North America Point Of Care Diagnostics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

19.77 Billion

USD

32.00 Billion

2024

2032

USD

19.77 Billion

USD

32.00 Billion

2024

2032

| 2025 –2032 | |

| USD 19.77 Billion | |

| USD 32.00 Billion | |

|

|

|

|

North America Point-Of-Care Diagnostics Market Segmentation, By Product (Glucose Monitoring Products, Cardiometabolic, Infectious Disease, Coagulation, Pregnancy, and Fertility, Tumour or Cancer Marker, Urinalysis, Cholesterol, Haematology, Drugs-of-Abuse, Fecal Occult, and Others), Platform (Lateral Flow Assays (Immunochromatography Tests), Dipsticks, Microfluidics,Molecular Diagnostics, and Immunoassays), Prescription (Prescription-Based Testing and OTC Testing), End User (Clinical Laboratories, Outpatient Healthcare and Ambulatory Care Settings, Hospitals or Critical Care Centres, Home Care, Research Laboratories and Others)- Industry Trends and Forecast to 2032

North America Point-Of-Care Diagnostics Market Size

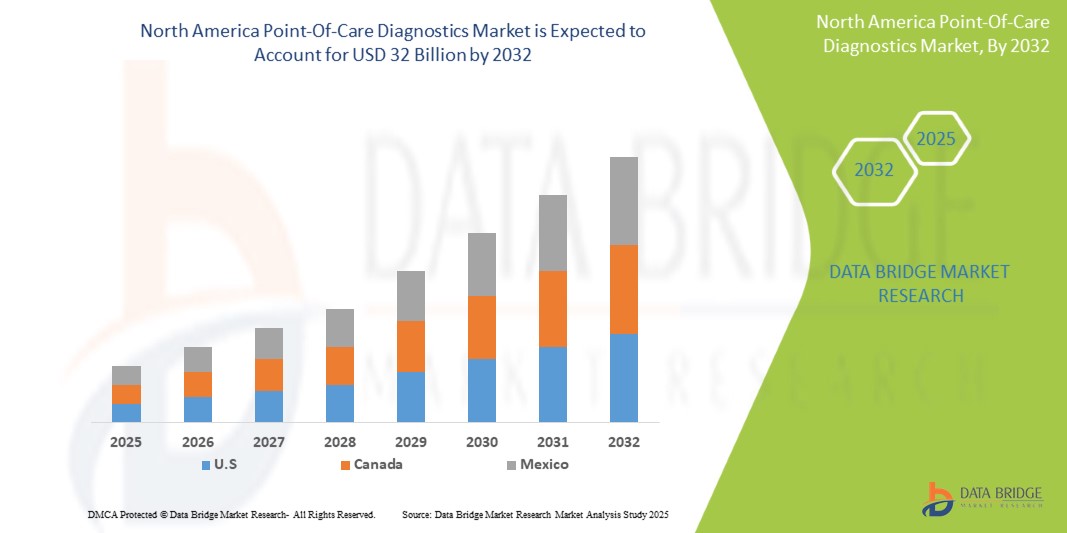

- The North America point-of-care diagnostics market size was valued atUSD 19.77 billion in 2024and is expected to reachUSD 32 billion by 2032, at aCAGR of 6.20%during the forecast period

- This growth is driven by factors such as the aging population, increasing prevalence of chronic diseases, and advancements in diagnostic technologies

North America Point-Of-Care Diagnostics Market Analysis

- Point-of-care diagnostics are essential tools used for quick and accurate medical testing at or near the site of patient care, enabling immediate results for conditions such as diabetes, cardiovascular diseases, andinfectious diseases

- The demand for point-of-care diagnostics is significantly driven by the increasing prevalence of chronic diseases, advancements in diagnostic technology, and the need for quicker healthcare responses

- U.S. is expected to dominate the North America point-of-care diagnostics market with largest market share of 45.6%, due to the presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics is positively influencing the market growth

- Canada is expected to be the fastest growing country in the North America point-of-care diagnostics market during the forecast period due to country’s aging population, with projections indicating that by 2036, one-fifth of Canadians will be over the age of 65. This demographic shift leads to a higher prevalence of chronic conditions, creating a greater demand for efficient and accessible diagnostic solutions

- Hospitals segment is expected to dominate the market with a largest market share of 37.69% due to the increasing demand for rapid, on-site diagnostic testing in hospital settings, which facilitates timely decision-making and enhances patient care. The integration of miniaturized and wireless POC devices within hospitals allows for efficient bedside testing, reducing the need for centralized laboratory services and expediting the diagnostic process

Report Scope and North America Point-Of-Care Diagnostics Market Segmentation

|

Attributes |

North America Point-Of-Care Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Point-Of-Care Diagnostics Market Trends

“Technological Advancements and Miniaturization in Point-of-Care Diagnostics”

- One prominent trend in the North America point-of-care diagnostics market is the rapid advancement and miniaturization of diagnostic technologies, enabling more portable, user-friendly, and faster testing solutions

- These innovations enhance diagnostic efficiency by delivering real-time results at the patient’s side, reducing turnaround times and facilitating quicker clinical decision-making in both hospital and home settings

- For instance, the development of handheld molecular testing devices and smartphone-integrated diagnostic platforms allows for accurate detection of conditions such as COVID-19, influenza, and chronic diseases outside traditional laboratory environments

- These advancements are reshaping the diagnostic landscape, expanding access to healthcare, improving patient outcomes, and driving demand for compact, connected, and high-performance point-of-care testing devices across North America

North America Point-Of-Care Diagnostics Market Dynamics

Driver

“Rising Burden of Chronic and Infectious Diseases Driving Diagnostic Demand”

- The increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and infectious diseases is a major driver of growth in the North America point-of-care diagnostics market

- With a growing aging population and lifestyle-related health risks, the region is experiencing a surge in demand for rapid, accessible diagnostic tools that support early detection and real-time health monitoring

- As more patients require ongoing monitoring and quick diagnosis, the healthcare industry is increasingly turning to point-of-care diagnostics to reduce hospital visits, streamline treatment, and improve outcomes

For instance,

- According to the Centers for Disease Control and Prevention (CDC), in 2023, more than 37 million Americans were living with diabetes, and cardiovascular diseases remain the leading cause of death—highlighting the urgent need for fast, reliable diagnostic solutions

- This surge in chronic and infectious diseases across the U.S. and Canada is fueling the demand for point-of-care diagnostics, supporting market growth through improved disease management and early intervention

Opportunity

“Integration of Artificial Intelligence to Enhance Diagnostic Accuracy and Efficiency”

- The integration ofartificial intelligence (AI)into point-of-care diagnostics presents a transformative opportunity for the North American healthcare landscape, offering improved accuracy, speed, and personalized care

- AI algorithms can analyze complex diagnostic data in real-time, assisting healthcare providers with faster decision-making and reducing diagnostic errors, especially in high-burden conditions like diabetes, cardiovascular diseases, and infectious diseases

- Additionally, AI-driven diagnostic platforms can streamline workflows, optimize resource utilization, and enable remote testing capabilities, which are particularly valuable in underserved or high-demand settings

For instance,

- In 2024, multiple AI-powered diagnostic devices received FDA clearance in the U.S., including tools capable of detecting diabetic retinopathy, COVID-19, and early cardiac events with high precision—highlighting the potential of AI in revolutionizing rapid care delivery

- The integration of AI into point-of-care diagnostics opens new opportunities for improving clinical outcomes, expanding access to care, and building a more responsive and data-driven healthcare system in North America

Restraint/Challenge

“High Cost of Advanced Diagnostic Devices Limiting Widespread Adoption”

- The high cost of advanced point-of-care diagnostic devices poses a significant restraint for market penetration, particularly among smaller clinics, rural healthcare providers, and low-budget institutions in North America

- These devices, while offering rapid and accurate results, often come with substantial upfront investment and ongoing maintenance costs, which can deter adoption despite their clinical benefits

- Smaller healthcare facilities may struggle to justify the investment without guaranteed reimbursement or sufficient patient volume, leading to slower uptake of cutting-edge diagnostic technologies

For instance,

- According to a 2024 report by the American Hospital Association (AHA), many rural and community hospitals in the U.S. face financial constraints that limit their ability to adopt newer diagnostic tools, including POC molecular testing platforms and AI-integrated devices

- This financial barrier can hinder equitable access to advanced diagnostics, creating disparities in patient outcomes and slowing the overall growth of the point-of-care diagnostics market in North America

North America Point-Of-Care Diagnostics Market Scope

The market is segmented on the basis of product, platform, prescription, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Platform |

|

|

By Prescription |

|

|

By End User |

|

In 2025, the hospitals is projected to dominate the market with a largest share in end user segment

The hospitals segment is expected to dominate the North America point-of-care diagnostics market with the largest share of 37.69% due to the increasing demand for rapid, on-site diagnostic testing in hospital settings, which facilitates timely decision-making and enhances patient care. The integration of miniaturized and wireless POC devices within hospitals allows for efficient bedside testing, reducing the need for centralized laboratory services and expediting the diagnostic process

The other infectious disease is expected to account for the largest share during the forecast period in product segment

In 2025, the other infectious disease segment is expected to dominate the market with the largest market share of 25.4% due to increasing cases of dengue fever, enteric, malaria, syphilis, tuberculosis, and others in the region. The significant demand for rapid tests has encouraged market players to offer point-of-care solutions to decentralized regions

North America Point-Of-Care Diagnostics Market Regional Analysis

“U.S. Holds the Largest Share in the Ophthalmic Operational Microscope Market”

- U.S. dominates the North America point-of-care diagnosticsmarket with largest market share of 45.6%, due to the presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Quidel Corporation, and Quest Diagnostics is positively influencing the market growth

- Additionally, robust government support and funding from agencies like the National Institutes of Health (NIH) and the Department of Defense (DoD) have accelerated the development and deployment of advanced POC diagnostic technologies

- The U.S. also benefits from a highly developed healthcare infrastructure that enables the widespread adoption of these tools across hospitals, clinics, and home-care settings. Furthermore, the high prevalence of chronic and infectious diseases has created a sustained demand for rapid and reliable diagnostic solutions, solidifying the U.S.'s dominant position in the regional market

“Canada is Projected to Register the Highest CAGR in the North America Point-Of-Care Diagnostics Market”

- Canada is expected to experience the highest growth rate in the North American point-of-care diagnostics market, driven by factors such as the expansion of healthcare infrastructure, increased demand for rapid diagnostic solutions, and rising healthcare expenditure

- The Canadian healthcare system is increasingly adopting advanced point-of-care diagnostic technologies, with particular growth in areas like diabetes monitoring, cardiovascular disease detection, and infectious disease testing, as the demand for decentralized testing rises

- Additionally, the government’s focus on improving healthcare access, combined with initiatives to expand telemedicine and remote healthcare services, is fostering the widespread integration of point-of-care diagnostic solutions across the country

- As the Canadian population ages, there is also a growing need for chronic disease management and preventative health measures, further propelling the demand for fast, reliable diagnostic tools to manage health conditions more efficiently

North America Point-Of-Care Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- BD (U.S.)

- Siemens Healthineers AG(Germany)

- bioMérieux SA(France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QuidelOrtho Corporation (U.S.)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Nova Biomedical (U.S.)

- Sekisui Diagnostics (U.S.)

- Trinity Biotech (Ireland)

- OraSure Technologies, Inc. (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Werfen (Spain)

- GenBody Inc. (South Korea)

Latest Developments in North America Point-Of-Care Diagnostics Market

- In 2023, QIAGEN received CE certification for its In Vitro Diagnostic (IVD) kit and NeuMoDx automated testing platform. This certification significantly enhanced the company’s market position and revenue, reflecting a key milestone in the adoption of their advanced diagnostic technologies. The approval paves the way for the broader integration of QIAGEN's innovative solutions across healthcare settings, facilitating quicker and more accurate diagnostic results, which are crucial for improving patient outcomes and expanding access to decentralized care

- In 2023, Danaher Corporation launched the Dxl 9000 Access Immunoassay Analyzer, which is capable of performing up to 215 tests per hour. This strategic move strengthened Danaher’s portfolio within the point-of-care diagnostics sector, focusing on enhancing testing efficiency. The introduction of this high-throughput analyzer addresses the growing demand for rapid, high-volume diagnostic testing, particularly in clinical environments where efficiency and accuracy are critical for improving patient care and operational workflows

- In 2022, Genes2Me Pvt. Ltd introduced the Rapi-Q Point of Care RT-PCR solution, designed for the detection of human papillomavirus (HPV) and tuberculosis. The device, which holds CE-IVD certification, delivers rapid results in under 45 minutes, offering superior performance, high sensitivity, and ease of use. This innovation meets the increasing demand for fast, reliable diagnostic solutions that enhance patient management and treatment outcomes, particularly in the detection of infectious diseases such as HPV and tuberculosis

- In 2022, LumiraDx Healthcare introduced its highly sensitive C-Reactive Protein (CRP) point-of-care antigen test in India. This innovative diagnostic solution is designed to meet the needs of clinical settings by helping reduce unnecessary antibiotic prescriptions, a crucial step in combating antimicrobial resistance (AMR). This development aligns with the increasing focus on improving diagnostic accuracy and promoting responsible antibiotic use. The introduction of such advanced diagnostic tools supports efforts to address AMR while enhancing patient care and optimizing healthcare resources in the region

- In 2022, Genes2Me Pvt. Ltd. introduced the Rapi-Q Point of Care RT-PCR solution for the detection of human papillomavirus (HPV) and tuberculosis. This device, which carries CE-IVD certification, is distinguished by its user-friendly design, providing rapid results in less than 45 minutes, alongside exceptional sensitivity and reliable detection capabilities. The launch of this solution addresses the growing need for efficient, accurate, and timely diagnostic tools, particularly in the detection of infectious diseases like HPV and tuberculosis, thereby supporting improved patient outcomes and streamlining healthcare processes

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.