North America Polybutylene Succinate Pbs Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

44.59 Million

USD

80.13 Million

2025

2033

USD

44.59 Million

USD

80.13 Million

2025

2033

| 2026 –2033 | |

| USD 44.59 Million | |

| USD 80.13 Million | |

|

|

|

|

North America Polybutylene Succinate (PBS) Market, By Product (Conventional Polybutylene Succinate (PBS) And Bio-Based Polybutylene Succinate(PBS)), Process (Trans-Esterification And Direct Esterification), Application (Bags, Mulch Film, Packaging Film, Flushable Hygiene Products, Fishing Nets, Coffee Capsules, Wood Plastic Composites And Others), Usage (Single-Use And Reusable) , Packaging Layer (Primary Packaging, Secondary Packaging And Tertiary Packaging) , End-Use (Packaging, Agriculture, Textile, Consumer Goods, Electrical And Electronics, Automotive And Others) Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028

Market Analysis and Insights: North America Polybutylene Succinate (PBS) Market

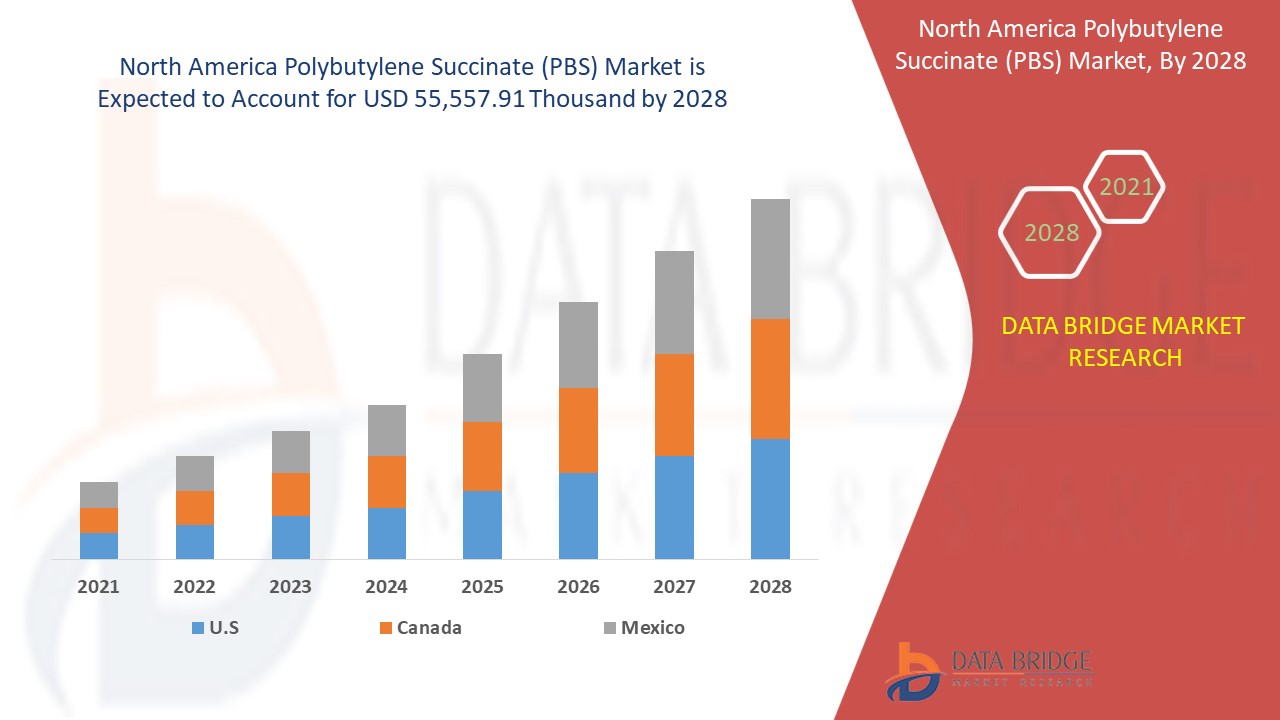

The polybutylene succinate (PBS) market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 7.6% in the forecast period of 2021 to 2028 and expected to reach USD 55,557.91 thousand by 2028.

The polybutylene succinate (PBS) is a thermoplastic polymer resin from the polyester family. PBS is a type of biodegradable aliphatic polyester with properties that are comparable to polypropylene. It is biodegradable or decompose polymer with a relatively high melting temperature, good toughness. It is a versatile semi-crystalline polymer with a semi-crystalline structure.

Several boosters associated with the polybutylene succinate (PBS) market include increasing preferences for eco-friendly and biodegradable products for packaging and growing demand for PBS in automotive interiors. In order to fulfill the growing demand for polybutylene succinate (PBS) products in the oil and gas industry reach, some companies are expanding their production capacities and entering into agreements across different regions. The major restraints that may impact the polybutylene succinate (PBS) market are rapid crystallization reaction that can deteriorate strength properties and unpredictable raw material prices. The fluctuation of the price of raw material can impact the market growth in the coming future.

This polybutylene succinate (PBS) market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Polybutylene Succinate (PBS) Market Scope and Market Size

The polybutylene succinate (PBS) market is segmented of the categorized into product, process, application, usage, packaging layer, end-use. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the polybutylene succinate (PBS) market is segmented into conventional polybutylene succinate (PBS) and bio-based polybutylene succinate (PBS). In 2021, the conventional polybutylene succinate (PBS) segment is expected to dominate the market as conventional polybutylene succinate (PBS) can be easily decompose in the soil without impacting environment, which increases its demand globally.

- On the basis of process, the polybutylene succinate (PBS) market is segmented into trans-esterification and direct esterification. In 2021, the trans-esterification segment is expected to dominate the market globally as trans-esterification process can be used for the large scale production, which increases the demand trans-esterification process for the polybutylene succinate (PBS).

- On the basis of application, the polybutylene succinate (PBS) market is segmented into bags, mulch film, packaging film, flushable hygiene products, fishing nets, coffee capsules, wood plastic composites and others. In 2021, mulch film segment is expected to dominate the market as the rising demand for agriculture products globally is increasing its requirement globally.

- On the basis of usage, the polybutylene succinate (PBS) market is segmented into single-use and reusable. In 2021, the re-usable segment is expected to dominate globally as re-useable PBS products are cost effective than single use PBS products.

- On the basis of packaging layer, the polybutylene succinate (PBS) market is segmented into primary packaging, secondary packaging and tertiary packaging. In 2021, primary packaging segment is expected to dominate the market as primary packaging attracts more customers for buying more goods which make primary packaging dominate in the market.

- On the basis of end-use, the polybutylene succinate (PBS) market is segmented into packaging, agriculture, textile, consumer goods, electrical and electronics, automotive and others. In 2021, packaging segment is expected to dominate market as the demand for packaging products is increasing in all industries makes packaging dominate in the market.

Global Polybutylene Succinate (PBS) Market Country Level Analysis

The polybutylene succinate (PBS) market is analysed and market size information is provided by country, product, process, application, usage, packaging layer, end-use.

The countries covered in the North America polybutylene succinate (PBS) market report are U.S., Canada, and Mexico.

The U.S. is dominating the North America market due to more strict policies for single use plastic products in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Use Of PBS in Baby Diapers Extensively

Polybutylene succinate (PBS) market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in baby diapers and changes in regulatory scenarios with their support for the polybutylene succinate (PBS) market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Polybutylene Succinate (PBS) Market Share Analysis

The polybutylene succinate (PBS) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to polybutylene succinate (PBS) market.

The major market players engaged in the polybutylene succinate (PBS) market are Mitsubishi Chemical Corporation, BASF SE, Wacker Chemie AG, Eastman Chemical Company, SHOWA DENKO K.K., Roquette Frères., BioAmber Inc., FILLPLAS, NaturePlast and Bio-disposable (a Subsidary of Inchel Technology Group Limited.) .and among others.

For instance,

- In 2021 April, Mitsubishi Chemical Corporation company have Develop Marine-Biodegradable Form of BioPBS. The company is making development plans to ensure that its BioPBS line of plant-derived polybutylene succinate (PBS) products. This development helps the company to increase revenue and product portfolio.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.