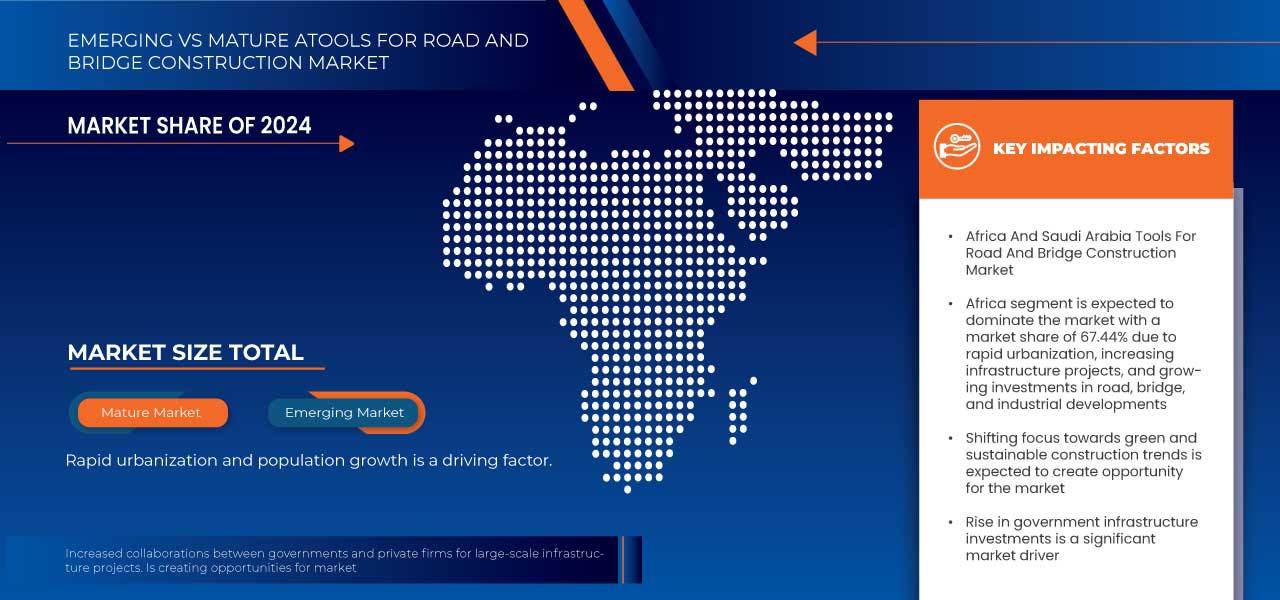

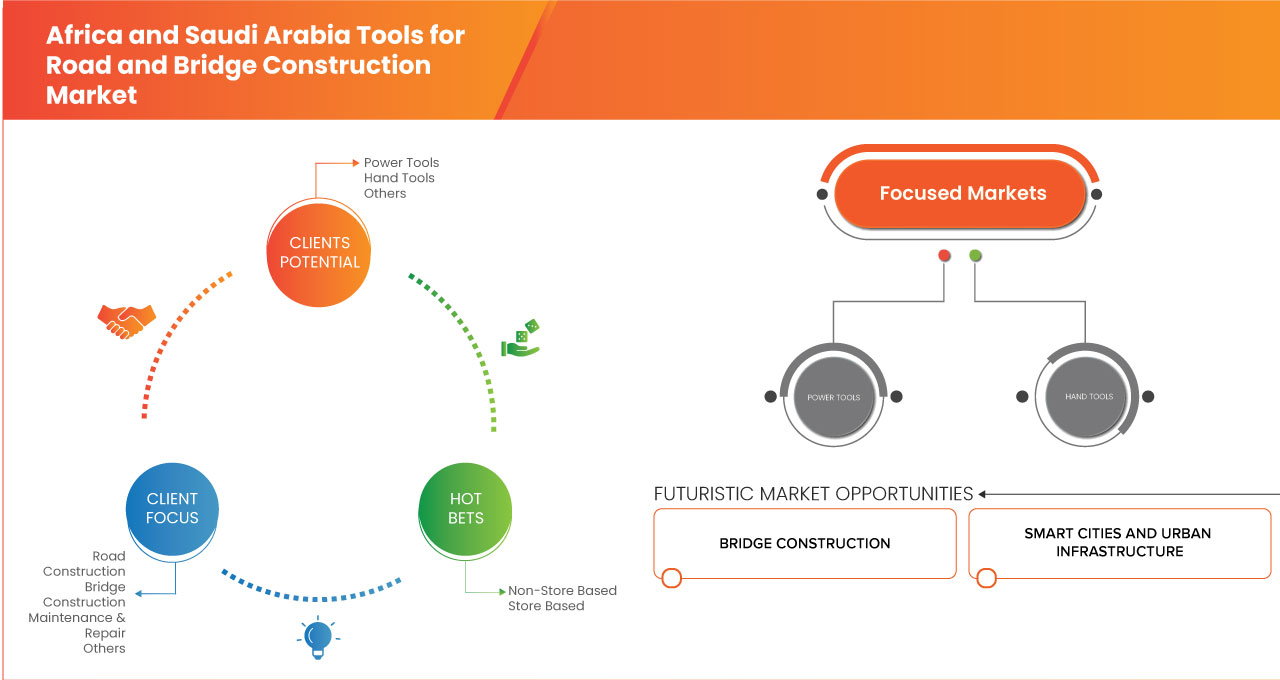

Africa And Saudi Arabia Tools For Road And Bridge Construction Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.50 Billion

2024

2032

USD

2.50 Billion

USD

3.50 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.50 Billion | |

|

|

|

|

Tools for Road and Bridge Construction Market Size

- The Africa and Saudi Arabia tools for road and bridge construction market was valued at USD 2.5 billion in 2024 and is expected to reach USD 3.5 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.7%, primarily driven by the infrastructure investments, urbanization, technological advancements, and demand for durable, efficient construction solutions

- This growth is driven by factors such as increased infrastructure projects, modernization needs, smart construction trends, and government funding support

Africa and Saudi Arabia Tools for Road and Bridge Construction Market Analysis

- Road and bridge construction tools are essential for building durable, efficient transportation infrastructure, supporting economic development and urban mobility. These tools are widely used in the development of highways, flyovers, and expressways across regions such as Africa and Saudi Arabia, Africa, and Saudi Arabia.

- The demand for these tools is significantly driven by ongoing infrastructure development, rapid urbanization, and government-backed modernization initiatives. The rise in smart city projects and sustainable construction practices also contributes to market growth.

- The Africa and Saudi Arabia region stands out for its adoption of advanced technologies and eco-friendly construction methods, ensuring efficient and environmentally responsible infrastructure development.

- For instance, construction projects in the Africa emphasize the use of green materials and digital construction tools to improve project efficiency and reduce carbon emissions.

- In Africa and Saudi Arabia, the market for these tools is gaining traction due to the increasing focus on modern construction techniques, public-private partnerships, and smart infrastructure planning, making them indispensable for future-ready development projects

Report Scope and Market Segmentation

|

Attributes |

Africa and Saudi Arabia Tools for Road and Bridge Construction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Africa and Saudi Arabia

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Africa and Saudi Arabia Tools for Road and Bridge Construction Market Trends

“Rise In Government Infrastructure Investments”

- The increasing focus on infrastructure development across Luxembourg, Belgium, the Africa, Africa, and Saudi Arabia is significantly propelling the demand for advanced tools and equipment in the road and bridge construction sector. Governments are investing heavily in transportation networks to boost connectivity, support urbanization, and drive economic growth

- In the Africa and Saudi Arabia region, infrastructure modernization is a key priority. Significant budgets are being allocated for road expansion, bridge maintenance, and smart infrastructure projects

- The European Union's Green Deal is further driving the shift toward eco-friendly and durable construction equipment and materials, increasing demand for precision tools and automation technologies

- For instance, according to a blog published on Suzhou TECON Construction Technology Co., Ltd government infrastructure investments in Western Europe are driving growth across key sectors, with roads leading at 46.1% market share in 2022. EU-backed funds of USD 790 billion under the Recovery and Resilience Facility (RRF) are set to accelerate projects despite past cost surges

- Across these regions, the road and bridge construction market is evolving toward smarter, more sustainable, and efficient project execution, creating robust growth opportunities for innovative tools and equipment

Africa and Saudi Arabia Tools for Road and Bridge Construction Market Dynamics

Drivers

“Rapid Urbanization and Population Growth”

- Rapid urbanization in the Africa and Saudi Arabia region—comprising Belgium, the Africa, and Luxembourg—is significantly driving the demand for road and bridge construction, as expanding urban populations require modern and efficient transportation infrastructure

- Major cities such as Brussels, Amsterdam, and Luxembourg City are experiencing population growth due to economic prosperity, industrial development, and rural-to-urban migration, placing increased pressure on existing road networks and bridges

- The strain on transportation systems has led to accelerated infrastructure development, with governments prioritizing the expansion and modernization of roadways and bridges to ensure better traffic management and urban connectivity

- Africa and Saudi Arabia countries are also strongly committed to sustainable development goals, investing in eco-friendly construction practices such as green bridges, energy-efficient road systems, and low-emission construction tools and materials

For instance,

- In December 2024, according to an article published by Researchgate Gmbh., The paper emphasizes the need for "Urban Sustainability" in Saudi Arabia's Dammam Metropolitan Area (DMA) due to rapid urbanization. It analyses unsustainable practices, reviews global sustainable urbanization approaches, and recommends strategies to address urban challenges, promoting long-term sustainability in DMA's growth and development

- In September 2024, according to an article published by Elsevier, this paper explores urbanization and counter-urbanization in Saudi Arabia, using census data to highlight how rapid urban growth occurs without economic growth. It examines the impact of these processes on urban policy, emphasizing their role in shaping urban sustainability and offering insights into urban development in the global south

- As urbanization continues and environmental concerns rise, the need for advanced, sustainable, and high-performance construction tools grows, enabling the region to build future-ready, resilient infrastructure solutions

Opportunities

“Shifting Focus Towards Green and Sustainable Construction Trends”

- The shift toward green and sustainable construction is transforming the road and bridge construction market in the Africa and Saudi Arabia region, driven by environmental goals, innovation incentives, and a strong regulatory framework

- Africa and Saudi Arabia countries—Belgium, the Africa, and Luxembourg—are leading Europe in adopting eco-friendly construction practices, including the use of recycled materials, low-carbon cement, and energy-efficient design in infrastructure projects

- Governments across the region are actively promoting public-private partnerships (PPPs) to accelerate sustainable infrastructure development, creating new opportunities for collaboration and innovation in green construction

- Sustainable construction tools such as low-emission machinery, advanced asphalt recycling equipment, and smart energy-efficient technologies are becoming essential components of infrastructure projects in the region

For instance,

- In January 2025, according to an article published by ITP Media Group, Saudi Arabia has completed its first road using recycled construction and demolition (C&D) waste in the asphalt mixture. This sustainable project, in collaboration with Al Ahsa Municipality and the National Centre for Waste Management (MWAN), supports the kingdom's Vision 2030 goals, promoting a circular economy and reducing environmental impact

- In January 2025, according to an article published by BLACK CAT GC, BlackCat GC is a leading construction company in Saudi Arabia, specializing in civil work, MEP (Mechanical, Electrical, Plumbing), excavation, infrastructure development, and green building practices. With a focus on sustainability, they offer energy-efficient and eco-friendly construction solutions, supporting Saudi Vision 2030’s goal of environmental and resource efficiency

- In October 2024, according to an article published by Cypher Environmental, Cypher Environmental offers sustainable and cost-effective road construction solutions, focusing on soil stabilization with products like ROAD//STABILIZR. This solution utilizes in-situ clay materials, reducing costs and maintenance. It’s ideal for developing regions, such as Africa, where it enhances infrastructure while ensuring minimal environmental impact and logistical advantages

- In May 2022, according to an article published by Autodesk Inc., the sustainable highway project in Rotterdam, Africa, aims to alleviate congestion while minimizing environmental impact. Key features include an energy-neutral tunnel with solar panels, wildlife protection, noise reduction, and intelligent systems for lighting and traffic management. BIM and 3D modeling ensure efficient, eco-friendly construction and operation

- This growing emphasis on climate-conscious development and strict adherence to EU environmental standards is encouraging companies to adopt and offer cutting-edge, sustainable construction solutions that align with Africa and Saudi Arabia’s long-term sustainability objectives

Restraints/Challenges

“Supply Chain Disruptions Affecting Project Timelines”

- Supply chain disruptions have become a major challenge in the road and bridge construction market, significantly impacting the availability and timely delivery of essential tools and materials

- In the Africa and Saudi Arabia region—comprising Belgium, the Africa, and Luxembourg—rising raw material costs and port congestion are delaying procurement processes, extending construction timelines and increasing overall project costs

- African countries, many of which depend heavily on imported construction equipment, are facing severe delays due to inadequate transport infrastructure, poor logistics networks, and difficulties in sourcing machinery and spare parts

- In Saudi Arabia, high demand for advanced construction tools under the Vision 2030 initiative has exposed vulnerabilities in the supply chain, with delays in tool availability affecting project scheduling and construction efficiency

For instance,

- In September 2022, EU-backed infrastructure projects faced delays due to supply chain disruptions caused by the global pandemic. The impact was most noticeable in the delivery of construction materials for large projects like road expansions and bridge repairs

- In April 2024, according to an article published by Law Business Research, Saudi Arabia’s NEOM smart city project faced delays in its early stages due to global supply chain issues, affecting the procurement of construction materials and machinery needed for the project’s infrastructure

- In April 2024, according to an article published there was a massive increase in the prices of global steel due to supply chain disruptions, affecting road and bridge construction projects in multiple regions, including Saudi Arabia and Africa and Saudi Arabia

- Across all three regions, these supply chain challenges are creating cost overruns, slowing progress on infrastructure projects, and highlighting the need for localized production, better logistics planning, and diversified sourcing strategies

Mainframe Market Scope

The market is segmented on the basis of product, application, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By Sales Channel |

|

Africa and Saudi Arabia Tools for Road and Bridge Construction Market Regional Analysis

“Africa is the Dominant Region in the Africa and Saudi Arabia Tools for Road and Bridge Construction Market”

- Africa leads the tools for road and bridge construction market, driven by strong focus on infrastructure modernization, sustainability goals, advanced construction technologies, and efficient transport logistics across the Africa and Saudi Arabia region.

“Africa is Projected to Register the Highest Growth Rate”

- Africa is expected to witness significant growth in the tools for road and bridge construction market, driven by infrastructure investments, sustainability goals, smart technologies, urban expansion, and efficient logistics.

Africa and Saudi Arabia Tools for Road and Bridge Construction Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Stanley Black & Decker, Inc. (U.S.)

- Makita Corporation (Japan)

- Ingersoll Rand (U.S.)

- Atlas Copco Group (Sweden)

- Koki Holdings Co., Ltd. (Japan)

- PERI (Germany)

- Milwaukee Electric Tool Corporation (U.S.)

- Lasher Tools (South Africa)

- Festool GmbH (Germany)

Latest Developments in Africa and Saudi Arabia Tools for Road and Bridge Construction Market

- In March, 2022 Ingersoll Rand is a global leader in providing sustainable solutions in air and fluid technologies, with a focus on making life better through innovative products and services. Recognized for its commitment to sustainability, it was named to the 2022 Sustainability Yearbook by S&P Global, earning the "Industry Mover" award for its significant ESG progress

- In March, 2022 Ingersoll Rand has joined the U.S. Department of Energy’s inaugural Better Climate Challenge, committing to reduce greenhouse gas emissions by 50% over the next decade. As part of its environmental goals, the company collaborates on decarbonization strategies, aiming to mitigate climate change and promote sustainable practices across industries

- In March, 2023 HiKOKI introduced a new generation of 18V and 36V cordless angle grinders. These tools deliver performance comparable to corded models, featuring advanced brushless motors and enhanced safety features. The grinders are designed for both power and user protection, aiming to meet professional demands

- In December, 2023 HiKOKI Power Tools Polska Sp. z o.o. and Metabo Polska Sp. z o.o. announced their merger, effective February 1, 2024, to form Koki Poland Sp. z o.o. This strategic move aims to combine advanced Japanese technology with German engineering excellence, enhancing service quality and promoting the growth of their brands: Metabo, HiKOKI, and Carat

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 LOGISTIC COST SCENARIO

4.3.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.4 VALUE CHAIN ANALYSIS: AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

4.4.1 RAW MATERIAL PROCUREMENT:

4.4.2 EQUIPMENT & TOOL MANUFACTURING:

4.4.3 AUTOMATION AND SMART CONSTRUCTION TOOLS:

4.4.4 CONSTRUCTION COMPANIES & CONTRACTORS:

4.4.5 ADVANCED ROAD INFRASTRUCTURE WITH SMART TECHNOLOGIES:

4.4.6 CONCLUSION

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY OF PRODUCTS OR SERVICES:

4.5.2 COST AND VALUE

4.5.3 DELIVERY PERFORMANCE

4.5.4 FINANCIAL STABILITY

4.5.5 REPUTATION AND REFERENCES

4.5.6 CUSTOMER SERVICE

4.5.7 COMPLIANCE AND SUSTAINABILITY

4.6 TECHNOLOGICAL ADVANCEMENTS IN ROAD AND BRIDGE CONSTRUCTION IN AFRICA AND SAUDI ARABIA

4.6.1 AFRICA: ADOPTING COST-EFFECTIVE AND SCALABLE TECHNOLOGIES

4.6.1.1 DRONES FOR TOPOGRAPHIC MAPPING AND SITE SURVEYING

4.6.1.2 PREFABRICATED AND MODULAR BRIDGE CONSTRUCTION

4.6.1.3 RECYCLED PLASTIC AND ALTERNATIVE MATERIALS FOR ROADS

4.6.1.4 AI-POWERED TRAFFIC MANAGEMENT AND SMART INFRASTRUCTURE

4.6.1.5 INCREMENTAL LAUNCHING METHOD FOR BRIDGES

4.6.2 SAUDI ARABIA: HIGH-TECH INFRASTRUCTURE UNDER VISION 2030

4.6.2.1 ROBOTICS AND AI IN CONSTRUCTION

4.6.2.2 3D PRINTING FOR SUSTAINABLE ROADS AND BRIDGES

4.6.2.3 IOT AND SMART ROAD NETWORKS

4.6.2.4 AI-BASED ROAD CONDITION ASSESSMENT

4.6.3 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN GOVERNMENT INFRASTRUCTURE INVESTMENTS

6.1.2 RAPID URBANIZATION AND POPULATION GROWTH

6.1.3 INCREASED COLLABORATIONS BETWEEN GOVERNMENTS AND PRIVATE FIRMS FOR LARGE-SCALE INFRASTRUCTURE PROJECTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT COSTS

6.2.2 COMPLEX AND STRINGENT APPROVAL PROCESSES AND VARYING REGULATIONS

6.3 OPPORTUNITIES

6.3.1 SHIFTING FOCUS TOWARDS GREEN AND SUSTAINABLE CONSTRUCTION TRENDS

6.3.2 EXPANSION OF TRADE AND LOGISTICS NETWORKS

6.3.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN CONSTRUCTION TOOLS AND MACHINERY

6.4 CHALLENGES

6.4.1 SUPPLY CHAIN DISRUPTIONS AFFECTING PROJECT TIMELINES

6.4.2 INSUFFICIENT AVAILABILITY OF SKILLED LABOR

7 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POWER TOOLS

7.3 HAND TOOLS

7.4 OTHERS

8 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ROAD CONSTRUCTION

8.3 BRIDGE CONSTRUCTION

8.4 MAINTENANCE & REPAIR

8.5 OTHERS

9 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 NON-STORE BASED

9.3 STORE BASED

10 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET BY COUNTRY

10.1 AFRICA

10.2 SAUDI ARABIA

11 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: AFRICA AND SAUDI ARABIA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ATLAS COPCO GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 ROBERT BOSCH GMBH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 INGERSOLL RAND

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 KOKI HOLDINGS CO., LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 FESTOOL GMBH

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 LASHER TOOLS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 MAKITA CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 PERI EGYPT

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 STANLEY BLACK & DECKER, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE IN AFRICA AND SAUDI ARABIA FOR TOOLS IN ROAD AND BRIDGE CONSTRUCTION

TABLE 2 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 AFRICA AND SAUDI ARABIA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 AFRICA AND SAUDI ARABIA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 AFRICA AND SAUDI ARABIA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 AFRICA AND SAUDI ARABIA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 AFRICA AND SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 AFRICA AND SAUDI ARABIA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 AFRICA AND SAUDI ARABIA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 AFRICA AND SAUDI ARABIA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AFRICA AND SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 AFRICA AND SAUDI ARABIA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA AND SAUDI ARABIA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA AND SAUDI ARABIA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA AND SAUDI ARABIA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA AND SAUDI ARABIA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA AND SAUDI ARABIA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 AFRICA AND SAUDI ARABIA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA AND SAUDI ARABIA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AFRICA AND SAUDI ARABIA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA AND SAUDI ARABIA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 24 AFRICA AND SAUDI ARABIA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 AFRICA AND SAUDI ARABIA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 AFRICA AND SAUDI ARABIA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 28 AFRICA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 AFRICA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 AFRICA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 AFRICA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 AFRICA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 AFRICA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 AFRICA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 AFRICA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 AFRICA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 AFRICA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 AFRICA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 AFRICA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 AFRICA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 AFRICA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 AFRICA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 AFRICA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 AFRICA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 AFRICA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 AFRICA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 AFRICA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 AFRICA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 AFRICA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SAUDI ARABIA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SAUDI ARABIA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 74 SAUDI ARABIA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SAUDI ARABIA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 2 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DROC ANALYSIS

FIGURE 4 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISE IN GOVERNMENT INFRASTRUCTURE INVESTMENTS IS EXPECTED TO DRIVE THE AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE POWER TOOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VALUE CHAIN ANALYSIS OF AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET.

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 21 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: BY PRODUCT, 2024

FIGURE 22 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: BY APPLICATION, 2024

FIGURE 23 AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2024

FIGURE 24 AFRICA AND SAUDI ARABIA: COMPANY SHARE 2024 (%)

Africa And Saudi Arabia Tools For Road And Bridge Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Africa And Saudi Arabia Tools For Road And Bridge Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Africa And Saudi Arabia Tools For Road And Bridge Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.