Us Europe And Far East Electronic Grade Sulfuric Acid Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.45 Billion

USD

5.63 Billion

2024

2032

USD

3.45 Billion

USD

5.63 Billion

2024

2032

| 2025 –2032 | |

| USD 3.45 Billion | |

| USD 5.63 Billion | |

|

|

|

|

Mercado de ácido sulfúrico de grau eletrônico dos EUA, Europa e Extremo Oriente para a indústria de semicondutores (gravação), tipo (partes por trilhão (PPT) e partes por bilhão (PPB)), pureza (96% puro, menos de 96% e 99% puro), embalagem (tanques ISO, IBC/revestimentos e tambores), aplicação (gravação úmida, gravação seca, gravação a laser e eletrolítica), país (China, Taiwan, Coreia do Sul, Japão, Cingapura, Malásia, Vietnã, Tailândia, Indonésia, Filipinas, Hong Kong, restante do Extremo Oriente, EUA, Alemanha, França, Reino Unido, Itália, Holanda, Suíça, Espanha, Rússia, Bélgica, Suécia, Dinamarca, Noruega, Finlândia, Turquia, restante da Europa) - Tendências e previsões da indústria até 2032

Mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) Tamanho

- O mercado de ácido sulfúrico de grau eletrônico dos EUA, Europa e Extremo Oriente para a indústria de semicondutores (gravação) foi avaliado em US$ 3,45 bilhões em 2024 e deve atingir US$ 5,63 bilhões até 2032, com um CAGR de 6,4% durante o período previsto.

- Este crescimento é impulsionado pela expansão da fabricação de semicondutores e pela necessidade de produtos químicos de alta pureza em processos avançados de gravação e limpeza

- O mercado é impulsionado pela crescente demanda por microeletrônica avançada, pela miniaturização de componentes semicondutores e pela crescente adoção de chips de alto desempenho em aplicações em eletrônicos de consumo, automotivo, telecomunicações e automação industrial.

Análise do mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação)

- O mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) refere-se ao segmento especializado da indústria química que fornece ácido sulfúrico de ultra-alta pureza usado na fabricação de dispositivos semicondutores

- Pela expansão da fabricação de semicondutores e pela necessidade de produtos químicos de alta pureza em processos avançados de gravação e limpeza

- A região do Extremo Oriente dominou e deverá apresentar o maior CAGR durante o período previsto. Isso se deve principalmente ao robusto ecossistema de fabricação de semicondutores da região, à forte presença de fundições de chips líderes, às instalações de produção de alto volume e ao apoio governamental consistente. Além disso, os avanços na eletrônica marítima e a crescente demanda por componentes de precisão impulsionam ainda mais o consumo de ácido sulfúrico de alta pureza nessa região.

- Espera-se que as Partes por Trilhão (PPT) dominem o mercado durante o período previsto, devido à crescente demanda por produtos químicos ultrapuros na fabricação de semicondutores. O aumento da produção de chips avançados, o crescimento dos setores de eletrônica e energia fotovoltaica e os rigorosos padrões de controle de contaminação — chegando a partes por trilhão (PPT) — impulsionam a expansão do mercado. Os avanços tecnológicos nos processos de purificação impulsionam ainda mais o crescimento do setor.

Escopo do Relatório e Segmentação do Mercado de Ácido Sulfúrico de Grau Eletrônico para a Indústria de Semicondutores (Gravação)

|

Atributos |

Mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) Principais insights do mercado |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de mudança climática, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação)

“Aumento da demanda da indústria de semicondutores”

- A crescente demanda global por eletrônicos avançados — como smartphones, dispositivos 5G, sistemas de IA e veículos elétricos — está impulsionando uma rápida expansão na produção de semicondutores

- Como agente crítico de limpeza e corrosão na fabricação de wafers, o ácido sulfúrico de grau eletrônico está apresentando um consumo crescente. Com os fabricantes de chips buscando maior precisão e pureza na fabricação, a necessidade de produtos químicos ultrapuros como o ácido sulfúrico tornou-se mais essencial do que nunca.

- Por exemplo, em março de 2024, um estudo da HPCi Media Limited destacou que a Chemtrade firmou uma parceria com a Modular Devices para construir uma sala limpa móvel personalizada para metais traço, com classificação ISO Classe 4, em sua fábrica em Cairo, Ohio. Essa instalação apoiou o objetivo da Chemtrade de expandir a produção de Ácido Sulfúrico Ultrapuro (UPS) nos EUA para atender à crescente demanda por semicondutores. A sala limpa utilizou materiais livres de metais e filtragem ULPA avançada, permitindo uma configuração rápida e alta eficiência operacional. Essa colaboração acelerou o fornecimento doméstico de ácido sulfúrico de alta pureza, fortalecendo a capacidade de produção dos EUA e aumentando o crescimento e a disponibilidade de ácido sulfúrico de grau eletrônico para a indústria de semicondutores.

- A indústria de semicondutores está no centro dos avanços tecnológicos em vários setores, incluindo eletrônicos de consumo, telecomunicações, automotivo e aplicações industriais

- Além disso, com o surgimento de tecnologias emergentes como IA, infraestrutura 5G e IoT, os fabricantes de semicondutores estão aumentando a produção para atender às necessidades futuras. Essa escalada na produção e o aumento da complexidade dos chips estão impulsionando o crescimento do mercado de ácido sulfúrico de grau eletrônico, visto que ele é essencial para alcançar a precisão, o rendimento e a qualidade necessários nos processos de fabricação de semicondutores.

Mercado de ácido sulfúrico de grau eletrônico para a dinâmica da indústria de semicondutores (gravação)

Motorista

“Expansão da indústria global de semicondutores”

- A expansão da indústria global de semicondutores está alimentando significativamente a demanda por ácido sulfúrico de grau eletrônico, um produto químico crítico usado em processos de limpeza, gravação e preparação de superfícies de wafers.

- À medida que a produção de semicondutores aumenta para atender à crescente demanda de setores como automotivo, eletrônicos de consumo, 5G e IA, o consumo de produtos químicos de processo ultrapuros cresceu em paralelo.

- A necessidade de insumos químicos consistentes e de alta qualidade, como o ácido sulfúrico de grau eletrônico, está aumentando, levando os fabricantes de produtos químicos a aumentar a produção e inovar em tecnologias de purificação. Essa tendência ressalta o papel vital do ácido sulfúrico na viabilização da próxima fase de crescimento da indústria de semicondutores.

- Por exemplo , em fevereiro de 2023, de acordo com a Business Wire, Inc., a MECS, subsidiária da Elessent Clean Technologies, foi escolhida para dois novos projetos de ácido sulfúrico de grau eletrônico de alta pureza nos EUA e em Taiwan, reforçando sua posição como fornecedora de tecnologia preferencial para 90% das plantas de ácido de grau eletrônico em regiões-chave de semicondutores. Isso destaca como o crescimento da indústria global de semicondutores — impulsionado pela crescente demanda de veículos elétricos, tecnologia 5G e dispositivos inteligentes — está impulsionando significativamente a demanda por ácido sulfúrico ultrapuro usado na produção de chips.

- A rápida expansão da indústria de semicondutores em regiões-chave, como EUA, Europa e Extremo Oriente, está impulsionando um aumento paralelo na demanda por ácido sulfúrico de grau eletrônico. À medida que processos avançados de fabricação se tornam mais prevalentes e o foco global se desloca para a autossuficiência tecnológica e a inovação, o papel dos produtos químicos ultrapuros na garantia da qualidade dos chips e da eficiência da produção é mais crítico do que nunca.

Restrição/Desafio

“Disponibilidade limitada de ácido sulfúrico ultrapuro afetando o fornecimento consistente”

- A disponibilidade limitada de ácido sulfúrico ultrapuro, essencial para processos como limpeza e corrosão de wafers, pode interromper os cronogramas de fabricação e prejudicar a eficiência da produção. Regulamentações ambientais rigorosas restringem ainda mais a capacidade de produção, exacerbando o desequilíbrio entre oferta e demanda.

- Além disso, a cadeia de suprimentos de ácido sulfúrico está sob pressão devido à disponibilidade de matérias-primas. Tradicionalmente obtido como subproduto da dessulfuração de combustíveis fósseis, a produção de ácido sulfúrico é impactada pela mudança global para fontes de energia mais limpas, levando à redução do processamento de combustíveis fósseis e, consequentemente, à diminuição da disponibilidade de ácido sulfúrico.

- Além disso, a evolução das políticas de armamento e as restrições comerciais em regiões politicamente instáveis complicam a dinâmica do mercado, reduzindo a flexibilidade dos fabricantes e desacelerando as perspectivas de crescimento em certas áreas. Essas barreiras regulatórias aumentam a complexidade e o custo das operações comerciais.

- Por exemplo , em novembro de 2024, de acordo com um artigo publicado pela TUW, a indústria de semicondutores enfrentou diversos desafios importantes relacionados a matérias-primas, incluindo cadeias de suprimentos globais interrompidas, tensões geopolíticas, preocupações ambientais e volatilidade de preços. A produção concentrada de elementos de terras raras e produtos químicos como ácido sulfúrico em regiões específicas levou à instabilidade no acesso. Esses problemas restringiram o crescimento e o fornecimento consistentes de ácido sulfúrico de grau eletrônico, um componente vital na fabricação de chips, limitando sua capacidade de escala, juntamente com a crescente demanda por produção de semicondutores avançados.

- A escassez de ácido sulfúrico ultrapuro representa um grande desafio à capacidade de escala da indústria de semicondutores, afetando tanto os cronogramas de produção quanto a eficiência geral. À medida que a demanda por chips de alto desempenho continua a crescer, o acesso inconsistente a esse produto químico essencial retarda o desenvolvimento do mercado e cria gargalos operacionais.

Mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação )

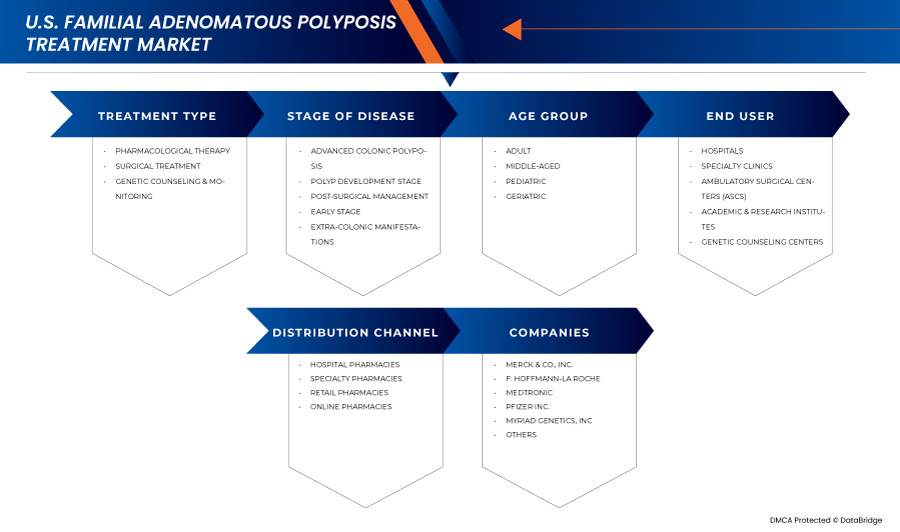

O mercado é segmentado com base no tipo, pureza, embalagem e aplicação

- Por tipo

Com base no tipo, o ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) é segmentado em Partes por Trilhão (PPT) e Partes por Bilhão (PPB). O segmento de Partes por Trilhão (PPT) deteve a maior participação de mercado na receita em 2025. Espera-se que testemunhe o CAGR mais rápido de 2025 a 2032. O segmento de pureza PPT atende à demanda por produtos químicos ultrapuros com níveis de impurezas abaixo de uma parte por trilhão. Esse nível de pureza é essencial para nós semicondutores de ponta, onde até mesmo o menor contaminante pode causar defeitos críticos. O ácido sulfúrico de grau PPT suporta processamento consistente e ultralimpo em fábricas de ponta.

- Por Pureza

Com base na pureza, o ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) é segmentado em 96% puro, menos de 96% e 99% puro. O segmento de 96% puro deteve a maior participação de mercado em 2025. Espera-se que testemunhe o CAGR mais rápido entre 2025 e 2032. Uma concentração de 96% equilibra eficácia e estabilidade para processos úmidos de semicondutores. Este grau específico oferece resistência ácida ideal para gravação e remoção de óxido sem comprometer o controle do processo. É amplamente adotado por sua versatilidade e compatibilidade com diversos materiais de substrato na fabricação de circuitos integrados e outras aplicações eletrônicas avançadas.

- Por embalagem

Com base na embalagem, o ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) é segmentado em tanques ISO, IBCs/revestimentos, tambores e outros. Os tanques ISO detiveram a maior participação de mercado em 2025 e devem apresentar o CAGR mais rápido entre 2025 e 2032. O uso de tanques ISO garante o transporte a granel seguro e livre de contaminação de ácido sulfúrico de alta pureza. Esses contêineres de aço inoxidável são projetados para manter a integridade química durante longas viagens. Para produtores de semicondutores, os tanques ISO reduzem os riscos de manuseio, preservam níveis de pureza ultra-altos e oferecem soluções logísticas escaláveis para a continuidade da cadeia de suprimentos global.

- Por aplicação

Com base no usuário final, o ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) é segmentado em gravação úmida, gravação seca, gravação a laser e eletrolítica. O segmento de gravação úmida foi responsável pela maior participação de mercado em 2024 e espera-se que testemunhe o CAGR mais rápido entre 2025 e 2032. A gravação úmida é uma etapa crítica na fabricação de semicondutores, removendo materiais indesejados de wafers usando produtos químicos líquidos como o ácido sulfúrico. Precisão e pureza são primordiais, especialmente em nós avançados. O ácido sulfúrico de alta pureza garante taxas de gravação controladas e minimiza a contaminação por partículas, proporcionando transferência consistente de padrões e integridade de características.

Análise regional do mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação)

- O Extremo Oriente dominou o mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação) devido à presença de grandes centros de fabricação de semicondutores como China, Taiwan, Coreia do Sul e Japão, que geram enorme demanda por produtos químicos de alta pureza.

- A região se beneficia do forte apoio e financiamento do governo para inovação e infraestrutura de semicondutores, acelerando ainda mais o consumo de ácido sulfúrico de grau eletrônico.

- A região abriga os principais produtores químicos e fornecedores de tecnologia especializados em materiais ultrapuros, permitindo a integração perfeita de ácido sulfúrico de grau eletrônico em processos avançados de fabricação de semicondutores.

- Além disso, o Extremo Oriente tem uma cadeia de suprimentos químicos e capacidade de exportação bem desenvolvidas, garantindo disponibilidade e distribuição consistentes de produtos químicos de corrosão de alta pureza em mercados globais.

Mercado de ácido sulfúrico de grau eletrônico dos EUA para a indústria de semicondutores (gravação)

O mercado de ácido sulfúrico de grau eletrônico dos EUA deve registrar a maior taxa de crescimento no mercado de ácido sulfúrico de grau eletrônico para a indústria de semicondutores (gravação), impulsionado pela expansão das capacidades de produção de semicondutores e pelo aumento dos investimentos em tecnologias de fabricação de chips de última geração.

Mercado Europeu de Ácido Sulfúrico de Grau Eletrônico para a Indústria de Semicondutores ( Gravação )

O mercado europeu de ácido sulfúrico de grau eletrônico deverá crescer a uma CAGR substancial ao longo do período previsto, devido à crescente demanda por eletrônicos de consumo, infraestrutura 5G e veículos elétricos, que está alimentando a necessidade de semicondutores avançados, impulsionando assim o consumo de produtos químicos de corrosão de alta pureza. Além disso, iniciativas governamentais estratégicas e parcerias regionais voltadas para a autossuficiência em semicondutores estão acelerando o crescimento do mercado de ácido sulfúrico de grau eletrônico na região. Os avanços tecnológicos contínuos e a localização das cadeias de suprimentos estão aumentando a eficiência e a escalabilidade da produção regional, apoiando a expansão sustentada do mercado.

Mercado de ácido sulfúrico de grau eletrônico na Alemanha para a indústria de semicondutores (gravação)

O mercado alemão de ácido sulfúrico de grau eletrônico foi responsável pela maior fatia da receita na Europa em 2025, devido à sua avançada indústria de semicondutores, à forte presença de importantes fabricantes de eletrônicos e às rigorosas regulamentações de pureza. Investimentos em fabricação de chips e tecnologias de salas limpas impulsionaram ainda mais a demanda por soluções de ácido ultrapuro.

Mercado de ácido sulfúrico de grau eletrônico na França para a indústria de semicondutores ( gravação )

O mercado francês de ácido sulfúrico de grau eletrônico representaria a segunda maior fatia de mercado na Europa em 2025, devido ao forte crescimento na fabricação de semicondutores, ao aumento dos investimentos governamentais em microeletrônica e à crescente demanda por produtos químicos ultrapuros. A inovação tecnológica e a expansão das salas limpas impulsionaram ainda mais o desenvolvimento do mercado.

Os principais líderes de mercado que operam no mercado são:

- Thermo Fisher Scientific Inc. (EUA)

- BASF SE (Alemanha)

- Linde PLC (Reino Unido)

- INEOS AG (Reino Unido)

- Honeywell International Inc. (EUA)

- LANXESS AG (Alemanha)

- Avantor, Inc. (EUA)

- Kanto Chemical Co., Inc. (Japão)

- PVS Chemicals Inc. (EUA)

- Produtos Químicos Reagentes (Índia)

- Asia Union Electronic Chemical Corporation (Taiwan)

- KMG Chemicals (EUA)

- Chemtrade Logistics Inc. (Canadá)

- Moses Lake Industries Inc. (EUA)

- Grupo Co. de Zhejiang Jihua, Ltd.

Últimos desenvolvimentos no mercado de ácido sulfúrico de grau eletrônico nos EUA, Europa e Extremo Oriente para a indústria de semicondutores (gravação)

- Em outubro de 2024, a Honeywell planeja desmembrar sua divisão de Materiais Avançados em uma empresa independente de capital aberto até o final de 2025 ou início de 2026, alinhando-se ao seu foco estratégico em automação, aviação e transição energética. A mudança simplificará o portfólio da Honeywell e permitirá que a nova entidade impulsione a inovação em produtos químicos especiais, incluindo ácido sulfúrico de grau eletrônico — crucial para a fabricação de semicondutores —, proporcionando-lhe maior foco estratégico e flexibilidade financeira.

- Em agosto de 2022, a Merck KGaA, de Darmstadt, Alemanha, anunciou um acordo definitivo para adquirir os negócios químicos da Mecaro Co. Ltd., fabricante coreana de precursores de semicondutores. Este movimento estratégico, parte do programa de crescimento "Level Up" de 3 bilhões de euros da Merck, aprimora seu portfólio de Soluções em Semicondutores. A aquisição inclui uma unidade de produção em Eumseong e um laboratório de P&D em Daejeon, apoiando os esforços de localização e expansão de capacidade da Merck no setor de semicondutores da Coreia do Sul.

- Em julho de 2024, a NES Materials, subsidiária da Namhae Chemical, forneceu um protótipo de ácido sulfúrico de alta pureza à Samsung para testes de produção de chips. A NES, uma joint venture com a ENF Technology e a Samsung C&T, concluiu sua fábrica em 2023, com capacidade anual de 54.000 toneladas métricas — 18% da produção total da Coreia do Sul. O ácido é produzido a partir do subproduto SO₃ da produção de fertilizantes da Namhae. A produção comercial está prevista para o final de 2024 ou início de 2025, posicionando a Namhae para competir com a Korea Zinc e outras empresas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S., EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID FOR SEMICONDUCTOR (ETCHING) INDUSTRY

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 DBMR MARKET POSITION GRID

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MULTIVARIATE MODELING

2.12 TYPE TIMELINE CURVE

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.3 RAW MATERIALS FOR ELECTRONIC GRADE SULFURIC ACID PRODUCTION

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 QUANTITATIVE TREND MOVEMENT: U.S., EUROPE, AND FAR EAST ELECTRONIC GRADE SULFURIC ACID FOR THE SEMICONDUCTOR INDUSTRY

4.5.1 CONCLUSION

4.6 IMPORT AND EXPORT SCENARIO OF ELECTRONIC GRADE SULFURIC ACID (EGSA) IN THE SEMICONDUCTOR INDUSTRY

4.6.1 KEY TRADE RELATIONSHIPS

4.6.2 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7.1 RAISING THE BAR ON PURITY STANDARDS

4.7.2 AUTOMATION AND SMART MONITORING ON THE FACTORY FLOOR

4.7.3 FOCUS ON RECYCLING AND WASTE REDUCTION

4.7.4 CLEANER, MORE EFFICIENT PRODUCTION

4.7.5 TRANSITIONING TO RENEWABLE ENERGY

4.8 VENDOR SELECTION CRITERIA

4.9 PRICE TREND ANALYSIS, 2018–2032 (USD/GALLON)

4.9.1 KEY FACTORS THAT DRIVE PRICES

4.9.2 REGIONAL OBSERVATION

4.1 PRICE TREND (2018-2032):

4.11 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.12 ELECTRONIC GRADE SULFURIC ACID FOR THE SEMICONDUCTOR INDUSTRY: SUPPLY CHAIN ANALYSIS IN THE US, EUROPE, AND FAR EAST

4.12.1 OVERVIEW

4.12.2 LOGISTIC COST SCENARIO

4.12.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.13 ENVIRONMENTAL CONCERNS

4.13.1 INDUSTRY RESPONSE

4.13.2 GOVERNMENT’S ROLE

4.13.3 ANALYST RECOMMENDATIONS

4.14 VALUE CHAIN OUTLOOK

4.15 TARIFF & ITS IMPACT

4.15.1 OVERVIEW OF TARIFFS AND TRADE REGULATIONS:

4.15.2 IMPACT ON PRICE OF EAST ELECTRONIC GRADE SULFURIC ACID

4.15.3 SUPPLY CHAIN DISRUPTIONS

4.15.4 IMPACT ON THE SEMICONDUCTOR INDUSTRY'S PROFIT MARGINS

4.15.5 GEOPOLITICAL TENSIONS AND ECONOMIC DIPLOMACY

4.16 U.S., EUROPE, AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR INDUSTRY, BY PURITY

4.17 MARKET TRENDS AND ADOPTION RATES ACROSS KEY SEMICONDUCTOR MANUFACTURING HUBS

4.17.1 OVERVIEW

4.17.2 FAR EAST

4.17.3 U.S. (NORTH AMERICA)

4.17.4 EUROPE

4.18 QUANTITATIVE INSIGHTS FOR (IN TERMS OF G5+ & G5 GRADE)

4.19 ELECTRONIC GRADE SULFURIC ACID (EGSA) – SUPPLIER LANDSCAPE AND CAPACITY ANALYSIS

4.19.1 OVERVIEW

5 U.S., EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID FOR SEMICONDUCTOR INDUSTRY

5.1 REGULATORY AND LOGISTICAL CHALLENGES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF THE GLOBAL SEMICONDUCTOR INDUSTRY DRIVING SULFURIC ACID CONSUMPTION

6.1.2 GROWING NEED FOR WAFER CLEANING AND ETCHING PROCESSES IN ELECTRONICS PRODUCTION

6.1.3 RISING EV AND IOT PRODUCTION DRIVING DEMAND FOR ULTRA-PURE SULFURIC ACID IN CHIP MANUFACTURING

6.1.4 TRANSITION TO ADVANCED SEMICONDUCTOR NODES INCREASES DEMAND FOR ULTRA-HIGH-PURITY SULFURIC ACID

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND PURIFICATION COSTS OF ELECTRONIC-GRADE SULFURIC ACID

6.2.2 STRINGENT ENVIRONMENTAL AND SAFETY REGULATIONS FOR HANDLING HAZARDOUS CHEMICALS

6.3 OPPORTUNITIES

6.3.1 GROWING EMPHASIS ON ECO-FRIENDLY CHEMICALS DRIVES INNOVATION IN SULFURIC ACID PRODUCTION

6.3.2 COLLABORATIONS BETWEEN CHEMICAL SUPPLIERS AND SEMICONDUCTOR FIRMS ENHANCE SUPPLY STABILITY

6.3.3 RISING INVESTMENTS IN SEMICONDUCTOR FABRICATION PLANTS

6.4 CHALLENGES

6.4.1 LIMITED AVAILABILITY OF ULTRA-PURE SULFURIC ACID IMPACTING CONSISTENT SUPPLY

6.4.2 COMPLEX LOGISTICS AND STORAGE REQUIREMENTS FOR HIGH-PURITY CHEMICAL HANDLING

7 U.S., EUROPE, AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE

7.1 OVERVIEW

7.2 PARTS PER TRILLION (PPT)

7.3 PARTS PER BILLION (PPB)

8 U.S., EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY

8.1 OVERVIEW

8.2 96% PURE

8.3 LESS THAN 96%

8.4 99% PURE

8.4.1 96% PURE, BY TYPE

8.4.1.1 G5

8.4.1.2 G+

9 U.S., EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING

9.1 OVERVIEW

9.2 ISO TANKS

9.3 IBC/LINERS

9.4 DRUMS

9.4.1 DRUMS, BY TYPE

9.4.1.1 PLASTIC

9.4.1.2 METAL

9.5 OTHERS

10 US, EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION

10.1 OVERVIEW

10.2 WET ETCHING

10.2.1 WET ETCHING, BY TYPE

10.2.1.1 THE SPIN/SPRAY METHOD

10.2.1.2 DIP METHOD

10.3 DRY ETCHING

10.3.1 DRY ETCHING, BY TYPE

10.3.1.1 REACTIVE ION ETCHING (RIE)

10.3.1.2 DEEP REACTIVE ION ETCHING (DRIE)

10.3.1.3 ICP-RIE ETCHING

10.3.1.4 ION BEAM ETCHING (IBE)

10.3.1.5 SPUTTER ETCHING/ION MILLING

10.4 LASER ETCHING

10.5 ELECTROLYTIC

11 US, EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID (ETCHING) FOR SEMICONDUCTOR INDUSTRY BY COUNTRY

11.1 FAR EAST

11.2 NORTH AMERICA

11.3 EUROPE

12 U.S., EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY

12.1 COMPANY SHARE ANALYSIS: U.S.

12.2 COMPANY SHARE ANALYSIS: FAR EAST

12.3 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 BASF

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 LANXESS

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT NEWS

14.3 SUMITOMO CHEMICAL CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 LINDE PLC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 THERMO FISHER SCIENTIFIC INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 AVANTOR, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 BRENNTAG NORTH AMERICA, INC. (PART OF BRENNTAG SE)

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 COLUMBUS CHEMICALS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FUJIFILM WAKO PURE CHEMICAL CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FURUKAWA CO.,LTD

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 HONEYWELL INTERNATIONAL INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 INEOS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 KANTO KAGAKU

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 KOREAZINC

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 MERCK KGAA

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 MOSES LAKE INDUSTRIES, INC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 NAMHAE CHEMICAL CORP

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 PVS CHEMICALS INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 REAGENTS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 SHIJIAZHUANG XINLONGWEI CHEMICAL CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SPECTRUM CHEMICAL

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 TAYCA CO., LTD.

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 HISTORICAL PRICE TRENDS-USD/GALLON (2018–2023)

TABLE 2 FORECASTED PRICE TRENDS-USD/GALLON (2024–2032)

TABLE 3 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 4 VENDOR LANDSCAPE U.S., EUROPE AND FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETHCHING) INDUSTRY

TABLE 5 REGULATORY AND LOGISTICAL CHALLENGES IN HANDLING AND DISTRIBUTION OF HIGH-PURITY ELECTRONIC GRADE SULFURIC ACID

TABLE 6 PRICE RANGE OF ELECTRONIC-GRADE SULFURIC ACID

TABLE 7 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 12 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 14 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 15 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 16 U.S. DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND GALLONS)

TABLE 18 EUROPE DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND GALLONS)

TABLE 20 FAR EAST DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 FAR EAST DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND GALLON)

TABLE 22 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 24 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD GALLONS)

TABLE 26 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD GALLONS)

TABLE 27 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD GALLONS)

TABLE 28 U.S. DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 FAR EAST DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 33 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 FAR EAST WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 FAR EAST DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 REGION

TABLE 41 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 42 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 44 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 45 FAR EAST 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 FAR EAST 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 47 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 48 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 49 FAR EAST DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 FAR EAST WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 FAR EAST DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 55 CHINA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 56 CHINA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CHINA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 58 CHINA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 59 CHINA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 60 CHINA DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CHINA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 CHINA WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 CHINA DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 TAIWAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 TAIWAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 66 TAIWAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 67 TAIWAN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 TAIWAN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 69 TAIWAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 70 TAIWAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 71 TAIWAN DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 TAIWAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 TAIWAN WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 TAIWAN DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 78 SOUTH KOREA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH KOREA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 80 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 82 SOUTH KOREA DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH KOREA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 85 SOUTH KOREA WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH KOREA DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 89 JAPAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 90 JAPAN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 JAPAN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 92 JAPAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 93 JAPAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 94 JAPAN DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SINGAPORE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SINGAPORE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 100 SINGAPORE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 101 SINGAPORE 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SINGAPORE 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 103 SINGAPORE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 104 SINGAPORE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 105 SINGAPORE DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SINGAPORE DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MALAYSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MALAYSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 111 MALAYSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 112 MALAYSIA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MALAYSIA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 114 MALAYSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 115 MALAYSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 116 MALAYSIA DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MALAYSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 MALAYSIA WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MALAYSIA DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 VIETNAM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 VIETNAM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 122 VIETNAM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 123 VIETNAM 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 VIETNAM 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 125 VIETNAM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 126 VIETNAM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 127 VIETNAM DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 VIETNAM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 VIETNAM WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 VIETNAM DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 134 THAILAND 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 136 THAILAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 138 THAILAND DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 THAILAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 THAILAND WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 THAILAND DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 INDONESIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 INDONESIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 144 INDONESIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 145 INDONESIA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 INDONESIA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 147 INDONESIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 148 INDONESIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 149 INDONESIA DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 INDONESIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 INDONESIA WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 INDONESIA DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 PHILIPPINES ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 PHILIPPINES ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 155 PHILIPPINES ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 156 PHILIPPINES 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 PHILIPPINES 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 158 PHILIPPINES ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 159 PHILIPPINES DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 PHILIPPINES ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 161 PHILIPPINES ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 PHILIPPINES DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 HONG KONG ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 HONG KONG ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 166 HONG KONG ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 167 HONG KONG 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 HONG KONG 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 169 HONG KONG ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 170 HONGKONG ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 171 HONG KONG DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 HONG KONG ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 173 HONG KONG WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 HONG KONG DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 REST OF FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 REST OF FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 177 REST OF FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 178 REST OF FAR EAST 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 REST OF FAR EAST 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 180 REST OF FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 181 REST OF FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 182 REST OF FAR EAST DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 REST OF FAR EAST ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 REST OF FAR EAST WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 REST OF FAR EAST DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 REGION

TABLE 187 NORTH AMERICA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 188 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 190 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 191 U.S. 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 U.S. 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 193 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 194 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 195 U.S. DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 U.S. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 197 U.S. WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 U.S. DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 REGION

TABLE 200 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY , BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 201 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 203 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 204 EUROPE 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 U.S. 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 206 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 207 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 208 EUROPE DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 EUROPE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 EUROPE WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 EUROPE DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 GERMANY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 GERMANY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 214 GERMANY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 215 GERMANY 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 GERMANY 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 217 GERMANY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 218 GERMANY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 219 GERMANY DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 GERMANY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 GERMANY WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 GERMANY DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 FRANCE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 FRANCE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 225 FRANCE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 226 FRANCE 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 FRANCE 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 228 FRANCE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 229 FRANCE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 230 FRANCE DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 FRANCE ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 232 FRANCE WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 FRANCE DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 U.K. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 U.K. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 236 U.K. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 237 U.K. 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 U.K. 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 239 U.K. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 240 U.K ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 241 U.K. DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 U.K. ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 243 U.K. WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 U.K. DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 ITALY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 ITALY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 247 ITALY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 248 ITALY 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 ITALY 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 250 ITALY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 251 ITALY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 252 ITALY DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 ITALY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 254 ITALY WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 ITALY DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 NETHERLANDS ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 NETHERLANDS ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 258 NETHERLANDS ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 259 NETHERLANDS 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 NETHERLANDS 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 261 NETHERLANDS ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 262 NETHERLANDS ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 263 NETHERLANDS DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 NETHERLANDS ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 265 NETHERLANDS WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 NETHERLANDS DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SWITZERLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SWITZERLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 269 SWITZERLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 270 SWITZERLAND 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SWITZERLAND 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 272 SWITZERLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 273 SWITZERLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 274 SWITZERLAND DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SWITZERLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 SWITZERLAND WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 SWITZERLAND DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 SPAIN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 SPAIN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 280 SPAIN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 281 SPAIN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 SPAIN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 283 SPAIN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 284 SPAIN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 285 SPAIN DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 SPAIN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 287 SPAIN WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SPAIN DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 RUSSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 RUSSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 291 RUSSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 292 RUSSIA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 RUSSIA 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 294 RUSSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 295 RUSSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 296 RUSSIA DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 RUSSIA ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 298 RUSSIA WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 RUSSIA DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 BELGIUM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 BELGIUM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 302 BELGIUM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 303 BELGIUM 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 BELGIUM 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 305 BELGIUM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 306 BELGIUM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 307 BELGIUM DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 BELGIUM ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 309 BELGIUM WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 BELGIUM DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SWEDEN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWEDEN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 313 SWEDEN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 314 SWEDEN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 SWEDEN 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 316 SWEDEN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 317 SWEDEN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 318 SWEDEN DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 SWEDEN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 320 SWEDEN WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 SWEDEN DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 DENMARK ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 DENMARK ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 324 DENMARK ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 325 DENMARK 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 DENMARK 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 327 DENMARK ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 328 DENMARK ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 329 DENMARK DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 DENMARK ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 331 DENMARK WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 DENMARK DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 NORWAY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 NORWAY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 335 NORWAY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 336 NORWAY 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 NORWAY 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 338 NORWAY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 339 NORWAY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)

TABLE 340 NORWAY DRUMS IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 NORWAY ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 342 NORWAY WET ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 NORWAY DRY ETCHING IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 FINLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 FINLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (USD THOUSAND)

TABLE 346 FINLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PURITY, 2018-2032 (THOUSAND GALLONS)

TABLE 347 FINLAND 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 FINLAND 96% PURE IN ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY TYPE, 2018-2032 (THOUSAND GALLONS)

TABLE 349 FINLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (USD THOUSAND)

TABLE 350 FINLAND ELECTRONIC GRADE SULFURIC ACID MARKET FOR SEMICONDUCTOR (ETCHING) INDUSTRY, BY PACKAGING, 2018-2032 (THOUSAND GALLONS)