North America Stainless Steel Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

50.12 Billion

USD

71.13 Billion

2024

2032

USD

50.12 Billion

USD

71.13 Billion

2024

2032

| 2025 –2032 | |

| USD 50.12 Billion | |

| USD 71.13 Billion | |

|

|

|

|

Segmentação do mercado de aço inoxidável na América do Norte, por tipo de produto (produtos planos, produtos longos, tubos e tubulações, conexões e flanges e outros), tipo de grau (aço inoxidável austenítico, aço inoxidável ferrítico, aço inoxidável duplex, aço inoxidável martensítico, aço inoxidável endurecido por precipitação (PH) e outros), processo de fabricação (laminação a quente, laminação a frio, fundição, forjamento e extrusão), método de produção (produção primária, processamento secundário e processamento final), resistência (aço inoxidável de baixa resistência, aço inoxidável de média resistência e aço inoxidável de alta resistência), revestimento e acabamento de superfície (revestimentos e acabamentos de superfície), vertical (construção e infraestrutura, automotivo e transporte, bens de consumo e eletrodomésticos, equipamentos e máquinas industriais, medicina e saúde, aeroespacial e defesa, energia e energia, processamento de alimentos e bebidas, eletrônicos e tecnologia e aplicações ambientais) - Tendências do setor e previsão até 2032

Tamanho do mercado de aço inoxidável

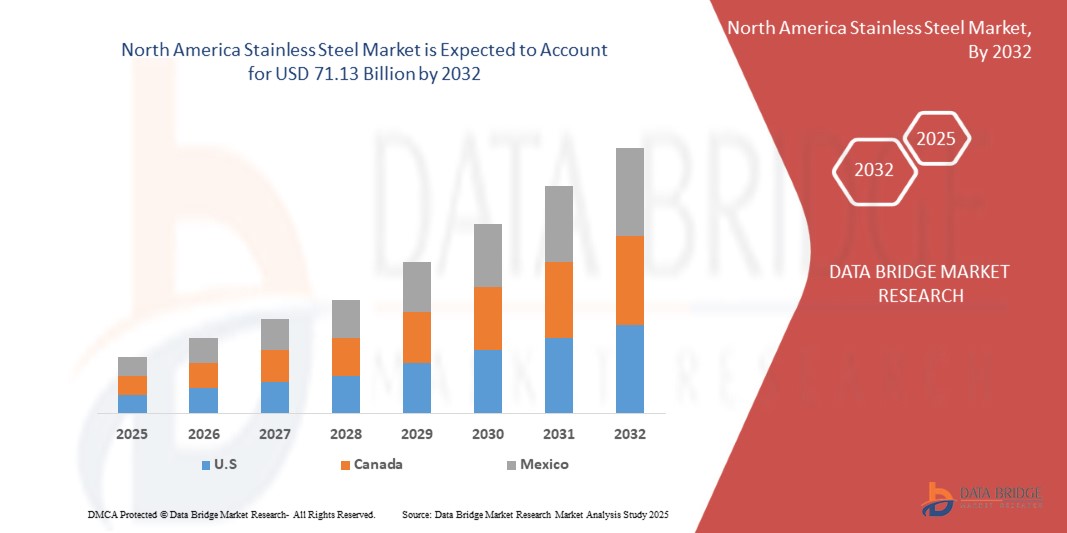

- O mercado de aço inoxidável da América do Norte foi avaliado em US$ 50,12 bilhões em 2024 e deve atingir US$ 71,13 bilhões até 2032

- Durante o período previsto de 2025 a 2032, o mercado deverá crescer a um CAGR de 4,68%, impulsionado principalmente pela crescente industrialização e expansão da infraestrutura

- Este crescimento é ainda mais impulsionado pelo uso crescente de aço inoxidável em aplicações de energia limpa, pela preferência crescente por materiais duráveis e resistentes à corrosão e por regulamentações ambientais e de segurança mais rigorosas que favorecem materiais recicláveis e de baixa emissão.

Análise de Mercado de Aço Inoxidável

- O mercado de aço inoxidável está em forte crescimento, impulsionado pelo crescente desenvolvimento de infraestrutura, urbanização e demanda nos setores automotivo, de construção e energia. A resistência à corrosão, a durabilidade e o apelo estético do aço inoxidável o tornam um material de escolha tanto para aplicações estruturais quanto decorativas. No entanto, a expansão do mercado enfrenta desafios devido à flutuação dos preços das matérias-primas, especialmente níquel e cromo, e às preocupações ambientais associadas aos métodos tradicionais de produção.

- A demanda por aço inoxidável é fortemente impulsionada pelo foco da indústria da construção em materiais de construção duráveis e de baixa manutenção. Além disso, sua crescente adoção em veículos elétricos (VEs), devido às suas propriedades de leveza e resistência, está impulsionando a demanda no setor automotivo. As indústrias de processamento de alimentos e equipamentos médicos também continuam a depender fortemente do aço inoxidável por suas características higiênicas e não reativas.

- Os aços inoxidáveis austeníticos dominam o mercado. Enquanto isso, os aços duplex e ferríticos estão ganhando força em aplicações específicas, como processamento químico e dessalinização, devido à sua robustez e resistência ao cloreto. Inovações tecnológicas, incluindo métodos de produção de baixo carbono e tecnologias de reciclagem aprimoradas, devem remodelar o cenário competitivo e impulsionar a sustentabilidade na indústria do aço inoxidável.

Escopo do Relatório e Segmentação do Mercado de Aço Inoxidável

|

Atributos |

Principais insights do mercado de aço inoxidável |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de aço inoxidável

“Inovação orientada para a sustentabilidade e desenvolvimento avançado de ligas”

- Uma tendência importante no mercado de aço inoxidável da América do Norte é o foco crescente na inovação voltada para a sustentabilidade e no desenvolvimento de ligas avançadas de aço inoxidável.

- O mercado está testemunhando uma demanda crescente por produtos de aço inoxidável resistentes à corrosão, leves e de alto desempenho em diversos setores, especialmente nos setores automotivo, de construção e de energia renovável. Essa tendência está intimamente ligada às metas de descarbonização e aos princípios da economia circular.

Por exemplo, em agosto de 2023, a Outokumpu lançou uma nova linha de aço inoxidável de baixa emissão, produzido com alto teor de material reciclado e energia renovável. Esta iniciativa apoia os objetivos do Pacto Ecológico Europeu e reforça o papel do aço inoxidável em infraestruturas resilientes ao clima.

- Os fabricantes estão investindo cada vez mais em tecnologia de forno elétrico a arco (EAF), produção baseada em sucata e métodos de captura de carbono para reduzir a pegada ambiental do aço inoxidável. Simultaneamente, formulações avançadas de ligas estão sendo adaptadas para aplicações críticas, como armazenamento de hidrogênio, veículos elétricos e construção naval.

- À medida que os padrões ambientais se tornam mais rigorosos globalmente, especialmente na América do Norte, os usuários finais estão priorizando aço inoxidável com desempenho ambiental certificado. Essa tendência está impulsionando a inovação de produtos, a adoção de certificações (por exemplo, materiais compatíveis com EPD e LEED) e uma integração mais profunda da cadeia de suprimentos para atender às metas de sustentabilidade em todos os setores.

Dinâmica do mercado de aço inoxidável

Motorista

“Crescente Industrialização e Expansão de Infraestrutura”

- Uma das principais tendências que impulsionam o mercado de aço inoxidável na América do Norte é o ritmo crescente das atividades industriais e a expansão da infraestrutura em economias emergentes e desenvolvidas. O aço inoxidável é um material essencial em máquinas industriais, equipamentos de processo e aplicações de construção devido à sua resistência, resistência à corrosão e longo ciclo de vida.

- A onda contínua de modernização industrial, incluindo manufatura inteligente, projetos de energia renovável e iniciativas de desenvolvimento urbano, está gerando uma demanda consistente por aço inoxidável na fabricação de equipamentos, componentes estruturais e sistemas de manuseio de fluidos.

- Setores como construção, geração de energia, processamento químico e petróleo e gás estão aumentando seus gastos de capital para atingir as metas de crescimento pós-pandemia, levando a um maior uso de aço inoxidável em ambientes pesados, de alta temperatura e corrosivos.

- À medida que os governos investem em planos nacionais de infraestrutura — como cidades inteligentes, corredores de energia e parques industriais — o papel do aço inoxidável em garantir desempenho, segurança e sustentabilidade torna-se mais proeminente. Espera-se que essa tendência acelere a adoção do aço inoxidável em economias industriais de alto crescimento em toda a América Latina.

Oportunidade

“Integração em Indústrias Verdes e Aplicações Sustentáveis”

- A integração com indústrias sustentáveis está emergindo como uma tendência transformadora no mercado de aço inoxidável da América do Norte, impulsionada pela busca por sustentabilidade, adoção de energias renováveis e práticas de economia circular. A reciclabilidade, a durabilidade e a resistência à corrosão dos aços inoxidáveis os tornam um material ideal para infraestruturas de energia limpa e indústrias ambientalmente responsáveis.

- O mercado está se beneficiando cada vez mais da aplicação do aço inoxidável em estruturas de painéis solares, componentes de turbinas eólicas, sistemas de armazenamento de hidrogênio e instalações de tratamento de água. Esses setores priorizam materiais que oferecem longevidade e mínimo impacto ambiental.

- Por exemplo, em 2024, a Aperam lançou uma nova linha de soluções de aço inoxidável projetadas especificamente para uso em sistemas de hidrogênio e energia limpa, reforçando o papel da liga em estratégias de descarbonização.

- Além disso, o aço inoxidável está se tornando parte integrante das certificações de construção verde (como LEED e BREEAM) e é cada vez mais usado em projetos de construção sustentável devido ao seu baixo custo de ciclo de vida e desempenho ambiental.

- O alinhamento do aço inoxidável com iniciativas verdes não está apenas abrindo novos mercados verticais de uso final, mas também fomentando inovações colaborativas entre siderúrgicas e indústrias de tecnologia limpa. Espera-se que essa integração expanda a relevância do aço inoxidável na transição para emissões líquidas zero, impulsionando o crescimento do mercado a longo prazo.

Restrição/Desafio

“Altos custos e volatilidade das matérias-primas na produção de aço inoxidável”

- O mercado de aço inoxidável é significativamente impactado pela flutuação dos custos de matérias-primas essenciais, como níquel, cromo e molibdênio. Esses insumos estão sujeitos à volatilidade de preços devido a tensões geopolíticas, restrições comerciais, desequilíbrios entre oferta e demanda e flutuações nos preços da energia, o que gera grandes pressões de custo para os fabricantes.

- A instabilidade de preços não afeta apenas a economia da produção, mas também interrompe as estratégias de aquisição de longo prazo, reduz as margens de lucro e prejudica a competitividade de pequenos e médios produtores. Essas flutuações de custos frequentemente levam a ajustes de preços posteriores, influenciando a acessibilidade e a adoção do aço inoxidável em setores-chave de uso final.

- Por exemplo, no final de 2023, a London Metal Exchange relatou um aumento de 20% nos preços do níquel após restrições à exportação pelos principais países produtores, incluindo a Indonésia e as Filipinas, impactando diretamente os preços do aço inoxidável.

- Além disso, o Fórum Internacional do Aço Inoxidável (ISSF) destacou no primeiro trimestre de 2024 que os preços do molibdênio dispararam devido à oferta limitada e à crescente demanda dos setores de energia e processamento químico, levando a efeitos de repasse de custos em toda a cadeia de valor do aço inoxidável.

- O custo elevado e imprevisível das matérias-primas representa uma grande restrição para os produtores de aço inoxidável. Limita o investimento em P&D, afeta a estabilidade de preços e complica o orçamento de projetos para usuários finais nos setores de infraestrutura, automotivo e indústria pesada. Os fabricantes estão explorando cada vez mais alternativas como a produção baseada em sucata e a diversificação da oferta para mitigar esses desafios e manter a resiliência do mercado.

Escopo de mercado do aço inoxidável

O mercado é segmentado com base no tipo de produto, tipo de classificação, método de produção, resistência, revestimento e acabamento de superfície, vertical e processo de fabricação.

• Por produto

Com base no produto, o mercado de aço inoxidável é segmentado em produtos planos, produtos longos, tubos, conexões e flanges, entre outros. Espera-se que o segmento de produtos planos domine o mercado com uma participação de 45,69% em 2025, impulsionado por sua ampla utilização em aplicações automotivas, de construção e industriais, devido à sua excelente conformabilidade, resistência à corrosão e soldabilidade. Essas características tornam os produtos planos ideais para componentes estruturais, eletrodomésticos e infraestrutura.

Espera-se que o segmento de produtos planos testemunhe a taxa de crescimento mais rápida de 5,10% entre 2025 e 2032, apoiado pela crescente demanda dos setores comercial e de hospitalidade por chapas e bobinas de aço inoxidável esteticamente atraentes e duráveis em aplicações arquitetônicas e de design de interiores.

• Por tipo de grau

Com base no tipo de aço inoxidável, o mercado de aço inoxidável é segmentado em aço inoxidável austenítico, aço inoxidável ferrítico, aço inoxidável duplex, aço inoxidável martensítico, aço inoxidável endurecido por precipitação (PH) e outros. Espera-se que o aço inoxidável austenítico cresça com a maior participação de mercado, atingindo 33,19% em 2025, devido à sua superior resistência à corrosão, boa conformabilidade e versatilidade em aplicações como utensílios de cozinha, equipamentos de processamento químico e fachadas de edifícios.

O segmento de aço inoxidável austenítico também deverá testemunhar o CAGR mais rápido de 2025 a 2032, impulsionado pela crescente adoção nos setores de alimentos e bebidas, saúde e marítimo, onde alta higiene e resistência à corrosão são essenciais.

• Por Processo de Fabricação

Com base no processo de fabricação, o mercado de aço inoxidável é segmentado em laminação a quente, laminação a frio, fundição, forjamento e extrusão. Espera-se que o segmento de laminação a quente cresça, atingindo a maior participação de mercado, de 42,46%, em 2025, impulsionado por sua eficiência de custos e capacidade de produzir componentes em larga escala utilizados na construção civil, construção naval e dutos.

Espera-se também que a laminação a quente registre o CAGR mais rápido entre 2025 e 2032, devido ao seu uso crescente na fabricação de componentes pesados e à crescente demanda por projetos de desenvolvimento de infraestrutura que exigem seções espessas de aço.

• Por Método de Produção

Com base no método de produção, o mercado de aço inoxidável é segmentado em produção primária (produção de aço inoxidável bruto), processamento secundário (refino e ligas) e processamento final. O segmento de Produção Primária (Produção de Aço Inoxidável Bruto) foi responsável pela maior participação de mercado na receita, com 63,34% em 2025, impulsionado pelo aumento da demanda por aço, urbanização e investimentos em infraestrutura industrial e de transporte.

Espera-se que o segmento de produção primária testemunhe o CAGR mais rápido de 2025 a 2032, apoiado por expansões de capacidade, avanços tecnológicos em processos de fusão e liga de aço e crescente adoção de fornos elétricos a arco para atender às metas de sustentabilidade.

• Por Força

Com base na resistência, o mercado de aço inoxidável é segmentado em aço inoxidável de média resistência, aço inoxidável de baixa resistência e aço inoxidável de alta resistência. O segmento de aço inoxidável de média resistência foi responsável pela maior participação de mercado, com 65,72% da receita em 2025, devido às suas propriedades equilibradas, que o tornam adequado para uma ampla gama de aplicações, incluindo utensílios de cozinha, painéis arquitetônicos e componentes de transporte.

Espera-se que o segmento de resistência média testemunhe o CAGR mais rápido de 2025 a 2032, impulsionado por seu uso crescente em estruturas de suporte de carga média e ambientes de corrosão moderada, proporcionando vantagens de custo e desempenho.

• Por revestimento e acabamento de superfície

Com base no revestimento e acabamento superficial, o mercado de aço inoxidável é segmentado em acabamentos superficiais e revestimentos. Espera-se que o segmento de acabamentos superficiais domine o mercado com uma participação de 73,25% em 2025, devido à crescente demanda por acabamentos visualmente atraentes e funcionais em arquitetura, equipamentos de cozinha e eletrônicos de consumo. Esses acabamentos melhoram tanto o apelo estético quanto a resistência à corrosão.

Espera-se que o segmento de acabamentos de superfície testemunhe o CAGR mais rápido de 2025 a 2032, impulsionado por avanços em técnicas de polimento, escovação e texturização, e pela crescente demanda por superfícies de aço inoxidável de aparência premium em aplicações industriais e voltadas ao consumidor.

• Por Vertical

Com base na vertical, o mercado de aço inoxidável é segmentado em construção e infraestrutura, automotivo e transporte, processamento de alimentos e bebidas, equipamentos e máquinas industriais, médico e saúde, energia e eletricidade, bens de consumo e eletrodomésticos, aeroespacial e defesa, eletrônicos e tecnologia, aplicações ambientais e outros. Espera-se que o segmento de construção e infraestrutura domine o mercado com a maior participação de 21,41% em 2025, impulsionado pela durabilidade, resistência à corrosão e baixa manutenção do aço inoxidável, o que o torna adequado para estruturas, pontes, revestimentos e sistemas de cobertura.

O segmento de construção e infraestrutura também deverá testemunhar o CAGR mais rápido de 2025 a 2032, apoiado por investimentos em infraestrutura, expansão urbana e um foco crescente em materiais de construção sustentáveis e resilientes.

Análise regional do mercado de aço inoxidável

- Espera-se que a América do Norte cresça no mercado de aço inoxidável com uma participação de mercado de 23,28% em 2025, impulsionada pela rápida industrialização, desenvolvimento de infraestrutura e investimentos crescentes em construção e manufatura.

- A forte demanda da região também é atribuída à presença de grandes produtores de aço inoxidável, aos crescentes setores automotivo e de bens de consumo e às políticas governamentais favoráveis que apoiam o crescimento industrial.

- A alta demanda em aplicações de construção, transporte e energia, juntamente com vantagens de custo e matérias-primas abundantes, posiciona a América do Norte como uma região-chave para o consumo de aço inoxidável

Visão do mercado de aço inoxidável dos EUA

O mercado de aço inoxidável dos EUA deverá crescer, atingindo uma participação de mercado de 63,58% em 2025, impulsionado pelo aumento da demanda nos setores de construção, petróleo e gás e automotivo. Investimentos em modernização de infraestrutura, juntamente com o foco em sustentabilidade e eficiência de materiais, impulsionam a expansão do mercado. O aço inoxidável é preferido por sua resistência, resistência à corrosão e apelo estético em projetos dos setores público e privado.

Participação de mercado do aço inoxidável

A indústria do aço inoxidável é liderada principalmente por empresas bem estabelecidas, incluindo :

- Shandong Baosteel Industry Co., Ltd. (China)

- Ternium (Luxemburgo/México/Argentina)

- ArcelorMittal (Luxemburgo)

- MITSUI & CO., LTD. (Japão)

- NUCOR (EUA)

- NIPPON STEEL CORPORATION (Japão)

- Tata Steel (Índia)

- JINDAL STAINLESS (Índia)

- Outokumpu (Finlândia)

- China Ansteel Group Corporation Limited (China)

- China BaoWu Steel Group Corporation Limited (China)

- Acciai Speciali Terni SpA (Itália)

- Universal Inoxidável (EUA)

- Daido Steel Co., Ltd. (Japão)

- Delong Metal (China)

- Acerinox (Espanha)

- Yieh Corp.

- Nitech Stainless Inc (Índia)

- JFE Steel Corporation (Japão)

- SSG Standard Solutions Group AB (Suécia)

- PazdelRío (Colômbia)

- POSCO (Coreia do Sul)

Últimos desenvolvimentos no mercado de aço inoxidável da América do Norte

- Em fevereiro, a Nippon Steel Corporation anunciou seus planos de adquirir a US Steel em um acordo de US$ 14,9 bilhões, com o objetivo de fortalecer sua competitividade e presença produtiva na América do Norte. Essa iniciativa faz parte da estratégia da Nippon Steel de garantir capacidades de fabricação avançadas e cadeias de suprimentos estáveis. A empresa expande sua presença internacional, aumenta sua escala operacional e impulsiona seu crescimento futuro por meio da consolidação internacional.

- Em maio, a Aperam anunciou o desenvolvimento da primeira linha de produtos circulares de aço inoxidável da Europa, utilizando insumos à base de sucata e métodos de reciclagem em circuito fechado em suas unidades fabris. A iniciativa apoia as regulamentações ambientais da UE e as metas de economia circular. A empresa inova em metalurgia sustentável, conquista participação de mercado com consciência ecológica e reduz as emissões relacionadas à produção.

- Em março, a Outokumpu firmou um acordo de longo prazo para fornecimento de energia renovável na Finlândia, garantindo energia de baixo carbono para seus processos de produção de aço inoxidável. Essa iniciativa está alinhada às suas metas climáticas para 2030 e contribui para a redução da pegada de carbono. A empresa promove metas de sustentabilidade, aprimora a percepção da marca sustentável e garante a estabilidade dos custos de energia a longo prazo.

- Em abril, a Nitech Stainless Inc. lançou uma nova linha de tubos e tubos de aço inoxidável duplex e super duplex, voltada para os setores químico, de petróleo e gás e dessalinização. A nova linha atende aos rigorosos padrões de resistência à corrosão e amplia as opções de personalização. A empresa amplia o portfólio de produtos, atende à demanda da indústria especializada e consolida sua marca como fornecedora de ligas de alto desempenho.

- Em janeiro, a Gibbs Wire & Steel Company LLC expandiu sua capacidade de distribuição com a abertura de um novo centro de serviços no sudeste dos EUA, permitindo uma entrega mais rápida de bobinas e fios de precisão para clientes na região. A instalação aumenta a flexibilidade logística e a capacidade de resposta dos serviços da empresa. A empresa melhora os níveis de atendimento ao cliente, apoia o crescimento regional e otimiza a eficiência da cadeia de suprimentos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTENSITY FOR COMPETITIVE RIVAL

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 CARBON EMISSIONS AND REGULATORY PRESSURES

4.3.3 SHIFT TOWARDS LOW-CARBON AND GREEN STEEL

4.3.4 CLIMATE-RESILIENT SUPPLY CHAINS

4.3.5 INVESTOR AND CONSUMER EXPECTATIONS

4.3.6 NORTH AMERICA COOPERATION AND INDUSTRY INITIATIVES

4.3.7 CONCLUSION

4.4 COMPARATIVE OVERVIEW OF GLOBAL

4.5 RAW MATERIAL COVERAGE

4.5.1 NICKEL

4.5.2 IRON ORE

4.5.3 CHROMIUM

4.5.4 SILICON

4.5.5 MOLYBDENUM

4.5.6 OTHERS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INDUSTRIAL ACTIVITIES

6.1.2 RISING URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.3 GROWING FOREIGN INVESTMENT AND TRADE AGREEMENTS

6.1.4 INCREASED DEMAND FROM AUTOMOTIVE AND TRANSPORTATION MANUFACTURING SECTORS.

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL COSTS

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION INTO GREEN INDUSTRIES

6.3.2 EXPANSION INTO MEDICAL AND HEALTHCARE SECTORS

6.3.3 RISING DEMAND FOR SUSTAINABLE AND RECYCLABLE MATERIALS

6.4 CHALLENGES

6.4.1 INFRASTRUCTURE AND LOGISTIC CHALLENGES

6.4.2 ENVIRONMENTAL REGULATIONS COMPLIANCE

7 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLAT PRODUCTS

7.2.1 FLAT PRODUCTS, BY TYPE

7.2.1.1 SHEETS, BY TYPE

7.2.1.2 SHEETS, BY THICKNESS

7.2.1.3 COILS, BY TYPE

7.2.1.4 PLATES, BY TYPE

7.2.1.5 STRIPS, BY TYPE

7.3 LONG PRODUCTS

7.3.1 LONG PRODUCTS, BY TYPE

7.3.1.1 BARS, BY TYPE

7.3.1.2 BARS, BY SIZE/WIDTH

7.3.1.3 BARS, BY GRADE

7.3.1.4 RODS, BY TYPE

7.3.1.5 WIRES, BY TYPE

7.3.1.6 ANGLES, BY TYPE

7.4 PIPES & TUBES

7.4.1 PIPES & TUBES, BY TYPE

7.4.1.1 SEAMLESS PIPES, BY PRODUCT

7.4.1.2 WELDED PIPES, BY PRODUCT

7.4.1.3 TUBES, BY PRODUCT

7.5 FITTINGS & FLANGES

7.5.1 FITTINGS & FLANGES, BY TYPE

7.5.1.1 PIPE FITTINGS, BY PRODUCT

7.5.1.1.1 ELBOWS, BY PRODUCT

7.5.1.2 FLANGES, BY TYPE

7.6 OTHERS

8 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE

8.1 OVERVIEW

8.2 AUSTENITIC STAINLESS STEEL

8.3 FERRITIC STAINLESS STEEL

8.4 DUPLEX STAINLESS STEEL

8.5 MARTENSITIC STAINLESS STEEL

8.6 PRECIPITATION-HARDENED (PH) STAINLESS STEEL

8.7 OTHERS

9 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCTION METHOD

9.1 OVERVIEW

9.2 PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION)

9.3 SECONDARY PROCESSING

9.4 FINAL PROCESSING

10 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH

10.1 OVERVIEW

10.2 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

10.3 MEDIUM STRENGTH STAINLESS STEEL

10.4 LOW STRENGTH STAINLESS STEEL

10.5 HIGH STRENGTH STAINLESS STEEL

11 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 CONSTRUCTION & INFRASTRUCTURE

11.2.1 CONSTRUCTION & INFRASTRUCTURE, BY PRODUCT TYPE

11.2.2 CONSTRUCTION & INFRASTRUCTURE, BY APPLICATION

11.2.2.1 STRUCTURAL COMPONENTS, BY TYPE

11.2.2.2 BRIDGES & TRANSPORTATION INFRASTRUCTURE, BY TYPE

11.2.2.3 PUBLIC BUILDINGS & URBAN INFRASTRUCTURE, BY TYPE

11.2.2.4 WATER SUPPLY & SEWAGE TREATMENT, BY TYPE

11.3 AUTOMOTIVE & TRANSPORTATION

11.3.1 AUTOMOTIVE & TRANSPORTATION, BY PRODUCT TYPE

11.3.2 AUTOMOTIVE & TRANSPORTATION, BY APPLICATION

11.3.2.1 AUTOMOTIVE INDUSTRY, BY TYPE

11.3.2.2 RAILWAYS, BY TYPE

11.3.2.3 MARINE INDUSTRY, BY TYPE

11.3.2.4 AEROSPACE INDUSTRY, BY TYPE

11.4 FOOD & BEVERAGE PROCESSING

11.4.1 FOOD & BEVERAGES, BY PRODUCT TYPE, BY PRODUCT TYPE

11.4.2 FOOD & BEVERAGES PROCESSING, BY APPLICATION

11.4.2.1 DAIRY INDUSTRY, BY TYPE

11.4.2.2 BREWING & DISTILLATION, BY TYPE

11.4.2.3 MEAT & POULTRY PROCESSING, BY TYPE

11.4.2.4 PACKAGING & STORAGE, BY TYPE

11.5 INDUSTRIAL EQUIPMENT & MACHINERY

11.5.1 INDUSTRIAL EQUIPMENT & MACHINERY, BY PRODUCT TYPE, BY PRODUCT TYPE

11.5.2 INDUSTRIAL EQUIPMENT & MACHINERY, BY APPLICATION

11.5.2.1 CHEMICAL & PETROCHEMICAL INDUSTRY, BY TYPE

11.5.2.2 HEAVY MACHINERY & MANUFACTURING, BY TYPE

11.5.2.3 MINING & METALLURGY, BY TYPE

11.5.2.4 TEXTILE INDUSTRY, BY TYPE

11.6 MEDICAL & HEALTHCARE

11.6.1 MEDICAL & HEALTHCARE, BY PRODUCT TYPE

11.6.2 MEDICAL & HEALTHCARE, BY APPLICATION

11.6.2.1 SURGICAL INSTRUMENTS, BY TYPE

11.6.2.2 MEDICAL IMPLANTS & PROSTHETICS, BY TYPE

11.6.2.3 HOSPITAL INFRASTRUCTURE, BY TYPE

11.7 ENERGY & POWER

11.7.1 ENERGY & POWER, BY PRODUCT TYPE

11.7.2 ENERGY & POWER, BY APPLICATION

11.7.2.1 OIL AND GAS INDUSTRY, BY TYPE

11.7.2.2 POWER GENERATION, BY TYPE

11.7.2.3 RENEWABLE ENERGY, BY TYPE

11.8 CONSUMER GOODS & HOME APPLIANCES

11.8.1 CONSUMER GOODS & HOME APPLIANCES, BY PRODUCT TYPE

11.8.2 CONSUMER GOODS & HOME APPLIANCES, BY APPLICATION

11.8.2.1 HOME APPLIANCES, BY TYPE

11.8.2.2 KITCHEN & COOKWARE, BY TYPE

11.8.2.3 FURNITURE & DÉCOR, BY TYPE

11.9 AEROSPACE & DEFENSE

11.9.1 AEROSPACE & DEFENSE, BY PRODUCT TYPE

11.9.2 AEROSPACE & DEFENSE, BY APPLICATION

11.9.2.1 DEFENSE EQUIPMENT, BY TYPE

11.9.2.2 SPACE INDUSTRY, BY TYPE

11.1 ELECTRONICS & TECHNOLOGY

11.10.1 ELECTRONICS & TECHNOLOGY, BY PRODUCT TYPE

11.10.2 ELECTRONICS & TECHNOLOGY, BY APPLICATION

11.10.2.1 SEMICONDUCTOR INDUSTRY, BY TYPE

11.10.2.2 CONSUMER ELECTRONICS, BY TYPE

11.11 ENVIRONMENTAL APPLICATIONS

11.11.1 ENVIRONMENTAL APPLICATIONS, BY PRODUCT TYPE

11.11.2 ENVIRONMENTAL APPLICATIONS, BY APPLICATION

11.11.2.1 WATER TREATMENT, BY TYPE

11.11.2.2 WASTE MANAGEMENT & RECYCLING, BY TYPE

11.12 OTHERS

12 NORTH AMERICA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH

12.1 OVERVIEW

12.2 SURFACE FINISHES

12.2.1 SURFACE FINISHES, BY TYPE

12.2.2 MILL FINISHES, BY TYPE

12.2.3 POLISHED FINISHES, BY TYPE

12.2.4 PATTERNED & TEXTURED FINISHES, BY TYPE

12.3 COATINGS

12.3.1 COATINGS, BY TYPE

13 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS

13.1 OVERVIEW

13.2 HOT ROLLING

13.3 COLD ROLLING

13.4 CASTING

13.5 FORGING

13.6 EXTRUSION

14 NORTH AMERICA STAINLESS STEEL MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA STAINLESS STEEL MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 SHANDONG BAOSTEEL INDUSTRY CO., LTD

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 TERNIUM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ARCELORMITTAL

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MITSUI & CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NUCOR CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ACCIAI SPECIALI TERNI S.P.A

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ACERINOX

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS/NEWS

17.8 CHINA ANSTEEL GROUP CORPORATION LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 RECENT FINANCIALS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 CHINA BAOWU STEEL GROUP CORPORATION LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 DAIDO STEEL CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 DELONG METAL

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATES

17.12 JFE STEEL CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 JINDAL STAINLESS

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NIPPON STEEL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 OUTOKUMPU

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 PAZDELRIO

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 TATA STEEL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 UNIVERSAL STAINLESS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 YIEH CORP.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 POSCO

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 KEY EN STANDARDS FOR STAINLESS STEEL:

TABLE 2 KEY STANDARDS FOR STAINLESS STEEL

TABLE 3 KEY STAINLESS STEEL STANDARDS:

TABLE 4 KEY STAINLESS STEEL STANDARDS

TABLE 5 KEY STAINLESS STEEL STANDARDS

TABLE 6 KEY STAINLESS STEEL STANDARDS

TABLE 7 KEY STAINLESS STEEL STANDARDS

TABLE 8 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 10 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 12 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 NORTH AMERICA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 19 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 20 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA PIPES & TUBES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA PIPES & TUBES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 29 NORTH AMERICA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 35 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 41 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA AUSTENITIC STAINLESS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA FERRITIC STAINLESS STEEL POLYMERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA DUPLEX STAINLESS-STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA MARTENSITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCTION METHOD, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA SECONDARY PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA MEDIUM STRENGTH STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA LOW STRENGTH STAINLESS STEEL IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 63 145

TABLE 64 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA AEROSPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA FOOD & BEVERAGE PROCESSING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA FOOD & BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA FOOD & BEVERAGES PROCESSING IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA DAIRY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 98 NORTH AMERICA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 99 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 100 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 101 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 102 NORTH AMERICA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 103 NORTH AMERICA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 104 NORTH AMERICA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 105 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 106 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 107 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 108 NORTH AMERICA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 109 NORTH AMERICA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 110 NORTH AMERICA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 111 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 112 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 113 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 114 NORTH AMERICA DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 115 NORTH AMERICA SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 116 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 117 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 118 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 119 NORTH AMERICA SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 120 NORTH AMERICA CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 121 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 122 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 123 NORTH AMERICA ENVIRONMENTAL APPLICATIONS IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 124 NORTH AMERICA WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 125 NORTH AMERICA WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 126 NORTH AMERICA OTHERS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 127 NORTH AMERICA STAINLESS STEEL MARKET, BY COATINGS & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 128 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 129 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 130 NORTH AMERICA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 131 NORTH AMERICA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 132 NORTH AMERICA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 133 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 134 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 135 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 136 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 137 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 138 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 139 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 140 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 141 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 142 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 143 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 144 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 145 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 146 NORTH AMERICA STAINLESS STEEL MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 147 NORTH AMERICA STAINLESS STEEL MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 148 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 149 NORTH AMERICA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 150 NORTH AMERICA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 151 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 152 NORTH AMERICA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 153 NORTH AMERICA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 154 NORTH AMERICA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 155 NORTH AMERICA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 156 NORTH AMERICA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 157 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 158 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 159 NORTH AMERICA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 160 NORTH AMERICA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 161 NORTH AMERICA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 162 NORTH AMERICA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 163 NORTH AMERICA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 164 NORTH AMERICA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 165 NORTH AMERICA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 166 NORTH AMERICA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 167 NORTH AMERICA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 168 NORTH AMERICA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 169 NORTH AMERICA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 170 NORTH AMERICA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 171 NORTH AMERICA STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 172 NORTH AMERICA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 173 NORTH AMERICA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 174 NORTH AMERICA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 175 NORTH AMERICA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 176 NORTH AMERICA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 177 NORTH AMERICA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 178 NORTH AMERICA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 179 NORTH AMERICA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 180 NORTH AMERICA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 181 NORTH AMERICA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 182 NORTH AMERICA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 183 NORTH AMERICA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 184 BY PRODUCTION METHOD

TABLE 185 NORTH AMERICA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 186 NORTH AMERICA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 187 NORTH AMERICA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 188 NORTH AMERICA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 189 NORTH AMERICA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 190 NORTH AMERICA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 191 NORTH AMERICA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 192 NORTH AMERICA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 193 NORTH AMERICA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 194 NORTH AMERICA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 195 NORTH AMERICA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 196 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 197 NORTH AMERICA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 198 NORTH AMERICA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 199 NORTH AMERICA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 200 NORTH AMERICA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 201 NORTH AMERICA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 202 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 203 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 204 NORTH AMERICA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 205 NORTH AMERICA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 206 NORTH AMERICA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 207 NORTH AMERICA AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 208 NORTH AMERICA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 209 NORTH AMERICA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 210 NORTH AMERICA DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 211 NORTH AMERICA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 212 NORTH AMERICA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 213 NORTH AMERICA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 214 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 215 NORTH AMERICA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 216 NORTH AMERICA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 217 NORTH AMERICA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 218 NORTH AMERICA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 219 NORTH AMERICA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 220 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 221 NORTH AMERICA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 222 NORTH AMERICA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 223 NORTH AMERICA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 224 NORTH AMERICA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 225 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 226 NORTH AMERICA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 227 NORTH AMERICA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 228 NORTH AMERICA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 229 NORTH AMERICA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 230 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 231 NORTH AMERICA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 232 NORTH AMERICA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 233 NORTH AMERICA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 234 NORTH AMERICA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 235 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 236 NORTH AMERICA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 237 NORTH AMERICA DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 238 NORTH AMERICA SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 239 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 240 NORTH AMERICA ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 241 NORTH AMERICA SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 242 NORTH AMERICA CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 243 NORTH AMERICA ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 244 NORTH AMERICA ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 245 NORTH AMERICA WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 246 NORTH AMERICA WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 247 U.S. STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 248 U.S. STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 249 U.S. FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 250 U.S. SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 251 U.S. SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 252 U.S. COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 253 U.S. PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 254 U.S. STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 255 U.S. LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 256 U.S. BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 257 U.S. BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 258 U.S. BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 259 U.S. RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 260 U.S. WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 261 U.S. ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 262 U.S. PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 263 U.S. SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 264 U.S. WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 265 U.S. TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 266 U.S. FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 267 U.S. PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 268 U.S. ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 269 U.S. FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 270 U.S. STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 271 U.S. AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 272 U.S. 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 273 U.S. 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 274 U.S. FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 275 U.S. DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 276 U.S. PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 277 U.S. STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 278 U.S. HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 279 U.S. COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 280 U.S. CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 281 U.S. FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 282 U.S. EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 283 BY PRODUCTION METHOD

TABLE 284 U.S. PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 285 U.S. SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 286 U.S. FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 287 U.S. STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 288 U.S. STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 289 U.S. SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 290 U.S. MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 291 U.S. POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 292 U.S. PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 293 U.S. COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 294 U.S. STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 295 U.S. CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 296 U.S. CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 297 U.S. STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 298 U.S. BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 299 U.S. PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 300 U.S. WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 301 U.S. AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 302 U.S. AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 303 U.S. AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 304 U.S. RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 305 U.S. MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 306 U.S. AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 307 U.S. FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 308 U.S. FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 309 U.S. DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 310 U.S. BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 311 U.S. MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 312 U.S. PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 313 U.S. INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 314 U.S. INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 315 U.S. CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 316 U.S. HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 317 U.S. MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 318 U.S. TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 319 U.S. MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 320 U.S. MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 321 U.S. SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 322 U.S. MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 323 U.S. HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 324 U.S. ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 325 U.S. ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 326 U.S. OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 327 U.S. POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 328 U.S. RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 329 U.S. CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 330 U.S. CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 331 U.S. HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 332 U.S. KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 333 U.S. FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 334 U.S. AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 335 U.S. AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 336 U.S. DEFENSE EQUIPMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 337 U.S. SPACE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 338 U.S. ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 339 U.S. ELECTRONICS & TECHNOLOGY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 340 U.S. SEMICONDUCTOR INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 341 U.S. CONSUMER ELECTRONICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 342 U.S. ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 343 U.S. ENVIRONMENTAL APPLICATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 344 U.S. WATER TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 345 U.S. WASTE MANAGEMENT & RECYCLING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 346 CANADA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 347 CANADA STAINLESS STEEL MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 348 CANADA FLAT PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 349 CANADA SHEETS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 350 CANADA SHEETS IN STAINLESS STEEL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

TABLE 351 CANADA COILS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 352 CANADA PLATES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 353 CANADA STRIPS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 354 CANADA LONG PRODUCTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 355 CANADA BARS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 356 CANADA BARS IN STAINLESS STEEL MARKET, BY SIZE/WIDTH, 2018-2032 (USD MILLION)

TABLE 357 CANADA BARS IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 358 CANADA RODS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 359 CANADA WIRES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 360 CANADA ANGLES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 361 CANADA PIPES & TUBE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 362 CANADA SEAMLESS PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 363 CANADA WELDED PIPES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 364 CANADA TUBES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 365 CANADA FITTINGS & FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 366 CANADA PIPE FITTINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 367 CANADA ELBOWS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 368 CANADA FLANGES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 369 CANADA STAINLESS STEEL MARKET, BY GRADE TYPE, 2018-2032 (USD MILLION)

TABLE 370 CANADA AUSTENITIC STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 371 CANADA 300 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 372 CANADA 200 SERIES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 373 CANADA FERRITIC STAINLESS STEEL (400 SERIES) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 374 CANADA DUPLEX STAINLESS STEEL IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 375 CANADA PRECIPITATION-HARDENED (PH) STAINLESS STEEL IN STAINLESS STEEL MARKET, BY GRADE, 2018-2032 (USD MILLION)

TABLE 376 CANADA STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 377 CANADA HOT ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 378 CANADA COLD ROLLING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 379 CANADA CASTING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 380 CANADA FORGING IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 381 CANADA EXTRUSION IN STAINLESS STEEL MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD MILLION)

TABLE 382 BY PRODUCTION METHOD

TABLE 383 CANADA PRIMARY PRODUCTION (RAW STAINLESS STEEL PRODUCTION) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 384 CANADA SECONDARY PROCESSING (REFINING & ALLOYING) IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 385 CANADA FINAL PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 386 CANADA STAINLESS STEEL MARKET, BY STRENGTH, 2018-2032 (USD MILLION)

TABLE 387 CANADA STAINLESS STEEL MARKET, BY COATING & SURFACE FINISH, 2018-2032 (USD MILLION)

TABLE 388 CANADA SURFACE FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 389 CANADA MILL FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 390 CANADA POLISHED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 391 CANADA PATTERNED & TEXTURED FINISHES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 392 CANADA COATINGS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 393 CANADA STAINLESS STEEL MARKET, BY VERTICAL, 2018-2032 (USD MILLION)

TABLE 394 CANADA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 395 CANADA CONSTRUCTION & INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 396 CANADA STRUCTURAL COMPONENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 397 CANADA BRIDGES & TRANSPORTATION INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 398 CANADA PUBLIC BUILDINGS & URBAN INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 399 CANADA WATER SUPPLY & SEWAGE TREATMENT IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 400 CANADA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 401 CANADA AUTOMOTIVE & TRANSPORTATION IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 402 CANADA AUTOMOTIVE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 403 CANADA RAILWAYS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 404 CANADA MARINE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 405 CANADA AEROSPACE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 406 CANADA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 407 CANADA FOOD AND BEVERAGES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 408 CANADA DIARY INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 409 CANADA BREWING & DISTILLATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 410 CANADA MEAT & POULTRY PROCESSING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 411 CANADA PACKAGING & STORAGE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 412 CANADA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 413 CANADA INDUSTRIAL EQUIPMENT & MACHINERY IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 414 CANADA CHEMICAL & PETROCHEMICAL INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 415 CANADA HEAVY MACHINERY & MANUFACTURING IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 416 CANADA MINING & METALLURGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 417 CANADA TEXTILE INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 418 CANADA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 419 CANADA MEDICAL & HEALTHCARE IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 420 CANADA SURGICAL INSTRUMENTS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 421 CANADA MEDICAL IMPLANTS & PROSTHETICS IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 422 CANADA HOSPITAL INFRASTRUCTURE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 423 CANADA ENERGY & POWER IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 424 CANADA ENERGY & POWER IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 425 CANADA OIL AND GAS INDUSTRY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 426 CANADA POWER GENERATION IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 427 CANADA RENEWABLE ENERGY IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 428 CANADA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 429 CANADA CONSUMER GOODS & HOME APPLIANCES IN STAINLESS STEEL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

TABLE 430 CANADA HOME APPLIANCES IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 431 CANADA KITCHEN & COOKWARE IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 432 CANADA FURNITURE & DÉCOR IN STAINLESS STEEL MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 433 CANADA AEROSPACE & DEFENSE IN STAINLESS STEEL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)