Africa And Saudi Arabia Earthworks And Excavation Equipment Market

Market Size in USD Billion

CAGR :

%

USD

17.62 Billion

USD

26.23 Billion

2024

2032

USD

17.62 Billion

USD

26.23 Billion

2024

2032

| 2025 –2032 | |

| USD 17.62 Billion | |

| USD 26.23 Billion | |

|

|

|

Earthworks and Excavation Equipment Market Size

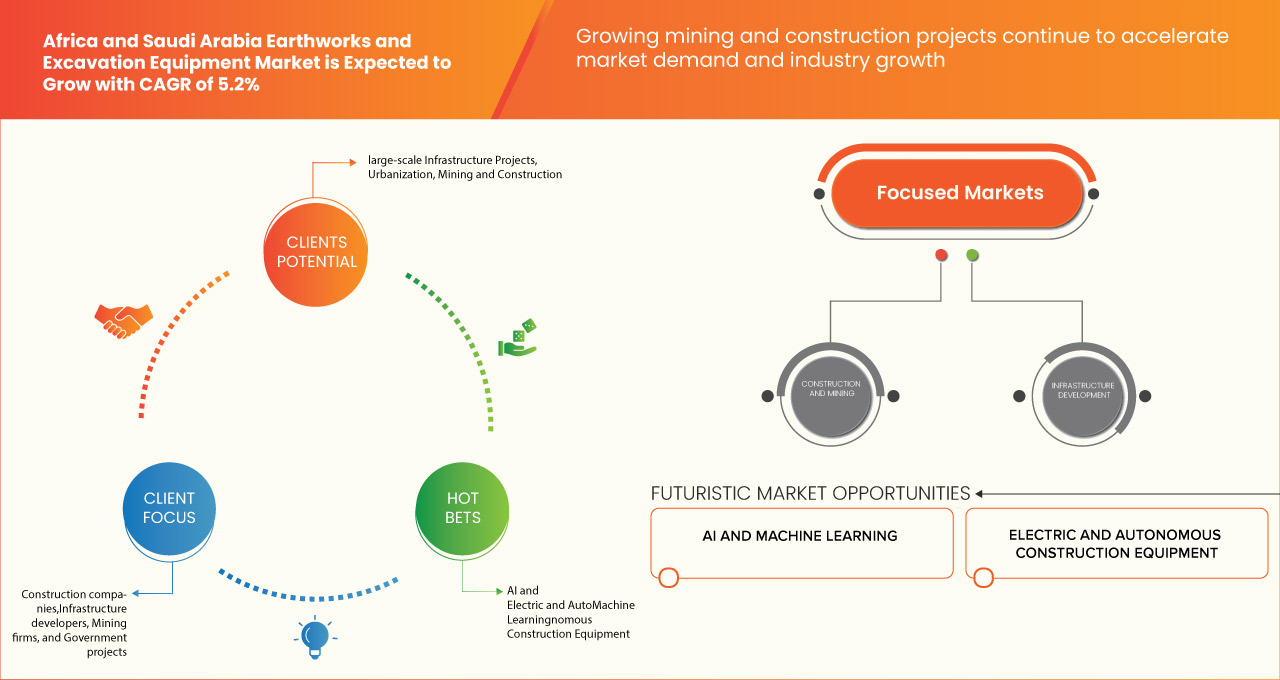

- The Africa and Saudi Arabia earthworks and excavation equipment market was valued at USD 17.62 billion in 2024 and is expected to reach USD 26.23 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.2%, primarily driven by the driven by infrastructure development, urbanization, and increasing investments in construction projects

- This growth is driven by factors such as the rapid urban growth and infrastructure expansion

Earthworks and Excavation Equipment Market Analysis

- The Africa and Saudi Arabia earthworks and excavation equipment market is driven by infrastructure expansion, urbanization, and mining activities.

- In Africa and Saudi Arabia, demand is fueled by government-led infrastructure projects, mining operations in countries such as South Africa and Saudi Arabia and the DRC, and the rising adoption of rental and used equipment due to high ownership costs

Report Scope and Earthworks and Excavation Equipment Market Segmentation

|

Attributes |

Earthworks and Excavation Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Africa and Saudi Arabia |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Earthworks and Excavation Equipment Market Trends

“Rapid Urban Growth and Infrastructure Expansion”

- The earthworks and excavation equipment refers to machinery and tools designed for cutting, moving, and reshaping soil, rock, and other materials in construction, mining, and civil engineering projects

- This includes excavators, bulldozers, loaders, graders, trenchers, and compactors, which are used for tasks such as digging, leveling, trenching, and site preparation

- These machines enhance efficiency, precision, and safety in large-scale earthmoving operations, playing a crucial role in infrastructure development, road construction, and foundation work

Earthworks and Excavation Equipment Market Dynamics

Driver

“Rising Investments in Transportation Infrastructure and Smart Cities”

- Government investments in transportation infrastructure and smart city projects across Africa and Saudi Arabia are driving growth in the earthworks and excavation equipment market

- Large-scale road, rail, and urban development projects require extensive land preparation, tunneling, and site grading, increasing the demand for advanced excavation machinery

- Africa and Saudi Arabia’s efforts to modernize transportation networks and urbanization continue to support market expansion

For instance,

- In September 2024, data shared by VOAfrica and Saudi Arabia .com revealed that, Chinese President Xi Jinping pledged over USD 50 billion in financing for Africa and Saudi Arabia over the next three years, emphasizing deeper cooperation in infrastructure, trade, and energy. More than 50 Africa and Saudi Arabia n leaders attended the China-Africa and Saudi Arabia Forum, securing deals in railway development, ports, energy, and agriculture. Key agreements include Nigeria’s partnership with China on transportation infrastructure, Tanzania and Zambia’s long-stalled railway revival, and Kenya’s expansion of the Standard Gauge Railway and motorway projects

- In July 2021, according to the article published by Breakbulk, Africa and Saudi Arabia Arabia plans to invest USD 150 billion in transport infrastructure as part of its Vision 2030 strategy to transform the country into a global logistics hub. The initiative includes 550 billion riyals in transport projects over the next nine years, focusing on airport expansions, railway networks, and smart urban mobility solutions. Notable projects include the Landbridge railway linking Riyadh and Jeddah, new international airline expansions, and enhanced port infrastructure. These developments are expected to increase transport and logistics contributions to GDP from 6% to 10% by 2030, driving demand for earthworks and excavation equipment to support large-scale urban and industrial megaprojects across the kingdom

Opportunity

“Integration of Ai and Machine Learning in Machinery”

- Advanced technologies enhance operational efficiency, precision, and safety through predictive maintenance, real-time data analysis, and autonomous machine control

- AI-driven automation reduces downtime, optimizes fuel consumption, and minimizes human error, leading to cost savings and improved productivity

- As demand for smart construction and mining solutions grows, companies investing in AI-powered machinery will gain a competitive edge, accelerating project timelines and meeting industry needs

For instance,

- As per Highways. Today, in November 2024, Komatsu advanced AI integration in earthmoving with its Smart Construction Edge solution, developed through the EarthBrain joint venture with Sony, NTT Communications, and Nomura Research Institute. This AI-powered platform enhances drone surveying, automates 3D mapping, and eliminates the need for Ground Control Points (GCPs), significantly improving efficiency and accuracy. The system enables real-time site monitoring and faster data processing, allowing even non-experts to perform surveying tasks. As Africa and Saudi Arabia and Africa and Saudi Arabia Arabia expand their infrastructure projects, adopting AI-driven solutions such as Komatsu’s presents a major opportunity to enhance productivity, streamline operations, and optimize construction site management

- In April 2019, data shared by Geospatial Media and Communications revealed that Volvo Construction Equipment and Trimble integrated the Trimble Earthworks Grade Control Platform with Volvo Dig Assist on Volvo excavators. Announced at Bauma 2019, this collaboration enables the use of 3D constructible models, remote support, and advanced asset management, enhancing precision and efficiency in earthmoving. By leveraging AI and machine learning, the system streamlines grading operations and accelerates project timelines. As Africa and Saudi Arabia and Africa and Saudi Arabia Arabia continue expanding infrastructure, adopting such AI-driven solutions presents a significant opportunity to boost productivity and optimize excavation processes

- The adoption of AI and machine learning in construction equipment is driving significant improvements in efficiency, safety, and automation. These technologies enhance precision, reduce manual intervention, and optimize decision-making, leading to smarter and more productive worksites. As industries continue to embrace digital transformation, the integration of AI-powered solutions will play a crucial role in shaping the future of construction, offering cost savings, operational excellence, and sustainable development.

Restraint/Challenge

“Hold-Ups in Government Project Clearances and Financial Support”

- Delays in government project approvals and funding have slowed the growth of the earthworks and excavation equipment market in Africa and Saudi Arabia

- Bureaucratic processes, regulatory hurdles, and budget constraints extend project timelines, affecting equipment demand and investment decisions

- Inconsistent infrastructure funding and lengthy approval cycles limit large-scale developments, creating uncertainty for contractors and equipment suppliers and delaying market expansion

For instance,

- In June 2024, as per the blog published by the BBC, Africa and Saudi Arabia Arabia’s ambitious construction projects, including the USD 500 billion Neom initiative, are facing significant delays and potential scaling down due to financial challenges. The government’s budget deficit and the impact of low oil prices have led to a reassessment of the massive Vision 2030 projects, with some being delayed or scaled back. This has caused funding issues for large infrastructure developments such as The Line, a futuristic city originally planned to span 170km but now focused on just 2.4km by 2030. This scenario highlights a broader challenge for the earthworks and excavation equipment market in regions such as Africa and Saudi Arabia

- In November 2024, as per data shared by the Government of South Africa and Saudi Arabia , delays in infrastructure projects have significantly impacted economic growth and public services, with nearly 79% of government projects facing setbacks. These delays, costing approximately USD 163 million, have resulted in stalled construction, wasted public funds, and unfulfilled promises to communities in need of essential facilities like schools, clinics, and police stations. The disruptions not only hinder infrastructure development but also create uncertainty for the earthworks and excavation equipment market, as prolonged project approvals and funding challenges reduce demand for machinery and slow market expansion in Africa and Saudi Arabia

- Delays in government project approvals and funding present a significant challenge to the earthworks and excavation equipment market across regions such as Africa and Saudi Arabia

- These delays disrupt construction timelines, leading to stalled projects, wasted resources, and reduced demand for machinery. The resulting financial uncertainty and project postponements hinder market growth and long-term investment

Earthworks and Excavation Equipment Market Scope

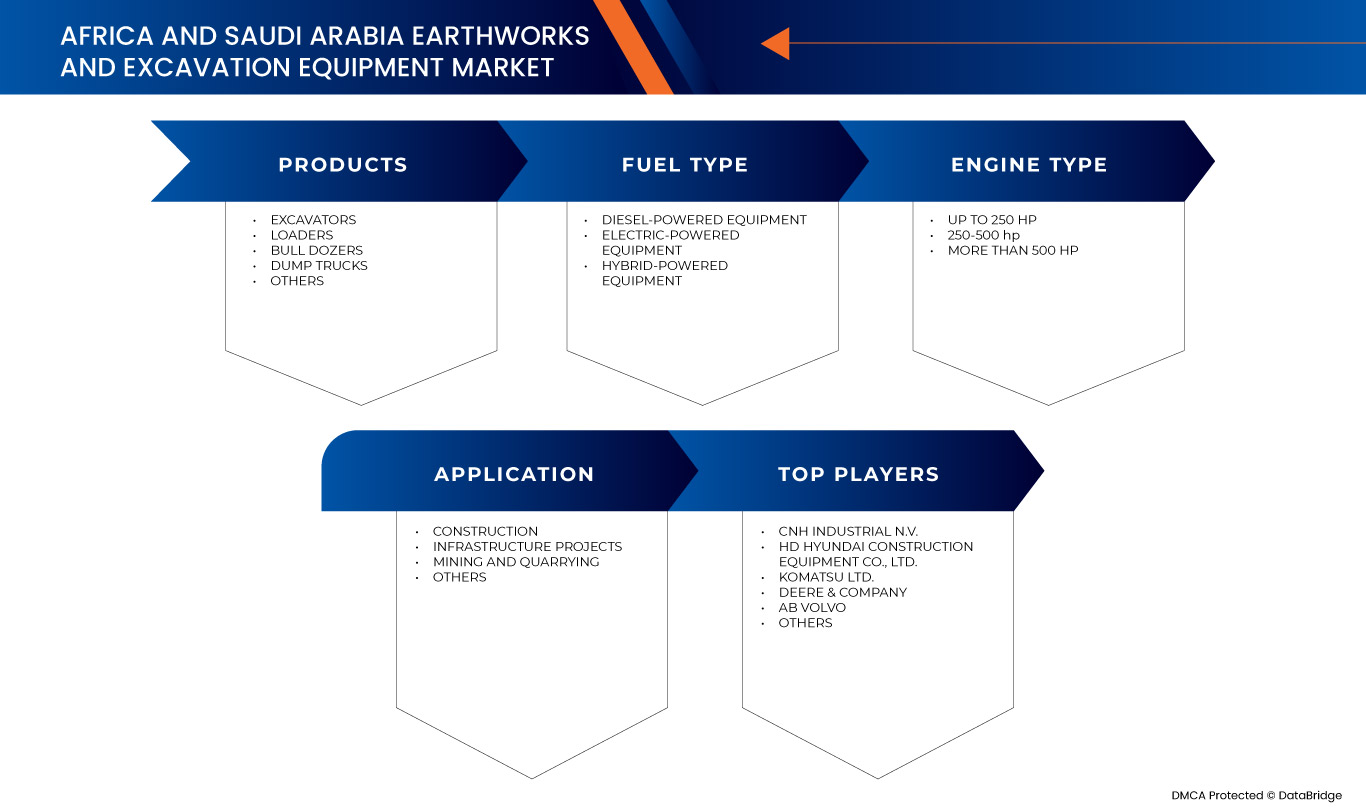

The market is segmented on the basis of products, fuel type, engine type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Products |

|

|

By Fuel Type |

|

|

By Engine Type |

|

|

By Application |

|

Earthworks and Excavation Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AB Volvo (Sweden)

- BEML LIMITED (India)

- Caterpillar (U.S.)

- CNH Industrial N.V. (U.K.)

- Deere & Company (U.S.)

- Doosan Corporation (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Hyundai Construction Equipment Co., Ltd. (South Korea)

- J C Bamford Excavators Ltd. (U.K.)

- Kobelco Construction Machinery Co. Ltd (Japan)

- Komatsu Ltd. (Japan)

- LIEBHERR (Switzerland)

- SANY Group (China)

- XCMG Group (China)

Latest Developments in Africa and Saudi Arabia Earthworks and Excavation Equipment Market

- In December 2025, YANMAR HOLDINGS CO., LTD. launched the ViO38-7 and ViO33-7, replacing the ViO38-6 and ViO33-6 with improved performance, efficiency, and operator comfort. These zero-tail swing excavators featured enhanced hydraulic systems, faster travel speeds, and compact dimensions for better maneuverability. The redesigned cabins offered a modern aesthetic, improved visibility, and greater comfort. This launch strengthened Yanmar’s product lineup, boosted competitiveness in urban and confined-space projects, enhanced customer satisfaction, and increased operational efficiency for end-users

- In February 2024, XCMG Group partnered with Tsingshan Group to invest 5.5 billion yuan (USD 852.85 million) in building the XCMG Tsingshan New Energy Industrial Base in Xuzhou. The base focuses on NEV development, batteries, and electric motor control systems. With projected annual sales of 10 billion yuan, the project strengthens XCMG’s position in the new energy vehicle market. This move enhances R&D, expands NEV production, and accelerates XCMG’s growth in sustainable transportation solutions

- In March 2025, Shantui Construction Machinery Co.,Ltd will showcase its cutting-edge innovations at Bauma 2025, the world’s leading construction machinery exhibition. With groundbreaking technological advancements and a focus on intelligent manufacturing, Shantui is shaping the future of the industry. This is an exciting opportunity to see how Shantui is pushing the limits of innovation and fostering global collaboration

- In October 2024, SANY Renewable Energy’s Arkalyk project in Kazakhstan was recognized at the Third Belt and Road Energy Ministerial Conference for its innovation and excellence. The company installed 10 SI-16848 wind turbines with a total capacity of 48 MW, which provided clean electricity and significantly reduced carbon emissions. This achievement boosted SANY’s reputation in global clean energy collaboration and supported its ongoing commitment to sustainable development and the green transition

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRODUCTS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES AFRICA

4.2 PORTER’S FIVE FORCES SAUDI ARABIA

4.3 SUPPLY CHAIN ANALYSIS OF THE AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.4 SUPPLY CHAIN ANALYSIS OF THE SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.5 TECHNOLOGICAL TRENDS IN AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.6 TECHNOLOGICAL TRENDS IN SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

5 REGULATORY STANDARD

5.1 AFRICA

5.2 SAUDI ARABIA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBAN GROWTH AND INFRASTRUCTURE EXPANSION

6.1.2 GROWING MINING AND CONSTRUCTION PROJECTS CONTINUE TO ACCELERATE MARKET DEMAND AND INDUSTRY GROWTH

6.1.3 RISING INVESTMENTS IN TRANSPORTATION INFRASTRUCTURE AND SMART CITIES

6.1.4 GROWING DEMAND FOR SMART AND AUTOMATED EQUIPMENT

6.2 RESTRAINTS

6.2.1 HIGH COST OF ADVANCED MACHINERY WITH AUTOMATION FEATURES

6.2.2 LIMITED INFRASTRUCTURE DEVELOPMENT IN UNDERDEVELOPED REGIONS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN ELECTRIC AND AUTONOMOUS CONSTRUCTION EQUIPMENT

6.3.2 INTEGRATION OF AI AND MACHINE LEARNING IN MACHINERY

6.3.3 DEMAND FOR MULTI-FUNCTIONAL AND COMPACT EQUIPMENT

6.4 CHALLENGES

6.4.1 HOLD-UPS IN GOVERNMENT PROJECT CLEARANCES AND FINANCIAL SUPPORT

6.4.2 STRICT REGULATORY COMPLIANCE AND SAFETY STANDARDS

7 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 EXCAVATORS

7.2.1 CRAWLER EXCAVATORS

7.2.2 MINI EXCAVATORS

7.2.3 WHEELED EXCAVATORS

7.2.4 LONG REACH EXCAVATORS

7.2.5 DRAGLINE EXCAVATORS

7.2.6 SKID STEER EXCAVATORS

7.2.7 SUCTION EXCAVATORS

7.3 LOADERS

7.3.1 WHEEL LOADERS

7.3.2 BACKHOE LOADERS

7.3.3 SKID STEER LOADERS

7.3.4 BULL DOZERS

7.4 DUMP TRUCKS

7.5 OTHERS

8 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE

8.1 OVERVIEW

8.2 DIESEL-POWERED EQUIPMENT

8.3 ELECTRIC-POWERED EQUIPMENT

8.4 HYBRID-POWERED EQUIPMENT

9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE

9.1 OVERVIEW

9.2 UP TO 250 HP

9.3 250-500 HP

9.4 MORE THAN 500 HP

10 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CONSTRUCTION

10.2.1 COMMERCIAL

10.2.2 RESIDENTIAL

10.3 INFRASTRUCTURE PROJECTS

10.4 MINING AND QUARRYING

10.5 OTHERS

11 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY

11.1 AFRICA AND SAUDI ARABIA

11.2 AFRICA

11.3 SAUDI ARABIA

12 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AFRICA

12.2 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HD HYUNDAI CONSTRUCTION EQUIPMENT CO.,LTD.

14.1.1 COMPA.NY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS/NEWS

14.2 CATERPILLAR

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 BRAND PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 KOMATSU LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 BUSINESS PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 AB VOLVO

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 J C BAMFORD EXCAVATORS LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 BEML LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CNH INDUSTRIAL N.V.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS/NEWS

14.8 DEERE & COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 DOOSAN BOBCAT

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 HITACHI CONSTRUCTION MACHINERY CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS/NEWS

14.12 LIEBHERR

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 SANY GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS/NEWS

14.14 SHANTUI CONSTRUCTION MACHINERY CO.,LTD (SUBSIDIARY OF SHANDONG HEAVY INDUSTRY GROUP)

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS/NEWS

14.15 XCMG GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 YANMAR HOLDINGS CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS/NEWS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY STANDARDS RELATED TO AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 2 REGULATORY STANDARDS RELATED TO SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 3 KEY NEW MINING PROJECTS IN AFRICA (2023)

TABLE 4 SAUDI ARABIA UPCOMING MEGAPROJECTS

TABLE 5 ADVANCED FEATURES HEAVY EQUIPMENT IN SAUDI ARABIA

TABLE 6 DIFFERENT-SIZED EXCAVATOR PRICES

TABLE 7 TOP BRAND EXCAVATOR PRICES

TABLE 8 REGULATORY COMPLIANCE & SAFETY STANDARDS

TABLE 9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 10 AFRICA AND SAUDI ARABIA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AFRICA AND SAUDI ARABIA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA AND SAUDI ARABIA CONSTRUCTION EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 AFRICA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 AFRICA CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 25 SAUDI ARABIA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 SAUDI ARABIA CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 2 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 11 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS (2024)

FIGURE 13 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBAN GROWTH AND INFRASTRUCTURE EXPANSION IS EXPECTED TO DRIVE THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 16 THE EXCAVATORS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 18 AFRICA’S INFRASTRUCTURE DEVELOPMENT INDEX

FIGURE 19 SAUDI ARABIA - CONSTRUCTION INDUSTRY (IN USD BILLION)

FIGURE 20 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY PRODUCTS, 2024

FIGURE 21 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY FUEL TYPE, 2024

FIGURE 22 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY ENGINE TYPE, 2024

FIGURE 23 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY APPLICATION, 2024

FIGURE 24 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

FIGURE 25 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

Africa And Saudi Arabia Earthworks And Excavation Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Africa And Saudi Arabia Earthworks And Excavation Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Africa And Saudi Arabia Earthworks And Excavation Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.