4.7.2.2 CLINICAL EVIDENCE AND RESEARCH SUPPORT

4.7.2.3 TECHNICAL PERFORMANCE AND DEVICE COMPATIBILITY

4.7.2.4 QUALITY MANAGEMENT AND MANUFACTURING STANDARDS

4.7.2.5 SERVICE, TRAINING, AND AFTER-SALES SUPPORT

4.7.2.6 SUPPLY CHAIN RELIABILITY

4.7.3 RECENT TRENDS IN VENDOR SELECTION

4.7.4 RISK FACTORS AND VULNERABILITIES

4.7.5 KEY PERFORMANCE INDICATORS

4.7.6 STRATEGIC RECOMMENDATIONS

4.7.7 CONCLUSION

4.8 PATENT ANALYSIS

4.8.1 PATENT QUALITY AND STRENGTH

4.8.2 PATENT FAMILIES

4.8.3 LICENSING AND COLLABORATIONS

4.8.4 REGIONAL PATENT LANDSCAPE

4.8.5 IP STRATEGY AND MANAGEMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9.4 CONCLUSION

4.1 INDUSTRY ECOSYSTEM ANALYSIS

4.10.1 INTRODUCTION

4.10.2 ECOSYSTEM ARCHITECTURE — KEY ACTORS AND ROLES

4.10.2.1 CORE TECHNOLOGY PROVIDERS

4.10.2.2 ENABLING INSTITUTIONS

4.10.3 VALUE CHAIN AND FUNCTIONAL FLOWS

4.10.3.1 RESEARCH AND DISCOVERY

4.10.3.2 CLINICAL DEVELOPMENT AND REGULATORY VALIDATION

4.10.3.3 MANUFACTURING AND QUALITY ASSURANCE

4.10.3.4 DISTRIBUTION, PROCUREMENT AND CLINICAL ADOPTION

4.10.4 MARKET ENABLERS AND INFRASTRUCTURE

4.10.4.1 SCIENTIFIC AND REGULATORY ENABLERS

4.10.4.2 REIMBURSEMENT AND HEALTH-ECONOMICS INFRASTRUCTURE

4.10.4.3 MANUFACTURING AND SUPPLY-CHAIN CAPACITY

4.10.5 INTERDEPENDENCIES AND STRATEGIC PARTNERSHIPS

4.10.5.1 ACADEMIA-INDUSTRY TECHNOLOGY TRANSFER

4.10.5.2 VERTICAL INTEGRATION AND CONTRACT MANUFACTURING

4.10.5.3 CLINICAL NETWORKS AND KOL ECOSYSTEMS

4.10.6 RISKS, CONSTRAINTS AND SYSTEMIC VULNERABILITIES

4.10.6.1 REGULATORY COMPLEXITY FOR COMBINED PRODUCTS

4.10.6.2 SUPPLY-CHAIN CONCENTRATION AND MATERIAL RISK

4.10.6.3 EVIDENCE AND REIMBURSEMENT UNCERTAINTY

4.10.6.4 CLINICAL OPERATIONAL BARRIERS

4.10.7 STRATEGIC IMPLICATIONS AND RECOMMENDATIONS

4.10.8 OUTLOOK — EVOLUTION OF THE ECOSYSTEM

4.10.9 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 INTRODUCTION

4.11.2 RECENT TECHNOLOGICAL INNOVATIONS

4.11.2.1 ADVANCED PHOTOSENSITIZERS

4.11.2.2 OXYGEN-SELF-SUFFICIENT PLATFORMS

4.11.2.3 ALTERNATIVE ACTIVATION MODALITIES

4.11.2.4 SMART NANOPLATFORMS

4.11.2.5 NOVEL CHEMICAL STRUCTURES

4.11.3 STRATEGIC INNOVATIONS IN DELIVERY SYSTEMS

4.11.3.1 LIGHT DELIVERY DEVICES

4.11.3.2 COMBINATION THERAPIES

4.11.3.3 IMAGING INTEGRATION

4.11.4 KEY CHALLENGES

4.11.5 STRATEGIC THEMES

4.11.6 STRATEGIC IMPLICATIONS FOR MARKET PLAYERS

4.11.7 RECOMMENDATIONS

4.11.8 OUTLOOK AND STRATEGIC RISKS

4.11.9 CONCLUSION

4.12 PRICING ANALYSIS

4.12.1 INTRODUCTION

4.12.2 COMPONENTS OF THE TOTAL TREATMENT PRICE

4.12.2.1 PHOTOSENSITIZING AGENT (DRUG) COSTS

4.12.2.2 DEVICE CAPITAL AND MAINTENANCE COST

4.12.2.3 CONSUMABLES AND PROCEDURAL OVERHEAD

4.12.2.4 INDIRECT AND DOWNSTREAM COSTS

4.12.3 PRICING MODELS AND APPROACHES

4.12.3.1 COST-PLUS AND MARKUP MODELS

4.12.3.2 VALUE-BASED AND OUTCOMES-LINKED PRICING

4.12.3.3 BUNDLED PAYMENTS AND PROCEDURAL TARIFFS

4.12.3.4 SUBSCRIPTION AND MANAGED-SERVICE MODELS FOR DEVICES

4.12.4 REIMBURSEMENT LANDSCAPE

4.12.4.1 UNITED STATES: MEDICARE AND COMMERCIAL PAYERS

4.12.4.2 EUROPE AND OTHER HIGH-INCOME MARKETS

4.12.4.3 EMERGING MARKETS AND OUT-OF-POCKET DYNAMICS

4.12.5 REGIONAL PRICE DIFFERENTIALS AND DRIVERS

4.12.5.1 MANUFACTURING FOOTPRINT AND SUPPLY-CHAIN EFFECTS

4.12.5.2 REGULATORY BURDEN AND MARKET ACCESS TIMELINES

4.12.5.3 CLINICAL PRACTICE PATTERNS AND REIMBURSEMENT POLICY

4.12.6 PRICE SENSITIVITY, ACCESS, AND EQUITY

4.12.6.1 PRICE ELASTICITY IN HOSPITAL PROCUREMENT

4.12.6.2 PATIENT ACCESS AND SOCIOECONOMIC BARRIERS

4.12.7 COMPETITIVE & STRATEGIC PRICING IMPLICATIONS

4.12.7.1 DIFFERENTIATION-BASED PREMIUM PRICING

4.12.7.2 PENETRATION PRICING AND VOLUME STRATEGIES

4.12.7.3 MANAGED ENTRY AGREEMENTS AND OUTCOMES GUARANTEES

4.12.8 RECOMMENDATIONS FOR STAKEHOLDERS

4.12.8.1 FOR MANUFACTURERS

4.12.8.2 FOR PROVIDERS AND HOSPITAL SYSTEMS

4.12.8.3 FOR PAYERS AND POLICYMAKERS

4.12.9 RISKS, UNCERTAINTIES, AND FUTURE PRICE PRESSURES

4.12.10 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 INTRODUCTION

5.2 TARIFF LANDSCAPE RELEVANT TO PDT PRODUCTS

5.2.1 CATEGORIES OF TRADE EXPOSURE

5.2.2 RECENT AND EMERGING TARIFF MEASURES OF CONSEQUENCE

5.3 DIRECT COST IMPACTS

5.3.1 INCREASED LANDED COSTS AND MARGIN COMPRESSION

5.3.2 PRICE VOLATILITY AND PROCUREMENT BUDGETING

5.4 SUPPLY-CHAIN & MANUFACTURING IMPLICATIONS

5.4.1 SUPPLIER DIVERSIFICATION AND RESHORING INCENTIVES

5.4.2 SOURCING OF HIGH-VALUE NANOMATERIALS AND COMPONENTS

5.4.3 REGULATORY AND QUALIFICATION COSTS FOR NEW SUPPLIERS

5.5 CLINICAL ACCESS, PRICING & REIMBURSEMENT EFFECTS

5.5.1 ACCESS RISK FOR PATIENTS AND PROVIDERS

5.5.2 REIMBURSEMENT PRESSURE AND HEALTH-ECONOMIC ASSESSMENTS

5.6 R&D, INNOVATION & COMPETITIVE IMPLICATIONS

5.6.1 DISRUPTION OF RESEARCH SUPPLIES AND COLLABORATION FLOWS

5.6.2 STRATEGIC REPOSITIONING AND COMPETITIVE ADVANTAGE

5.7 POLICY, COMPLIANCE & REGULATORY CONSIDERATIONS

5.7.1 USE OF WTO AND PREFERENTIAL TRADE RULES

5.7.2 TARIFF MITIGATION TOOLS AND ADVOCACY

5.8 RECOMMENDATIONS FOR STAKEHOLDERS

5.9 CONCLUSION

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.1.1 CERTIFIED STANDARDS

6.1.2 SAFETY STANDARDS

6.1.3 MATERIAL HANDLING & STORAGE

6.1.4 TRANSPORT & PRECAUTIONS

6.1.5 HAZARD IDENTIFICATION

6.1.6 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 GROWING PREFERENCE FOR MINIMALLY INVASIVE THERAPIES

7.1.3 TECHNOLOGICAL ADVANCEMENTS IN PHOTOSENSITIZERS AND DEVICES

7.1.4 EXPANDING RESEARCH AND CLINICAL DEVELOPMENT PIPELINE

7.2 RESTRAINTS

7.2.1 LIMITED DEPTH OF LIGHT PENETRATION

7.2.2 HIGH COST OF TREATMENT

7.3 OPPORTUNITIES

7.3.1 INTEGRATION WITH OTHER CANCER THERAPIES

7.3.2 DEVELOPMENT OF NOVEL PHOTOSENSITIZERS

7.3.3 M&A AND PARTNERSHIPS WITH ONCOLOGY DEVICE/LASER FIRMS AND PHARMA

7.4 CHALLENGES

7.4.1 TUMOR HYPOXIA AS A BIOLOGICAL BARRIER TO PHOTODYNAMIC THERAPY EFFICACY

7.4.2 COMPETITION FROM ALTERNATIVE TREATMENTS

8 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 PHOTOSENSITIZER DRUGS

8.3 PHOTODYNAMIC THERAPY DEVICES

9 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION

9.1 OVERVIEW

9.2 SKIN & CUTANEOUS ONCOLOGY

9.3 HEAD & NECK

9.4 ESOPHAGAL

9.5 LUNG

9.6 BLADDER

9.7 CERVICAL

9.8 PROSTATE

10 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY

10.1 OVERVIEW

10.2 STANDALONE THERAPY

10.3 ADJUNCTIVE THERAPY

10.4 PALLIATION THERAPY

10.5 OTHERS

11 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE

11.1 OVERVIEW

11.2 EXTERNAL BEAM

11.3 INTRACAVITARY (ENDOSCOPIC) DELIVERY

11.4 INTERSTITIAL (INTERNAL) DELIVERY

11.5 OTHERS

12 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE

12.1 OVERVIEW

12.2 EARLY-STAGE CANCER

12.3 LATE-STAGE CANCER

13 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS

13.1 OVERVIEW

13.2 GERIATRIC

13.3 ADULTS

13.4 PEDIATRIC

14 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 DERMATOLOGY & SKIN-CANCER CLINICS

14.4 AMBULATORY SURGICAL CENTERS (ASCS)

14.5 ACADEMIC & RESEARCH INSTITUTES

14.6 OTHERS

15 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDER

15.3 THIRD PARTY DISTRIBUTORS

15.4 ONLINE

15.5 OTHERS

16 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION

16.1 MIDDLE EAST AND AFRICA

16.1.1 SOUTH AFRICA

16.1.2 SAUDI ARABIA

16.1.3 EGYPT

16.1.4 U.A.E

16.1.5 ISRAEL

16.1.6 BAHRAIN

16.1.7 KUWAIT

16.1.8 OMAN

16.1.9 QATAR

16.1.10 REST OF MIDDLE EAST AND AFRICA

17 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 NOVERTIS AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 GALDERMA S. A.

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 PHOTOCURE

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 ADVANZ PHARMA CORP.

19.4.1 COMPANY SNAPSHOT

19.4.2 COMPANY SHARE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT DEVELOPMENT

19.5 AMERISOURCE BERGEN CORPORATION

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 BIOFRONTERA AG

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 BIOLITEC HOLDING GMBH & CO KG

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 CARDINAL HEALTH

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 HEMERION THERAPEUTICS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 IMPACT BIOTECH

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENTS

19.11 INOVA

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 LUMIBIRD

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENT

19.13 LUZITIN

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 MCKESSON

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 PRODUCT PORTFOLIO

19.14.4 RECENT DEVELOPMENTS

19.15 MODULIGHT CORPORATION

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 ONCOLUX INC (FORMERLY LUMEDA INC.)

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SUN PHARMACEUTICAL INDUSTRIES LTD

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENT

19.18 THERALASE TECHNOLOGIES INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA STANDALONE THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ADJUNCTIVE THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PALLIATION THERAPY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA EXTERNAL BEAM IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA INTRACAVITARY (ENDOSCOPIC) DELIVERY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA INTERSTITIAL (INTERNAL) DELIVERY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA EARLY-STAGE CANCER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA LATE-STAGE CANCER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA GERIATRIC IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ADULTS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA PEDIATRIC IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA DERMATOLOGY & SKIN-CANCER CLINICS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA AMBULATORY SURGICAL CENTERS (ASCS) IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ACADEMIC & RESEARCH INSTITUTES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA DIRECT TENDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA THIRD PARTY DISTRIBUTORS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA ONLINE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA OTHERS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AFRICA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH AFRICA ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH AFRICA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH AFRICA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 114 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 115 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 116 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 117 SOUTH AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SOUTH AFRICA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH AFRICA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 129 SAUDI ARABIA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 131 SAUDI ARABIA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 133 SAUDI ARABIA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 135 SAUDI ARABIA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 137 SAUDI ARABIA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 139 SAUDI ARABIA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 141 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 142 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 143 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 144 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SAUDI ARABIA HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 149 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 EGYPT PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 151 EGYPT PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 EGYPT ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 156 EGYPT SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 158 EGYPT HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 160 EGYPT ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 162 EGYPT LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 EGYPT LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 174 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 178 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.A.E PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 180 U.A.E PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 181 U.A.E PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.A.E LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 U.A.E ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 185 U.A.E SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 U.A.E SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 187 U.A.E HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 U.A.E HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 189 U.A.E ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 U.A.E ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 191 U.A.E LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 U.A.E LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 193 U.A.E BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.A.E BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 195 U.A.E CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 U.A.E CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 197 U.A.E PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 U.A.E PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 199 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 200 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 201 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 202 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 203 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 204 U.A.E HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 U.A.E HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 206 U.A.E CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 207 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 ISRAEL PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 209 ISRAEL PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 210 ISRAEL PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 ISRAEL LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 ISRAEL ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 ISRAEL SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 ISRAEL SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 216 ISRAEL HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 ISRAEL HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 218 ISRAEL ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 ISRAEL ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 220 ISRAEL LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 ISRAEL LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 222 ISRAEL BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 ISRAEL BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 224 ISRAEL CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ISRAEL CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 226 ISRAEL PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ISRAEL PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 228 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 229 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 230 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 231 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 232 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 233 ISRAEL HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 ISRAEL HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 235 ISRAEL CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 236 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 BAHRAIN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 238 BAHRAIN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 239 BAHRAIN PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 BAHRAIN LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 BAHRAIN ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 243 BAHRAIN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 BAHRAIN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 245 BAHRAIN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 BAHRAIN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 247 BAHRAIN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 BAHRAIN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 249 BAHRAIN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 BAHRAIN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 251 BAHRAIN BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 BAHRAIN BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 253 BAHRAIN CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 BAHRAIN CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 255 BAHRAIN PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 BAHRAIN PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 257 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 258 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 259 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 260 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 261 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 262 BAHRAIN HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 BAHRAIN HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 264 BAHRAIN CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 265 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 KUWAIT PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 267 KUWAIT PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 268 KUWAIT PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 KUWAIT LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 KUWAIT ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 272 KUWAIT SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 KUWAIT SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 274 KUWAIT HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 KUWAIT HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 276 KUWAIT ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 KUWAIT ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 278 KUWAIT LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 KUWAIT LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 280 KUWAIT BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 KUWAIT BLADDER IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 282 KUWAIT CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 KUWAIT CERVICAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 284 KUWAIT PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 KUWAIT PROSTATE IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 286 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY THERAPY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 287 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY PROCEDURE TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 288 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY DISEASE STAGE, 2018-2032 (USD THOUSAND)

TABLE 289 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 290 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 291 KUWAIT HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 KUWAIT HOSPITALS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 293 KUWAIT CANCER PHOTODYNAMIC THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 294 OMAN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 OMAN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY CLASS, 2018-2032 (USD THOUSAND)

TABLE 296 OMAN PHOTOSENSITIZER DRUGS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 297 OMAN PHOTODYNAMIC THERAPY DEVICES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 OMAN LIGHT DELIVERY SYSTEMS IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 OMAN ACCESSORIES & CONSUMABLES IN CANCER PHOTODYNAMIC THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 OMAN CANCER PHOTODYNAMIC THERAPY MARKET, BY CANCER INDICATION, 2018-2032 (USD THOUSAND)

TABLE 301 OMAN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 OMAN SKIN & CUTANEOUS ONCOLOGY IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 303 OMAN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 OMAN HEAD & NECK IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 305 OMAN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 OMAN ESOPHAGAL IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)

TABLE 307 OMAN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 OMAN LUNG IN CANCER PHOTODYNAMIC THERAPY MARKET, BY PATIENT DEMOGRAPHICS, 2018-2032 (USD THOUSAND)