Saudi Arabia Glass Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.53 Billion

USD

2.50 Billion

2024

2032

USD

1.53 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.53 Billion | |

| USD 2.50 Billion | |

|

|

|

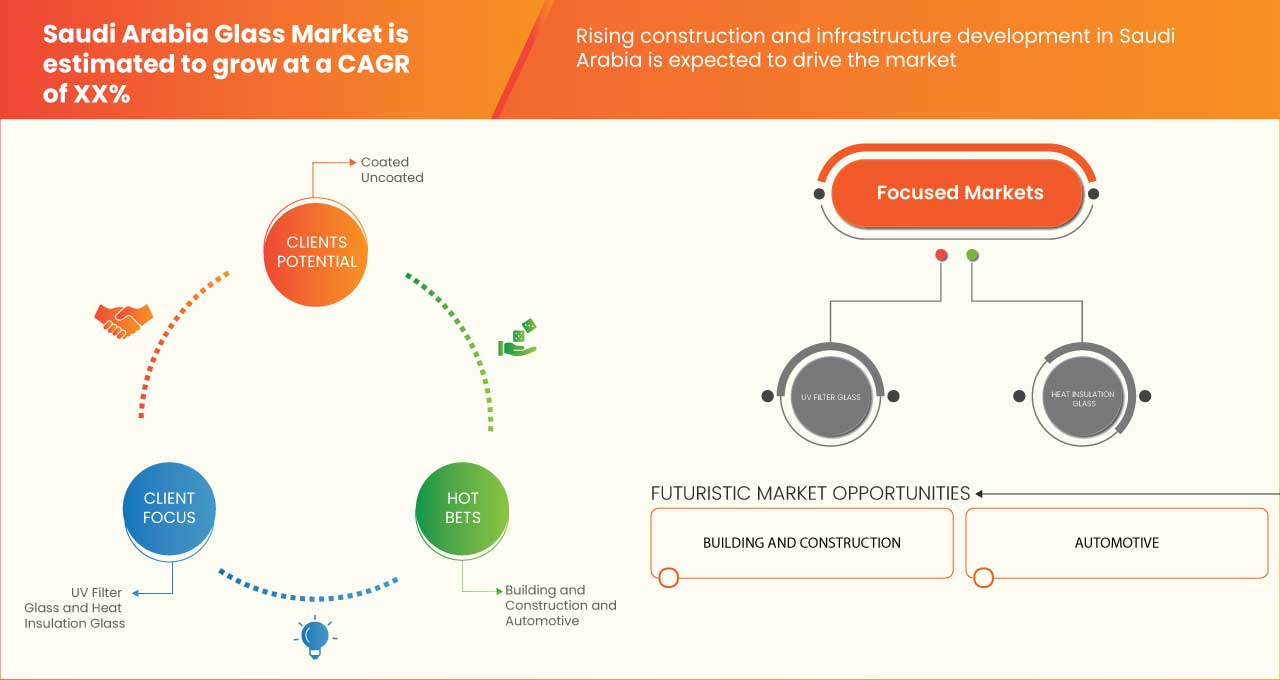

Saudi Arabia Glass Market Segmentation, By Type (Float Glass, Cast Glass, Tinted Glass, Architectural Glass, Tempered Glass, Laminated Glass, Double Glazing Glass, Security Glass, Patterned Glass or Textured Glass, Wired Glass, Extra Clear Glass, Blown Glass, Skylights Glass, Sand Blasting Glass, Fire-Rated or Resistance Glass, Special Glass, Decorative Glass, Clear Glass, Digital Printing Glass, and Others), Product (Coated and Uncoated), Function (UV Filter Glass, Heat Insulation Glass, Safety Glazing, Soundproofed Glazing, Self-Cleaning Glass, Ion Exchange Glass, and Others), Thickness (4 mm, 5 mm, 6 mm, 8 mm, 2 mm, 3 mm, 10 mm, 12 mm, and More Than 12 mm), Application (Building and Construction, Automotive, Aerospace, Electronic Appliances, Solar Energy, and Others) – Industry Trends and Forecast to 2032

Glass Market Analysis

Saudi Arabia glass market is experiencing growth due to increased demand in construction, automotive, and packaging sectors. Driven by infrastructure development projects, including Vision 2030, the construction industry’s demand for architectural glass, such as energy-efficient and decorative glass, is rising. The automotive sector also contributes significantly with increased vehicle production. Moreover, the growing consumer demand for packaged goods boosts the glass packaging market. Sustainability trends and the adoption of eco-friendly technologies in glass production are also becoming important factors. Local production is growing, with several glass manufacturers investing in advanced technologies, while imports remain significant, especially for specialized glass products.

Glass Market Size

Saudi Arabia glass market is expected to reach USD 2.50 billion by 2032 from USD 1.53 billion in 2024, growing with a substantial CAGR of 6.4% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Glass Market Trends

“Increasing Demand for Energy-Efficient and Aesthetically Pleasing Glass Products”

The glass market in Saudi Arabia has been experiencing steady growth, driven by the booming construction and real estate sectors. Increasing demand for energy-efficient and aesthetically pleasing glass products, such as tempered, laminated, and insulating glass, is fueling market expansion. The government's push for large-scale infrastructure projects, including smart cities and commercial complexes, further accelerates glass consumption. In addition, the rise of green building trends and sustainability initiatives is driving the demand for eco-friendly and high-performance glass solutions. Key players in the market are focusing on innovation and technological advancements to meet these requirements. With ongoing urbanization and a focus on modernization, the Saudi Arabia glass market is expected to continue its positive trajectory.

Report Scope and Glass Market Segmentation

|

Attributes |

Glass Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Guardian Industries Holdings Site (U.S.), IKKGlass (Saudi Arabia), AGC Inc. (Japan), Saint-Gobain (France), Obeikan Glass Company (Saudi Arabia), Alma (Saudi Arabia), United float glass (Saudi Arabia), ARABIAN PROCESSING GLASS CO. (Saudi Arabia), and REGION GLASS (Saudi Arabia) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glass Market Definition

The glass market refers to the global industry involved in the production, distribution, and consumption of glass products. This market encompasses various types of glass, such as float glass, tempered glass, laminated glass, and specialty glass, which are used in industries like construction, automotive, packaging, electronics, and consumer goods. The market is influenced by factors such as technological advancements, raw material availability, environmental regulations, and consumer demand for sustainable and innovative glass solutions. Key players in the glass market include manufacturers, distributors, and end-users, all contributing to the growth and diversification of the sector.

Glass Market Dynamics

Drivers

- Rapid Urbanization and Infrastructure Development

Rapid urbanization and extensive infrastructure development are significant drivers of the glass market, shaping the landscape of modern construction and design in the region. As the Kingdom continues to diversify its economy away from oil dependency, large-scale projects under initiatives such as Saudi Vision 2030 have catalyzed a surge in urban development. One of the key aspects of this urbanization is the growth of megacities and urban centers, particularly in cities such as Riyadh, Jeddah, and Dammam. The increasing population and the demand for housing, commercial spaces, and public infrastructure are driving the need for modern architectural solutions, where glass plays a crucial role. Glass facades are not only aesthetically pleasing but also enhance the functionality of buildings by allowing natural light to enter, improving energy efficiency, and providing thermal insulation. In addition to residential and commercial development, the burgeoning educational and healthcare sectors also drive demand for glass. Modern schools and hospitals increasingly incorporate glass for design aesthetics, improved natural lighting, and enhanced safety features. This holistic growth across various sectors underscores the vital role of glass in Saudi Arabia's urban transformation.

For instance,

According to a blog by United Nations Human Settlements Programme, the Future Saudi Cities Programme, a collaboration between the Saudi Ministry of Municipal and Rural Affairs and UN-Habitat, aims to enhance urban policies in 17 major cities by promoting balanced regional development. The initiative focuses on community engagement, particularly involving women and youth in city planning, through strategic profiles and pilot projects.

- Rising Focus on Sustainability Goals and Green Building Initiatives

The Saudi Arabia glass market is experiencing significant growth, primarily driven by the rising focus on sustainability goals and green building initiatives. As the nation moves towards a more sustainable future, glass plays a crucial role in enhancing energy efficiency, reducing carbon footprints, and promoting environmentally friendly building practices. One of the key drivers for the glass market is its inherent ability to improve energy efficiency in buildings. High-performance glass, such as Low-Emissivity (low-E) and triple-glazed units, can significantly reduce energy consumption by minimizing heat transfer. In a country like Saudi Arabia, where temperatures can soar, energy-efficient glazing helps maintain comfortable indoor environments, reducing the reliance on air conditioning systems. This not only lowers energy bills for consumers but also contributes to national efforts to reduce overall energy consumption, aligning with Saudi Vision 2030's goals. The emphasis on green building certifications, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), further fuels the demand for glass. Buildings that incorporate sustainable materials, including eco-friendly glass, are more likely to receive these certifications, enhancing their marketability and value. As Saudi Arabia continues to invest in mega-projects like NEOM and the Red Sea Project, which prioritize sustainable design, the demand for innovative glass solutions is expected to grow.

Opportunities

- Technological Advancements and Innovations in Glass Manufacturing

Saudi Arabia's glass market stands on the brink of significant transformation driven by technological advancements and innovations in glass manufacturing. With the nation's Vision 2030 initiative promoting diversification and sustainable development, there is a growing demand for high-performance glass solutions that enhance energy efficiency and aesthetic appeal in modern architecture. Innovations such as Low-Emissivity (Low-E) coatings and advanced insulating glass units not only improve thermal performance but also contribute to reducing energy consumption, aligning with global sustainability trends. Furthermore, the introduction of smart glass technologies, which can adjust transparency based on environmental conditions, offers architects unprecedented design flexibility while enhancing user comfort.

For instance,

In May 2024, an article published by Centuro Global stated that Vision 2030 aims to diversify Saudi Arabia's economy away from oil dependency, addressing looming peak oil predictions. Under Crown Prince MBS, the initiative also promotes social reforms, including cultural development. At its halfway point, progress is evident, yet challenges remain in fully achieving these ambitious goals.

- Rising Government Initiatives for Urban Development

Saudi Arabia's glass market is poised for significant growth, driven by a surge in government initiatives focused on urban development. Saudi Vision 2030 strategy emphasizes diversification and modernization, aiming to transform cities into sustainable, technologically advanced urban centers. This shift is generating increased demand for innovative architectural solutions, particularly in glass manufacturing, which plays a crucial role in enhancing both functionality and aesthetics in modern buildings. Government investments in mega-projects, such as NEOM and the Red Sea Project among many others, highlight the need for high-performance glass products that meet stringent sustainability standards. These projects prioritize energy efficiency and architectural glass solutions such as Low-Emissivity (Low-E) and insulating glass, which are essential for minimizing energy consumption and optimizing climate control. In addition, the trend towards smart cities incorporates advanced glass technologies that enable dynamic control of light and energy use, further aligning with national sustainability goals.

Restraints/Challenges

- High Initial Costs of Advanced Architectural Glasses

The Saudi Arabia glass market demand faces significant disruption from high initial costs of advanced architectural glasses. These advanced products include energy-efficient, solar control, and smart glass technologies, which offer numerous benefits such as thermal insulation, UV protection, and aesthetic appeal. However, the elevated costs associated with their production and installation can be a considerable barrier to market growth. The production of advanced architectural glass involves sophisticated manufacturing processes and cutting-edge technologies, which require substantial capital investment. The need for high-quality raw materials, precise engineering, and state-of-the-art facilities contributes to the elevated production costs. These expenses can be particularly burdensome for Small and Medium-Sized Enterprises (SMEs) attempting to enter the market, as they may lack the financial resources to invest in such advanced technologies.

- Stringent Environmental Regulations and Building Safety Standards

The glass market in Saudi Arabia faces significant challenges due to stringent environmental regulations and building safety standards. As the nation increasingly prioritizes sustainability, manufacturers and builders are required to comply with rigorous guidelines aimed at reducing environmental impact. While these regulations foster innovation in energy-efficient and sustainable glass products, they also impose constraints on production processes and materials, potentially raising costs for manufacturers. The demand for high-performance glass that meets new energy efficiency standards has become paramount. Low-Emissivity (Low-E) coatings and insulating glass units are now essential in architectural projects, as they help to minimize energy consumption and enhance thermal comfort. However, the development and integration of such advanced technologies require significant investment in research and development, which can be challenging for smaller companies.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Glass Market Scope

O mercado está segmentado com base no tipo, produto, espessura, função e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo

- Vidro flutuante

- Vidro fundido

- Vidro colorido

- Vidro plano de controlo solar colorido

- Alumínio

- Prata

- Vidro Arquitetónico

- Vidro temperado

- Vidro laminado

- Vidro Duplo

- Vidro de segurança

- Vidro à prova de bala

- Vidro à prova de fogo

- Vidro à prova de explosão

- Vidro à prova de ataque

- Outros

- Vidro estampado ou vidro texturado

- Vidro com fio

- Vidro extra transparente

- Vidro soprado

- Claraboias em vidro

- Vidro para jato de areia

- Vidro resistente ao fogo ou de resistência

- Vidro Especial

- Vidro Decorativo

- Vidro Transparente

- Vidro para impressão digital

- Outros

Produto

- Revestido

- Revestido, por revestimento de resina

- Poliuretano

- Acrílico

- Epóxi

- Resina Alquídica

- Resina de silicone

- Outros

- Revestido, por tecnologia de revestimento

- À base de solvente

- À base de água

- Nanorrevestimentos

- Revestido, Processo de Revestimento

- Deposição Física de Vapor (PVD) (Puttering Magnetron)

- Sol-Gel

- Deposição Química de Vapor (CVD) (Pirolítica)

- Deposição química de vapor (CVD) (pirolítica), por tipo

- Aprimorado por Plasma (PECVD)

- Pressão Atmosférica (APCVD)

- Baixa Pressão (LPCVD)

- Deposição química de vapor (CVD) (pirolítica), por tipo

- Revestido, por revestimento de resina

- Não revestido

Função

- Vidro de filtro UV

- Vidro de isolamento térmico

- Vidros de segurança

- Vidros à prova de som

- Vidro autolimpante

- Vidro de troca iónica

- Outros

Grossura

- 4mm

- 5mm

- 6mm

- 8mm

- 2mm

- 3mm

- 10mm

- 12mm

- Mais de 12mm

Aplicação

- Construção e Construção

- residencial

- Comercial

- Industrial

- Institucional

- Automotivo

- OEM

- Pós-venda

- Aeroespacial

- Eletrodomésticos

- Energia solar

- Vidro Fotovoltaico

- Sistema de energia solar concentrada

- Outros

Participação no mercado do vidro

O cenário competitivo do mercado fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento de produto, largura e amplitude do produto, aplicação domínio. Os dados acima fornecidos estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado do vidro que operam no mercado são:

- Site da Guardian Industries Holdings (EUA)

- IKKGlass (Arábia Saudita)

- AGC Inc. (Japão)

- Saint Gobain (França)

- Obeikan Glass Company (Arábia Saudita)

- Alma (Arábia Saudita)

- Vidro float unido (Arábia Saudita)

- ARABIAN PROCESSING GLASS CO.

- REGIÃO DO VIDRO (Arábia Saudita)

Últimos desenvolvimentos no mercado do vidro

- Em setembro de 2024, o Guardian Industries Holdings Site estabeleceu recentemente uma parceria com a Privacy Glass Solutions para comercializar a tecnologia de blackout total. Este desenvolvimento concentra-se em melhorar as características de privacidade do vidro, permitindo uma opacidade completa quando necessário, ideal para aplicações arquitetónicas dinâmicas. A tecnologia visa comercializar uma solução de vidro de alto desempenho para fachadas de edifícios e outros ambientes onde a privacidade é crucial

- Em abril de 2024, o site Guardian Industries Holdings lançou o Guardian CrystalClear, um vidro com um teor de ferro reduzido que oferece uma nitidez e transmissão de luz superiores. Este novo produto foi concebido para aplicações arquitetónicas e interiores, proporcionando uma transparência e precisão de cores excecionais. É ideal para aplicações como janelas, fachadas e claraboias, ajudando a maximizar a luz natural e ao mesmo tempo melhorando o apelo estético de qualquer espaço. O vidro também melhora a eficiência energética devido à sua elevada qualidade ótica

- Em novembro de 2024, a AGC Inc. alcançou recentemente um marco significativo com os seus substratos de vidro da série M100/200 para óculos AR/MR a serem nomeados 'Homenageados' nos CES 2025 Innovation Awards. Este prestigiado reconhecimento destaca as contribuições inovadoras da AGC na categoria 'XR Technologies & Accessories'

- Em fevereiro de 2023, a AGC e a Saint-Gobain, fabricantes mundiais de vidro plano líderes em sustentabilidade, anunciaram que estão a colaborar no projeto de uma linha piloto inovadora de vidro plano que deverá reduzir significativamente as suas emissões diretas de CO2.

- Em fevereiro de 2022, a Obeikan Glass Company detém 50% do mercado saudita de vidro float e concentra-se em novas indústrias transformadoras. Isto ajudou a empresa a expandir o seu portfólio de produtos em diversos setores

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET APPLICATION COVERAGE GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF SUPPLIERS

4.1.4 BARGAINING POWER OF BUYERS

4.1.5 COMPETITIVE RIVALRY

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 CLIMATE CHANGE SCENARIO FOR SAUDI ARABIA GLASS MARKET

4.7.1 IMPACT OF CLIMATE CHANGE ON SAUDI ARABIA GLASS MARKET

4.7.2 RISING TEMPERATURES AND ENERGY EFFICIENCY DEMANDS

4.7.3 DEMAND FOR SOLAR CONTROL AND UV FILTER GLASS

4.7.4 THE ROLE OF COATED AND INSULATED GLASS

4.7.5 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY

4.7.6 URBANIZATION AND THE CONSTRUCTION BOOM

4.7.7 CONCLUSION

4.8 PRODUCTION CAPACITY OVERVIEW

4.9 RAW MATERIAL COVERAGE

4.9.1 KEY RAW MATERIALS FOR GLASS

4.9.2 SOURCING AND SUPPLY CHAIN CONSIDERATIONS

4.9.3 CHALLENGES AND OPPORTUNITIES

4.9.4 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.10.4 CONCLUSION

4.11 SUPPLY AND DEMAND ANALYSIS

4.11.1 DEMAND DYNAMICS

4.11.2 SUPPLY TRENDS

4.11.3 IMPORT AND EXPORT BALANCE

4.11.4 FACTORS IMPACTING SUPPLY AND DEMAND

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12.1 LOW-EMISSIVITY (LOW-E) GLASS

4.12.2 SMART GLASS INTEGRATION

4.12.3 SOLAR CONTROL GLASS

4.12.4 LAMINATED SAFETY GLASS

4.12.5 INSULATED GLASS UNITS (IGUS)

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.2 RISING FOCUS ON SUSTAINABILITY GOALS AND GREEN BUILDING INITIATIVES

6.1.3 RAPIDLY GROWING TOURISM AND HOSPITALITY INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS OF ADVANCED ARCHITECTURAL GLASSES

6.2.2 STIFF COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN GLASS MANUFACTURING

6.3.2 RISING GOVERNMENT INITIATIVES FOR URBAN DEVELOPMENT

6.4 CHALLENGES

6.4.1 STRINGENT ENVIRONMENTAL REGULATIONS AND BUILDING SAFETY STANDARDS

6.4.2 FLUCTUATING RAW MATERIAL PRICES

7 SAUDI ARABIA GLASS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLOAT GLASS

7.3 CAST GLASS

7.4 TINTED GLASS

7.5 ARCHITECTURAL GLASS

7.6 TEMPERED GLASS

7.7 LAMINATED GLASS

7.8 DOUBLE GLAZING GLASS

7.9 SECURITY GLASS

7.1 PATTERNED GLASS OR TEXTURED GLASS

7.11 WIRED GLASS

7.12 EXTRA CLEAR GLASS

7.13 BLOWN GLASS

7.14 SKYLIGHTS GLASS

7.15 SAND BLASTING GLASS

7.16 FIRE-RATED OR RESISTANCE GLASS

7.17 SPECIAL GLASS

7.18 DECORATIVE GLASS

7.19 CLEAR GLASS

7.2 DIGITAL PRINTING GLASS

7.21 OTHERS

8 SAUDI ARABIA GLASS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 COATED

8.3 UNCOATED

9 SAUDI ARABIA GLASS MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 UV FILTER GLASS

9.3 HEAT INSULATION GLASS

9.4 SAFETY GLAZING

9.5 SOUNDPROOFED GLAZING

9.6 SELF-CLEANING GLASS

9.7 ION EXCHANGE GLASS

9.8 OTHERS

10 SAUDI ARABIA GLASS MARKET, BY THICKNESS

10.1 OVERVIEW

10.2 4 MM

10.3 5 MM

10.4 6 MM

10.5 8 MM

10.6 2 MM

10.7 3 MM

10.8 10 MM

10.9 12 MM

10.1 MORE THAN 12 MM

11 SAUDI ARABIA GLASS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 BUILDING AND CONSTRUCTION

11.3 AUTOMOTIVE

11.4 AEROSPACE

11.5 ELECTRONIC APPLIANCES

11.6 SOLAR ENERGY

11.7 OTHERS

12 SAUDI ARABIA GLASS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GUARDIAN INDUSTRIES HOLDINGS SITE

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 IKKGLASS

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 AGC INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 SAINT-GOBAIN

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 OBEIKAN GLASS COMPANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ALMA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 ARABIAN PROCESSING GLASS CO.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 REGIONGLASS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 UNITED FLOAT GLASS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 COMPANIES ESTIMATED PRODUCTION CAPACITY OVERVIEW, 2023 (THOUSAND SQUARE METER)

TABLE 2 REGULATORY COVERAGE

TABLE 3 SAUDI ARABIA GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 SAUDI ARABIA GLASS MARKET, BY TYPE, 2018-2032 (THOUSAND SQUARE METER)

TABLE 5 SAUDI ARABIA TINTED GLASS IN GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 SAUDI ARABIA SECURITY GLASS IN GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 SAUDI ARABIA GLASS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 SAUDI ARABIA COATED IN GLASS MARKET, BY COATING RESIN, 2018-2032 (USD THOUSAND)

TABLE 9 SAUDI ARABIA COATED IN GLASS MARKET, BY COATING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 10 SAUDI ARABIA COATED IN GLASS MARKET, BY COATING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 11 SAUDI ARABIA CHEMICAL VAPOR DEPOSITION (CVD) (PYROLYTIC) IN GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 SAUDI ARABIA GLASS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 13 SAUDI ARABIA GLASS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 14 SAUDI ARABIA GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 SAUDI ARABIA BUILDING AND CONSTRUCTION IN GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 SAUDI ARABIA AUTOMOTIVE IN GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SOLAR ENERGY IN GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 SAUDI ARABIA GLASS MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA GLASS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA GLASS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA GLASS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA GLASS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA GLASS MARKET: MULTIVARIATE MODELLING

FIGURE 7 SAUDI ARABIA GLASS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SAUDI ARABIA GLASS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA GLASS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 SAUDI ARABIA GLASS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SAUDI ARABIA GLASS MARKET: SEGMENTATION

FIGURE 12 SAUDI ARABIA GLASS MARKET:-EXECUTIVE SUMMARY

FIGURE 13 TWENTY SEGMENTS COMPRISE THE SAUDI ARABIA GLASS MARKET, BY TYPE (2024)

FIGURE 14 SAUDI ARABIA GLASS MARKET:-STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT IN SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA GLASS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE FLOAT GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA GLASS MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 PESTEL ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 SAUDI ARABIA GLASS MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/SQUARE METER)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: SAUDI ARABIA GLASS MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR SAUDI ARABIA GLASS MARKET

FIGURE 24 SAUDI ARABIA GLASS MARKET: BY TYPE, 2024

FIGURE 25 SAUDI ARABIA GLASS MARKET: BY PRODUCT, 2024

FIGURE 26 SAUDI ARABIA GLASS MARKET: BY FUNCTION, 2024

FIGURE 27 SAUDI ARABIA GLASS MARKET: BY THICKNESS, 2024

FIGURE 28 SAUDI ARABIA GLASS MARKET: BY APPLICATION, 2024

FIGURE 29 SAUDI ARABIA GLASS MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.