Middle East And Africa Fishery And Aquaculture Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.18 Billion

USD

3.39 Billion

2024

2032

USD

2.18 Billion

USD

3.39 Billion

2024

2032

| 2025 –2032 | |

| USD 2.18 Billion | |

| USD 3.39 Billion | |

|

|

|

|

Segmentação do mercado de pesca e aquicultura no Oriente Médio e África, por tipo de produto (equipamentos e ração para aquicultura), sistema de produção de aquicultura (sistemas terrestres, sistemas aquáticos, sistemas de reciclagem, sistema de agricultura integrada e outros), meio ambiente (água marinha, água doce e água salobra), aplicação (larva, juvenil e adulta), escala de produção (pequena, média e grande escala), categoria (orgânica e convencional), fonte (vegetal e animal), forma (seca, úmida e úmida), função (valor racional da pesca e aquicultura, reforço energético, melhora da digestibilidade, preservação de ração, manejo citotóxico e outros), tecnologia (pesca e aquicultura inteligentes, pesca e aquicultura convencionais), especiarias (peixes, crustáceos e moluscos) - tendências e previsões do setor até 2032

Tamanho do mercado de pesca e aquicultura no Oriente Médio e na África

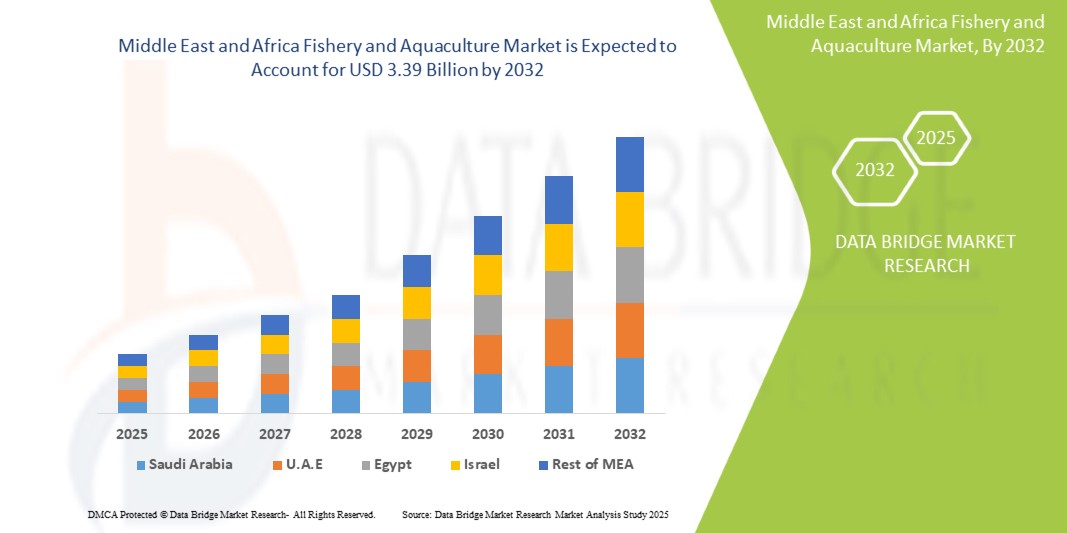

- O tamanho do mercado de pesca e aquicultura do Oriente Médio e da África foi avaliado em US$ 2,18 bilhões em 2024 e deve atingir US$ 3,39 bilhões até 2032 , com um CAGR de 5,7% durante o período previsto.

- O mercado de pesca e aquicultura do Oriente Médio e da África é impulsionado pela crescente demanda por frutos do mar no Oriente Médio e na África, pelo crescimento populacional, pelos avanços na tecnologia de aquicultura e pela crescente conscientização sobre saúde.

- Práticas sustentáveis, apoio governamental e oportunidades de exportação em expansão impulsionam ainda mais o crescimento do mercado e atraem investimentos significativos no setor

Análise do Mercado de Pesca e Aquicultura no Oriente Médio e África

- O mercado de pesca e aquicultura do Oriente Médio e da África é um segmento vital da indústria de alimentos e agricultura do Oriente Médio e da África, abrangendo a criação, a colheita e o processamento de organismos aquáticos, incluindo peixes, mariscos e algas marinhas. Serve como uma importante fonte de proteína e meio de subsistência, especialmente em regiões costeiras e em desenvolvimento. O mercado inclui a pesca de captura selvagem e a aquicultura (piscicultura), com esta última ganhando destaque devido às preocupações com a sobrepesca e às demandas por sustentabilidade.

- Os participantes do mercado estão se concentrando em inovações tecnológicas, como sistemas de aquicultura de recirculação (SAR), reprodução seletiva e manejo de doenças para aumentar a produtividade e a eficiência ambiental. Esses avanços são essenciais para atender à crescente demanda por frutos do mar no Oriente Médio e na África, impulsionada pelo crescimento populacional, pela urbanização e pela mudança nas preferências alimentares para opções com alto teor de proteína e baixo teor de gordura.

- Prevê-se que o Egito domine o mercado de pesca e aquicultura do Oriente Médio e da África com uma participação de 41,78% e espera-se que mostre o crescimento mais rápido durante o período previsto, impulsionado por seu amplo litoral, condições climáticas favoráveis, apoio governamental e alto consumo doméstico.

- Espera-se que o segmento Aquafeed domine o mercado de pesca e aquicultura do Oriente Médio e África até 2025, respondendo pela maior fatia, 63,09%, devido à sua escalabilidade, potencial de sustentabilidade e capacidade de atender à demanda consistente. Este segmento é cada vez mais influenciado pela preferência do consumidor por produtos de frutos do mar cultivados, rastreáveis e com selo ecológico, reforçando seu papel na segurança alimentar do Oriente Médio e da África.

Escopo do relatório e segmentação do mercado de pesca e aquicultura no Oriente Médio e na África

|

Atributos |

Principais insights do mercado de pesca e aquicultura no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade de empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas de tendências de preços e análises de déficit da cadeia de suprimentos e demanda. |

Tendências do mercado de pesca e aquicultura no Oriente Médio e na África

Inovação em Produtos Funcionais para Aquicultura e Nutrição Personalizada

- O mercado de pesca e aquicultura do Oriente Médio e da África está passando por uma transformação notável à medida que aumenta a demanda por produtos de frutos do mar funcionais e nutrição personalizada, adaptada às necessidades individuais de saúde, estilos de vida alimentares e preferências de sustentabilidade.

- Essa tendência está levando os produtores a irem além das ofertas tradicionais e desenvolverem produtos de aquicultura enriquecidos contendo ácidos graxos ômega-3, probióticos, colágeno e outros ingredientes bioativos que promovem a saúde cardíaca, a função cerebral, a imunidade e o bem-estar geral.

- Por exemplo, as empresas estão a inovar com rações fortificadas para peixes e métodos de criação controlada que melhoram os perfis nutricionais de espécies cultivadas como o salmão, a tilápia e o camarão, tornando-os mais apelativos para os consumidores preocupados com a saúde.

- O crescente interesse em rações aquáticas à base de plantas, ingredientes derivados de algas e aquicultura sem antibióticos está reforçando essa tendência, alinhando-se às demandas de consumidores ecoconscientes e de rótulos limpos.

- O aumento da nutrição personalizada no setor de frutos do mar também é impulsionado por avanços em IA e genômica, permitindo soluções dietéticas personalizadas que incorporam tipos específicos de frutos do mar ou nutrientes para objetivos de saúde individuais.

- Isso reflete uma mudança mais ampla do consumidor em direção à assistência médica preventiva, à transparência de rótulos limpos e a fontes de alimentos ricos em nutrientes, posicionando a aquicultura funcional como um contribuidor crítico para dietas modernas e alinhadas à saúde.

Dinâmica do mercado de pesca e aquicultura no Oriente Médio e na África

Motorista

Aumento da demanda no Oriente Médio e na África por fontes alimentares sustentáveis e ricas em proteínas

- À medida que as populações do Oriente Médio e da África crescem e as rendas aumentam, especialmente nos mercados emergentes, o consumo de frutos do mar está acelerando devido ao seu alto teor de proteína, baixo perfil de gordura e nutrientes essenciais como ômega-3.

- A aquicultura emergiu como a fonte de proteína animal de crescimento mais rápido no Oriente Médio e na África, apoiada por avanços tecnológicos que permitem a criação eficiente de peixes em larga escala com impacto ambiental mínimo.

- Os consumidores estão cada vez mais buscando produtos de frutos do mar certificados e de origem sustentável, o que leva os principais varejistas e marcas a investir em cadeias de suprimentos de aquicultura rastreáveis e com rótulo ecológico.

- Em janeiro de 2025, de acordo com um relatório da Aliança de Aquicultura do Oriente Médio e África, mais de 55% dos frutos do mar consumidos no Oriente Médio e na África agora são originários da aquicultura, refletindo seu crescente domínio e confiabilidade em comparação com a pesca de captura selvagem.

- Além disso, as empresas estão adotando Sistemas de Aquicultura de Recirculação (RAS), aquicultura offshore e monitoramento baseado em IA para melhorar a produtividade e, ao mesmo tempo, reduzir as pegadas ecológicas — fatores-chave na expansão do mercado.

- A aquicultura também oferece estabilidade na produção, evitando problemas sazonais e de sobrepesca que afetam os estoques selvagens, tornando-se uma fonte de proteína mais confiável e escalável para o futuro.

Restrição/Desafio

Altos custos operacionais e de conformidade para pequenos produtores de aquicultura

- Embora a procura por produtos de aquicultura premium e sustentáveis esteja a aumentar, o custo de cumprimento das normas de qualidade, segurança e sustentabilidade apresenta desafios significativos, especialmente para os pequenos e médios produtores.

- As despesas incluem alimentação especializada, sistemas de filtragem de água, medidas de prevenção de doenças, monitoramento ambiental, mão de obra e certificações (por exemplo, ASC, BAP, orgânico)

- Em setembro de 2024, um estudo do Banco Mundial observou que o custo de estabelecimento de um sistema de aquicultura de recirculação de média escala poderia exceder 1 milhão de dólares americanos, tornando-o inacessível a operadores menores sem apoio financeiro.

- Além disso, as frequentes mudanças regulatórias em torno do impacto ambiental, do uso de antibióticos e do bem-estar animal aumentam a carga sobre os produtores, especialmente em regiões com apoio institucional limitado.

- Barreiras tecnológicas e a falta de infraestrutura digital também dificultam a adoção de ferramentas agrícolas inteligentes, como monitoramento de IA, alimentação automatizada e controle preciso da qualidade da água.

- Estes desafios restringem a inovação, a escalabilidade da produção e a capacidade dos pequenos intervenientes de participarem em mercados de exportação de alto valor, levando à concentração de mercado entre empresas maiores e bem capitalizadas.

- Sem melhor acesso a financiamento, formação e incentivos governamentais, muitas pequenas empresas de aquicultura correm o risco de ficar para trás no esforço de modernização da indústria

Âmbito do mercado de pesca e aquicultura no Oriente Médio e na África

O mercado é segmentado com base no tipo de produto, sistema de produção aquícola, ambiente, aplicação, venda de produção, categoria, fonte, forma, função, tecnologia e espécie.

• Por tipo de produto

Com base no tipo de produto, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em ração para aquicultura e equipamentos. Espera-se que a ração para aquicultura domine a participação de mercado de 63,09% em 2025 e espera-se que mostre o crescimento mais rápido durante o período previsto. A crescente demanda global por ração para peixes de alta qualidade e rica em nutrientes está alimentando esse crescimento. Inovações em proteínas vegetais, probióticos e aditivos funcionais estão melhorando a saúde dos peixes, melhorando as taxas de crescimento e promovendo práticas de aquicultura sustentáveis. Esses avanços atendem às necessidades de sistemas de cultivo intensivo, ao mesmo tempo em que se alinham às preferências ecologicamente conscientes dos consumidores, impulsionando a ampla adoção em todas as operações comerciais. A pressão regulatória para reduzir a sobrepesca e a dependência de peixes selvagens como ingredientes para ração acelerou a mudança para formulações alternativas. Os fabricantes de ração para aquicultura estão investindo pesadamente em P&D para melhorar a digestibilidade e minimizar o escoamento de nutrientes, o que contribui para a poluição da água. A integração de ferramentas digitais para formulação de ração e controle de dosagem está otimizando ainda mais a eficiência. Os equipamentos, embora menores em tamanho, oferecem suporte à automação na alimentação, aeração e monitoramento, especialmente em instalações de aquicultura inteligentes.

• Por Sistema de Produção Aquícola

Com base no Sistema de Produção de Aquicultura, o Mercado de Pesca e Aquicultura do Oriente Médio e África é segmentado em Sistemas Baseados em Água, Sistemas Baseados em Terra, Sistemas de Reciclagem, Sistemas Integrados de Agricultura, Outros. Os Sistemas Baseados em Água detinham a maior participação, 71,69% em 2025, e prevê-se que apresentem o crescimento mais rápido durante o período previsto. Este segmento inclui lagoas, tanques e gaiolas offshore que utilizam corpos d'água naturais para a criação de peixes. Esses sistemas são favorecidos por sua relação custo-benefício, escalabilidade e capacidade de fornecer ambientes naturais de criação. Com controle de qualidade da água gerenciável e menores custos de infraestrutura, eles atraem investimentos significativos de operadores comerciais. Sua adaptabilidade a várias espécies e regiões suporta altos rendimentos, tornando-os uma escolha preferida para a expansão sustentável e em larga escala da aquicultura. As lagoas continuam sendo o método mais comum em países em desenvolvimento devido às baixas barreiras de entrada e ao uso dos recursos hídricos existentes. As nações costeiras estão investindo cada vez mais em sistemas de gaiolas offshore para reduzir o impacto ambiental e aumentar a capacidade de produção. Subsídios governamentais e parcerias público-privadas estão apoiando a modernização de fazendas tradicionais baseadas em água. Esses sistemas se beneficiam da troca natural de água, reduzindo a necessidade de filtragem artificial.

• Por Meio Ambiente

Com base no Meio Ambiente, o Mercado de Pesca e Aquicultura do Oriente Médio e África é segmentado em Água Doce, Água Marinha e Água Salobra. A Água Doce detinha a maior participação, 59,56% em 2025, e prevê-se que apresente o crescimento mais rápido durante o período previsto. Esse crescimento é impulsionado pela abundância de recursos hídricos interiores, como rios, lagos e reservatórios, particularmente em regiões em desenvolvimento. Os sistemas de água doce enfrentam menos desafios técnicos em comparação com ambientes marinhos ou salinos, tornando-os acessíveis e econômicos. Espécies como tilápia, carpa e bagre prosperam nessas condições e são amplamente consumidas localmente. Os baixos custos operacionais, juntamente com a forte demanda interna e o apoio governamental, tornam a aquicultura de água doce um contribuinte fundamental para a segurança alimentar e os meios de subsistência rurais. China, Índia e Egito são os principais produtores, alavancando vastas bacias hidrográficas e redes de irrigação. Pequenos agricultores frequentemente integram a piscicultura com o cultivo de arroz, aumentando a produtividade por unidade de área. Sistemas de recirculação estão sendo adotados em fazendas de água doce para conservar água e melhorar a biossegurança.

• Por aplicação

Com base na aplicação, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em adultos, juvenis e larvas. Os adultos detinham a maior participação, 75,74% em 2025, e espera-se que apresentem o crescimento mais rápido durante o período previsto. Essa dominância se deve à alta demanda do consumidor por peixes maduros, prontos para o mercado, adequados para consumo direto e exportação. Os peixes adultos são normalmente vendidos inteiros ou processados, tornando-os a principal fonte de receita na aquicultura. Estratégias de alimentação eficientes, manejo sanitário otimizado e técnicas de reprodução aprimoradas garantem altas taxas de sobrevivência e ganho de peso ideal. Os produtores em larga escala se concentram nesta fase para maximizar a lucratividade, tornando-a a fase economicamente mais significativa na cadeia de valor da aquicultura. A fase de crescimento (fase adulta) representa mais de 70% dos custos totais de produção, enfatizando a necessidade de eficiência. Sistemas automatizados de alimentação e monitoramento de oxigênio são amplamente utilizados para apoiar o crescimento rápido. Surtos de doenças nesta fase podem levar a perdas massivas, levando a investimentos em vacinas e biossegurança.

• Por escala de produção

Com base na escala de produção, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em grande escala, média escala e pequena escala. A grande escala detinha a maior participação, 54,11%, em 2025, e prevê-se que apresente o crescimento mais rápido durante o período previsto. Essas operações se beneficiam da automação industrial, sistemas avançados de monitoramento e cadeias de suprimentos integradas que garantem produção consistente e controle de qualidade. Grandes fazendas alcançam economias de escala, reduzindo os custos por unidade e aumentando a lucratividade. Elas estão adotando cada vez mais tecnologias de agricultura inteligente para alimentação, gestão de água e prevenção de doenças. Com o aumento da demanda por frutos do mar no Oriente Médio e na África, os produtores em grande escala estão bem posicionados para atender às necessidades do mercado de forma eficiente e sustentável, atraindo investimentos privados e públicos significativos. Corporações multinacionais e agronegócios estão entrando no setor, trazendo capital e expertise.

• Por categoria

Com base na categoria, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em convencional e orgânico. O convencional detinha a maior participação, 88,76% em 2025, e prevê-se que apresente o crescimento mais rápido durante o período previsto. Continua sendo o método preferido devido ao menor investimento inicial, às práticas agrícolas estabelecidas e à ampla disponibilidade de insumos como ração e sementes. Embora as preocupações com o impacto ambiental persistam, os sistemas convencionais são altamente produtivos e acessíveis, especialmente em regiões rurais e em desenvolvimento. A maioria dos produtores depende desse modelo devido ao acesso limitado à certificação orgânica ou a tecnologias avançadas. Sua familiaridade e escalabilidade o tornam a espinha dorsal da indústria aquícola regional, apoiando o fornecimento de alimentos e o desenvolvimento econômico. A agricultura convencional frequentemente usa tratamentos químicos e antibióticos, levantando preocupações sobre resíduos e resistência antimicrobiana.

• Por fonte

Com base na origem, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em produtos à base de plantas e produtos à base de animais. Os produtos à base de plantas detinham a maior participação, 63,76% em 2025, e prevê-se que apresentem o crescimento mais rápido durante o período previsto. Esse crescimento é impulsionado pela necessidade de alternativas sustentáveis à farinha e ao óleo de peixe, que consomem muitos recursos e são ambientalmente prejudiciais. Ingredientes como soja, algas, milho e leguminosas fornecem proteínas e nutrientes essenciais, ao mesmo tempo que reduzem a dependência de peixes selvagens. As rações à base de plantas também se alinham com práticas de aquicultura ecologicamente corretas e éticas, atraindo consumidores e reguladores ambientalmente conscientes. Pesquisas contínuas sobre proteínas alternativas continuam a aprimorar a eficiência alimentar e a saúde dos peixes, impulsionando a adoção em todo o setor. Microalgas e farinhas de insetos estão sendo misturadas com proteínas vegetais para melhorar os perfis de aminoácidos. Tecnologias de modificação genética e fermentação estão sendo usadas para desenvolver culturas ricas em proteínas adaptadas para ração aquática. As taxas de conversão alimentar (CA) melhoraram significativamente com formulações otimizadas à base de plantas.

• Por Formulário

Com base na forma, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em forma seca, forma úmida e forma úmida. A forma seca deteve a maior participação, 59,84%, em 2025, e prevê-se que apresente o crescimento mais rápido durante o período previsto. É preferida por sua longa vida útil, facilidade de armazenamento e resistência à deterioração, tornando-a ideal para operações em larga escala. As rações secas oferecem uma formulação precisa de nutrientes, garantindo uma alimentação consistente e o crescimento ideal dos peixes. São compatíveis com sistemas de alimentação automatizados, reduzindo os custos de mão de obra e o desperdício de ração. Sua durabilidade durante o transporte e o manuseio as torna adequadas para fazendas remotas e comerciais. À medida que a aquicultura moderna se torna mais mecanizada, a ração seca continua sendo a solução de alimentação mais prática e eficiente. A tecnologia de extrusão permite a produção de pellets flutuantes, que afundam ou afundam lentamente, adaptados ao comportamento das espécies. Essa forma minimiza a poluição da água, reduzindo a desintegração. Em contraste, as rações úmidas e úmidas são mais perecíveis e requerem armazenamento refrigerado, limitando seu uso. A ração seca predomina na criação de camarão, tilápia e bagre, que são setores de alto volume.

• Por Função

Com base na função, o Mercado de Pesca e Aquicultura do Oriente Médio e África é segmentado em Valor Racional de Pesca e Aquicultura, Reforço Energético, Melhoria da Digestibilidade, Preservação de Ração, Manejo Citotóxico, Outros. O Valor Racional de Pesca e Aquicultura detinha a maior participação, 40,62% em 2025, e prevê-se que apresente o crescimento mais rápido durante o período previsto. O valor racional enfatiza a eficiência de custos, a otimização de recursos e o retorno sobre o investimento em operações de aquicultura. Os produtores priorizam métodos que maximizam a produção, minimizando os custos de insumos e o impacto ambiental. Isso inclui estratégias de alimentação eficiente, prevenção de doenças e otimização da produtividade. Ao equilibrar objetivos econômicos e ecológicos, o valor racional apoia a lucratividade e a sustentabilidade a longo prazo. Ele atrai tanto pequenos produtores quanto fazendas comerciais que buscam modelos de aquicultura resilientes, escaláveis e financeiramente viáveis em mercados competitivos. O conceito integra a análise do custo do ciclo de vida, as taxas de conversão alimentar e as taxas de mortalidade na tomada de decisões.

• Por Tecnologia

Com base na tecnologia, o mercado de pesca e aquicultura do Oriente Médio e África é segmentado em pesca e aquicultura convencionais, pesca e aquicultura inteligentes. A pesca e aquicultura convencionais detinham a maior participação, 75,39% em 2025, e prevê-se que apresentem o crescimento mais rápido durante o período previsto. Esses métodos incluem a captura selvagem tradicional, a criação em tanques e a criação em gaiolas, que permanecem dominantes devido às baixas barreiras tecnológicas e à ampla adoção. Eles apoiam o emprego rural e a segurança alimentar local em todo o Oriente Médio e África. Apesar dos desafios ambientais, os sistemas convencionais são confiáveis e bem compreendidos pelos produtores. Embora a aquicultura inteligente esteja emergindo, o alto custo e a complexidade das ferramentas digitais limitam seu alcance, permitindo que as práticas convencionais mantenham sua liderança no curto prazo. Pescadores artesanais e pequenos agricultores dependem do conhecimento geracional e de insumos de baixo custo. Mais de 90% da aquicultura na África e no Sul da Ásia é conduzida usando métodos convencionais.

• Por Espécie

Com base nas espécies, o Mercado de Pesca e Aquicultura do Oriente Médio e África é segmentado em peixes, crustáceos e moluscos. Os peixes detinham a maior participação, 64,09%, em 2025, e prevê-se que apresentem o crescimento mais rápido durante o período previsto. Peixes como tilápia, salmão, bagre e carpa são os mais cultivados devido ao seu rápido crescimento, alta aceitação do consumidor e adaptabilidade a vários sistemas de cultivo. Eles servem como uma fonte primária de proteína animal acessível, especialmente em regiões em desenvolvimento. A crescente demanda por frutos do mar, juntamente com a sobrepesca de estoques selvagens, acelerou a produção aquícola. A piscicultura apoia a segurança alimentar, as receitas de exportação e o desenvolvimento econômico, tornando-se a pedra angular da indústria global de aquicultura. A tilápia é popular na África e nas Américas por sua robustez e requisitos de alimentação de baixo custo. A criação de salmão na Noruega e no Chile impulsiona exportações de alto valor para a Europa e a Ásia.

Análise regional do mercado de pesca e aquicultura no Oriente Médio e na África

- Espera-se que o Egito domine o mercado de pesca e aquicultura do Oriente Médio e da África com a maior participação na receita de 41,78% em 2025. O mercado de pesca e aquicultura do Oriente Médio e da África do Egito é impulsionado pela crescente demanda populacional, iniciativas governamentais para expandir a aquicultura e condições favoráveis do rio Nilo e do delta

- O aumento dos investimentos na criação de tilápias, as metas de substituição de importações e o potencial de exportação impulsionam a produção. Apesar de desafios como o custo da ração e a escassez de água, o setor está se expandindo rapidamente sob as estratégias nacionais de segurança alimentar.

Visão geral do mercado de pesca e aquicultura na Arábia Saudita, Oriente Médio e África

O mercado de pesca e aquicultura da Arábia Saudita, Oriente Médio e África, conquistou uma fatia de mais de 25,20% no Oriente Médio e na África em 2025. A Arábia Saudita é impulsionada por vastos recursos de água doce, subsídios governamentais e um forte mercado doméstico de frutos do mar. Avanços tecnológicos, fazendas de peixes em larga escala e uma crescente indústria de exportação fazem dela um polo central para o fornecimento de aquicultura no Oriente Médio e na África.

Visão geral do mercado de pesca e aquicultura na África do Sul, Oriente Médio e África

O mercado pesqueiro e aquicultura da África do Sul, Oriente Médio e África conquistou uma participação de mais de 15,61% no Oriente Médio e África em 2025. O mercado pesqueiro e aquicultura da África do Sul, Oriente Médio e África é impulsionado pela crescente demanda por frutos do mar, pelo apoio governamental à aquicultura sustentável e pelas oportunidades de exportação. Desafios como escassez de água e limitações de infraestrutura persistem, mas os investimentos na criação de tilápias e abalones, aliados à gestão dos recursos marinhos, estão fomentando o crescimento tanto nos setores comerciais quanto em pequena escala.

Participação no mercado de pesca e aquicultura no Oriente Médio e na África

O mercado de pesca e aquicultura do Oriente Médio e da África é liderado principalmente por empresas bem estabelecidas, incluindo:

- Nireu (Grécia)

- Pentair (EUA)

- AES International Healthcare (Reino Unido)

- ASAKUA (Noruega)

- Corbion (Holanda)

- LINN Gerätebau GmbH (Alemanha)

- CPI Equipment Inc. (Canadá)

- Proteon Pharmaceuticals (Polônia)

- Kai Chuang Marine International (Taiwan)

- Thai Union Group PCL (Tailândia)

- ZHEJIANG FORDY IMP. & EXP. CO., LTD. (China)

- Fish Treatment Ltd (Reino Unido)

- BHUVAN BIOLOGICALS (Índia)

- Aquaculture Equipment Ltd (Reino Unido)

- Alltech (EUA)

- Grupo AKVA (Noruega)

- SRR Aqua Suppliers LLP (Índia)

- Skretting (Noruega)

- Kemin Aqua Science (EUA)

- Aquicultura Sagar (Índia)

- GiliOcean Technology Ltda. (China)

- Equipamentos Marítimos GaelForce (Reino Unido)

- Neospark Drugs & Chemicals Pvt. Ltd. (Índia)

- Inve Aquaculture (Bélgica)

- Syndel (Canadá)

- Alimentador de piscicultura (Dinamarca)

- Nanrong Xangai Co., Ltd.

- Grupo Baader (Alemanha)

- Pioneer AE Company Limited (Tailândia)

- Grupo Faivre (França)

- Corporação Sino-Aqua (China)

- Dura-Tech Industrial and Marine Limited (Canadá)

- Hung Star Enterprise Corp. (Taiwan)

- Hesy (Itália)

- Veramaris (Holanda)

- Fluval (Canadá)

- Growel (Índia)

- Innovasea Systems, Inc. (EUA)

- Sistemas AQ1 (Irlanda)

- Vijaya Saradhi Feeds (Índia)

- Deep Trekker Inc. (Canadá)

- Eruvaka Technologies Pvt Ltd (Índia)

- Feeds de Sreema (Índia)

- Lifegard Aquatics (EUA)

- Jala Tech (Indonésia)

- In-Situ Inc (EUA)

- Imenco AS – (Noruega)

- Pesca Mustad (Noruega)

- Gamakatsu Co., Ltd. (Japão)

- PHARMAQ (Noruega)

- AquaByte (Noruega)

- CageEye (Noruega)

- Hipra (Espanha)

- VAKI AQUACULTURE SYSTEMS LTD. (Dinamarca)

- Vaxxinova Norway AS (Noruega)

- Integrated Aqua Systems, Inc. (EUA)

Últimos desenvolvimentos no mercado de pesca e aquicultura no Oriente Médio e na África

- Em maio de 2025, a Wildtype recebeu autorização regulatória da FDA dos EUA para vender seu salmão prateado cultivado nos Estados Unidos. Tornou-se a primeira startup autorizada a comercializar frutos do mar cultivados em células no país — agora disponível em restaurantes selecionados.

- Em julho de 2025, a Grieg Seafood, da Noruega, anunciou a venda de suas operações de criação de salmão no Canadá para a Cermaq. A mudança marca uma reestruturação estratégica, à medida que a empresa continua se concentrando em suas principais operações na Noruega, Colúmbia Britânica e Shetland.

- Em junho de 2024, a Huon Aquaculture anunciou planos para uma instalação de Sistema de Aquicultura Recirculante (RAS) de AU$ 110 milhões em Whale Point, Tasmânia, com construção prevista para começar no início de 2025. Uma vez operacional, estará entre as maiores instalações de RAS no Hemisfério Sul, permitindo a criação de salmão em terra por até 60% do ciclo de vida do peixe até 2027.

- Em abril de 2023, a empresa japonesa Nissui (Nippon Suisan Kaisha) lançou sua primeira fazenda comercial de camarão em terra em Ei, Kagoshima, e está planejando uma fazenda de cavala em terra com início de operações previsto para 2026, sinalizando sua mudança para uma aquicultura mais sustentável.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE TO HIGH

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 PATENT ANALYSIS

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 REGION PATENT LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VALUE CHAIN

4.3.1 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET VALUE CHAIN

4.3.2 PRODUCTION:

4.3.3 PROCESSING:

4.3.4 MARKETING/DISTRIBUTION:

4.3.5 BUYERS:

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 HATCHERIES AND FISH SEED SUPPLIERS

4.4.2 FISH FARMERS / AQUACULTURE PRODUCERS

4.4.3 CAPTURE FISHERIES (WILD CATCH)

4.4.4 FEED PRODUCERS

4.4.5 PROCESSORS

4.4.6 PACKAGERS

4.4.7 DISTRIBUTORS / WHOLESALERS

4.4.8 EXPORTERS

4.4.9 RETAIL CHANNELS

4.5 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5.1 VERTICAL INTEGRATION FOR SUPPLY CHAIN EFFICIENCY

4.5.2 SUSTAINABLE AQUACULTURE CERTIFICATIONS AND ECO-LABELING

4.5.3 STRATEGIC MERGERS AND ACQUISITIONS

4.5.4 INVESTMENT IN R&D AND BIOTECHNOLOGICAL ADVANCEMENTS

4.5.5 EXPANSION INTO NUTRITION

4.5.6 INNOVATION AND SMART AQUACULTURE

4.5.7 PUBLIC-PRIVATE PARTNERSHIPS AND GOVERNMENT COLLABORATIONS

4.6 RAW MATERIAL SOURCING IN THE MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET

4.6.1 OVERVIEW OF RAW MATERIALS IN AQUACULTURE

4.6.2 SOURCING OF AQUAFEED RAW MATERIALS

4.6.2.1 Protein and Amino Acid Sources

4.6.2.2 Lipid Sources

4.6.2.3 Functional Additives and Micronutrients

4.6.3 RAW MATERIALS IN AQUACULTURE EQUIPMENT MANUFACTURING

4.6.3.1 Polymer Materials

4.6.3.2 Metal Components

4.6.3.3 Sensor and Electronic Inputs

4.6.4 RAW MATERIAL INPUTS FOR PHARMACEUTICALS AND HEALTH MANAGEMENT

4.6.4.1 Active Pharmaceutical Ingredients (APIs)

4.6.4.2 Excipients and Carriers

4.6.4.3 Diagnostic Reagents

4.6.5 SOURCING OF WATER TREATMENT AND BIOSECURITY INPUTS

4.6.5.1 Disinfectants and Oxidizing Agents

4.6.5.2 Mineral and pH Modifiers

4.6.5.3 Biological Agents

4.6.6 SUPPLY CHAIN CONSIDERATIONS AND CHALLENGES

4.6.6.1 Globalization and Regional Dependencies

4.6.6.2 Sustainability and Ethical Sourcing

4.6.6.3 Quality Assurance and Traceability

4.6.7 CONCLUSION

4.7 BRAND OUTLOOK

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 JOINT VENTURES

4.8.2 MERGERS AND ACQUISITIONS

4.8.3 LICENSING AND PARTNERSHIP

4.8.4 TECHNOLOGY COLLABORATIONS

4.8.5 STRATEGIC DIVESTMENTS

4.8.6 NUMBER OF PRODUCTS IN DEVELOPMENT

4.8.7 STAGE OF DEVELOPMENT

4.8.8 TIMELINES AND MILESTONES

4.8.9 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.10 RISK ASSESSMENT AND MITIGATION

4.8.11 FUTURE OUTLOOK

4.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.9.1 PRODUCT QUALITY AND FRESHNESS

4.9.2 PRICE COMPETITIVENESS AND VALUE

4.9.3 SUSTAINABILITY AND CERTIFICATIONS

4.9.4 AVAILABILITY AND SUPPLY RELIABILITY

4.9.5 TECHNOLOGICAL INTEGRATION AND TRANSPARENCY

4.9.6 BRAND REPUTATION AND CONSUMER PREFERENCES

4.1 IMPACT OF ECONOMIC SLOWDOWN ON MARKET MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET

4.10.1 IMPACT OF PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 IMPACT ON SHIPMENT

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.10.5 CONCLUSION

4.11 OVERVIEW OF TECHNOLOGICAL ANALYSIS.

4.11.1 DATA ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

4.11.2 THE INTERNET OF THINGS (IOT) AND SENSOR TECHNOLOGY

4.11.3 AUTOMATION AND ROBOTICS

4.11.4 BLOCKCHAIN FOR TRACEABILITY AND SUPPLY CHAIN MANAGEMENT

4.11.5 CONCLUSION:

4.12 IMPORT EXPORT SCENARIO

4.13 PRODUCTION CONSUMPTION ANALYSIS

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.3.1 COMPLIANCE AND COST EFFICIENCY

5.3.2 SUSTAINABILITY PRACTICES

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.5.3 IMPACT ON PRICES

5.6 REGULATORY INCLINATION

5.6.1 GEOPOLITICAL SITUATION

5.6.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.6.2.1 FREE TRADE AGREEMENTS

5.6.2.2 ALLIANCES ESTABLISHMENTS

5.6.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.6.4 DOMESTIC COURSE OF CORRECTION

5.6.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.6.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

5.7 CONCLUSION

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 POPULATION GROWTH IS ACCELERATING SEAFOOD DEMAND

7.1.2 TECHNOLOGICAL ADVANCES IN AQUACULTURE SYSTEMS ADOPTION

7.1.3 CONSUMER PREFERENCE SHIFTING TOWARD HEALTHFUL PROTEINS

7.1.4 TECHNOLOGICAL IMPROVEMENTS IN COLD CHAIN LOGISTICS AND DISTRIBUTION

7.2 RESTRAINTS

7.2.1 COST VOLATILITY FOR FEED AND PRODUCTION OPERATIONS

7.2.2 INCREASING REGULATORY REQUIREMENTS FOR MARKET COMPLIANCE

7.3 OPPORTUNITIES

7.3.1 EXPANSION OF SUSTAINABLE AND ECO-FRIENDLY PRACTICES

7.3.2 INNOVATION IN VALUE-ADDED SEAFOOD PRODUCT OFFERINGS

7.3.3 GROWING MARKET ACCESS IN EMERGING ECONOMIES

7.4 CHALLENGES

7.4.1 CLIMATE CHANGE IS DISRUPTING MARINE ECOSYSTEMS STABILITY

7.4.2 DISEASE OUTBREAKS HEAVILY IMPACTING FARMED SPECIES

8 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 AQUAFEED

8.3 EQUIPMENT

9 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM

9.1 OVERVIEW

9.2 WATER-BASED SYSTEMS

9.3 LAND-BASED SYSTEMS

9.4 RECYCLING SYSTEMS

9.5 INTEGRATED FARMING SYSTEM

9.6 OTHERS

10 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT

10.1 OVERVIEW

10.2 FRESH WATER

10.3 MARINE WATER

10.4 BRACKISH WATER

11 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ADULT

11.3 JUVENILE

11.4 LARVA

12 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE

12.1 OVERVIEW

12.2 LARGE-SCALE

12.3 MEDIUM-SCALE

12.4 SMALL-SCALE

13 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 ORGANIC

14 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY SOURCE

14.1 OVERVIEW

14.2 PLANT-BASED

14.3 ANIMAL-BASED

15 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY FORM

15.1 OVERVIEW

15.2 DRY

15.3 WET FORM

15.4 MOIST FORM

16 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION

16.1 OVERVIEW

16.2 FISHERY AND AQUACULTURE RATIONAL VALUE

16.3 ENERGY BOOSTER

16.4 IMPROVE DIGESTIBILITY

16.5 FEED PRESERVATION

16.6 CYTOTOXIC MANAGEMENT

16.7 OTHERS

17 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 CONVENTIONAL FISHERY & AQUACULTURE

17.3 SMART FISHERY & AQUACULTURE

18 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY SPECIES

18.1 OVERVIEW

18.2 FISH

18.3 CRUSTACEANS

18.4 MOLLUSKS

19 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY REGION

19.1 MIDDLE EAST AND AFRICA

19.1.1 EGYPT

19.1.2 SAUDI ARABIA

19.1.3 SOUTH AFRICA

19.1.4 OMAN

19.1.5 U.A.E..

19.1.6 ISRAEL

19.1.7 BAHRAIN

19.1.8 KUWAIT

19.1.9 QATAR

19.1.10 REST OF MIDDLE EAST AND AFRICA

20 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 SKRETTING

22.1.1 COMPANY SNAPSHOT

22.1.2 COMPANY SHARE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT DEVELOPMENT

22.2 ALLTECH

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENT

22.3 PENTAIRAES

22.3.1 COMPANY SNAPSHOT

22.3.2 COMPANY SHARE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENT

22.4 KEMIN INDUSTRIES, INC.

22.4.1 COMPANY SNAPSHOT

22.4.2 COMPANY SHARE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT DEVELOPMENT

22.5 CORBION

22.5.1 COMPANY SNAPSHOT

22.5.2 RECENT FINANCIALS

22.5.3 COMPANY SHARE ANALYSIS

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 AKVA GROUP ASA

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 REC.ENT DEVELOPMENTS/NEWS

22.7 AQ1 SYSTEMS PTY LTD

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT UPDATES

22.8 AQUABYTE

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 AQUACULTURE EQUIPMENT LTD

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENTS/NEWS

22.1 ASAKUA

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS/NEWS

22.11 BAADER

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 BHUVAN BIOLOGICALS

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS/NEWS

22.13 CAGE EYE

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENT

22.14 CPI EQUIPMENT INC

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS/NEWS

22.15 DEEP TREKKER INC.

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENT

22.16 DURA TECH INDUSTRIAL & MARINE LIMITED

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENTS/NEWS

22.17 ERUVAKA TECHNOLOGIES

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 FAIVRE SASU

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS/NEWS

22.19 FISHFARMFEEDER

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 FISH TREATMENT

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 FLUVAL

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 GAEL FORCE GROUP LIMITED

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS/NEWS

22.23 GAMAKATSU CO., LTD.

22.23.1 COMPANY SNAPSHOT

22.23.2 PRODUCT PORTFOLIO

22.23.3 RECENT DEVELOPMENT

22.24 GILIOCEAN TECHNOLOGY

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS/NEWS

22.25 GROWEL

22.25.1 COMPANY SNAPSHOT

22.25.2 PRODUCT PORTFOLIO

22.25.3 RECENT DEVELOPMENT

22.26 HESY AQUACULTURE B.V.

22.26.1 COMPANY SNAPSHOT

22.26.2 PRODUCT PORTFOLIO

22.26.3 RECENT DEVELOPMENTS/NEWS

22.27 HIPRA, S.A.

22.27.1 COMPANY SNAPSHOT

22.27.2 PRODUCT PORTFOLIO

22.27.3 RECENT DEVELOPMENT

22.28 HUNG STAR ENTERPRISE CORP.

22.28.1 COMPANY SNAPSHOT

22.28.2 PRODUCT PORTFOLIO

22.28.3 RECENT DEVELOPMENTS/NEWS

22.29 IMENCO AQUA AS

22.29.1 COMPANY SNAPSHOT

22.29.2 PRODUCT PORTFOLIO

22.29.3 RECENT DEVELOPMENT

22.3 INNOVASEA SYSTEMS INC.

22.30.1 COMPANY SNAPSHOT

22.30.2 PRODUCT PORTFOLIO

22.30.3 RECENT DEVELOPMENT

22.31 IN- SITU INC.

22.31.1 COMPANY SNAPSHOT

22.31.2 PRODUCT PORTFOLIO

22.31.3 RECENT DEVELOPMENT

22.32 INTEGRATED AQUA SYSTEMS, INC

22.32.1 COMPANY SNAPSHOT

22.32.2 PRODUCT PORTFOLIO

22.32.3 RECENT DEVELOPMENTS/NEWS

22.33 INTERNATIONAL HEALTHCARE

22.33.1 COMPANY SNAPSHOT

22.33.2 PRODUCT PORTFOLIO

22.33.3 RECENT DEVELOPMENTS/NEWS

22.34 INVE AQUACULTURE

22.34.1 COMPANY SNAPSHOT

22.34.2 PRODUCT PORTFOLIO

22.34.3 RECENT DEVELOPMENT

22.35 KAI CHUANG MARINE INTERNATIONAL

22.35.1 COMPANY SNAPSHOT

22.35.2 PRODUCT PORTFOLIO

22.35.3 RECENT DEVELOPMENT

22.36 LIFEGARD AQUATICS

22.36.1 COMPANY SNAPSHOT

22.36.2 PRODUCT PORTFOLIO

22.36.3 RECENT DEVELOPMENT

22.37 LINN GERATEBAU

22.37.1 COMPANY SNAPSHOT

22.37.2 PRODUCT PORTFOLIO

22.37.3 RECENT DEVELOPMENTS/NEWS

22.38 MUSTAD FISHING

22.38.1 COMPANY SNAPSHOT

22.38.2 PRODUCT PORTFOLIO

22.38.3 RECENT DEVELOPMENT

22.39 NANRONG SHANGHAI CO., LTD.

22.39.1 COMPANY SNAPSHOT

22.39.2 PRODUCT PORTFOLIO

22.39.3 RECENT DEVELOPMENT

22.4 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

22.40.1 COMPANY SNAPSHOT

22.40.2 PRODUCT PORTFOLIO

22.40.3 RECENT DEVELOPMENTS/NEWS

22.41 NIREUS

22.41.1 COMPANY SNAPSHOT

22.41.2 PRODUCT PORTFOLIO

22.41.3 RECENT DEVELOPMENT

22.42 PHARMAQ AS (SUBSIDIARY OF ZOETIS INC.)

22.42.1 COMPANY SNAPSHOT

22.42.2 PRODUCT PORTFOLIO

22.42.3 RECENT DEVELOPMENT

22.43 PIONEER GROUP

22.43.1 COMPANY SNAPSHOT

22.43.2 PRODUCT PORTFOLIO

22.43.3 RECENT DEVELOPMENT

22.44 PROTEON PHARMACEUTICALS S.A.

22.44.1 COMPANY SNAPSHOT

22.44.2 PRODUCT PORTFOLIO

22.44.3 RECENT DEVELOPMENT

22.45 PT JALA AKUAKULTUR LESTARI ALAMKU

22.45.1 COMPANY SNAPSHOT

22.45.2 PRODUCT PORTFOLIO

22.45.3 RECENT DEVELOPMENT

22.46 SAGAR AQUACULTURE PVT LTD

22.46.1 COMPANY SNAPSHOT

22.46.2 PRODUCT PORTFOLIO

22.46.3 RECENT DEVELOPMENT

22.47 SINO-AQUA CORPORATION

22.47.1 COMPANY SNAPSHOT

22.47.2 PRODUCT PORTFOLIO

22.47.3 RECENT DEVELOPMENTS/NEWS

22.48 SREEMA’S FEEDS

22.48.1 COMPANY SNAPSHOT

22.48.2 PRODUCT PORTFOLIO

22.48.3 RECENT DEVELOPMENT

22.49 SRR AQUA SUPPLIERS LLP

22.49.1 COMPANY SNAPSHOT

22.49.2 PRODUCT PORTFOLIO

22.49.3 RECENT DEVELOPMENTS/NEWS

22.5 SYNDEL

22.50.1 COMPANY SNAPSHOT

22.50.2 PRODUCT PORTFOLIO

22.50.3 RECENT DEVELOPMENTS/NEWS

22.51 THAI UNION FEEDMILL PUBLIC COMPANY LIMITED.

22.51.1 COMPANY SNAPSHOT

22.51.2 REVENUE ANALYSIS

22.51.3 PRODUCT PORTFOLIO

22.51.4 RECENT DEVELOPMENT

22.52 VAKI AQUACULTURE SYSTEMS LTD. (SUBSIDIARY OF MERCK & CO., INC. )

22.52.1 COMPANY SNAPSHOT

22.52.2 PRODUCT PORTFOLIO

22.52.3 RECENT DEVELOPMENT

22.53 VAXXINOVA INTERNATIONAL BV

22.53.1 COMPANY SNAPSHOT

22.53.2 PRODUCT PORTFOLIO

22.53.3 RECENT DEVELOPMENTS/NEWS

22.54 VERAMARIS

22.54.1 COMPANY SNAPSHOT

22.54.2 PRODUCT PORTFOLIO

22.54.3 RECENT DEVELOPMENT

22.55 VIJAYA SARADHI FEEDS

22.55.1 COMPANY SNAPSHOT

22.55.2 PRODUCT PORTFOLIO

22.55.3 RECENT DEVELOPMENT

22.56 IAERATOR (ZHEJIANG FORDY IMP. & EXP. CO.,LTD.)

22.56.1 COMPANY SNAPSHOT

22.56.2 PRODUCT PORTFOLIO

22.56.3 RECENT DEVELOPMENT

23 QUESTIONNAIRE

24 RELATED REPORTS

Lista de Tabela

TABLE 1 PATENT BY COUNTRY

TABLE 2 APPLICANTS OF PATENTS

TABLE 3 INVENTORS OF PATENTS

TABLE 4 IPC CODES OF PATENTS

TABLE 5 PUBLICATION OF PATENTS YEARLY

TABLE 6 BRAND OUTLOOK: KEY COMPANIES IN THE MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE EQUIPMENT MARKET

TABLE 7 REGULATORY COVERAGE

TABLE 8 COST OF FEED AND PRODUCTION OPERATIONS

TABLE 9 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 11 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 12 MIDDLE EAST AND AFRICA AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA AQUAFEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA INTEGRATED FARMING SYSTEM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA FRESH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA MARINE WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BRACKISH WATER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA ADULT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA JUVENILE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA LARVA IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA LARGE-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA MEDIUM-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA SMALL-SCALE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA CONVENTIONAL IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA ORGANIC IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PLANT-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA ANIMAL-BASED IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA DRY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA WET FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA MOIST FORM IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE RATIONAL VALUE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA ENERGY BOOSTER IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA IMPROVE DIGESTIBILITY IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA FEED PRESERVATION IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA CYTOTOXIC MANAGEMENT IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA OTHERS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA CONVENTIONAL FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA SMART FISHERY & AQUACULTURE IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA FISH IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND METRIC TONS)

TABLE 95 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 96 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 98 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 99 MIDDLE EAST AND AFRICA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MIDDLE EAST AND AFRICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MIDDLE EAST AND AFRICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MIDDLE EAST AND AFRICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MIDDLE EAST AND AFRICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MIDDLE EAST AND AFRICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 MIDDLE EAST AND AFRICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MIDDLE EAST AND AFRICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 130 MIDDLE EAST AND AFRICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MIDDLE EAST AND AFRICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MIDDLE EAST AND AFRICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 134 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 136 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 137 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 138 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 139 MIDDLE EAST AND AFRICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 141 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 142 MIDDLE EAST AND AFRICA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 143 MIDDLE EAST AND AFRICA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MIDDLE EAST AND AFRICA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 MIDDLE EAST AND AFRICA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 EGYPT FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 EGYPT FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 148 EGYPT FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 149 EGYPT AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 EGYPT FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 EGYPT LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 EGYPT AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 EGYPT TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 EGYPT ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 EGYPT FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 EGYPT PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 EGYPT ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 EGYPT MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 EGYPT PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 EGYPT EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 EGYPT CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 EGYPT WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 EGYPT WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 EGYPT FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 EGYPT MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 EGYPT SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 EGYPT SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 EGYPT FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 EGYPT OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 EGYPT CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 EGYPT UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 EGYPT AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 EGYPT FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 180 EGYPT WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 EGYPT LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 EGYPT RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 EGYPT FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 184 EGYPT FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 EGYPT FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 186 EGYPT FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 187 EGYPT FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 188 EGYPT FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 189 EGYPT DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 EGYPT FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 191 EGYPT FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 192 EGYPT FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 193 EGYPT FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 EGYPT CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 EGYPT MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 198 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 199 SAUDI ARABIA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SAUDI ARABIA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SAUDI ARABIA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SAUDI ARABIA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SAUDI ARABIA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SAUDI ARABIA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SAUDI ARABIA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SAUDI ARABIA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SAUDI ARABIA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SAUDI ARABIA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SAUDI ARABIA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 SAUDI ARABIA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 SAUDI ARABIA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 SAUDI ARABIA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 SAUDI ARABIA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 SAUDI ARABIA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 SAUDI ARABIA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 SAUDI ARABIA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 SAUDI ARABIA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 SAUDI ARABIA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SAUDI ARABIA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SAUDI ARABIA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SAUDI ARABIA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SAUDI ARABIA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SAUDI ARABIA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 SAUDI ARABIA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 SAUDI ARABIA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SAUDI ARABIA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SAUDI ARABIA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SAUDI ARABIA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 230 SAUDI ARABIA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SAUDI ARABIA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SAUDI ARABIA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 234 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 236 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 237 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 238 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 239 SAUDI ARABIA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 241 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 242 SAUDI ARABIA FISHERY AND AQUACULTURE MARKET, BY SPECIES, 2018-2032 (USD THOUSAND)

TABLE 243 SAUDI ARABIA FISH IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SAUDI ARABIA CRUSTACEANS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 SAUDI ARABIA MOLLUSKS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND METRIC TONS)

TABLE 248 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNIT)

TABLE 249 SOUTH AFRICA AQUAFEED IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SOUTH AFRICA FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SOUTH AFRICA LIVE FEED IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 SOUTH AFRICA BROODSTOCK DIETS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 SOUTH AFRICA AQUAFEED ADDITIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 SOUTH AFRICA AMINO ACIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SOUTH AFRICA VITAMINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SOUTH AFRICA TRACE MINERALS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 SOUTH AFRICA PROBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 SOUTH AFRICA ENZYMES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 SOUTH AFRICA ANTIOXIDANTS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SOUTH AFRICA FEED ACIDIFIERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SOUTH AFRICA CAROTENOIDS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SOUTH AFRICA PHOSPHATES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SOUTH AFRICA ANTIBIOTICS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SOUTH AFRICA MYCOTOXINS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SOUTH AFRICA PRESERVATIVES IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SOUTH AFRICA EQUIPMENT IN FISHERY AND AQUACULTURE BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SOUTH AFRICA CONTAINMENT EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SOUTH AFRICA WATER CIRCULATING AND AERATING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SOUTH AFRICA WATER PUMPS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SOUTH AFRICA FILTERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SOUTH AFRICA MONITORING & CONTROL SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SOUTH AFRICA SENSORS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 SOUTH AFRICA SMART FEEDING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 SOUTH AFRICA FEEDERS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SOUTH AFRICA OXYGENATION OF WATER IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 SOUTH AFRICA CLEANING EQUIPMENT IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 SOUTH AFRICA UNDERWATER (ROVS) IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 SOUTH AFRICA AQUACULTURE INTELLIGENCE IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY AQUACULTURE PRODUCTION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 280 SOUTH AFRICA WATER-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 SOUTH AFRICA LAND-BASED SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 SOUTH AFRICA RECYCLING SYSTEMS IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY ENVIRONMENT, 2018-2032 (USD THOUSAND)

TABLE 284 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 285 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY PRODUCTION SCALE, 2018-2032 (USD THOUSAND)

TABLE 286 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 287 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 288 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 289 SOUTH AFRICA DRY IN FISHERY AND AQUACULTURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SOUTH AFRICA FISHERY AND AQUACULTURE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)