North America Construction Management Software Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.73 Billion

USD

3.08 Billion

2024

2032

USD

1.73 Billion

USD

3.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.73 Billion | |

| USD 3.08 Billion | |

|

|

|

|

Segmentação do mercado de software de gestão de construção na América do Norte, por oferta (soluções e serviços), tipo de dispositivo (smartphones e computadores), tipo de edifício (edifícios comerciais e residenciais), tipo de implantação (nuvem e local), modelo de preços (baseado em licenças e por assinatura), aplicação (pré-construção, gestão e planejamento de projetos, gestão de recursos, gestão financeira, software de gestão de relacionamento com o cliente , segurança e relatórios, gestão de serviços de campo, contabilidade de custos, projeto e outros), setor vertical (construtoras e empreiteiras, empresas de construção, engenheiros, arquitetos e outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de software de gerenciamento de construção na América do Norte

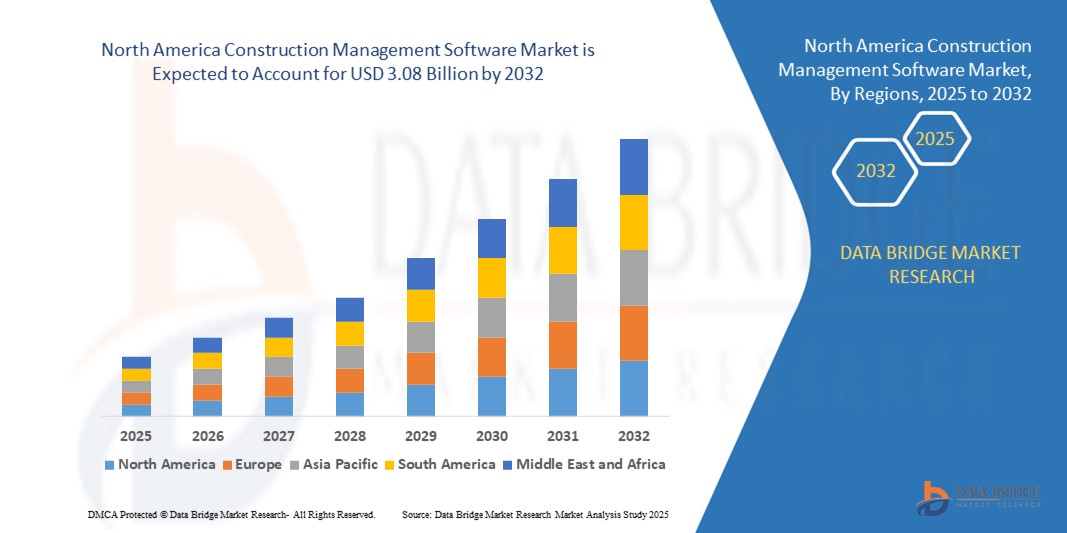

- O mercado de software de gestão de construção na América do Norte foi avaliado em US$ 1,73 bilhão em 2024 e deverá atingir US$ 3,08 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 7,50% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela expansão do setor da construção civil e pela crescente adoção de ferramentas digitais de planejamento de projetos na América do Norte, motivadas pela rápida urbanização, projetos de modernização da infraestrutura e pela crescente demanda por processos de construção econômicos e dentro do prazo. A transição para plataformas digitais na construção civil está sendo acelerada por investimentos governamentais em cidades inteligentes, infraestrutura pública e empreendimentos imobiliários, principalmente nos EUA e no Canadá.

- Além disso, a crescente demanda de empreiteiras e incorporadoras por plataformas de rastreamento de dados em nuvem, colaborativas e em tempo real está consolidando o software de gerenciamento de construção como uma necessidade operacional essencial na região. Esses fatores convergentes estão acelerando a adoção de soluções avançadas de software de gerenciamento de construção, impulsionando significativamente o crescimento do setor em projetos de construção públicos e privados na América do Norte.

Análise do mercado de software de gerenciamento de construção na América do Norte

- As soluções de software para gestão de construção na América do Norte estão se tornando cada vez mais vitais para garantir a execução eficiente de projetos, o controle de custos e a conformidade com as normas em projetos residenciais, comerciais e de infraestrutura. Essas plataformas permitem a colaboração em tempo real, a gestão de recursos, o planejamento e a documentação — elementos essenciais para otimizar os fluxos de trabalho da construção e minimizar atrasos.

- A crescente ênfase da região na transformação digital do setor da construção, aliada ao aumento dos investimentos em infraestrutura, à escassez de mão de obra e à necessidade de plataformas de dados centralizadas, está impulsionando a adoção de softwares de gestão de obras nos setores público e privado.

- Os EUA dominaram o mercado de software de gestão de construção na América do Norte, com a maior participação de receita, de 40,2% em 2024, impulsionados pela presença de grandes fornecedores de software, pelo rápido desenvolvimento urbano e pela ampla implementação de ferramentas de gestão de projetos baseadas em nuvem por empreiteiras, arquitetos e gerentes de projeto.

- Prevê-se que o Canadá seja o país com o crescimento mais rápido no mercado de software de gestão de construção na América do Norte, com uma taxa de crescimento anual composta (CAGR) de 9,85% entre 2025 e 2032, impulsionada pelo aumento dos esforços de modernização da infraestrutura, pela adoção do BIM (Modelagem da Informação da Construção) e por parcerias público-privadas nos setores de transporte, energia e habitação.

- O segmento baseado em assinatura dominou o mercado de software de gestão de construção na América do Norte em 2024, com uma participação de 69,4% na receita, impulsionado pela sua acessibilidade para PMEs e pela tendência de modelos SaaS que oferecem atualizações contínuas e suporte ao cliente.

Escopo do relatório e segmentação do mercado de software de gerenciamento de construção na América do Norte

|

Atributos |

Análise do mercado de software de gestão de construção na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de software de gestão de construção na América do Norte

Crescente integração de tecnologias de automação digital e conformidade no mercado de software de gestão de construção na América do Norte

- Uma tendência significativa que molda o mercado de software de gestão de construção na América do Norte é a rápida integração da automação, plataformas em nuvem e ferramentas de conformidade regulatória nos fluxos de trabalho da construção civil. Essas tecnologias estão transformando a maneira como as empresas de construção gerenciam projetos complexos, aumentam a produtividade e atendem aos padrões do setor.

- O software de gestão de construção baseado na nuvem está ganhando popularidade por permitir a colaboração em tempo real entre várias equipes, melhorar a visibilidade do projeto e reduzir a burocracia. Essas plataformas ajudam as partes interessadas a monitorar cronogramas, orçamentos, materiais e mão de obra remotamente, aumentando a eficiência operacional em projetos de infraestrutura de grande escala nos EUA e no Canadá.

- Soluções baseadas em IoT e IA estão sendo cada vez mais incorporadas em plataformas de construção para monitorar as condições do canteiro de obras, rastrear o uso de equipamentos e detectar possíveis atrasos ou riscos. Esse uso proativo de dados em tempo real permite que as empresas respondam rapidamente e otimizem a alocação de recursos.

- A adoção da integração do Building Information Modeling (BIM) com softwares de gerenciamento de construção também está em ascensão. Essa sinergia permite aprimorar a modelagem 3D, a detecção de conflitos e a precisão do planejamento, que são vitais para empreendimentos urbanos complexos e projetos de infraestrutura pública em toda a América do Norte.

- Para cumprir as normas da OSHA, LEED e regulamentações locais, as empresas de construção estão implementando módulos de gestão de conformidade em plataformas de software para rastrear licenças, inspeções, certificações de segurança do trabalho e indicadores ambientais.

- Fluxos de trabalho automatizados e plataformas compatíveis com dispositivos móveis estão simplificando funções como processamento de RFI (Solicitação de Informação), rastreamento de ordens de alteração, listas de pendências e relatórios diários, reduzindo a carga administrativa e agilizando a tomada de decisões.

- As empresas de construção também estão utilizando ferramentas integradas de gestão financeira e de contratos nessas plataformas para garantir a responsabilidade, evitar estouros de orçamento e cumprir as normas de auditoria locais e federais.

- Essa convergência de automação, computação em nuvem, conformidade e relatórios em tempo real está remodelando o cenário digital da indústria da construção na América do Norte, posicionando a região para um crescimento tecnológico contínuo e melhores resultados de projetos até 2032.

Dinâmica do mercado de software de gestão de construção na América do Norte

Motorista

Demanda crescente devido à expansão de projetos de infraestrutura e às necessidades de construção digital.

- O mercado de software de gestão de construção na América do Norte está testemunhando um forte crescimento, impulsionado pelo aumento do desenvolvimento de infraestrutura, pela crescente complexidade dos projetos de construção e pela necessidade de colaboração em tempo real e acompanhamento da conformidade em obras de grande escala.

- Com investimentos significativos direcionados a projetos de transporte, saúde, comércio e residenciais — particularmente no âmbito da Lei de Investimento e Empregos em Infraestrutura dos EUA — empreiteiras e proprietários de projetos estão priorizando a adoção de plataformas de gerenciamento de construção integradas e baseadas em nuvem para melhorar o controle de custos, a documentação e a eficiência no canteiro de obras.

- A crescente necessidade de entrega digital de projetos, incluindo a integração do Building Information Modeling (BIM), está impulsionando a implementação de ferramentas de software que otimizam o planejamento, o orçamento, a alocação de recursos e a conformidade regulatória.

- O Canadá e os EUA estão na vanguarda do desenvolvimento de cidades inteligentes e iniciativas de construção sustentável, o que exige maior coordenação entre arquitetos, engenheiros e empreiteiros — algo possibilitado por plataformas centralizadas para automação de fluxos de trabalho, registros de inspeção, gerenciamento de solicitações de informação (RFI) e acompanhamento do progresso.

- Além disso, a crescente escassez de mão de obra e o aumento dos custos das matérias-primas estão impulsionando as empreiteiras a adotarem ferramentas de previsão baseadas em IA, análises preditivas e gerenciamento de campo móvel — tornando a transformação digital uma necessidade estratégica, e não uma opção.

Restrição/Desafio

Altos custos de software e barreiras de implementação para pequenas empresas contratadas.

- Apesar dos benefícios evidentes, o mercado de software de gestão de construção na América do Norte enfrenta limitações, especialmente entre pequenas e médias empresas, devido aos altos custos iniciais de licenciamento, treinamento e resistência à mudança de fluxo de trabalho.

- Práticas tradicionais, como planilhas e processos manuais, ainda são comuns entre empreiteiras de pequeno porte que não possuem orçamento ou conhecimento técnico para implementar plataformas totalmente integradas.

- A personalização e a escalabilidade também continuam sendo preocupações, visto que algumas plataformas prontas para uso são muito rígidas ou complexas demais para projetos com escopo limitado ou processos não padronizados.

- Em canteiros de obras rurais e remotos, os problemas de conectividade continuam a dificultar o uso eficaz de ferramentas baseadas na nuvem e o acesso a dados em tempo real, limitando a adoção digital plena.

- Para mitigar essas restrições, os fornecedores de software estão oferecendo cada vez mais modelos de preços modulares baseados em assinatura, designs que priorizam dispositivos móveis e APIs fáceis de integrar, permitindo uma integração digital gradual sem interromper as operações principais.

Escopo do mercado de software de gerenciamento de construção na América do Norte

O mercado é segmentado com base na oferta, tipo de dispositivo, tipo de edifício, tipo de implantação, modelo de preços, aplicação e setor vertical.

- Ao oferecer

Com base na oferta, o mercado de software de gestão de construção na América do Norte é segmentado em soluções e serviços. O segmento de soluções dominou o mercado com a maior participação na receita, de 58,7% em 2024, devido à alta demanda por software de construção integrado que possa gerenciar múltiplos fluxos de trabalho, como planejamento, orçamento e documentação em tempo real. Essas plataformas ajudam as empresas a otimizar as operações, melhorar a colaboração e reduzir atrasos nos projetos.

Prevê-se que o segmento de serviços apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 11,6%, entre 2025 e 2032, impulsionado pela crescente necessidade de treinamento, consultoria e suporte pós-implantação entre pequenas e médias empresas de construção que adotam ferramentas digitais pela primeira vez.

- Por tipo de dispositivo

Com base no tipo de dispositivo, o mercado de software de gestão de construção na América do Norte é segmentado em smartphones e computadores. O segmento de computadores representou a maior participação de mercado, com 64,3% em 2024, impulsionado pelo seu uso generalizado entre arquitetos e gerentes de projeto para tarefas de projeto detalhado, geração de relatórios e análise.

Prevê-se que o segmento de smartphones cresça à taxa composta de crescimento anual (CAGR) mais rápida, de 13,2%, entre 2025 e 2032, impulsionado pela crescente tendência de soluções "mobile-first" que permitem aos trabalhadores de campo e supervisores de obra acessar e atualizar informações do projeto remotamente e em tempo real.

- Por tipo de edifício

Com base no tipo de construção, o mercado de software de gestão de obras na América do Norte é segmentado em edifícios comerciais e residenciais. O segmento de edifícios comerciais detinha a maior participação na receita de mercado, com 61,5% em 2024, devido aos altos investimentos em infraestrutura, escritórios, centros comerciais e edifícios industriais, onde o planejamento e a coordenação de projetos complexos são essenciais.

Prevê-se que o segmento de edifícios residenciais apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 10,9%, entre 2025 e 2032, impulsionado pelo aumento de projetos habitacionais urbanos, pela procura de casas modulares e pela crescente adoção de tecnologia de construção na arquitetura e planeamento residencial.

- Por tipo de implantação

Com base no tipo de implantação, o mercado de software de gerenciamento de construção na América do Norte é segmentado em nuvem e local (on-premises). O segmento de nuvem dominou o mercado com uma participação de 67,1% em 2024, devido à flexibilidade, aos menores custos iniciais e à facilidade de acesso oferecidos pelas plataformas baseadas em nuvem, especialmente para equipes de projeto geograficamente dispersas.

Prevê-se que o segmento de soluções locais (on-premises) cresça de forma constante de 2025 a 2032, impulsionado por grandes empresas que buscam alta personalização e maior controle de dados em sistemas internos seguros.

- Por modelo de precificação

Com base no modelo de preços, o mercado de software de gestão de construção na América do Norte é segmentado em software baseado em licenças e software baseado em assinaturas. O segmento baseado em assinaturas liderou o mercado em 2024, com uma participação de 69,4% na receita, impulsionado pela sua acessibilidade para pequenas e médias empresas (PMEs) e pela tendência de modelos SaaS que oferecem atualizações contínuas e suporte ao cliente.

O segmento baseado em licenças deverá apresentar um crescimento moderado entre 2025 e 2032, sendo utilizado principalmente por grandes empreiteiras e empresas que preferem compras únicas e amplo controle sobre o uso do software.

- Por meio de aplicação

Com base na aplicação, o mercado de software de gestão de construção na América do Norte é segmentado em pré-construção, gestão e planejamento de projetos, gestão de recursos, gestão financeira, software de gestão de relacionamento com o cliente (CRM), segurança e relatórios, gestão de serviços de campo, contabilidade de custos, projeto e outros. O segmento de gestão e planejamento de projetos detinha a maior participação de mercado, com 29,3% em 2024, impulsionado pela crescente complexidade dos projetos de construção e pela necessidade de alocação eficiente de tarefas, cumprimento de prazos e acompanhamento de marcos.

Prevê-se que o segmento de gestão de serviços de campo registre a maior taxa de crescimento anual composta (CAGR) de 12,7% entre 2025 e 2032, devido ao foco crescente na coleta de dados em tempo real no local, na gestão da força de trabalho e no monitoramento de equipamentos.

- Por Vertical

Com base no setor vertical, o mercado de software de gestão de construção na América do Norte é segmentado em construtoras e empreiteiras, empresas de construção, engenheiros, arquitetos e outros. O segmento de construtoras e empreiteiras dominou o mercado com uma participação de 37,6% em 2024, impulsionado pela crescente adoção de ferramentas digitais para orçamento, coordenação de subempreiteiros e operações no canteiro de obras.

Prevê-se que o segmento de engenheiros e arquitetos apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 11,8% entre 2025 e 2032, à medida que esses profissionais dependem cada vez mais de plataformas de software para integração BIM, análise estrutural e projeto colaborativo.

Análise Regional do Mercado de Software de Gestão de Construção na América do Norte

- A América do Norte representou 33% da receita global do mercado de software de gerenciamento de construção em 2024, impulsionada pelo aumento dos investimentos em infraestrutura, pela rápida digitalização dos fluxos de trabalho da construção e pela crescente adoção de ferramentas de gerenciamento de projetos baseadas em nuvem nos EUA, Canadá e México.

- Os sistemas de software de gestão de construção desempenham um papel cada vez mais vital na otimização do planejamento, controle de custos, gestão de documentos e colaboração em tempo real em projetos de infraestrutura públicos e privados na região.

- A demanda está sendo impulsionada por programas de modernização de infraestrutura em larga escala, regulamentações rigorosas de códigos de construção e pela crescente necessidade de coordenação eficiente das partes interessadas em empreendimentos de construção complexos e multifásicos.

Análise do Mercado de Software de Gestão de Construção nos EUA e na América do Norte

O mercado global de software de gestão de construção dos EUA dominou o mercado da América do Norte com a maior participação de receita, de 40,2% em 2024, impulsionado pela presença de grandes fornecedores de software, pelo rápido desenvolvimento urbano e pela ampla implementação de soluções de construção baseadas em nuvem. A alta adoção do BIM (Modelagem da Informação da Construção), aplicativos móveis para campo e ferramentas de análise com inteligência artificial está transformando a maneira como as construtoras nos EUA gerenciam estimativas de custos, cronogramas, coordenação de subempreiteiros e monitoramento de conformidade. Os investimentos governamentais apoiados pela Lei de Investimento em Infraestrutura e Empregos (IIJA) estão acelerando ainda mais a transição para a execução digital de projetos de construção.

Análise do mercado de software de gestão de construção no Canadá e na América do Norte

Prevê-se que o mercado canadense de software de gestão de construção seja o de crescimento mais rápido na América do Norte, registrando uma taxa de crescimento anual composta (CAGR) de 9,85% entre 2025 e 2032, impulsionado por esforços nacionais de modernização da infraestrutura, particularmente em transporte público, habitação e energias renováveis. A adoção de padrões BIM, a crescente ênfase em construções sustentáveis e ecológicas e a colaboração intersetorial entre autoridades públicas e incorporadoras privadas estão impulsionando a adoção de plataformas de entrega integrada de projetos (IPD) em todo o país. Programas de infraestrutura federais e provinciais estão incentivando o uso de ferramentas digitais para melhorar a transparência, a eficiência de custos e a rastreabilidade dos projetos.

Análise do Mercado de Software de Gestão de Construção no México e América do Norte

O mercado global de software de gestão de construção no México está emergindo como um mercado em crescimento, impulsionado pelo desenvolvimento de infraestrutura em transporte, centros logísticos e parques industriais — particularmente perto da fronteira entre os EUA e o México. O crescimento também é alimentado por uma base crescente de empreiteiras e empresas de engenharia que adotam ferramentas digitais para planejamento, rastreamento de materiais e licitação de projetos, visando manter a competitividade. Espera-se que o México registre uma taxa de crescimento anual composta (CAGR) constante de 7,1% de 2025 a 2032, auxiliada por investimentos estrangeiros diretos na construção civil e pela crescente demanda por plataformas de gestão de projetos baseadas em nuvem e com foco em dispositivos móveis.

Participação de mercado de software de gerenciamento de construção na América do Norte

O mercado de software de gestão de construção na América do Norte é liderado principalmente por empresas consolidadas, incluindo:

- Bentley Systems, Incorporated (EUA)

- Autodesk Inc. (EUA)

- Nexvia (Austrália)

- Fortivo (EUA)

- Intuit Inc. (EUA)

- Mestre de Obras de Empreiteiras (EUA)

- Oracle Corporation (EUA)

- Procore Technologies, Inc. (EUA)

- Microsoft Corporation (EUA)

- BPA Solutions (Suíça)

- Trimble Inc. (EUA)

- Constellation Software Inc. (Canadá)

- SAP SE (Alemanha)

- Vectorworks, Inc. (EUA)

- Sage Group plc (Reino Unido)

- RIB Software SE (Alemanha)

Últimos desenvolvimentos no mercado de software de gestão de construção na América do Norte

- Em novembro de 2022, a Bentley Systems lançou a fase 2 do metaverso de arquitetura em sua conferência de infraestrutura em Londres. Esse avanço visa preencher lacunas entre os processos de dados em TI, TO e ET, aprimorando a colaboração e a transferência de fluxo de trabalho no mercado de software de gerenciamento de construção. Os aprimoramentos da Bentley têm como objetivo otimizar os fluxos de trabalho de projeto, construção e operação, representando um passo significativo na integração de tecnologia para um gerenciamento de projetos de infraestrutura mais eficiente e coeso.

- Em novembro de 2022, a Trimble Inc. lançou uma solução de software que aprimora a produtividade, a eficiência e a comunicação em projetos no mercado de softwares de gerenciamento de construção. Essa inovação permite que empreiteiros rastreiem ferramentas e atribuam tarefas por meio de uma interface que integra o sistema de gerenciamento de ativos ON! Track, do Grupo Hilti, com o ERP Viewpoint Vista e o pacote Construction One, da Trimble. A integração simplifica o uso de dados, reduz o desperdício e promove uma melhor colaboração entre os membros da equipe, oferecendo uma solução completa para gerenciamento de projetos.

- Em maio de 2022, a colaboração da Oracle com a Deloitte visa aprimorar os aplicativos da Oracle, incluindo aqueles relevantes para o mercado de software de gerenciamento de construção. Essa parceria estratégica concentra-se no avanço das tecnologias de nuvem e aplicativos, com o objetivo de fornecer um portfólio de soluções aprimorado para os clientes. Ao aproveitar a expertise da Deloitte, a Oracle busca elevar o valor de sua marca e oferecer soluções mais robustas e inovadoras para atender às necessidades em constante evolução do setor de software de gerenciamento de construção.

- Em maio de 2022, a Procore Technologies, Inc. alcançou o status de Produto de Construção Mais Bem Avaliado pela TrustRadius, elevando sua posição no mercado de software de gerenciamento de construção. Esse reconhecimento fortalece o valor da marca da empresa e constrói confiança entre os clientes, contribuindo para o aumento da credibilidade no mercado. O reconhecimento como um produto de alta qualidade está prestes a acelerar o crescimento das vendas, enfatizando o compromisso da Procore em fornecer soluções tecnológicas de alta qualidade no setor de gerenciamento de construção.

- Em junho de 2024, a Procore Technologies apresentou importantes avanços em seu Innovation Summit 2024, lançando o Procore Copilot AI, o Planejamento com Inteligência Artificial e o Procore Maps. Essas ferramentas aprimoram a colaboração em todo o ciclo de vida da construção, incorporando contexto baseado em IA aos fluxos de trabalho da equipe, promovendo uma entrega de projetos mais inteligente e coordenada.

- Em novembro de 2024, durante o Groundbreak 2024, a Procore lançou seu módulo de Gestão de Recursos — uma ferramenta integrada para gerenciar mão de obra, materiais e equipamentos em uma plataforma unificada. A solução conecta diretamente o planejamento de recursos com as áreas financeira, de programação e de análise de riscos, visando aumentar a produtividade e a precisão das previsões.

- Em dezembro de 2024, a Procore expandiu sua ferramenta de Relatórios 360, oferecendo maior visibilidade dos fluxos de pagamento, rastreamento de destinatários e análises financeiras. Essa atualização proporciona insights mais profundos sobre custos e aprovações de projetos, atendendo à demanda dos contratados por uma gestão financeira transparente.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.