North America Medical Device Regulatory Affairs Outsourcing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.93 Billion

USD

7.46 Billion

2025

2033

USD

2.93 Billion

USD

7.46 Billion

2025

2033

| 2026 –2033 | |

| USD 2.93 Billion | |

| USD 7.46 Billion | |

|

|

|

|

Segmentação do mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte, por serviços (serviços de assuntos regulatórios, consultoria de qualidade e redação médica), produto (produtos acabados, eletrônicos e matéria-prima), tipo de dispositivo (classe I, classe II e classe III), aplicação (cardiologia, diagnóstico por imagem, ortopedia, diagnóstico in vitro, oftalmologia, cirurgia geral e plástica, administração de medicamentos, odontologia, endoscopia, tratamento de diabetes e outros), usuário final (pequena, média e grande empresa de dispositivos médicos) - Tendências e previsões do setor até 2033.

Tamanho do mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

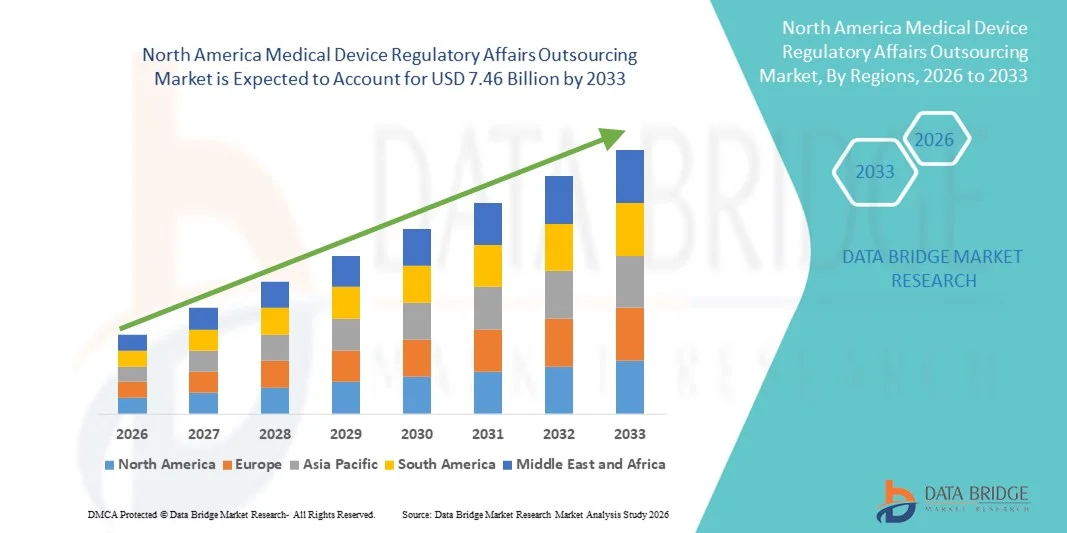

- O mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte foi avaliado em US$ 2,93 bilhões em 2025 e deverá atingir US$ 7,46 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 12,40% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente complexidade dos requisitos regulatórios nos setores farmacêutico, biotecnológico e de dispositivos médicos, o que leva as empresas a buscarem serviços especializados de terceirização para a gestão da conformidade.

- Além disso, a crescente demanda por submissões regulatórias econômicas, eficientes e oportunas está impulsionando a adoção de soluções de terceirização de assuntos regulatórios. Esses fatores convergentes estão acelerando a adoção de serviços de terceirização de assuntos regulatórios, impulsionando significativamente o crescimento do setor globalmente.

Análise do mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

- O mercado de terceirização de assuntos regulatórios de dispositivos médicos, que envolve a delegação de estratégias regulatórias, documentação de conformidade, registro de produtos e atividades de vigilância pós-comercialização a provedores de serviços especializados, está se tornando cada vez mais importante para empresas de dispositivos médicos que operam sob estruturas regulatórias complexas e em constante evolução no Oriente Médio.

- A crescente rigidez das regulamentações de dispositivos médicos, a demanda cada vez maior por aprovações mais rápidas e a necessidade de conhecimento especializado em assuntos regulatórios locais são fatores-chave que impulsionam a adoção de serviços de terceirização de assuntos regulatórios para dispositivos médicos. As empresas estão recorrendo a parceiros de terceirização para minimizar riscos de conformidade, agilizar os prazos de aprovação e se concentrar em suas principais atividades de desenvolvimento e comercialização de produtos.

- Os EUA dominaram o mercado de terceirização de assuntos regulatórios de dispositivos médicos, com a maior participação de receita, de aproximadamente 42,5% em 2025, impulsionados por um ecossistema de saúde e dispositivos médicos bem estabelecido, forte supervisão regulatória do FDA, alto volume de procedimentos com dispositivos médicos e a presença de empresas líderes em consultoria regulatória. A ênfase do país em conformidade, aprovações oportunas e processos robustos de autorização de mercado aumentou significativamente a demanda por serviços especializados de terceirização.

- Prevê-se que o Canadá seja o mercado de crescimento mais rápido, registrando uma taxa de crescimento anual composta (CAGR) de cerca de 10,1% durante o período de previsão, impulsionado pela rápida modernização do sistema de saúde, pela crescente presença de fabricantes internacionais de dispositivos médicos e pela evolução dos marcos regulatórios sob a responsabilidade da Health Canada. A crescente conscientização sobre soluções eficientes de terceirização e processos regulatórios simplificados está impulsionando ainda mais a expansão do mercado em todo o país.

- O segmento de Produtos Acabados detinha a maior participação na receita de mercado, com 52,1% em 2025, visto que os dispositivos médicos finais são submetidos a rigorosos processos de aprovação pré-comercialização e requisitos de vigilância pós-comercialização.

Escopo do relatório e segmentação do mercado de terceirização de assuntos regulatórios de dispositivos médicos

|

Atributos |

Principais insights de mercado sobre terceirização de assuntos regulatórios de dispositivos médicos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

Complexidade crescente das regulamentações de dispositivos médicos em diferentes regiões

- Uma tendência significativa e crescente no mercado de terceirização de assuntos regulatórios de dispositivos médicos é a complexidade cada vez maior e a evolução contínua dos marcos regulatórios que regem esses dispositivos. Países em toda a região estão fortalecendo os processos de aprovação, os requisitos de vigilância pós-comercialização e os padrões de conformidade para se alinharem mais estreitamente aos padrões internacionais.

- Por exemplo, as autoridades reguladoras dos países do Conselho de Cooperação do Golfo (CCG) e da África do Sul introduziram sistemas de registro de dispositivos médicos mais estruturados, o que levou os fabricantes a recorrerem a parceiros especializados em terceirização de assuntos regulatórios para lidar com os procedimentos de submissão e os requisitos de documentação locais de forma eficiente.

- A crescente adoção de normas internacionais, como a ISO 13485 e sistemas de classificação baseados em risco, está impulsionando a demanda por conhecimento especializado externo para gerenciar registros regulatórios, documentação técnica e atividades de conformidade com a qualidade. Parceiros de terceirização fornecem conhecimento específico da região, o que ajuda a reduzir os prazos de aprovação e os riscos regulatórios.

- Além disso, a expansão de empresas multinacionais de dispositivos médicos para os mercados do Oriente Médio e da África está incentivando o uso de serviços regulatórios terceirizados para gerenciar registros em vários países por meio de uma abordagem centralizada e com boa relação custo-benefício.

- Essa tendência em direção a serviços profissionais de suporte regulatório está remodelando a forma como os fabricantes abordam a entrada no mercado e a conformidade, com a terceirização se tornando uma necessidade estratégica em vez de um serviço opcional em toda a região.

- Com o aumento da fiscalização regulatória, a demanda por prestadores de serviços especializados em assuntos regulatórios com conhecimento regional continua a crescer entre fabricantes de dispositivos médicos, tanto globais quanto locais.

Dinâmica do mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

Motorista

Crescimento do mercado de dispositivos médicos e rigor regulatório

- A rápida expansão do setor de dispositivos médicos em todo o mundo, impulsionada pelo aumento dos investimentos em saúde, pelo crescimento populacional e pela crescente prevalência de doenças crônicas, é um dos principais fatores que contribuem para a demanda por serviços de terceirização de assuntos regulatórios.

- Por exemplo, o crescente desenvolvimento da infraestrutura de saúde em países como Arábia Saudita, Emirados Árabes Unidos e África do Sul levou a uma maior demanda por dispositivos médicos, aumentando assim a carga de trabalho regulatória para os fabricantes que buscam aprovações de mercado em tempo hábil.

- Com a introdução de requisitos de conformidade mais rigorosos por parte das autoridades reguladoras, os fabricantes estão cada vez mais terceirizando as atividades regulatórias para empresas especializadas, a fim de garantir precisão, consistência e aprovações de produtos mais rápidas.

- Além disso, pequenas e médias empresas de dispositivos médicos frequentemente não possuem conhecimento interno especializado em regulamentação para as diversas normas regionais, tornando a terceirização uma solução prática para gerenciar custos e reduzir riscos de não conformidade.

- A necessidade de manter a conformidade regulamentar ao longo de todo o ciclo de vida do produto, incluindo renovações, variações e vigilância pós-comercialização, continua a sustentar a procura por serviços de terceirização na região.

Restrição/Desafio

Harmonização regulatória limitada e escassez de profissionais qualificados.

- Um dos principais desafios no mercado de terceirização de assuntos regulatórios de dispositivos médicos é a falta de harmonização dos marcos regulatórios entre os países, o que aumenta a complexidade e as necessidades de recursos tanto para os prestadores de serviços quanto para os fabricantes.

- Por exemplo, diferentes formatos de submissão, prazos de aprovação e expectativas regulatórias nos mercados africanos e do Oriente Médio podem levar a atrasos e aumento dos custos operacionais, mesmo com a terceirização das atividades regulatórias.

- Outra limitação significativa é a disponibilidade restrita de profissionais altamente qualificados na área regulatória, com conhecimento profundo tanto das regulamentações locais quanto dos padrões internacionais, principalmente nos mercados africanos emergentes.

- Além disso, preocupações relacionadas à confidencialidade dos dados, falhas de comunicação e dependência de fornecedores de serviços terceirizados podem fazer com que alguns fabricantes hesitem antes de terceirizar completamente as funções regulatórias.

- Superar esses desafios por meio do fortalecimento da capacidade regulatória, iniciativas de harmonização regional e investimento no desenvolvimento de mão de obra qualificada será fundamental para o crescimento e a eficácia a longo prazo do mercado de terceirização de assuntos regulatórios de dispositivos médicos no Oriente Médio e na África.

Escopo do mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

O mercado está segmentado com base em serviços, produto, tipo de dispositivo, aplicação e usuário final.

- Por serviços

Com base nos serviços oferecidos, o mercado de terceirização de assuntos regulatórios para dispositivos médicos é segmentado em Serviços de Assuntos Regulatórios, Consultoria de Qualidade e Redação Médica. O segmento de Serviços de Assuntos Regulatórios detinha a maior participação na receita do mercado, com 46,8% em 2025, devido à crescente complexidade das regulamentações de dispositivos médicos em regiões importantes como América do Norte, Europa e Ásia-Pacífico. As empresas dependem de serviços regulatórios terceirizados para submissões pré-mercado, documentação técnica e gestão de conformidade pós-mercado. Os crescentes requisitos regulatórios para dispositivos de Classe II e Classe III impulsionam a demanda. A globalização das operações de dispositivos médicos e os registros de produtos transfronteiriços também alimentam o segmento. A terceirização de assuntos regulatórios reduz os custos operacionais, garantindo a conformidade com as diretrizes da FDA, EU MDR e IVDR. O segmento se beneficia do aumento das auditorias regulatórias e das frequentes atualizações nos padrões de documentação. A gestão do ciclo de vida dos dispositivos, a notificação de vigilância e a mitigação de riscos são fatores críticos. As empresas priorizam cada vez mais a terceirização para acelerar o lançamento de produtos no mercado, reduzindo a sobrecarga de recursos internos. A crescente adoção de dispositivos médicos avançados e a rápida inovação de produtos reforçam ainda mais a dominância do segmento. A expansão para mercados emergentes cria uma demanda sustentada por serviços de assuntos regulatórios.

O segmento de Redação Médica deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 11,4%, entre 2026 e 2033, impulsionado pela crescente demanda global por relatórios de avaliação clínica, dossiês técnicos e documentação regulatória de alta qualidade. Pequenas e médias empresas de dispositivos médicos dependem cada vez mais de redatores médicos terceirizados. As autoridades regulatórias exigem documentação precisa e em conformidade com as normas para a aprovação de dispositivos, o que impulsiona o crescimento. A adoção de plataformas de submissão eletrônica acelera a terceirização. O crescimento de ensaios clínicos, coleta de evidências do mundo real e relatórios de dados pós-comercialização aumenta a demanda. A digitalização e as ferramentas de redação médica assistidas por IA contribuem para uma preparação mais rápida dos documentos. As empresas buscam contratos de terceirização flexíveis para reduzir a carga de trabalho interna. A expansão das áreas terapêuticas, incluindo cardiologia, ortopedia e dispositivos de diagnóstico in vitro (IVD), impulsiona ainda mais o crescimento. A crescente harmonização regulatória internacional apoia as necessidades de terceirização transfronteiriça. No geral, o segmento se beneficia da crescente complexidade regulatória e da importância cada vez maior da documentação médica precisa.

- Por produto

Com base no produto, o mercado de terceirização de assuntos regulatórios para dispositivos médicos é segmentado em produtos acabados, eletrônicos e matéria-prima. O segmento de produtos acabados detinha a maior participação na receita de mercado, com 52,1% em 2025, visto que os dispositivos médicos finais são submetidos a rigorosos processos de aprovação pré-mercado e requisitos de vigilância pós-mercado. As empresas terceirizam os processos regulatórios para garantir a conformidade com as regulamentações da FDA, do Regulamento de Dispositivos Médicos da UE (EU MDR) e de outras regulamentações regionais. Os produtos acabados incluem dispositivos nas áreas de cardiologia, ortopedia, diagnóstico in vitro (IVD) e oftalmologia. A terceirização ajuda a reduzir a carga de trabalho interna, garantindo a adesão aos padrões de qualidade e segurança. Os fabricantes buscam suporte especializado para rotulagem, documentação, validação e preparação de evidências clínicas. O aumento da fiscalização de produtos combinados, dispositivos com software integrado e dispositivos médicos conectados sustenta a dominância do mercado. A expansão global das operações de dispositivos médicos impulsiona contratos de terceirização de longo prazo. A terceirização mitiga os riscos associados a auditorias e penalidades por não conformidade. As empresas priorizam a rapidez no lançamento de produtos no mercado sem comprometer a conformidade. A vigilância pós-mercado e a notificação de eventos adversos são fatores adicionais que impulsionam essa tendência. Os fabricantes visam otimizar a alocação de recursos e a relação custo-benefício por meio da terceirização.

Prevê-se que o segmento de Eletrônicos apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 10,7%, entre 2026 e 2033, devido à crescente integração de software e componentes digitais em dispositivos médicos. A conformidade regulatória para software, firmware e cibersegurança de dispositivos conectados é complexa e está em constante evolução. A terceirização é a opção preferencial para garantir a conformidade regulatória e aprovações mais rápidas. O crescimento de dispositivos vestíveis, sistemas de monitoramento remoto e soluções de saúde digital impulsiona o segmento. Startups e PMEs dependem cada vez mais de parceiros regulatórios especializados para dispositivos com alta complexidade eletrônica. A adoção de IA e aprendizado de máquina em dispositivos médicos aumenta os requisitos de documentação e testes. A comercialização internacional impulsiona a demanda por documentação regulatória padronizada. A tendência de soluções de saúde conectadas acelera a terceirização de atividades de conformidade. As empresas buscam reduzir a carga operacional interna, mantendo-se em conformidade com os padrões regulatórios globais. A expansão de dispositivos de telemedicina e dispositivos médicos habilitados para IoT também contribui para o crescimento.

- Por tipo de dispositivo

Com base no tipo de dispositivo, o mercado de terceirização de assuntos regulatórios para dispositivos médicos é segmentado em dispositivos de Classe I, Classe II e Classe III. O segmento de dispositivos de Classe II dominou o mercado com uma participação de 41,6% da receita em 2025, devido ao alto volume de dispositivos moderadamente regulamentados que entraram no mercado. As submissões regulatórias para dispositivos de Classe II envolvem documentação, arquivos técnicos e conformidade com as diretrizes do FDA 510(k) ou da marcação CE. A terceirização ajuda os fabricantes a agilizar as aprovações e reduzir a carga de trabalho interna. Dispositivos ortopédicos, de diagnóstico e de monitoramento constituem uma parte importante dos produtos de Classe II. As empresas aproveitam a expertise terceirizada para gerenciar o ciclo de vida do produto, a vigilância pós-comercialização e as auditorias regulatórias. A globalização das operações com dispositivos e o aumento da inovação impulsionam ainda mais a demanda. Redução de custos, eficiência e entrada oportuna no mercado são vantagens importantes. A complexidade regulatória em várias regiões fortalece a dependência da terceirização. As atividades de gerenciamento do ciclo de vida, incluindo modificações, atualizações e relatórios de dispositivos, impulsionam o segmento. A crescente adoção de dispositivos médicos em mercados emergentes contribui para a dominância do segmento. Os dispositivos de Classe II representam um equilíbrio entre inovação e complexidade regulatória, tornando a terceirização essencial.

Prevê-se que o segmento de dispositivos de Classe III apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 12,8% entre 2026 e 2033, impulsionado pelo crescente desenvolvimento de dispositivos implantáveis, de suporte à vida e de alto risco. Esses dispositivos exigem ampla evidência clínica, estudos de validação e aprovações regulatórias. A terceirização de assuntos regulatórios minimiza os atrasos nas aprovações e garante a conformidade com os padrões globais. A análise rigorosa de dispositivos de alto risco, incluindo implantes cardíacos e dispositivos de neuromodulação, impulsiona o crescimento do mercado. Os fabricantes contam com parceiros regulatórios para documentação, relatórios de avaliação clínica e arquivos técnicos. A crescente tendência de produtos combinados aumenta a demanda por terceirização. A vigilância pós-comercialização contínua e os requisitos de notificação de eventos adversos também contribuem para a expansão. As atualizações regulatórias sob o MDR e o IVDR impulsionam o crescimento do segmento. Pequenas e médias empresas terceirizam cada vez mais a conformidade com os requisitos de dispositivos de Classe III devido à complexidade. A inovação em materiais biocompatíveis e implantes inteligentes sustenta a aceleração do segmento. Os produtos de alto valor agregado e o risco regulatório do segmento impulsionam a demanda contínua por terceirização.

- Por meio de aplicação

Com base na aplicação, o mercado de terceirização de assuntos regulatórios de dispositivos médicos é segmentado em Cardiologia, Diagnóstico por Imagem, Ortopedia, Diagnóstico In Vitro (IVD), Oftalmologia, Cirurgia Geral e Plástica, Administração de Medicamentos, Odontologia, Endoscopia, Tratamento de Diabetes e Outros. O segmento de IVD representou a maior participação na receita do mercado, com 30,2% em 2025, impulsionado pela crescente demanda por testes diagnósticos e medicina personalizada. A terceirização é crucial devido aos rigorosos requisitos de conformidade do Regulamento Europeu de Dispositivos Médicos para Diagnóstico In Vitro (IVDR) e da FDA. Os fabricantes dependem de especialistas em assuntos regulatórios para aprovações, validação, rotulagem e vigilância pós-comercialização de dispositivos. A expansão de centros de diagnóstico, laboratórios clínicos e instalações de diagnóstico molecular sustenta o crescimento. O aumento da prevalência de doenças crônicas impulsiona a demanda por dispositivos de diagnóstico precisos. As empresas buscam reduzir custos operacionais e mitigar riscos regulatórios. A globalização da distribuição de dispositivos IVD fortalece ainda mais a necessidade de terceirização. A rápida inovação de produtos exige suporte regulatório oportuno. A classificação de IVDs com base no risco impulsiona a dependência da terceirização. Auditorias regulatórias, marcação CE e aprovações da FDA aumentam a atividade do mercado. O segmento se beneficia do aumento dos investimentos em detecção precoce de doenças e medicina de precisão.

O segmento de Cuidados com Diabetes deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 13,3%, entre 2026 e 2033, impulsionado pelo aumento global da prevalência de diabetes e pela adoção de sistemas conectados de monitoramento de glicose. Os requisitos regulatórios para monitores contínuos de glicose e dispositivos inteligentes de administração de insulina são complexos, aumentando a demanda por terceirização. Startups e fabricantes de médio porte dependem de parceiros especializados para documentação, arquivos técnicos e conformidade. Dispositivos de gerenciamento de diabetes integrados com inteligência artificial exigem suporte regulatório adicional. O crescimento de dispositivos vestíveis e soluções de cuidados domiciliares impulsiona a expansão do segmento. A entrada em mercados internacionais exige submissões regulatórias harmonizadas. A integração de terapias digitais e telemedicina impulsiona ainda mais a terceirização. A vigilância pós-comercialização e o gerenciamento de riscos são fatores críticos. O foco de governos e provedores de saúde no gerenciamento do diabetes fortalece o mercado. O aumento do financiamento de capital de risco em soluções digitais para diabetes acelera o crescimento. Fabricantes de pequena escala se beneficiam da redução dos custos internos de conformidade. A lacuna de conhecimento regulatório entre novas empresas promove uma alta adoção da terceirização.

- Por usuário final

Com base no usuário final, o mercado de terceirização de assuntos regulatórios para dispositivos médicos é segmentado em pequenas, médias e grandes empresas de dispositivos médicos. O segmento de grandes empresas de dispositivos médicos dominou o mercado com uma participação de 44,9% da receita em 2025, devido aos seus amplos portfólios de produtos e operações globais. A terceirização oferece suporte a submissões regulatórias em diversos países e garante a conformidade com diferentes padrões. Lançamentos frequentes de produtos e atividades de gerenciamento do ciclo de vida exigem suporte especializado. As empresas utilizam a terceirização para otimizar a alocação de recursos e reduzir a carga interna de conformidade. Grandes empresas enfrentam alto escrutínio regulatório para dispositivos de Classe II e III, impulsionando o crescimento do segmento. A vigilância pós-comercialização, as avaliações clínicas e a documentação técnica são terceirizadas para empresas especializadas. Auditorias regulatórias, marcação CE e aprovações FDA 510(k) aumentam a adoção da terceirização. Mitigação de riscos, eficiência de custos e entrada mais rápida no mercado impulsionam a dominância. A expansão para mercados emergentes exige expertise em terceirização. A integração de software e dispositivos conectados aumenta ainda mais a demanda. A terceirização permite que grandes empresas se concentrem em P&D, garantindo a conformidade regulatória.

Prevê-se que o segmento de pequenas empresas de dispositivos médicos apresente o crescimento mais rápido, com uma taxa composta de crescimento anual (CAGR) de 13,1% entre 2026 e 2033, impulsionado pela limitada expertise regulatória interna. Startups e empresas em estágio inicial dependem fortemente de serviços terceirizados para atender aos requisitos de conformidade global. A terceirização ajuda a reduzir os prazos de aprovação e os custos operacionais. A crescente inovação em dispositivos vestíveis, de diagnóstico e de cuidados domiciliares impulsiona o crescimento. A complexidade da documentação, da avaliação clínica e dos requisitos pós-comercialização tornam a terceirização essencial. Empresas financiadas por capital de risco buscam soluções regulatórias com boa relação custo-benefício. A expansão para o mercado global exige expertise em regulamentações regionais. A rápida evolução dos requisitos do MDR e do IVDR acelera a adoção da terceirização. Ferramentas regulatórias com auxílio de inteligência artificial (IA) auxiliam pequenas empresas na documentação eficiente. A mitigação de riscos de conformidade é um dos principais impulsionadores do crescimento do segmento. Startups utilizam a terceirização para obter um tempo de lançamento no mercado mais rápido e reduzir a carga de trabalho interna. O aumento das parcerias com CROs e consultores regulatórios fortalece as perspectivas de crescimento.

Análise Regional do Mercado de Terceirização de Assuntos Regulatórios de Dispositivos Médicos na América do Norte

- Prevê-se que o mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte cresça de forma constante durante o período de previsão, impulsionado pelo fortalecimento dos marcos regulatórios, pelo aumento das aprovações de dispositivos médicos e pela expansão da infraestrutura de saúde em toda a região.

- Os governos estão cada vez mais enfatizando a conformidade regulatória, o registro de produtos e a vigilância pós-comercialização para garantir a segurança do paciente e os padrões de qualidade. Como resultado, os fabricantes de dispositivos médicos estão terceirizando cada vez mais as atividades de assuntos regulatórios para provedores de serviços especializados, a fim de lidar com os requisitos regulatórios complexos e em constante evolução de forma eficiente.

- Os crescentes investimentos na modernização da saúde, juntamente com a adoção cada vez maior de tecnologias médicas avançadas, estão acelerando ainda mais a demanda por serviços de terceirização de assuntos regulatórios em toda a América do Norte.

Panorama do Mercado de Terceirização de Assuntos Regulatórios de Dispositivos Médicos nos EUA:

O mercado de terceirização de assuntos regulatórios de dispositivos médicos nos EUA dominou o mercado de terceirização de assuntos regulatórios de dispositivos médicos, representando aproximadamente 42,5% da receita regional em 2025. Essa dominância é impulsionada principalmente por um ecossistema de saúde e dispositivos médicos bem estabelecido, forte supervisão regulatória do FDA, alto volume de procedimentos com dispositivos médicos e a presença de empresas líderes em consultoria regulatória. A ênfase do país em conformidade, aprovações oportunas e processos robustos de autorização de mercado aumentou significativamente a demanda por serviços especializados de terceirização.

Panorama do Mercado de Terceirização de Assuntos Regulatórios de Dispositivos Médicos no Canadá:

O mercado canadense de terceirização de assuntos regulatórios de dispositivos médicos deverá registrar o crescimento mais rápido na América do Norte, com uma taxa de crescimento anual composta (CAGR) projetada em torno de 10,1% durante o período de previsão. Esse crescimento é impulsionado pela rápida modernização do sistema de saúde, pela crescente presença de fabricantes internacionais de dispositivos médicos e pela evolução dos marcos regulatórios sob a responsabilidade da Health Canada. A crescente conscientização sobre soluções de terceirização eficientes e processos regulatórios simplificados também impulsiona a expansão do mercado em todo o país.

Participação de mercado da terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

O setor de terceirização de assuntos regulatórios de dispositivos médicos é liderado principalmente por empresas consolidadas, incluindo:

- Accell Clinical Research, LLC (EUA)

- Genpact (EUA)

- CRITERIUM, INC. (EUA)

- Promedica Internacional (EUA)

- WuXiAppTec (China)

- Medpace (EUA)

- PPD Inc. (EUA)

- Charles River Laboratories (EUA)

- ICON plc (EUA)

- Covance (EUA)

- Parexel International Corporation (EUA)

- Freyr

- Navitas Clinical Research, Inc. (EUA)

- Medelis, Inc. (EUA)

- Sciformix (EUA)

- Tecnologia Tammina (EUA)

- Acorn Regulatory Consultancy Services Ltd. (Irlanda)

- BIOMAPAS (Lituânia)

- PROFISSIONAIS REGULADORES (Austrália)

- CompareNetworks, Inc. (EUA)

Novidades no mercado de terceirização de assuntos regulatórios de dispositivos médicos na América do Norte

- Em janeiro de 2023, a Medistri SA, uma prestadora de serviços de tecnologia médica com sede na Suíça, lançou uma solução integrada de consultoria em assuntos regulatórios e gestão da qualidade, personalizada para fabricantes de dispositivos médicos de pequeno e médio porte. Essa oferta simplificou os caminhos para a conformidade, fornecendo suporte econômico para a marcação CE, preparação de dossiês técnicos e vigilância pós-comercialização, atendendo a uma necessidade fundamental para empresas que não possuem equipes internas completas dedicadas aos assuntos regulatórios.

- Em março de 2023, a ICON plc lançou uma nova plataforma de Inteligência Regulatória projetada para auxiliar empresas de dispositivos médicos no acompanhamento da evolução das regulamentações globais, no gerenciamento de estratégias de submissão e no acesso a modelos de conformidade. A plataforma visava aprimorar a estratégia regulatória e a eficiência operacional para registros complexos em múltiplas jurisdições.

- Em março de 2023, a Freyr Solutions inaugurou um novo centro global de serviços regulatórios na região da Ásia-Pacífico, ampliando sua capacidade de apoiar empresas de dispositivos médicos com a conformidade integral para aprovações específicas de cada país. Essa oferta de serviços regionais aprimorada destacou o rápido crescimento da demanda por terceirização de serviços regulatórios em mercados emergentes.

- Em abril de 2023, a Parexel International Corporation expandiu seus serviços globais de consultoria regulatória para melhor apoiar os desenvolvedores de dispositivos médicos e produtos combinados que enfrentam os requisitos cada vez mais complexos do Regulamento de Dispositivos Médicos (MDR) e do Regulamento de Dispositivos de Diagnóstico In Vitro (IVDR) da UE. Essa expansão estratégica refletiu a crescente demanda do setor por conhecimento especializado em MDR/IVDR.

- Em março de 2024, a Emergo by UL estabeleceu um novo centro de consultoria regulatória em Singapura, focado em atender ao crescente mercado de dispositivos médicos da região Ásia-Pacífico, com ênfase no apoio a iniciativas de harmonização regulatória da ASEAN e aprovações em múltiplos países. Essa iniciativa reforçou a forte expansão geográfica dos serviços regulatórios terceirizados.

- Em julho de 2024, a Parexel International lançou sua Plataforma Regulatória Digital, integrando inteligência artificial e aprendizado de máquina para agilizar os processos de submissão regulatória de dispositivos médicos, fornecer gerenciamento de documentos baseado em nuvem e aprimorar a colaboração entre patrocinadores e órgãos reguladores.

- Em setembro de 2024, a IQVIA expandiu suas capacidades em assuntos regulatórios por meio da aquisição da divisão de consultoria regulatória da Pharm-Olam, reforçando sua expertise global em regulamentação de dispositivos médicos e aprimorando os serviços na região Ásia-Pacífico e América Latina — especialmente para estratégias regulatórias em mercados emergentes.

- Em janeiro de 2025, o ProPharma Group firmou parceria com a MedTech Europe para desenvolver programas de treinamento regulatório especializados para profissionais da área de dispositivos médicos, visando suprir lacunas críticas de habilidades decorrentes da implementação de estruturas regulatórias mais rigorosas, como o MDR.

- Em fevereiro de 2025, a IQVIA anunciou uma parceria estratégica com um fabricante europeu de dispositivos médicos para apoiar a preparação de dossiês regulatórios e a elaboração de relatórios de avaliação clínica de acordo com o Regulamento de Dispositivos Médicos da UE (EU MDR), reforçando a dependência do setor em relação à expertise terceirizada para documentação complexa de conformidade.

- Em março de 2025, análises de mercado indicaram que a ICON plc expandiu seus serviços de terceirização de assuntos regulatórios na região da Ásia-Pacífico, em resposta à crescente demanda local por consultoria regulatória e suporte a ensaios clínicos em mercados de alto crescimento, como China e Índia.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.