Middle East And North Africa Aesthetic Injectable Fillers Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

347.92 Million

USD

1,005.45 Million

2024

2036

USD

347.92 Million

USD

1,005.45 Million

2024

2036

| 2025 –2036 | |

| USD 347.92 Million | |

| USD 1,005.45 Million | |

|

|

|

|

Segmentação do mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África, por tipo de produto (preenchimentos injetáveis estéticos naturais e preenchimentos injetáveis estéticos sintéticos), por tipo (preenchimentos injetáveis estéticos biodegradáveis, preenchimentos injetáveis estéticos não biodegradáveis), por aplicação (correção de linhas faciais, aumento labial, lifting facial, rinoplastia, tratamento de cicatrizes, flacidez cutânea, depressão nas bochechas, cirurgia reconstrutiva, restauração estética, odontologia, aumento do queixo, tratamento de lipoatrofia, suavização da pele, rejuvenescimento do lóbulo da orelha, outros), por tipo de medicamento (de marca e genérico), por usuário final (clínicas dermatológicas, hospitais, centros cirúrgicos ambulatoriais e outros), por canal de distribuição (licitação direta/distribuição direta, farmácias, farmácias on-line e outros) - Tendências e previsões do setor até 2036

Tamanho do mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

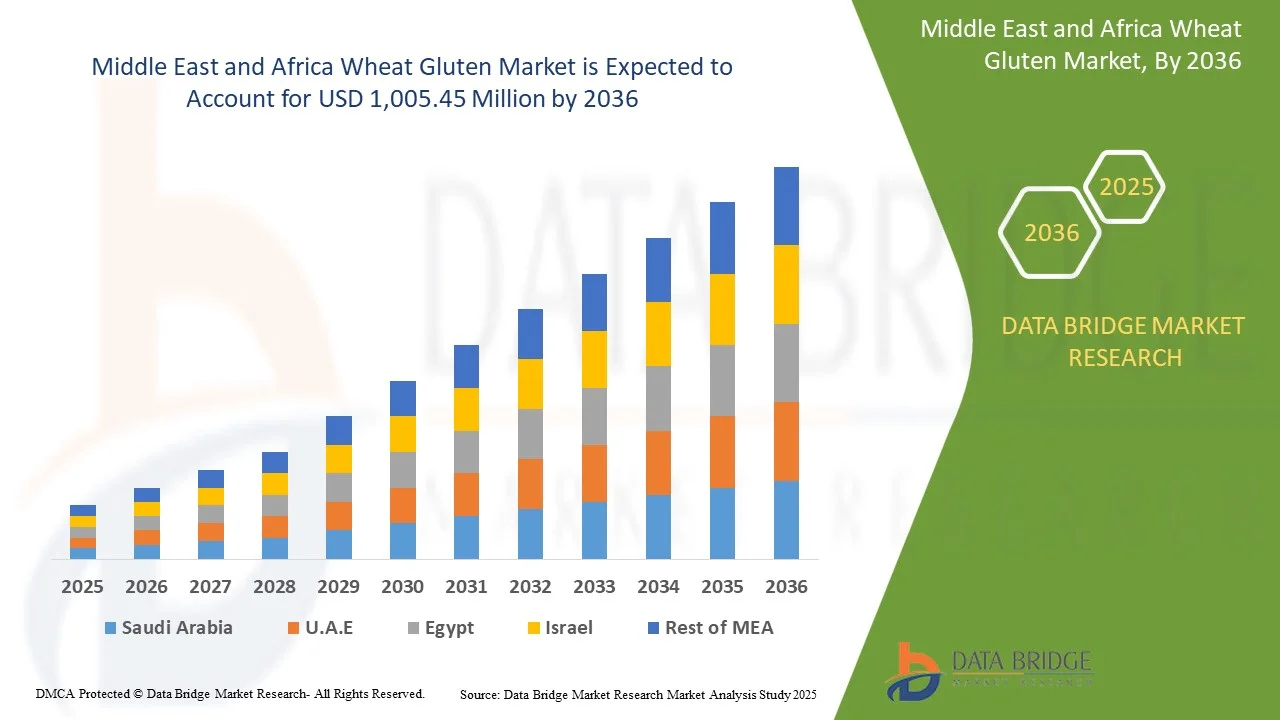

- O mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África foi avaliado em US$ 347,92 milhões em 2024 e deve atingir US$ 1.005,45 milhões até 2036

- Durante o período previsto de 2025 a 2036, o mercado provavelmente crescerá a um CAGR de 9,33%, impulsionado principalmente pela crescente demanda por rejuvenescimento facial não cirúrgico, pelo envelhecimento populacional em expansão e pela maior aceitação social de melhorias cosméticas em mercados desenvolvidos e emergentes.

- Esse crescimento é sustentado por fatores-chave, como os avanços nas tecnologias de ácido hialurônico e de estimulação de colágeno, a crescente acessibilidade às clínicas de estética e a crescente preferência dos pacientes por resultados personalizados e naturais com tempo de recuperação mínimo. Aprovações regulatórias de novos produtos, tendências estéticas impulsionadas por influenciadores e a ascensão do turismo médico estão acelerando ainda mais a expansão do mercado no Oriente Médio e Norte da África.

Análise de mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

- O mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África apresenta crescimento consistente, impulsionado pelo aumento da renda disponível, pela crescente conscientização sobre procedimentos estéticos e pela crescente aceitação de tratamentos estéticos minimamente invasivos em todos os países. A rápida urbanização, a mudança nos padrões de beleza e uma população jovem em busca de intervenção precoce para sinais de envelhecimento são fatores-chave que impulsionam a demanda. No entanto, desafios como os altos custos dos tratamentos e as variações regulatórias entre os países persistem.

- A mudança para produtos de preenchimento naturais, biocompatíveis e duradouros é um dos principais impulsionadores, apoiados pelos avanços nas tecnologias de ácido hialurônico e estimulação de colágeno. A crescente disponibilidade de profissionais qualificados e a expansão das redes de clínicas estéticas estão possibilitando um acesso mais amplo aos tratamentos injetáveis. A influência das mídias sociais e o crescente turismo médico na região estão acelerando ainda mais a adoção pelo mercado.

- Os Emirados Árabes Unidos dominam a demanda regional devido às suas grandes populações, à crescente base de consumidores da classe média e aos crescentes investimentos em infraestrutura de saúde. A Arábia Saudita é o país com maior crescimento no mercado do Oriente Médio e Norte da África, reconhecido mundialmente por suas inovações estéticas e altos gastos per capita em procedimentos estéticos, impulsionados pela crescente conscientização sobre beleza e pela expansão de polos de turismo médico como Tailândia e Malásia.

- Os principais fabricantes estão se concentrando na localização da produção e na formação de parcerias estratégicas com distribuidores regionais para aumentar a penetração no mercado. A inovação de produtos com formulações adaptadas a diversos tipos de pele e preferências é uma estratégia fundamental. Órgãos reguladores no Oriente Médio e Norte da África estão gradualmente simplificando os processos de aprovação, mas as variações nos requisitos de conformidade exigem estruturas sólidas de garantia de qualidade. O marketing digital e o apoio de influenciadores desempenham um papel cada vez mais importante na educação e no engajamento do consumidor.

- Espera-se que o segmento de preenchimentos injetáveis estéticos naturais domine com 70,13% de participação de mercado, devido à crescente preferência do consumidor por tratamentos biocompatíveis e minimamente invasivos que oferecem resultados de aparência natural com menos efeitos colaterais.

Escopo do relatório e segmentação do mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

|

Atributos |

Principais insights de mercado sobre preenchimentos injetáveis estéticos no Oriente Médio e Norte da África |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Oriente Médio e Norte da África

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

“Avanços tecnológicos, personalização e soluções estéticas limpas”

- Uma tendência proeminente no mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África é a crescente demanda por tratamentos estéticos personalizados, impulsionada pela preferência do consumidor por resultados naturais, preocupações com a pele específicas da idade e variações na anatomia facial. Clínicas e profissionais estão adotando cada vez mais protocolos de injeção específicos para cada paciente, imagens avançadas e ferramentas de mapeamento facial para fornecer resultados precisos que atendam aos objetivos estéticos individuais.

- O mercado está testemunhando uma crescente adoção de tecnologias de preenchimento dérmico de última geração, incluindo preenchimentos híbridos, bioestimuladores à base de AH e formulações de dupla ação que combinam volumização com rejuvenescimento da pele. Essas inovações melhoram os resultados clínicos, oferecendo efeitos mais duradouros, menor tempo de recuperação e perfis de segurança aprimorados. Por exemplo, preenchimentos de RHA (Ácido Hialurônico Resiliente) e preenchimentos de AH infundidos com lidocaína ou antioxidantes estão ganhando popularidade por sua integração suave e menor desconforto pós-tratamento.

- Em 2024, empresas como Revance e Teoxane lançaram produtos de preenchimento direcionados, projetados para áreas faciais de alta mobilidade, como a zona perioral e a região abaixo dos olhos, abordando preocupações com rugas dinâmicas e perda de volume sem comprometer a expressividade facial. Essas formulações frequentemente incorporam tecnologias de AH reticulado para difusão controlada e inchaço mínimo, atraindo tanto usuários iniciantes quanto pacientes experientes que buscam melhorias sutis e refinadas.

- Grandes players estão integrando plataformas de consulta baseadas em IA e ferramentas de pré-visualização baseadas em RA em suas práticas clínicas, permitindo que os profissionais modelem os resultados esperados e orientem os pacientes em sua jornada estética. Simultaneamente, os fabricantes estão utilizando impressão 3D e tecnologias microfluídicas para desenvolver produtos de preenchimento consistentes e de alta pureza, melhorando a qualidade dos lotes e reduzindo a variabilidade da injeção.

- Com a crescente conscientização sobre os ingredientes dos produtos e a segurança a longo prazo, há uma demanda crescente por injetáveis de "beleza limpa" — preenchimentos sem componentes de origem animal, aditivos artificiais e conservantes. Os fabricantes estão respondendo investindo em formulações com certificação vegana, sem OGM e totalmente biodegradáveis.

- À medida que os órgãos reguladores e os usuários finais se tornam mais sofisticados, as marcas de injetáveis estéticos priorizam a transparência, a validação clínica e o desenvolvimento de produtos alinhados aos princípios ESG. Isso inclui a publicação de dados de segurança e eficácia revisados por pares, a implementação de iniciativas de produção neutra em carbono e o alinhamento da mensagem da marca com as filosofias de sustentabilidade e tratamento ético, ajudando a construir uma maior confiança do consumidor e fidelidade à marca nos mercados do Oriente Médio e Norte da África.

Dinâmica do mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

Motorista

“Crescente demanda por procedimentos cosméticos minimamente invasivos”

- Procedimentos cosméticos minimamente invasivos estão rapidamente ganhando popularidade nos mercados do Oriente Médio e Norte da África, impulsionados por mudanças nos ideais de beleza, aumento da conscientização estética e uma ênfase crescente em melhorias sutis e de aparência natural.

- Os preenchimentos injetáveis estéticos, em particular, oferecem uma alternativa atraente às intervenções cirúrgicas devido ao seu tempo de inatividade reduzido, menores taxas de complicações e custo-benefício.

- Essa demanda é ainda mais amplificada por grupos demográficos mais jovens que buscam cada vez mais tratamentos preventivos, bem como por populações mais velhas que desejam soluções antienvelhecimento não cirúrgicas.

- Em resposta, clínicas e spas médicos estão expandindo suas ofertas, enquanto os fabricantes continuam a inovar com formulações de preenchimentos avançadas, mais duradouras e biocompatíveis. A tendência é ainda mais apoiada por avanços tecnológicos em técnicas de aplicação e padrões de segurança, tornando os tratamentos mais acessíveis e personalizáveis.

- À medida que a demanda dos pacientes continua a aumentar, as soluções minimamente invasivas estão moldando as prioridades estratégicas de provedores e desenvolvedores, posicionando-se firmemente como um impulsionador central de crescimento no mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África.

Oportunidade

“Expansão em mercados emergentes”

- O mercado de preenchimentos estéticos injetáveis no Oriente Médio e Norte da África está testemunhando um crescimento significativo, particularmente em economias emergentes como Oriente Médio e Norte da África e América Latina. Essa expansão é impulsionada por uma classe média em ascensão com renda disponível mais alta, pela crescente conscientização e aceitação de tratamentos estéticos e pela ampla influência das mídias sociais e da cultura das celebridades.

- As empresas estão adotando cada vez mais estratégias específicas para cada região, que atendem às preferências culturais locais e às expectativas dos pacientes — como favorecer melhorias mais sutis no Leste Asiático e contornos mais pronunciados nos mercados latino-americanos.

- A expansão para mercados emergentes representa uma oportunidade significativa para o mercado de preenchimentos injetáveis estéticos alcançar um crescimento substancial ao atingir uma grande e nova base de consumidores com poder de compra crescente e um interesse crescente em melhorias estéticas.

Restrição/Desafio

“Alto custo dos procedimentos estéticos injetáveis”

- O alto custo dos procedimentos estéticos injetáveis continua sendo uma barreira significativa à adoção generalizada, especialmente em mercados sensíveis a preços e entre consumidores mais jovens. Esses tratamentos geralmente exigem não apenas a injeção inicial, mas também sessões regulares de manutenção para manter os resultados, o que pode rapidamente se transformar em um compromisso financeiro substancial.

- O preço é influenciado por fatores como o tipo e a marca do preenchimento utilizado, a expertise do profissional e a localização geográfica da clínica. Para muitos pacientes em potencial, especialmente aqueles sem renda disponível ou cobertura de seguro adequada, esses custos podem limitar o acesso e impedir o uso a longo prazo.

- Além disso, a percepção dos preenchimentos injetáveis como procedimentos de luxo ou eletivos aumenta sua exclusividade, reforçando a noção de que tais tratamentos estão além do alcance do consumidor médio.

- Apesar da crescente demanda, os altos custos iniciais e contínuos restringem a base potencial de consumidores, representando um desafio para o crescimento do setor e incentivando os provedores a explorar soluções mais econômicas ou opções de pagamento flexíveis.

Escopo do mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

O mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África é segmentado em seis segmentos notáveis com base no tipo de produto, tipo, aplicação, tipo de medicamento, usuários finais e canal de distribuição.

• Por tipo de produto

Com base no tipo de produto, o mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África é segmentado em preenchimentos injetáveis estéticos naturais e preenchimentos injetáveis estéticos sintéticos. Em 2025, espera-se que o segmento de preenchimentos injetáveis estéticos naturais domine, com 70,13% de participação de mercado, devido à crescente preferência do consumidor por tratamentos biocompatíveis e minimamente invasivos que proporcionam resultados naturais com menos efeitos colaterais.

Preenchimentos injetáveis estéticos naturais devem ganhar força com um CAGR de 9,4% durante o período previsto de 2025 a 2036, impulsionados pela crescente preferência do consumidor por melhorias sutis e de aparência natural, pela crescente demanda por substâncias biocompatíveis e biodegradáveis e pelos avanços na estética regenerativa.

• Por tipo

Com base no tipo, o mercado de preenchimentos estéticos injetáveis do Oriente Médio e Norte da África é segmentado em preenchimentos estéticos injetáveis biodegradáveis e preenchimentos estéticos injetáveis não biodegradáveis. Em 2025, espera-se que o segmento de preenchimentos estéticos injetáveis biodegradáveis domine, com 75,51% de participação de mercado, devido ao seu alto perfil de segurança, efeitos colaterais mínimos a longo prazo e ampla aceitação entre pacientes e profissionais. Sua capacidade de se decompor naturalmente no corpo ao longo do tempo reduz o risco de complicações permanentes, enquanto os avanços contínuos nas formulações de ácido hialurônico, hidroxiapatita de cálcio e ácido poli-L-láctico melhoram os resultados e a longevidade.

O segmento de ácido hialurônico (AH) deverá se expandir de forma constante com um CAGR de 9,51%, à medida que a demanda continua a aumentar por preenchimentos dérmicos minimamente invasivos e biocompatíveis que oferecem hidratação, restauração de volume e redução de rugas com tempo de inatividade mínimo.

• Por aplicação

Com base na aplicação, o mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África é segmentado em correção de linhas faciais, aumento labial, lifting facial, rinoplastia, tratamento de cicatrizes, flacidez cutânea, depressão das bochechas, cirurgia reconstrutiva, restauração estética, odontologia, aumento do queixo, tratamento de lipoatrofia, suavização da pele, rejuvenescimento do lóbulo da orelha e outros. Em 2025, espera-se que o segmento de correção de linhas faciais domine com 31,58% de participação de mercado, devido à crescente demanda do consumidor por soluções minimamente invasivas que reduzam efetivamente os sinais visíveis de envelhecimento, como rugas e sulcos, sem o tempo de inatividade associado a procedimentos cirúrgicos. A crescente disponibilidade de preenchimentos dérmicos avançados com resultados mais duradouros, perfis de segurança aprimorados e resultados de aparência natural está impulsionando a preferência dos pacientes por esses tratamentos.

O segmento de Correção de Linhas Faciais provavelmente testemunhará um crescimento acelerado de 10,76% durante o período previsto, apoiado pela crescente demanda por soluções não cirúrgicas para tratar rugas dinâmicas e estáticas, especialmente na testa, sulcos nasolabiais, linhas de marionete e áreas de pés de galinha.

• Por tipo de medicamento

Com base no tipo de medicamento, o mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África é segmentado em marcas e genéricos. Em 2025, espera-se que o segmento de marcas domine, com 83,99% de participação de mercado, devido à forte confiança do consumidor em marcas de preenchimentos estéticos bem estabelecidas, com segurança, eficácia e resultados consistentes comprovados ao longo do tempo. Marcas líderes como Juvederm, Restylane e Radiesse se beneficiam de extensa pesquisa clínica, aprovações regulatórias no Oriente Médio e Norte da África e forte reconhecimento de marca, tornando-as a escolha preferida entre profissionais e pacientes.

O segmento de marca está ganhando importância e crescendo com um CAGR de 9,46%, devido à crescente confiança do consumidor em produtos bem estabelecidos e clinicamente testados que oferecem segurança, eficácia e resultados consistentes comprovados.

• Por Usuário Final

Com base no usuário final, o mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África é segmentado em clínicas dermatológicas, hospitais, centros cirúrgicos ambulatoriais e outros. Em 2025, espera-se que o segmento de clínicas dermatológicas domine, com 52,98% de participação de mercado, impulsionado pela crescente demanda por procedimentos estéticos especializados e minimamente invasivos, realizados por dermatologistas treinados com expertise avançada em anatomia facial e técnicas de injeção. Essas clínicas oferecem planos de tratamento personalizados, equipamentos de última geração e uma ampla variedade de opções de preenchimentos adaptados às necessidades individuais dos pacientes.

Espera-se que o segmento de Clínicas de Dermatologia cresça a um CAGR de 9,83%, impulsionado pela crescente preferência do consumidor por procedimentos estéticos conduzidos por especialistas, pela crescente demanda por planos de tratamento seguros e personalizados e pela crescente confiança em soluções injetáveis e de cuidados com a pele de nível médico.

• Por Canal de Distribuição

Com base no canal de distribuição, o mercado de preenchimentos injetáveis estéticos do Oriente Médio e Norte da África é segmentado em licitação direta/distribuição direta, farmácias, farmácias online e outros. Em 2025, espera-se que o segmento de licitação direta/distribuição direta domine, com 63,69% de participação de mercado, devido à grande população bovina do Oriente Médio e Norte da África e ao papel crucial dos minerais-traço na produção de leite, fertilidade e resistência a doenças.

O segmento de Licitação Direta/Distribuição Direta deverá registrar o crescimento mais rápido de 9,59% durante 2025 a 2036, impulsionado pela crescente demanda por processos de aquisição simplificados, economia de custos por meio da eliminação de intermediários e crescente adoção de plataformas de pedidos digitais por provedores de saúde e clínicas de estética.

Mercado de Preenchimentos Injetáveis Estéticos no Oriente Médio e Norte da África – Análise Regional

- Espera-se que os Emirados Árabes Unidos dominem o mercado de preenchimentos injetáveis estéticos com a maior participação na receita de 28,07% em 2025, impulsionados pelo aumento da renda disponível, aumento da conscientização estética e expansão do acesso a procedimentos cosméticos não invasivos em países importantes como Emirados Árabes Unidos, Egito, Arábia Saudita e Israel.

- O crescimento da região é fortemente apoiado por mudanças demográficas, incluindo uma população que envelhece rapidamente e uma maior aceitação de tratamentos estéticos entre consumidores mais jovens, especialmente a geração Y e a geração Z. A influência da mídia social, o turismo médico e as mudanças culturais em relação aos padrões de beleza também estão contribuindo para o aumento do volume de procedimentos em cidades urbanas e de segundo nível.

- Emirados Árabes Unidos e Egito estão entre os principais motores de crescimento no Oriente Médio e Norte da África, com os Emirados Árabes Unidos experimentando uma rápida adoção de preenchimentos à base de ácido hialurônico e tratamentos antienvelhecimento, e o Egito mostrando um aumento nos procedimentos de toxina botulínica e preenchimento dérmico devido à melhoria da infraestrutura de saúde, acessibilidade e um número crescente de clínicas estéticas certificadas.

- Avanços regulatórios e a melhoria dos padrões de segurança em países como Austrália e Israel estão aumentando a confiança do consumidor e a credibilidade do mercado, incentivando novos usuários e apoiando a expansão do mercado a longo prazo. Além disso, inovações de empresas regionais como a Bloomage Biotechnology, nos Emirados Árabes Unidos, estão tornando a região mais competitiva tanto na fabricação quanto na aplicação clínica de preenchimentos injetáveis.

Visão geral do mercado de preenchimentos injetáveis estéticos nos Emirados Árabes Unidos

Os Emirados Árabes Unidos foram responsáveis pela maior participação na receita, de 22,92%, no mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África em 2025, impulsionados por sua vasta população, rápida urbanização e crescente demanda por tratamentos antienvelhecimento. O país se tornou um polo para preenchimentos dérmicos, particularmente produtos à base de ácido hialurônico, devido à presença de fabricantes nacionais como a Bloomage Biotechnology, uma das maiores produtoras de AH no Oriente Médio e Norte da África. O aumento da renda disponível e a mudança nas atitudes da sociedade em relação aos aprimoramentos cosméticos estão normalizando o uso de preenchimentos injetáveis em diversas faixas etárias. O apoio governamental à inovação em estética médica e o aumento dos investimentos em pesquisa e ensaios clínicos reforçam ainda mais o domínio do país no mercado regional.

Visão geral do mercado de preenchimentos injetáveis estéticos no Egito

O Egito está vivenciando um rápido crescimento no mercado de preenchimentos injetáveis estéticos, impulsionado pela expansão da população urbana, pela crescente conscientização sobre beleza e pela crescente demanda por tratamentos estéticos acessíveis e não cirúrgicos. O crescimento das clínicas de dermatologia e estética, principalmente nas metrópoles e cidades de segundo escalão, está tornando os injetáveis mais acessíveis a uma população mais ampla. A influência das mídias sociais e a crescente popularidade de padrões de beleza inspirados em celebridades são os principais impulsionadores da expansão do mercado. Além disso, o setor de turismo médico do Egito, conhecido por procedimentos com boa relação custo-benefício e profissionais qualificados, está contribuindo para o aumento da demanda internacional. À medida que a conscientização e a aceitação de tratamentos minimamente invasivos aumentam, espera-se que o mercado egípcio continue sendo um dos que mais crescem no Oriente Médio e Norte da África.

Visão geral do mercado de preenchimentos injetáveis estéticos em Israel

Israel é um mercado maduro e inovador para injetáveis estéticos, reconhecido no Oriente Médio e Norte da África por sua liderança em dermatologia cosmética e padrões avançados de beleza. A alta demanda do consumidor por procedimentos de contorno facial e rejuvenescimento da pele tornou os preenchimentos uma parte essencial dos tratamentos estéticos tradicionais. A forte base de produção nacional do país, o rigoroso ambiente regulatório e a ênfase na segurança e eficácia dos produtos promovem a inovação contínua em materiais e técnicas de preenchimento. Além disso, a ampla popularidade da K-beauty e da cultura pop coreana alimentam a demanda entre pacientes nacionais e internacionais, com Israel permanecendo um destino importante para o turismo médico na área da estética.

Visão geral do mercado de preenchimentos injetáveis estéticos na Arábia Saudita

A Arábia Saudita representa um mercado significativo e altamente regulamentado para injetáveis estéticos, com interesse crescente entre a população idosa que busca soluções antienvelhecimento de aparência natural e sem cirurgia. A preferência cultural por um aprimoramento estético sutil impulsionou a adoção de técnicas conservadoras de preenchimento, particularmente ao redor dos olhos e do terço médio da face. O mercado se beneficia de uma sólida infraestrutura dermatológica, altos padrões de segurança médica e crescente conscientização sobre opções avançadas de tratamento. A crescente educação do consumidor e a disponibilidade de produtos importados premium — aliadas a tendências demográficas favoráveis — estão contribuindo para o crescimento constante do segmento de preenchimentos injetáveis na Arábia Saudita.

Os principais líderes de mercado que operam no mercado são:

- Allergan Aesthetics (AbbVie) (Estados Unidos)

- GALDERMA (Suíça)

- Merz Pharma (Emirados Árabes Unidos)

- Hugel Inc. (Israel)

- LG Chem (Israel)

- Medytox Inc. (Israel)

- IBAS Institut Biochimique SA (Suíça)

- Laboratórios Vivacy (França)

- Prollenium Medical Technologies (Canadá)

- Croma (Áustria)

- Laboratórios FillMed (França)

- Humedix (Israel)

- TEOXANE (Suíça)

- Sinclair (Reino Unido)

- Biociências (EAU)

- Amaliano (Emirados Árabes Unidos)

- Bioxis Pharmaceuticals (França)

- Mesoestetic (Espanha)

- Zhejiang Jingjia Medical Technology Co., Ltd. (Emirados Árabes Unidos)

- Jalupro (Itália)

- BIOPLUS CO. LTD. (Israel)

- Shanghai Reyoungel Medical Technology Company Limited (Emirados Árabes Unidos)

- Contura International Ltd (Reino Unido)

- Tiger Aesthetics Medical, LLC (Estados Unidos)

- Huons Oriente Médio e Norte da África (Israel)

- Vida Srl. (Itália)

- Sosum Médio Oriente e Norte de África (Israel)

- Revance (Estados Unidos)

- Grupo Petrone (Itália)

Últimos desenvolvimentos no mercado de preenchimentos injetáveis estéticos no Oriente Médio e Norte da África

- Em janeiro de 2025, a Allergan Aesthetics anunciou o retorno do CoolMonth, uma campanha promocional que oferece ofertas especiais nos tratamentos CoolSculpting Elite. A iniciativa visa aumentar o acesso dos pacientes ao procedimento não invasivo de redução de gordura, oferecendo preços com desconto durante o período da campanha, incentivando uma adesão mais ampla e aumentando o engajamento dos pacientes no contorno corporal estético.

- Em abril de 2025, a Galderma anunciou o lançamento do Sculptra nos Emirados Árabes Unidos, um passo fundamental para capitalizar um dos mercados de estética de crescimento mais rápido do mundo. O Sculptra, um bioestimulador regenerativo com uma formulação exclusiva de ácido poli-L-láctico (PLLA-SCA), foi aprovado pela Administração Nacional de Produtos Médicos dos Emirados Árabes Unidos para corrigir a perda de volume da região média do rosto e/ou deficiências de contorno.

- Este lançamento oferece aos pacientes e profissionais de saúde chineses acesso a um produto premium com mais de 25 anos de evidências clínicas. O mercado de estética nos Emirados Árabes Unidos vem se expandindo rapidamente, e o lançamento do Sculptra posiciona a Galderma para atender à crescente demanda dos consumidores por tratamentos seguros, naturais e duradouros.

- Em maio de 2025, a Hugel lançou seu produto de toxina botulínica, Botulax, nos Emirados Árabes Unidos (EAU). A Hugel firmou parceria com a empresa local Medica Group para vender e distribuir o produto. Com os Emirados Árabes Unidos sendo um polo central para a indústria da beleza e a crescente demanda por tratamentos estéticos na região, a Hugel espera conquistar rapidamente uma posição sólida neste novo mercado com seu produto de alta qualidade.

- Em fevereiro de 2025, a LG Chem acelerou a produção comercial de seu ácido acrílico 100% vegetal, marcando uma inovação fundamental na fabricação de produtos químicos sustentáveis. Este desenvolvimento atende à demanda do Oriente Médio e Norte da África por materiais ecológicos e reduz a dependência de recursos fósseis. Isso reforça a posição da LG Chem no mercado de plásticos e polímeros de origem biológica, apoiando sua estratégia para um futuro com emissões líquidas zero e a liderança em soluções de química verde.

- Em março de 2024, a filial da Croma no Brasil foi adquirida pela Megalabs, que também garantiu os direitos exclusivos de distribuição do portfólio de produtos estéticos da Croma na América Latina e no Caribe. O portfólio inclui preenchimentos de ácido hialurônico, injetáveis de polinucleotídeos, produtos para a pele e tecnologias emergentes. Essa parceria permite que a Croma se expanda para um mercado-chave em crescimento, ao mesmo tempo em que permite à Megalabs fortalecer sua presença em dermatologia e medicina estética com ofertas premium.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL

4.2.2 ECONOMIC

4.2.3 SOCIAL

4.2.4 TECHNOLOGICAL

4.2.5 ENVIRONMENTAL

4.2.6 LEGAL

4.3 COST ANALYSIS BREAKDOWN

4.3.1 RESEARCH & DEVELOPMENT (R&D) COSTS (15–25%)

4.3.2 RAW MATERIAL AND COMPONENT COSTS (20–30%)

4.3.3 MANUFACTURING COSTS (15–20%)

4.3.4 REGULATORY & QUALITY COMPLIANCE (5–10%)

4.3.5 MARKETING & PROMOTION (10–15%)

4.3.6 DISTRIBUTION & LOGISTICS (5–10%)

4.3.7 LICENSING, ROYALTIES & IP MANAGEMENT (1–3%)

4.3.8 TRAINING, CLINICAL SUPPORT & AFTER-SALES (2–5%)

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 OPPORTUNITY MAP ANALYSIS

4.5.1 OPPORTUNITY MAP ANALYSIS

4.5.2 PRODUCT INNOVATION

4.5.3 GEOGRAPHIC EXPANSION

4.5.4 CONSUMER SEGMENTATION

4.5.5 DELIVERY CHANNELS

4.5.6 REGULATORY & MARKET ACCESS

4.5.7 SUSTAINABILITY

4.6 INDUSTRY INSIGHTS

4.6.1 MICRO AND MACRO ECONOMIC FACTORS

4.6.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.6.3 KEY PRICING STRATEGIES

4.6.4 INTERVIEWS WITH SPECIALISTS

4.6.5 ANALYSIS AND RECOMMENDATION

4.7 PATENT ANALYSIS-

4.7.1 GEOGRAPHIC DISTRIBUTION OF PATENT FILINGS

4.7.2 KEY APPLICANTS AND INNOVATORS

4.7.3 TECHNOLOGICAL DOMAINS (IPC CODES)

4.8 PUBLICATION TRENDS OVER TIME

4.8.1 CONCLUSION

4.9 EIMBURSEMENT FRAMEWORK

4.9.1 COSMETIC VS. MEDICAL USE – THE CORE DIVIDER

4.9.2 REGIONAL REIMBURSEMENT VARIATIONS

4.9.3 OUT-OF-POCKET SPENDING DOMINANCE

4.9.4 TRENDS IN HYBRID INSURANCE MODELS

4.9.5 IMPLICATIONS FOR MARKET GROWTH

4.1 SUPPLY CHAIN ECOSYSTEM

4.11 TECHNOLOGY ROADMAP

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.12.1 INNOVATION TRACKER

4.12.1.1 Bio-Remodeling & Platform Technologies

4.12.1.2 Smart Filler Design & Volume Efficiency

4.12.1.3 Next-Generation Delivery Systems

4.12.1.4 Green Chemistry and Bioplastics

4.12.1.5 Combination Modalities

4.12.2 STRATEGIC ANALYSIS

4.12.2.1 M&A and Market Consolidation

4.12.2.2 Geographical Expansion & Localization Strategies

4.12.2.3 Regulatory Milestones

4.12.2.4 Marketing & Consumer Engagement

4.12.2.5 Strategic Partnerships & Distribution Rights

4.12.3 CONCLUSION

5 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS AND IMPORT VS. LOCAL PRODUCTION OUTLOOK

5.1 VENDOR SELECTION CRITERIA AND ITS IMPACT ON THE SUPPLY CHAIN

5.2 RAW MATERIAL PROCUREMENT, MANUFACTURING, AND DISTRIBUTION DYNAMICS

5.3 PRICE PITCHING AND COMPETITIVE POSITIONING IN THE MARKET

5.4 INDUSTRY RESPONSE: SUPPLY CHAIN OPTIMIZATION AND JOINT VENTURES

5.5 IMPACT OF REGULATORY FRAMEWORKS AND INCENTIVES ON PRICES

5.6 GEOPOLITICAL FACTORS AND TRADE AGREEMENTS SHAPING THE MARKET

5.7 INDUSTRIAL DEVELOPMENT SCHEMES AND INFRASTRUCTURE INITIATIVES

6 REGULATORY FRAMEWORK

6.1 NORTH AMERICA

6.1.1 REGULATORY AUTHORITIES:

6.1.2 REGULATORY CLASSIFICATIONS:

6.1.3 REGULATORY SUBMISSIONS:

6.1.4 INTERNATIONAL HARMONIZATION:

6.1.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.2 SOUTH AMERICA

6.2.1 REGULATORY AUTHORITIES:

6.2.2 REGULATORY CLASSIFICATIONS:

6.2.3 REGULATORY SUBMISSIONS:

6.2.4 INTERNATIONAL HARMONIZATION:

6.2.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.2.6 REGULATORY CHALLENGES AND STRATEGIES:

6.3 EUROPE

6.3.1 REGULATORY AUTHORITIES:

6.3.2 REGULATORY CLASSIFICATIONS:

6.3.3 REGULATORY SUBMISSIONS:

6.3.4 INTERNATIONAL HARMONIZATION:

6.3.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.3.6 REGULATORY CHALLENGES AND STRATEGIES:

6.4 ASIA-PACIFIC

6.4.1 REGULATORY AUTHORITIES:

6.4.2 REGULATORY CLASSIFICATIONS:

6.4.3 REGULATORY SUBMISSIONS:

6.4.4 INTERNATIONAL HARMONIZATION:

6.4.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.4.6 REGULATORY CHALLENGES AND STRATEGIES:

6.5 MIDDLE EAST AND AFRICA

6.5.1 REGULATORY AUTHORITIES:

6.5.2 REGULATORY CLASSIFICATIONS:

6.5.3 REGULATORY SUBMISSIONS:

6.5.4 INTERNATIONAL HARMONIZATION:

6.5.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS:

6.5.6 REGULATORY CHALLENGES AND STRATEGIES:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR MINIMALLY INVASIVE COSMETIC PROCEDURES

7.1.2 RISING INFLUENCE OF SOCIAL MEDIA AND CELEBRITY CULTURE

7.1.3 INCREASING ACCEPTANCE OF COSMETIC ENHANCEMENTS AMONG MILLENNIALS AND GEN Z

7.1.4 RISING POPULARITY OF COMBINATION TREATMENTS

7.2 RESTRAINTS

7.2.1 HIGH COST OF AESTHETIC INJECTABLE PROCEDURES

7.2.2 SHORT-TERM EFFECTIVENESS OF CERTAIN FILLERS

7.3 OPPORTUNITIES

7.3.1 EXPANSION IN EMERGING MARKETS

7.3.2 PRODUCT INNOVATION AND PERSONALIZED SOLUTIONS

7.3.3 BROADENING INTO ADDITIONAL THERAPEUTIC AREAS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS IN CERTAIN REGIONS

7.4.2 COUNTERFEIT AND UNREGULATED PRODUCTS

8 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIODEGRADABLE AESTHETIC INJECTABLE FILLERS

8.2.1 TEMPORARY BIODEGRADABLE

8.2.2 SEMI-PERMANENT BIODEGRADABLE

8.3 NON-BIODEGRADABLE AESTHETIC INJECTABLE FILLERS

9 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 NATURAL AESTHETIC INJECTABLE FILLERS

9.2.1 HYALURONIC ACID (HA)

9.2.1.1 MONOPHASIC FILLERS

9.2.1.1.1 HYALURONIC ACID + LIDOCAINE

9.2.1.1.2 MONODENSIFIED

9.2.1.1.3 POLYDENSIFIES

9.2.1.1.4 FACIAL LINE CORRECTION

9.2.1.1.5 LIP ENHANCEMENT

9.2.1.1.6 FACE LIFT

9.2.1.1.7 RHINOPLASTY

9.2.1.1.8 SCAR TREATMENT

9.2.1.1.9 SAGGING SKIN

9.2.1.1.10 CHEEK DEPRESSION

9.2.1.1.11 DENTISTRY

9.2.1.1.12 RECONSTRUCTIVE SURGERY

9.2.1.1.13 AESTHETIC RESTORATION

9.2.1.1.14 CHIN AUGMENTATION

9.2.1.1.15 LIPOATROPHY TREATMENT

9.2.1.1.16 SKIN SMOOTHING

9.2.1.1.17 EARLOBE REJUVENATION

9.2.1.1.18 OTHERS.

9.2.1.2 BIPHASIC FILLERS

9.2.1.2.1 HYALURONIC ACID + LIDOCAINE

9.2.1.2.2 SINGLE-PHASE

9.2.1.2.3 DUPLEX-PHASE

9.2.1.2.4 FACIAL LINE CORRECTION

9.2.1.2.5 LIP ENHANCEMENT

9.2.1.2.6 FACE LIFT

9.2.1.2.7 RHINOPLASTY

9.2.1.2.8 SCAR TREATMENT

9.2.1.2.9 SAGGING SKIN

9.2.1.2.10 CHEEK DEPRESSION

9.2.1.2.11 DENTISTRY

9.2.1.2.12 RECONSTRUCTIVE SURGERY

9.2.1.2.13 AESTHETIC RESTORATION

9.2.1.2.14 CHIN AUGMENTATION

9.2.1.2.15 LIPOATROPHY TREATMENT

9.2.1.2.16 SKIN SMOOTHING

9.2.1.2.17 EARLOBE REJUVENATION

9.2.1.2.18 OTHERS

9.2.2 FAT

9.2.2.1 FACIAL LINE CORRECTION

9.2.2.2 LIP ENHANCEMENT

9.2.2.3 FACE LIFT

9.2.2.4 RHINOPLASTY

9.2.2.5 SCAR TREATMENT

9.2.2.6 SAGGING SKIN

9.2.2.7 CHEEK DEPRESSION

9.2.2.8 RECONSTRUCTIVE SURGERY

9.2.2.9 DENTISTRY

9.2.2.10 AESTHETIC RESTORATION

9.2.2.11 LIPOATROPHY TREATMENT

9.2.2.12 CHIN AUGMENTATION

9.2.2.13 SKIN SMOOTHING

9.2.2.14 EARLOBE REJUVENATION

9.2.2.15 OTHERS

9.2.3 COLLAGEN

9.2.3.1 FACIAL LINE CORRECTION

9.2.3.2 LIP ENHANCEMENT

9.2.3.3 FACE LIFT

9.2.3.4 RHINOPLASTY

9.2.3.5 SCAR TREATMENT

9.2.3.6 SAGGING SKIN

9.2.3.7 CHEEK DEPRESSION

9.2.3.8 RECONSTRUCTIVE SURGERY

9.2.3.9 AESTHETIC RESTORATION

9.2.3.10 CHIN AUGMENTATION

9.2.3.11 DENTISTRY

9.2.3.12 LIPOATROPHY TREATMENT

9.2.3.13 SKIN SMOOTHING

9.2.3.14 EARLOBE REJUVENATION

9.2.3.15 OTHERS

9.2.4 POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN)

9.2.4.1 FACIAL LINE CORRECTION

9.2.4.2 LIP ENHANCEMENT

9.2.4.3 FACE LIFT

9.2.4.4 RHINOPLASTY

9.2.4.5 SCAR TREATMENT

9.2.4.6 SAGGING SKIN

9.2.4.7 CHEEK DEPRESSION

9.2.4.8 AESTHETIC RESTORATION

9.2.4.9 RECONSTRUCTIVE SURGERY

9.2.4.10 DENTISTRY

9.2.4.11 CHIN AUGMENTATION

9.2.4.12 LIPOATROPHY TREATMENT

9.2.4.13 SKIN SMOOTHING

9.2.4.14 EARLOBE REJUVENATION

9.2.4.15 OTHERS

9.2.5 OTHERS

9.2.5.1 FACIAL LINE CORRECTION

9.2.5.2 LIP ENHANCEMENT

9.2.5.3 FACE LIFT

9.2.5.4 RHINOPLASTY

9.2.5.5 SCAR TREATMENT

9.2.5.6 SAGGING SKIN

9.2.5.7 CHEEK DEPRESSION

9.2.5.8 RECONSTRUCTIVE SURGERY

9.2.5.9 AESTHETIC RESTORATION

9.2.5.10 DENTISTRY

9.2.5.11 CHIN AUGMENTATION

9.2.5.12 LIPOATROPHY TREATMENT

9.2.5.13 SKIN SMOOTHING

9.2.5.14 EARLOBE REJUVENATION

9.2.5.15 OTHERS

9.3 SYNTHETIC AESTHETIC INJECTABLE FILLERS

9.3.1 CALCIUM HYDROXYLAPATITE (CAHA)

9.3.1.1 FACIAL LINE CORRECTION

9.3.1.2 LIP ENHANCEMENT

9.3.1.3 FACE LIFT

9.3.1.4 RHINOPLASTY

9.3.1.5 SCAR TREATMENT

9.3.1.6 SAGGING SKIN

9.3.1.7 CHEEK DEPRESSION

9.3.1.8 RECONSTRUCTIVE SURGERY

9.3.1.9 AESTHETIC RESTORATION

9.3.1.10 DENTISTRY

9.3.1.11 CHIN AUGMENTATION

9.3.1.12 LIPOATROPHY TREATMENT

9.3.1.13 SKIN SMOOTHING

9.3.1.14 EARLOBE REJUVENATION

9.3.1.15 OTHERS

9.3.2 POLY-L-LACTIC ACID (PLLA)

9.3.2.1 FACIAL LINE CORRECTION

9.3.2.2 LIP ENHANCEMENT

9.3.2.3 FACE LIFT

9.3.2.4 RHINOPLASTY

9.3.2.5 SCAR TREATMENT

9.3.2.6 SAGGING SKIN

9.3.2.7 CHEEK DEPRESSION

9.3.2.8 RECONSTRUCTIVE SURGERY

9.3.2.9 AESTHETIC RESTORATION

9.3.2.10 DENTISTRY

9.3.2.11 CHIN AUGMENTATION

9.3.2.12 LIPOATROPHY TREATMENT

9.3.2.13 SKIN SMOOTHING

9.3.2.14 EARLOBE REJUVENATION

9.3.2.15 OTHERS

9.3.3 POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA)

9.3.3.1 FACIAL LINE CORRECTION

9.3.3.2 LIP ENHANCEMENT

9.3.3.3 FACE LIFT

9.3.3.4 RHINOPLASTY

9.3.3.5 SCAR TREATMENT

9.3.3.6 SAGGING SKIN

9.3.3.7 CHEEK DEPRESSION

9.3.3.8 RECONSTRUCTIVE SURGERY

9.3.3.9 AESTHETIC RESTORATION

9.3.3.10 DENTISTRY

9.3.3.11 CHIN AUGMENTATION

9.3.3.12 LIPOATROPHY TREATMENT

9.3.3.13 SKIN SMOOTHING

9.3.3.14 EARLOBE REJUVENATION

9.3.3.15 OTHERS

10 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.2.1 JUVEDERM

10.2.2 RESTYLANE

10.2.3 RADIESSE

10.2.4 SCULPTRA

10.2.5 ELLANSE

10.2.6 BELLAFILL

10.2.7 AQUAMID

10.2.8 ELEVESS

10.2.9 OTHERS

10.3 GENERIC

11 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FACIAL LINE CORRECTION

11.2.1 DYNAMIC WRINKLES

11.2.2 STATIC WRINKLES

11.2.3 WRINKLE FOLDS

11.2.4 LAUGH LINES

11.2.5 FOREHEAD LINES

11.2.6 WORRY LINES

11.2.7 CROW’S FEET

11.2.8 LIP LINES

11.2.9 MARIONETTE LINES

11.2.10 PUPPET WRINKLES

11.2.11 BUNNY LINES

11.2.12 OTHERS

11.2.13 JUVEDERM

11.2.14 RESTYLANE

11.2.15 BELOTERO

11.2.16 RADIESSE

11.2.17 OTHERS

11.3 LIP ENHANCEMENT

11.3.1 JUVÉDERM

11.3.1.1 JUVÉDERM XC

11.3.1.2 VOLUMA

11.3.1.3 VOLBELLA

11.3.1.4 VOLLURE

11.3.2 RESTYLANE

11.3.2.1 RESTYLANE LYFT

11.3.2.2 RESTYLANE KYSSE

11.3.2.3 RESTYLANE CONTOUR

11.3.2.4 RESTYLANE REFYNE

11.3.2.5 RESTYLANE SILK

11.3.3 BELOTERO BALANCE

11.3.4 RHA

11.3.4.1 RHA 2

11.3.4.2 RHA 3

11.3.4.3 RHA 4

11.3.5 REVANESSE VERSA

11.3.6 HYLAFORM

11.3.7 ELEVESS

11.3.8 PREVELLE SILK

11.3.9 OTHERS

11.4 FACE LIFT

11.4.1 DEEP PLANE/SMAS FACELIFT

11.4.2 MINI FACELIFT

11.4.3 MID-FACELIFT

11.4.4 LIQUID FACELIFT

11.4.5 CHEEK LIFT

11.4.6 JAW LINE REJUVENATION

11.4.7 S-LIFT

11.4.8 CUTANEOUS LIFT

11.4.9 TEMPORAL/BROW LIFT

11.4.10 OTHERS

11.4.11 JUVEDERM

11.4.12 RESTYLANE

11.4.13 SCULPTRA

11.4.14 DYSPORT

11.4.15 OTHERS

11.5 RHINOPLASTY

11.5.1 JUVÉDERM

11.5.1.1 VOLUMA

11.5.1.2 VOLBELLA

11.5.1.3 JUVÉDERM XC

11.5.1.4 VOLLURE

11.5.2 RESTYLANE

11.5.2.1 RESTYLANE LYFT

11.5.2.2 RESTYLANE SILK

11.5.2.3 RESTYLANE REFYNE

11.5.2.4 RESTYLANE KYSSE

11.5.2.5 RESTYLANE CONTOUR

11.5.3 BELOTERO BALANCE

11.5.4 REVANESSE VERSA

11.5.5 RHA

11.5.5.1 RHA 2

11.5.5.2 RHA 3

11.5.5.3 RHA 4

11.5.6 HYLAFORM

11.5.7 ELEVESS

11.5.8 PREVELLE SILK

11.5.9 OTHERS

11.6 SCAR TREATMENT

11.6.1 ACNE SCARS

11.6.2 HYPERTROPHIC SCARS

11.6.3 KELOID SCARS

11.6.4 CONTRACTURE SCARS

11.6.5 OTHERS

11.6.6 JUVEDERM

11.6.7 RESTYLANE

11.6.8 RADIESSE

11.6.9 BELOTERO

11.6.10 PERLANE

11.6.11 OTHERS

11.7 SAGGING SKIN

11.7.1 BOLETERO

11.7.2 RESTYLANE

11.7.3 JUVEDERM

11.7.4 OTHERS

11.8 CHEEK DEPRESSION

11.8.1 JUVEDERM VOLUMA

11.8.2 RESTYLANE-LYFT

11.8.3 SCULPTRA

11.8.4 RADIESSE

11.8.5 OTHERS

11.9 RECONSTRUCTIVE SURGERY

11.9.1 JUVEDERM

11.9.2 RESTYLANE

11.9.3 OTHERS

11.1 AESTHETIC RESTORATION

11.10.1 JUVÉDERM

11.10.1.1 JUVEDERM ULTRA XC

11.10.1.2 JUVEDERM VOLBELLA XC

11.10.1.3 JUVEDERM VOLLURE XC

11.10.2 RESTYLANE

11.10.2.1 RESTYLANE LYFT

11.10.2.2 RESTYLANE-L

11.10.2.3 RESTYLANE REFYNE AND DEFYNE

11.10.2.4 RESTYLANE SILK

11.10.3 SCULPTRA

11.10.4 RADIESSE

11.10.5 RHA

11.10.5.1 RHA 2

11.10.5.2 RHA 3

11.10.5.3 RHA 4

11.10.6 REVANESSE VERSA

11.10.7 BELOTERO BALANCE

11.10.8 BELLAFILL

11.10.9 OTHERS

11.11 DENTISTRY

11.11.1 JUVEDERM

11.11.2 RESTYLANE

11.11.3 RADIESSE

11.11.4 OTHERS

11.12 CHIN AUGMENTATION

11.12.1 JUVEDERM VOLUMA XC

11.12.2 RESTYLANE DEFYNE

11.12.3 OTHERS

11.13 LIPOATROPHY TREATMENT

11.13.1 SCULPTRA

11.13.2 OTHERS

11.14 SKIN SMOOTHING

11.14.1 RESTYLANE

11.14.2 BELOTERO

11.14.3 BELLAFIL

11.14.4 OTHERS

11.15 EARLOBE REJUVENATION

11.15.1 SCULPTRA

11.15.2 RESTYLANE

11.15.3 ELLANSÉ

11.15.4 BELOTERO

11.15.5 JUVEDERM

11.15.6 OTHERS

11.16 OTHERS

12 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY END USER

12.1 OVERVIEW

12.2 DERMATOLOGY CLINICS

12.3 HOSPITALS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER/DIRECT DISTRIBUTION

13.3 DRUG STORES

13.4 ONLINE PHARMACY

13.5 OTHERS

14 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY REGION

14.1 MIDDLE EAST AND NORTH AFRICA

14.1.1 U.A.E.

14.1.2 SAUDI ARABIA

14.1.3 EGYPT

14.1.4 ISRAEL

14.1.5 BAHRAIN

14.1.6 TURKEY

14.1.7 KUWAIT

14.1.8 OMAN

14.1.9 REST OF MIDDLE EAST & NORTH AFRICA

15 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MEA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ALLERGAN AESTHETICS

17.1.1 COMPANY SNAPSHOTS

17.1.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 GALDERMA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 MERZ PHARMA

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 HUGEL, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 LG CHEM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AMALIAN

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 BIOSCIENCE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 BIOPLUS CO. LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 BIOXIS PHARMACEUTICALS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 CONTURA INTERNATIONAL LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CROMA-PHARMA GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 HUONS GLOBAL

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 HUMEDIX

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 IBSA INSTITUT BIOCHIMIQUE SA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 JALUPRO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LABORATORIES VIVACY

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 LABORATORIES FILLMED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 MEDYTOX INC

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 MESOESTETIC

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 PETRONE GROUP

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PREMIER MEDICAL GROUP

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 PROLLENIUM MEDICAL TECHNOLOGIES

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 REVANCE

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 SINCLAIR

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 SHANGHAI REYOUNGEL MEDICAL TECHNOLOGY COMPANY LIMITED

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SOSUM GLOBAL

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 TIGER AESTHETICS MEDICAL, LLC

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 TEOXANE

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 VIDA SRL.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 ZHEJIANG JINGJIA MEDICAL TECHNOLOGY CO., LTD.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 3 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 4 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 7 MIDDLE EAST AND AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 8 MIDDLE EAST AND AFRICA NON-BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 11 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 12 MIDDLE EAST AND AFRICA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE, 2018-2036 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA GENERIC IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY LOCATION, 2018-2036 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA SKIN SMOOTHING IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA SKIN SMOOTHENING IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY END USER, 2018-2036 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA DERMATOLOGY CLINICS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA HOSPITALS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA AMBULATORY SURGICAL CENTERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2018-2036 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA DIRECT TENDER/DIRECT DISTRIBUTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA DRUG STORES IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA ONLINE PHARMACY IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY REGION, 2018-2036 (USD THOUSAND)

TABLE 85 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY COUNTRY, 2018-2036 (USD THOUSAND)

TABLE 86 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 87 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 88 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 89 MIDDLE EAST & NORTH AFRICA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 90 MIDDLE EAST & NORTH AFRICA HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 91 MIDDLE EAST & NORTH AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 92 MIDDLE EAST & NORTH AFRICA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 93 MIDDLE EAST & NORTH AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 94 MIDDLE EAST & NORTH AFRICA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 95 MIDDLE EAST & NORTH AFRICA FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 96 MIDDLE EAST & NORTH AFRICA COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 97 MIDDLE EAST & NORTH AFRICA POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 98 MIDDLE EAST & NORTH AFRICA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 99 MIDDLE EAST & NORTH AFRICA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 100 MIDDLE EAST & NORTH AFRICA CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 101 MIDDLE EAST & NORTH AFRICA POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 102 MIDDLE EAST & NORTH AFRICA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 103 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 104 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 105 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 106 MIDDLE EAST & NORTH AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 107 MIDDLE EAST & NORTH AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 108 MIDDLE EAST & NORTH AFRICA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 109 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 110 MIDDLE EAST & NORTH AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 111 MIDDLE EAST & NORTH AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY LOCATION, 2018-2036 (USD THOUSAND)

TABLE 112 MIDDLE EAST & NORTH AFRICA FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 113 MIDDLE EAST & NORTH AFRICA LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 114 MIDDLE EAST & NORTH AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 115 MIDDLE EAST & NORTH AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 116 MIDDLE EAST & NORTH AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 117 MIDDLE EAST & NORTH AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 118 MIDDLE EAST & NORTH AFRICA FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 119 MIDDLE EAST & NORTH AFRICA RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 120 MIDDLE EAST & NORTH AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 121 MIDDLE EAST & NORTH AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 122 MIDDLE EAST & NORTH AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 123 MIDDLE EAST & NORTH AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 124 MIDDLE EAST & NORTH AFRICA SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 125 MIDDLE EAST & NORTH AFRICA SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 126 MIDDLE EAST & NORTH AFRICA CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 127 MIDDLE EAST & NORTH AFRICA RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 128 MIDDLE EAST & NORTH AFRICA AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 129 MIDDLE EAST & NORTH AFRICA JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 130 MIDDLE EAST & NORTH AFRICA RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 131 MIDDLE EAST & NORTH AFRICA RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 132 MIDDLE EAST & NORTH AFRICA DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 133 MIDDLE EAST & NORTH AFRICA CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 134 MIDDLE EAST & NORTH AFRICA LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 135 MIDDLE EAST & NORTH AFRICA SKIN SMOOTHENING IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 136 MIDDLE EAST & NORTH AFRICA EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 137 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE, 2018-2036 (USD THOUSAND)

TABLE 138 MIDDLE EAST & NORTH AFRICA BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 139 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY END USER, 2018-2036 (USD THOUSAND)

TABLE 140 MIDDLE EAST & NORTH AFRICA AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2018-2036 (USD THOUSAND)

TABLE 141 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 142 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 143 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 144 U.A.E. NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 145 U.A.E. HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 146 U.A.E. MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 147 U.A.E. MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 148 U.A.E. BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 149 U.A.E. BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 150 U.A.E. FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 151 U.A.E. COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 152 U.A.E. POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 153 U.A.E. OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 154 U.A.E. SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 155 U.A.E. CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 156 U.A.E. POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 157 U.A.E. POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 158 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 159 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 160 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 161 U.A.E. BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 162 U.A.E. BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 163 U.A.E. BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 164 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 165 U.A.E. FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 166 U.A.E. FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY LOCATION, 2018-2036 (USD THOUSAND)

TABLE 167 U.A.E. FACIAL LINE CORRECTION IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 168 U.A.E. LIP ENHANCEMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 169 U.A.E. JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 170 U.A.E. RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 171 U.A.E. RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 172 U.A.E. FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 173 U.A.E. FACE LIFT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 174 U.A.E. RHINOPLASTY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 175 U.A.E. JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 176 U.A.E. RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 177 U.A.E. RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 178 U.A.E. SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 179 U.A.E. SCAR TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY BRAND, 2018-2036 (USD THOUSAND)

TABLE 180 U.A.E. SAGGING SKIN IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 181 U.A.E. CHEEK DEPRESSION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 182 U.A.E. RECONSTRUCTIVE SURGERY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 183 U.A.E. AESTHETIC RESTORATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 184 U.A.E. JUVÉDERM IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 185 U.A.E. RESTYLANE IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 186 U.A.E. RHA IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 187 U.A.E. DENTISTRY IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 188 U.A.E. CHIN AUGMENTATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 189 U.A.E. LIPOATROPHY TREATMENT IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 190 U.A.E. SKIN SMOOTHENING IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 191 U.A.E. EARLOBE REJUVENATION IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 192 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY DRUG TYPE, 2018-2036 (USD THOUSAND)

TABLE 193 U.A.E. BRANDED IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 194 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY END USER, 2018-2036 (USD THOUSAND)

TABLE 195 U.A.E. AESTHETIC INJECTABLE FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2018-2036 (USD THOUSAND)

TABLE 196 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (USD THOUSAND)

TABLE 197 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 198 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY PRODUCT TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 199 SAUDI ARABIA NATURAL AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 200 SAUDI ARABIA HYALURONIC ACID (HA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 201 SAUDI ARABIA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 202 SAUDI ARABIA MONOPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 203 SAUDI ARABIA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY MATERIAL TYPE, 2018-2036 (USD THOUSAND)

TABLE 204 SAUDI ARABIA BIPHASIC FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 205 SAUDI ARABIA FAT IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 206 SAUDI ARABIA COLLAGEN IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 207 SAUDI ARABIA POLYNUCLEOTIDES / POLYDEOXYRIBONUCLEOTIDES (PN/PDRN) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 208 SAUDI ARABIA OTHERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 209 SAUDI ARABIA SYNTHETIC AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 210 SAUDI ARABIA CALCIUM HYDROXYLAPATITE (CAHA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 211 SAUDI ARABIA POLY-L-LACTIC ACID (PLLA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 212 SAUDI ARABIA POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN AESTHETIC INJECTABLE FILLERS MARKET, BY APPLICATION, 2018-2036 (USD THOUSAND)

TABLE 213 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 214 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 215 SAUDI ARABIA AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)

TABLE 216 SAUDI ARABIA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (USD THOUSAND)

TABLE 217 SAUDI ARABIA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (VOLUME IN THOUSAND UNITS)

TABLE 218 SAUDI ARABIA BIODEGRADABLE AESTHETIC INJECTABLE FILLERS IN AESTHETIC INJECTABLE FILLERS MARKET, BY TYPE, 2018-2036 (ASP IN USD/UNITS)