North America Sensors Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

65,414.17 Million

USD

152,795.44 Million

2024

2032

USD

65,414.17 Million

USD

152,795.44 Million

2024

2032

| 2025 –2032 | |

| USD 65,414.17 Million | |

| USD 152,795.44 Million | |

|

|

|

|

Segmentação do mercado de sensores na América do Norte, por tipo ( sensor de temperatura , sensor de imagem , sensor de movimento , sensor de pressão , sensor de toque , sensor de proximidade e deslocamento , acelerómetro e sensor de velocidade, sensor de humidade, sensor de gás, sensor ótico, sensor de força, sensor de fluxo, sensor de nível, biossensorsensor de posição e outros), tecnologia (MEMS, CMOS, NEMS e outros), utilizador final (automóvel, eletrónica de consumo, saúde, fabrico, aeroespacial e defesa, energia e energia, TI e telecomunicações, petróleo e gás, produtos químicos, alimentos e bebidas, construção, mineração, papel e celulose e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de sensores

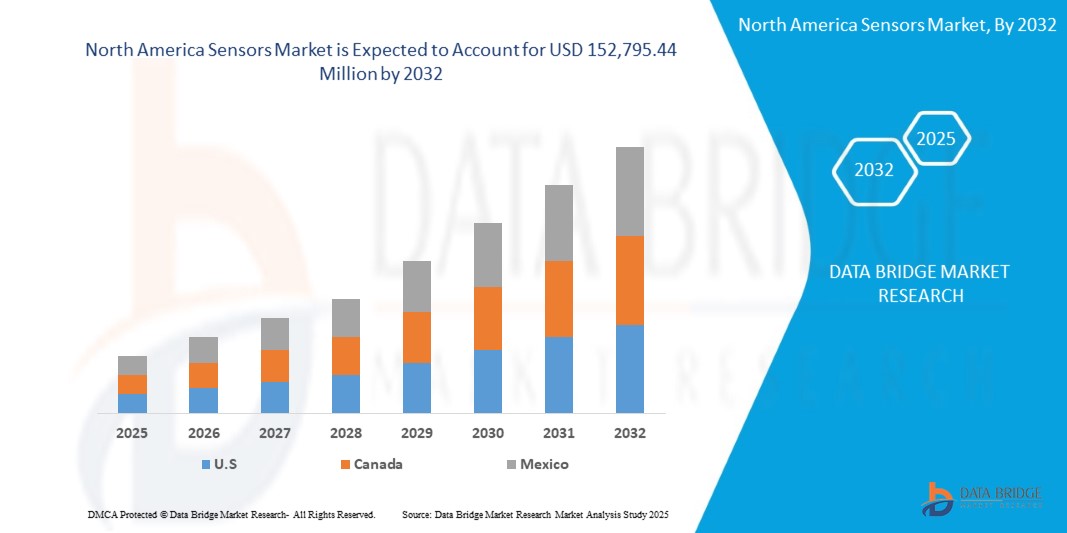

- O tamanho do mercado de sensores da América do Norte foi avaliado em 65.414,17 milhões de dólares em 2024 e deverá atingir os 152.795,44 milhões de dólares até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 11,3%, impulsionado principalmente pela crescente procura em setores como o automóvel, saúde, eletrónica de consumo e automação industrial.

- Este crescimento é impulsionado por fatores como o aumento da IoT, dispositivos inteligentes e aplicações baseadas em IA que impulsionaram a adoção de sensores avançados para monitorização em tempo real e recolha de dados

Análise de Mercado de Sensores

- O mercado norte-americano de sensores tem assistido a um crescimento significativo, impulsionado pela crescente procura de soluções de embalagens sustentáveis, leves e duráveis em vários setores. Setores-chave como o comércio eletrónico, alimentos e bebidas, produtos farmacêuticos e bens de consumo

- As inovações em impressão digital e tecnologias de embalagens inteligentes estão a melhorar ainda mais as oportunidades de branding e personalização, atendendo às preferências em evolução do consumidor

- O futuro da indústria é moldado pelos avanços na automação, inovação de materiais e iniciativas de economia circular, garantindo maior eficiência e sustentabilidade na produção de embalagens

- Por exemplo, em março de 2023, a Sony Semiconductor Solutions revelou um sensor de profundidade SPAD (Single-Photon Avalanche Diode) concebido para smartphones , oferecendo um desempenho de medição de distância de alta precisão e baixo consumo de energia. Este sensor apresenta a mais alta eficiência de deteção de fotões do setor, permitindo uma deteção precisa de profundidade e capacidades 3D melhoradas

- Além disso, as regulamentações ambientais rigorosas e a procura de soluções de embalagens ecológicas estão a acelerar a expansão do mercado

Âmbito do Relatório e Segmentação do Mercado de Sensores

|

Atributos |

Principais insights do mercado de sensores |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de défice da cadeia de abastecimento e da procura. |

Tendência do mercado de sensores

“Avanços em IA e ML melhoram capacidades de sensores para análise preditiva”

- A integração de IA e aprendizagem automática com sensores está a transformar indústrias ao permitir o processamento de dados em tempo real, a deteção de anomalias e a manutenção preditiva. Estas tecnologias permitem que os sensores forneçam insights inteligentes, reduzindo o tempo de inatividade operacional e melhorando a eficiência

- À medida que os algoritmos de IA se tornam mais sofisticados, os sensores estão a evoluir para lidar com conjuntos de dados complexos , permitindo uma tomada de decisão mais rápida e precisa. A procura por sensores habilitados para IA está a crescer em setores como as redes inteligentes, os veículos autónomos e a IoT industrial, onde as capacidades preditivas aumentam a segurança e a eficiência operacional

- Por exemplo, em agosto de 2024, de acordo com o digit7, os algoritmos de aprendizagem automática foram aplicados em cenários do mundo real. A regressão logística ajudou a detetar fraudes com cartões de crédito, as árvores de decisão melhoraram o apoio ao cliente e o Random Forest permitiu a manutenção preditiva. As redes neuronais impulsionaram os veículos autónomos e o reconhecimento de fala, enquanto a filtragem colaborativa melhorou as recomendações personalizadas. Os avanços na IA e no ML melhoraram as capacidades dos sensores para análise preditiva, permitindo às indústrias analisar dados de sensores em tempo real para monitorização de equipamentos, análise de alterações climáticas e avaliação de riscos na área da saúde.

- Como resultado, as indústrias que adotam soluções inteligentes baseadas em dados e sensores melhorados por IA estão a impulsionar um crescimento significativo no mercado de sensores da América do Norte

- A ampla adoção de tecnologias de casas inteligentes e soluções de manutenção preditiva está a impulsionar ainda mais a implementação de sensores

Dinâmica do Mercado de Sensores

Motorista

“A expansão da saúde inteligente aumenta a procura por biossensores e dispositivos wearable”

- Os biossensores e os dispositivos wearable estão a revolucionar os cuidados de saúde ao permitir a monitorização em tempo real de sinais vitais, como o ritmo cardíaco, os níveis de glicose e a temperatura corporal.

- Os avanços na miniaturização e na conectividade sem fios estão a tornar estes dispositivos mais acessíveis, melhorando o atendimento ao paciente e o diagnóstico . A crescente adoção de soluções de monitorização baseadas em IoT e IA está a impulsionar ainda mais a procura por biossensores

- Além disso, os biossensores wearable integrados em plataformas baseadas na cloud permitem a partilha perfeita de dados entre pacientes e profissionais de saúde. Este avanço melhora a deteção precoce de doenças, melhora a gestão de doenças crónicas e apoia intervenções médicas proativas para melhores resultados de saúde.

- Por exemplo, em fevereiro de 2025, o futurista médico relatou que as tecnologias de saúde digital, incluindo sensores inteligentes, poderiam melhorar os cuidados aos idosos através da monitorização das condições de saúde e da análise de dados utilizando a IA. Apesar de desafios como a acessibilidade e a falta de inovações direcionadas, a procura por esta tecnologia está a crescer à medida que os sistemas de saúde priorizam a qualidade de vida. Com os sensores a desempenharem um papel crucial no rastreio de sinais vitais e no apoio ao atendimento remoto, espera-se que a sua adoção aumente, contribuindo para os avanços nas soluções de saúde para os idosos

- À medida que a assistência médica evolui para a monitorização remota e soluções baseadas em dados, a adoção de sensores avançados está a acelerar o mercado

- Com os avanços contínuos a melhorar a precisão, eficiência e acessibilidade, a integração de soluções baseadas em sensores deverá aumentar ainda mais

Oportunidade

“A expansão da Indústria 4.0 vai acelerar a implementação de sensores na automação e na manufatura”

- O rápido avanço da Indústria 4.0 está a alimentar a procura por sensores inteligentes em automação e fabrico. À medida que as indústrias adotam a IoT, a IA e a aprendizagem automática, os sensores desempenham um papel crucial ao permitir a recolha de dados em tempo real, a manutenção preditiva e a tomada de decisões automatizada.

- Com a crescente adoção de robótica, gémeos digitais e fábricas inteligentes, a necessidade de sensores de alta precisão continua a crescer em vários setores, incluindo automóvel, eletrónico e saúde. As empresas que investem em sistemas automatizados e conectados dispõem de sensores para monitorizar processos, garantir o controlo de qualidade e otimizar a utilização dos recursos

- Esta tendência não só acelera a inovação como também expande as oportunidades para os fabricantes de sensores desenvolverem soluções de última geração, energeticamente eficientes e altamente integradas.

- Por exemplo, em dezembro de 2023, de acordo com a Oracle, a Indústria 4.0 está a transformar a manufatura ao integrar a automação, a IA e a análise de dados para criar fábricas inteligentes que aumentam a eficiência, reduzem os custos e melhoram a qualidade. Empresas como a BMW, Siemens e LG estão a aproveitar os sensores, a robótica e a análise em tempo real para otimizar a produção. Esta expansão está a gerar uma maior procura por sensores, incluindo sensores de proximidade, visão, temperatura e movimento, permitindo a recolha de dados em tempo real, a manutenção preditiva e a automação contínua.

- A crescente integração de tecnologias avançadas em processos industriais apresenta uma oportunidade significativa para a inovação e expansão de sensores

- À medida que a automatização, a IA e a adoção da IoT continuam a aumentar, a procura por sensores inteligentes, fiáveis e de alto desempenho só aumentará

Restrição/Desafio

“Os elevados custos de implementação limitam a adoção de sensores nas pequenas e médias empresas”

- Embora os sensores ofereçam benefícios significativos, o elevado investimento inicial necessário para a instalação, calibração e integração em sistemas existentes continua a ser um desafio, especialmente para as pequenas e médias empresas

- Os sensores avançados, especialmente aqueles com tecnologia de IA e IoT, geralmente exigem atualizações dispendiosas da infraestrutura e pessoal qualificado para operar. Este encargo financeiro limita a adopção generalizada, atrasando a transformação digital em sectores como a indústria transformadora, a saúde e o retalho.

- Muitas PME têm dificuldade em justificar o retorno do investimento na dispendiosa automatização baseada em sensores, o que leva a taxas de adoção mais lentas. Os esforços para desenvolver soluções de sensores acessíveis e plug-and-play podem ajudar a preencher a lacuna para as empresas mais pequenas

- Por exemplo, em novembro de 2024, a análise da Qviro BV demonstra que o custo da automação industrial variou em 2025 com base no tipo de sistema, nas necessidades do setor e nas personalizações. As despesas incluem hardware, software, instalação, formação e manutenção. Os robôs custam entre 20.000 a 500.000 dólares, com custos adicionais para integração e suporte. Os elevados custos de implementação restringiram o crescimento do mercado de sensores, uma vez que as pequenas empresas enfrentaram barreiras financeiras para adotar tecnologias de automatização avançadas

- No entanto, o peso financeiro da implementação de sensores continua a ser um desafio significativo para as PME, limitando a sua capacidade de adotar a automação e as tecnologias inteligentes.

- Os elevados custos associados à instalação, manutenção e integração de sistemas atrasam a expansão do mercado, restringindo o acesso a aplicações avançadas de sensores

Âmbito de mercado de sensores

O mercado está segmentado em três segmentos notáveis com base no tipo, tecnologia e utilizador final.

|

Segmentação |

Sub-segmentação |

|

Por tipo |

|

|

Por Tecnologia |

|

|

Por utilizador final |

|

Análise regional do mercado de sensores

“Espera-se que os EUA dominem o mercado norte-americano de sensores”

- Espera-se que os EUA dominem o mercado norte-americano de sensores devido à rápida industrialização, à crescente adoção da automatização e à crescente procura de dispositivos habilitados para IoT

- O setor transformador em expansão da região, juntamente com as iniciativas governamentais que promovem as fábricas inteligentes e a Indústria 4.0, está a impulsionar a procura de sensores avançados em vários setores

- Além disso, a crescente penetração de dispositivos inteligentes, veículos elétricos e sistemas de monitorização da saúde está a impulsionar o crescimento do mercado. A forte presença de fabricantes de semicondutores e os avanços nas tecnologias de sensores baseadas em IA contribuem ainda mais para a liderança da região no mercado de sensores da América do Norte

Participação no mercado de sensores

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na América do Norte, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas em relação ao mercado.

Os principais líderes de mercado que operam no mercado são:

- Taiwan Semiconductor Manufacturing Company Limited (China)

- Bosch Sensortec GmbH (Alemanha)

- Sony Semiconductor Solutions Corporation (Japão)

- Mitsubishi Electric Corporation (Japão)

- Honeywell International Inc (EUA)

- Qualcomm Technologies, Inc. (EUA)

- Endress+Hauser Group Services AG (Suíça)

- NXP Semiconductors (Holanda)

- TE Connectivity (Irlanda)

- Renesas Electronics Corporation (Japão)

- Teledyne Technologies Incorporated (EUA)

- Rockwell Automation (EUA)

- Infineon Technologies AG (Alemanha)

- ams-OSRAM AG (Áustria)

- TDK Corporation (Japão)

- Sensirion AG (Suíça)

- Figaro Engineering Inc. (Japão)

- Omega Engineering Inc (EUA)

- First Sensor AG (Alemanha)

- Instrumentos Dwyer, LLC. (NÓS)

- Açafrão (França)

- Amphenol Corporation (EUA)

- Panasonic Holdings Corporation (Japão)

- Emerson Electric Co. (EUA)

- STMicroelectronics (Holanda)

- Microchip Technology Inc. (EUA)

- Siemens (Alemanha)

- Texas Instruments Incorporated (EUA)

- Yokogawa Electric Corporation (Japão)

Últimos desenvolvimentos no mercado de sensores

- Em fevereiro de 2025, o Medical Futurist informou que as tecnologias de saúde digital, incluindo sensores inteligentes, poderiam melhorar os cuidados aos idosos através da monitorização das condições de saúde e da análise de dados utilizando IA. Apesar de desafios como a acessibilidade e a falta de inovações direcionadas, a procura por esta tecnologia está a crescer à medida que os sistemas de saúde priorizam a qualidade de vida. Com os sensores a desempenharem um papel crucial no rastreio de sinais vitais e no apoio ao atendimento remoto, espera-se que a sua adoção aumente, contribuindo para os avanços nas soluções de saúde para os idosos

- Em dezembro de 2023, dados partilhados pela TriMedika revelaram que os sensores foram integrados em vários dispositivos médicos, desde monitores de glicose a rastreadores de saúde vestíveis, melhorando os cuidados prestados aos doentes. O termómetro sem contacto TRITEMP demonstrou como a tecnologia de sensores melhorou a precisão e a conveniência. À medida que a área da saúde adotou sensores mais avançados, a procura por soluções baseadas em sensores cresceu, impulsionando a expansão do mercado de sensores

- Em junho de 2021 , a Honeywell International Inc. relataram que os sensores médicos melhoraram significativamente os cuidados de saúde ao melhorar o diagnóstico, a monitorização e o tratamento. Foram integrados em dispositivos como ventiladores, bombas de infusão e camas hospitalares para fornecer dados precisos e em tempo real. A monitorização da saúde domiciliária também avançou com a tecnologia de sensores, permitindo o atendimento remoto ao paciente. À medida que o setor da saúde adotou cada vez mais dispositivos acionados por sensores, a procura por sensores cresceu, impulsionando o mercado de sensores

- Em outubro de 2024, a Spirit Electronics assinou um contrato de distribuição franchisado para os produtos de sensores da TE Connectivity, oferecendo soluções de elevada fiabilidade para os setores aeroespacial e de defesa . Os sensores TE foram utilizados em controlos de cabine, sistemas de voo, motores e missões espaciais, incluindo projetos da NASA. A sua tecnologia avançada e durabilidade em ambientes adversos aumentaram a procura por aplicações de deteção em satélites e operações militares. Esta parceria contribuiu para o crescente mercado de sensores ao expandir as soluções especializadas para as indústrias aeroespacial e de defesa

- Em setembro de 2023 , a AMETEK Sensors and Fluid Management Systems forneceu sensores avançados para aeronaves militares, incluindo sensores de pressão, temperatura, nível de fluido e movimento . Estes sensores melhoraram o desempenho, a segurança e a eficiência da missão da aeronave em ambientes hostis de campo de batalha. A tecnologia da AMETEK apoiou grandes aeronaves militares, como o F-35 e o F/A-18. A crescente procura por sensores fiáveis e de alto desempenho em aplicações de defesa contribuiu para o crescimento do mercado de sensores na América do Norte

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 COMPETITOR KEY PRICING STRATEGIES

4.3 TECHNOLOGY ANALYSIS OF THE NORTH AMERICA SENSOR MARKET

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.5 GROWTH PROSPECT ANALYSIS:

4.6 COMPETITIVE INTELLIGENCE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVANCEMENTS IN AI AND ML ENHANCE SENSOR CAPABILITIES FOR PREDICTIVE ANALYTICS

5.1.2 EXPANSION OF SMART HEALTHCARE INCREASES DEMAND FOR BIOSENSORS AND WEARABLE DEVICES

5.1.3 INCREASING DEFENSE AND AEROSPACE INVESTMENTS ACCELERATE THE ADOPTION OF HIGH-PRECISION SENSORS

5.1.4 DEMAND FOR SMART RETAIL SOLUTIONS IS DRIVING THE EXPANSION OF RFID AND TRACKING SENSOR TECHNOLOGY

5.1.5 EXPANSION OF PRECISION FARMING INCREASES DEMAND FOR SOIL MOISTURE, TEMPERATURE, NUTRIENT, AND REMOTE SENSING SENSORS

5.2 RESTRAINTS

5.2.1 HIGH IMPLEMENTATION COSTS LIMIT SENSOR ADOPTION IN SMALL AND MID-SIZED BUSINESSES

5.2.2 HARSH ENVIRONMENTAL CONDITIONS REDUCE SENSOR DURABILITY AND LONG-TERM EFFICIENCY

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF INDUSTRY 4.0 WILL ACCELERATE SENSOR DEPLOYMENT IN AUTOMATION AND MANUFACTURING

5.3.2 GROWTH OF AUTONOMOUS AND ELECTRIC VEHICLES WILL INCREASE DEMAND FOR LIDAR AND RADAR SENSORS

5.3.3 INCREASING INTEGRATION OF SENSORS IN BUILDINGS AND INFRASTRUCTURE TO DETECT STRESS POINTS

5.3.4 ONGOING ADVANCEMENTS IN SENSOR TECHNOLOGIES, ALONG WITH GOVERNMENT INVESTMENTS

5.4 CHALLENGES

5.4.1 SECURITY AND PRIVACY CONCERNS POSE RISKS FOR IOT-ENABLED SENSORS

5.4.2 COMPLEX INTEGRATION WITH EXISTING SYSTEMS INCREASES DEPLOYMENT DIFFICULTIES

6 NORTH AMERICA SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 TEMPERATURE SENSOR

6.2.1 TEMPERATURE SENSOR, BY TYPE

6.2.1.1 CONTACT

6.2.1.1.1 CONTACT, BY TYPE

6.2.1.1.1.1 THERMISTORS

6.2.1.1.1.2 THERMOCOUPLES

6.2.1.1.1.3 RESISTIVE TEMPERATURE DETECTORS (RTDS)

6.2.1.1.1.4 TEMPERATURE SENSOR ICS

6.2.1.1.1.5 BIMETALLIC TEMPERATURE SENSORS

6.2.1.2 NON-CONTACT

6.2.1.2.1 NON-CONTACT, BY TYPE

6.2.1.2.1.1 INFRARED TEMPERATURE SENSORS

6.2.1.2.1.2 FIBER OPTIC TEMPERATURE SENSORS

6.2.2 TEMPERATURE SENSOR, BY OUTPUT

6.2.2.1 DIGITAL

6.2.2.1.1 DIGITAL, BY TYPE

6.2.2.1.1.1 SINGLE CHANNEL

6.2.2.1.1.2 MULTI CHANNEL

6.2.2.2 ANALOG

6.2.3 TEMPERATURE SENSOR, BY CONNECTIVITY

6.2.3.1 WIRED

6.2.3.2 WIRELESS

6.2.4 TEMPERATURE SENSOR, BY MATERIAL

6.2.4.1 IRON/CONSTANTAN (CODE J)

6.2.4.2 NICKEL CHROMIUM/CONSTANTAN (CODE E)

6.2.4.3 COPPER/CONSTANTAN (CODE T)

6.2.4.4 CERAMIC

6.2.4.5 POLYMER

6.2.4.6 NICKEL MOLYBDENUM-NICKEL COBALT THERMOCOUPLES (TYPE M)

6.2.4.7 OTHERS

6.3 IMAGE SENSOR

6.3.1 IMAGE SENSOR, BY TECHNOLOGY

6.3.1.1 CMOS

6.3.1.2 CCD

6.3.1.3 OTHERS

6.3.2 IMAGE SENSOR, BY PROCESSING TECHNIQUE

6.3.2.1 2D IMAGE SENSORS

6.3.2.2 3D IMAGE SENSORS

6.3.3 IMAGE SENSOR, BY RESOLUTION

6.3.3.1 12 MP TO 16 MP

6.3.3.2 5 MP TO 10 MP

6.3.3.3 LESS THAN 3MP

6.3.3.4 MORE THAN 16 MP

6.3.4 IMAGE SENSOR, BY SPECTRUM

6.3.4.1 VISIBLE

6.3.4.2 NON-VISIBLE

6.3.5 IMAGE SENSOR, BY ARRAY TYPE

6.3.5.1 AREA IMAGE SENSOR

6.3.5.2 LINEAR IMAGE SENSOR

6.4 MOTION SENSOR

6.4.1 MOTION SENSOR, BY MOTION TECHNOLOGY

6.4.1.1 PASSIVE

6.4.1.1.1 PASSIVE, BY TYPE

6.4.1.1.1.1 INFRARED MOTION SENSOR

6.4.1.1.1.2 DUAL OR HYBRID TECHNOLOGY

6.4.1.1.1.3 OTHERS

6.4.1.2 ACTIVE

6.4.1.2.1 ACTIVE, BY TYPE

6.4.1.2.1.1 MICROWAVE SENSOR

6.4.1.2.1.2 ULTRASONIC SENSOR

6.4.1.2.1.3 TOMOGRAPHIC SENSOR

6.4.2 MOTION SENSOR, BY FUNCTION

6.4.2.1 FULLY-AUTOMATIC

6.4.2.2 SEMI-AUTOMATIC

6.5 PRESSURE SENSOR

6.5.1 PRESSURE SENSOR, BY TYPE

6.5.1.1 WIRED

6.5.1.2 WIRELESS

6.5.2 PRESSURE SENSOR, BY PRODUCT

6.5.2.1 GAUGE PRESSURE SENSORS

6.5.2.2 DIFFERENTIAL PRESSURE SENSORS

6.5.2.3 ABSOLUTE PRESSURE SENSORS

6.5.2.4 VACUUM PRESSURE SENSORS

6.5.2.5 SEALED PRESSURE SENSORS

6.5.3 PRESSURE SENSOR, BY TECHNOLOGY

6.5.3.1 PIEZORESISTIVE

6.5.3.2 CAPACITIVE

6.5.3.3 PIEZOELECTRIC

6.5.3.4 OPTICAL

6.5.3.5 RESONANT SOLID-STATE

6.5.3.6 THERMAL

6.5.3.7 ELECTROMAGNETIC

6.5.3.8 POTENTIOMETRIC

6.6 TOUCH SENSOR

6.7 PROXIMITY AND DISPLACEMENT SENSOR

6.7.1 PROXIMITY AND DISPLACEMENT SENSOR, BY TYPE

6.7.1.1 ADJUSTABLE DISTANCE PROXIMITY SENSOR

6.7.1.2 FIXED DISTANCE PROXIMITY SENSOR TYPE

6.7.2 PROXIMITY AND DISPLACEMENT SENSOR, BY TECHNOLOGY

6.7.2.1 INDUCTIVE

6.7.2.2 CAPACITIVE

6.7.2.3 PHOTOELECTRIC

6.7.2.4 MAGNETIC

6.8 ACCELEROMETER AND SPEED SENSOR

6.8.1 ACCELEROMETER AND SPEED SENSOR, BY DIMENSION

6.8.1.1 1-AXIS

6.8.1.2 2-AXIS

6.8.1.3 3-AXIS

6.8.2 ACCELEROMETER AND SPEED SENSOR, BY TYPE

6.8.2.1 PIEZORESISTIVE

6.8.2.2 MEMS

6.8.2.3 PIEZOELECTRIC

6.8.2.4 OTHERS

6.9 HUMIDITY AND MOISTURE SENSOR

6.9.1 HUMIDITY AND MOISTURE SENSOR, BY TYPE

6.9.1.1 DIGITAL

6.9.1.1.1 DIGITAL, BY TYPE

6.9.1.1.1.1 RELATIVE HUMIDITY AND TEMPERATURE (RHT) SENSORS

6.9.1.1.1.2 RELATIVE HUMIDITY SENSOR (RHS)

6.9.1.2 ANALOG

6.9.2 HUMIDITY AND MOISTURE SENSOR, BY PRODUCT

6.9.2.1 RELATIVE HUMIDITY SENSORS

6.9.2.2 OSCILLATING HYGROMETER

6.9.2.3 ABSOLUTE HUMIDITY SENSORS

6.9.2.4 OPTICAL HYGROMETER

6.9.2.5 GRAVIMETRIC HYGROMETER

6.1 GAS SENSOR

6.10.1 GAS SENSOR, BY GAS TYPE

6.10.1.1 CARBON MONOXIDE

6.10.1.2 METHANE

6.10.1.3 CARBON DIOXIDE

6.10.1.4 OXYGEN

6.10.1.5 HYDROGEN SULFIDE

6.10.1.6 NITROGEN OXIDES

6.10.1.7 VOLATILE ORGANIC COMPOUNDS

6.10.1.8 AMMONIA

6.10.1.9 CHLORINE

6.10.1.10 HYDROCARBONS

6.10.1.11 HYDROGEN

6.10.2 GAS SENSOR, BY TECHNOLOGY

6.10.2.1 ELECTROCHEMICAL

6.10.2.2 SOLID STATE/METAL-OXIDE-SEMICONDUCTORS

6.10.2.3 CATALYTIC

6.10.2.4 INFRARED

6.10.2.5 ZIRCONIA

6.10.2.6 PHOTOIONIZATION DETECTORS (PID)

6.10.2.7 LASER-BASED

6.10.2.8 HOLOGRAPHIC

6.10.3 GAS SENSOR, BY PRODUCT TYPE

6.10.3.1 GAS DETECTORS

6.10.3.2 GAS ANALYZER AND MONITOR

6.10.3.3 AIR QUALITY MONITOR

6.10.3.4 HVAC

6.10.3.5 MEDICAL EQUIPMENT

6.10.3.6 AIR PURIFIER/AIR CLEANER

6.10.3.7 OTHERS

6.10.4 GAS SENSOR, BY OUTPUT TYPE

6.10.4.1 DIGITAL

6.10.4.2 ANALOG

6.10.5 GAS SENSOR, BY CONNECTIVITY

6.10.5.1 WIRED

6.10.5.2 WIRELESS

6.11 OPTICAL SENSOR

6.11.1 OPTICAL SENSOR, BY SENSING

6.11.1.1 INTRINSIC

6.11.1.1.1 INTRINSIC, BY TYPE

6.11.1.1.1.1 ENCODERS

6.11.1.1.1.2 OPTICAL COHERENCE TOMOGRAPHY (OCT)

6.11.1.1.1.3 SPECTROSCOPY

6.11.1.1.1.4 PYROMETERS

6.11.1.1.1.5 LASER DOPPLER VELOCIMETRY (LDV)

6.11.1.1.1.6 FABRY–PEROT INTERFEROMETERS

6.11.1.2 EXTRINSIC

6.11.1.2.1 EXTRINSIC, BY TYPE

6.11.1.2.1.1 SCATTERING BASED

6.11.1.2.1.2 SCATTERING BASED, BY TYPE

6.11.1.2.1.3 RAYLEIGH SCATTERING

6.11.1.2.1.4 RAMAN SCATTERING

6.11.1.2.1.5 BRILLOUIN SCATTERING

6.11.1.2.1.6 Fiber Bragg Grating Based

6.11.1.2.1.7 FIBER BRAGG GRATING BASED, BY TYPE

6.11.1.2.1.8 SPATIALLY CONTINUOUS BASED

6.11.1.2.1.9 POINT FBG BASED

6.11.2 OPTICAL SENSOR, BY APPLICATION

6.11.2.1 PRESSURE AND STRAIN SENSING

6.11.2.2 TEMPERATURE SENSING

6.11.2.3 BIOCHEMICAL

6.11.2.4 BIOMETRIC AND AMBIENCE

6.11.2.5 GEOLOGICAL SURVEY

6.11.2.6 OTHERS

6.12 FORCE SENSOR

6.12.1 FORCE SENSOR, BY FORCE TYPE

6.12.1.1 COMPRESSION

6.12.1.2 COMPRESSION AND TENSION

6.12.1.3 TENSION

6.12.2 FORCE SENSOR, BY TECHNOLOGY

6.12.2.1 STRAIN GAUGE

6.12.2.2 LOAD CELL

6.12.2.3 PIEZOELECTRIC

6.12.2.4 CAPACITIVE

6.12.2.5 MAGNETOELASTIC

6.12.2.6 OTHERS

6.12.3 FORCE SENSOR, BY OPERATION

6.12.3.1 DIGITAL

6.12.3.2 ANALOG

6.13 FLOW SENSOR

6.13.1 FLOW SENSOR, BY TYPE

6.13.1.1 LIQUID

6.13.1.2 GAS

6.13.2 FLOW SENSOR, BY APPLICATION

6.13.2.1 MAGNETIC

6.13.2.1.1 MAGNETIC, BY TYPE

6.13.2.1.1.1 IN-LINE MAGNETIC

6.13.2.1.1.2 LOW FLOW MAGNETIC

6.13.2.1.1.3 INSERTION MAGNETIC

6.13.2.2 ULTRASONIC

6.13.2.2.1 ULTRASONIC, BY TYPE

6.13.2.2.1.1 CLAMP-ON ULTRASONIC

6.13.2.2.1.2 INSERTION MAGNETIC

6.13.2.2.1.3 INSERTION MAGNETIC

6.13.2.3 DIFFERENTIAL FLOW

6.13.2.4 CORIOLIS

6.13.2.5 VORTEX

6.13.2.6 POSITICE DISPLACEMENT

6.13.2.7 OTHERS

6.14 LEVEL SENSOR

6.14.1 LEVEL SENSOR, BY TYPE

6.14.1.1 ULTRASONIC

6.14.1.2 RADAR/MICROWAVE

6.14.1.3 HYDROSTATIC

6.14.1.4 CAPACITANCE

6.14.1.5 MAGNETIC & MECHANICAL FLOAT

6.14.1.6 GUIDED WAVE RADAR

6.14.1.7 VIBRATORY PROBE

6.14.1.8 OPTICAL

6.14.1.9 MAGNETOSTRICTIVE

6.14.1.10 PNEUMATIC

6.14.1.11 NUCLEAR

6.14.1.12 LASER

6.14.1.13 OTHERS

6.14.2 LEVEL SENSOR, BY TECHNOLOGY

6.14.2.1 CONTACT

6.14.2.2 NON CONTACT

6.14.3 LEVEL SENSOR, BY MONITORING TYPE

6.14.3.1 CONTINUOUS LEVEL MONITORING

6.14.3.2 POINT LEVEL MONITORING

6.15 BIOSENSOR

6.15.1 BIOSENSOR, BY TYPE

6.15.1.1 ELECTROCHEMICAL

6.15.1.2 SENSOR PATCH

6.15.2 BIOSENSOR, BY TECHNOLOGY

6.15.2.1 ELECTROCHEMICAL

6.15.2.1.1 ELECTROCHEMICAL, BY TYPE

6.15.2.1.1.1 AMPEROMETRIC SENSORS

6.15.2.1.1.2 CONDUCTOMETRIC SENSORS

6.15.2.1.1.3 POTENTIOMETRIC SENSORS

6.15.2.2 OPTICAL BIOSENSORS

6.15.2.2.1 OPTICAL BIOSENSORS, BY TYPE

6.15.2.2.1.1 COLORIMETRIC BIOSENSORS

6.15.2.2.1.2 SPR

6.15.2.2.1.3 FLUORESCENCE BIOSENSORS

6.15.2.3 PIEZOELECTRIC BIOSENSORS

6.15.2.3.1 PIEZOELECTRIC BIOSENSORS, BY TYPE

6.15.2.3.1.1 ACOUSTIC BIOSENSORS

6.15.2.3.1.2 MICROCANTILEVER BIOSENSORS

6.15.3 BIOSENSOR, BY COMPONENT

6.15.3.1 BIORECEPTOR MOLECULES

6.15.3.2 TRANSDUCER

6.15.3.3 BIOLOGICAL ELEMENT

6.15.3.4 OTHERS

6.15.4 BIOSENSOR, BY PRODUCT TYPE

6.15.4.1 NON-WEARABLE BIOSENSORS

6.15.4.2 WEARABLE BIOSENSORS

6.15.4.2.1 WEARABLE BIOSENSOR, BY TYPE

6.15.4.2.1.1 WRISTWEAR

6.15.4.2.1.2 FOOTWEAR

6.15.4.2.1.3 BODYWEAR

6.15.4.2.1.4 EYEWEAR

6.15.4.2.1.5 NECKWEAR

6.15.4.2.1.6 OTHERS

6.16 POSITION SENSOR

6.16.1 POSITION SENSOR, BY TYPE

6.16.1.1 PROXIMITY SENSORS

6.16.1.2 DISPLACEMENT SENSORS

6.16.1.3 LINEAR SENSORS

6.16.1.3.1 LINEAR SENSOR, BY TYPE

6.16.1.3.1.1 MAGNETOSTRICTIVE SENSORS

6.16.1.3.1.2 LINEAR VARIABLE DIFFERENTIAL TRANSFORMERS

6.16.1.3.1.3 LASER POSITION SENSORS

6.16.1.3.1.4 LINEAR ENCODERS

6.16.1.3.1.5 LINEAR POTENTIOMETERS

6.16.1.4 PHOTOELECTRIC SENSORS

6.16.1.5 ROTARY SENSORS

6.16.1.5.1 ROTARY SENSORS, BY TYPE

6.16.1.5.1.1 ROTARY ENCODERS

6.16.1.5.1.2 ROTARY POTENTIOMETERS

6.16.1.5.1.3 ROTARY VARIABLE DIFFERENTIAL TRANSFORMERS

6.16.1.5.1.4 RESOLVERS

6.16.1.6 3D SENSORS

6.16.2 POSITION SENSOR, BY CONTACT TYPE

6.16.2.1 CONTACT

6.16.2.2 NON CONTACT

6.16.3 POSITION SENSOR, BY OUTPUT

6.16.3.1 ANALOG

6.16.3.2 DIGITAL

6.16.4 POSITION SENSOR, BY APPLICATION

6.16.4.1 MATERIAL HANDLING

6.16.4.2 MOTION SYSTEMS

6.16.4.3 ROBOTICS

6.16.4.4 TEST EQUIPMENT

6.16.4.5 MACHINE TOOLS

6.16.4.6 OTHERS

6.17 OTHERS

7 NORTH AMERICA SENSORS MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 MEMS

7.3 CMOS

7.4 NEMS

7.5 OTHERS

8 NORTH AMERICA SENSORS MARKET, BY END USER

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.2.1 AUTOMOTIVE, BY APPLICATION

8.2.1.1 POWERTRAIN

8.2.1.2 DRIVER ASSISTANCE & APPLICATION

8.2.1.3 SAFETY & CONTROLS SYSTEMS

8.2.1.4 CHASSIS

8.2.1.5 TELEMATICS SYSTEMS

8.2.1.6 VEHICLE BODY ELECTRONICS

8.2.1.7 EXHAUST SYSTEMS

8.2.1.8 OTHERS

8.2.2 AUTOMOTIVE, BY VEHICLE TYPE

8.2.2.1 PASSENGER CAR

8.2.2.2 LIGHT COMMERCIAL VEHICLE

8.2.2.3 HEAVY COMMERCIAL VEHICLE

8.2.3 AUTOMOTIVE, BY SALES CHANNEL

8.2.3.1 OEMS

8.2.3.2 AFTERMARKETS

8.2.4 AUTOMOTIVE, BY TYPE

8.2.4.1 RADAR SENSORS

8.2.4.2 IMAGE SENSORS

8.2.4.3 LIDAR SENSORS

8.2.4.4 CURRENT SENSORS

8.2.4.5 LEVEL SENSORS

8.2.4.6 INERTIAL SENSORS

8.2.4.7 ULTRASONIC SENSORS

8.2.4.8 TEMPERATURE SENSORS

8.2.4.9 PRESSURE SENSORS

8.2.4.10 OXYGEN SENSORS

8.2.4.11 POSITION SENSORS

8.2.4.12 SPEED SENSORS

8.2.4.13 CHEMICAL SENSORS

8.2.4.14 NOX SENSORS

8.2.4.15 OTHERS

8.3 CONSUMER ELECTRONICS

8.3.1 CONSUMER ELECTRONICS, BY TYPE

8.3.1.1 IMAGE SENSOR

8.3.1.2 MOTION SENSOR

8.3.1.3 TEMPERATURE SENSOR

8.3.1.4 PRESSURE SENSOR

8.3.1.5 PROXIMITY AND DISPLACEMENT SENSOR

8.3.1.6 OPTICAL SENSOR

8.3.1.7 ACCELEROMETER & SPEED SENSOR

8.3.1.8 HUMIDITY AND MOISTURE SENSOR

8.3.1.9 GAS SENSOR

8.3.1.10 FLOW SENSOR

8.3.1.11 LEVEL SENSOR

8.3.1.12 POSITION SENSOR

8.3.1.13 BIOSENSOR

8.3.1.14 FORCE SENSOR

8.3.1.15 OTHERS

8.4 HEALTHCARE

8.4.1 HEALTHCARE, BY TYPE

8.4.1.1 BIOSENSOR

8.4.1.2 TEMPERATURE SENSOR

8.4.1.3 PRESSURE SENSOR

8.4.1.4 IMAGE SENSOR

8.4.1.5 FLOW SENSOR

8.4.1.6 OPTICAL SENSOR

8.4.1.7 GAS SENSOR

8.4.1.8 ACCELEROMETER & SPEED SENSOR

8.4.1.9 MOTION SENSOR

8.4.1.10 PROXIMITY AND DISPLACEMENT SENSOR

8.4.1.11 FORCE SENSOR

8.4.1.12 HUMIDITY AND MOISTURE SENSOR

8.4.1.13 LEVEL SENSOR

8.4.1.14 POSITION SENSOR

8.4.1.15 OTHERS

8.5 MANUFACTURING

8.5.1 MANUFACTURING, BY TYPE

8.5.1.1 IMAGE SENSOR

8.5.1.2 FLOW SENSOR

8.5.1.3 TEMPERATURE SENSOR

8.5.1.4 PRESSURE SENSOR

8.5.1.5 LEVEL SENSOR

8.5.1.6 HUMIDITY AND MOISTURE SENSOR

8.5.1.7 GAS SENSOR

8.5.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.5.1.9 BIOSENSOR

8.5.1.10 OPTICAL SENSOR

8.5.1.11 MOTION SENSOR

8.5.1.12 FORCE SENSOR

8.5.1.13 ACCELEROMETER & SPEED SENSOR

8.5.1.14 POSITION SENSOR

8.5.1.15 OTHERS

8.6 AEROSPACE & DEFENCE

8.6.1 AEROSPACE & DEFENCE, BY TYPE

8.6.1.1 IMAGE SENSOR

8.6.1.2 PRESSURE SENSOR

8.6.1.3 TEMPERATURE SENSOR

8.6.1.4 ACCELEROMETER & SPEED SENSOR

8.6.1.5 PROXIMITY AND DISPLACEMENT SENSOR

8.6.1.6 OPTICAL SENSOR

8.6.1.7 POSITION SENSOR

8.6.1.8 MOTION SENSOR

8.6.1.9 FLOW SENSOR

8.6.1.10 GAS SENSOR

8.6.1.11 FORCE SENSOR

8.6.1.12 HUMIDITY AND MOISTURE SENSOR

8.6.1.13 LEVEL SENSOR

8.6.1.14 BIOSENSOR

8.6.1.15 OTHERS

8.7 ENERGY & POWER

8.7.1 ENERGY & POWER, BY TYPE

8.7.1.1 CURRENT SENSOR

8.7.1.2 PRESSURE SENSOR

8.7.1.3 TEMPERATURE SENSOR

8.7.1.4 FLOW SENSOR

8.7.1.5 GAS SENSOR

8.7.1.6 LEVEL SENSOR

8.7.1.7 HUMIDITY AND MOISTURE SENSOR

8.7.1.8 OPTICAL SENSOR

8.7.1.9 PROXIMITY AND DISPLACEMENT SENSOR

8.7.1.10 MOTION SENSOR

8.7.1.11 ACCELEROMETER & SPEED SENSOR

8.7.1.12 POSITION SENSOR

8.7.1.13 FORCE SENSOR

8.7.1.14 BIOSENSOR

8.7.1.15 OTHERS

8.8 IT & TELECOMMUNICATION

8.8.1 IT & TELECOMMUNICATION, BY TYPE

8.8.1.1 PRESSURE SENSOR

8.8.1.2 TEMPERATURE SENSOR

8.8.1.3 OPTICAL SENSOR

8.8.1.4 PROXIMITY AND DISPLACEMENT SENSOR

8.8.1.5 ACCELEROMETER & SPEED SENSOR

8.8.1.6 HUMIDITY AND MOISTURE SENSOR

8.8.1.7 GAS SENSOR

8.8.1.8 MOTION SENSOR

8.8.1.9 FLOW SENSOR

8.8.1.10 LEVEL SENSOR

8.8.1.11 POSITION SENSOR

8.8.1.12 IMAGE SENSOR

8.8.1.13 FORCE SENSOR

8.8.1.14 BIOSENSOR

8.8.1.15 OTHERS

8.9 OIL & GAS

8.9.1 OIL & GAS, BY TYPE

8.9.1.1 GAS SENSOR

8.9.1.2 FLOW SENSOR

8.9.1.3 PRESSURE SENSOR

8.9.1.4 TEMPERATURE SENSOR

8.9.1.5 LEVEL SENSOR

8.9.1.6 HUMIDITY AND MOISTURE SENSOR

8.9.1.7 OPTICAL SENSOR

8.9.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.9.1.9 POSITION SENSOR

8.9.1.10 MOTION SENSOR

8.9.1.11 ACCELEROMETER & SPEED SENSOR

8.9.1.12 IMAGE SENSOR

8.9.1.13 FORCE SENSOR

8.9.1.14 BIOSENSOR

8.9.1.15 OTHERS

8.1 CHEMICAL

8.10.1 CHEMICAL, BY TYPE

8.10.1.1 GAS SENSOR

8.10.1.2 FLOW SENSOR

8.10.1.3 PRESSURE SENSOR

8.10.1.4 TEMPERATURE SENSOR

8.10.1.5 LEVEL SENSOR

8.10.1.6 HUMIDITY AND MOISTURE SENSOR

8.10.1.7 BIOSENSOR

8.10.1.8 OPTICAL SENSOR

8.10.1.9 POSITION SENSOR

8.10.1.10 MOTION SENSOR

8.10.1.11 IMAGE SENSOR

8.10.1.12 PROXIMITY AND DISPLACEMENT SENSOR

8.10.1.13 FORCE SENSOR

8.10.1.14 ACCELEROMETER & SPEED SENSOR

8.10.1.15 OTHERS

8.11 FOOD & BEVERAGES

8.11.1 FOOD & BEVERAGES, BY TYPE

8.11.1.1 BIOSENSOR

8.11.1.2 FLOW SENSOR

8.11.1.3 LEVEL SENSOR

8.11.1.4 TEMPERATURE SENSOR

8.11.1.5 POSITION SENSOR

8.11.1.6 HUMIDITY AND MOISTURE SENSOR

8.11.1.7 GAS SENSOR

8.11.1.8 OPTICAL SENSOR

8.11.1.9 MOTION SENSOR

8.11.1.10 ACCELEROMETER & SPEED SENSOR

8.11.1.11 FORCE SENSOR

8.11.1.12 IMAGE SENSOR

8.11.1.13 PROXIMITY AND DISPLACEMENT SENSOR

8.11.1.14 PRESSURE SENSOR

8.11.1.15 OTHERS

8.12 CONSTRUCTION

8.12.1 CONSTRUCTION, BY TYPE

8.12.1.1 PRESSURE SENSOR

8.12.1.2 TEMPERATURE SENSOR

8.12.1.3 PROXIMITY AND DISPLACEMENT SENSOR

8.12.1.4 HUMIDITY AND MOISTURE SENSOR

8.12.1.5 LEVEL SENSOR

8.12.1.6 MOTION SENSOR

8.12.1.7 FLOW SENSOR

8.12.1.8 GAS SENSOR

8.12.1.9 FORCE SENSOR

8.12.1.10 OPTICAL SENSOR

8.12.1.11 POSITION SENSOR

8.12.1.12 ACCELEROMETER & SPEED SENSOR

8.12.1.13 IMAGE SENSOR

8.12.1.14 BIOSENSOR

8.12.1.15 OTHERS

8.13 MINING

8.13.1 MINING, BY TYPE

8.13.1.1 GAS SENSOR

8.13.1.2 PRESSURE SENSOR

8.13.1.3 FLOW SENSOR

8.13.1.4 LEVEL SENSOR

8.13.1.5 TEMPERATURE SENSOR

8.13.1.6 HUMIDITY AND MOISTURE SENSOR

8.13.1.7 OPTICAL SENSOR

8.13.1.8 PROXIMITY AND DISPLACEMENT SENSOR

8.13.1.9 ACCELEROMETER & SPEED SENSOR

8.13.1.10 MOTION SENSOR

8.13.1.11 POSITION SENSOR

8.13.1.12 IMAGE SENSOR

8.13.1.13 FORCE SENSOR

8.13.1.14 BIOSENSOR

8.13.1.15 OTHERS

8.14 PAPER & PULP

8.14.1 PAPER & PULP, BY TYPE

8.14.1.1 FLOW SENSOR

8.14.1.2 TEMPERATURE SENSOR

8.14.1.3 PRESSURE SENSOR

8.14.1.4 LEVEL SENSOR

8.14.1.5 HUMIDITY AND MOISTURE SENSOR

8.14.1.6 OPTICAL SENSOR

8.14.1.7 POSITION SENSOR

8.14.1.8 GAS SENSOR

8.14.1.9 PROXIMITY AND DISPLACEMENT SENSOR

8.14.1.10 MOTION SENSOR

8.14.1.11 FORCE SENSOR

8.14.1.12 ACCELEROMETER & SPEED SENSOR

8.14.1.13 IMAGE SENSOR

8.14.1.14 BIOSENSOR

8.14.1.15 OTHERS

8.15 OTHERS

9 NORTH AMERICA SENSORS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA SENSORS MARKET

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 BOSCH SENSORTEC GMBH

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 SONY SEMICONDUCTOR SOLUTIONS CORPORATION

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT/NEWS

12.4 MITSUBISHI ELECTRIC CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 HONEYWELL INTERNATIONAL INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 AMPHENOL CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 AMS-OSRAM AG

12.7.1 COMPANY SNAPSHOTS

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DWYER INSTRUMENTS, LLC.

12.8.1 COMPANY SNAPSHOTS

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EMERSON ELECTRIC CO.

12.9.1 COMPANY SNAPSHOTS

12.9.2 REVENUE ANALYSIS AND SEGMENTED ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 ENDRESS+HAUSER GROUP SERVICES AG

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT CERTIFICATION

12.11 FIGARO ENGINEERING INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 FIRST SENSOR AG

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENT

12.13 INFINEON TECHNOLOGIES AG

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 MICROCHIP TECHNOLOGY INC.

12.14.1 COMPANY SNAPSHOTS

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 NXP SEMICONDUCTORS

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENT

12.16 OMEGA ENGINEERING INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 PANASONIC HOLDINGS CORPORATION

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENT

12.18 QUALCOMM TECHNOLOGIES, INC.

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 RENESAS ELECTRONICS CORPORATION.

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 1.1.5RECENT DEVELOPMENT

12.2 ROCKWELL AUTOMATION

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENT

12.21 SAFRAN

12.21.1 COMPANY SNAPSHOT

12.21.2 REVENUE ANALYSIS

12.21.3 PRODUCT PORTFOLIO

12.21.4 RECENT DEVELOPMENT/NEWS

12.22 SENSIRION AG

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENT

12.23 SIEMENS

12.23.1 COMPANY SNAPSHOT

12.23.2 REVENUE ANALYSIS

12.23.3 PRODUCT PORTFOLIO

12.23.4 RECENT DEVELOPMENT

12.24 STMICROELECTRONICS

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENT/NEWS

12.25 TDK CORPORATION.

12.25.1 COMPANY SNAPSHOTS

12.25.2 REVENUE ANALYSIS

12.25.3 PRODUCT PORTFOLIO

12.25.4 RECENT DEVELOPMENT

12.26 TE CONNECTIVITY

12.26.1 COMPANY SNAPSHOT

12.26.2 REVENUE ANALYSIS

12.26.3 PRODUCT PORTFOLIO

12.26.4 RECENT DEVELOPMENT

12.27 TELEDYNE TECHNOLOGIES INCORPORATED.

12.27.1 COMPANY SNAPSHOTS

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENT/NEWS

12.28 TEXAS INSTRUMENTS INCORPORATED

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENTS

12.29 WIKA INSTRUMENTS INDIA PVT. LTD.

12.29.1 COMPANY SNAPSHOT

12.29.2 PRODUCT PORTFOLIO

12.29.3 RECENT DEVELOPMENT/NEWS

12.3 YOKOGAWA ELECTRIC CORPORATION

12.30.1 COMPANY SNAPSHOTS

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT/NEWS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tabela

TABLE 1 KEY PLAYERS AND THEIR TECHNOLOGY ANALYSIS IN SENSOR MARKET

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

TABLE 4 SENSOR COST COMPARISON

TABLE 5 NORTH AMERICA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 7 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA NON-CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA TOUCH SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA BIOSENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA OTHERS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA MEMS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA CMOS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA NEMS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA OTHERS SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA CONSUMER ELECTRONICS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA HEALTHCARE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA MANUFACTURING IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA AEROSPACE & DEFENCE IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA AEROSPACE & DEFENCE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA ENERGY & POWER IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA IT & TELECOMMUNICATION IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 106 NORTH AMERICA OIL & GAS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA CHEMICAL IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA FOOD & BEVERAGES IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA CONSTRUCTION IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA MINING IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA PAPER & PULP IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA OTHERS IN SENSORS MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA SENSORS MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 148 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 150 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 152 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 153 NORTH AMERICA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 NORTH AMERICA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NORTH AMERICA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 NORTH AMERICA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 NORTH AMERICA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 158 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 159 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 160 NORTH AMERICA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 161 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 NORTH AMERICA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 163 NORTH AMERICA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 NORTH AMERICA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 166 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 167 NORTH AMERICA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 168 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 169 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 170 NORTH AMERICA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 NORTH AMERICA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 172 NORTH AMERICA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 174 NORTH AMERICA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 175 NORTH AMERICA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 176 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 NORTH AMERICA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 178 NORTH AMERICA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 179 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 180 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 181 NORTH AMERICA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 182 NORTH AMERICA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 183 NORTH AMERICA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 184 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 185 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 186 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 187 NORTH AMERICA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 NORTH AMERICA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 189 NORTH AMERICA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 190 NORTH AMERICA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 NORTH AMERICA AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 NORTH AMERICA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 NORTH AMERICA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 NORTH AMERICA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 NORTH AMERICA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 196 NORTH AMERICA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 197 NORTH AMERICA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 198 NORTH AMERICA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 NORTH AMERICA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 U.S. SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 U.S. CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 203 U.S. NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 204 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 205 U.S. DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 207 U.S. TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 208 U.S. IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 209 U.S. IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 210 U.S. IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 211 U.S. IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 212 U.S. IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 213 U.S. MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 214 U.S. PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 215 U.S. ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 216 U.S. MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 217 U.S. PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 U.S. PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 219 U.S. PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 220 U.S. PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 221 U.S. PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 222 U.S. ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 223 U.S. ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 U.S. HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 U.S. DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 226 U.S. HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 227 U.S. GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 228 U.S. GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 229 U.S. GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 230 U.S. GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 231 U.S. GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 232 U.S. OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 233 U.S. INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 U.S. EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 U.S. SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 236 U.S. FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 237 U.S. OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 238 U.S. FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 239 U.S. FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 240 U.S. FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 241 U.S. FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 U.S. FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 243 U.S. MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 U.S. ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 U.S. LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 U.S. LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 247 U.S. LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 248 U.S. BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 249 U.S. BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 250 U.S. ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 251 U.S. OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 252 U.S. PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 U.S. BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 254 U.S. BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 255 U.S. WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 U.S. POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 U.S. LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 258 U.S. ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 259 U.S. POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 260 U.S. POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 261 U.S. POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 262 U.S. SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 263 U.S. SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 264 U.S. AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 265 U.S. AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 266 U.S. AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 267 U.S. AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 U.S. CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 U.S. HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 U.S. MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 271 U.S. AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 U.S. ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 U.S. IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 U.S. OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 U.S. CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 U.S. FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 277 U.S. CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 278 U.S. MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 279 U.S. PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 280 CANADA SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 281 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 282 CANADA CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 283 CANADA NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 284 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 285 CANADA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 287 CANADA TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 288 CANADA IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 289 CANADA IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 290 CANADA IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 291 CANADA IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 292 CANADA IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 293 CANADA MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 294 CANADA PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 295 CANADA ACTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 296 CANADA MOTION SENSOR IN SENSORS MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

TABLE 297 CANADA PRESSURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 CANADA PRESSURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 299 CANADA PRESSURE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 300 CANADA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 CANADA PROXIMITY AND DISPLACEMENT SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 302 CANADA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY DIMENSION, 2018-2032 (USD MILLION)

TABLE 303 CANADA ACCELEROMETER AND SPEED SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 CANADA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 CANADA DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 CANADA HUMIDITY AND MOISTURE SENSOR IN SENSORS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 307 CANADA GAS SENSOR IN SENSORS MARKET, BY GAS TYPE, 2018-2032 (USD MILLION)

TABLE 308 CANADA GAS SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 309 CANADA GAS SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 310 CANADA GAS SENSOR IN SENSORS MARKET, BY OUTPUT TYPE, 2018-2032 (USD MILLION)

TABLE 311 CANADA GAS SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 312 CANADA OPTICAL SENSOR IN SENSORS MARKET, BY SENSING, 2018-2032 (USD MILLION)

TABLE 313 CANADA INTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 314 CANADA EXTRINSIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 315 CANADA SCATTERING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 CANADA FIBER BRAGG GRATING BASED IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 CANADA OPTICAL SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 318 CANADA FORCE SENSOR IN SENSORS MARKET, BY FORCE TYPE, 2018-2032 (USD MILLION)

TABLE 319 CANADA FORCE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 320 CANADA FORCE SENSOR IN SENSORS MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 321 CANADA FLOW SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 322 CANADA FLOW SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 323 CANADA MAGNETIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 CANADA ULTRASONIC IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 325 CANADA LEVEL SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 326 CANADA LEVEL SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 327 CANADA LEVEL SENSOR IN SENSORS MARKET, BY MONITORING TYPE, 2018-2032 (USD MILLION)

TABLE 328 CANADA BIO SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 CANADA BIO SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 330 CANADA ELECTROCHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 331 CANADA OPTICAL BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 332 CANADA PIEZOELECTRIC BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 CANADA BIO SENSOR IN SENSORS MARKET, BY COMPONENT, 2018-2032 (USD MILLION)

TABLE 334 CANADA BIO SENSOR IN SENSORS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 335 CANADA WEARABLE BIOSENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 336 CANADA POSITION SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 CANADA LINEAR SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 CANADA ROTARY SENSORS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 339 CANADA POSITION SENSOR IN SENSORS MARKET, BY CONTACT TYPE, 2018-2032 (USD MILLION)

TABLE 340 CANADA POSITION SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 341 CANADA POSITION SENSOR IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 342 CANADA SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 343 CANADA SENSORS MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 344 CANADA AUTOMOTIVE IN SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 345 CANADA AUTOMOTIVE IN SENSORS MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 346 CANADA AUTOMOTIVE IN SENSORS MARKET, BY SALES CHANNEL, 2018-2032 (USD MILLION)

TABLE 347 CANADA AUTOMOTIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 348 CANADA CONSUMER ELECTRONICS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 CANADA HEALTHCARE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 CANADA MANUFACTURING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 351 CANADA AEROSPACE & DEFENSE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 CANADA ENERGY & POWER IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 CANADA IT & TELECOMMUNICATION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 CANADA OIL & GAS IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 CANADA CHEMICAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 CANADA FOOD & BEVERAGES IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 357 CANADA CONSTRUCTION IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 358 CANADA MINING IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 CANADA PAPER & PULP IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 MEXICO SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 MEXICO CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 MEXICO NON CONTACT IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY OUTPUT, 2018-2032 (USD MILLION)

TABLE 365 MEXICO DIGITAL IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 366 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY CONNECTIVITY, 2018-2032 (USD MILLION)

TABLE 367 MEXICO TEMPERATURE SENSOR IN SENSORS MARKET, BY MATERIAL, 2018-2032 (USD MILLION)

TABLE 368 MEXICO IMAGE SENSOR IN SENSORS MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 369 MEXICO IMAGE SENSOR IN SENSORS MARKET, BY PROCESSING TECHNIQUE, 2018-2032 (USD MILLION)

TABLE 370 MEXICO IMAGE SENSOR IN SENSORS MARKET, BY RESOLUTION, 2018-2032 (USD MILLION)

TABLE 371 MEXICO IMAGE SENSOR IN SENSORS MARKET, BY SPECTRUM, 2018-2032 (USD MILLION)

TABLE 372 MEXICO IMAGE SENSOR IN SENSORS MARKET, BY ARRAY TYPE, 2018-2032 (USD MILLION)

TABLE 373 MEXICO MOTION SENSOR IN SENSORS MARKET, BY MOTION TECHNOLOGY, 2018-2032 (USD MILLION)

TABLE 374 MEXICO PASSIVE IN SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION)