Middle East And Africa Plant Based Protein Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

799.77 Million

USD

1,752.14 Million

2025

2033

USD

799.77 Million

USD

1,752.14 Million

2025

2033

| 2026 –2033 | |

| USD 799.77 Million | |

| USD 1,752.14 Million | |

|

|

|

|

Segmentação do mercado de proteínas vegetais no Oriente Médio e na África, por fonte (proteína de soja, proteína de trigo, proteína de ervilha, proteína de canola, proteína de batata, proteína de arroz, proteína de milho, proteína de aveia, proteína de linhaça, proteína de cânhamo, proteína de quinoa, proteína de chia e outras), concentração de proteína (concentrada, isolada e hidrolisada), grau de hidrólise (intacta, levemente hidrolisada e fortemente hidrolisada), natureza (orgânica e convencional), forma (seca e líquida), função (solubilidade, gelificação, emulsificação, retenção de água, formação de espuma e outras) e aplicação (alimentos e bebidas e ração animal) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de proteínas vegetais no Oriente Médio e na África?

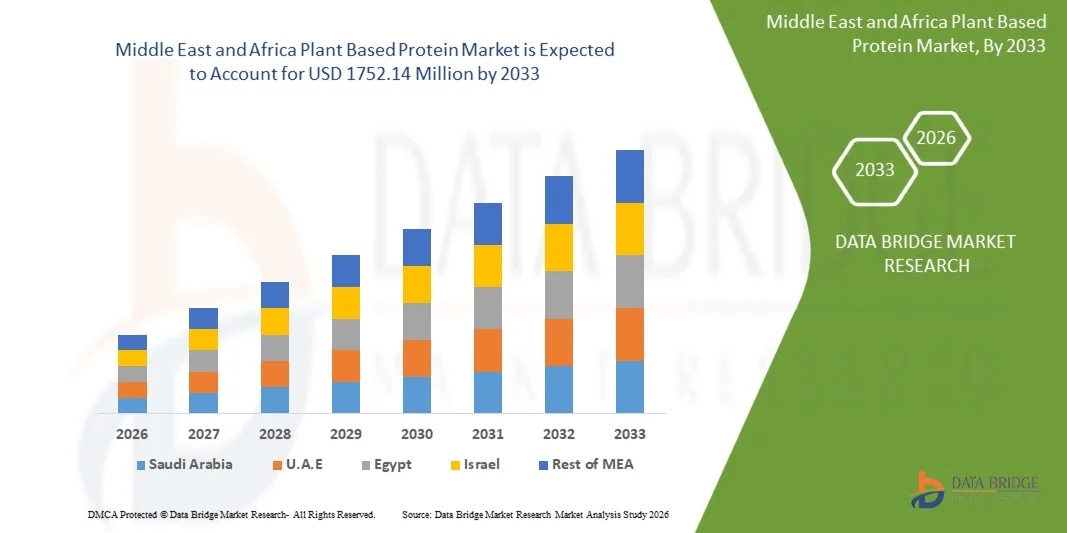

- O mercado de proteínas vegetais no Oriente Médio e na África foi avaliado em US$ 799,77 milhões em 2025 e deverá atingir US$ 1.752,14 milhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 10,3% durante o período de previsão.

- Os fatores que impulsionam o crescimento do mercado de proteínas vegetais no Oriente Médio e na África são o aumento do número de consumidores preocupados com a saúde, o crescimento da população com intolerância à lactose, a maior conscientização sobre os benefícios das proteínas vegetais, os investimentos e colaborações no setor e o uso crescente dessas proteínas em diversas aplicações.

Quais são os principais destaques do mercado de proteínas vegetais no Oriente Médio e na África?

- Preocupados com as mudanças climáticas e o impacto ambiental da pecuária convencional, os consumidores buscam alternativas sustentáveis.

- As proteínas vegetais, derivadas de culturas com menor impacto ambiental, são vistas como uma opção mais ecológica, atraindo consumidores que buscam alinhar suas escolhas alimentares com metas de conservação ambiental. Essa demanda impulsionada pela sustentabilidade está incentivando a inovação e o investimento na indústria de proteínas vegetais.

- A Arábia Saudita dominou o mercado de proteínas vegetais no Oriente Médio e na África, com uma participação estimada de 46,2% da receita em 2025, impulsionada pela crescente adoção de dietas veganas, vegetarianas e flexitarianas pelos consumidores, pela maior conscientização sobre saúde e bem-estar e pela crescente demanda por alternativas alimentares sustentáveis e éticas.

- Prevê-se que os Emirados Árabes Unidos registem a taxa de crescimento anual composta (CAGR) mais rápida, de 9,21%, durante o período de previsão, impulsionados pela forte procura por alimentos premium à base de plantas, pelo aumento da população expatriada e pela crescente preocupação com dietas saudáveis e sustentáveis.

- O segmento de proteína de soja dominou o mercado com a maior participação na receita, de 39,4% em 2024, devido à sua alta concentração de proteína, custo-benefício e aplicações versáteis em bebidas, panificação, substitutos de carne e alternativas lácteas.

Escopo do relatório e segmentação do mercado de proteínas vegetais no Oriente Médio e na África.

|

Atributos |

Principais informações sobre o mercado de proteínas vegetais no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de proteínas vegetais no Oriente Médio e na África?

“ Inovação em textura e sabor através de tecnologias avançadas de processamento ”

- Uma tendência significativa e crescente no mercado global de proteínas vegetais é o uso de tecnologias avançadas de processamento de alimentos, como extrusão, fermentação e tratamento enzimático, para aprimorar a textura, o sabor e o valor nutricional. Essas inovações visam replicar fielmente a experiência sensorial das proteínas de origem animal.

- Por exemplo, a Nestlé SA e a Impossible Foods Inc. estão investindo fortemente em extrusão de alta umidade e fermentação de precisão para melhorar a textura e a suculência de alternativas de carne à base de plantas. Essas tecnologias ajudam a eliminar o gosto residual de feijão e a melhorar a digestibilidade da proteína.

- O uso de inteligência artificial (IA) e análise de dados também está revolucionando o desenvolvimento de produtos, prevendo interações entre ingredientes e otimizando formulações para maior satisfação do consumidor. A Givaudan e a Tate & Lyle estão aproveitando o mapeamento sensorial baseado em IA para acelerar os ciclos de inovação.

- Além disso, proteínas derivadas da fermentação de fungos, algas e bactérias estão surgindo como alternativas sustentáveis e altamente funcionais. Essas proteínas podem aprimorar os perfis de aminoácidos e melhorar a uniformidade da textura em diversas aplicações, como substitutos de laticínios e bebidas proteicas.

- Essa tendência em direção a proteínas vegetais tecnologicamente aprimoradas está remodelando as expectativas do consumidor, reduzindo a diferença sensorial entre produtos de origem vegetal e animal, impulsionando uma maior aceitação nos principais mercados.

Quais são os principais fatores que impulsionam o mercado de proteínas vegetais no Oriente Médio e na África?

- A crescente tendência dos consumidores em direção a dietas sustentáveis e saudáveis, aliada às preocupações com o bem-estar animal e o impacto ambiental, é um fator-chave para o crescimento do mercado de proteínas vegetais.

- Por exemplo, em março de 2024, a Danone SA anunciou a expansão de sua linha de produtos à base de plantas na Europa, com foco em bebidas à base de proteína de soja, aveia e ervilha para atender à crescente demanda do consumidor por nutrição sustentável.

- O aumento da incidência de intolerância à lactose e das preocupações com a saúde relacionadas ao consumo de carne está levando os consumidores a optarem por alternativas à base de plantas, isentas de colesterol e ricas em fibras e antioxidantes.

- Iniciativas governamentais que promovem dietas com foco em vegetais e investimentos em agricultura sustentável impulsionam ainda mais o crescimento do mercado. Programas como o Plano de Proteínas da UE visam reduzir a dependência de proteínas importadas para ração animal e incentivar a produção local de proteínas vegetais.

- Além disso, a maior disponibilidade de alimentos vegetais prontos para consumo, as inovações em embalagens e prazos de validade, e as parcerias entre startups de tecnologia alimentar e produtores tradicionais de carne estão expandindo a penetração de mercado nos setores de varejo e serviços de alimentação.

Que fator está desafiando o crescimento do mercado de proteínas vegetais no Oriente Médio e na África?

- Um dos principais desafios que impedem o crescimento do mercado é o alto custo de produção associado às tecnologias avançadas de processamento e aos ingredientes de alta qualidade, o que eleva os preços dos produtos em comparação com as proteínas tradicionais de origem animal.

- Por exemplo, a Beyond Meat, Inc. e a Impossible Foods Inc. têm sido criticadas pelos seus preços de varejo relativamente altos, o que limita o acesso em mercados sensíveis a preços, apesar da forte demanda.

- Além disso, limitações sensoriais como textura inconsistente, sabores desagradáveis ou falta de suculência em certas formulações continuam a afetar a recompra, especialmente entre os consumidores flexitarianos que buscam experiências semelhantes às da carne autêntica.

- Restrições na cadeia de suprimentos e flutuações nos preços de matérias-primas como isolados de proteína de ervilha e soja também representam barreiras para a produção e precificação consistentes.

- Abordar esses desafios por meio da otimização de custos, diversificação de ingredientes e inovação tecnológica será essencial para garantir escalabilidade e acessibilidade. Espera-se que o investimento contínuo em fermentação, formulação assistida por IA e fornecimento sustentável impulsione a próxima onda de crescimento no mercado global de proteínas vegetais.

Como está segmentado o mercado de proteínas vegetais no Oriente Médio e na África?

O mercado é segmentado com base na fonte, concentração de proteína, nível de hidrólise, forma, natureza, função e usuário final.

- Por Fonte

Com base na fonte, o mercado de proteínas vegetais é segmentado em proteína de soja, proteína de trigo, proteína de ervilha, proteína de canola, proteína de batata, proteína de arroz, proteína de milho, proteína de aveia, proteína de linhaça, proteína de cânhamo, proteína de quinoa, proteína de chia e outras. O segmento de proteína de soja dominou o mercado com a maior participação de receita, de 39,4% em 2024, devido à sua alta concentração proteica, custo-benefício e aplicações versáteis em bebidas, panificação, substitutos de carne e alternativas lácteas. Seu perfil completo de aminoácidos e tecnologia de processamento bem estabelecida a tornam a escolha preferida dos fabricantes.

Espera-se que o segmento de proteína de ervilha apresente a taxa de crescimento anual composta (CAGR) mais rápida de 2025 a 2032, impulsionado pela crescente preferência do consumidor por fontes de proteína livres de alérgenos e não transgênicas. As excelentes propriedades emulsificantes e texturizantes da proteína de ervilha, aliadas aos benefícios de sustentabilidade, estão expandindo seu uso em análogos de carne e produtos nutricionais em todo o mundo.

- Por concentração de proteína

Com base na concentração de proteína, o mercado é segmentado em concentrado, isolado e hidrolisado. O segmento de isolado proteico dominou o mercado com a maior participação de receita, de 45,7% em 2024, devido ao seu alto nível de pureza (até 90% de proteína), sabor neutro e digestibilidade superior. Os isolados são amplamente utilizados em nutrição esportiva, bebidas e alimentos funcionais ricos em proteínas. Seu baixo teor de gordura e carboidratos os torna ideais para consumidores preocupados com a saúde.

Prevê-se que o segmento de hidrolisados registre a taxa de crescimento anual composta (CAGR) mais rápida de 2025 a 2032, impulsionado pelo aumento das aplicações em nutrição infantil, alimentos para fins medicinais especiais e suplementos para recuperação esportiva. Os hidrolisados oferecem rápida absorção, solubilidade aprimorada e melhor biodisponibilidade, tornando-os adequados para necessidades dietéticas específicas e formulações pós-treino.

- Por nível de hidrólise

Com base no nível de hidrólise, o mercado é segmentado em proteínas intactas, levemente hidrolisadas e fortemente hidrolisadas. O segmento de proteínas intactas detinha a maior participação de mercado, com 41,2% em 2024, pois preserva a estrutura natural e as propriedades nutricionais da proteína, tornando-a adequada para aplicações alimentares em geral, como panificação, alternativas lácteas e snacks. As proteínas intactas são preferidas por seu sabor neutro e versatilidade funcional.

Espera-se que o segmento de hidrólise leve apresente a taxa de crescimento anual composta (CAGR) mais rápida entre 2025 e 2032, impulsionado pela crescente demanda por formulações hipoalergênicas e de fácil digestão. A hidrólise leve aumenta a solubilidade sem afetar significativamente o sabor ou a estrutura, tornando-a ideal para bebidas nutricionais e fórmulas infantis.

- Por natureza

Com base na natureza, o mercado é segmentado em orgânico e convencional. O segmento convencional dominou o mercado de proteínas vegetais, com a maior participação de receita, de 68,5% em 2024, impulsionado por sua acessibilidade, maior disponibilidade e cadeias de suprimentos estabelecidas. As proteínas vegetais convencionais continuam a dominar as aplicações em alimentos de mercado de massa, incluindo panificação, snacks e bebidas.

No entanto, prevê-se que o segmento orgânico registre a taxa de crescimento anual composta (CAGR) mais rápida de 2025 a 2032, à medida que os consumidores exigem cada vez mais fontes de proteína com rótulos limpos e livres de químicos. O aumento das certificações orgânicas e das práticas de agricultura sustentável tornou as proteínas vegetais orgânicas mais acessíveis, atraindo consumidores preocupados com a saúde e o meio ambiente em todo o mundo.

- Por formulário

Com base na forma, o mercado é segmentado em seco e líquido. O segmento de forma seca dominou o mercado com uma participação de receita de 72,8% em 2024, devido à sua maior vida útil, estabilidade e facilidade de transporte e armazenamento. Os pós secos são amplamente utilizados em shakes de proteína, misturas para panificação e barras nutricionais devido à sua compatibilidade e propriedades de reconstituição.

Espera-se que o segmento de líquidos apresente a taxa de crescimento anual composta (CAGR) mais rápida de 2025 a 2032, impulsionado pelo aumento do uso em bebidas prontas para consumo e alternativas lácteas à base de plantas. A praticidade da formulação direta sem necessidade de reidratação e a crescente preferência por nutrição para consumo imediato são os principais fatores que sustentam a expansão do segmento.

- Por função

Com base na função, o mercado é segmentado em solubilidade, gelificação, emulsificação, retenção de água, formação de espuma e outras. O segmento de emulsificação dominou o mercado de proteínas vegetais com uma participação de 34,6% da receita em 2024, visto que as proteínas vegetais são amplamente utilizadas como emulsificantes naturais em análogos de carne, molhos para salada e recheios de produtos de panificação. Sua capacidade de estabilizar misturas de gordura e água melhora a textura e a consistência do produto.

Prevê-se que o segmento de solubilidade apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2025 e 2032, impulsionado pela crescente demanda por bebidas e bebidas funcionais enriquecidas com proteínas. A melhoria da solubilidade aprimora a sensação na boca, a miscibilidade e a absorção, tornando-se um parâmetro de desempenho crítico em formulações proteicas modernas.

- Por usuário final

Com base no usuário final, o mercado é segmentado em produtos nutricionais, panificação, alimentos prontos para consumo, snacks e cereais, laticínios, confeitaria e sobremesas, alimentos de conveniência, bebidas, ração animal e outros. O segmento de produtos nutricionais dominou o mercado com uma participação de 29,8% em 2024, impulsionado pelo crescente consumo de suplementos proteicos, shakes e barras entre entusiastas do fitness e consumidores preocupados com a saúde. As proteínas vegetais estão ganhando preferência devido à sua digestibilidade e menor impacto ambiental em comparação com as alternativas de origem animal.

Prevê-se que o segmento de bebidas apresente a taxa de crescimento anual composta (CAGR) mais rápida entre 2025 e 2032, impulsionado pela inovação em leites vegetais, águas proteicas e smoothies. A crescente demanda por bebidas veganas e sem lactose, tanto em mercados desenvolvidos quanto emergentes, está impulsionando a diversificação e a expansão de produtos neste segmento.

Qual região detém a maior participação no mercado de proteínas vegetais do Oriente Médio e da África?

- A Arábia Saudita dominou o mercado de proteínas vegetais no Oriente Médio e na África, com uma participação estimada de 46,2% da receita em 2025, impulsionada pela crescente adoção de dietas veganas, vegetarianas e flexitarianas pelos consumidores, pela maior conscientização sobre saúde e bem-estar e pela crescente demanda por alternativas alimentares sustentáveis e éticas. A forte expansão do varejo moderno, a inovação em serviços de alimentação e a crescente disponibilidade de carnes vegetais, alternativas a laticínios e suplementos proteicos continuam a sustentar o crescimento regional.

- A presença de recursos avançados de processamento de alimentos, o aumento dos investimentos em P&D e a adoção precoce de fontes proteicas importantes, como proteínas de soja, ervilha e trigo, aceleraram a inovação de produtos em toda a Arábia Saudita. Os principais fabricantes de alimentos e startups estão se concentrando ativamente em formulações com rótulos limpos, aprimoramento do sabor e fortificação nutricional para fortalecer sua participação no mercado.

- A crescente ênfase em dietas ricas em proteínas, segurança alimentar e iniciativas de sustentabilidade, combinada com o aumento dos investimentos na fabricação de alimentos à base de plantas, expansão do varejo e adoção pelo setor de hotelaria, continua impulsionando o crescimento do mercado no Oriente Médio e na África.

Análise do Mercado de Proteínas Vegetais nos Emirados Árabes Unidos, Oriente Médio e África

Prevê-se que os Emirados Árabes Unidos registrem a taxa de crescimento anual composta (CAGR) mais rápida, de 9,21%, durante o período de previsão, impulsionados pela forte demanda por alimentos premium à base de plantas, pelo aumento da população expatriada e pelo crescente foco em dietas saudáveis e sustentáveis. Iniciativas governamentais de segurança alimentar, a rápida expansão de estabelecimentos de alimentação fora do lar e a inovação em proteínas alternativas também contribuem para a expansão do mercado.

Análise do Mercado de Proteínas Vegetais na África do Sul, Oriente Médio e África

A África do Sul está testemunhando um crescimento constante no mercado de proteínas vegetais do Oriente Médio e da África, impulsionado pela crescente urbanização, pela maior conscientização sobre saúde e pela crescente aceitação de dietas à base de plantas pelos consumidores. A expansão da infraestrutura de varejo moderna, a maior disponibilidade de alternativas à carne e aos laticínios e as mudanças graduais nos hábitos alimentares devem impulsionar o desenvolvimento do mercado a longo prazo em todo o país.

Quais são as principais empresas no mercado de proteínas vegetais do Oriente Médio e da África?

O setor de proteínas vegetais é liderado principalmente por empresas já consolidadas, incluindo:

- DSM (Países Baixos)

- SOTEXPRO (França)

- Alimentos Batory (EUA)

- Glanbia plc (Irlanda)

- AGT Alimentos e Ingredientes (Canadá)

- Axiom Foods, Inc. (EUA)

- Yantai Shuangta Food Co.

- Almirante (EUA)

- Wilmar International Ltd. (Singapura)

- COSCURA (Áustria)

- Empresa de responsabilidade limitada Emsland-Stärke (Alemanha)

- Cargill, Incorporated (EUA)

- DuPont (EUA)

- Ingredion Incorporated (EUA)

- Roquette Frères (França)

- ETChem (Taiwan)

- The Green Labs LLC (EUA)

- Grupo Shandong Jianyuan (China)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.