North America Photo Printing And Merchandise Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

7.11 Billion

USD

12.49 Billion

2025

2033

USD

7.11 Billion

USD

12.49 Billion

2025

2033

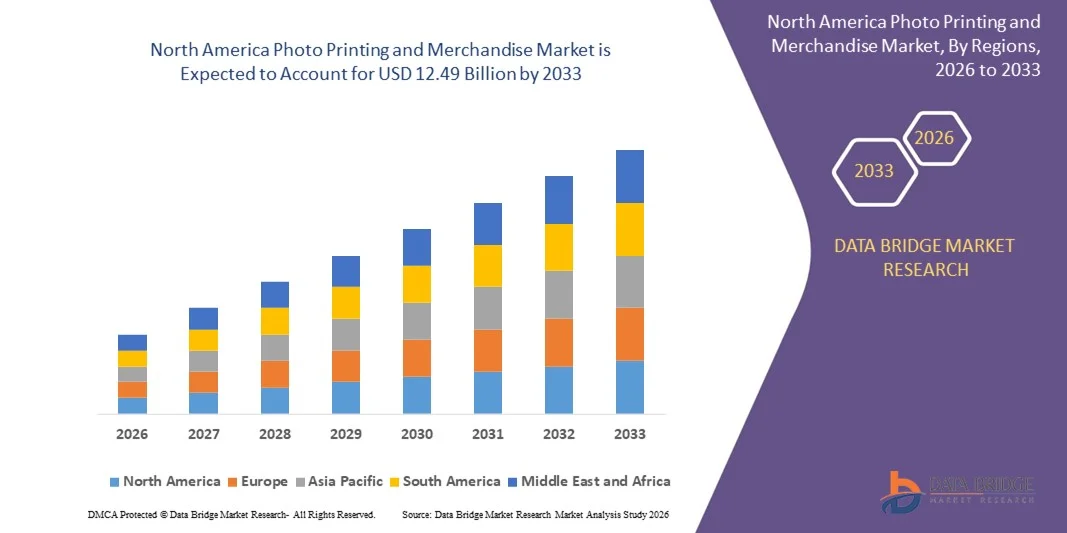

| 2026 –2033 | |

| USD 7.11 Billion | |

| USD 12.49 Billion | |

|

|

|

|

Segmentação do mercado de impressão fotográfica e produtos personalizados na América do Norte, por produto (calendários, cartões, canecas, álbuns de fotos, presentes fotográficos, impressões, camisetas, quadros e outros), modelo de impressão (impressão digital e impressão offset), dispositivo (desktop e celular), canal de distribuição (quiosques de atendimento rápido, lojas online, lojas físicas e outros) - Tendências e previsões do setor até 2033.

Qual é o tamanho e a taxa de crescimento do mercado de impressão fotográfica e produtos personalizados na América do Norte?

- O mercado de impressão fotográfica e produtos personalizados na América do Norte foi avaliado em US$ 7,11 bilhões em 2025 e deverá atingir US$ 12,49 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 7,3% durante o período de previsão.

- O uso crescente de dispositivos móveis para fotos de alta resolução e a demanda cada vez maior por impressões e imagens em 3D são fatores importantes para o crescimento do mercado. Além disso, o desenvolvimento acelerado da tecnologia de captura de fotos também impulsiona o crescimento do mercado.

Quais são os principais pontos a serem considerados no mercado de impressão fotográfica e produtos personalizados?

- A integração da inteligência artificial com a tecnologia de impressão digital está criando novas oportunidades para o mercado. No entanto, a substituição dos calendários de papel por planejadores digitais representa um grande desafio para o crescimento do mercado.

- Os EUA dominaram o mercado global de impressão fotográfica e produtos personalizados, com uma participação estimada em 64,6% da receita em 2025, impulsionados pelo forte consumo de presentes personalizados, álbuns de fotos premium e produtos customizados.

- O México está registrando o crescimento mais rápido do país, com uma taxa de 11,36%, devido ao aumento da penetração de smartphones, à crescente renda disponível da classe média e à maior conscientização sobre presentes personalizados.

- O segmento de álbuns de fotos dominou o mercado com uma participação estimada em 34,6% em 2025, impulsionado pela forte demanda por lembranças personalizadas e de alta qualidade, utilizadas para recordações, casamentos, álbuns de viagem e portfólios de fotografia profissional.

Escopo do relatório e segmentação do mercado de impressão fotográfica e de produtos personalizados.

|

Atributos |

Principais informações de mercado sobre impressão fotográfica e merchandising |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de impressão fotográfica e produtos personalizados?

Tendência crescente em direção à impressão de fotos e produtos personalizados, de alta qualidade e sob demanda.

- O mercado de impressão fotográfica e de produtos personalizados está testemunhando uma forte adoção de produtos de alta resolução, personalizados e impressos digitalmente, incluindo álbuns de fotos, decoração de parede, calendários, vestuário e presentes personalizados.

- Os fabricantes estão expandindo seus portfólios com produtos específicos para cada aplicação, como impressões fotográficas duráveis, acabamentos de papel premium, telas emolduradas e produtos funcionais para o dia a dia, ideais para presentes e decoração.

- A crescente demanda por personalização, valor emocional e narrativa visual está impulsionando a adoção por consumidores individuais, fotógrafos profissionais e segmentos de presentes corporativos.

- Por exemplo, empresas como WhiteWall, Kodak Alaris, Cimpress, District Photo e Walmart estão investindo em tecnologias avançadas de impressão digital, automação e plataformas de personalização em massa.

- O crescente foco em prazos de entrega rápidos, serviços de impressão sob demanda e experiências de compra omnichannel está acelerando a demanda por produtos fotográficos premium.

- À medida que os consumidores valorizam cada vez mais experiências personalizadas e produtos visuais de alta qualidade, a impressão fotográfica e os produtos promocionais continuarão sendo essenciais para uso pessoal, profissional e comercial.

Quais são os principais fatores que impulsionam o mercado de impressão fotográfica e de produtos personalizados?

- A crescente demanda por presentes personalizados, decoração para casa e produtos de estilo de vida customizados está ocorrendo em diversos mercados consumidores globais.

- Por exemplo, entre 2024 e 2025, empresas líderes como Cimpress, WhiteWall, Kodak Alaris e Hallmark expandiram suas capacidades de impressão digital e lançaram novas ofertas de produtos personalizados.

- O rápido crescimento das plataformas de comércio eletrônico, do uso de fotos em dispositivos móveis e da criação de conteúdo para mídias sociais nos EUA, Europa e América do Norte está impulsionando a demanda por serviços de impressão de fotos.

- Os avanços na impressão a jato de tinta, no gerenciamento de cores, no aprimoramento de imagens baseado em IA e no processamento automatizado de pedidos melhoraram a qualidade de impressão, a velocidade e a relação custo-benefício.

- A crescente adoção de produtos fotográficos personalizados em estratégias de branding corporativo, campanhas promocionais e brindes para eventos impulsiona ainda mais a expansão do mercado.

- Impulsionado pelo aumento da renda disponível, pela adoção da fotografia digital e pela preferência do consumidor por produtos personalizados, o mercado de Impressão Fotográfica e Produtos Promocionais deverá apresentar um crescimento constante a longo prazo.

Que fator está desafiando o crescimento do mercado de impressão fotográfica e produtos personalizados?

- Os elevados custos operacionais associados a equipamentos de impressão de alta qualidade, tintas especiais, substratos e logística podem impactar a rentabilidade.

- Por exemplo, durante o período de 2024–2025, as flutuações nos preços do papel, nos custos de energia e as interrupções na cadeia de suprimentos afetaram os cronogramas de produção de diversos fornecedores de serviços globais.

- A intensa concorrência de plataformas de impressão online de baixo custo e gráficas locais gera pressão sobre os preços e restrições de margem.

- A limitada conscientização do consumidor em certas regiões sobre a qualidade de impressão premium, materiais de arquivo e durabilidade a longo prazo retarda a adoção de soluções baseadas em valor.

- A crescente tendência para o armazenamento e compartilhamento de fotos exclusivamente digitais reduz o volume de impressões em alguns segmentos de consumidores.

- Para enfrentar esses desafios, as empresas estão se concentrando em automação, materiais sustentáveis, serviços de valor agregado, modelos de entrega mais rápidos e experiências digitais aprimoradas para o usuário, visando fortalecer a adoção global da impressão fotográfica e de produtos personalizados.

Como é segmentado o mercado de impressão fotográfica e produtos personalizados?

O mercado é segmentado com base no produto, tipo de modelo de impressão, dispositivo e canal de distribuição .

- Por produto

Com base no produto, o mercado de impressão fotográfica e produtos licenciados é segmentado em calendários, cartões, canecas, fotolivros, presentes fotográficos, impressões, camisetas, quadros e outros. O segmento de fotolivros dominou o mercado com uma participação estimada em 34,6% em 2025, impulsionado pela forte demanda por lembranças personalizadas e de alta qualidade para recordações, casamentos, álbuns de viagem e portfólios de fotografia profissional. O alto valor emocional, as opções de personalização e a qualidade de impressão aprimorada aumentaram a preferência do consumidor por fotolivros tanto em plataformas online quanto em lojas físicas.

O segmento de presentes com fotos deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda por soluções de presentes personalizados em festivais, eventos corporativos e ocasiões especiais. A maior disponibilidade de canecas, almofadas, molduras e acessórios de estilo de vida personalizados, aliada à rápida produção e à acessibilidade do comércio eletrônico, está acelerando a adoção global dessa tecnologia.

- Por modelo de tipo de impressão

Com base no modelo de tipo de impressão, o mercado é segmentado em Impressão Digital e Impressão Offset e em Filme. O segmento de Impressão Digital dominou o mercado com uma participação de 58,2% em 2025, devido à sua flexibilidade, capacidade de produção de pequenas tiragens, prazos de entrega mais rápidos e custo-benefício para impressão personalizada e sob demanda. A impressão digital permite a impressão de dados variáveis, saída de alta resolução e integração perfeita com plataformas de pedidos online, tornando-se a opção preferida para produtos fotográficos personalizados.

Prevê-se que o segmento de Impressão Offset e Filmes apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela demanda por produção em grande volume, qualidade de cor consistente e custo-benefício em aplicações de impressão em massa. A impressão offset continua sendo amplamente utilizada para calendários, cartões comemorativos e produtos fotográficos padronizados em ambientes comerciais e institucionais.

- Por dispositivo

Com base no dispositivo, o mercado de impressão e comercialização de fotos é segmentado em plataformas Desktop e Mobile. O segmento Mobile dominou o mercado com uma participação de 61,4% em 2025, impulsionado pela ampla adoção de smartphones, câmeras móveis de alta qualidade e aplicativos de impressão de fotos fáceis de usar. Os consumidores preferem cada vez mais dispositivos móveis para capturar, editar e encomendar produtos fotográficos devido à conveniência, acessibilidade e fluxos de trabalho integrados baseados em aplicativos.

O segmento de desktops deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pelo uso contínuo por fotógrafos profissionais, designers e usuários corporativos que necessitam de ferramentas avançadas de edição, telas maiores e processamento de arquivos de alta resolução. O crescimento na impressão fotográfica profissional e em aplicativos corporativos também contribui para a adoção da plataforma desktop.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Lojas Online, Lojas Físicas, Quiosques Instantâneos e Outros. O segmento de Lojas Online dominou o mercado com uma participação de 46,9% em 2025, impulsionado pela conveniência, amplas opções de personalização de produtos, preços competitivos e entrega em domicílio. As plataformas online permitem que os consumidores carreguem imagens, personalizem designs e façam pedidos com o mínimo de esforço, o que contribui para uma alta adesão em mercados globais.

Prevê-se que o segmento de quiosques de impressão instantânea apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela demanda por serviços rápidos de impressão de fotos em shoppings, aeroportos, pontos turísticos e locais de eventos. Os avanços em quiosques de autoatendimento e tecnologia de impressão instantânea estão acelerando ainda mais o crescimento do segmento.

Qual região detém a maior participação no mercado de impressão fotográfica e produtos licenciados?

- Os EUA dominaram o mercado global de impressão fotográfica e produtos personalizados, com uma participação estimada em 64,6% da receita em 2025, impulsionados pelo forte consumo de presentes personalizados, álbuns de fotos premium e produtos customizados.

- Tecnologias de impressão avançadas, redes de distribuição eficientes e integração com canais de comércio eletrônico e varejo impulsionam o crescimento contínuo.

- A crescente demanda por brindes corporativos, personalização impulsionada pelas redes sociais e plataformas de compartilhamento de fotos digitais alimenta ainda mais a adoção do mercado.

Análise do Mercado Canadense de Impressão Fotográfica e Produtos Promocionais

No Canadá, o mercado está crescendo de forma constante, impulsionado pelo crescente interesse na personalização de fotos, pela alta alfabetização digital e pela expansão da infraestrutura de comércio eletrônico. Os consumidores preferem cada vez mais impressões de alta qualidade, calendários e presentes fotográficos temáticos. Investimentos em soluções de impressão automatizadas e sistemas de distribuição eficientes aumentam a acessibilidade e a conveniência, impulsionando a adoção a longo prazo.

Análise do Mercado Mexicano de Impressão Fotográfica e Produtos Promocionais

O México está registrando o crescimento mais rápido do mercado, com uma taxa de 11,36%, impulsionado pela crescente penetração de smartphones, pelo aumento da renda disponível da classe média e pela maior conscientização sobre presentes personalizados. Plataformas de pedidos online, serviços de impressão móvel e gráficas locais com preços acessíveis contribuem para a expansão do mercado. A adoção de soluções de impressão digital para álbuns de fotos, canecas e quadros decorativos está aumentando em áreas urbanas e semiurbanas.

Quais são as principais empresas no mercado de impressão fotográfica e produtos personalizados?

O setor de impressão fotográfica e de produtos personalizados é liderado principalmente por empresas consolidadas, incluindo:

- Walmart (EUA)

- Kodak Alaris Inc. (Reino Unido)

- Cimpress (Irlanda)

- HALLMARK LICENSING, LLC (EUA)

- WhiteWall (Alemanha)

- District Photo, Inc. (EUA)

- JONDO, Ltda. (Japão)

Quais são os desenvolvimentos recentes no mercado global de impressão fotográfica e produtos personalizados?

- Em maio de 2025, a Xiaomi, empresa chinesa líder em eletrônicos de consumo, anunciou o lançamento global da sua impressora fotográfica portátil Xiaomi 1S, com tecnologia de impressão sem tinta (ZINK), resolução de 313 x 512 dpi e tamanho de impressão compacto de 2 x 3 polegadas. Com isso, a empresa fortalece sua presença no segmento de impressão fotográfica portátil e acelera a adoção de soluções de impressão fotográfica instantânea pelos consumidores.

- Em novembro de 2024, a Sticker Mule, uma importante fornecedora de impressão personalizada, lançou o Stores, uma solução completa que permite que influenciadores, criadores de conteúdo e marcas vendam produtos personalizados diretamente pelo site da empresa, enquanto a Sticker Mule cuida da logística e do atendimento ao cliente, ampliando as oportunidades de monetização e simplificando a distribuição de mercadorias.

- Em outubro de 2024, a FastEditor, fornecedora líder de software de edição, lançou o Logo Editor, uma nova ferramenta hospedada nos sites de parceiros de impressão que permite aos clientes criar e visualizar logotipos em toda a sua gama de produtos antes da impressão, aprimorando as opções de personalização e simplificando o processo de encomenda de impressão.

- Em dezembro de 2022, a American Greetings, em colaboração com Alicia Keys, lançou o Creatacard™, cartões de Natal digitais personalizados criados pela artista vencedora de 15 prêmios GRAMMY®, ampliando as ofertas de personalização digital premium e elevando o engajamento do consumidor no segmento de cartões digitais.

- Em abril de 2021, a Eastman Kodak Company adquiriu os ativos da divisão de dispositivos de impressão computadorizada para chapas (CTP) da ECRM Incorporated, que atende aos setores de artes gráficas e jornalístico, fortalecendo o portfólio de tecnologia de impressão da Kodak e reforçando sua posição em soluções de imagem profissional.

- Em 2021, a Card Factory anunciou a abertura de uma nova loja no Flintshire Retail Park, no norte do País de Gales, para expandir seu portfólio de produtos e fortalecer sua presença no varejo, aumentando a visibilidade da marca e impulsionando o crescimento nos canais de vendas físicas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.