Middle East And Africa Self Adhesive Vinyl Films Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

192.43 Million

USD

263.56 Million

2024

2032

USD

192.43 Million

USD

263.56 Million

2024

2032

| 2025 –2032 | |

| USD 192.43 Million | |

| USD 263.56 Million | |

|

|

|

|

Segmentação do mercado de filmes de vinil autoadesivos do Oriente Médio e África, por tipo (opaco, transparente e translúcido), categoria (imprimível e não imprimível), largura (largura média (aprox. 137 cm), largura grande (152-160 cm) e largura pequena (abaixo de 110 cm)), processo de fabricação (filmes calandrados e filmes fundidos), tipo de adesivo (filme de vinil autoadesivo removível e filme de vinil autoadesivo permanente), substrato (plásticos, vidro, piso e outros), espessura (fina (2-3 mils) e espessa (mais de 3 mils)), aplicação (gráficos de frota, gráficos de piso, gráficos de janela, envelopamento de carro, etiquetas e adesivos, exposição e adesivos, publicidade externa, decoração de móveis, publicidade e branding, revestimento de parede e outros) - Tendências do setor e previsão para 2032

Tamanho do mercado de filmes de vinil autoadesivos no Oriente Médio e na África

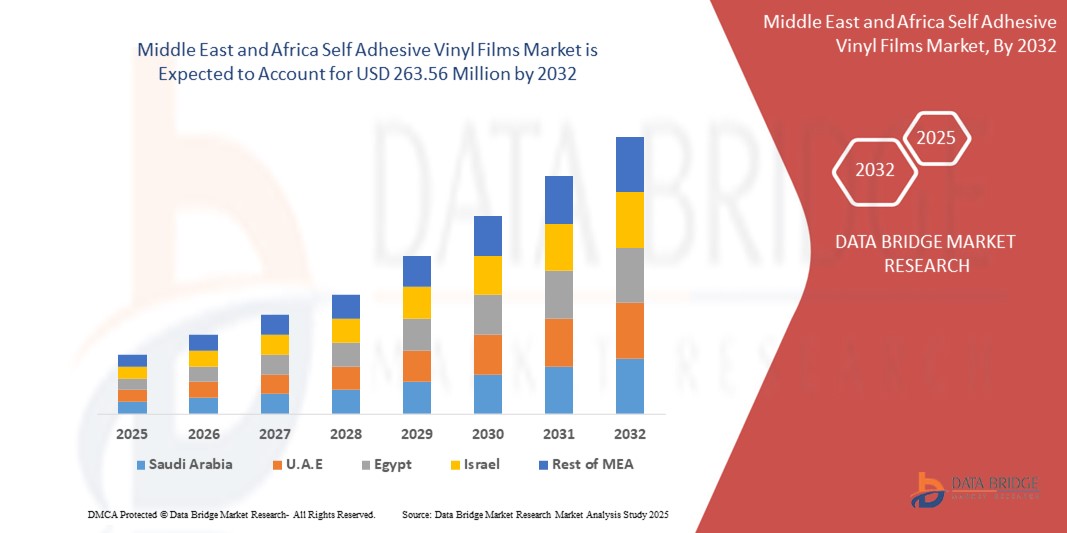

- O tamanho do mercado de filmes de vinil autoadesivos do Oriente Médio e da África foi avaliado em US$ 192,43 milhões em 2024 e deve atingir US$ 263,56 milhões até 2032 , com um CAGR de 4,01% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente demanda por materiais promocionais e publicitários duráveis e econômicos, juntamente com a crescente adoção de filmes de vinil em envoltórios automotivos, gráficos de construção e aplicações de decoração de interiores.

- A expansão dos setores de comércio eletrônico e varejo está acelerando ainda mais o uso de filmes de vinil autoadesivos para embalagens, rotulagem e branding de produtos, fortalecendo assim seu papel no aprimoramento do apelo visual e do envolvimento do consumidor.

Análise de mercado de filmes vinílicos autoadesivos para o Oriente Médio e África

- A crescente popularidade das tendências de impressão digital e personalização está impulsionando a adoção de filmes de vinil autoadesivos em todos os setores, pois eles fornecem soluções de alta qualidade, versáteis e flexíveis para uso interno e externo.

- Além disso, o aumento dos investimentos em construção, branding de varejo e infraestrutura de transporte está criando oportunidades lucrativas para o mercado, enquanto os desenvolvimentos de produtos ecológicos em filmes de vinil estão aumentando ainda mais sua demanda globalmente.

- O mercado de filmes vinílicos autoadesivos da África do Sul foi responsável pela maior fatia de receita na África em 2024, impulsionado pela indústria de publicidade estabelecida no país, pelo setor varejista em expansão e pela crescente demanda por soluções modernas de decoração de interiores.

- Espera-se que os Emirados Árabes Unidos testemunhem a maior taxa de crescimento anual composta (CAGR) no mercado de filmes vinílicos autoadesivos do Oriente Médio e da África devido ao aumento dos investimentos em infraestrutura, projetos comerciais e iniciativas modernas de branding de varejo, juntamente com a crescente adoção de filmes vinílicos decorativos e protetores de alta qualidade.

- O segmento opaco deteve a maior fatia de mercado em 2024, impulsionado por seu amplo uso em publicidade externa, sinalização e aplicações de branding, onde alta visibilidade e durabilidade são necessárias. Os filmes opacos oferecem excelente vibração de cor, resistência aos raios UV e desempenho externo de longo prazo, tornando-os a escolha preferida para campanhas publicitárias comerciais.

Escopo do relatório e segmentação do mercado de filmes de vinil autoadesivos no Oriente Médio e na África

|

Atributos |

Principais insights de mercado sobre filmes de vinil autoadesivos no Oriente Médio e na África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de filmes vinílicos autoadesivos no Oriente Médio e na África

Adoção crescente de filmes de vinil em publicidade e envelopamento de veículos

• A crescente demanda por soluções publicitárias atraentes e duráveis está impulsionando a adoção de películas vinílicas autoadesivas no Oriente Médio e na África. Sua flexibilidade, resistência às intempéries e facilidade de aplicação as tornam ideais para banners, outdoors e displays de varejo. Isso está impulsionando significativamente seu uso no setor de publicidade comercial.

• O envelopamento de veículos está emergindo como uma grande tendência, com empresas utilizando filmes de vinil para personalização e personalização de marca com boa relação custo-benefício. A capacidade de aplicar e remover envelopamentos sem danificar as superfícies os tornou populares no marketing automotivo e de frotas em centros urbanos.

• A crescente expansão do comércio eletrônico e do varejo nas economias em desenvolvimento está acelerando o uso de películas vinílicas para embalagens, displays promocionais e decoração de interiores. As marcas estão se concentrando em designs atraentes para atrair os consumidores, impulsionando uma maior adoção pelo mercado.

• Por exemplo, em 2023, diversas redes de varejo adotaram filmes vinílicos autoadesivos ecológicos para campanhas de branding em lojas, melhorando a visibilidade e reduzindo o desperdício de impressão. Essa mudança aumentou a lembrança da marca e apoiou práticas de marketing sustentáveis.

• Embora a adoção esteja aumentando, a inovação contínua em filmes vinílicos recicláveis e sem PVC é fundamental. Os fabricantes devem se concentrar na otimização de custos, em cadeias de suprimentos localizadas e em soluções ambientalmente corretas para capitalizar totalmente essa demanda crescente.

Dinâmica do mercado de filmes vinílicos autoadesivos no Oriente Médio e na África

Motorista

Expandindo a construção e o desenvolvimento de infraestrutura em toda a região

• A rápida urbanização e os projetos de infraestrutura nos países estão impulsionando o uso de películas vinílicas autoadesivas em decoração de interiores, decoração de paredes e proteção de superfícies. Sua capacidade de proporcionar apelo estético e desempenho duradouro é altamente valorizada tanto em complexos comerciais quanto em empreendimentos residenciais. A crescente demanda por soluções visualmente atraentes, duráveis e de baixa manutenção continua a impulsionar a adoção em todo o setor da construção.

• Construtores e arquitetos estão recorrendo cada vez mais a películas vinílicas como alternativas econômicas a tintas e laminados. Sua durabilidade, facilidade de instalação e variedade de acabamentos atendem aos requisitos de design moderno e aumentam a eficiência do projeto, especialmente em empreendimentos de alto volume. Além disso, as películas vinílicas ajudam a reduzir o tempo de inatividade em reformas, tornando-as a escolha preferida para projetos urbanos de ritmo acelerado.

• Iniciativas governamentais de apoio a cidades inteligentes e à modernização da infraestrutura estão criando uma forte atração no mercado. Da identidade visual para o transporte público à sinalização comercial, os filmes de vinil desempenham um papel crucial em projetos urbanos de grande porte que exigem soluções econômicas e duradouras. O uso crescente de tecnologias de impressão digital aprimora ainda mais a personalização, expandindo as oportunidades de mercado.

• Por exemplo, em 2022, grandes projetos de infraestrutura utilizaram películas vinílicas autoadesivas para sinalização e branding, aprimorando a experiência do usuário e promovendo uma identidade visual consistente em todas as instalações. Adoção semelhante está sendo observada em centros de transporte e complexos comerciais, onde películas vinílicas são aplicadas para equilibrar estética e durabilidade. Isso estabelece um precedente para uma adoção mais ampla, impulsionada por infraestrutura.

• Com a crescente demanda, os fabricantes precisam priorizar a confiabilidade do fornecimento e garantir a conformidade com os rigorosos padrões ambientais regionais para manter um forte impulso de crescimento. Empresas focadas em produção localizada e linhas de produtos sustentáveis estão mais bem posicionadas para aproveitar as oportunidades crescentes. Uma abordagem proativa em relação às certificações verdes fortalecerá ainda mais a competitividade no mercado.

Restrição/Desafio

Preocupações ambientais e custos flutuantes de matérias-primas

• As crescentes preocupações com resíduos plásticos e materiais à base de PVC estão criando pressões regulatórias sobre o mercado de filmes vinílicos autoadesivos. As restrições aos plásticos descartáveis estão levando as indústrias a buscar alternativas mais ecológicas, limitando o crescimento em certas aplicações e aumentando os custos de conformidade. À medida que a sustentabilidade se torna um fator determinante nas compras, os filmes tradicionais à base de PVC enfrentam desafios significativos.

• A volatilidade dos preços das matérias-primas, especialmente polímeros e adesivos, impacta significativamente os custos de produção. Os fabricantes enfrentam desafios para manter preços competitivos e, ao mesmo tempo, garantir a qualidade e a durabilidade dos produtos, especialmente em mercados sensíveis a custos. Essas flutuações frequentemente resultam em margens de lucro reduzidas e instabilidade de preços, desacelerando contratos de longo prazo.

• A falta de conscientização do consumidor sobre opções de vinil reciclável e sustentável retarda ainda mais a adoção de alternativas verdes. Muitas pequenas empresas ainda dependem de produtos de vinil convencionais devido às vantagens de custo, apesar da vida útil mais curta e das desvantagens ambientais. Essa lacuna de conhecimento dificulta a transformação do mercado e limita a penetração de soluções avançadas e ecologicamente corretas.

• Por exemplo, em 2023, as regulamentações sobre gestão de resíduos de PVC levaram as empresas a explorar soluções de vinil de base biológica e reciclável. Isso aumentou os custos de conformidade, mas também incentivou a inovação em produtos sustentáveis. Projetos-piloto estão demonstrando o potencial de filmes sem PVC em aplicações convencionais.

• Superar esses desafios exige fortes investimentos em P&D, parcerias para modelos de reciclagem circular e campanhas educativas para promover alternativas ecológicas em toda a cadeia de valor. Empresas que alinham a inovação de produtos com as regulamentações regionais e metas de sustentabilidade não apenas mitigarão os riscos, mas também desbloquearão novas oportunidades em mercados premium.

Escopo de mercado de filmes de vinil autoadesivos no Oriente Médio e na África

O mercado é segmentado com base no tipo, categoria, largura, processo de fabricação, tipo de adesivo, substrato, espessura e aplicação.

- Por tipo

Com base no tipo, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em opacos, transparentes e translúcidos. O segmento opaco deteve a maior fatia de mercado em 2024, impulsionado por seu amplo uso em publicidade externa, sinalização e aplicações de branding, onde alta visibilidade e durabilidade são necessárias. Os filmes opacos oferecem excelente vibração de cor, resistência aos raios UV e desempenho de longo prazo em ambientes externos, tornando-os a escolha preferida para campanhas publicitárias comerciais.

Espera-se que o segmento transparente apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por adesivos para vitrines, superfícies decorativas e displays promocionais. Películas transparentes permitem sobreposições criativas e aplicações versáteis, proporcionando um acabamento uniforme e aprimorando a estética em projetos de varejo e decoração de interiores.

- Por categoria

Com base na categoria, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em filmes imprimíveis e não imprimíveis. O segmento imprimível dominou a participação de mercado em 2024, devido à sua ampla adoção na impressão digital de banners, sinalização e envelopamento de veículos. Os filmes imprimíveis oferecem excelente aderência de tinta e compatibilidade com uma ampla gama de impressoras, impulsionando seu uso em branding e publicidade.

Espera-se que o segmento de filmes não imprimíveis apresente a maior taxa de crescimento entre 2025 e 2032, principalmente devido ao aumento das aplicações em camadas de proteção, revestimentos de superfícies e acabamentos decorativos. Esses filmes são valorizados por sua relação custo-benefício e utilidade em aplicações industriais e domésticas.

- Por largura

Com base na largura, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em largura média (aproximadamente 137 cm), largura grande (152–160 cm) e largura pequena (abaixo de 110 cm). O segmento de largura média deteve a maior participação em 2024, pois é amplamente compatível com máquinas de impressão padrão e adequado para a maioria das aplicações comerciais e decorativas.

Espera-se que o segmento de grandes dimensões apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo seu uso crescente em publicidade externa de grande porte, envelopamento de veículos e gráficos para exposições. Sua capacidade de cobrir áreas maiores com costuras mínimas aumenta a eficiência e o apelo visual.

- Por processo de fabricação

Com base no processo de fabricação, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em filmes calandrados e filmes fundidos. O segmento de filmes calandrados obteve a maior participação na receita em 2024, devido à sua acessibilidade e adequação para aplicações de curto a médio prazo em publicidade e decoração. Sua relação custo-benefício e boa durabilidade os tornam a escolha preferida para pequenas empresas.

Espera-se que o segmento de filmes fundidos apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado por sua qualidade premium, maior vida útil e flexibilidade superior para superfícies complexas. Esses filmes são muito procurados em envelopamento de veículos e em materiais gráficos externos de alto desempenho.

- Por tipo de adesivo

Com base no tipo de adesivo, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em filmes vinílicos autoadesivos removíveis e filmes vinílicos autoadesivos permanentes. O segmento permanente representou a maior fatia de mercado em 2024, devido às suas fortes propriedades de adesão e adequação para aplicações duradouras, como sinalização externa e branding.

Espera-se que o segmento removível apresente a maior taxa de crescimento entre 2025 e 2032, com sua adoção crescente em campanhas de curto prazo, publicidade sazonal e materiais gráficos para exposições. Sua facilidade de remoção sem danificar a superfície o torna altamente atraente para varejistas e anunciantes.

- Por substrato

Com base no substrato, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em plásticos, vidros, pisos e outros. O segmento de plásticos liderou o mercado em 2024, com amplas aplicações em publicidade, decoração de móveis e etiquetagem de produtos. Sua versatilidade, durabilidade e compatibilidade com diferentes adesivos impulsionam sua forte adoção.

Espera-se que o segmento de vidros apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pelo uso crescente de películas transparentes e decorativas em janelas, divisórias e vitrines. A crescente demanda por interiores estéticos em espaços comerciais e residenciais está impulsionando ainda mais esse segmento.

- Por espessura

Com base na espessura, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em finos (2 a 3 mils) e grossos (mais de 3 mils). O segmento fino deteve a maior fatia da receita em 2024, devido à sua flexibilidade, facilidade de aplicação e custo-benefício para usos temporários e de médio prazo em publicidade e displays.

Espera-se que o segmento espesso testemunhe a maior taxa de crescimento entre 2025 e 2032, apoiado por sua maior durabilidade e resistência ao desgaste, tornando-o adequado para gráficos de piso, decoração de móveis e aplicações pesadas.

- Por aplicação

Com base na aplicação, o mercado de filmes vinílicos autoadesivos do Oriente Médio e da África é segmentado em: adesivos para frotas, adesivos para pisos, adesivos para janelas, envelopamento de veículos, etiquetas e adesivos, adesivos para exposições, publicidade externa, decoração de móveis, publicidade e branding, revestimentos de parede, entre outros. O segmento de publicidade externa dominou o mercado em 2024, impulsionado pela crescente demanda por materiais promocionais visualmente impactantes, econômicos e duráveis nos centros urbanos.

Espera-se que o segmento de envelopamento de veículos apresente a maior taxa de crescimento entre 2025 e 2032, à medida que a personalização e a divulgação de marcas de veículos ganham força em toda a região. O uso crescente de filmes fundidos de alta qualidade para envelopamentos totais e parciais melhora tanto a estética quanto a visibilidade de marketing.

Análise regional do mercado de filmes vinílicos autoadesivos para o Oriente Médio e África

- O mercado de filmes vinílicos autoadesivos da África do Sul foi responsável pela maior fatia de receita na África em 2024, impulsionado pela indústria de publicidade estabelecida no país, pelo setor varejista em expansão e pela crescente demanda por soluções modernas de decoração de interiores.

- Os filmes de vinil são amplamente utilizados em publicidade externa, gráficos de veículos e displays promocionais em centros urbanos como Joanesburgo, Cidade do Cabo e Durban. As atividades de construção e reforma do país também estão impulsionando a adoção em revestimentos de parede, decoração de móveis e proteção de superfícies.

- Além disso, a presença crescente de marcas internacionais, aliada a uma preferência crescente por materiais decorativos duradouros e económicos, continua a fortalecer a posição dominante da África do Sul no mercado regional.

Visão geral do mercado de filmes de vinil autoadesivos dos Emirados Árabes Unidos

O mercado de filmes vinílicos autoadesivos dos Emirados Árabes Unidos deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pelos prósperos setores de varejo, hotelaria e turismo do país. A demanda por soluções premium de publicidade e branding, especialmente em shoppings, hotéis e espaços públicos, está impulsionando a adoção. Além disso, o forte foco do país em sustentabilidade e inovação está impulsionando o mercado para filmes vinílicos ecológicos e imprimíveis digitalmente. A expansão de empreendimentos imobiliários, projetos de cidades inteligentes e a alta renda disponível estão impulsionando ainda mais o crescimento do mercado, tornando os Emirados Árabes Unidos um dos mercados mais dinâmicos da região.

Participação no mercado de filmes vinílicos autoadesivos no Oriente Médio e na África

A indústria de filmes vinílicos autoadesivos do Oriente Médio e da África é liderada principalmente por empresas bem estabelecidas, incluindo:

- Taghleef Industries PJSC (Emirados Árabes Unidos)

- Juta Ltd. (África do Sul)

- Al-Kifah Plastics (Arábia Saudita)

- Plástico Nacional (EAU)

- Afriplast (África do Sul)

- Nilex (África do Sul)

- Fabricantes egípcios de PVC e filmes (Egito)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.