North America Liver Fibrosis Treatment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

7.55 Billion

USD

16.87 Billion

2024

2032

USD

7.55 Billion

USD

16.87 Billion

2024

2032

| 2025 –2032 | |

| USD 7.55 Billion | |

| USD 16.87 Billion | |

|

|

|

Mercado de tratamento da fibrose hepática na América do Norte, por tipo de tratamento (medicação e cirurgia/terapia), estádios (F2, F1, F3 e F4), indicação (esteato-hepatite não alcoólica (NASH), fibrose induzida por hepatite B e C, doença hepática alcoólica (ALD), doenças hepáticas autoimunes, distúrbios genéticos e outros), género (masculino e feminino), utilizador final (hospitais, clínicas especializadas, clínicas, centros de ambulatório e de investigação e outros), canal de distribuição (licitação direta e vendas a retalho) - tendências do setor e previsão até 2032

Tamanho do mercado de tratamento da fibrose hepática na América do Norte

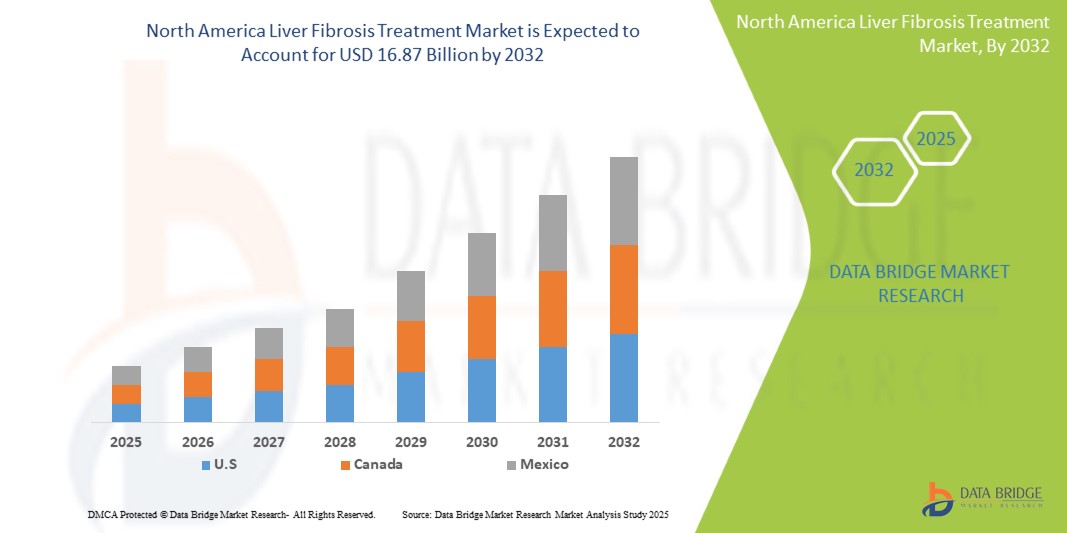

- O mercado de tratamento da fibrose hepática na América do Norte foi avaliado em 7,55 mil milhões de dólares em 2024 e prevê-se que atinja os 16,87 mil milhões de dólares até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 10,8%, impulsionado principalmente pela crescente consciencialização dos consumidores sobre as soluções naturais de saúde

- Este crescimento é impulsionado por fatores como o aumento da prevalência de doenças do fígado. Além disso, a acessibilidade impulsiona o aumento do consumo de álcool.

Análise do mercado de tratamento da fibrose hepática na América do Norte

- O número crescente de doenças hepáticas cria uma maior população de doentes que necessitam de opções terapêuticas eficazes, especialmente para condições como a hepatite B e C. Fatores contribuintes, como o aumento do consumo de álcool, hábitos alimentares pouco saudáveis e um aumento das taxas de obesidade, levaram ao diagnóstico de mais pessoas com estas doenças hepáticas.

- À medida que os danos hepáticos avançam, o risco de desenvolver fibrose hepática aumenta, colocando uma carga significativa nos sistemas de saúde para oferecer opções de tratamento eficazes. Esta crescente procura impulsiona o desenvolvimento e a disponibilidade de terapias direcionadas, alimentando o crescimento do mercado à medida que os prestadores de cuidados de saúde procuram soluções inovadoras para a gestão desta condição.

- Além disso, a crescente consciencialização entre os profissionais de saúde e o público em geral levou a que mais indivíduos fossem examinados e diagnosticados em fases iniciais da doença hepática. Os avanços nas técnicas de diagnóstico, incluindo exames de imagem e de sangue não invasivos, facilitaram a identificação da fibrose hepática mais cedo na progressão da doença. Esta detecção precoce permite intervenções oportunas, estimulando a procura de tratamentos inovadores que revertam ou controlem eficazmente a fibrose hepática.

- Por exemplo, em agosto de 2023, de acordo com um artigo publicado pelo NCBI, a doença hepática é responsável por dois milhões de mortes anualmente e é responsável por 4% de todas as mortes (1 em cada 25 mortes no mundo); aproximadamente dois terços de todas as mortes relacionadas com o fígado ocorrem em homens. Esta estatística alarmante sublinha a necessidade urgente de opções de tratamento eficazes e realça o significativo fardo para a saúde pública imposto pelas doenças hepáticas, motivando ainda mais os sistemas de saúde e as empresas farmacêuticas a priorizar o desenvolvimento de terapias inovadoras que visem especificamente a fibrose hepática e as suas causas subjacentes.

- Consequentemente, as empresas farmacêuticas e os investigadores médicos são obrigados a investir no desenvolvimento de novas opções terapêuticas, impulsionando assim o mercado, à medida que os intervenientes procuram combater a crescente incidência de doenças hepáticas e as suas complicações associadas.

Âmbito do relatório e segmentação do mercado de tratamento da fibrose hepática na América do Norte

|

Atributos |

Principais insights do mercado global de tratamento da fibrose hepática |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção, a análise do consumo de produção, a análise da tendência dos preços, o cenário das alterações climáticas, a análise da cadeia de abastecimento, a análise da cadeia de valor, a visão geral da matéria-prima/consumíveis, os critérios de seleção de fornecedores, a análise PESTLE, a análise de Porter e a estrutura regulamentar. |

Tendências do mercado de tratamento da fibrose hepática na América do Norte

“Aumento da prevalência de doenças hepáticas”

- A crescente prevalência de doenças hepáticas está a emergir como uma preocupação significativa de saúde na América do Norte, contribuindo substancialmente para os problemas de saúde em todo o mundo.

- Fatores como o consumo excessivo de álcool, o aumento das taxas de obesidade, as infeções por hepatite viral e estilos de vida pouco saudáveis estão a levar a um aumento de condições como a doença hepática gordurosa, a cirrose e o cancro do fígado.

- A crescente incidência de doença hepática gordurosa não alcoólica (DHGNA), particularmente associada à diabetes e à síndrome metabólica, é também alarmante. Como resultado, há uma procura crescente por diagnóstico precoce, opções de tratamento eficazes e iniciativas de saúde pública. Espera-se que esta tendência impulsione a inovação e o crescimento no mercado de tratamento de doenças hepáticas

Dinâmica do mercado de tratamento da fibrose hepática na América do Norte

Motoristas

“Aumento do consumo de álcool”

- O aumento do consumo de álcool contribui significativamente para o mercado de tratamento da fibrose hepática na América do Norte devido à sua correlação direta com a incidência de doenças hepáticas, particularmente a doença hepática alcoólica (ALD).

- À medida que mais indivíduos consomem álcool regularmente e em maiores quantidades, o risco de desenvolver complicações relacionadas com o fígado, incluindo fibrose hepática e cirrose, aumenta significativamente

- O alcoolismo crónico leva à inflamação, à acumulação de gordura e, em última análise, à fibrose, à medida que o fígado sofre danos e reparações repetidas.

- Esta crescente prevalência de doenças hepáticas relacionadas com o álcool cria uma procura urgente por tratamentos e estratégias de gestão eficazes para ajudar a mitigar os danos hepáticos e melhorar os resultados dos doentes

Por exemplo,

- Em outubro de 2024, de acordo com um artigo publicado pelo International Journal of Mental Health Systems, a prevalência do consumo de álcool foi de 54,5% e 47,7% no início e no seguimento, respetivamente. Além disso, 12% dos homens referiram ter começado a beber recentemente. Esta prevalência do consumo de álcool leva a um aumento da incidência de fibrose hepática na América do Norte, impactando potencialmente o crescimento do mercado

- Em Junho de 2024, de acordo com o STAT, as mortes relacionadas com o álcool estão a aumentar, e os especialistas estão particularmente preocupados com o aumento entre os jovens e as mulheres. Os EUA registaram um aumento de 25,5% nas mortes relacionadas com o álcool entre 2019 e 2020 — representando 3% de todas as mortes. Além disso, os maiores aumentos nas mortes relacionadas com o álcool ocorreram entre as pessoas dos 25 aos 34 e dos 35 aos 44 anos, onde as mortes em ambos os grupos aumentaram mais de 37%.

- Além disso, a crescente aceitação social e a normalização do consumo de álcool, particularmente nos grupos demográficos mais jovens, agravam ainda mais o problema, levando a um maior número de indivíduos em risco de alterações fibróticas no fígado.

- Esta tendência promove o crescimento do mercado de tratamento da fibrose hepática e enfatiza a importância das iniciativas de saúde pública que visam a redução do consumo de álcool e a prevenção de doenças hepáticas.

Oportunidades

“Tecnologias emergentes e tratamentos avançados no tratamento da fibrose hepática”

-

Tecnologias emergentes como a terapia genética, as terapias moleculares dirigidas e os agentes biológicos estão a transformar o panorama do tratamento

-

As inovações recentes centram-se em medicamentos que visam especificamente as vias de progressão da fibrose, como os agonistas do FXR, os inibidores do TGF-β e os agentes anti-inflamatórios. Além disso, ferramentas de diagnóstico não invasivas como a elastografia estão a melhorar a deteção precoce

-

Estes avanços oferecem tratamentos mais eficazes e personalizados para condições como a NASH (esteato-hepatite não alcoólica) e a cirrose, levando a melhores resultados para os doentes.

-

Em fevereiro de 2024, um artigo publicado na Springer Nature, O artigo analisa as abordagens emergentes para diagnosticar e inibir a fibrogénese hepática. Os avanços incluem biomarcadores não invasivos, tecnologias de imagem e terapias celulares, como as células estaminais mesenquimais. Os medicamentos antifibróticos promissores, incluindo a pirfenidona e o ácido obeticólico, juntamente com as inovações na engenharia de tecidos, nanotecnologia e modelos microfluídicos, mostram potencial para tratamentos personalizados e de precisão.

-

Um artigo de setembro de 2021 do NCBI destacou que as tecnologias emergentes no tratamento da fibrose hepática se concentram em terapias avançadas que visam vias moleculares, como a ativação das células estreladas hepáticas. Inovações como a terapia genética, produtos biológicos, inibidores de pequenas moléculas e diagnósticos não invasivos melhoram a deteção e o tratamento precoces. As terapias com células estaminais e a engenharia de tecidos também prometem reverter a fibrose e melhorar a recuperação

-

Com a evolução contínua das estratégias de tratamento e das tecnologias de diagnóstico, as terapêuticas para a fibrose hepática estão a avançar rapidamente

-

Estas inovações trazem esperança para uma melhor gestão das doenças hepáticas, garantindo que os doentes têm acesso a tratamentos mais eficazes e personalizados, com menos efeitos secundários, melhorando, em última análise, os resultados de saúde na América do Norte.

Restrições/Desafio

“ Consciência limitada sobre as doenças hepáticas”

- A limitada sensibilização sobre as doenças do fígado dificulta o diagnóstico precoce e a intervenção adequada. Muitas pessoas desconhecem os factores de risco e os sintomas associados às doenças hepáticas, atribuindo frequentemente sinais vagos de doença a outros problemas menos graves.

- Esta falta de conhecimento adia as consultas médicas até que a doença evolua para fases avançadas, como a fibrose hepática ou a cirrose, onde as opções de tratamento se tornam mais complexas e menos eficazes.

- Consequentemente, os diagnósticos tardios reduzem o potencial de resultados bem-sucedidos do tratamento e restringem o crescimento global do mercado, ao limitar a população de doentes que procura cuidados atempados.

Por exemplo,

- Em abril de 2024, Lupin afirmou que os doentes não têm conhecimento da sua condição até que a doença atinja um estágio crítico, desencadeando uma necessidade urgente de reavaliar a abordagem de sensibilização, deteção e tratamento da saúde do fígado. No entanto, um obstáculo significativo na gestão da saúde hepática reside na compreensão limitada das doenças hepáticas e dos factores de risco associados

- Em julho de 2021, de acordo com um estudo que incluiu 11.700 adultos (maiores de 18 anos) de cinco Inquéritos Nacionais de Exame de Saúde e Nutrição, quase 96% dos adultos com DHGNA nos EUA não sabiam que tinham doença hepática, especialmente entre os adultos jovens. Por conseguinte, aumentar a sensibilização e a educação sobre a saúde hepática é crucial para melhorar os resultados dos doentes e promover uma abordagem mais proativa à gestão da fibrose hepática e à expansão do mercado de tratamento.

- Em janeiro de 2021, a Springer Nature informou que, entre os 825 doentes incluídos na análise da investigação realizada no artigo científico "Falta de sensibilização para os danos hepáticos em doentes com diabetes tipo 2", 8,1% (IC 95% 5,1%-12,7%) dos doentes com esteatose sabiam que tinham uma doença hepática. Além disso, numa amostra nacionalmente representativa de adultos norte-americanos com DM2, a prevalência de fibrose hepática avançada é elevada. Menos de 20% das pessoas com fibrose avançada sabem que têm alguma doença hepática

- A sensibilização limitada prejudica os resultados potenciais do tratamento para os doentes e sufoca o crescimento do mercado ao reduzir o número de indivíduos que interagem com os serviços de saúde desde o início

- Assim, aumentar a sensibilização e a educação sobre a saúde hepática é crucial para melhorar o diagnóstico precoce, aumentar a eficácia do tratamento e, em última análise, promover um mercado mais robusto para as terapias para a fibrose hepática.

Âmbito do mercado de tratamento da fibrose hepática na América do Norte

O mercado é segmentado com base no tipo de produto, tratamento, base de origem, aplicação, via de administração, modo de compra, faixa etária, género, utilizador final e canal de distribuição.

|

Segmentação |

Sub-segmentação |

|

Por tipo de tratamento |

|

|

Por etapas |

|

|

Por Indicação |

|

|

Por utilizador final |

|

|

Por canal de distribuição |

|

Análise regional do mercado de tratamento da fibrose hepática na América do Norte

“Os EUA são o país dominante no mercado de tratamento da fibrose hepática”

- Os EUA lideram o mercado de tratamento da fibrose hepática na América do Norte, impulsionados pela sua robusta infraestrutura de saúde, elevada prevalência de doenças relacionadas com o fígado e forte foco no diagnóstico precoce e nas estratégias de intervenção.

- O país beneficia de uma ampla cobertura de saúde, de políticas de reembolso bem estabelecidas e de uma procura crescente por opções de diagnóstico e tratamento não invasivas.

- A liderança dos EUA na investigação clínica e a sua participação ativa em campanhas de sensibilização para as doenças hepáticas apoiam ainda mais o crescimento do mercado

- A crescente adoção de terapias avançadas, a crescente consciencialização dos doentes e as iniciativas governamentais para combater as doenças hepáticas crónicas contribuem para o domínio dos EUA na região.

“Os EUA devem registar a maior taxa de crescimento”

- Os EUA são também o mercado de crescimento mais rápido, impulsionado pela inovação contínua em biomarcadores de fibrose, pelo aumento dos investimentos em I&D por parte das empresas farmacêuticas e pelo aumento das taxas de doenças hepáticas gordurosas relacionadas com o álcool e não alcoólicas.

- Estes factores posicionam colectivamente os EUA como um centro central para o tratamento da fibrose hepática na América do Norte, tornando-se o maior e mais rápido mercado em expansão na região.

Participação no mercado de tratamento da fibrose hepática na América do Norte

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- F. Hoffmann-La Roche Ltd (Suíça)

- Abbott (EUA)

- La Renon Healthcare Pvt. Lda. (Índia)

- GENFIT SA (França)

- Madrigal Pharmaceuticals (EUA)

- Aligos Therapeutics (EUA)

- Pfizer Inc. (EUA)

- Enanta Pharmaceuticals, Inc.

- Bristol-Myers Squibb Company (EUA)

- Vertex Pharmaceuticals Incorporated (EUA)

- Takeda Pharmaceutical Company Limited (Japão)

- Hepion Pharmaceuticals (EUA)

- Echosens (França)

- Galectin Therapeutics, Inc. (EUA)

- Conatus Pharmaceuticals (EUA)

- Tvardi Therapeutics (EUA)

- Viking Therapeutics (EUA)

- Calliditas Therapeutics AB (Suécia)

- Novomedix (EUA)

- Galecto Biotech (Dinamarca)

- Pilant Therapeutics, Inc. (EUA)

- Sagimet Biosciences (EUA)

- Gyre Therapeutics, Inc. (EUA)

- Akero Therapeutics, Inc. (EUA)

- CureVac SE (Alemanha)

- Novo Nordisk A/S (Dinamarca)

- Ipsen Pharma (França)

- AdAlta Limited (Austrália)

- Alentis Therapeutics AG (Suíça)

- Gilead Sciences, Inc. (EUA)

- AbbVie Inc. (EUA)

- Merck & Co., Inc. (EUA)

- Novartis AG (Suíça)

- Intercept Pharmaceuticals, Inc. (EUA)

Últimos desenvolvimentos no mercado de tratamento da fibrose hepática na América do Norte

- Em junho de 2024, a Gilead Sciences apresentou a nova investigação no Congresso da Associação Europeia para o Estudo do Fígado (EASL) de 2024, em Milão, com foco em doenças hepáticas como a colangite biliar primária (CBP), hepatite B (VHB), vírus da hepatite delta (VHD) e outras. As principais apresentações incluirão dados a longo prazo do estudo ASSURE sobre seladelpar para PBC, resultados sobre tenofovir para prevenção do cancro do fígado no VHB e conclusões dos estudos MYR204 e MYR301 sobre Hepcludex para HDV. Esta investigação destaca o compromisso da Gilead em avançar nas opções de tratamento para as doenças do fígado

- Em outubro de 2024, a Intercept Pharmaceuticals, Inc discutiu os seus esforços contínuos para explorar as diferenças e disparidades raciais no tratamento da colangite biliar primária (CBP). A empresa está a abordar como diferentes populações podem enfrentar diferentes desafios no diagnóstico, tratamento e gestão da PBC. Ao explorar estas disparidades, o Intercept visa melhorar o acesso aos cuidados e aos resultados do tratamento para todos os doentes, reduzindo potencialmente as barreiras ao tratamento eficaz das doenças hepáticas, incluindo a fibrose.

- Em novembro de 2022, a Food and Drug Administration (FDA) dos EUA aprovou o Vemlidy (tenofovir alafenamida) para o tratamento da infeção crónica pelo vírus da hepatite B (HBV) em doentes pediátricos com 12 anos ou mais com doença hepática compensada. Esta aprovação alarga a utilização do Vemlidy, que foi inicialmente aprovado em 2016 para adultos com VHB crónico. A aprovação baseia-se num ensaio clínico de Fase 2 que demonstra a eficácia e segurança do Vemlidy neste grupo de doentes mais jovens

- Em setembro de 2022, a Gilead Sciences concluiu a aquisição da MiroBio, uma empresa de biotecnologia sediada no Reino Unido focada em restaurar o equilíbrio imunitário através de agonistas que têm como alvo os recetores imunoinibitórios. A aquisição, avaliada em aproximadamente 405 milhões de dólares, fornece à Gilead a plataforma de descoberta da MiroBio e o seu portefólio de agonistas de recetores imunoinibitórios. O principal anticorpo experimental da MiroBio, o MB272, tem como alvo as células imunes para suprimir as respostas imunes inflamatórias e está atualmente em ensaios clínicos de Fase 1. Esta aquisição reforça os esforços da Gilead no tratamento de doenças crónicas imunomediadas

- Em março de 2021, a Gilead Sciences e a Novo Nordisk expandiram a sua colaboração no tratamento da esteato-hepatite não alcoólica (NASH) iniciando um ensaio clínico de Fase 2b. O estudo investiga a segurança e a eficácia do semaglutido, um agonista do recetor GLP-1 da Novo Nordisk, combinado com o cilofexor da Gilead (um agonista do FXR) e o firsocostat (um inibidor do ACC) em doentes com cirrose devido a NASH. O ensaio irá avaliar o impacto dos tratamentos na fibrose hepática e na resolução da NASH, estando o recrutamento previsto para começar no segundo semestre de 2021.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TREATMENT TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.2.1 LIVER TRANSPLANTATION VOLUME AND THEIR COST FOR LIVER FIBROSIS BY COUNTRY

4.2.2 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES FOR LIVER FIBROSIS: VOLUME AND COST BY COUNTRY

4.2.3 PARTIAL HEPATECTOMY (LIVER RESECTION) COST BY COUNTRY

4.2.4 CELL-BASED THERAPY COST FOR LIVER FIBROSIS TREATMENT BY COUNTRY

4.3 EPIDEMIOLOGY

4.3.1 INCIDENCE OF ALL BY GENDER

4.3.2 TREATMENT RATE

4.3.3 TREATMENT RATE

4.3.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.3.5 PATIENT TREATMENT SUCCESS RATES

4.4 MARKETED DRUG ANALYSIS

4.5 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.5.1 PATIENT FLOW DIAGRAM

4.5.2 KEY PRICING STRATEGIES

4.5.3 KEY PATIENT ENROLLMENT STRATEGIES

5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF LIVER DISEASES

6.1.2 RISING CONSUMPTION OF ALCOHOL

6.1.3 RISING LIVER TRANSPLANTATION RATES

6.1.4 GROWING INCIDENCE OF NON-ALCOHOLIC FATTY LIVER DISEASE (NAFLD) & NASH

6.2 RESTRAINTS

6.2.1 LIMITED AWARENESS OF LIVER DISEASES

6.2.2 REGULATORY CHALLENGES

6.3 OPPORTUNITIES

6.3.1 EMERGING TECHNOLOGIES AND ADVANCED TREATMENTS IN LIVER FIBROSIS MANAGEMENT

6.3.2 PROGRESS IN PIPELINE PRODUCTS FOR LIVER FIBROSIS TREATMENT

6.3.3 STRATEGIC MERGERS AND ACQUISITIONS AMONG THE KEY PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF EFFECTIVE AND APPROVED ANTI-FIBROTIC DRUGS

6.4.2 HIGH COST OF TREATMENTS IN LIVER FIBROSIS CARE

7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 ANTIVIRAL AGENTS

7.2.1.1 VELPATASVIR/SOFOSBUVIR

7.2.1.2 TENOFOVIR

7.2.1.3 LEDIPASVIR/SOFOSBUVIR

7.2.1.4 SOFOSBUVIR

7.2.1.5 ENTECAVIR

7.2.2 ANTIFIBROTIC AGENTS

7.2.2.1 OBETICHOLIC ACID

7.2.2.2 TGF-Β INHIBITORS

7.2.2.3 CONNECTIVE TISSUE GROWTH FACTOR (CTGF) INHIBITORS

7.2.2.4 LYSYL OXIDASE-LIKE 2 (LOXL2) INHIBITORS

7.2.2.5 OTHERS

7.2.3 ANTI-INFLAMMATORY DRUGS

7.2.3.1 CORTICOSTEROIDS

7.2.3.1.1 PREDNISONE

7.2.3.1.2 DEXAMETHASONE

7.2.3.2 TUMOR NECROSIS FACTOR (TNF) INHIBITORS

7.2.3.2.1 INFLIXIMAB

7.2.3.2.2 ETANERCEPT

7.2.3.3 INTERLEUKIN (IL) INHIBITORS

7.2.3.3.1 IL-6 INHIBITORS (TOCILIZUMAB)

7.2.3.3.2 IL-1 INHIBITORS (ANAKINRA)

7.2.4 IMMUNOSUPPRESSANTS

7.2.4.1 MYCOPHENOLATE MOFETIL

7.2.4.2 TACROLIMUS

7.2.4.3 CYCLOSPORINE

7.2.5 MARKETED DRUGS

7.2.5.1 VELPATASVIR/SOFOSBUVIR

7.2.5.2 TENOFOVIR

7.2.5.3 LEDIPASVIR/SOFOSBUVIR

7.2.5.4 OBETICHOLIC ACID (OCA)

7.2.5.5 SOFOSBUVIR

7.2.5.6 PIRFENIDONE

7.2.5.7 OTHERS

7.2.6 PIPELINE DRUGS

7.2.7 BRANDED DRUGS

7.2.7.1 EPCLUSA

7.2.7.2 VIREAD AND VEMLIDY

7.2.7.3 OCALIVA

7.2.7.4 HARVONI

7.2.7.5 SOVALDI

7.2.7.6 BARACLUDE

7.2.7.7 ACTOS

7.2.7.8 OTHERS

7.2.8 GENERIC DRUGS

7.2.9 ORAL

7.2.10 PARENTERAL

7.2.11 OTHERS

7.3 SURGERY/THERAPY

7.3.1 LIVER TRANSPLANTATION

7.3.2 ORTHOTOPIC LIVER TRANSPLANT (OLT)

7.3.3 LIVING DONOR LIVER TRANSPLANT (LDLT)

7.3.4 SPLIT LIVER TRANSPLANTATION

7.3.5 DOMINO LIVER TRANSPLANT

7.3.6 ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES

7.3.6.1 ENDOSCOPIC VARICEAL LIGATION (EVL)

7.3.6.2 TRANSJUGULAR INTRAHEPATIC PORTOSYSTEMIC SHUNT (TIPS)

7.3.6.3 LIVER ABLATION PROCEDURES

7.3.6.3.1 RADIOFREQUENCY ABLATION (RFA)

7.3.6.3.2 MICROWAVE ABLATION (MWA)

7.3.7 PARTIAL HEPATECTOMY (LIVER RESECTION)

7.3.7.1 SEGMENTAL RESECTION

7.3.7.2 LOBECTOMY

7.3.7.3 WEDGE RESECTION

7.3.8 CELL-BASED THERAPY

7.3.8.1 STEM CELL THERAPY

7.3.8.1.1 MESENCHYMAL STEM CELLS (MSCS)

7.3.8.1.2 HEMATOPOIETIC STEM CELLS (HSCS)

7.3.8.2 GENE THERAPY

7.3.8.2.1 CRISPR-BASED LIVER REGENERATION

7.3.8.2.2 HEPATIC STELLATE CELL (HSC) INHIBITORS

7.3.8.2.3 SIRNA-BASED THERAPIES

7.3.8.2.4 HEPATOCYTE APOPTOSIS INHIBITORS

7.3.8.2.4.1 OXIDATIVE STRESS INHIBITORS

7.3.8.2.4.2 EMRICASAN

7.3.8.2.4.3 PENTOXIFYLLINE

7.3.8.2.4.4 LOSARTAN

7.3.8.2.4.5 METHYL FERULIC ACID

7.3.8.2.4.6 OTHERS

7.4 OTHERS

8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES

8.1 OVERVIEW

8.2 F2

8.3 F1

8.4 F3

8.5 F4

9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION

9.1 OVERVIEW

9.2 NON-ALCOHOLIC STEATOHEPATITIS (NASH)

9.3 HEPATITIS B & C-INDUCED FIBROSIS

9.3.1 CHRONIC HEPATITIS B VIRUS (HBV) FIBROSIS

9.3.2 CHRONIC HEPATITIS C VIRUS (HCV) FIBROSIS

9.4 ALCOHOLIC LIVER DISEASE (ALD)

9.5 AUTOIMMUNE LIVER DISEASES

9.5.1 AUTOIMMUNE HEPATITIS (AIH)

9.5.2 PRIMARY BILIARY CHOLANGITIS (PBC)

9.5.3 PRIMARY SCLEROSING CHOLANGITIS (PSC)

9.6 GENETIC DISORDERS

9.6.1 HEMOCHROMATOSIS

9.6.2 WILSON’S DISEASE

9.6.3 ALPHA-1 ANTITRYPSIN DEFICIENCY

9.7 OTHERS

10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER

10.1 OVERVIEW

10.2 MALE

10.2.1 40-55 YEARS

10.2.2 ABOVE 55 YEARS

10.2.3 BELOW 40 YEARS

10.3 FEMALE

10.3.1 ABOVE 55 YEARS

10.3.2 40-55 YEARS

10.3.3 BELOW 40 YEARS

11 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 PUBLIC HOSPITALS

11.2.2 PRIVATE HOSPITALS

11.3 SPECIALTY CLINICS

11.3.1 HEPATOLOGY CLINICS

11.3.2 GASTROENTEROLOGY CLINICS

11.4 CLINICS

11.5 AMBULATORY AND RESEARCH CENTERS

11.6 OTHERS

12 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.2.1 RETAIL SALES

12.2.1.1 HOSPITAL PHARMACY

12.2.1.2 RETAIL PHARMACY

12.2.1.3 ONLINE PHARMACY

13 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 GILEAD SCIENCES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT/NEWS

16.2 ABBVIE, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MERCK & CO, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NOVARTIS AG

16.4.1 COMPANY SNAPSHOTS

16.4.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 PIPELINE PRODUCT PORTFOLIO

16.4.6 RECENT DEVELOPMENT

16.5 INTERCEPT PHARMACEUTICALS, INC.

16.5.1 COMPANY SNAPSHOTS

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 PIPELINE PRODUCT PORTFOLIO

16.5.6 RECENT NEWS

16.6 ABBOTT

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 1.1.5 RECENT DEVELOPMENT

16.7 ALIGOS THERAPEUTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ALNICHE LIFE SCIENCES PVT. LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ALENTIS THERAPEUTICS AG

16.9.1 COMPANY SNAPSHOT

16.9.2 PIPELINE PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 ADALTA LIMITED

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PIPELINE PRODUCT PORTFOLIO

16.10.4 RECENT NEWS

16.11 AKERO THERAPEUTICS, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PIPELINE PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 BRISTOL-MYERS SQUIBB

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 CALLIDITAS THERAPEUTICS AB

16.13.1 COMPANY SNAPSHOT

16.13.2 PIPELINE PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 CUREVAC SE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 CONATUSPHARMA

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT/NEWS

16.16 ENANTA PHARMACEUTICALS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 ECHOSENS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT/NEWS

16.18 F. HOFFMANN-LA ROCHE LTD

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 COMPANY SHARE ANALYSIS

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 GALECTO BIOTECH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PIPELINE PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT/NEWS

16.2 GALECTIN THERAPEUTICS, INC.

16.20.1 COMPANY SNAPSHOTS

16.20.2 REVENUE ANALYSIS AND SEGMENTAL ANALYSIS

16.20.3 PIPELINE PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 GYRE THERAPEUTICS, INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT/NEWS

16.22 GENFIT SA

16.22.1 COMPANY SNAPSHOTS

16.22.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.22.3 PIPELINE PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 HEPION PHARMACEUTICALS

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PIPELINE PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 IPSEN PHARMA

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PIPELINE PRODUCT PORTFOLIO

16.24.4 RECENT NEWS/DEVELOPMENTS

16.25 LA RENON HEALTHCARE PVT. LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 MADRIGAL PHARMACEUTICALS

16.26.1 COMPANY SNAPSHOTS

16.26.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENT

16.27 NOVO NORDISK A/S

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PIPELINE PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 NOVOMEDIX

16.28.1 COMPANY SNAPSHOT

16.28.2 PIPELINE PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 PILANT THERAPEUTICS, INC.

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 PIPELINE PRODUCT PORTFOLIO

16.29.4 RECENT NEWS

16.3 PFIZER INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PIPELINE PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENT/NEWS

16.31 SAGIMET BIOSCIENCES

16.31.1 COMPANY SNAPSHOTS

16.31.2 REVENUE ANALYSIS

16.31.3 1.1.4 PRODUCT PORTFOLIO

16.31.4 RECENT DEVELOPMENT/NEWS

16.32 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.32.1 COMPANY SNAPSHOT

16.32.2 REVENUE ANALYSIS

16.32.3 PIPELINE PRODUCT PORTFOLIO

16.32.4 PRODUCT PORTFOLIO

16.32.5 RECENT DEVELOPMENT

16.33 TVARDI THERAPEUTICS

16.33.1 COMPANY SNAPSHOT

16.33.2 PIPELINE PRODUCT PORTFOLIO

16.33.3 RECENT DEVELOPMENT/NEWS

16.34 VERTEX PHARMACEUTICALS INCORPORATED

16.34.1 COMPANY SNAPSHOT

16.34.2 REVENUE ANALYSIS

16.34.3 PRODUCT PORTFOLIO

16.34.4 RECENT DEVELOPMENT

16.35 VIKING THERAPEUTICS

16.35.1 COMPANY SNAPSHOT

16.35.2 REVENUE ANALYSIS

16.35.3 PIPELINE PRODUCT PORTFOLIO

16.35.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 NORTH AMERICA INCIDENCE OF CIRRHOSIS BY GENDER (2019)

TABLE 2 TREATMENT ADHERENCE LEVELS IN LIVER DISEASE PATIENTS

TABLE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 7 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 9 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 10 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 12 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 13 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 16 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 17 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 19 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 20 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 22 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 23 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 24 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 26 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 27 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA F2 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA F1 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA F3 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA F4 IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA NON-ALCOHOLIC STEATOHEPATITIS (NASH) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ALCOHOLIC LIVER DISEASE (ALD) IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA AMBULATORY AND RESEARCH CENTERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA DIRECT TENDER IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 78 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 80 NORTH AMERICA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 81 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 83 NORTH AMERICA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 84 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 86 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 88 NORTH AMERICA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 89 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 91 NORTH AMERICA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 92 NORTH AMERICA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 94 NORTH AMERICA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 95 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 97 NORTH AMERICA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 98 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NORTH AMERICA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 128 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 130 U.S. ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 131 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 133 U.S. ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 134 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 136 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 138 U.S. CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 139 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 141 U.S. TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 142 U.S. INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 144 U.S. INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 145 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 147 U.S. IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 148 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 U.S. CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 U.S. STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.S. GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 U.S. HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 U.S. LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 163 U.S. LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 164 U.S. HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.S. AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 U.S. GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 U.S. LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 168 U.S. MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.S. FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.S. LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 U.S. HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.S. SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.S. LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 U.S. RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 178 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 180 CANADA ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 181 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 183 CANADA ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 184 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 186 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 188 CANADA CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 189 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 191 CANADA TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 192 CANADA INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 194 CANADA INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 195 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 197 CANADA IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 198 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 CANADA BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 CANADA MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 203 CANADA SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 CANADA LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 CANADA ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 CANADA LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 CANADA PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 CANADA CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 CANADA STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 CANADA GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 CANADA HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 CANADA LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 213 CANADA LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 214 CANADA HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 CANADA AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 CANADA GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 CANADA LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 218 CANADA MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 CANADA FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 CANADA LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 221 CANADA HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 CANADA SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 CANADA LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 224 CANADA RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 228 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 230 MEXICO ANTIVIRAL AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 231 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 233 MEXICO ANTIFIBROTIC AGENTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 234 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MEXICO ANTI-INFLAMMATORY DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 236 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 238 MEXICO CORTICOSTEROIDS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 239 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 241 MEXICO TUMOR NECROSIS FACTOR (TNF) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 242 MEXICO INTERLEUKIN (IL) INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 244 MEXICO INTERLEUKIN (IL) INHIBITOR IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 245 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (VOLUME IN THOUSAND UNITS)

TABLE 247 MEXICO IMMUNOSUPPRESSANTS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (ASP IN USD/UNITS)

TABLE 248 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG STATUS, 2018-2032 (USD THOUSAND)

TABLE 249 MEXICO MARKETED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY DRUG TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MEXICO BRANDED DRUGS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 MEXICO MEDICATION IN LIVER FIBROSIS TREATMENT MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 253 MEXICO SURGERY/THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 MEXICO LIVER TRANSPLANTATION IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MEXICO ENDOSCOPIC & MINIMALLY INVASIVE PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MEXICO LIVER ABLATION PROCEDURES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 MEXICO PARTIAL HEPATECTOMY (LIVER RESECTION) IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MEXICO CELL-BASED THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 MEXICO STEM CELL THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MEXICO GENE THERAPY IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MEXICO HEPATOCYTE APOPTOSIS INHIBITORS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY STAGES, 2018-2032 (USD THOUSAND)

TABLE 263 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY INDICATION, 2018-2032 (USD THOUSAND)

TABLE 264 MEXICO HEPATITIS B & C-INDUCED FIBROSIS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 MEXICO AUTOIMMUNE LIVER DISEASES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 MEXICO GENETIC DISORDERS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 268 MEXICO MALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MEXICO FEMALE IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 271 MEXICO HOSPITALS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 MEXICO SPECIALTY CLINICS IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 MEXICO LIVER FIBROSIS TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 274 MEXICO RETAIL SALES IN LIVER FIBROSIS TREATMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF LIVER DISEASES IS EXPECTED TO DRIVE THE GROWTH OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET FROM 2025 TO 2032

FIGURE 12 THE MEDICATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET IN 2025-2032

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET, BY TREATMENT TYPE

FIGURE 14 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET

FIGURE 17 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2024

FIGURE 18 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2024

FIGURE 22 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, 2025-2032 (USD THOUSAND)

FIGURE 23 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY STAGES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2024

FIGURE 26 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, 2025-2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2024

FIGURE 30 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, 2025-2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY GENDER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2024

FIGURE 34 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL 2024

FIGURE 38 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 40 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: SNAPSHOT (2024)

FIGURE 42 NORTH AMERICA LIVER FIBROSIS TREATMENT MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.