Middle East And Africa Fibc Packaging Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

497.09 Million

USD

721.32 Million

2025

2033

USD

497.09 Million

USD

721.32 Million

2025

2033

| 2026 –2033 | |

| USD 497.09 Million | |

| USD 721.32 Million | |

|

|

|

|

Segmentação do mercado de embalagens FIBC no Oriente Médio e África, por tipo de produto (Tipo A, Tipo B, Tipo C (Condutivo), Tipo D (Dissipativo de Estática)), por construção da bolsa (Com defletor (Q-Bag), Painel em U, Quatro Painéis, Circular/Tubular), por aplicação (Químicos (2000), Alimentos e Bebidas (1000 e 1100), Agricultura (0100), Produtos Farmacêuticos (2100), Construção (4100), Mineração e Minerais (0100 e 0001), Resíduos e Reciclagem (3800), Outros), por usuário final (Fabricantes de Produtos Químicos (2000), Produtores e Cooperativas Agrícolas (0100), Processadores de Alimentos e Fornecedores de Ingredientes (1000 e 1100), Empreiteiras de Construção (4100), Empresas de Mineração (0100 e 0001), Empresas Farmacêuticas (2100), Empresas de Gestão de Resíduos e Reciclagem) (3800), Outros), Por Canal de Distribuição (Indireto, Direto) - Tendências e Previsões do Setor até 2033

Tamanho do mercado de embalagens FIBC no Oriente Médio e na África

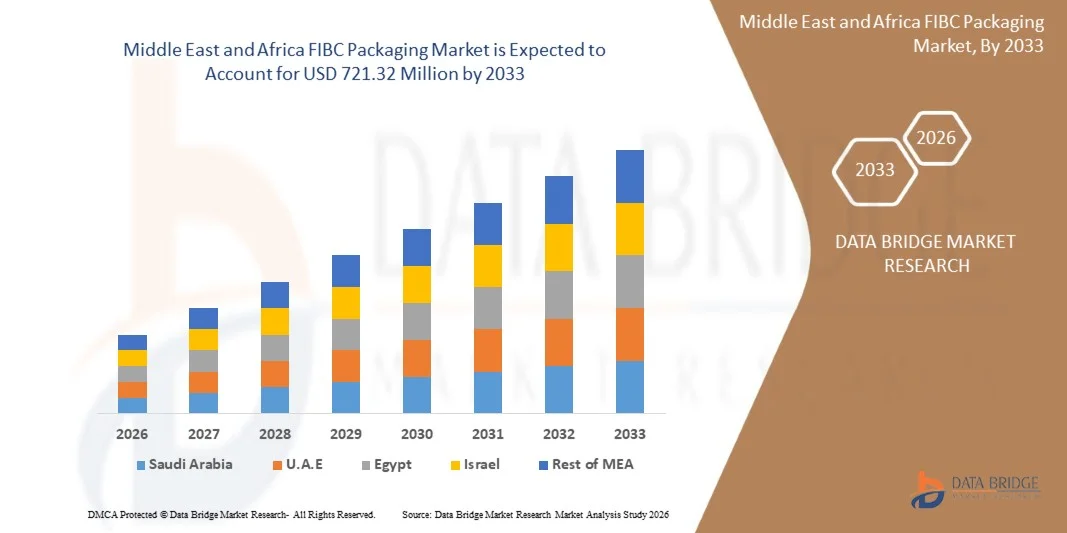

- O mercado de embalagens FIBC no Oriente Médio e na África foi avaliado em US$ 497,09 milhões em 2025 e deverá atingir US$ 721,32 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 4,8% durante o período de previsão.

- O mercado de embalagens FIBC (Fiber Big Container) no Oriente Médio e na África está experimentando um crescimento constante, impulsionado pela demanda de setores industriais como o químico, o de alimentos e bebidas, o de materiais de construção e o de produtos agrícolas. O aumento do comércio intra-Oriente Médio e África, as atividades de exportação e a necessidade de armazenamento eficiente e transporte a granel estão sustentando a expansão do mercado.

- A crescente ênfase em serviços de valor agregado, incluindo soluções FIBC personalizadas, integração 3PL/4PL e armazenamento em ambiente controlado para produtos a granel sensíveis, está reforçando o Oriente Médio e a África como um mercado emergente com robusto potencial de crescimento a longo prazo em soluções de embalagens a granel.

Análise do mercado de embalagens FIBC no Oriente Médio e na África

- O mercado de embalagens FIBC no Oriente Médio e na África abrange a produção, distribuição e utilização de soluções de embalagens a granel (sacos FIBC) em diversos setores, como o químico, o de produtos agrícolas, o de materiais de construção, o farmacêutico, entre outros. O crescimento é impulsionado pela crescente demanda por soluções eficientes de armazenamento, transporte a granel e manuseio, sustentada pelo aumento do comércio intra-Oriente Médio e África, da atividade industrial e da logística do comércio eletrônico.

- A Arábia Saudita deverá dominar o mercado de embalagens FIBC no Oriente Médio e na África, com a maior participação de mercado, de 22,25% em 2026, e também deverá registrar a maior taxa de crescimento anual composta (CAGR) de 6,7% durante o período de previsão. Isso se deve à sua forte base industrial, setor de manufatura avançado, investimentos substanciais em logística e infraestrutura de embalagens FIBC, além da adoção estratégica de soluções inovadoras para manuseio de materiais a granel por setores-chave.

- Espera-se que os produtos FIBC do tipo A dominem o mercado da Ásia-Pacífico, detendo a maior participação de 37,29%, devido à sua versatilidade, custo-benefício e adequação para o manuseio de uma ampla gama de materiais a granel em aplicações industriais e agrícolas.

Escopo do relatório e segmentação do mercado de embalagens FIBC no Oriente Médio e África

|

Atributos |

Principais informações sobre o mercado de embalagens FIBC no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de embalagens FIBC no Oriente Médio e na África

“ Integração com embalagens FIBC digitais e automatizadas ”

- As empresas estão cada vez mais incorporando FIBCs em sistemas automatizados de armazenamento e movimentação de materiais, permitindo uma movimentação mais rápida, segura e eficiente de produtos a granel dentro de armazéns e centros de distribuição.

- A adoção de tecnologias digitais de gestão e rastreamento de estoque permite o monitoramento em tempo real dos estoques de FIBCs (contêineres FIBC), melhorando a visibilidade da cadeia de suprimentos, reduzindo erros e otimizando a utilização do espaço de armazenamento.

- A integração com soluções logísticas avançadas oferece suporte a operações de alto volume e distribuição de comércio eletrônico, impulsionando a demanda por soluções de embalagens FIBC padronizadas, duráveis e compatíveis com automação nos setores industrial e comercial.

Por exemplo,

- Em abril de 2024, a Packem Umasree Pvt Ltd (uma joint venture entre a brasileira Packem SA e a indiana Umasree Texplast) inaugurou aquela que provavelmente é a primeira fábrica da Índia a produzir FIBCs 100% sustentáveis a partir de garrafas PET recicladas (rPET). Essa fábrica, que transforma garrafas em sacolas, está localizada perto de Ahmedabad e utiliza tecnologia de produção avançada para converter PET pós-consumo em sacolas FIBC de alto desempenho.

- Em abril de 2023, a LC Packaging International BV anunciou uma "solução de reciclagem em circuito fechado" para FIBCs em parceria com a recicladora RAFF Plastics, com o objetivo de coletar Big Bags usados, reciclá-los e reintroduzir o material, alinhando as embalagens FIBC aos objetivos da economia circular.

Dinâmica do mercado de embalagens FIBC no Oriente Médio e na África

Motorista

“Aumento do comércio transfronteiriço de produtos químicos e ingredientes alimentares”

- O aumento do comércio transfronteiriço de produtos químicos e ingredientes alimentares está impulsionando a demanda por soluções de embalagens a granel, como os FIBCs (Contêineres Fibre Channel), uma vez que exportadores e importadores necessitam de contêineres seguros, duráveis e padronizados para transportar materiais de forma eficiente pelos mercados internacionais.

- A expansão nos setores de fabricação química, processamento de alimentos e agroindustrial está impulsionando a necessidade de sistemas organizados de armazenamento e manuseio, incentivando as empresas a investir em sacos FIBC especializados de alta capacidade para matérias-primas, produtos intermediários e produtos acabados.

- As empresas estão adotando tecnologias modernas de cadeia de suprimentos, incluindo gerenciamento de estoque, manuseio automatizado e otimização logística, para garantir uma movimentação transfronteiriça mais rápida, segura e confiável de mercadorias a granel, apoiando diretamente o crescimento do mercado de embalagens FIBC no Oriente Médio e na África.

Por exemplo

- Em dezembro de 2024, a Conferência das Nações Unidas sobre Comércio e Desenvolvimento (UNCTAD) informou que o comércio global de mercadorias deveria atingir quase US$ 33 trilhões em 2024, um aumento de US$ 1 trilhão em relação ao ano anterior, refletindo um amplo crescimento no comércio de bens em diversos setores, incluindo produtos químicos e ingredientes alimentícios.

- Em julho de 2025, a UNCTAD indicou que o comércio global cresceu aproximadamente 300 bilhões de dólares no primeiro semestre do ano, impulsionado em parte pela continuidade das importações e exportações das principais economias – um crescimento que implica em maiores fluxos transfronteiriços de mercadorias, exigindo soluções de embalagens a granel.

- A edição de 2024 do "Relatório de Comércio Mundial 2024" da Organização Mundial do Comércio (OMC) destacou que o crescimento do comércio internacional continua sendo um fator central para as indústrias dependentes do comércio, incluindo as de produtos químicos e alimentos a granel, que normalmente utilizam contêineres a granel e FIBCs para o transporte.

Restrição/Desafio

“Volatilidade do preço do polipropileno e interrupções no fornecimento impactam o custo dos FIBCs”

- A flutuação dos preços do polipropileno afeta diretamente o custo de fabricação dos FIBCs, resultando em preços mais altos para os usuários finais e impactando as margens de lucro gerais de produtores e distribuidores.

- Interrupções na cadeia de suprimentos, incluindo escassez de matéria-prima ou restrições logísticas, podem atrasar os cronogramas de produção e entrega de FIBCs (Big Bags), afetando setores que dependem de soluções de embalagem a granel com entregas rápidas.

- A volatilidade na disponibilidade de matérias-primas incentiva os fabricantes a explorar estratégias alternativas de fornecimento, mas a oferta inconsistente e a instabilidade de custos continuam sendo um desafio fundamental para o crescimento do mercado e a previsibilidade de preços.

Por exemplo,

- Em setembro de 2023, a ChemAnalyst relatou que os preços do PP dispararam em toda a Europa após a suspensão, por um mês, das operações de várias grandes fábricas (incluindo a Borealis), levando a um déficit mensal estimado de 13.333 toneladas métricas.

- Em janeiro de 2024, notícias do mercado de compras indicaram que os preços do PP na Europa subiram ligeiramente devido à redução das importações da Ásia e do Oriente Médio, consequência de interrupções no transporte marítimo global (como os riscos de trânsito no Mar Vermelho) que restringiram a oferta local.

- Em fevereiro de 2025, os relatórios sobre os preços do polipropileno no mercado asiático indicavam uma oferta mais restrita de PP devido a paralisações em fábricas e escassez regional. Como resultado, alguns compradores asiáticos foram forçados a recorrer à resina nacional de custo mais elevado, pressionando ainda mais os preços do PP.

Escopo do mercado de embalagens FIBC no Oriente Médio e na África

O mercado global de embalagens FIBC (Fuel Increment Bag) para o Oriente Médio e África é categorizado em cinco segmentos principais, com base no tipo de produto, construção da embalagem, aplicação, uso final e canal de distribuição.

Por tipo de produto

Com base no tipo de produto, o mercado global de embalagens FIBC no Oriente Médio e na África é segmentado em Tipo A, Tipo B, Tipo C (Condutivo) e Tipo D (Dissipativo de Estática).

Espera-se que o segmento Tipo A domine o mercado com uma participação de 37,29% e apresente o maior crescimento anual composto (CAGR) de 4,9%, devido ao seu baixo custo, ampla disponibilidade e uso extensivo em aplicações para materiais a granel não perigosos. Sua versatilidade, facilidade de fabricação e forte demanda de indústrias de alto volume, como agricultura, ingredientes alimentícios, materiais de construção e produtos químicos em geral, fazem dos FIBCs Tipo A a escolha preferida para embalagens a granel. Além disso, a rápida expansão das exportações de commodities em economias emergentes e a crescente tendência em direção a soluções de embalagem com melhor custo-benefício continuam a reforçar a liderança de mercado dos FIBCs Tipo A.

Por construção de saco

Com base na construção da embalagem, o mercado global de embalagens FIBC no Oriente Médio e na África é segmentado em Baffle (Q-Bag), U-Panel, Four-Panel e Circular/Tubular.

O segmento de embalagens com defletores (Q-Bag) deverá dominar o mercado com 41,16% e apresentar o maior crescimento anual composto (CAGR) de 4,9%, devido à sua excelente retenção de forma, maior eficiência de empilhamento e otimização do espaço durante o armazenamento e transporte. As embalagens Q-Bag oferecem até 30-40% mais eficiência de espaço em comparação com os FIBCs convencionais, tornando-as altamente preferenciais em setores que exigem embalagens estáveis e em formato de cubo, como ingredientes alimentícios, produtos farmacêuticos, produtos químicos e pós de alta densidade. Sua capacidade de manter uma forma uniforme, reduzir deformações e melhorar a capacidade de carga dos contêineres diminui significativamente os custos logísticos, impulsionando uma forte adoção em cadeias de suprimentos globais. Além disso, a crescente demanda por embalagens a granel voltadas para exportação e a mudança para sistemas de gerenciamento de armazéns com melhor custo-benefício reforçam ainda mais a liderança da construção com defletores (Q-Bag) no mercado de FIBCs.

• Mediante inscrição

Com base na aplicação, o mercado global de embalagens FIBC do Oriente Médio e África é segmentado em Produtos Químicos (2000), Alimentos e Bebidas (1000 e 1100), Agricultura (0100), Produtos Farmacêuticos (2100), Construção (4100), Mineração e Minerais (0100 e 0001), Resíduos e Reciclagem (3800), Outros.

O segmento de Produtos Químicos (2000) deverá dominar o mercado com uma participação de 41,33% e apresentar o maior CAGR (Taxa de Crescimento Anual Composta) de 4,7%, devido à sua ampla dependência de FIBCs (Contêineres Compactos de Fibra) para o transporte de pós, grânulos, resinas, aditivos e produtos intermediários nas cadeias de suprimentos petroquímicas, de especialidades químicas e de produtos químicos industriais. A indústria química é uma das maiores consumidoras globais de embalagens a granel, impulsionada pelos altos volumes de produção, frequentes remessas internacionais e rigorosos requisitos de segurança para o manuseio de materiais perigosos e sensíveis à umidade. Os FIBCs oferecem durabilidade superior, controle de contaminação, custo-benefício e conformidade com as normas da ONU para produtos perigosos, tornando-os o formato de embalagem preferido pelos fabricantes de produtos químicos. Além disso, o crescente investimento em especialidades químicas, a expansão da produção de polímeros no Oriente Médio e na África e o aumento do comércio global de compostos químicos reforçam ainda mais a forte dominância do segmento de Produtos Químicos no mercado.

Por uso final

Com base no uso final, o mercado global de embalagens FIBC do Oriente Médio e África é segmentado em fabricantes de produtos químicos (2000), produtores agrícolas e cooperativas (0100), processadores de alimentos e fornecedores de ingredientes (1000 e 1100), empreiteiros de construção (4100), empresas de mineração (0100 e 0001), empresas farmacêuticas (2100), empresas de gerenciamento de resíduos e reciclagem (3800) e outros.

O segmento de Fabricantes de Produtos Químicos (2000) deverá dominar o mercado com 40,26% e apresentar o maior crescimento anual composto (CAGR) de 4,7%, devido à demanda excepcionalmente alta por FIBCs (Contêineres Compactos de Grande Porte) no manuseio, armazenamento e transporte global de produtos químicos a granel, polímeros, intermediários e compostos especiais. A indústria química opera com grandes volumes de pós, grânulos, resinas e substâncias perigosas que exigem soluções de embalagem seguras, eficientes e em conformidade com as normas. Os FIBCs, especialmente os tipos B, C e D, oferecem proteção superior contra contaminação, umidade e riscos eletrostáticos, que são críticos em ambientes químicos. Além disso, o aumento da produção química no Oriente Médio e na África, o crescimento das exportações de produtos petroquímicos e químicos especiais e as rigorosas regulamentações globais para embalagens de materiais perigosos impulsionaram significativamente o uso de FIBCs neste setor.

Por canal de distribuição

Com base no canal de distribuição, o mercado global de embalagens FIBC no Oriente Médio e na África é segmentado em indireto e direto.

Espera-se que o segmento indireto domine o mercado com uma participação de 65,26% e cresça a uma taxa composta de crescimento anual (CAGR) de 4,7%, devido ao seu amplo alcance, redes de fornecimento estabelecidas e forte presença em diversos setores de uso final. Distribuidores e revendedores desempenham um papel crucial ao fornecer disponibilidade confiável, entregas rápidas e preços competitivos, tornando-os a escolha preferencial para compradores de pequeno e médio porte. Além disso, a rápida expansão das plataformas online e de comércio eletrônico impulsionou significativamente as vendas indiretas, oferecendo maior visibilidade do produto, facilidade de aquisição e comparação simplificada dos tipos de FIBC (caixas de contêineres FIBC).

Análise Regional do Mercado de Embalagens FIBC no Oriente Médio e África

- O Oriente Médio e a África (liderados pela Arábia Saudita, Emirados Árabes Unidos, África do Sul e Egito) representam um mercado regional significativo para embalagens FIBC, com a Arábia Saudita detendo a maior participação, com 22,25% da demanda regional. O mercado é sustentado por fortes setores industriais, incluindo os de produtos químicos, agropecuários, materiais de construção e farmacêuticos, que dependem de embalagens a granel para produtos secos, pós e commodities industriais. Espera-se que a região cresça de forma constante, impulsionada pelo comércio intraeuropeu, pela expansão da manufatura e pela crescente adoção de FIBCs para armazenamento e transporte eficientes de produtos a granel.

- O Oriente Médio e a África se beneficiam de infraestrutura industrial avançada, padrões regulatórios rigorosos (especialmente para segurança química, alimentar e farmacêutica) e redes logísticas e de armazenagem bem desenvolvidas. A crescente tendência de soluções FIBC de valor agregado, automação de armazéns e instalações de armazenamento especializadas fortalece a penetração no mercado, enquanto a liderança da China como maior contribuinte garante um potencial de crescimento estável e investimentos contínuos em soluções de embalagens a granel em toda a região.

Análise do mercado de embalagens FIBC na Arábia Saudita, Oriente Médio e África

A Arábia Saudita é o maior mercado de embalagens FIBC do Oriente Médio e da África, atendendo à demanda regional, impulsionada por sua forte base industrial e setores de manufatura avançados. Indústrias-chave como a química, a de produtos agrícolas, a de materiais de construção e a farmacêutica dependem fortemente de FIBCs para o armazenamento e transporte seguros e eficientes de pós, grânulos e produtos secos a granel. O crescimento do mercado é sustentado por uma infraestrutura logística moderna, padrões regulatórios rigorosos e pela adoção de automação de armazéns e sistemas digitais de gestão de estoque. Os FIBCs do tipo A dominam o mercado, representando uma parcela significativa, devido à sua versatilidade, custo-benefício e adequação para diversas aplicações de manuseio de materiais a granel.

Participação de mercado de embalagens FIBC no Oriente Médio e na África

O setor de embalagens FIBC é liderado principalmente por empresas consolidadas, incluindo:

- Amcor plc (Suíça)

- IPG (EUA)

- Greif (EUA)

- LC Packaging (Países Baixos)

- Empresa Sonoco Products (EUA)

- Umasree Texplast Pvt. Ltd. (Índia)

- Gaoqing Antente Container Package Co., Ltd.

- FlexiTuff Ventures International Ltd. (Índia)

- Shankar Packaging Limited (Índia)

- BAG Corp (EUA)

- Global-Pak, Inc. (EUA)

- Bulk-Pack, Inc. (EUA)

Últimos desenvolvimentos no mercado de embalagens FIBC no Oriente Médio e na África

- Em fevereiro de 2023, a LC Packaging anunciou uma parceria com a Buenassa (RDC) e a Shankar Packagings (Índia) para a distribuição de FIBCs e produção local no setor de mineração da RDC.

- Em fevereiro de 2025, a United Bags, Inc. adquiriu a BAG Corp, expandindo a oferta de produtos FIBC, incluindo os big bags SUPER SACK, para agregar valor aos clientes em embalagens a granel.

- Em agosto de 2025, a Sackmaker aumentou seu estoque de sacos de areia cheios para mais de 4.000 unidades, prontas para envio imediato, aprimorando a capacidade de resposta a emergências, defesa contra enchentes e necessidades de construção. O aumento do estoque e a capacidade de entrega rápida reforçam a confiabilidade operacional durante picos de demanda.

- Em março, a Greif concluiu a aquisição da Ipackchem, líder global em galões e pequenos recipientes plásticos de alto desempenho, com e sem barreira, em uma transação em dinheiro no valor de US$ 538 milhões. Isso expande a presença global da Greif no segmento de pequenos recipientes plásticos/galões e adiciona recursos de embalagens com barreira.

- Em 2025, a Jumbo Bag Limited fortaleceu sua capacidade de produção por meio de suas instalações de fabricação totalmente integradas em Chennai e Mumbai, com uma capacidade de produção anual superior a 4,3 milhões de big bags (FIBCs), e continuou focando na produção de FIBCs em salas limpas para aplicações alimentícias e farmacêuticas, refletindo seu compromisso em expandir soluções de embalagens a granel de alta qualidade e focadas no cliente.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 SHIFT FROM PRICE-BASED TO VALUE-BASED PURCHASING

4.2.2 STRONG DEMAND FOR CUSTOMIZATION AND APPLICATION-SPECIFIC DESIGNS

4.2.3 GROWING IMPORTANCE OF TRACEABILITY, QUALITY ASSURANCE, AND CERTIFICATIONS

4.2.4 INCREASING ADOPTION OF SMART PACKAGING TECHNOLOGIES

4.2.5 SUSTAINABILITY AS A CORE PURCHASE DRIVER

4.2.6 PREFERENCE FOR RELIABLE, LARGE-SCALE VENDORS WITH MIDDLE EAST AND AFRICA REACH

4.2.7 EMPHASIS ON SAFETY AND REGULATORY COMPLIANCE

4.2.8 COLLABORATIVE SUPPLIER RELATIONSHIPS OVER TRANSACTIONAL PURCHASING

4.2.9 INFLUENCE OF MIDDLE EAST AND AFRICA ECONOMIC CONDITIONS ON BUYING VOLUME

4.2.10 CONCLUSION

4.3 COST ANALYSIS BREAKDOWN – MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET

4.3.1 INTRODUCTION

4.3.2 MATERIAL COSTS

4.3.3 MANUFACTURING AND PROCESSING COSTS

4.3.4 LABOR AND WORKFORCE COSTS

4.3.5 QUALITY ASSURANCE AND COMPLIANCE COSTS

4.3.6 LOGISTICS AND SUPPLY CHAIN COSTS

4.3.7 PACKAGING, HANDLING, AND POST-PRODUCTION COSTS

4.3.8 OVERHEADS AND ADMINISTRATIVE COSTS

4.3.9 CONCLUSION

4.4 PATENT ANALYSIS – MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET

4.4.1 INTRODUCTION

4.4.2 PATENT QUALITY AND STRENGTH

4.4.2.1 STRUCTURAL INNOVATION

4.4.2.2 MATERIAL-ORIENTED PATENTS

4.4.2.3 SAFETY-CENTRIC ENHANCEMENTS

4.4.2.4 SUSTAINABILITY-FOCUSED SOLUTIONS

4.4.3 PATENT FAMILIES

4.4.3.1 MATERIAL ENGINEERING FAMILIES

4.4.3.2 STRUCTURAL AND DESIGN FAMILIES

4.4.3.3 FILLING, HANDLING, AND DISCHARGE SYSTEM FAMILIES

4.4.3.4 SAFETY AND STATIC CONTROL FAMILIES

4.4.3.5 REUSABILITY AND SUSTAINABILITY FAMILIES

4.4.4 LICENSING AND COLLABORATIONS

4.4.4.1 MATERIAL SUPPLIER AND MANUFACTURER PARTNERSHIPS

4.4.4.2 TECHNOLOGY INTEGRATION AGREEMENTS

4.4.4.3 INDUSTRY–ACADEMIA COLLABORATION

4.4.4.4 CROSS-INDUSTRY KNOWLEDGE SHARING

4.4.5 REGIONAL PATENT LANDSCAPE

4.4.5.1 EUROPE

4.4.5.2 ASIA-PACIFIC

4.4.5.3 NORTH AMERICA

4.4.5.4 MIDDLE EAST

4.4.6 IP STRATEGY AND MANAGEMENT

4.4.6.1 STRATEGIC PATENT FILING

4.4.6.2 PORTFOLIO DIVERSIFICATION

4.4.6.3 CONTINUOUS MONITORING

4.4.6.4 LIFECYCLE OPTIMIZATION

4.4.6.5 ALIGNMENT WITH SUSTAINABILITY GOALS

4.4.7 CONCLUSION

4.5 PORTERS FIVE FORCES ANALYSIS

4.6 PRICING ANALYSIS

4.7 PROFIT MARGINS SCENARIO IN THE MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET

4.7.1 INTRODUCTION

4.7.2 RAW MATERIAL COST PRESSURES AND MARGIN SENSITIVITY

4.7.3 OPERATIONAL EFFICIENCY AND PRODUCTION COST OPTIMIZATION

4.7.4 MARKET PRICING DYNAMICS AND COMPETITIVE PRESSURE

4.7.5 REGIONAL PRODUCTION ECONOMICS AND MARGIN VARIABILITY

4.7.6 VALUE-ADDED PRODUCTS AND PREMIUM OFFERINGS

4.7.7 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 POLYPROPYLENE (PP): THE BACKBONE OF FIBC MANUFACTURING

4.8.2 POLYETHYLENE (PE) FOR LINERS AND PROTECTIVE BARRIERS

4.8.3 ADDITIVES AND MASTERBATCHES

4.8.4 CONDUCTIVE YARNS AND THREADS

4.8.5 SEWING THREADS AND WEBBING MATERIALS

4.8.6 FILMS, COATINGS & LAMINATION MATERIALS

4.8.7 RECYCLED PP & SUSTAINABLE MATERIAL STREAMS

4.8.8 METAL AND PLASTIC COMPONENTS

4.8.9 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 OVERVIEW

4.10.2 SMART FIBCS: RFID, QR CODES, AND SENSOR INTEGRATION

4.10.3 MATERIAL SCIENCE UPGRADES: LINERS, COATINGS, AND NANOTECH

4.10.4 SUSTAINABILITY: RECYCLED RESINS, BIODEGRADABLE BLENDS, AND CIRCULAR DESIGN

4.10.5 SAFETY AND COMPLIANCE TECHNOLOGIES

4.10.6 AUTOMATION AND SMARTER FABRICATION

4.10.7 CUSTOMISATION AND APPLICATION-SPECIFIC ENGINEERING

4.10.8 BUSINESS IMPLICATIONS

4.10.9 CHALLENGES AND WHERE THE MARKET GOES NEXT

4.10.10 CONCLUSION

4.11 MIDDLE EAST AND AFRICA FBIC PACKAGING MARKET – VALUE CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 RAW MATERIAL SUPPLY

4.11.3 COMPONENT MANUFACTURING AND PROCESSING

4.11.4 EQUIPMENT & TECHNOLOGY PROVIDERS

4.11.5 DISTRIBUTION AND LOGISTICS

4.11.6 END-USERS (BRANDS & INDUSTRY SECTORS)

4.11.7 CONCLUSION

4.12 VENDOR SELECTION CRITERIA

4.12.1 PRODUCT QUALITY & TECHNICAL SPECIFICATIONS

4.12.2 CERTIFICATIONS & REGULATORY COMPLIANCE

4.12.3 MATERIAL INNOVATION & TECHNOLOGY ADOPTION

4.12.4 SUSTAINABILITY CAPABILITIES

4.12.5 CUSTOMISATION AND DESIGN FLEXIBILITY

4.12.6 PRODUCTION SCALE, RELIABILITY & LEAD TIMES

4.12.7 COST STRUCTURE & VALUE FOR MONEY

4.12.8 MIDDLE EAST AND AFRICA PRESENCE & CUSTOMER SUPPORT

4.12.9 TRACK RECORD, REPUTATION & CLIENT PORTFOLIO

4.12.9.1 ETHICAL, SOCIAL & SAFETY PRACTICES

4.12.10 CONCLUSION

4.13 INNOVATION TRACKER & STRATEGIC ANALYSIS – MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET

4.13.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.13.1.1 Joint Ventures

4.13.1.2 Mergers and Acquisitions (M&A)

4.13.1.3 Licensing and Partnerships

4.13.1.4 Technology Collaborations

4.13.1.5 Strategic Divestments

4.13.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.13.3 TIMELINES AND MILESTONES

4.13.4 INNOVATION STRATEGIES AND METHODOLOGIES

4.13.5 RISK ASSESSMENT AND MITIGATION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATORY COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CROSS-BORDER TRADE OF CHEMICALS, FOOD INGREDIENTS

7.1.2 AGRICULTURAL COMMODITIES USING BULK BAGS

7.1.3 COST EFFICIENCY AND HANDLING BENEFITS OVER DRUMS AND SMALL SACKS

7.1.4 GROWING PREFERENCE FOR REUSABLE/MULTI-TRIP FIBCS

7.2 RESTRAINS

7.2.1 POLYPROPYLENE PRICE VOLATILITY AND SUPPLY DISRUPTIONS IMPACTING FIBC COST

7.2.2 ENVIRONMENTAL REGULATIONS ON PLASTICS AND END-OF-LIFE WASTE MANAGEMENT

7.3 OPPORTUNITY

7.3.1 ADOPTION OF FOOD- AND PHARMA-GRADE FIBCS WITH ADVANCED LINERS AND HYGIENE CERTIFICATIONS

7.3.2 GROWTH IN TYPE C/TYPE D ANTISTATIC SOLUTIONS FOR HAZARDOUS POWDERS

7.3.3 RFID AND TRACK-AND-TRACE ADOPTION ENHANCES FIBC EFFICIENCY

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH UN HAZARDOUS GOODS NORMS AND ELECTROSTATIC SAFETY

7.4.2 QUALITY ASSURANCE, COUNTERFEIT RISKS, AND VARIABILITY IN MIDDLE EAST AND AFRICA TESTING/STANDARDS

8 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TYPE A

8.2.1 COATED

8.2.2 UNCOATED

8.2.3 UNLINED

8.2.4 PE LINED

8.3 TYPE B

8.3.1 COATED

8.3.2 UNCOATED

8.3.3 UNLINED

8.3.4 PE LINED

8.4 TYPE C (CONDUCTIVE)

8.4.1 EXTERNAL GROUNDING CLIPS

8.4.2 SEWN-IN GROUND TABS

8.4.3 CONDUCTIVE LINER

8.4.4 ANTISTATIC LINER

8.5 TYPE D (STATIC DISSIPATIVE)

8.5.1 STATIC DISSIPATIVE YARNS

8.5.2 CORONA DISCHARGE FABRICS

8.5.3 ANTISTATIC LINER

8.5.4 FOOD-GRADE LINER

9 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION

9.1 OVERVIEW

9.2 BAFFLE (Q-BAG)

9.2.1 CORNER BAFFLES

9.2.2 INTERNAL TIES

9.2.3 VENTED

9.2.4 DUST-PROOF

9.3 U-PANEL

9.3.1 4 LOOP

9.3.2 2 LOOP

9.3.3 FLAT

9.3.4 CONICAL

9.3.5 FULL DISCHARGE

9.4 FOUR-PANEL

9.4.1 4-LOOP

9.4.2 SINGLE-POINT LIFT

9.4.3 WITH BAFFLES

9.4.4 WITHOUT BAFFLES

9.5 CIRCULAR / TUBULAR

9.5.1 4-LOOP

9.5.2 2-LOOP

9.5.3 COATED

9.5.4 UNCOATED

10 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CHEMICALS (2000)

10.2.1 PETROCHEMICALS & POLYMERS

10.2.2 DYES, PIGMENTS & COLORANTS

10.2.3 INDUSTRIAL CHEMICALS

10.2.4 SPECIALTY CHEMICALS & ADDITIVES

10.2.5 DETERGENTS & CLEANING AGENTS

10.2.6 ADHESIVES & SEALANTS RAW MATERIALS

10.2.7 FERTILIZER INTERMEDIATES

10.3 FOOD & BEVERAGES (1000 & 1100)

10.3.1 CEREALS & GRAINS

10.3.2 SUGAR, SALT & FLOUR

10.3.3 NUTS & DRY FRUITS

10.3.4 POWDERED INGREDIENTS & SPICES

10.3.5 PET FOOD & ADDITIVES

10.3.6 OILS & FATS

10.3.7 BEVERAGE RAW MATERIALS

10.4 AGRICULTURE (0100)

10.4.1 GRAINS & SEEDS

10.4.2 FERTILIZERS

10.4.3 ANIMAL FEED & SUPPLEMENTS

10.4.4 FRUIT & VEGETABLE BULK PACKAGING

10.4.5 ORGANIC COMPOST & SOIL AMENDMENTS

10.4.6 HERBS & SPICES (RAW)

10.4.7 BULB & ROOT CROPS

10.5 PHARMACEUTICALS (2100)

10.5.1 ACTIVE PHARMACEUTICAL INGREDIENTS (APIS)

10.5.2 BULK INTERMEDIATES & EXCIPIENTS

10.5.3 NUTRACEUTICAL POWDERS & SUPPLEMENTS

10.5.4 FINE CHEMICALS

10.5.5 COSMETIC & PERSONAL CARE INGREDIENTS

10.5.6 MEDICAL SALT & SALINE

10.6 CONSTRUCTION (4100)

10.6.1 CEMENT & SAND

10.6.2 AGGREGATES

10.6.3 MORTAR & PLASTER PREMIXES

10.6.4 GYPSUM & LIME

10.6.5 INDUSTRIAL POWDERS

10.6.6 ROOFING & INSULATION MATERIALS

10.7 MINING & MINERALS (0100 & 0001)

10.7.1 COAL & COKE FINES

10.7.2 IRON ORE, COPPER ORE, BAUXITE

10.7.3 INDUSTRIAL MINERALS

10.7.4 METAL CONCENTRATES & POWDERS

10.7.5 LIMESTONE & DOLOMITE

10.7.6 PRECIOUS METAL RESIDUES

10.8 WASTE & RECYCLING (3800)

10.8.1 PLASTIC WASTE

10.8.2 CONSTRUCTION & DEMOLITION WASTE

10.8.3 HAZARDOUS & INDUSTRIAL WASTE

10.8.4 SCRAP METAL & METAL POWDERS

10.8.5 COMPOST & ORGANIC WASTE COLLECTION

10.8.6 ELECTRONIC WASTE (E-WASTE)

10.9 OTHERS

10.9.1 TEXTILE FIBERS & YARN WASTE

10.9.2 WOOD CHIPS & BIOMASS PELLETS

10.9.3 RUBBER & TIRE RECYCLING MATERIALS

10.9.4 PAPER & PULP MATERIALS

10.9.5 DEFENSE & RELIEF MATERIALS

10.9.6 HOUSEHOLD GOODS BULK TRANSPORT

11 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY END USE

11.1 OVERVIEW

11.2 CHEMICAL MANUFACTURERS (2000)

11.2.1 TYPE C

11.2.2 TYPE B

11.2.3 TYPE D

11.2.4 TYPE A

11.3 AGRICULTURAL PRODUCERS & CO-OPS (0100)

11.3.1 TYPE A

11.3.2 TYPE B

11.3.3 TYPE C

11.3.4 TYPE D

11.4 FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100)

11.4.1 TYPE A

11.4.2 TYPE C

11.4.3 TYPE D

11.4.4 TYPE B

11.5 CONSTRUCTION CONTRACTORS (4100)

11.5.1 TYPE A

11.5.2 TYPE B

11.5.3 TYPE C

11.5.4 TYPE D

11.6 MINING COMPANIES (0100 & 0001)

11.6.1 TYPE A

11.6.2 TYPE C

11.6.3 TYPE D

11.6.4 TYPE B

11.7 PHARMACEUTICAL COMPANIES (2100)

11.7.1 TYPE A

11.7.2 TYPE C

11.7.3 TYPE D

11.7.4 TYPE B

11.8 WASTE MANAGEMENT & RECYCLING FIRMS (3800)

11.8.1 TYPE B

11.8.2 TYPE A

11.8.3 TYPE C

11.8.4 TYPE D

11.9 OTHERS

11.9.1 TYPE A

11.9.2 TYPE B

11.9.3 TYPE C

11.9.4 TYPE D

12 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.2.1 DISTRIBUTORS/DEALERS

12.2.2 ONLINE/E-COMMERCE

12.3 DIRECT

12.3.1 OEM DIRECT SALES

12.3.2 KEY ACCOUNT/ENTERPRISE CONTRACTS

13 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 UNITED ARAB EMIRATES

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 QATAR

13.1.7 OMAN

13.1.8 KUWAIT

13.1.9 BAHRAIN

13.1.10 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 AMCOR PLC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IPG.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 GREIF.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 LC PACKAGING

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 SONOCO PRODUCTS COMPANY (CONITEX SONOCO)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACTION BAGS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ALPINE FIBC PVT.LTD

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AMERIGLOBE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIG BAGS INTERNATIONAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BAG CORP.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 BULK-PACK, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 CENTURY FIBC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FIBC SILVASSA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 FLEXITUFF VENTURES INTERNATIONAL LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 GLOBAL-PAK, INC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 IPG.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 İŞBIR MEWAR.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 JUMBO BAG LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 LANGSTON BAG

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 PALMETTO INDUSTRIES INTERNATIONAL INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PACIFICBULKBAGS.COM

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 RDA BULK PACKAGING LTD.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 S.R. INDUSTRY

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SACKMAKER

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SHANKAR PACKAGINGS LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SHREE MARUTI EXIM

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TAIHUA FIBC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TISZATEXTIL

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 UMASREE TEXPLAST PVT. LTD.

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 WOVEN INTERNATIONAL

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 COMPANY PROFILES DISTRIBUTOR

17.1 HALSTED CORPORATION

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 BULK BAG DEPOT

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 MIDWESTERN BAG

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 NATIONAL BULK BAG (A SUBSIDIARY COMPANY OF RAPID PACKAGING)

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 FIBC DIRECT

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 CONSUMER PREFERENCE MATRIX

TABLE 3 ILLUSTRATIVE PROFIT MARGINS OF FIBC PRODUCTS (2018–2024)

TABLE 4 STAGE OF DEVELOPMENT

TABLE 5 INNOVATION AND STRATEGIC MILESTONES TIMELINE (2018–2024)

TABLE 6 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA TYPE A IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA TYPE B IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA TYPE C IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA CIRCULAR / TUBULAR IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA OTHERS IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA OTHERS IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA INDIRECT IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA DIRECT IN FIBC PACKAGING MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 SAUDI ARABIA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 SAUDI ARABIA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 113 SAUDI ARABIA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 114 SAUDI ARABIA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 115 SAUDI ARABIA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 116 SAUDI ARABIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 117 SAUDI ARABIA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 118 SAUDI ARABIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 119 SAUDI ARABIA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 120 SAUDI ARABIA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 121 SAUDI ARABIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 122 SAUDI ARABIA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 123 SAUDI ARABIA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 124 SAUDI ARABIA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 SAUDI ARABIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 126 SAUDI ARABIA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 127 SAUDI ARABIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 128 SAUDI ARABIA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 129 SAUDI ARABIA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 SAUDI ARABIA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 SAUDI ARABIA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 SAUDI ARABIA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 SAUDI ARABIA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 SAUDI ARABIA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 SAUDI ARABIA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 SAUDI ARABIA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 SAUDI ARABIA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 SAUDI ARABIA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 139 SAUDI ARABIA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 SAUDI ARABIA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 SAUDI ARABIA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 SAUDI ARABIA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 SAUDI ARABIA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 SAUDI ARABIA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 SAUDI ARABIA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 SAUDI ARABIA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 SAUDI ARABIA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 148 SAUDI ARABIA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 SAUDI ARABIA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 152 UNITED ARAB EMIRATES TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 153 UNITED ARAB EMIRATES TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 154 UNITED ARAB EMIRATES TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 155 UNITED ARAB EMIRATES TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 156 UNITED ARAB EMIRATES TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 157 UNITED ARAB EMIRATES TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 158 UNITED ARAB EMIRATES TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 159 UNITED ARAB EMIRATES FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 160 UNITED ARAB EMIRATES BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 161 UNITED ARAB EMIRATES BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 162 UNITED ARAB EMIRATES U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 163 UNITED ARAB EMIRATES U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 UNITED ARAB EMIRATES FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 165 UNITED ARAB EMIRATES FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 166 UNITED ARAB EMIRATES CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 167 UNITED ARAB EMIRATES CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 168 UNITED ARAB EMIRATES FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 169 UNITED ARAB EMIRATES CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 UNITED ARAB EMIRATES FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 UNITED ARAB EMIRATES AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 UNITED ARAB EMIRATES PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 UNITED ARAB EMIRATES CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 UNITED ARAB EMIRATES MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 UNITED ARAB EMIRATES WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 UNITED ARAB EMIRATES OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 UNITED ARAB EMIRATES FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 178 UNITED ARAB EMIRATES CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 UNITED ARAB EMIRATES AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 UNITED ARAB EMIRATES FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 UNITED ARAB EMIRATES CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 UNITED ARAB EMIRATES MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 UNITED ARAB EMIRATES PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 UNITED ARAB EMIRATES WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 UNITED ARAB EMIRATES OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 UNITED ARAB EMIRATES FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 187 UNITED ARAB EMIRATES INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 UNITED ARAB EMIRATES DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SOUTH AFRICA FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 SOUTH AFRICA TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 191 SOUTH AFRICA TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 192 SOUTH AFRICA TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 193 SOUTH AFRICA TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 194 SOUTH AFRICA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 195 SOUTH AFRICA TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 196 SOUTH AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 197 SOUTH AFRICA TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 198 SOUTH AFRICA FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 199 SOUTH AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 200 SOUTH AFRICA BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 201 SOUTH AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 202 SOUTH AFRICA U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 SOUTH AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 204 SOUTH AFRICA FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 205 SOUTH AFRICA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 206 SOUTH AFRICA CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 207 SOUTH AFRICA FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 208 SOUTH AFRICA CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 SOUTH AFRICA FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 SOUTH AFRICA AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 SOUTH AFRICA PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 SOUTH AFRICA CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 SOUTH AFRICA MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 SOUTH AFRICA WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 SOUTH AFRICA OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 SOUTH AFRICA FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 217 SOUTH AFRICA CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 SOUTH AFRICA AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 SOUTH AFRICA FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 SOUTH AFRICA CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 SOUTH AFRICA MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 SOUTH AFRICA PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 SOUTH AFRICA WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 SOUTH AFRICA OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SOUTH AFRICA FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 226 SOUTH AFRICA INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 SOUTH AFRICA DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 EGYPT FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 EGYPT TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 230 EGYPT TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 231 EGYPT TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 232 EGYPT TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 233 EGYPT TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 234 EGYPT TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 235 EGYPT TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 236 EGYPT TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 237 EGYPT FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 238 EGYPT BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 239 EGYPT BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 240 EGYPT U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 241 EGYPT U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 EGYPT FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 243 EGYPT FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 244 EGYPT CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 245 EGYPT CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 246 EGYPT FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 247 EGYPT CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 EGYPT FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 EGYPT AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 EGYPT PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 EGYPT CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 EGYPT MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 EGYPT WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 EGYPT OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 EGYPT FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 256 EGYPT CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 EGYPT AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 EGYPT FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 EGYPT CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 EGYPT MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 EGYPT PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 EGYPT WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 EGYPT OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 EGYPT FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 265 EGYPT INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 EGYPT DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 ISRAEL FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 ISRAEL TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 269 ISRAEL TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 270 ISRAEL TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 271 ISRAEL TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 272 ISRAEL TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 273 ISRAEL TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 274 ISRAEL TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 275 ISRAEL TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 276 ISRAEL FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 277 ISRAEL BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 278 ISRAEL BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 279 ISRAEL U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 280 ISRAEL U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 281 ISRAEL FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 282 ISRAEL FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 283 ISRAEL CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 284 ISRAEL CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 285 ISRAEL FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 286 ISRAEL CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 ISRAEL FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 ISRAEL AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 ISRAEL PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 ISRAEL CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 ISRAEL MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 292 ISRAEL WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 ISRAEL OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 ISRAEL FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 295 ISRAEL CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 ISRAEL AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 ISRAEL FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 298 ISRAEL CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 ISRAEL MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 300 ISRAEL PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 301 ISRAEL WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 ISRAEL OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 303 ISRAEL FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 304 ISRAEL INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 305 ISRAEL DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 QATAR FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 307 QATAR TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 308 QATAR TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 309 QATAR TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 310 QATAR TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 311 QATAR TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)

TABLE 312 QATAR TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 313 QATAR TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY FABRIC TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 314 QATAR TYPE D (STATIC DISSIPATIVE) IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 315 QATAR FIBC PACKAGING MARKET, BY BAG CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 316 QATAR BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY STABILITY FEATURES, 2018-2033 (USD THOUSAND)

TABLE 317 QATAR BAFFLE (Q-BAG) IN FIBC PACKAGING MARKET, BY PERMEABILITY, 2018-2033 (USD THOUSAND)

TABLE 318 QATAR U-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 319 QATAR U-PANEL IN FIBC PACKAGING MARKET, BY BASE TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 QATAR FOUR-PANEL IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 321 QATAR FOUR-PANEL IN FIBC PACKAGING MARKET, BY BAFFLES, 2018-2033 (USD THOUSAND)

TABLE 322 QATAR CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY LIFTING LOOPS, 2018-2033 (USD THOUSAND)

TABLE 323 QATAR CIRCULAR/TUBULAR IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 324 QATAR FIBC PACKAGING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 325 QATAR CHEMICALS (2000) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 QATAR FOOD & BEVERAGES (1000 & 1100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 327 QATAR AGRICULTURE (0100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 328 QATAR PHARMACEUTICALS (2100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 QATAR CONSTRUCTION (4100) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 330 QATAR MINING & MINERALS (0100 & 0001) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 331 QATAR WASTE & RECYCLING (3800) IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 332 QATAR OTHERS IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 QATAR FIBC PACKAGING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 334 QATAR CHEMICAL MANUFACTURERS (2000) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 335 QATAR AGRICULTURAL PRODUCERS & CO-OPS (0100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 336 QATAR FOOD PROCESSORS & INGREDIENT SUPPLIERS (1000 & 1100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 337 QATAR CONSTRUCTION CONTRACTORS (4100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 338 QATAR MINING COMPANIES (0100 & 0001) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 339 QATAR PHARMACEUTICAL COMPANIES (2100) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 340 QATAR WASTE MANAGEMENT & RECYCLING FIRMS (3800) IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 341 QATAR OTHERS IN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 342 QATAR FIBC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 343 QATAR INDIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 344 QATAR DIRECT IN FIBC PACKAGING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 345 OMAN FIBC PACKAGING MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 346 OMAN TYPE A IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 347 OMAN TYPE A IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 348 OMAN TYPE B IN FIBC PACKAGING MARKET, BY COATING, 2018-2033 (USD THOUSAND)

TABLE 349 OMAN TYPE B IN FIBC PACKAGING MARKET, BY LINER, 2018-2033 (USD THOUSAND)

TABLE 350 OMAN TYPE C (CONDUCTIVE) IN FIBC PACKAGING MARKET, BY GROUNDING METHOD, 2018-2033 (USD THOUSAND)