North America Natural Terpenes Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

104.74 Million

USD

170.56 Million

2024

2032

USD

104.74 Million

USD

170.56 Million

2024

2032

| 2025 –2032 | |

| USD 104.74 Million | |

| USD 170.56 Million | |

|

|

|

|

Segmentação do mercado de terpenos naturais da América do Norte, por tipo (monoterpenos, sesquiterpenos, politerpenos, diterpenos, triterpenos, tetraterpenos, norisoprenoides e outros), fonte (frutas cítricas, plantas coníferas, eucalipto, ervas e especiarias, lavanda, árvore do chá, olíbano, patchouli, cannabis e cânhamo, gengibre e outros), categoria (óleos essenciais contendo terpenos, terpenos misturados, terpenos puros/isolados e outros), forma (líquido, emulsão, pó, sólido, cristalino e outros), nível de pureza (≥98%, ≥95% a

Tamanho do mercado de terpenos naturais na América do Norte

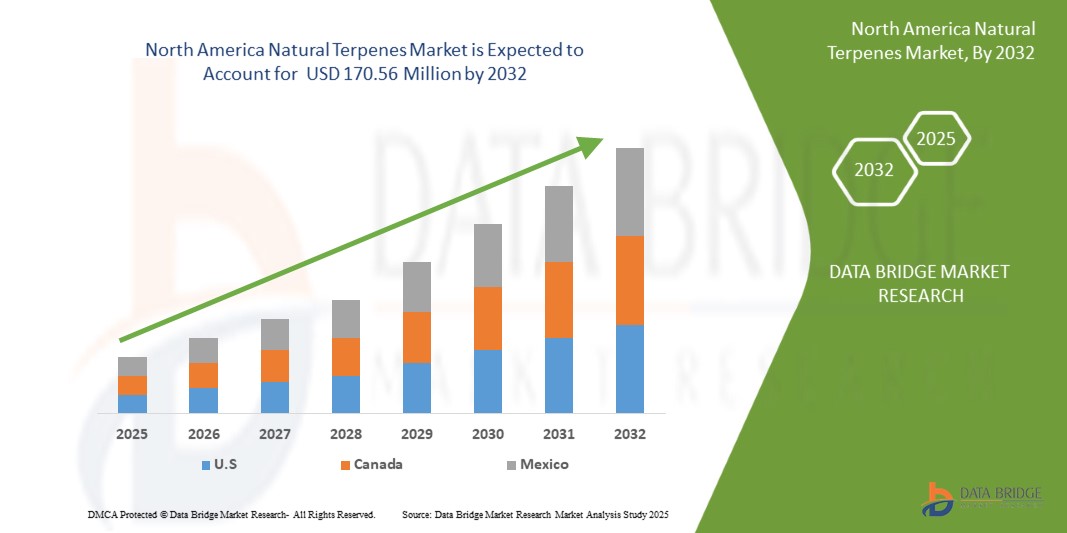

- O tamanho do mercado de terpenos naturais da América do Norte foi avaliado em US$ 104,74 milhões em 2024 e deve atingir US$ 170,56 milhões até 2032 , com um CAGR de 6,34% durante o período previsto.

- O crescimento do mercado está aumentando a demanda por produtos naturais e de rótulo limpo, o crescimento na legalização da cannabis e na inovação de produtos e a adoção crescente em aplicações farmacêuticas e terapêuticas.

- Além disso, espera-se que o mercado apresente inovações em produtos personalizados de aromaterapia e bem-estar, mercados emergentes para alimentos funcionais e sabores naturais, desenvolvimento de tecnologias avançadas de extração e purificação.

Análise do mercado de terpenos naturais na América do Norte

- O aumento da demanda por ingredientes naturais na América do Norte, o uso crescente de terpenos em produtos farmacêuticos, alimentos e bebidas e cosméticos, juntamente com as crescentes aplicações na indústria da cannabis e os avanços nas tecnologias de extração, são os principais fatores que devem impulsionar o crescimento do mercado de terpenos na América do Norte.

- Fatores-chave como a crescente demanda por ingredientes sustentáveis e naturais, crescentes investimentos em P&D baseados em produtos naturais, tecnologias aprimoradas de extração e formulação e um forte impulso político em direção a produtos de rótulo limpo, de base biológica e ecologicamente corretos estão impulsionando o crescimento do mercado de terpenos da América do Norte.

- Os EUA dominam o mercado de terpenos naturais da América do Norte com uma participação de mercado de 81,40% em 2024 devido ao crescimento do mercado, à crescente demanda por produtos naturais e de rótulo limpo, ao crescimento da legalização da cannabis e à inovação de produtos, além da crescente adoção em aplicações farmacêuticas e terapêuticas.

- Os EUA são o país com crescimento mais rápido no mercado de terpenos naturais da América do Norte, impulsionado por aplicações emergentes. O mercado deve gerar inovações em produtos personalizados de aromaterapia e bem-estar, mercados emergentes para alimentos funcionais e sabores naturais, desenvolvimento de tecnologias avançadas de extração e purificação.

- O segmento de monoterpenos domina o mercado com uma participação de mercado de 34,5% em 2024, crescendo com um CAGR de 6,83% no período previsto de 2025 a 2032. Impulsionado pela crescente demanda por produtos naturais e de rótulo limpo, crescimento na legalização da cannabis e inovação de produtos

Escopo do relatório e segmentação do mercado de terpenos naturais na América do Norte

|

Atributos |

Principais insights de mercado sobre terpenos naturais na América do Norte |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de terpenos naturais na América do Norte

Aumento da demanda por ingredientes de base biológica e sustentáveis em indústrias de uso final

- A demanda por ingredientes naturais à base de plantas está crescendo rapidamente, impulsionada pela preferência do consumidor por produtos com rótulos limpos, pela crescente conscientização sobre saúde e pela mudança para alternativas sustentáveis nos setores alimentício, cosmético e farmacêutico. Os terpenos atendem a essas demandas oferecendo benefícios funcionais, como sabor, fragrância e propriedades terapêuticas, além de serem derivados de fontes naturais renováveis.

- À medida que as indústrias buscam reduzir a dependência de produtos químicos sintéticos e se alinhar às metas de sustentabilidade da América do Norte, há uma crescente mudança em direção à integração de terpenos naturais nas formulações de produtos. Essa transição é crucial para atender aos padrões regulatórios, aumentar o apelo do produto e apoiar a mudança em direção a sistemas de produção mais sustentáveis e ecologicamente corretos.

- Grandes players da indústria, como Givaudan, Symrise e DSM-Firmenich, estão aumentando significativamente seus esforços de P&D para desenvolver formulações de terpenos de alta pureza e de base biológica que sejam mais eficientes, multifuncionais e ambientalmente sustentáveis, impulsionando ainda mais a inovação e o crescimento do mercado.

- Avanços em tecnologias de extração — como extração com CO₂ supercrítico, processos assistidos por enzimas e métodos assistidos por micro-ondas — estão aumentando o rendimento, a pureza e a escalabilidade dos terpenos. Essas inovações estão permitindo uma aplicação mais ampla em todos os setores e apoiando a expansão do mercado de terpenos naturais na América do Norte.

Dinâmica do mercado de terpenos naturais na América do Norte

Motorista

Aumento da demanda por produtos naturais e de rótulo limpo

- A crescente demanda global por ingredientes naturais e sustentáveis está levando os fabricantes a substituir aditivos sintéticos em alimentos, cosméticos, produtos farmacêuticos e produtos de bem-estar por alternativas ecologicamente corretas e de rótulo limpo.

- As empresas estão investindo rapidamente em tecnologias de extração de terpenos e atualizações da cadeia de suprimentos para fornecer soluções de alta pureza e ecologicamente corretas em escala, respondendo às preferências em evolução dos consumidores e às pressões regulatórias.

- Essas inovações estão promovendo ecossistemas de produção mais eficientes e sustentáveis, refletindo os avanços na agricultura de precisão que visam reduzir o desperdício de insumos e, ao mesmo tempo, maximizar o rendimento e a eficiência operacional.

- Em agosto de 2024, pesquisadores da Queen's University Belfast e do St. John Institute da Índia enfatizaram o potencial terapêutico dos óleos essenciais, reforçando o papel da aromaterapia nas práticas holísticas de saúde e bem-estar.

- Suas descobertas destacam a importância dos óleos essenciais na medicina complementar, aumentando a credibilidade da aromaterapia como uma abordagem integrativa baseada em plantas para apoiar o equilíbrio emocional, a imunidade e o bem-estar geral.

- Empresas líderes como Givaudan, Symrise e BASF estão desenvolvendo formulações avançadas de terpenos, métodos de extração natural e sistemas de entrega inovadores para melhorar o desempenho do produto e a vantagem competitiva

- O investimento público e privado em química sustentável está posicionando os terpenos naturais como centrais para a economia de base biológica, impulsionando o crescimento em mercados globais mais seguros, limpos e mais alinhados ao consumidor.

Restrição/Desafio

Altos custos de extração e baixos rendimentos

- Os altos custos de extração e os baixos rendimentos dificultam significativamente a adoção generalizada de terpenos, especialmente para pequenos produtores e empresas em mercados em desenvolvimento com acesso limitado a equipamentos avançados e mão de obra qualificada

- Os processos complexos necessários para extrair terpenos raros ou menos abundantes aumentam os desafios operacionais e os custos de produção, muitas vezes atrasando a comercialização e a escalabilidade em setores de alto crescimento

- Em fevereiro de 2025, um estudo da Universidade de Mostar otimizou a extração de CO₂ supercrítico da Artemisia annua , mostrando-a como um método mais ecológico e eficiente do que as técnicas tradicionais de destilação.

- O estudo utilizou um planejamento fatorial completo para analisar variáveis de pressão e temperatura, demonstrando melhor rendimento e integridade do terpeno com sc-CO₂ em comparação aos métodos convencionais

- Apesar da pesquisa em andamento sobre otimização de extração, os desafios de custo-eficiência e escalabilidade persistem, restringindo o uso mais amplo de terpenos e o acesso ao mercado para participantes menores e emergentes da indústria

Escopo do mercado de terpenos naturais na América do Norte

O mercado é segmentado com base no tipo, fonte, categoria, forma, nível de pureza, método de extração, função, embalagem, aplicação e canal de distribuição.

- Por tipo

Com base no tipo, o mercado é segmentado em monoterpenos, sesquiterpenos, politerpenos, diterpenos, triterpenos, tetraterpenos, norisoprenoides e outros. Em 2025, espera-se que o segmento de monoterpenos domine o mercado, com uma participação de mercado de 34,67%, crescendo com um CAGR de 6,83% no período previsto de 2025 a 2032, impulsionado por crescentes avanços em pesquisa, tecnologias de extração aprimoradas e aplicações em expansão nas indústrias de aromas, fragrâncias e bem-estar.

- Por fonte

Com base na fonte, o mercado é segmentado em frutas cítricas, coníferas, eucalipto, ervas e especiarias, lavanda, melaleuca, olíbano, patchouli, cannabis e cânhamo, gengibre e outros. Em 2025, espera-se que as frutas cítricas dominem o mercado, com uma participação de mercado de 39,62%, crescendo a uma taxa composta de crescimento anual (CAGR) de 7,20% no período previsto de 2025 a 2032, impulsionada pela crescente demanda do consumidor por ingredientes naturais à base de frutas cítricas, pela expansão do uso em cosméticos e produtos de limpeza e pelo foco crescente em práticas de abastecimento sustentáveis.

- Por categoria

Com base na categoria, o mercado é segmentado em terpenos puros/isolados, terpenos misturados, óleos essenciais contendo terpenos e outros. Em 2025, espera-se que o segmento de óleos essenciais contendo terpenos domine o mercado, com uma participação de mercado de 44,36%, crescendo com um CAGR de 6,27% no período previsto de 2025 a 2032, impulsionado pela crescente preferência do consumidor por bem-estar holístico, pela expansão do uso em produtos de aromaterapia e cuidados pessoais e pelos avanços em métodos de extração sustentáveis.

Por Formulário

Com base na forma, o mercado é segmentado em líquido, sólido, pó, emulsão, cristalino e outros. Em 2025, espera-se que o segmento líquido domine o mercado com 51,55%, crescendo com um CAGR de 6,27% no período previsto de 2025 a 2032, impulsionado pelo aumento da demanda por formulações de fácil aplicação, aumento do uso em bebidas e cosméticos e melhorias na estabilidade e nos sistemas de liberação de terpenos líquidos.

- Por nível de pureza

Com base no nível de pureza, o mercado é segmentado em ≥98%, ≥95% a <98% e <95%. Em 2024, espera-se que o segmento ≥98% domine o mercado com 51,09%, crescendo com um CAGR de 6,08% no período previsto de 2025 a 2032, impulsionado pela crescente demanda por terpenos de alta qualidade e grau farmacêutico, padrões regulatórios rigorosos e aplicações crescentes em medicina de precisão e formulações especiais.

- Por Método de Extração

Com base no método de extração, o mercado é segmentado em destilação a vapor, hidrodestilação, prensagem a frio, extração por solvente, extração com CO2 supercrítico, extração assistida por enzimas, extração assistida por micro-ondas, entre outros. Em 2025, espera-se que o segmento de destilação a vapor domine o mercado com 37,67%, crescendo com um CAGR de 7,14% no período previsto de 2025 a 2032, impulsionado por sua relação custo-benefício, ampla adoção pela indústria e capacidade de preservar a integridade dos terpenos em extratos naturais.

- Por função

Com base na função, o mercado é segmentado em antimicrobianos, anti-inflamatórios, antioxidantes, aromatizantes, fragrâncias, solventes, conservantes, repelentes de insetos, entre outros. Em 2025, espera-se que o segmento antimicrobiano domine o mercado com 33,31%, crescendo com um CAGR de 7,38% no período previsto de 2025 a 2032, impulsionado pela crescente preferência do consumidor por conservantes naturais, pelo aumento da demanda em segurança alimentar e pela expansão do uso em saúde e cuidados pessoais.

- Por embalagem

Com base na embalagem, o mercado é segmentado em garrafas, recipientes, frascos para amostras, sachês, blisters, tambores e outros. Em 2025, espera-se que o segmento de garrafas domine o mercado com 34,49%, crescendo com um CAGR de 6,88% no período previsto de 2025 a 2032, impulsionado por sua conveniência, reutilização e amplo uso em óleos essenciais e produtos de bem-estar.

- Por aplicação

Com base na aplicação, o mercado é segmentado em alimentos e bebidas, cosméticos e cuidados pessoais, produtos farmacêuticos, agricultura, solventes e limpeza industrial, indústria de cannabis e outros. Em 2025, espera-se que o setor de alimentos e bebidas domine o mercado com uma participação de 39,60%, crescendo com um CAGR de 6,20% no período previsto de 2025 a 2032, impulsionado pela crescente preferência do consumidor por sabores naturais, tendências crescentes de alimentos funcionais e expansão do uso de terpenos como conservantes naturais.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em direto e indireto. Em 2025, espera-se que o segmento de licitação direta domine o mercado com 59,75%, crescendo a uma taxa composta de crescimento anual (CAGR) de 6,28% no período previsto de 2025 a 2032, impulsionado por relacionamentos mais fortes entre fabricantes e clientes, cadeias de suprimentos simplificadas e crescente demanda por soluções de produtos personalizadas.

Análise regional do mercado de terpenos naturais na América do Norte

Visão geral do mercado de terpenos naturais na América do Norte

- O mercado de terpenos naturais da América do Norte deve atingir US$ 170,56 milhões até 2032, ante US$ 104,74 milhões em 2024, crescendo a uma taxa composta de crescimento anual (CAGR) de 6,34% no período previsto de 2025 a 2032.

- As regiões desenvolvidas da América do Norte destinam uma parcela significativa do seu PIB à saúde e ao bem-estar, garantindo financiamento para pesquisa e desenvolvimento de produtos naturais avançados, como terpenos. Em contrapartida, os mercados emergentes estão aumentando seus gastos com produtos naturais para a saúde devido à crescente conscientização do consumidor e à crescente demanda por terapias alternativas.

- Na América do Norte, produtos naturais à base de terpenos estão amplamente disponíveis e integrados às principais aplicações de saúde e bem-estar em mercados desenvolvidos. Em contrapartida, mercados emergentes com infraestruturas de saúde e bem-estar em evolução estão vivenciando um rápido crescimento no acesso a produtos à base de terpenos, impulsionado pela expansão das redes de distribuição e pelo aumento da demanda do consumidor.

Visão geral do mercado de terpenos naturais da América do Norte

Espera-se que os EUA registrem um CAGR de 6,8% no período previsto de 2025 a 2032, impulsionado pela crescente preferência do consumidor por produtos naturais para a saúde, pelo crescimento do uso de fitoterápicos e pela expansão da produção agrícola de plantas aromáticas.

Visão geral do mercado de terpenos naturais na América do Norte e Canadá

Espera-se que o Canadá registre um CAGR de 6,04% no período previsto de 2025 a 2032, impulsionado pela crescente demanda por produtos naturais para a saúde, pelo aumento dos investimentos em pesquisa farmacêutica e pela expansão da conscientização do consumidor sobre ingredientes de rótulo limpo.

Visão geral do mercado de terpenos naturais na América do Norte, México

Espera-se que o México registre um CAGR de 5,41% no período previsto de 2025 a 2032, impulsionado pela expansão da agricultura orgânica, pela crescente conscientização do consumidor sobre o bem-estar natural e pelo aumento do apoio governamental ao desenvolvimento de produtos sustentáveis.

Participação no mercado de terpenos naturais na América do Norte

O mercado de terpenos naturais da América do Norte é liderado principalmente por empresas bem estabelecidas, incluindo:

- Kraton Corporation (EUA)

- Sensient Technologies Corporation (EUA)

- Takasago International Corporation (Japão)

- International Flavors & Fragrances Inc. (EUA)

- Privi Speciality Chemicals Limited (Índia)

- Arakawa Chemical Industries, Ltd. (Japão)

- Symrise (Alemanha)

- Mangalam Organics (Índia)

- Kelvin Natural Mint Pvt. Ltd. (Índia)

- dsm-firmenich (Suíça)

- Givaudan (Suíça)

- AOS Products Pvt. Ltd. (Índia)

- YASUHARA CHEMICAL CO. LTD. (Japão)

- HTPPL (Índia)

- Arora Aromatics Pvt. Ltd. (Índia)

- Foreverest Resources Ltda. (China)

- BASF (Alemanha)

- ROBERTET SA (França)

- Indústria Química Foshan Baolin Co., Ltd. (China)

- Ciências BOC (EUA)

Últimos desenvolvimentos no mercado de terpenos naturais da América do Norte

- Em junho de 2024, a Privi Speciality Chemicals Limited anunciou a aprovação de uma aquisição estratégica para investir na Privi Fine Sciences Private Limited (PFSPL). Esta aquisição proposta envolve a subscrição e/ou aquisição de ações da PFSPL no valor de 36 milhões de dólares, representando aproximadamente 50,95% do capital social emitido e integralizado da PFSPL.

- Em dezembro de 2023, a LMR Naturals, da IFF, ganhou um prestigioso prêmio por seu Extrato Essencial de Neroli, reconhecido por sua composição 100% natural e reciclada. Este ingrediente inovador alavanca o design circular ao utilizar água pós-destilada, criando um material de fragrância sustentável e único.

- Em maio de 2024, a IFF comemorou o 40º aniversário de sua linha LMR Naturals, uma prova de seu compromisso de longa data com ingredientes naturais para fragrâncias. Este marco enfatiza o legado de sustentabilidade, respeito e inovação da LMR na obtenção e produção de matérias-primas naturais para perfumaria.

- Em fevereiro de 2025, a IFF lançou o ScentChat, um aplicativo de mensagens instantâneas com tecnologia de IA, projetado para aprimorar a criação de fragrâncias por meio do feedback do consumidor em tempo real. Esta ferramenta utiliza IA avançada e processamento de linguagem natural para coletar insights, agilizando o desenvolvimento de novas fragrâncias.

- Em abril de 2025, a BASF Aroma Ingredients lançou seus primeiros produtos com Pegada de Carbono (PCF) reduzida, começando com o L-Mentol FCC rPCF. Esses produtos, parte de um portfólio crescente de rPCF, alcançam uma redução de PCF de 10 a 15% em comparação com os produtos convencionais da BASF. Isso é possível graças a uma abordagem de balanço de massa, substituindo matéria-prima fóssil por biomassa de resíduos, mantendo a qualidade.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA NATURAL TERPENES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 COMPETITIVE RIVALRY – HIGH

4.1.2 THREAT OF NEW ENTRANTS – MODERATE TO HIGH

4.1.3 BARGAINING POWER OF BUYERS – HIGH

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.5 THREAT OF SUBSTITUTES – MODERATE

4.2 IMPORT EXPORT SCENARIO

4.3 VALUE CHAIN ANALYSIS: NORTH AMERICA NATURAL TERPENES MARKET

4.3.1 PROCUREMENT:

4.3.2 MANUFACTURING:

4.3.3 MARKETING & DISTRIBUTION:

4.4 PATENT ANALYSIS

4.4.1 PATENT QUALITY AND STRENGTH

4.4.2 PATENT FAMILIES

4.4.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.4.4 REGION PATENT LANDSCAPE

4.4.5 IP STRATEGY AND MANAGEMENT

4.4.6 PATENT ANALYSIS – TOP APPLICANTS

4.5 IMPACT OF ECONOMIC SLOWDOWN ON THE NORTH AMERICA NATURAL TERPENES MARKET

4.5.1 IMPACT OF PRICE

4.5.2 IMPACT ON SUPPLY CHAIN

4.5.3 IMPACT ON SHIPMENT

4.5.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.5.5 CONCLUSION

4.6 INDUSTRY ECO-SYSTEM ANALYSIS OF THE NORTH AMERICA NATURAL TERPENES MARKET

4.6.1 RAW MATERIAL SUPPLIERS

4.6.2 EXTRACTION & PROCESSING PLANTS

4.6.3 PRODUCT FORMULATION & BLENDING

4.6.4 DISTRIBUTION & LOGISTICS

4.6.5 REGULATORY & QUALITY CERTIFICATIONS

4.6.6 CERTIFICATIONS & TRACEABILITY SYSTEMS

4.7 RAW MATERIAL SOURCING ANALYSIS ON THE NORTH AMERICA NATURAL TERPENES MARKET

4.7.1 CITRUS TERPENE (D LIMONENE)

4.7.2 PINE RESIN TERPENES (E.G., Α-PINENE, Β-PINENE)

4.7.3 EUCALYPTUS-DERIVED TERPENES (E.G., CINEOLE, EUCALYPTOL)

4.7.4 MINT AND HERB-BASED TERPENES (E.G., MENTHOL, CARVONE, PIPERITONE)

4.7.5 HEMP AND ARTEMISIA-DERIVED TERPENES

4.7.6 RECENT NORTH AMERICA ACTIVITIES

4.7.7 CONCLUSION

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW OF THE NORTH AMERICA NATURAL TERPENE SUPPLY CHAIN

4.8.2 SUPPLY CHAIN CHALLENGES:

4.8.3 LOGISTICS COST SCENARIO

4.8.3.1 TRANSPORTATION COSTS

4.8.3.2 WAREHOUSING AND STORAGE COSTS

4.8.3.3 HANDLING AND PACKAGING COSTS

4.8.4 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8.4.1 TRANSPORTATION MANAGEMENT

4.8.4.2 WAREHOUSING AND DISTRIBUTION SERVICES

4.8.4.3 REGULATORY AND COMPLIANCE EXPERTISE

4.8.5 CONCLUSION

4.9 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA NATURAL TERPENE MARKET

4.9.1 ADVANCED EXTRACTION AND PURIFICATION TECHNOLOGIES

4.9.2 BIOCATALYTIC AND SYNTHETIC BIOLOGY-DRIVEN TERPENE PRODUCTION

4.9.3 NOVEL FORMULATION AND DELIVERY SYSTEMS

4.9.4 DIGITAL ANALYTICS AND QUALITY CONTROL IN TERPENE PRODUCTION

4.9.5 SUSTAINABILITY AND GREEN TECHNOLOGIES IN TERPENE MARKETING

4.9.6 INTEGRATION OF TERPENES IN EMERGING INDUSTRIES AND APPLICATIONS

4.9.7 DIGITAL MARKETING AND CUSTOMER ENGAGEMENT PLATFORMS

4.1 PRODUCTION CONSUMPTION ANALYSIS

4.11 PROFIT MARGINS SCENARIO ON NORTH AMERICA NATURAL TERPENES MARKET

4.11.1 UPSTREAM PROFITABILITY – FEEDSTOCK PRODUCERS & TERPENE EXTRACTORS

4.11.2 MIDSTREAM – ISOLATION, PROCESSING & BULK SUPPLIERS

4.11.3 DOWNSTREAM – BRANDS, FORMULATORS & END-USE MANUFACTURERS

4.11.4 MARKET PRESSURES AND COST DRIVERS

4.11.5 CONCLUSION

4.12 COST ANALYSIS BREAKDOWN

4.12.1 RAW MATERIAL PROCUREMENT COSTS

4.12.2 EXTRACTION AND PROCESSING COSTS

4.12.3 QUALITY CONTROL & COMPLIANCE COSTS

4.12.4 PACKAGING AND HANDLING COSTS

4.12.5 COLD CHAIN & LOGISTICS EXPENSES

4.12.6 LABOR AND SKILLED TECHNICIAN COSTS

4.12.7 R&D, INNOVATION, AND SUSTAINABILITY COSTS

4.12.8 SALES, MARKETING, AND BRANDING COSTS

4.12.9 CONCLUSION

4.13 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USE

4.13.1 PRICE

4.13.2 PRODUCT QUALITY

4.13.3 BRAND REPUTATION

4.13.4 ADVERTISEMENT AND PROMOTIONS

4.13.5 PRODUCT AVAILABILITY

4.13.6 FINANCIAL ACCESSIBILITY

4.13.7 PEER AND EXPERT RECOMMENDATIONS

4.13.8 CONCLUSION

4.14 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.14.1 GIVAUDAN

4.14.2 SYMRISE

4.14.3 DSM-FIRMENICH

4.14.4 IFF (INTERNATIONAL FLAVORS & FRAGRANCES)

4.14.5 ROBERTET GROUP

4.14.6 TAKASAGO INTERNATIONAL CORPORATION

4.14.7 THE ANTHEA GROUP

4.14.8 MENTHA & ALLIED PRODUCTS

4.14.9 AOS PRODUCTS

4.14.10 NATURAL FRACTIONS

4.14.11 LESCO CHEMICAL LIMITED

4.14.12 FOREVEREST RESOURCES LTD.

4.14.13 CONCLUSION

4.15 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.15.1 JOINT VENTURES

4.15.2 MERGERS AND ACQUISITIONS (M&A)

4.15.3 LICENSING AND PARTNERSHIPS

4.15.4 TECHNOLOGY COLLABORATIONS

4.15.5 COMPANY’S OVERVIEW

4.15.6 CONCLUSION

4.16 INTRODUCTION: ROLE OF TARIFFS IN THE NORTH AMERICA NATURAL TERPENE MARKET

4.16.1 TARIFF LANDSCAPE: NORTH AMERICA DUTIES APPLIED TO NATURAL TERPENES

4.16.2 IMPACT OF TARIFFS ON COST STRUCTURES AND SUPPLY CHAIN DYNAMICS

4.16.3 INFLUENCE OF TRADE AGREEMENTS AND REGIONAL POLICIES

4.16.4 MARKET TRENDS AMPLIFYING TARIFF IMPACTS

4.16.5 CHALLENGES AND OPPORTUNITIES ARISING FROM TARIFFS

4.16.6 CONCLUSION: TARIFFS AS A STRUCTURAL FORCE IN THE NORTH AMERICA TERPENE MARKET

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR NATURAL & CLEAN-LABEL PRODUCTS

6.1.2 GROWTH IN CANNABIS LEGALIZATION & PRODUCT INNOVATION

6.1.3 INCREASING ADOPTION IN PHARMACEUTICAL AND THERAPEUTIC APPLICATIONS

6.1.4 INCREASING UTILIZATION IN FOOD & BEVERAGE FLAVORING APPLICATIONS

6.2 RESTRAINTS

6.2.1 HIGH EXTRACTION COSTS AND LOW YIELDS

6.2.2 SUPPLY CHAIN INSTABILITY OF BOTANICAL RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 INNOVATIONS IN PERSONALIZED AROMATHERAPY & WELLNESS PRODUCTS

6.3.2 EMERGING MARKETS FOR FUNCTIONAL FOODS & NATURAL FLAVORS

6.3.3 DEVELOPMENT OF ADVANCED EXTRACTION & PURIFICATION TECHNOLOGIES

6.4 CHALLENGES

6.4.1 STIFF COMPETITION FROM SYNTHETIC & SEMI-SYNTHETIC ALTERNATIVES

6.4.2 DIFFICULTY IN MAINTAINING CONSISTENT TERPENE PROFILES FROM NATURAL SOURCES

7 NORTH AMERICA NATURAL TERPENES MARKET, BY SOURCE

7.1 OVERVIEW

7.2 CITRUS FRUITS

7.3 CONIFEROUS PLANT

7.4 EUCALYPTUS

7.5 HERBS & SPICES

7.6 LAVENDER

7.7 TEA TREE

7.8 FRANKINCENSE

7.9 PATCHOULI

7.1 CANNABIS & HEMP

7.11 GINGER

7.12 OTHERS

8 NORTH AMERICA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION

8.1 OVERVIEW

8.2 STEAM DISTILLATION

8.3 HYDRODISTILLATION

8.4 COLD PRESSING

8.5 SOLVENT EXTRACTION

8.6 SUPERCRITICAL CO2 EXTRACTION

8.7 ENZYME-ASSISTED EXTRACTION

8.8 MICROWAVE-ASSISTED EXTRACTION

8.9 OTHERS

9 NORTH AMERICA NATURAL TERPENES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD & BEVERAGES

9.3 COSMETIC & PERSONAL CARE

9.4 PHARMACEUTICALS

9.5 AGRICULTURE

9.6 SOLVENT & INDUSTRIAL CLEANING

9.7 CANNABIS INDUSTRY

9.8 OTHERS

10 NORTH AMERICA NATURAL TERPENES MARKET, BY TYPE

10.1 OVERVIEW

10.2 MONOTERPENES

10.3 SESQUITERPENES

10.4 POLYTERPENES

10.5 DITERPENES

10.6 TRITERPENES

10.7 TETRATERPENES

10.8 NORISOPRENOIDS

10.9 OTHERS

11 NORTH AMERICA NATURAL TERPENES MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 BOTTLES

11.3 CONTAINERS

11.4 SAMPLE VIALS

11.5 SACHETS

11.6 BLISTERS PACKS

11.7 DRUMS

11.8 OTHERS

12 NORTH AMERICA NATURAL TERPENES MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 ESSENTIAL OILS CONTAINING TERPENES

12.3 BLENDED TERPENE

12.4 PURE/ISOLATED

12.5 OTHERS

13 NORTH AMERICA NATURAL TERPENES MARKET, BY FORM

13.1 OVERVIEW

13.2 LIQUID

13.3 EMULSION

13.4 POWDER

13.5 SOLID

13.6 CRYSTALLINE

13.7 OTHERS

14 NORTH AMERICA NATURAL TERPENES MARKET, BY FUNCTION

14.1 OVERVIEW

14.2 ANTIMICROBIAL

14.3 ANTI-INFLAMMATORY

14.4 ANTIOXIDANT

14.5 FLAVORING AGENT

14.6 FRAGRANCE AGENT

14.7 SOLVENT

14.8 PRESERVATIVE

14.9 INSECT REPELLENT

14.1 OTHERS

15 NORTH AMERICA NATURAL TERPENES MARKET, BY PURITY LEVEL

15.1 OVERVIEW

15.2 >98%

15.3 >95% TO <98%

15.4 <95%

16 NORTH AMERICA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT

16.3 INDIRECT

17 NORTH AMERICA NATURAL TERPENE MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA NATURAL TERPENES MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 KRATON CORPORATION

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 SENSIENT TECHNOLOGIES CORPORATION

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 TAKASAGO INTERNATIONAL CORPORATION

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 INTERNATIONAL FLAVORS & FRAGRANCES INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS/NEWS

20.5 PRIVI SPECIALITY CHEMICALS LIMITED

20.5.1 COMPANY SNAPSHOT

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 AOS PRODUCTS PVT. LTD.

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 ARAKAWA CHEMICAL INDUSTRIES,LTD.

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 ARORA AROMATICS PVT.LTD

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 BASF

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 BOC SCIENCES

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DSM-FIRMENICH

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 FOREVEREST RESOURCES LTD.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 FOSHAN BAOLIN CHEMICAL INDUSTRY CO., LTD

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 GIVAUDAN

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENT

20.15 GOLDENSEA CHEMICALS

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 GREEN EXCHANGE LAB SAS

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 HTPPL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 JIANGXI NORTH AMERICA NATURAL SPICE CO., LTD.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 KELVIN NATURAL MINT PVT. LTD.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 LESCO CHEMICAL LIMITED

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 MANGALAM ORGANICS

20.21.1 COMPANY SNAPSHOT

20.21.2 562

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

20.22 MENTHA & ALLIED PRODUCTS PRIVATE LIMITED

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 NATURAL FRACTIONS PTY LTD.

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 ROBERTET SA

20.24.1 COMPANY SNAPSHOT

20.24.2 REVENUE ANALYSIS

20.24.3 PRODUCT PORTFOLIO

20.24.4 RECENT DEVELOPMENT

20.25 SUZHOU MEGAWIDE CHEMICALS CO. LTD.

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

20.26 SYMRISE

20.26.1 COMPANY SNAPSHOT

20.26.2 REVENUE ANALYSIS

20.26.3 PRODUCT PORTFOLIO

20.26.4 RECENT DEVELOPMENT

20.27 THE ANTHEA GROUP

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

20.28 UTTARANCHAL TERPENE PRODUCTS PVT. LTD.

20.28.1 COMPANY SNAPSHOT

20.28.2 PRODUCT PORTFOLIO

20.28.3 RECENT DEVELOPMENT

20.29 VIZAGCHEMICAL

20.29.1 COMPANY SNAPSHOT

20.29.2 PRODUCT PORTFOLIO

20.29.3 RECENT DEVELOPMENT

20.3 YASUHARA CHEMICAL CO., LTD.

20.30.1 COMPANY SNAPSHOT

20.30.2 REVENUE ANALYSIS

20.30.3 PRODUCT PORTFOLIO

20.30.4 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Lista de Tabela

TABLE 1 NUMBER OF PATENTS PER YEAR

TABLE 2 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 3 TOP PATENT APPLICANTS.

TABLE 4 ECOSYSTEM COMPONENT AND KEY DRIVERS & STRATEGIC COMPONENT

TABLE 5 INNOVATION TYPE & STRATEGIC VALUE COMPRISING NATURAL TARPEENE MARKET

TABLE 6 COMPETITIVE IMPLICATIONS FOR MARKET PLAYERS

TABLE 7 KEY PLAYERS AND TARIFF STRATEGY OVERVIEW

TABLE 8 REGULATORY COVERAGE

TABLE 9 NORTH AMERICA NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 11 NORTH AMERICA CITRUS FRUITS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA CITRUS FRUITS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA CONIFEROUS PLANTS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CONIFEROUS PLANTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA EUCALYPTUS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA HERBS & SPICES IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA HERBS & SPICES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA LAVENDER IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA TEA TREE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA FRANKINCENSE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA PATCHOULI IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA CANNABIS & HEMP IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA CANNABIS & HEMP IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA GINGER IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (TONS)

TABLE 28 NORTH AMERICA STEAM DISTILLATION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA HYDRODISTILLATION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA COLD PRESSING IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA SOLVENT EXTRACTION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SUPERCRITICAL CO2 EXTRACTION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA ENZYME-ASSISTED EXTRACTION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA MICROWAVE-ASSISTED EXTRACTION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 38 NORTH AMERICA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA BEVERAGE ADDITIVES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SKINCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA FRAGRANCE INGREDIENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA HAIRCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA ORAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA PHARMACEUTICALS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA PHARMACEUTICALS IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA NEUROLOGICAL SUPPORT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA AGRICULTURE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA AGRICULTURE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA AGRICULTURE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA BIOPESTICIDE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA ELECTRONICS AND PRECISION COMPONENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA PAINT, COATINGS AND VARNISHES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA COATING FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA INKS AND PRINTING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA ADHESIVE FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA INDUSTRIAL DEGREASERS AND MAINTENANCE CLEANERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA NATURAL TERPENES MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 73 NORTH AMERICA MONOTERPENES IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA MONOCYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA ACYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA BICYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA PINENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA SESQUITERPENE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA SESQUITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA POLYTERPENE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA DITERPENE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA DITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA TRITERPENE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA TRITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA TETRATERPENE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA TETRATERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA NORISOPRENOIDS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA TETRATERPENE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (TONS)

TABLE 92 NORTH AMERICA BOTTLES IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA BOTTLES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA CONTAINERS IN NATURAL TERPENES MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA CONTAINER IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA SAMPLE VIALS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA SACHETS IN NATURAL TERPENES MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA BLISTERS PACKS IN NATURAL TERPENES MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA DRUMS IN NATURAL TERPENES MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA DRUMS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA ESSENTIAL OILS CONTAINING TERPENES IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA ESSENTIAL OILS CONTAINING TERPENES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA BLENDED TERPENES IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA CITRUS FRUITS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA PURE/ISOLATED IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (TONS)

TABLE 111 NORTH AMERICA LIQUID IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA EMULSION IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA POWDER IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA SOLID IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA CRYSTALLINE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA NATURAL TERPENE MARKET, BY FUNCTION, 2018-2032 (TONS)

TABLE 119 NORTH AMERICA ANTIMICROBIAL IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 120 NORTH AMERICA ANTI-INFLAMMATORY IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 121 NORTH AMERICA ANTIOXIDANT IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 122 NORTH AMERICA FLAVORING AGENT IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 123 NORTH AMERICA FRAGRANCE AGENT IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 124 NORTH AMERICA SOLVENT IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 125 NORTH AMERICA PRESERVATIVE IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 126 NORTH AMERICA INSECT REPELLENT IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 127 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 128 NORTH AMERICA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD THOUSAND)

TABLE 129 NORTH AMERICA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (TONS)

TABLE 130 NORTH AMERICA >98% IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 131 NORTH AMERICA >95% TO <98% IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 132 NORTH AMERICA <95% IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 133 NORTH AMERICA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 134 NORTH AMERICA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 135 NORTH AMERICA DIRECT TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 136 NORTH AMERICA INDIRECT IN NATURAL TERPENES MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 137 NORTH AMERICA INDIRECT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 NORTH AMERICA NON-STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 NORTH AMERICA STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 NORTH AMERICA NATURAL TERPENES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 141 NORTH AMERICA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 NORTH AMERICA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 143 NORTH AMERICA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 144 NORTH AMERICA MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 NORTH AMERICA MONOCYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 NORTH AMERICA ACYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 NORTH AMERICA BICYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 NORTH AMERICA PINENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 NORTH AMERICA SESQUITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 NORTH AMERICA DITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 NORTH AMERICA TRITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 NORTH AMERICA TETRATERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 NORTH AMERICA NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 154 NORTH AMERICA NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 155 NORTH AMERICA CITRUS FRUITS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 NORTH AMERICA CONIFEROUS PLANTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 NORTH AMERICA HERBS & SPICES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 NORTH AMERICA CANNABIS & HEMP IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 NORTH AMERICA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 160 NORTH AMERICA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 161 NORTH AMERICA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD/KG)

TABLE 162 NORTH AMERICA ESSENTIAL OILS CONTAINING TERPENES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 NORTH AMERICA BLENDED TERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NORTH AMERICA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 165 NORTH AMERICA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (TONS)

TABLE 166 NORTH AMERICA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 167 NORTH AMERICA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD THOUSAND)

TABLE 168 NORTH AMERICA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (TONS)

TABLE 169 NORTH AMERICA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD/KG)

TABLE 170 NORTH AMERICA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD THOUSAND)

TABLE 171 NORTH AMERICA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (TONS)

TABLE 172 NORTH AMERICA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD/KG)

TABLE 173 NORTH AMERICA NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 174 NORTH AMERICA NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (TONS)

TABLE 175 NORTH AMERICA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 176 NORTH AMERICA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (TONS)

TABLE 177 NORTH AMERICA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD/KG)

TABLE 178 NORTH AMERICA BOTTLES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NORTH AMERICA CONTAINER IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NORTH AMERICA DRUMS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 NORTH AMERICA NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 NORTH AMERICA NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 183 NORTH AMERICA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 NORTH AMERICA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 NORTH AMERICA BEVERAGE ADDITIVES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 NORTH AMERICA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 NORTH AMERICA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 NORTH AMERICA SKINCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 NORTH AMERICA FRAGRANCE INGREDIENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 NORTH AMERICA HAIRCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 NORTH AMERICA ORAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 NORTH AMERICA PHARMACEUTICAL IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 NORTH AMERICA PHARMACEUTICALS IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 NORTH AMERICA NEUROLOGICAL SUPPORT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 NORTH AMERICA AGRICULTURE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 NORTH AMERICA AGRICULTURE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 NORTH AMERICA BIOPESTICIDE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 NORTH AMERICA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 NORTH AMERICA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 NORTH AMERICA ELECTRONICS AND PRECISION COMPONENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 NORTH AMERICA PAINT, COATINGS AND VARNISHES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 NORTH AMERICA COATING FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 NORTH AMERICA INKS AND PRINTING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 NORTH AMERICA ADHESIVE FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 NORTH AMERICA INDUSTRIAL DEGREASERS AND MAINTENANCE CLEANERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 NORTH AMERICA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 NORTH AMERICA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 NORTH AMERICA OTHERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 NORTH AMERICA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 210 NORTH AMERICA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 211 NORTH AMERICA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD/KG)

TABLE 212 NORTH AMERICA INDIRECT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 NORTH AMERICA NON STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 NORTH AMERICA STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 U.S. NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 U.S. NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 217 U.S. NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 218 U.S. MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 U.S. MONOCYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 U.S. ACYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 U.S. BICYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 U.S. PINENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 U.S. SESQUITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 U.S. DITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 U.S. TRITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 U.S. TETRATERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 U.S. NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 228 U.S. NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 229 U.S. CITRUS FRUITS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 U.S. CONIFEROUS PLANTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 U.S. HERBS & SPICES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 U.S. CANNABIS & HEMP IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 U.S. NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 234 U.S. NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 235 U.S. NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD/KG)

TABLE 236 U.S. ESSENTIAL OILS CONTAINING TERPENES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 U.S. BLENDED TERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.S. NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 239 U.S. NATURAL TERPENES MARKET, BY FORM, 2018-2032 (TONS)

TABLE 240 U.S. NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 241 U.S. NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD THOUSAND)

TABLE 242 U.S. NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (TONS)

TABLE 243 U.S. NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD/KG)

TABLE 244 U.S. NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD THOUSAND)

TABLE 245 U.S. NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (TONS)

TABLE 246 U.S. NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD/KG)

TABLE 247 U.S. NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 248 U.S. NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (TONS)

TABLE 249 U.S. NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 250 U.S. NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (TONS)

TABLE 251 U.S. NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD/KG)

TABLE 252 U.S. BOTTLES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 U.S. CONTAINER IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 U.S. DRUMS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 U.S. NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 256 U.S. NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 257 U.S. FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 U.S. FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 U.S. BEVERAGE ADDITIVES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 U.S. COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 U.S. COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 U.S. SKINCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 U.S. FRAGRANCE INGREDIENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 U.S. HAIRCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 U.S. ORAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 U.S. PHARMACEUTICAL IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 U.S. PHARMACEUTICALS IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 U.S. NEUROLOGICAL SUPPORT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 U.S. AGRICULTURE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 U.S. AGRICULTURE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 U.S. BIOPESTICIDE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 U.S. SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 U.S. SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 U.S. ELECTRONICS AND PRECISION COMPONENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 U.S. PAINT, COATINGS AND VARNISHES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 U.S. COATING FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 U.S. INKS AND PRINTING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 U.S. ADHESIVE FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 U.S. INDUSTRIAL DEGREASERS AND MAINTENANCE CLEANERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 U.S. CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 U.S. CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 U.S. OTHERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 U.S. NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 284 U.S. NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 285 U.S. NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD/KG)

TABLE 286 U.S. INDIRECT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 U.S. NON STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 U.S. STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 CANADA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 CANADA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 291 CANADA NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 292 CANADA MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 CANADA MONOCYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 CANADA ACYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 CANADA BICYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 CANADA PINENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 CANADA SESQUITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 CANADA DITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 CANADA TRITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 CANADA TETRATERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 CANADA NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 302 CANADA NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 303 CANADA CITRUS FRUITS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 CANADA CONIFEROUS PLANTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 CANADA HERBS & SPICES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 CANADA CANNABIS & HEMP IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 CANADA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 308 CANADA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 309 CANADA NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD/KG)

TABLE 310 CANADA ESSENTIAL OILS CONTAINING TERPENES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 CANADA BLENDED TERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 CANADA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 313 CANADA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (TONS)

TABLE 314 CANADA NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 315 CANADA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD THOUSAND)

TABLE 316 CANADA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (TONS)

TABLE 317 CANADA NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD/KG)

TABLE 318 CANADA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD THOUSAND)

TABLE 319 CANADA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (TONS)

TABLE 320 CANADA NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD/KG)

TABLE 321 CANADA NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 322 CANADA NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (TONS)

TABLE 323 CANADA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 324 CANADA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (TONS)

TABLE 325 CANADA NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD/KG)

TABLE 326 CANADA BOTTLES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 CANADA CONTAINER IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 CANADA DRUMS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 CANADA NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 330 CANADA NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 331 CANADA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 CANADA FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 CANADA BEVERAGE ADDITIVES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 CANADA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 CANADA COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 CANADA SKINCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 CANADA FRAGRANCE INGREDIENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 CANADA HAIRCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 CANADA ORAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 CANADA PHARMACEUTICAL IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 CANADA PHARMACEUTICALS IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 CANADA NEUROLOGICAL SUPPORT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 CANADA AGRICULTURE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 CANADA AGRICULTURE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 CANADA BIOPESTICIDE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 CANADA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 CANADA SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 CANADA ELECTRONICS AND PRECISION COMPONENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 CANADA PAINT, COATINGS AND VARNISHES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 CANADA COATING FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 CANADA INKS AND PRINTING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 CANADA ADHESIVE FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 CANADA INDUSTRIAL DEGREASERS AND MAINTENANCE CLEANERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 CANADA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 CANADA CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 CANADA OTHERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 CANADA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 358 CANADA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 359 CANADA NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD/KG)

TABLE 360 CANADA INDIRECT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 CANADA NON STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 CANADA STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 MEXICO NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 MEXICO NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 365 MEXICO NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 366 MEXICO MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 MEXICO MONOCYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 MEXICO ACYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 369 MEXICO BICYCLIC MONOTERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 MEXICO PINENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 MEXICO SESQUITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 MEXICO DITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 373 MEXICO TRITERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 MEXICO TETRATERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 MEXICO NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 376 MEXICO NATURAL TERPENES MARKET, BY SOURCE, 2018-2032 (TONS)

TABLE 377 MEXICO CITRUS FRUITS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 MEXICO CONIFEROUS PLANTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 MEXICO HERBS & SPICES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 MEXICO CANNABIS & HEMP IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 MEXICO NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 382 MEXICO NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 383 MEXICO NATURAL TERPENES MARKET, BY CATEGORY, 2018-2032 (USD/KG)

TABLE 384 MEXICO ESSENTIAL OILS CONTAINING TERPENES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 MEXICO BLENDED TERPENE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 MEXICO NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 387 MEXICO NATURAL TERPENES MARKET, BY FORM, 2018-2032 (TONS)

TABLE 388 MEXICO NATURAL TERPENES MARKET, BY FORM, 2018-2032 (USD/KG)

TABLE 389 MEXICO NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD THOUSAND)

TABLE 390 MEXICO NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (TONS)

TABLE 391 MEXICO NATURAL TERPENES MARKET, BY PURITY LEVEL, 2018-2032 (USD/KG)

TABLE 392 MEXICO NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD THOUSAND)

TABLE 393 MEXICO NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (TONS)

TABLE 394 MEXICO NATURAL TERPENES MARKET, BY METHODS OF EXTRACTION, 2018-2032 (USD/KG)

TABLE 395 MEXICO NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 396 MEXICO NATURAL TERPENES MARKET, BY FUNCTION, 2018-2032 (TONS)

TABLE 397 MEXICO NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 398 MEXICO NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (TONS)

TABLE 399 MEXICO NATURAL TERPENES MARKET, BY PACKAGING, 2018-2032 (USD/KG)

TABLE 400 MEXICO BOTTLES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 MEXICO CONTAINER IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 MEXICO DRUMS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 MEXICO NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 404 MEXICO NATURAL TERPENES MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 405 MEXICO FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 MEXICO FOOD & BEVERAGES IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 MEXICO BEVERAGE ADDITIVES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 MEXICO COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 409 MEXICO COSMETIC & PERSONAL CARE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 MEXICO SKINCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 MEXICO FRAGRANCE INGREDIENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 MEXICO HAIRCARE PRODUCTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 413 MEXICO ORAL CARE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 MEXICO PHARMACEUTICAL IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 MEXICO PHARMACEUTICALS IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 MEXICO NEUROLOGICAL SUPPORT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 MEXICO AGRICULTURE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 MEXICO AGRICULTURE IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 MEXICO BIOPESTICIDE IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 MEXICO SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 MEXICO SOLVENT & INDUSTRIAL CLEANING IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 422 MEXICO ELECTRONICS AND PRECISION COMPONENTS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 MEXICO PAINT, COATINGS AND VARNISHES IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 MEXICO COATING FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 MEXICO INKS AND PRINTING IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 426 MEXICO ADHESIVE FORMULATION IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 MEXICO INDUSTRIAL DEGREASERS AND MAINTENANCE CLEANERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 MEXICO CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 429 MEXICO CANNABIS INDUSTRY IN NATURAL TERPENES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 MEXICO OTHERS IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 431 MEXICO NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 432 MEXICO NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 433 MEXICO NATURAL TERPENES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD/KG)

TABLE 434 MEXICO INDIRECT IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 MEXICO NON STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 MEXICO STORE BASED IN NATURAL TERPENES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 NORTH AMERICA NATURAL TERPENES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA NATURAL TERPENES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA NATURAL TERPENES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA NATURAL TERPENES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA NATURAL TERPENES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA NATURAL TERPENES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA NATURAL TERPENES MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA NATURAL TERPENES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA NATURAL TERPENES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA NATURAL TERPENES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA NATURAL TERPENES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA NATURAL TERPENES MARKET: EXECUTIVE SUMMARY

FIGURE 13 EIGHT SEGMENTS COMPRISE THE NORTH AMERICA NATURAL TARPENE MARKET, BY TYPE

FIGURE 14 NORTH AMERICA NATURAL TERPENES MARKET: STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR NATURAL & CLEAN-LABEL PRODUCTS IS DRIVING THE GROWTH OF THE NORTH AMERICA NATURAL TERPENES MARKET FROM 2025 TO 2032

FIGURE 16 THE MONOTERPENES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA NATURAL TERPENES MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 VALUE CHAIN ANALYSIS OF THE NORTH AMERICA NATURAL TERPENES MARKET

FIGURE 20 IPC CODE V/S NUMBER OF PATENTS

FIGURE 21 NUMBER OF PATENTS PER YEAR