Global Fine Fragrances Market

Market Size in USD Billion

CAGR :

%

USD

9.70 Billion

USD

14.01 Billion

2024

2032

USD

9.70 Billion

USD

14.01 Billion

2024

2032

| 2025 –2032 | |

| USD 9.70 Billion | |

| USD 14.01 Billion | |

|

|

|

|

Fine Fragrances Market Size

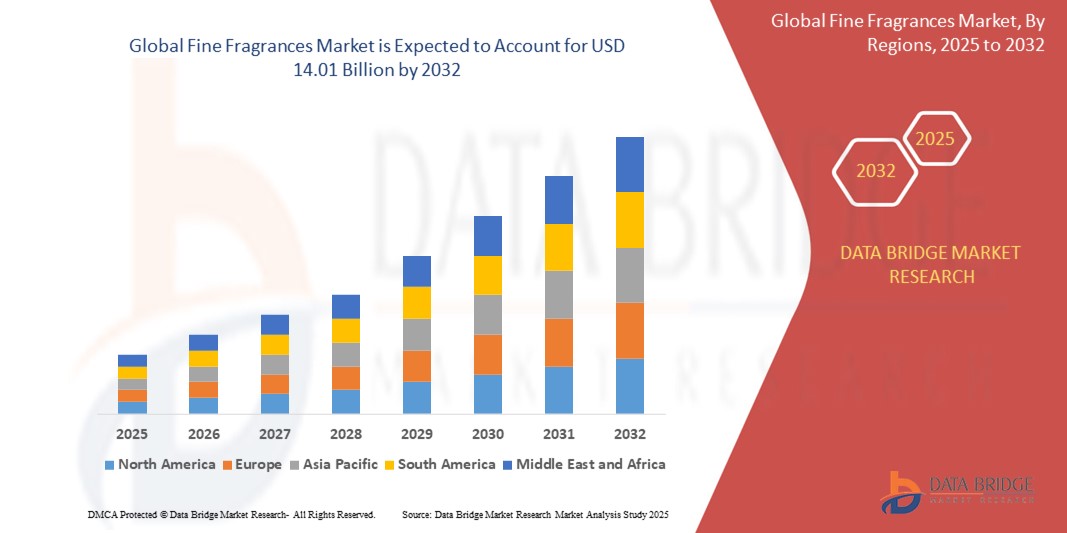

- The global fine fragrances market size was valued at USD 9.70 billion in 2024 and is expected to reach USD 14.01 billion by 2032, at a CAGR of 4.70% during the forecast period

- Market growth is primarily driven by the increasing consumer demand for premium and personalized scents, supported by rising disposable incomes and shifting preferences toward luxury and niche fragrance brands

- In addition, the expansion of e-commerce platforms and digital marketing strategies by key players have significantly enhanced product accessibility and consumer engagement, fueling market expansion across emerging economies

Fine Fragrances Market Analysis

- Fine fragrances are becoming increasingly vital across various sectors, particularly in personal care, luxury goods, and lifestyle products, due to rising consumer interest in self-expression, premium scents, and natural/clean label formulations. Innovations in fragrance creation, including AI-assisted perfumery and sustainable sourcing, are reshaping market dynamics

- The rising use of fine fragrances in deodorants, niche perfumes, and wellness products, along with their growing incorporation into home care (candles, diffusers) and cosmetics, is a primary driver of market growth. This is supported by expanding demand across e-commerce, influencer marketing, and premium retail channels globally

- Europe dominates the fine fragrances market with the largest revenue share of 37.2% in 2025, owing to a strong heritage in perfumery, particularly in France, Italy, and the U.K., where established fragrance houses and global brands continue to drive innovation, clean-label trends, and high-end exports

- Asia-Pacific is expected to be the fastest-growing region in the fine fragrances market during the forecast period, driven by rising middle-class income levels, urbanization, and increasing consumer demand for luxury and personal grooming products. Markets such as China, India, and South Korea are experiencing a boom in both local and international fine fragrance offering

- The deodorants segment is projected to dominate the market with a market share of 41.5% in 2025, as fine fragrances are widely used in premium deodorant formulations to enhance consumer experience, ensure long-lasting scent retention, and cater to the growing preference for multi-functional, gender-neutral, and skin-friendly products

Report Scope and Fine Fragrances Market Segmentation

|

Attributes |

Fine Fragrances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Fine Fragrances Market Trends

“Innovative Scent Technologies and Integrated Supply Chain Solutions”

- A prominent and accelerating trend in the global fine fragrances market is the adoption of advanced formulation technologies, including micro-encapsulation, 3D scent printing, and AI-driven fragrance design, which enhance scent longevity, customization, and consumer engagement across premium perfumes, personal care, and luxury home fragrances

- For instances, in January 2024, Givaudan launched an AI-powered fragrance creation platform that enables rapid prototyping and personalization of scents tailored to individual preferences, improving R&D efficiency and reducing time-to-market for niche fragrance collections

- Leading fragrance houses and raw material suppliers are pursuing vertical integration along the value chain, encompassing sustainable raw material sourcing, fragrance oil production, and direct-to-consumer sales channels. In November 2023, Firmenich expanded its in-house botanical extraction capabilities to secure supply and maintain high-quality standards amid rising demand for natural and clean-label ingredients

- The increasing consumer demand for sustainable and ethically sourced fragrances is driving the use of bio-based aroma chemicals, cruelty-free testing methods, and eco-friendly packaging solutions. In March 2024, Symrise introduced a new line of biodegradable fragrance compounds designed for use in natural perfumes and cosmetic formulations, complying with global environmental and safety regulations such as the EU’s Green Deal and California’s Proposition 65

- Digital transformation and supply chain transparency are advancing rapidly. In August 2023, IFF deployed a blockchain-based ingredient tracking system to verify the provenance and authenticity of rare natural extracts, addressing concerns around counterfeit ingredients and enabling end-to-end traceability from farm to final product

- Circular economy initiatives are gaining traction in the fine fragrances sector, including ingredient recycling and refillable packaging models. In 2024, Puig initiated a pilot program for refill stations and recyclable atomizers in key global markets, aiming to reduce plastic waste and enhance consumer convenience

- These trends illustrate a comprehensive evolution in the fine fragrances market, where cutting-edge scent innovation, sustainability imperatives, and supply chain integration collectively drive competitive advantage and market growth. Industry leaders are increasingly investing in smart formulation technologies, green sourcing, and circular business models to meet evolving consumer expectations and regulatory landscapes

Fine Fragrances Market Dynamics

Driver

“Rising Consumer Demand for Personalized, Sustainable, and Experiential Fragrances”

- The growing global demand for personalized and niche fragrances, driven by consumers’ increasing desire for unique scent identities and luxury experiences, is a key driver fueling the fine fragrances market expansion

- For instances, in February 2024, L’Oréal launched a bespoke fragrance service leveraging AI scent profiling technology to create tailor-made perfumes, appealing to millennials and Gen Z consumers focused on individuality

- The shift toward sustainability and clean beauty is intensifying demand for eco-friendly, natural, and ethically sourced fragrance ingredients, supporting market growth across premium and artisanal fragrance segments

- The expansion of the luxury personal care sector in emerging markets such as China, India, and the Middle East is accelerating demand for fine fragrances, especially those incorporating rare natural extracts and exotic notes

- Increasing collaborations between fragrance houses and fashion brands, influencers, and lifestyle platforms are amplifying consumer engagement and market reach, driving sales through omni-channel retail and direct-to-consumer models

- In addition, advancements in fragrance delivery systems—such as micro-encapsulation and long-lasting formulations—enhance consumer satisfaction and repeat purchase rates

- Overall, evolving consumer preferences for personalization, sustainability, and premium experiences remain the strongest growth catalysts for the fine fragrances industry globally

Restraint/Challenge

“Stringent Regulatory Compliance and Raw Material Sourcing Complexities”

- Regulatory challenges pose a significant restraint on the fine fragrances market, with stringent safety, allergen disclosure, and environmental regulations such as the EU’s IFRA standards and REACH compliance imposing formulation constraints and increasing compliance costs

- For instance, in 2023–2024, several synthetic aroma compounds were restricted or banned due to toxicity and sensitization concerns, forcing reformulation efforts that can disrupt product portfolios and delay launches

- The sourcing of high-quality, sustainable natural ingredients faces supply chain risks including climate change impacts, agricultural variability, and ethical sourcing demands, which can lead to price volatility and ingredient scarcity

- Additionally, counterfeit and adulterated fragrance ingredients in some regions undermine product integrity and consumer trust, creating challenges for brand protection and quality assurance

- The capital-intensive nature of innovation in fragrance R&D, including AI technologies and sustainable extraction methods, creates entry barriers for smaller fragrance houses and independent perfumers

- Moreover, consumer preferences shift rapidly, increasing the pressure on brands to continuously innovate while managing complex global distribution and marketing channels

- To overcome these challenges, the industry is investing in alternative sustainable raw materials, advanced analytical testing, and regulatory expertise to ensure compliant, high-quality fragrance products that resonate with conscious consumer

Fine Fragrances Market Scope

The market is segmented on the basis of ingredient, form, application, and distribution channel.

• By Ingredient

On the basis of ingredient, the Fine Fragrances market is segmented into synthetic and natural. The Synthetic segment dominates the largest market revenue share in 2025, driven by its cost-effectiveness, stability, and versatility in creating a wide range of scent profiles across various fragrance products. Manufacturers often prioritize synthetic ingredients for their consistent quality, longer shelf life, and ability to replicate rare or novel aromas that may be difficult or unsustainable to source naturally. The market also witnesses strong demand for synthetic ingredients due to their compatibility with modern formulation technologies and regulatory compliance in diverse global markets

The Natural segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer preference for clean-label, organic, and sustainably sourced fragrances. Natural ingredients find growing usage in niche and premium perfume lines, body care products, and eco-conscious cosmetic formulations, offering authenticity and marketing appeal aligned with evolving sustainability trends

• By Form

On the basis of form, the Fine Fragrances market is segmented into liquid and gas. The Liquid segment held the largest market revenue share in 2025, driven by the widespread use of liquid formulations in spray perfumes, deodorants, and personal care products due to ease of application, formulation flexibility, and consumer familiarity. Liquid fragrances also enable complex scent layering and longer-lasting olfactory experiences

The Gas segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for aerosol and vaporized fragrance products such as air fresheners and room sprays. Gas formulations provide rapid scent diffusion and enhanced coverage in home care and commercial environments, aligning with consumer preferences for instant and refreshing aroma delivery

• By Application

On the basis of application, the Fine Fragrances market is segmented into spray perfumes, deodorants, body care, home care, cosmetics, soaps and detergents, incense, and others. The Spray Perfumes segment held the largest market revenue share in 2025, driven by its strong consumer appeal as a primary fragrance format offering versatility, portability, and premium branding opportunities. Spray perfumes dominate luxury and mass-market categories, supported by continuous innovation in scent composition and packaging

The Deodorants segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its expanding use in both personal hygiene and active lifestyle products. Fragrance formulations in deodorants are evolving to provide long-lasting protection, skin-friendly profiles, and appealing scents, fueling growth in emerging markets and among younger demographics

• By Distribution Channel

On the basis of distribution channel, the Fine Fragrances market is segmented into direct sales, e-commerce, specialty stores, convenience stores, and others. The Specialty Stores segment held the largest market revenue share in 2025, driven by the experiential shopping environment, expert consultation, and premium product availability that specialty retailers offer. These stores remain the preferred channel for luxury and artisanal fragrances, supporting brand differentiation and customer loyalty

The E-commerce segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing consumer comfort with online shopping, wider product accessibility, and digital marketing innovations such as virtual scent sampling and personalized recommendations. E-commerce platforms enable brands to reach new markets and demographics while offering convenience and competitive pricing

Fine Fragrances Market Regional Analysis

- Europe dominates the global Fine Fragrances market, accounting for the largest revenue share of 37.2% in 2025, driven by the region’s strong heritage in luxury perfumes, high consumer spending on premium personal care products, and well-established fragrance houses based in countries such as France, Italy, and Germany. Europe benefits from its reputation as a global hub for innovation, craftsmanship, and high-quality raw material sourcing

- In addition, significant investments in sustainable and clean-label fragrance development, stringent regulatory compliance with standards such as IFRA and REACH, and growing consumer demand for natural and eco-friendly fragrances are propelling market growth. Leading players such as Givaudan, Firmenich, and Symrise continue to expand their R&D capabilities and production capacities within the region to meet evolving market needs

- The regional market also benefits from supportive policies promoting sustainability, circular economy practices, and chemical safety, alongside robust retail infrastructure encompassing specialty stores and luxury boutiques. Ongoing advancements in digital marketing and personalized fragrance technologies further strengthen Europe’s market leadership by enhancing consumer engagement and brand differentiation

Germany Fine Fragrances Market Insight

The Germany Fine Fragrances market is expanding significantly, driven by the country’s strong luxury cosmetics industry, established fragrance manufacturing expertise, and high consumer demand for premium and sustainable scents. German companies are focusing on natural and synthetic ingredient innovation to meet stringent EU regulations and consumer preferences for eco-friendly and high-performance fragrances. The rise in demand for niche and artisanal fragrances, alongside growing investments in green chemistry and product personalization, is further supporting market growth

U.K. Fine Fragrances Market Insight

The U.K. Fine Fragrances market is gaining momentum owing to growing demand from luxury personal care, fashion, and lifestyle sectors. Manufacturers and retailers are increasingly adopting sustainable sourcing and clean-label fragrance formulations to cater to eco-conscious consumers. Government initiatives promoting green chemistry and regulations around ingredient transparency are encouraging the use of low-impact, natural-based fragrances. The market benefits from a strong presence of niche brands and robust e-commerce channels facilitating wider product accessibility

North America Fine Fragrances Market Insight

The North America Fine Fragrances market is witnessing robust growth due to rising consumer spending on premium beauty and personal care products, especially in the U.S. and Canada. Increasing adoption of gender-neutral and wellness-inspired fragrances, coupled with advances in scent personalization technologies, fuels market expansion. The presence of major global fragrance houses and innovative startups enhances product variety and availability. Additionally, growing demand for environmentally friendly and hypoallergenic fragrances aligns with shifting consumer priorities

U.S. Fine Fragrances Market Insight

The U.S. Fine Fragrances market holds the largest share in North America in 2025, fueled by the country's mature cosmetic manufacturing infrastructure and diverse consumer preferences. Rising demand for natural and organic fragrance ingredients, along with premium and niche scent offerings, drives product innovation. Increasing investments in R&D, digital marketing, and direct-to-consumer sales channels strengthen the domestic supply chain and export capabilities, further boosting market growth

Asia-Pacific Fine Fragrances Market Insight

The Asia-Pacific Fine Fragrances market is projected to expand steadily, driven by rapid urbanization, increasing disposable incomes, and growing middle-class populations in China, India, Japan, and Southeast Asia. The region benefits from expanding e-commerce platforms and rising consumer interest in luxury and natural fragrances. Manufacturers and brands are focusing on localized scents and sustainable ingredient sourcing to meet regional preferences. Strategic collaborations and innovations in product formats further support market penetration and growth

Japan Fine Fragrances Market Insight

The Japan Fine Fragrances market is characterized by consumers’ preference for subtle and refined scents, combined with an interest in wellness and eco-conscious products. Japanese companies emphasize high-quality raw materials, blending traditional and modern fragrance profiles. The market benefits from advanced retail and digital distribution channels, fostering accessibility to premium and niche fragrances. Innovation in scent personalization and sustainable sourcing continues to drive market development

China Fine Fragrances Market Insight

The China Fine Fragrances market is expected to dominate the Asia-Pacific region, driven by rapid growth in luxury goods consumption, rising middle and upper-class demographics, and expanding distribution networks. Domestic brands are gaining traction alongside established international players by offering culturally relevant and sustainable fragrance products. Government regulations promoting cosmetic safety and environmental responsibility encourage innovation in clean and green fragrance formulations, bolstering consumer confidence and market expansion

Fine Fragrances Market Share

The fine fragrances industry is primarily led by well-established companies, including:

- Firmenich SA (Switzerland)

- Amouage (Oman)

- Dolce & Gabbana S.r.l. (Italy)

- Avon (U.K.)

- M.Sentiment (U.A.E.)

- Gulf Flavours & Fragrances (U.A.E.)

- Bath & Body Works, Inc. (U.S.)

- KERING (France)

- Takasago International Corporation (Japan)

- Parfex (France)

- Hermès (France)

- Zohoor Alreef (Saudi Arabia)

- CHANEL (France)

- TAC PERFUMES (U.A.E.)

- LVMH (France)

Latest Developments in Global Fine Fragrances Market

- In March 2025, Interparfums, Inc. acquired Maison Goutal, securing worldwide intellectual property rights from Amorepacific Europe. This strategic move strengthens Interparfums' presence in the high-end fragrance sector, leveraging Goutal’s iconic lines, including L’Eau d’Hadrien and Petite Chérie. The acquisition aligns with Interparfums' expansion strategy, with brand development set to begin in 2026

- In January 2024, L’Occitane Group acquired Dr. Vranjes Firenze, a luxury home fragrance brand from Italy. This strategic move strengthens L’Occitane’s high-end product portfolio, particularly in the Chinese market, by integrating Dr. Vranjes Firenze’s premium home fragrances. The acquisition aligns with L’Occitane’s expansion strategy, leveraging Dr. Vranjes’ expertise in artisanal scent creation

- In September 2024, Noyz launched The Solid Fragrance Pair, its first solid fragrance product featuring two bestselling scents: Unmute and Love Club. Designed for on-the-go application, the fragrances come in a sleek, refillable magnetic bullet, offering versatility and convenience for active lifestyles. The alcohol-free formula melts with body warmth, ensuring long-lasting scent throughout the day

- In October 2024, Merit Beauty debuted its first fragrance, Retrospect Extrait de Parfum, crafted by French perfumer Fanny Bal. This rich, nuanced scent evolves throughout the day, featuring notes of pear, ambrette, jasmine, and vanilla. Designed to break away from fleeting trends, Retrospect offers long-lasting complexity with clean, vegan ingredients

- In January 2024, Puig acquired a majority stake in Dr. Barbara Sturm, a premium skincare brand founded in 2014. This strategic move strengthens Puig’s presence in the high-end skincare market, reinforcing its competitive position with a globally recognized luxury brand. Dr. Barbara Sturm will retain a minority stake and continue as Chief Product Development Officer and Brand Ambassador

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fine Fragrances Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fine Fragrances Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fine Fragrances Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.