Middle East And Africa Flexible Hybrid Electronics Fhe Productions Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

211.96 Million

USD

377.19 Million

2024

2032

USD

211.96 Million

USD

377.19 Million

2024

2032

| 2025 –2032 | |

| USD 211.96 Million | |

| USD 377.19 Million | |

|

|

|

|

Segmentação do mercado de produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África, processo de fabricação (preparação do substrato, impressão de trilhas condutoras, impressão/deposição de camadas dielétricas e isolantes, posicionamento de componentes (pick-and-place), interconexão e colagem, encapsulamento/proteção, testes e garantia de qualidade, corte/moldagem/montagem final), materiais (materiais de substrato, material condutor, adesivos e materiais de fixação de chips, materiais de encapsulamento e proteção, materiais isolantes e dielétricos, materiais extensíveis ou emergentes), usuários finais (setores de saúde e medicina, eletrônicos de consumo, automotivo, industrial e robótica, varejo e logística, telecomunicações, aeroespacial e defesa, têxtil e moda, energia e serviços públicos, educação e pesquisa) - tendências e previsões do setor até 2032.

Tamanho do mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África

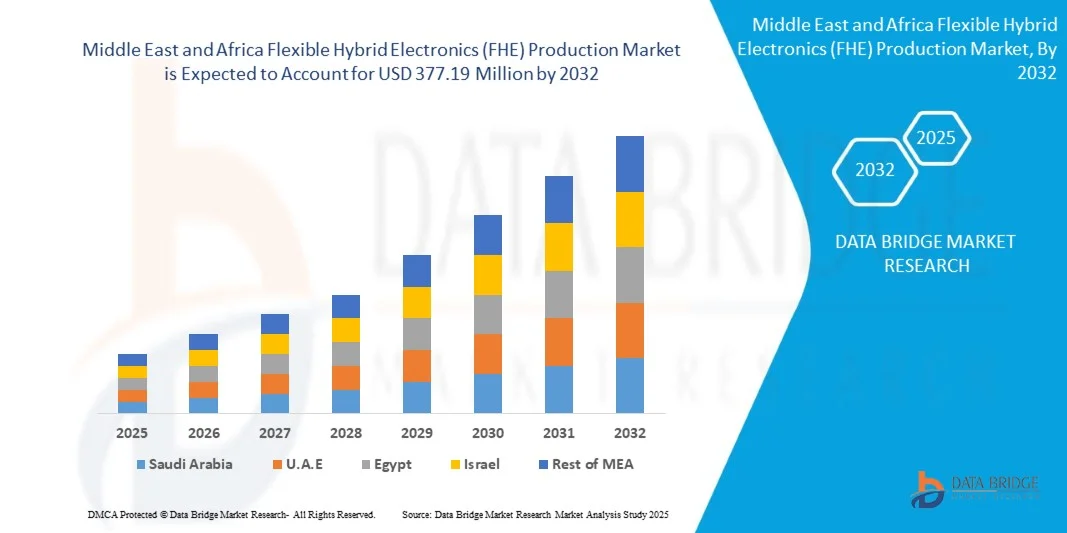

- O mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África deverá atingir US$ 377,19 milhões em 2032, partindo de US$ 211,96 milhões em 2024, crescendo a uma taxa composta de crescimento anual (CAGR) substancial de 7,6% no período de previsão de 2025 a 2032.

- O mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África está experimentando um forte crescimento, impulsionado pela crescente demanda em setores como saúde, eletrônicos de consumo, automotivo e embalagens. A tecnologia FHE combina as vantagens da eletrônica impressa com substratos flexíveis, possibilitando dispositivos leves, duráveis e multifuncionais para aplicações como sensores vestíveis, embalagens inteligentes e telas flexíveis.

- A expansão do mercado é impulsionada pelo aumento da automação, pelas tendências de miniaturização e pelos investimentos em pesquisa e desenvolvimento voltados para a melhoria do desempenho, da confiabilidade e da escalabilidade. Além disso, a crescente industrialização, o apoio governamental à manufatura avançada e o surgimento de soluções de produção economicamente viáveis por parte de fabricantes regionais estão aprimorando a competitividade do Oriente Médio e da África. Como resultado, a produção de alta eficiência (FHE) está se tornando um fator essencial para dispositivos eletrônicos de próxima geração e sistemas de manufatura inteligentes.

Análise do mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África

- O Oriente Médio e a África são os principais mercados para a produção de eletrônica híbrida flexível (FHE), impulsionados pela rápida industrialização, crescente adoção da automação e demanda cada vez maior por soluções de fabricação de alta precisão em setores como saúde, eletrônica, automotivo e embalagens.

- As tecnologias de eletrônica híbrida flexível (FHE) desempenham um papel vital no aumento da eficiência, precisão e sustentabilidade nos processos de produção, permitindo que os fabricantes atendam a padrões de qualidade rigorosos, minimizando o desperdício de materiais e os custos operacionais. Sua integração na manufatura inteligente está alinhada com as tendências do Oriente Médio e da África em direção à digitalização, à eficiência energética e à produção ambientalmente responsável.

- Os Estados Unidos, a China e o Japão continuam a ser importantes contribuintes para o crescimento do mercado de FHE (eletrônica flexível de alta eficiência) no Oriente Médio e na África, devido à sua sólida infraestrutura industrial, avançadas capacidades de P&D e inovação contínua em materiais, design e circuitos flexíveis. Esses países estão na vanguarda do desenvolvimento de sistemas de FHE de última geração, que apresentam impressão de precisão, controle de qualidade automatizado e integração perfeita com a Indústria 4.0.

- Em 2025, espera-se que o Oriente Médio e a África mantenham uma forte trajetória de crescimento, impulsionada por investimentos em larga escala na modernização industrial, iniciativas governamentais que promovem a manufatura sustentável e a expansão de instalações de produção de eletrônicos inteligentes. A América do Norte continua a priorizar tecnologias de eficiência energética e atualizações de automação, garantindo uma demanda consistente por sistemas avançados de produção de eletrônicos flexíveis ao longo do período previsto.

Escopo do relatório e segmentação do mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África.

|

Atributos |

Principais análises de mercado sobre a produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de déficits na cadeia de suprimentos e demanda. |

Tendências do mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África

“Avanços em Materiais Condutores”

- A produção de eletrônicos híbridos flexíveis (FHE, na sigla em inglês) está em constante inovação, com o uso de tintas condutoras à base de prata, cobre e carbono para melhorar a condutividade elétrica, a flexibilidade e a imprimibilidade, possibilitando componentes FHE mais eficientes e duráveis.

- Novos materiais, como grafeno, nanofios e polímeros condutores, estão sendo utilizados para criar circuitos flexíveis e transparentes, ideais para dispositivos vestíveis, sensores médicos e telas flexíveis.

- Os avanços na formulação estão melhorando a adesão e a estabilidade térmica de materiais condutores em substratos flexíveis como PET, PI e TPU, garantindo desempenho e confiabilidade a longo prazo.

- Os fabricantes estão optando por materiais condutores de baixo custo, recicláveis e à base de água para reduzir o impacto ambiental e apoiar práticas de produção sustentáveis na fabricação de equipamentos de eletrólise de fluidos.

Dinâmica do mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África

Motorista

“Crescente demanda por dispositivos vestíveis e portáteis”

- A crescente demanda por dispositivos vestíveis e portáteis está impulsionando o crescimento da produção de eletrônicos híbridos flexíveis (FHE).

- Tecnologias vestíveis, como relógios inteligentes, rastreadores de fitness, adesivos de monitoramento médico, óculos de realidade aumentada (RA) e telas flexíveis, exigem componentes leves, finos e dobráveis, características que os eletrônicos rígidos convencionais não podem oferecer.

- A tecnologia FHE, que integra perfeitamente a eletrônica impressa com dispositivos semicondutores tradicionais em substratos flexíveis, fornece a base tecnológica ideal para tais aplicações.

- Portanto, à medida que os consumidores buscam cada vez mais dispositivos vestíveis multifuncionais, duráveis e confortáveis, os fabricantes estão recorrendo à tecnologia FHE para possibilitar maior flexibilidade de design e uma experiência de usuário aprimorada.

Por exemplo

- Em setembro de 2025, de acordo com o Departamento de Informação à Imprensa do Governo da Índia, no segundo trimestre de 2025, a Índia ultrapassou a China e se tornou o maior exportador de smartphones para os Estados Unidos. As exportações de smartphones da Índia ultrapassaram 1 trilhão de rúpias indianas (INR) apenas nos primeiros cinco meses do ano fiscal de 2025-2026, um aumento de 55% em relação ao mesmo período do ano anterior.

- Em outubro de 2023, de acordo com o relatório anual State of Mobile Internet Connectivity Report 2023 do Groupe Spécial Mobile Association (GSMA), mais da metade (54%) da população do Oriente Médio e da África, cerca de 4,3 bilhões de pessoas, possuía um smartphone.

- Em julho de 2025, de acordo com o Bangkok Post, em 2024, o mercado total de smartphones da Tailândia era composto por 16,4 milhões de unidades, das quais 34.542 eram dispositivos dobráveis e 69.862 eram dispositivos flip.

- Segundo a Administração de Comércio Internacional do Departamento de Comércio dos EUA, em 2023, a Alemanha atingiu uma penetração de smartphones de 90,1% e uma penetração geral da internet de 93,1%, um aumento significativo em relação aos 79,8% de penetração de smartphones antes da COVID-19.

- Em novembro de 2024, de acordo com o relatório “Nações Digitais no Oriente Médio e na África” do Groupe Spécial Mobile Association (GSMA), a adoção de smartphones deverá atingir 92% da população até 2030 nas Filipinas.

Restrição/Desafio

“Cadeia de suprimentos complexa e disponibilidade de materiais”

- Uma cadeia de suprimentos complexa e a disponibilidade limitada de materiais dificultam significativamente a produção e a adoção em larga escala de eletrônicos híbridos flexíveis (FHE), apesar do vasto potencial da tecnologia em diversos setores.

- A fabricação de FHE requer uma gama diversificada de materiais avançados, incluindo substratos flexíveis, tintas condutoras, adesivos extensíveis, filmes de encapsulamento e componentes semicondutores miniaturizados, que devem ser integrados com precisão para atingir o desempenho e a confiabilidade desejados.

- No entanto, muitos desses materiais especializados ainda não são produzidos em larga escala ou estão disponíveis apenas por meio de um número limitado de fornecedores, o que leva à complexidade do fornecimento e ao aumento dos prazos de produção.

- A dependência de fornecedores de matérias-primas de nicho e de equipamentos de fabricação especializados aumenta a complexidade da cadeia de valor, dificultando a coordenação entre fornecedores, fabricantes e integradores.

Por exemplo,

- Em abril de 2022, de acordo com a Comissão de Comércio Internacional dos EUA, a Ucrânia fornecia cerca de 50% do néon mundial essencial para a fabricação e produção de chips.

- Em agosto de 2023, a Autoridade do Canal do Panamá reduziu o peso máximo permitido para navios e o número de travessias diárias, numa tentativa de conservar água. Essas medidas para o Oriente Médio e a África incluem a redução do número de travessias diárias e o endurecimento das restrições ao peso e ao calado dos navios.

Oportunidades

“Expansão do setor automotivo e aeroespacial”

- A expansão dos setores automotivo e aeroespacial está criando oportunidades substanciais para a produção de eletrônica híbrida flexível (FHE), impulsionada pela crescente demanda por sistemas eletrônicos leves, compactos e energeticamente eficientes.

- Existe uma crescente necessidade de componentes eletrônicos que ofereçam alto desempenho e, ao mesmo tempo, resistam a condições mecânicas e ambientais complexas, visto que ambos os setores passam por uma rápida transformação tecnológica, adotando a eletrificação, a digitalização e a automação.

- A FHE, que integra eletrônica impressa com a funcionalidade tradicional de semicondutores em substratos flexíveis, oferece uma solução ideal para atender a esses requisitos de design e desempenho em constante evolução.

- Na indústria automotiva, a FHE (Flexible Heterogeneity - Eletrônica Flexível) está possibilitando o desenvolvimento de superfícies inteligentes, eletrônica integrada ao molde, sistemas de iluminação flexíveis, sensores de pressão e temperatura e circuitos leves de gerenciamento de baterias, que contribuem para a eficiência do veículo e a segurança do motorista.

Por exemplo,

- Em maio de 2023, segundo a Associação Europeia de Fabricantes de Automóveis (ACEA), foram produzidos 85,4 milhões de veículos motorizados em todo o mundo em 2022, um aumento de 5,7% em comparação com 2021.

- Em abril de 2025, de acordo com a India Brand Equity Foundation, uma fundação criada pelo Departamento de Comércio do Ministério do Comércio e Indústria do Governo da Índia, as exportações de automóveis aumentaram 19% no ano fiscal de 2025, para mais de 5,3 milhões de unidades, impulsionadas pela forte demanda por veículos de passageiros, motocicletas e veículos comerciais.

- Em agosto de 2025, a VinFast inaugurou sua fábrica de montagem de veículos elétricos em Thoothukudi, Tamil Nadu, no valor de 16.000 crore de rúpias (US$ 1,87 bilhão), a primeira fora do Vietnã, com o objetivo de transformar a cidade em um polo de exportação do sul da Ásia, com capacidade inicial de 50.000 veículos por ano, expansível para 150.000 unidades.

- Em fevereiro de 2025, de acordo com a General Aviation Manufacturers Association, as entregas de aeronaves a pistão em 2024, em comparação com 2023, aumentaram 4,2%, totalizando 1.772 unidades.

Escopo do mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África

O mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África é segmentado por processo de fabricação, materiais e usuário final.

• Por processo de fabricação

Com base no processo de fabricação, o mercado de produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África é segmentado em preparação do substrato, impressão de trilhas condutoras, impressão/deposição de camadas dielétricas e isolantes, posicionamento de componentes (pick-and-place), interconexão e colagem, encapsulamento/proteção, testes e garantia de qualidade e corte/moldagem/montagem final. Em 2025, espera-se que o segmento de impressão de trilhas condutoras domine o mercado com 25,99% de participação.

O segmento de impressão de trilhas condutoras também deverá registrar a maior taxa de crescimento anual composta (CAGR) de 8,1%, devido ao seu papel fundamental em viabilizar a funcionalidade elétrica em uma ampla gama de dispositivos flexíveis. A impressão de trilhas condutoras constitui a espinha dorsal da fabricação de FHE (eletrodo de alta eficiência), permitindo a integração de circuitos eletrônicos em substratos flexíveis, como poliimida, PET e PEN.

• Por material

Com base nos materiais, o mercado de produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África é segmentado em materiais de substrato, materiais condutores, adesivos e materiais de fixação de chips, materiais de encapsulamento e proteção, materiais isolantes e dielétricos e materiais extensíveis ou emergentes. Em 2025, espera-se que o segmento de materiais de substrato domine o mercado com uma participação de 34,08%.

O segmento de materiais de substrato também deverá registrar a maior taxa de crescimento anual composta (CAGR) de 7,7%, devido à sua importância fundamental na determinação do desempenho geral, flexibilidade e durabilidade dos componentes eletrônicos. Os substratos atuam como a camada fundamental sobre a qual as trilhas condutoras, os sensores e os componentes ativos são impressos ou integrados, tornando-os essenciais para a eficiência e a confiabilidade dos dispositivos FHE.

• Por usuário final

Com base no usuário final, o mercado de produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África é segmentado em saúde e medicina, eletrônicos de consumo, automotivo, industrial e robótica, varejo e logística, telecomunicações, aeroespacial e defesa, têxtil e moda, energia e serviços públicos, educação e pesquisa, e outros. Em 2025, espera-se que o segmento de saúde e medicina domine o mercado com 24,63% de participação.

O segmento de saúde e medicina também deverá registrar a maior taxa de crescimento anual composta (CAGR) de 8,3%, devido à rápida integração de tecnologias eletrônicas flexíveis e vestíveis em diagnósticos médicos, monitoramento e aplicações terapêuticas. A tecnologia FHE (eletrônica flexível e vestível) permite o desenvolvimento de dispositivos leves, biocompatíveis e altamente flexíveis que se adaptam ao corpo humano, tornando-os ideais para monitoramento contínuo da saúde e cuidados personalizados. A crescente demanda por sensores de saúde vestíveis, adesivos inteligentes, dispositivos implantáveis e sistemas de monitoramento remoto de pacientes está impulsionando investimentos significativos nesse setor.

Análise Regional do Mercado de Produção de Eletrônica Híbrida Flexível (FHE) no Oriente Médio e na África

Espera-se que os Emirados Árabes Unidos dominem o mercado de produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África, devido ao aumento das exportações, à fabricação de baixo custo e ao crescente investimento em prensas automatizadas e semiautomatizadas, fatores que impulsionam o crescimento do mercado. A urbanização e a crescente demanda do consumidor por têxteis personalizados também contribuem para a expansão regional.

Análise do mercado de produção de eletrônica híbrida flexível (FHE) na Arábia Saudita, Oriente Médio e África

O mercado de produção de eletrônicos híbridos flexíveis (FHE) da Arábia Saudita, Oriente Médio e África está em rápida expansão, impulsionado pela fabricação de eletrônicos em larga escala do país, pela crescente adoção de dispositivos inteligentes e pela demanda cada vez maior dos setores automotivo, de saúde e de eletrônicos de consumo. Investimentos em pesquisa e desenvolvimento, materiais avançados e tecnologias de produção automatizadas estão aprimorando a eficiência, a precisão e a escalabilidade da fabricação de FHE. O apoio governamental à inovação, às iniciativas da Indústria 4.0 e às práticas de produção sustentáveis está acelerando ainda mais o crescimento do mercado. A forte infraestrutura industrial e a capacidade de fabricação com boa relação custo-benefício da Arábia Saudita permitem a rápida comercialização de sensores flexíveis, circuitos impressos e dispositivos vestíveis, posicionando o país como um importante ator no ecossistema de produção de FHE no Oriente Médio e na África.

Análise do mercado de produção de eletrônica híbrida flexível (FHE) na África do Sul, Oriente Médio e África.

O mercado de produção de eletrônicos híbridos flexíveis (FHE) na África do Sul, Oriente Médio e África está testemunhando um forte crescimento, impulsionado pela crescente demanda dos setores automotivo, de saúde, de eletrônicos de consumo e industrial. Iniciativas governamentais e o apoio à adoção da Indústria 4.0 estão impulsionando investimentos em manufatura avançada, P&D e instalações de produção inteligentes. Seus fabricantes estão focados no desenvolvimento de sensores flexíveis, circuitos impressos e dispositivos vestíveis, aproveitando as capacidades de produção com boa relação custo-benefício e a inovação local. Colaborações com instituições de pesquisa e parceiros tecnológicos estão acelerando os avanços em materiais e a otimização de processos. Com a crescente industrialização e digitalização, a África do Sul está emergindo como um polo estratégico para a produção de FHE escalável, de alto desempenho e multifuncional no Oriente Médio e na África.

Participação de mercado na produção de eletrônicos híbridos flexíveis (FHE) no Oriente Médio e na África

O setor de produção de eletrônica híbrida flexível (FHE) é liderado principalmente por empresas consolidadas, incluindo:

- American Semiconductor, Inc. (Estados Unidos)

- Elephantech Inc. (Japão)

- DoMicro BV (Países Baixos)

- Panasonic Corporation of North America (Estados Unidos)

- Molex (Estados Unidos)

- InnovaFlex (Canadá)

- CMTC (Consultoria em Tecnologia de Manufatura da Califórnia) (Estados Unidos)

- ALMAX (Estados Unidos)

- Jabil Inc. (Estados Unidos)

- Tapecon, Inc. (Estados Unidos)

- In2tec (Reino Unido)

Últimos desenvolvimentos no mercado de produção de eletrônica híbrida flexível (FHE) no Oriente Médio e na África

- Em outubro de 2025, a Jabil enfatizou a crescente importância da eletrônica híbrida flexível para viabilizar novas tecnologias "inteligentes" em diversas aplicações, destacando a colaboração contínua do setor para ampliar essas soluções avançadas.

- Em junho de 2025, a Jabil anunciou um investimento plurianual de US$ 500 milhões em manufatura nos EUA, com foco em infraestrutura de data center em nuvem e IA, que dá suporte às capacidades avançadas de produção eletrônica da empresa, incluindo FHE.

- Em agosto de 2024, a Tapecon Inc., líder em conversão personalizada, impressão e manufatura avançada, firmou uma parceria com a CondAlign AS, empresa norueguesa de tecnologia de ponta especializada em filmes condutores anisotrópicos. Por meio dessa colaboração, a Tapecon se torna a revendedora exclusiva de valor agregado dos produtos E-Align da CondAlign nos Estados Unidos e Canadá. A tecnologia E-Align aprimora a conectividade eletrônica e o gerenciamento térmico por meio do alinhamento de partículas em uma matriz polimérica, oferecendo alta flexibilidade e desempenho para aplicações em IoT, cartões inteligentes e dispositivos médicos.

- Em outubro de 2024, a In2tec apresentou sua tecnologia Flexi-hibrid como uma alternativa sustentável às placas de circuito impresso (PCBA) de resina convencionais, oferecendo economia de custos de material e substratos de poliéster recicláveis. A empresa destacou circuitos 3D avançados com toque capacitivo, superfícies iluminadas e feedback tátil, auxiliando fabricantes automotivos a atingirem suas metas de emissão zero.

- Em novembro de 2024, a Molex prevê uma expansão contínua em interconexões avançadas e confiáveis e em soluções miniaturizadas, impulsionando a inovação nos setores automotivo, eletrônico e de tecnologia médica, ligada aos avanços da tecnologia FHE.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

5 TECHNOLOGY MATRIX

5.1 COMPANY COMPARATIVE ANALYSIS

5.2 NEW BUSINESS & EMERGING BUSINESS — REVENUE OPPORTUNITIES & FUTURE OUTLOOK

5.2.1 NEAR-TERM (2025–2028): SCALING THROUGH MATERIALS AND PILOT MANUFACTURING

5.2.2 MID-TERM (2028–2031): PENETRATION INTO DEFENSE, AUTOMOTIVE, AND HEALTHCARE DOMAINS

5.2.3 LONG-TERM (2031–2035): SMART SURFACE INTEGRATION AND SUSTAINABLE ELECTRONICS

5.2.4 STRATEGIC OUTLOOK

5.3 PENETRATION AND GROWTH PROSPECT MAPPING

5.3.1 EXECUTIVE SUMMARY

5.3.2 PENETRATION MATRIX (CURRENT STATE VS NEAR-TERM GROWTH POTENTIAL)

5.3.3 SEGMENT-LEVEL GROWTH PROSPECTS & DRIVERS

5.3.4 REGIONAL OPPORTUNITY HEATMAP

5.3.5 TECHNOLOGY & SUPPLY-CHAIN READINESS MAPPING

5.3.6 BARRIERS TO PENETRATION

5.3.7 GROWTH ENABLERS & MARKET CATALYSTS

5.4 VALUE CHAIN ANALYSIS

6 REGULATION STANDARDS

6.1 INTRODUCTION

6.2 PRODUCT CODES

6.3 CERTIFIED MANUFACTURING STANDARDS

6.4 ENVIRONMENTAL & CHEMICAL COMPLIANCE

6.5 SAFETY AND WORKPLACE STANDARDS

6.6 TESTING, CERTIFICATION & PRODUCT SAFETY

6.7 TRANSPORTATION & STORAGE REGULATIONS

6.8 HAZARD IDENTIFICATION & LABELING

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR WEARABLE AND PORTABLE DEVICES

7.1.2 INTEGRATION OF IOT AND SMART SYSTEMS IN INDUSTRIES

7.1.3 GOVERNMENT AND INDUSTRY INVESTMENTS IN ELECTRONICS

7.1.4 INCREASING HEALTHCARE SPENDING IN EMERGING ECONOMIES

7.2 RESTRAINTS

7.2.1 HIGH INITIAL PRODUCTION AND DEVELOPMENT COSTS

7.2.2 COMPLEX SUPPLY CHAIN AND MATERIAL AVAILABILITY

7.3 OPPORTUNITIES

7.3.1 EXPANDING AUTOMOTIVE AND AEROSPACE SECTOR

7.3.2 GROWING INVESTMENT IN 5G INFRASTRUCTURE

7.3.3 GROWING GOVERNMENT INITIATIVES PROMOTING DIGITALIZATION

7.4 CHALLENGES

7.4.1 INTELLECTUAL PROPERTY (IP), TESTING, AND CERTIFICATION HURDLES

7.4.2 COMPETITION FROM TRADITIONAL RIGID ELECTRONICS

8 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS

8.1 OVERVIEW

8.2 PRINTING CONDUCTIVE TRACES

8.2.1 SCREEN PRINTING

8.2.2 INKJET PRINTING

8.2.3 AEROSOL JET PRINTING

8.3 SUBSTRATE PREPARATION

8.3.1 SURFACE TREATMENT

8.3.2 CLEANING

8.3.3 CUTTING OR COATING

8.4 INTERCONNECTION & BONDING

8.4.1 FLIP-CHIP BONDING

8.4.2 WIRE BONDING

8.4.3 ANISOTROPIC CONDUCTIVE FILMS (ACF)

8.4.4 Z-AXIS ADHESIVES

8.5 ENCAPSULATION / PROTECTION

8.5.1 LAMINATION

8.5.2 CONFORMAL COATING

8.5.3 SPRAY COATING OR DIP COATING

8.6 TESTING & QUALITY ASSURANCE

8.6.1 ELECTRICAL TESTING

8.6.2 MECHANICAL TESTING

8.6.3 ENVIRONMENTAL TESTING

8.6.4 VISUAL INSPECTION

8.7 CUTTING / SHAPING / FINAL ASSEMBLY

8.8 COMPONENT PLACEMENT (PICK-AND-PLACE)

8.9 PRINTING / DEPOSITING DIELECTRIC & INSULATING LAYERS

9 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: BY MATERIAL

9.1 OVERVIEW

9.2 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

9.3 SUBSTRATE MATERIALS

9.4 CONDUCTOR MATERIAL

9.5 ADHESIVES & DIE ATTACH MATERIALS

9.6 ENCAPSULATION & PROTECTIVE MATERIALS

9.7 INSULATING & DIELECTRIC MATERIALS

9.8 STRETCHABLE OR EMERGING MATERIALS

9.9 MIDDLE EAST AND AFRICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.9.1 POLYIMIDE (PI)

9.9.2 POLYETHYLENE TEREPHTHALATE (PET)

9.9.3 POLYETHYLENE NAPHTHALATE (PEN)

9.9.4 THERMOPLASTIC POLYURETHANE (TPU)

9.9.5 OTHERS

9.1 MIDDLE EAST AND AFRICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.10.1 SILVER NANOPARTICLES / SILVER INKS

9.10.2 COPPER INKS / COPPER NANOWIRES

9.10.3 CARBON-BASED INKS (GRAPHENE, CARBON BLACK)

9.10.4 GOLD NANOPARTICLES

9.10.5 OTHERS

9.11 MIDDLE EAST AND AFRICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.11.1 EPOXY ADHESIVES

9.11.2 ACRYLIC ADHESIVES

9.11.3 SILICONE ADHESIVES

9.11.4 OTHERS

9.12 MIDDLE EAST AND AFRICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.12.1 SILICONE COATINGS

9.12.2 POLYURETHANE

9.12.3 EPOXY ENCAPSULANTS

9.12.4 UV-CURABLE POLYMERS

9.13 MIDDLE EAST AND AFRICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

9.13.1 POLYIMIDE FILMS

9.13.2 PHOTOIMAGEABLE DIELECTRICS (PID)

9.13.3 UV-CURABLE DIELECTRIC INKS

10 FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER

10.1 OVERVIEW

10.2 HEALTHCARE & MEDICAL SECTOR

10.2.1 HEALTHCARE & MEDICAL SECTOR, BY TYPE

10.2.1.1 MEDICAL DEVICE MANUFACTURERS

10.2.1.2 WEARABLE HEALTH TECH COMPANIES

10.2.1.3 HOSPITALS AND CLINICS

10.2.1.4 HOME HEALTHCARE PROVIDERS

10.2.2 HEALTHCARE & MEDICAL SECTOR, BY TYPE

10.2.2.1 PRINTING CONDUCTIVE TRACES

10.2.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.2.2.3 TESTING & QUALITY ASSURANCE

10.2.2.4 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.2.2.5 ENCAPSULATION / PROTECTION

10.2.2.6 SUBSTRATE PREPARATION

10.2.2.7 INTERCONNECTION & BONDING

10.2.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.3 CONSUMER ELECTRONICS

10.3.1 CONSUMER ELECTRONICS, BY TYPE

10.3.1.1 ELECTRONICS OEMS (E.G., SAMSUNG, APPLE, SONY)

10.3.1.2 WEARABLE TECH STARTUPS

10.3.1.3 SMART HOME DEVICE COMPANIES

10.3.2 CONSUMER ELECTRONICS, BY TYPE

10.3.2.1 PRINTING CONDUCTIVE TRACES

10.3.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.3.2.3 SUBSTRATE PREPARATION

10.3.2.4 ENCAPSULATION / PROTECTION

10.3.2.5 INTERCONNECTION & BONDING

10.3.2.6 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.3.2.7 TESTING & QUALITY ASSURANCE

10.3.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.4 AUTOMOTIVE

10.4.1 AUTOMOTIVE, BY TYPE

10.4.1.1 AUTOMOTIVE OEMS

10.4.1.2 TIER-1 SUPPLIERS

10.4.1.3 EV BATTERY MANUFACTURERS

10.4.1.4 OTHERS

10.4.2 AUTOMOTIVE, BY TYPE

10.4.2.1 PRINTING CONDUCTIVE TRACES

10.4.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.4.2.3 TESTING & QUALITY ASSURANCE

10.4.2.4 ENCAPSULATION / PROTECTION

10.4.2.5 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.4.2.6 SUBSTRATE PREPARATION

10.4.2.7 INTERCONNECTION & BONDING

10.4.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.5 INDUSTRIAL AND ROBOTICS

10.5.1 INDUSTRIAL AND ROBOTICS BY TYPE

10.5.1.1 INDUSTRIAL AUTOMATION COMPANIES

10.5.1.2 ROBOTICS STARTUPS

10.5.1.3 IOT SOLUTION PROVIDERS

10.5.1.4 SMART PACKAGING MANUFACTURERS

10.5.2 INDUSTRIAL AND ROBOTICS BY TYPE

10.5.2.1 PRINTING CONDUCTIVE TRACES

10.5.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.5.2.3 TESTING & QUALITY ASSURANCE

10.5.2.4 SUBSTRATE PREPARATION

10.5.2.5 INTERCONNECTION & BONDING

10.5.2.6 ENCAPSULATION / PROTECTION

10.5.2.7 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.5.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.6 AEROSPACE & DEFENCE

10.6.1 AEROSPACE & DEFENCE BY TYPE

10.6.1.1 DEFENSE CONTRACTORS

10.6.1.2 AEROSPACE COMPANIES

10.6.1.3 SPACE AGENCIES

10.6.1.4 MILITARY THOUSAND UNITS

10.6.2 AEROSPACE & DEFENCE BY TYPE

10.6.2.1 TESTING & QUALITY ASSURANCE

10.6.2.2 PRINTING CONDUCTIVE TRACES

10.6.2.3 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.6.2.4 INTERCONNECTION & BONDING

10.6.2.5 ENCAPSULATION / PROTECTION

10.6.2.6 SUBSTRATE PREPARATION

10.6.2.7 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.6.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.7 TELECOMMUNICATIONS

10.7.1 TELECOMMUNICATIONS, BY TYPE

10.7.1.1 5G MODULES & ANTENNAS

10.7.1.2 OPTICAL TRANSCEIVERS

10.7.1.3 SMALL CELLS & REPEATERS

10.7.1.4 ROUTERS & SWITCHES

10.7.1.5 OTHERS

10.7.2 TELECOMMUNICATIONS, BY TYPE

10.7.2.1 PRINTING CONDUCTIVE TRACES

10.7.2.2 SUBSTRATE PREPARATION

10.7.2.3 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.7.2.4 INTERCONNECTION & BONDING

10.7.2.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.7.2.6 ENCAPSULATION / PROTECTION

10.7.2.7 TESTING & QUALITY ASSURANCE

10.7.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.8 RETAIL AND LOGISTICS

10.8.1 RETAIL AND LOGISTICS, BY TYPE

10.8.1.1 RETAIL CHAINS

10.8.1.2 LOGISTICS AND COURIER SERVICES

10.8.1.3 COLD CHAIN MANAGEMENT PROVIDERS

10.8.2 RETAIL AND LOGISTICS, BY TYPE

10.8.2.1 PRINTING CONDUCTIVE TRACES

10.8.2.2 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.8.2.3 TESTING & QUALITY ASSURANCE

10.8.2.4 SUBSTRATE PREPARATION

10.8.2.5 ENCAPSULATION / PROTECTION

10.8.2.6 INTERCONNECTION & BONDING

10.8.2.7 PRINTING/DEPOSITING DIELECTRIC AND INSULATING LAYERS

10.8.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.9 TEXTILES & FASHION

10.9.1 TEXTILES & FASHION, BY TYPE

10.9.1.1 SMART CLOTHING BRANDS

10.9.1.2 E-TEXTILE DEVELOPERS

10.9.1.3 SPORTSWEAR COMPANIES

10.9.2 TEXTILES & FASHION, BY TYPE

10.9.2.1 PRINTING CONDUCTIVE TRACES

10.9.2.2 ENCAPSULATION / PROTECTION

10.9.2.3 SUBSTRATE PREPARATION

10.9.2.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.9.2.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.9.2.6 TESTING & QUALITY ASSURANCE

10.9.2.7 INTERCONNECTION & BONDING

10.9.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.1 ENERGY & UTILITIES

10.10.1 ENERGY & UTILITIES, BY TYPE

10.10.1.1 RENEWABLE ENERGY COMPANIES

10.10.1.2 SMART GRID SOLUTION PROVIDERS

10.10.1.3 UTILITY METER MANUFACTURERS

10.10.2 ENERGY & UTILITIES, BY TYPE

10.10.2.1 PRINTING CONDUCTIVE TRACES

10.10.2.2 TESTING & QUALITY ASSURANCE

10.10.2.3 ENCAPSULATION / PROTECTION

10.10.2.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.10.2.5 SUBSTRATE PREPARATION

10.10.2.6 INTERCONNECTION & BONDING

10.10.2.7 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.10.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.11 EDUCATION & RESEARCH

10.11.1 EDUCATION & RESEARCH, BY TYPE

10.11.1.1 UNIVERSITIES & RESEARCH LABS

10.11.1.2 GOVERNMENT R&D AGENCIES

10.11.1.3 TECHNOLOGY INCUBATORS

10.11.2 EDUCATION & RESEARCH, BY TYPE

10.11.2.1 PRINTING CONDUCTIVE TRACES

10.11.2.2 TESTING & QUALITY ASSURANCE

10.11.2.3 SUBSTRATE PREPARATION

10.11.2.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.11.2.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.11.2.6 ENCAPSULATION / PROTECTION

10.11.2.7 INTERCONNECTION & BONDING

10.11.2.8 CUTTING / SHAPING / FINAL ASSEMBLY

10.12 OTHERS

10.12.1 OTHERS, BY TYPE

10.12.1.1 PRINTING CONDUCTIVE TRACES

10.12.1.2 TESTING & QUALITY ASSURANCE

10.12.1.3 SUBSTRATE PREPARATION

10.12.1.4 COMPONENT PLACEMENT (PICK-AND-PLACE)

10.12.1.5 PRINTING/DEPOSITING DIELECTRIC & INSULATING LAYERS

10.12.1.6 ENCAPSULATION / PROTECTION

10.12.1.7 INTERCONNECTION & BONDING

10.12.1.8 CUTTING / SHAPING / FINAL ASSEMBLY

11 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION

11.1 MIDDLE EAST & AFRICA

11.1.1 UNITED ARAB EMIRATES

11.1.2 SAUDI ARABIA

11.1.3 ISRAEL

11.1.4 SOUTH AFRICA

11.1.5 EGYPT

11.1.6 QATAR

11.1.7 KUWAIT

11.1.8 OMAN

11.1.9 BAHRAIN

11.1.10 REST OF MIDDLE EAST & AFRICA

12 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 TAPECON INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 CMTC

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 IN2TEC

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ALMAX

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ELEPHANTECH INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 AMERICAN SEMICONDUCTOR INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 DOMICRO BV

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 INNOVAFLEX

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 JABIL INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 MOLEX

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 PANASONIC CORPORATION OF NORTH AMERICA

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

Lista de Tabela

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 NEW & EMERGING BUSINESS REVENUE OPPORTUNITIES AND FUTURE OUTLOOK

TABLE 4 REGIONAL REGULATORY COMPARISON FOR FLEXIBLE HYBRID ELECTRONICS (FHE)

TABLE 5 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 7 MIDDLE EAST AND AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 10 MIDDLE EAST AND AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST AND AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 16 MIDDLE EAST AND AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 19 MIDDLE EAST AND AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 22 MIDDLE EAST AND AFRICA CUTTING / SHAPING / FINAL ASSEMBLY IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA COMPONENT PLACEMENT (PICK-AND-PLACE) IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PRINTING / DEPOSITING DIELECTRIC & INSULATING LAYERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CONDUCTOR MATERIAL IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA ADHESIVES & DIE ATTACH MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ENCAPSULATION & PROTECTIVE MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA INSULATING & DIELECTRIC MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA STRETCHABLE OR EMERGING MATERIALS IN LIQUID FILLING MACHINES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 72 MIDDLE EAST AND AFRICA

TABLE 73 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 75 MIDDLE EAST AND AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 77 MIDDLE EAST AND AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 79 MIDDLE EAST AND AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 81 MIDDLE EAST AND AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 83 MIDDLE EAST AND AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 85 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MIDDLE EAST AND AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MIDDLE EAST AND AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MIDDLE EAST AND AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MIDDLE EAST AND AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MIDDLE EAST AND AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MIDDLE EAST AND AFRICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 UNITED ARAB EMIRATES FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 114 UNITED ARAB EMIRATES FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 115 UNITED ARAB EMIRATES PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATES PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 117 UNITED ARAB EMIRATES SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 UNITED ARAB EMIRATES SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 119 UNITED ARAB EMIRATES INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 120 UNITED ARAB EMIRATES INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 121 UNITED ARAB EMIRATES ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 UNITED ARAB EMIRATES ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 123 UNITED ARAB EMIRATES TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 124 UNITED ARAB EMIRATES TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 125 UNITED ARAB EMIRATES FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 126 UNITED ARAB EMIRATES SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 UNITED ARAB EMIRATES CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 UNITED ARAB EMIRATES ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 UNITED ARAB EMIRATES ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 UNITED ARAB EMIRATES FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 132 UNITED ARAB EMIRATES HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 UNITED ARAB EMIRATES CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 UNITED ARAB EMIRATES AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 UNITED ARAB EMIRATES AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 UNITED ARAB EMIRATES INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 UNITED ARAB EMIRATES INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 UNITED ARAB EMIRATES AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 UNITED ARAB EMIRATES AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 UNITED ARAB EMIRATES TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 UNITED ARAB EMIRATES TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 UNITED ARAB EMIRATES RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 UNITED ARAB EMIRATES TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 UNITED ARAB EMIRATES OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 155 SAUDI ARABIA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 157 SAUDI ARABIA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 159 SAUDI ARABIA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 161 SAUDI ARABIA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SAUDI ARABIA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 163 SAUDI ARABIA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 164 SAUDI ARABIA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 165 SAUDI ARABIA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 166 SAUDI ARABIA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 SAUDI ARABIA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SAUDI ARABIA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SAUDI ARABIA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 SAUDI ARABIA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SAUDI ARABIA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 172 SAUDI ARABIA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SAUDI ARABIA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SAUDI ARABIA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SAUDI ARABIA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SAUDI ARABIA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SAUDI ARABIA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SAUDI ARABIA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SAUDI ARABIA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SAUDI ARABIA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SAUDI ARABIA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SAUDI ARABIA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SAUDI ARABIA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 SAUDI ARABIA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SAUDI ARABIA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SAUDI ARABIA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SAUDI ARABIA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SAUDI ARABIA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SAUDI ARABIA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SAUDI ARABIA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SAUDI ARABIA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SAUDI ARABIA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 ISRAEL FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 194 ISRAEL FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 195 ISRAEL PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 196 ISRAEL PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 197 ISRAEL SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 ISRAEL SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 199 ISRAEL INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 200 ISRAEL INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 201 ISRAEL ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 ISRAEL ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 203 ISRAEL TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 204 ISRAEL TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 205 ISRAEL FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 206 ISRAEL SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 ISRAEL CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 ISRAEL ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 ISRAEL ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 ISRAEL INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 ISRAEL FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 212 ISRAEL HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 ISRAEL HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 ISRAEL CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 ISRAEL CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 ISRAEL AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 ISRAEL AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 ISRAEL INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 ISRAEL INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 ISRAEL AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 ISRAEL AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 ISRAEL TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 ISRAEL TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 ISRAEL RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 ISRAEL RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 ISRAEL TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 ISRAEL TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 ISRAEL ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 ISRAEL ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 ISRAEL EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 ISRAEL EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 ISRAEL OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SOUTH AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 234 SOUTH AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 235 OUTH AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 236 SOUTH AFRICA PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 237 SOUTH AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SOUTH AFRICA SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 239 SOUTH AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 240 SOUTH AFRICA INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 241 SOUTH AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SOUTH AFRICA ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 243 SOUTH AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 244 SOUTH AFRICA TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 245 SOUTH AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 246 SOUTH AFRICA SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SOUTH AFRICA CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 SOUTH AFRICA ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SOUTH AFRICA ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SOUTH AFRICA INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 SOUTH AFRICA FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 252 SOUTH AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 SOUTH AFRICA HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 SOUTH AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 SOUTH AFRICA CONSUMER ELECTRONICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 SOUTH AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 SOUTH AFRICA AUTOMOTIVE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 SOUTH AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 SOUTH AFRICA INDUSTRIAL AND ROBOTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 SOUTH AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 SOUTH AFRICA AEROSPACE & DEFENCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 SOUTH AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 SOUTH AFRICA TELECOMMUNICATIONS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 SOUTH AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 SOUTH AFRICA RETAIL AND LOGISTICS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SOUTH AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SOUTH AFRICA TEXTILES & FASHION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SOUTH AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SOUTH AFRICA ENERGY & UTILITIES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SOUTH AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SOUTH AFRICA EDUCATION & RESEARCH IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SOUTH AFRICA OTHERS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 EGYPT FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 274 EGYPT FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MANUFACTURING PROCESS, 2018-2032 (THOUSAND UNITS)

TABLE 275 EGYPT PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 276 EGYPT PRINTING CONDUCTIVE TRACES IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY PRINTING TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 277 EGYPT SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 EGYPT SUBSTRATE PREPARATION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 279 EGYPT INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 280 EGYPT INTERCONNECTION & BONDING IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 281 EGYPT ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 EGYPT ENCAPSULATION / PROTECTION IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 283 EGYPT TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 284 EGYPT TESTING & QUALITY ASSURANCE IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TECHNIQUES, 2018-2032 (THOUSAND UNITS)

TABLE 285 EGYPT FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 286 EGYPT SUBSTRATE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 EGYPT CONDUCTOR MATERIAL IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 EGYPT ADHESIVES & DIE ATTACH MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 EGYPT ENCAPSULATION & PROTECTIVE MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 EGYPT INSULATING & DIELECTRIC MATERIALS IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 EGYPT FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 292 EGYPT HEALTHCARE & MEDICAL SECTOR IN FLEXIBLE HYBRID ELECTRONICS (FHE) PRODUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)