Africa Pharmaceutical Molecules Market

Market Size in USD Million

CAGR :

%

USD

13,480.00 Million

USD

26,715.53 Million

2024

2032

USD

13,480.00 Million

USD

26,715.53 Million

2024

2032

| 2025 –2032 | |

| USD 13,480.00 Million | |

| USD 26,715.53 Million | |

|

|

|

|

Africa Pharmaceutical Molecules Market Analysis

The history of the African pharmaceutical molecules market has evolved significantly, marked by key shifts in manufacturing capabilities and healthcare needs. During the colonial era, Africa largely depended on imported pharmaceutical products, with traditional medicine playing a dominant role. After many nations gained independence in the 1960s, there was an increasing push to establish local pharmaceutical manufacturing, although political instability and limited infrastructure hindered growth. By the 1980s and 1990s, countries such as South Africa, Egypt, and Kenya started developing local production capabilities, particularly for generic drugs, with a focus on affordable medications as health crises such as HIV/AIDS escalated. The early 2000s saw further growth, spurred by public-private partnerships and foreign investments, as well as the establishment of regional initiatives such as the African Medicines Regulatory Harmonization (AMRH) to standardize regulations. Today, the market continues to expand, with key players such as South Africa, Egypt, Morocco, and Nigeria leading in local production, though challenges such as regulatory differences and access to raw materials remain.

Africa Pharmaceutical Molecules Market Size

The Africa pharmaceutical molecules market is expected to reach USD 26,715.53 million by 2032 from USD 13,480.00 million in 2024, growing at a CAGR of 9.03% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Africa Pharmaceutical Molecules Market Trends

“Growth of Generic Drug Production and Local Manufacturing”

One of the significant trends in Africa's pharmaceutical molecules market is the increasing focus on generic drug production and the expansion of local manufacturing capabilities. This shift is driven by the rising demand for affordable medications, particularly for the treatment of chronic diseases such as HIV/AIDS, malaria, and tuberculosis, which are prevalent in many African countries. In response to this demand, African governments have been promoting local pharmaceutical manufacturing to reduce dependence on expensive imports and improve access to essential medicines. Countries such as South Africa, Egypt, and Nigeria have become regional leaders in pharmaceutical manufacturing, with more companies establishing facilities to produce generic versions of patented drugs. This trend not only helps improve the availability and affordability of critical medications but also fosters economic growth and job creation within the pharmaceutical sector. In addition, it has spurred the establishment of regulatory frameworks to ensure the quality and safety of locally produced medicines, further strengthening the industry.

Report Scope and Africa Pharmaceutical Molecules Market Segmentation

|

Attributes |

Africa Pharmaceutical Molecules Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Angola, Botswana, Eswatini (Formerly Swaziland), Lesotho, Malawi, Dr Congo (Kinshasa), Namibia, Madagascar, Mauritius, Seychelles, Comoros, Tanzania, South Africa, Zambia, Zimbabwe, Mozambique, Eritrea, Djibouti, Somalia, Kenya, Burundi, Rwanda, Uganda, South Sudan, Sudan, Ethiopia, Gabon, Congo (Brazzaville), Central Africa Republic, Guinea Equatorial, Cameroun, Chad, Burkina Faso, Niger, Nigeria, Togo, Guinea Bissau, Guinea Republic, Senegal, Sierra Leone, Liberia, Cote D'ivoire, Ghana, Mali, Cape Verde, and Mauritania |

|

Key Market Players |

Adcock Ingram (South Africa), Advacare Pharma (U.S.), AstraZeneca (U.K.), BAYER AG (Germany), Boehringer Ingelheim International GmbH (Germany), Cipla (India), F.Hoffmann-La Roche Ltd (Switzerland), Ferring (Switzerland), GSK plc. ( U.K.), Johson & Johnson Services, Inc. (U.S.), MERCK KGAA (Germany), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Pharma Dekho plc (Nigeria), SANOFI (France), Sun Pharmaceutical Industries Ltd. ( India), and swiss pharma Nigeria limited (Nigeria) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Africa Pharmaceutical Molecules Market Definition

Pharmaceutical molecules are chemical or biological substances that serve as active ingredients in medications, playing a crucial role in diagnosing, treating, preventing, or managing diseases and medical conditions. These molecules can be synthetic, semi-synthetic, or naturally derived compounds designed to interact with specific biological targets such as proteins, enzymes, or receptors within the body to produce a desired therapeutic effect. The development of pharmaceutical molecules involves extensive research, including drug discovery, optimization, and clinical testing, to ensure safety, efficacy, and stability before regulatory approval.

Africa Pharmaceutical Molecules Market Dynamics

Drivers

- Regulatory Improvements Create Favorable Market Environments

Regulatory improvements have become a significant driver in the growth of the African pharmaceutical molecules market. Over the past decade, various countries across the continent have strengthened their regulatory frameworks, establishing clearer, more efficient processes for drug approval, distribution, and safety monitoring. This shift has led to increased investor confidence, encouraging both local and international pharmaceutical companies to enter the market with innovative molecules and therapies. As governments continue to align their regulations with international standards, the speed at which new drugs expected to introduced to the market is improving, reducing delays and ensuring that essential medicines reach consumers more quickly. Moreover, stronger regulatory systems have enhanced the quality and safety of pharmaceutical products, building public trust and further stimulating market demand. These changes are also fostering partnerships between local authorities and global pharmaceutical companies, which boosts both local production capabilities and access to advanced medicines.

Furthermore, many African nations have implemented harmonized regulatory processes through regional bodies such as the African Medicines Agency (AMA), which facilitates collaboration between countries and ensures that drug standards are consistent across borders. This streamlining has made it easier for pharmaceutical companies to expand their market reach within the region, promoting cross-border trade of pharmaceutical molecules. As regulatory bodies become more transparent and efficient, international stakeholders are increasingly looking to Africa as a viable and growing market for investment. These improvements not only boost local manufacturing but also create opportunities for African countries to establish themselves as competitive players in the global pharmaceutical industry.

For instance,

- In September 2021, according to the article published by Purdue University, Improving Africa's regulatory landscape requires strengthening licensing systems, enhancing product registration, and implementing robust market control mechanisms. Establishing pharmacovigilance programs, improving clinical trial oversight, and ensuring better communication and transparency are essential. In addition, investing in trained staff, sustainable funding, and modern infrastructure will significantly elevate National Medicines Regulatory Authorities' effectiveness

- In August 2021, according to the article published by NCBI, the East African Community's Medicines Regulatory Harmonization (MRH) initiative, launched in 2012, aims to improve access to safe, quality medicines by simplifying regulatory processes while maintaining rigor. Key future actions include drug safety monitoring, regional technical officers, Cooperation Framework Agreements, sustainable funding, and broadening the scope of medical products

In February 2023, according to the article published by matrix4prevention, WHO recognized Nigeria's National Regulatory Agencies with a stable, well-functioning, and integrated regulatory system at level 3 on the Global Benchmarking Tool. Tanzania, Ghana, Nigeria, and Egypt have achieved ML3 status, marking effective regulatory systems. Less than 30% of global regulatory authorities are fully functioning and operational

Regulatory improvements in Africa have streamlined drug approval and safety processes, boosting investor confidence and market access. Harmonized regulations through bodies such as the African Medicines Agency promote cross-border trade and faster drug introduction. These reforms enhance product quality, foster local manufacturing, and position Africa as a competitive pharmaceutical market.

- Advancements in Technology Enhance Healthcare Service Delivery

Technology and digital health solutions are driving the growth of the Africa Pharmaceutical Molecules Market by improving healthcare access and efficiency. Mobile health (mHealth) apps and telemedicine have made healthcare more accessible, especially in remote areas, allowing patients to consult doctors, track conditions, and adhere to treatments. In addition, Artificial Intelligence (AI) in drug discovery accelerates the development of targeted therapies, while digital tools such as blockchain enhance supply chain management, reducing counterfeit drugs and improving distribution. These technological advancements are making healthcare more efficient, boosting the demand for pharmaceuticals, and contributing to the overall growth of the pharmaceutical market in Africa.

The adoption of technology and digital health solutions is also helping overcome significant barriers in the healthcare system, such as a shortage of healthcare professionals and infrastructure challenges. Telemedicine allows doctors in urban areas to remotely consult with patients in rural regions, expanding access to specialized care. Mobile technologies enable health monitoring and real-time communication between patients and healthcare providers, reducing delays in treatment. Furthermore, digital platforms are improving data collection and analysis, leading to better-informed decisions in drug development, regulatory processes, and public health strategies. These advancements are fostering a more responsive and sustainable healthcare system, further supporting the growth of the pharmaceutical market across the continent.

For instance,

- In December 2023, according to the article published by Newtown partners, the pharmaceutical market is undergoing a transformation as technology and digital health solutions take center stage. With the rise of health tech startups, e-commerce models, and home delivery services, patients in remote areas can now access essential medications, creating new opportunities for innovation and growth in the pharmaceutical sector

- In February 2024, according to the article published by IQVIA, the rise of digital health solutions and local vaccine production. Technologies such as telemedicine, AI-driven diagnostics, and mobile health platforms are expanding access to healthcare, addressing challenges such as infrastructure limitations and improving the quality of care across the continent

Technology and digital health solutions, such as mHealth apps, telemedicine, and AI in drug discovery, are driving Africa's pharmaceutical market growth. These innovations improve healthcare access, efficiency, and supply chain management. They overcome infrastructure challenges, enhance patient care, and support faster drug development, fostering a more responsive, sustainable healthcare system

Opportunities

- Government And Foreign Investments Promoting Pharmaceutical Industry Growth

Increasing government and foreign investments present significant opportunities for the growth of Africa's pharmaceutical molecules market. Governments across the continent are recognizing the strategic importance of building a self-sustaining pharmaceutical industry and are implementing policies that encourage both local and foreign investments. These include offering tax incentives, reducing import duties on raw materials, and improving regulatory frameworks to create a favorable business environment. As a result, many multinational pharmaceutical companies are establishing manufacturing facilities and partnerships in African countries, drawn by the promise of a growing consumer base, economic diversification, and access to emerging markets. This influx of foreign capital is also boosting the development of local pharmaceutical production capabilities, particularly in the production of active pharmaceutical ingredients (APIs) and generic medicines, which are essential to reducing healthcare costs and improving access to treatments.

Furthermore, government-backed initiatives and public-private partnerships are fostering innovation and expanding R&D capabilities. This combination of local and international investments is not only strengthening Africa's pharmaceutical manufacturing sector but also improving the continent’s healthcare infrastructure. As these investments continue to rise, they present a promising opportunity to meet Africa's growing healthcare demands, reduce dependency on imports, and create a more resilient and competitive pharmaceutical market.

For instance,

- In November 2023, according to the article published by Prosper-Africa Increasing government and foreign investments in Africa’s pharmaceutical sector are essential for building local production capacity, strengthening supply chains, and improving healthcare resilience. Investment in diagnostics and healthtech will enhance disease management, while technology-driven healthcare improvements boost asset productivity, ensuring sustainable, efficient healthcare systems across the continent

Increasing government and foreign investments are driving Africa's pharmaceutical market growth. Policies supporting local and foreign investments, along with tax incentives and improved regulations, are fostering manufacturing capabilities, particularly in APIs and generic medicines. These investments are boosting R&D, strengthening healthcare infrastructure, and reducing dependency on imports, creating a competitive pharmaceutical sector.

- Strengthening Collaboration Between Public-Private Sector Partnerships

Public-private partnerships (PPPs) present a powerful opportunity for the growth of Africa’s pharmaceutical molecules market, fostering collaboration between governments, private companies, and international organizations to address the continent’s healthcare challenges. By pooling resources, expertise, and infrastructure, PPPs can significantly accelerate the development of local pharmaceutical manufacturing, reducing reliance on imported medicines and improving access to essential treatments. Governments benefit from the expertise and efficiency of the private sector, while private companies gain from favorable policies, financial incentives, and access to large markets. These partnerships can lead to the establishment of state-of-the-art manufacturing facilities, the production of affordable generic medicines, and the development of essential drugs tailored to meet local health needs.

Moreover, PPPs facilitate the expansion of research and development (R&D) initiatives, enabling the creation of region-specific treatments for diseases prevalent in Africa, such as malaria, tuberculosis, and HIV. They also improve regulatory frameworks and create training programs to build local expertise in the pharmaceutical sector. As African governments increasingly prioritize healthcare and economic diversification, the growing number of public-private collaborations offers a promising pathway to strengthen the continent’s pharmaceutical market, ensuring a more sustainable, competitive, and self-reliant healthcare ecosystem.

For instance,

- In February 2021, according to the article published by Public-private partnerships (PPPs) in Africa's pharmaceutical sector are driving scientific advancement and addressing public health challenges. Collaborations between governments, academic institutions, and pharmaceutical companies foster drug discovery, data integration, and machine learning models. These partnerships are crucial for advancing treatments in neglected diseases, cancer, and neurological disorders across the continent

- In September 2024, according to the article published by Africa's pharmaceutical market leverage private sector innovation and funding with public sector incentives to overcome challenges such as high development costs. By aligning efforts and resources, PPPs improve operational efficiency, accelerate research, and enhance infrastructure, boosting drug discovery and delivery in an economically diverse, sustainable manner

- In October 2022, according to the article published by African development bank group, pivotal in expanding Africa's $1.3Bn vaccine market, which accounts for 25% of global public volumes. Through collaborations with organizations such as Gavi and UNICEF, PPPs drive increased access, demographic shifts, and innovative vaccine technologies, ensuring long-term contracts and sustainable growth in the sector

Public-private partnerships (PPPs) are driving Africa's pharmaceutical market growth by combining resources, expertise, and infrastructure. These collaborations promote local manufacturing, reduce import reliance, and improve access to treatments. PPPs also boost R&D, create region-specific medicines, and enhance regulatory frameworks, fostering a more sustainable, competitive, and self-reliant healthcare system.

Restraints/Challenges

- High Costs of Pharmaceutical Molecules Production

The high cost of pharmaceuticals remains a significant challenge for the African pharmaceutical molecules market, hindering access to essential medicines and placing a heavy burden on both patients and healthcare systems. Many African countries rely heavily on imported medicines, which are often expensive due to tariffs, transportation costs, and currency fluctuations. This reliance on imports also limits competition, keeping prices high and making it difficult for lower-income populations to afford necessary treatments. The high cost of branded drugs, particularly for chronic disease management and specialized treatments, exacerbates this issue. Furthermore, while there is a growing market for generic medicines, many local manufacturers struggle with limited production capacities, regulatory barriers, and insufficient infrastructure to meet demand at affordable prices. In addition, the cost of raw materials for drug production, especially active pharmaceutical ingredients (APIs), can be high, further driving up production costs.

These challenges create a significant gap in healthcare access, particularly in rural areas where healthcare infrastructure is already limited. Addressing the high cost of pharmaceuticals requires strengthening local manufacturing capabilities, improving supply chain efficiency, and encouraging government policies that promote the production of affordable, high-quality medicines. Overcoming these challenges is crucial to improving healthcare outcomes and ensuring equitable access to medicines across Africa.

For instance,

- In November 2022, according to the article published by Institute For Economic Justice ,the high costs of pharmaceutical molecule production in Ghana stem from various factors, including a lack of qualified personnel, higher raw material and transport costs, expensive machinery, elevated interest rates on loans, high utility charges, and insufficient collaboration between local research institutions and manufacturers for R&D-driven production

- In July 2021, according to the article published by NCBI, Rising pharmaceutical costs are a significant driver of increasing healthcare expenses in Africa, where access to affordable drugs remains a challenge. The global trend of escalating pharmaceutical expenditures, projected to reach $1.5 trillion in 2023, directly impacts African nations, placing further strain on healthcare systems and affordability for local populations

High pharmaceutical costs in Africa, driven by import reliance, tariffs, and limited local manufacturing, hinder access to essential medicines. This issue is exacerbated by expensive branded drugs and inadequate infrastructure. Strengthening local production, improving supply chains, and supportive government policies are key to reducing costs and improving healthcare access across the continent.

- Limited Skilled Workforce in Pharmaceutical Industry

The lack of a skilled workforce remains a significant challenge for the growth of Africa's pharmaceutical molecules market, impeding the development of a robust and self-sustaining pharmaceutical industry. While demand for medicines continues to rise across the continent, there is a shortage of qualified professionals in key areas such as pharmaceutical manufacturing, research and development (R&D), quality control, and regulatory affairs. This skills gap limits the ability of local pharmaceutical companies to meet international standards, hindering their ability to produce high-quality, competitive medicines. In addition, the absence of a strong scientific and technical workforce slows the progress of drug discovery and innovation, particularly for diseases that are endemic to the region. The shortage of skilled labor also impacts the efficient operation of manufacturing facilities, leading to delays, increased costs, and reliance on imported expertise.

To address this challenge, there is a need for increased investment in education, vocational training programs, and partnerships with international organizations to build local capacity. Expanding training opportunities for scientists, engineers, and technicians will not only strengthen the pharmaceutical sector but also drive economic growth by fostering a skilled workforce capable of supporting the production and innovation of medicines tailored to Africa's specific healthcare needs.

For instance,

- In July 2024, according to the article published by WHO, the African pharmaceutical market faces a critical shortage of skilled professionals, including pharmacists, biomedical engineers, and chemists, with insufficient industrial and regulatory training available. This lack of a skilled workforce hinders the growth of local manufacturing, distribution, and regulatory systems, emphasizing the need for government investment in workforce development

- In January 2024, according to the article published by The lack of skilled workers across African markets undermines growth prospects for healthcare firms. This shortage of technical expertise, particularly in manufacturing and regulatory processes, creates significant challenges for investment in the pharmaceutical sector, limiting capacity building and hindering the region's ability to develop a robust local healthcare industry

The shortage of skilled professionals in Africa’s pharmaceutical sector, particularly in manufacturing, R&D, and regulatory affairs, hampers industry growth. This skills gap limits local production capacity and innovation. Addressing this challenge requires investment in education, vocational training, and international partnerships to develop a capable workforce and improve pharmaceutical self-sufficiency.

Africa Pharmaceutical Molecules Market Scope

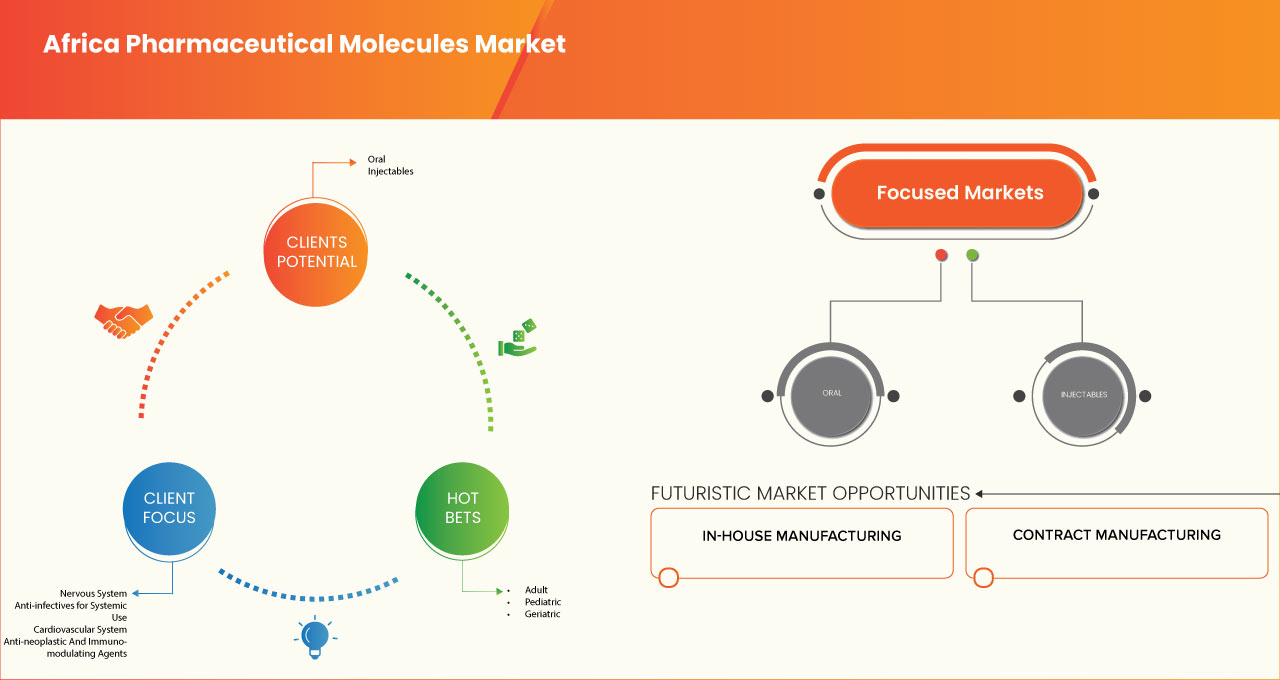

The market is segmented seven notable segments based on type, dosage form, potency, manufacturing method, age group, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Nervous System

- Paracetamol Solution For Infusion

- Escitalopram Film-Coated Tablets

- 20 Mg

- 5 Mg

- 10 Mg

- Pregabalin Capsules

- Gabapentin Tablet And Capsules

- Gabapentin Film-Coated Tablets

- 800 Mg

- 600 Mg

- Gabapentin Capsules

- 400 Mg

- 300 Mg

- 100 Mg

- Gabapentin Film-Coated Tablets

- Sertraline Film-Coated Tablets

- 100 Mg

- 50 Mg

- Aripiprazole Tablets

- Aripiprazole Tablets (Various Strengths)

- Aripiprazole Orodispersible Tablets (Various Strengths)

- Olanzapine Film-Coated Tablets

- Risperidone Tablets 1mg

- Donepezil Film-Coated Tablets

- 10 Mg

- 5 Mg

- Lorazepam Film-Coated Tablets

- Atomoxetine Tablet And Solution

- Atomoxetine Tablets (Various Strengths)

- Atomoxetine Oral Solution

- Mirtazapine Film-Coated Tablets

- Levetiracetam

- Levetiracetam Film-Coated Tablets

- Levetiracetam Oral Syrup (Various Strengths)

- Topiramate Film-Coated Tablets

- Memantine Film-Coated Tablets

- 20 Mg

- 5 Mg

- 10 Mg

- Cinnarizine + Dimenhydrinate Film-Coated Tablets

- Oxcarbazepine Tablets

- 600 Mg

- 300 Mg

- Vortioxetine Film-Coated Tablets

- Lacosamide Tablets

- 200 Mg

- 150 Mg

- 100 Mg

- 50 Mg

- Lacosamide Syrup

- Anti-Infectives For Systemic Use

- Azithromycin Powder For Solution For Infusion: 500mg

- Levofloxacin Film-Coated Tablets

- 500mg

- 250mg

- Fluconazole Capsule

- 150 Mg

- 50 Mg

- 200 Mg

- Others

- Valaciclovir Film-Coated Tablets

- 500 Mg

- 1000 Mg

- Tigecycline Powder For Solution For Infusion: 5mg/5ml

- Cardiovascular System

- Amlodipine Tablets

- 5 Mg

- 10 Mg

- Atorvastatin Film-Coated Tablets

- 10 Mg

- 20 Mg

- 40 Mg

- Losartan

- Losartan Film-Coated Tablets

- Losartan + Hctz Film-Coated Tablets

- Rosuvastatin Film-Coated Tablets

- 10 Mg

- 20 Mg

- 5 Mg

- Valsartan Film-Coated Tablets

- 80 Mg

- 160 Mg

- 40 Mg

- 120 Mg

- Carvedilol Tablets

- 6.25 Mg

- 25 Mg

- Irbesartan

- Irbesartan Film-Coated Tablets

- 150 Mg

- 75 Mg

- 300 Mg

- Irbesartan + Hctz Film-Coated Tablets

- 300 Mg+12.5 Mg

- 150 Mg+12.5 Mg

- 300 Mg+25 Mg

- Irbesartan Film-Coated Tablets

- Chlortalidone Tablets

- 12.5 Mg

- 25 Mg

- 50 Mg

- Ezetimibe

- Ezetimibe + Simvastatin Film-Coated

- 10 Mg + 10 Mg

- 10 Mg + 20 Mg

- 10 Mg + 40 Mg

- Ezetimibe + Rosuvastatin Capsule

- 10 Mg + 10 Mg

- 10 Mg + 20 Mg

- 10 Mg + 5 Mg

- Ezetimibe Film-Coated Tablets

- 25 Mg

- 50 Mg

- Ezetimibe + Simvastatin Film-Coated

- Perindopril + Indapamide Tablets

- 4 Mg + 1.25 Mg

- 8 Mg + 2.5 Mg

- 2 Mg + 0.625 Mg

- Telmisartan Tablets

- 20 Mg

- 40 Mg

- 80 Mg

- Pitavastatin Film-Coated Tablets

- 4 Mg

- 2 Mg

- 1 Mg

- Sildenafil Film-Coated Tablets (20mg)

- Valsartan + Hydrochlorothiazide (Hctz) Tablets

- 360 Mg + 25 Mg

- 80 Mg + 12.5 Mg

- 160 Mg + 25 Mg

- 160 Mg + 12.5 Mg

- 320 Mg + 12.5 Mg

- Eplerenone Film-Coated Tablets

- 25 Mg

- 50 Mg

- Macitentan Film-Coated Tablets (10mg)

- Amlodipine Tablets

- Anti-Neoplastic And Immunomodulating Agents

- Abiraterone

- 250mg

- 500mg

- Tamoxifen

- 10 Mg

- 20 Mg

- Bicalutamide

- 50 Mg

- 150 Mg

- Lenalidomide

- Bortezomib

- Mycophenolate Mofetil

- Sunitinib

- Letrozole

- Palbociclib

- Teriflunomide

- 7 Mg

- 14 Mg

- Dimethyl Fumarate

- Leflunomide

- 10 Mg

- 20 Mg

- Pirfenidone

- Pomalidomide

- Fingolimod

- Abiraterone

- Alimentary Tract & Metabolism

- Sitagliptin Tablets

- Sitagliptin Film-Coated Tablets (Various Strengths)

- Sitagliptin + Metformin Film-Coated Tablets (Various Combinations)

- Empagliflozin Tablets

- Empagliflozin Film-Coated Tablets

- 10 Mg

- 25 Mg

- Empagliflozin + Metformin Film-Coated Tablets (Various Combinations)

- Empagliflozin Film-Coated Tablets

- Empagliflozin + Linagliptin Tablets (Various Combinations)

- Dapagliflozin Tablets

- 10 Mg

- 5 Mg

- Ondansetron Injection – 4mg/8mg

- Vildagliptin Tablets – 50mg

- Pantoprazole Injection – 40mg

- Pioglitazone Tablets

- Pioglitazone Tablets Various Strengths

- Pioglitazone + Metformin Coated Tablets (Various Combinations)

- Esomeprazole Injection – 40mg

- Canagliflozin Tablets

- Canagliflozin Film-Coated Tablets

- 300 Mg

- 100 Mg

- Canagliflozin + Metformin Film-Coated Tablets (Various Combinations)

- Canagliflozin Film-Coated Tablets

- Acarbose Tablets

- 50mg

- 100mg

- Sitagliptin Tablets

- Musculo-Skeletal System

- Etoricoxib Film-Coated Tablets

- Celecoxib Capsules

- 100 Mg

- 200 Mg

- Alendronic Acid Film-Coated Tablets 70 Mg

- Febuxostat Film-Coated Tablets

- 80 Mg

- 120 Mg

- Ibandronic Acid Film-Coated Tablets 150 Mg

- 50 Mg

- 150 Mg

- Genito-Urinary System And Sex Hormones

- Sildenafil Film-Coated Tablets

- Tadalafil Film-Coated Tablets

- Finasteride Film-Coated Tablets

- Silodosin Film-Coated Tablets

- 8mg

- 4mg

- Solifenacin Film-Coated Tablets

- 5mg

- 10mg

- Mirabegron Prolonged-Release Tablets

- Respiratory System

- Montelukast Film-Coated Tablets: 10mg

- Others

- Blood And Blood Forming Agents

- Clopidogrel Film-Coated Tablets 75mg

- 75mg+75mg

- 75mg+100mg

- Clopidogrel + Asa Hard-Coated Tablets

- Apixaban Film-Coated Tablets

- 5 Mg

- 2.5 Mg

- Rivaroxaban Film-Coated Tablets

- 20mg

- 10mg

- 15mg

- 2.5mg

- Ticagrelor Film-Coated Tablets

- 60mg

- 90mg

- Prasugrel Film-Coated Tablets

- 5mg

- 10mg

- Clopidogrel Film-Coated Tablets 75mg

- Vaccines

- Mmr (Measles, Mumps, Rubella)

- Yellow Fever

- Hepatitis B

- Hpv (Human Papillomavirus)

- Malaria

- Flu (Influenza)

Dosage Form

- Oral

- Injectables

Potency

- Traditional Potency

- High-Potency

Manufacturing Method

- In-House Manufacturing

- Contract Manufacturing

Age Group

- Adult

- Pediatric

- Geriatric

Distribution Channel

- Direct Tenders

- Retail Sales

- Hospital Pharmacies

- Drug Stores

- E-Pharmacy

- Others

- Others

Africa Pharmaceutical Molecules Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Africa Pharmaceutical Molecules Market Leaders Operating in the Market Are:

- Adcock Ingram (South Africa)

- Advacare Pharma (U.S.)

- AstraZeneca (U.K.)

- BAYER AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Cipla (India)

- F.Hoffmann-La Roche Ltd (Switzerland)

- Ferring (Switzerland)

- GSK plc. (U.K.)

- Johson & Johnson Services, Inc. ( U.S.)

- MERCK KGAA (Germany)

- Novartis AG (Switzerland)

- Pfizer Inc. ( U.S.)

- Pharma Dekho plc (Nigeria)

- SANOFI (France)

- Sun Pharmaceutical Industries Ltd. ( India)

- swiss pharma Nigeria limited (Nigeria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE AFRICA PHARMACEUTICAL MOLECULES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 DBMR TRIPOD DATA VALIDATION MODEL

2.3 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.4 DBMR MARKET POSITION GRID

2.5 VENDOR SHARE ANALYSIS

2.6 SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

5 AFRICA PHARMACEUTICAL MOLECULES MARKET: REGULATIONS

5.1 REGULATORY FRAMEWORK FOR AFRICA PHARMACEUTICAL MOLECULES MARKET

5.2 NATIONAL MEDICINES REGULATORY AUTHORITIES (NMRAS)

5.3 EAST AFRICAN COMMUNITY (EAC) MEDICINES REGULATORY HARMONIZATION

5.4 ECONOMIC COMMUNITY OF WEST AFRICAN STATES (ECOWAS) MEDICINES REGULATORY HARMONIZATION

5.5 SOUTHERN AFRICAN DEVELOPMENT COMMUNITY (SADC) MEDICINES REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 REGULATORY IMPROVEMENTS CREATE FAVORABLE MARKET ENVIRONMENTS

6.1.2 ADVANCEMENTS IN TECHNOLOGY ENHANCE HEALTHCARE SERVICE DELIVERY

6.1.3 PHARMACEUTICAL MANUFACTURING GROWTH FOSTERS LOCAL PRODUCTION CAPABILITIES

6.1.4 RISING MIDDLE CLASS SPARKS RAPID URBANIZATION ACROSS AFRICA

6.2 RESTRAINTS

6.2.1 HEAVY RELIANCE ON IMPORTS INCREASES MARKET VULNERABILITY

6.2.2 LIMITED RESEARCH AND DEVELOPMENT INFRASTRUCTURE HAMPERS INNOVATION

6.3 OPPORTUNITIES

6.3.1 GOVERNMENT AND FOREIGN INVESTMENTS PROMOTING PHARMACEUTICAL INDUSTRY GROWTH

6.3.2 STRENGTHENING COLLABORATION BETWEEN PUBLIC-PRIVATE SECTOR PARTNERSHIPS

6.3.3 RISING DEMAND FOR CHRONIC DISEASE TREATMENT SOLUTIONS

6.4 CHALLENGES

6.4.1 HIGH COSTS OF PHARMACEUTICAL MOLECULES PRODUCTION

6.4.2 LIMITED SKILLED WORKFORCE IN PHARMACEUTICAL INDUSTRY

7 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY TYPE

7.1 OVERVIEW

7.2 NERVOUS SYSTEM

7.2.1 PARACETAMOL SOLUTION FOR INFUSION

7.2.2 ESCITALOPRAM FILM-COATED TABLETS

7.2.3 PREGABALIN CAPSULES

7.2.4 GABAPENTIN TABLET AND CAPSULES

7.2.5 SERTRALINE FILM-COATED TABLETS

7.2.6 ARIPIPRAZOLE TABLETS

7.2.7 OLANZAPINE FILM-COATED TABLETS

7.2.8 RISPERIDONE TABLETS 1MG

7.2.9 DONEPEZIL FILM-COATED TABLETS

7.2.10 LORAZEPAM FILM-COATED TABLETS

7.2.11 ATOMOXETINE TABLET AND SOLUTION

7.2.12 MIRTAZAPINE FILM-COATED TABLETS

7.2.13 LEVETIRACETAM

7.2.14 TOPIRAMATE FILM-COATED TABLETS

7.2.15 MEMANTINE FILM-COATED TABLETS

7.2.16 CINNARIZINE + DIMENHYDRINATE FILM-COATED TABLETS

7.2.17 OXCARBAZEPINE TABLETS

7.2.18 VORTIOXETINE FILM-COATED TABLETS

7.2.19 LACOSAMIDE TABLETS

7.2.20 LACOSAMIDE SYRUP

7.2.20.1 20 MG

7.2.20.2 5 MG

7.2.20.3 10 MG

7.2.21 GABAPENTIN FILM-COATED TABLETS

7.2.22 GABAPENTIN CAPSULES

7.2.22.1 800 MG

7.2.22.2 600 MG

7.2.23 400 MG

7.2.24 300 MG

7.2.25 100 MG

7.2.26 100 MG

7.2.27 50 MG

7.2.27.1 ARIPIPRAZOLE TABLETS (VARIOUS STRENGTHS)

7.2.27.2 ARIPIPRAZOLE ORODISPERSIBLE TABLETS (VARIOUS STRENGTHS)

7.2.28 10 MG

7.2.29 5 MG

7.2.29.1 ATOMOXETINE TABLETS (VARIOUS STRENGTHS)

7.2.29.2 ATOMOXETINE ORAL SOLUTION

7.2.29.2.1 LEVETIRACETAM FILM-COATED TABLETS

7.2.29.2.2 LEVETIRACETAM ORAL SYRUP (VARIOUS STRENGTHS)

7.2.30 20 MG

7.2.31 5 MG

7.2.32 10 MG

7.2.32.1 600 MG

7.2.32.2 300 MG

7.2.32.2.1 200 MG

7.2.32.2.2 150 MG

7.2.32.2.3 100 MG

7.2.32.2.4 50 MG

7.3 ANTI-INFECTIVES FOR SYSTEMIC USE

7.3.1 AZITHROMYCIN POWDER FOR SOLUTION FOR INFUSION: 500MG

7.3.2 LEVOFLOXACIN FILM-COATED TABLETS

7.3.3 FLUCONAZOLE CAPSULE

7.3.4 VALACICLOVIR FILM-COATED TABLETS

7.3.5 TIGECYCLINE POWDER FOR SOLUTION FOR INFUSION: 5MG/5ML

7.3.5.1 500MG

7.3.5.2 250MG

7.3.5.2.1 150 MG

7.3.5.2.2 50 MG

7.3.5.2.3 200 MG

7.3.5.2.4 OTHERS

7.3.5.2.4.1 500 MG

7.3.5.2.4.2 1000 MG

7.4 CARDIOVASCULAR SYSTEM

7.4.1 AMLODIPINE TABLETS

7.4.2 ATORVASTATIN FILM-COATED TABLETS

7.4.3 LOSARTAN

7.4.4 ROSUVASTATIN FILM-COATED TABLETS

7.4.5 VALSARTAN FILM-COATED TABLETS

7.4.6 CARVEDILOL TABLETS

7.4.7 IRBESARTAN

7.4.8 CHLORTALIDONE TABLETS

7.4.9 EZETIMIBE

7.4.10 PERINDOPRIL + INDAPAMIDE TABLETS

7.4.11 TELMISARTAN TABLETS

7.4.12 PITAVASTATIN FILM-COATED TABLETS

7.4.13 SILDENAFIL FILM-COATED TABLETS (20MG)

7.4.14 VALSARTAN + HYDROCHLOROTHIAZIDE (HCTZ) TABLETS

7.4.15 EPLERENONE FILM-COATED TABLETS

7.4.16 MACITENTAN FILM-COATED TABLETS (10MG)

7.4.16.1 5 MG

7.4.16.2 10 MG

7.4.16.2.1 10 MG

7.4.16.2.2 20 MG

7.4.16.2.3 40 MG

7.4.16.2.4 LOSARTAN FILM-COATED TABLETS

7.4.16.2.5 LOSARTAN + HCTZ FILM-COATED TABLETS

7.4.16.2.5.1 10 MG

7.4.16.2.5.2 20 MG

7.4.16.2.5.3 5 MG

7.4.16.2.6 80 MG

7.4.16.2.7 160 MG

7.4.16.2.8 40 MG

7.4.16.2.9 120 MG

7.4.16.2.9.1 6.25 MG

7.4.16.2.9.2 25 MG

7.4.16.3 IRBESARTAN FILM-COATED TABLETS

7.4.16.4 IRBESARTAN + HCTZ FILM-COATED TABLETS

7.4.16.5 150 MG

7.4.16.6 75 MG

7.4.16.7 300 MG

7.4.16.7.1 300 MG+12.5 MG

7.4.16.7.2 150 MG+12.5 MG

7.4.16.7.3 300 MG+25 MG

7.4.16.7.3.1 12.5 MG

7.4.16.7.3.2 25 MG

7.4.16.7.3.3 50 MG

7.4.17 EZETIMIBE + SIMVASTATIN FILM-COATED

7.4.18 EZETIMIBE + ROSUVASTATIN CAPSULE

7.4.19 EZETIMIBE FILM-COATED TABLETS

7.4.19.1 10 MG + 10 MG

7.4.19.2 10 MG + 20 MG

7.4.19.3 10 MG + 40 MG

7.4.19.3.1 10 MG + 10 MG

7.4.19.3.2 10 MG + 20 MG

7.4.19.3.3 10 MG + 5 MG

7.4.19.3.3.1 25 MG

7.4.19.3.3.2 50 MG

7.4.19.3.4 4 MG + 1.25 MG

7.4.19.3.5 8 MG + 2.5 MG

7.4.19.3.6 2 MG + 0.625 MG

7.4.19.3.6.1 20 MG

7.4.19.3.6.2 40 MG

7.4.19.3.6.3 80 MG

7.4.19.4 4 MG

7.4.19.5 2 MG

7.4.19.6 1 MG

7.4.19.6.1 360 MG + 25 MG

7.4.19.6.2 80 MG + 12.5 MG

7.4.19.6.3 160 MG + 25 MG

7.4.19.6.4 160 MG + 12.5 MG

7.4.19.6.5 320 MG + 12.5 MG

7.4.19.6.5.1 25 MG

7.4.19.6.5.2 50 MG

7.5 ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS

7.5.1 ABIRATERONE

7.5.2 TAMOXIFEN

7.5.3 BICALUTAMIDE

7.5.4 LENALIDOMIDE

7.5.5 BORTEZOMIB

7.5.6 MYCOPHENOLATE MOFETIL

7.5.7 SUNITINIB

7.5.8 LETROZOLE

7.5.9 PALBOCICLIB

7.5.10 TERIFLUNOMIDE

7.5.11 DIMETHYL FUMARATE

7.5.12 LEFLUNOMIDE

7.5.13 PIRFENIDONE

7.5.14 POMALIDOMIDE

7.5.15 FINGOLIMOD

7.5.15.1 250MG

7.5.15.2 500MG

7.5.15.2.1 10MG

7.5.15.2.2 20MG

7.5.15.2.3 50MG

7.5.15.2.4 50MG

7.5.15.2.4.1 7MG

7.5.15.2.4.2 14MG

7.5.15.2.5 10MG

7.5.15.2.6 20MG

7.6 ALIMENTARY TRACT & METABOLISM

7.6.1 SITAGLIPTIN TABLETS

7.6.2 EMPAGLIFLOZIN TABLETS

7.6.3 DAPAGLIFLOZIN TABLETS

7.6.4 ONDANSETRON INJECTION – 4MG/8MG

7.6.5 VILDAGLIPTIN TABLETS – 50MG

7.6.6 PANTOPRAZOLE INJECTION – 40MG

7.6.7 PIOGLITAZONE TABLETS

7.6.8 ESOMEPRAZOLE INJECTION – 40MG

7.6.9 CANAGLIFLOZIN TABLETS

7.6.10 ACARBOSE TABLETS

7.6.10.1 SITAGLIPTIN FILM-COATED TABLETS (VARIOUS STRENGTHS)

7.6.10.2 SITAGLIPTIN + METFORMIN FILM-COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.2.1 EMPAGLIFLOZIN FILM-COATED TABLETS

7.6.10.2.2 EMPAGLIFLOZIN + METFORMIN FILM-COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.2.3 EMPAGLIFLOZIN + LINAGLIPTIN TABLETS (VARIOUS COMBINATIONS)

7.6.10.2.3.1 10 MG

7.6.10.2.3.2 25 MG

7.6.10.3 10 MG

7.6.10.4 5 MG

7.6.10.4.1 PIOGLITAZONE TABLETS VARIOUS STRENGTHS

7.6.10.4.2 PIOGLITAZONE + METFORMIN COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.4.2.1 CANAGLIFLOZIN FILM-COATED TABLETS

7.6.10.4.2.2 CANAGLIFLOZIN + METFORMIN FILM-COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.5 300 MG

7.6.10.6 100 MG

7.6.10.6.1 50MG

7.6.10.6.2 100MG

7.7 MUSCULO-SKELETAL SYSTEM

7.7.1 ETORICOXIB FILM-COATED TABLETS

7.7.2 CELECOXIB CAPSULES

7.7.3 ALENDRONIC ACID FILM-COATED TABLETS 70 MG

7.7.4 FEBUXOSTAT FILM-COATED TABLETS

7.7.5 IBANDRONIC ACID FILM-COATED TABLETS 150 MG

7.7.5.1 100 MG

7.7.5.2 200 MG

7.7.5.2.1 80 MG

7.7.5.2.2 120 MG

7.7.5.2.2.1 50 MG

7.7.5.2.2.2 150 MG

7.8 GENITO-URINARY SYSTEM AND SEX HORMONES

7.8.1 SILDENAFIL FILM-COATED TABLETS

7.8.2 TADALAFIL FILM-COATED TABLETS

7.8.3 FINASTERIDE FILM-COATED TABLETS

7.8.4 SILODOSIN FILM-COATED TABLETS

7.8.5 SOLIFENACIN FILM-COATED TABLETS

7.8.6 MIRABEGRON PROLONGED-RELEASE TABLETS

7.8.6.1 8 MG

7.8.6.2 4 MG

7.8.6.2.1 5MG

7.8.6.2.2 10MG

7.8.6.2.2.1 50MG

7.8.6.2.2.2 25MG

7.9 RESPIRATORY

7.9.1 MONTELUKAST FILM-COATED TABLETS: 10MG

7.9.2 OTHERS

7.1 BLOOD AND BLOOD FORMING AGENTS

7.10.1 CLOPIDOGREL FILM-COATED TABLETS 75MG

7.10.2 CLOPIDOGREL + ASA HARD-COATED TABLETS

7.10.3 APIXABAN FILM-COATED TABLETS

7.10.4 RIVAROXABAN FILM-COATED TABLETS

7.10.5 TICAGRELOR FILM-COATED TABLETS

7.10.6 PRASUGREL FILM-COATED TABLETS

7.10.6.1 75MG+75MG

7.10.6.2 75MG+100MG

7.10.6.2.1 5 MG

7.10.6.2.2 2.5 MG

7.10.6.2.2.1 20MG

7.10.6.2.2.2 10MG

7.10.6.2.2.3 15MG

7.10.6.2.2.4 2.5MG

7.10.6.2.3 60MG

7.10.6.2.4 90MG

7.10.6.2.5 5MG

7.10.6.2.6 10MG

7.11 VACCINES

7.11.1 MMR (MEASLES, MUMPS, RUBELLA)

7.11.2 YELLOW FEVER

7.11.3 HEPATITIS B

7.11.4 HPV (HUMAN PAPILLOMAVIRUS)

7.11.5 MALARIA

7.11.6 FLU (INFLUENZA)

8 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY POTENCY

8.1 OVERVIEW

8.2 TRADITIONAL POTENCY

8.3 HIGH-POTENCY

9 AFRICA PHARMACEUTICAL MOLECULES MARKET, MANUFACTURING METHOD

9.1 OVERVIEW

9.2 IN-HOUSE MANUFACTURING

9.3 CONTRACT MANUFACTURING

10 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 ORAL

10.2.1 TABLET

10.2.2 CAPSULES

10.2.3 SOLUTION/SYRUPS

10.3 INJECTABLES

10.3.1 SOLUTION

10.3.2 POWDER

11 AFRICA PHARMACEUTICAL MOLECULES MARKET, AGE GROUP

11.1 OVERVIEW

11.2 ADULT

11.3 PEDIATRIC

11.4 GERIATRIC

12 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 RETAIL SALES

12.3.1 HOSPITAL PHARMACIES

12.3.2 DRUG STORES

12.3.3 E-PHARMACY

12.3.4 OTHERS

12.4 OTHERS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ADCOCK INGRAM

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 ADVACARE PHARMA

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 ASTRAZENECA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 BAYER AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 CIPLA

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 F. HOFFMANN-LA ROCHE LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 FERRING

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 GSK PLC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 JOHNSON & JOHNSON SERVICES, INC.

14.10.1 COMPANY PROFILES

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 MERCK KGAA

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NOVARTIS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 PFIZER INC.

14.13.1 COMPANY PROFILES

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 PHARMA DEKHO PLC.

14.14.1 COMPANY SNAPSOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PHARMA DEKHO PLC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SANOFI

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SWISS PHARMA NIGERIA LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 2 AFRICA NERVOUS SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 AFRICA NERVOUS SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 4 TABLE 3: AFRICA NERVOUS SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 5 AFRICA ESCITALOPRAM FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 AFRICA GABAPENTIN TABLET AND CAPSULES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 AFRICA GABAPENTIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 AFRICA GABAPENTIN CAPSULES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 AFRICA SERTRALINE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 AFRICA ARIPIPRAZOLE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 AFRICA DONEPEZIL FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 ATOMOXETINE TABLET AND SOLUTIONS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 AFRICA LEVETIRACETAM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 MEMANTINE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 AFRICA OXCARBAZEPINE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 16 AFRICA LACOSAMIDE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 AFRICA ANTI-INFECTIVES FOR SYSTEMIC USE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 AFRICA ANTI-INFECTIVES FOR SYSTEMIC USE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 19 AFRICA ANTI-INFECTIVES FOR SYSTEMIC USE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 20 AFRICA LACOSAMIDE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 AFRICA FLUCONAZOLE CAPSULE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 AFRICA VALACICLOVIR FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 AFRICA CARDIOVASCULAR SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 AFRICA CARDIOVASCULAR SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 25 AFRICA CARDIOVASCULAR SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 26 AMLODIPINE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 AFRICA ATORVASTATIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 28 AFRICA LOSARTAN IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 29 AFRICA ROSUVASTATIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 AFRICA VALSARTAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 AFRICA CARVEDILOL TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 AFRICA IRBESARTAN IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 AFRICA IRBESARTAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 34 AFRICA IRBESARTAN + HCTZ FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 35 AFRICA CHLORTALIDONE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 AFRICA EZETIMIBE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 AFRICA EZETIMIBE + SIMVASTATIN FILM-COATED IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 AFRICA EZETIMIBE + ROSUVASTATIN CAPSULE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 AFRICA EZETIMIBE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 40 AFRICA PERINDOPRIL + INDAPAMIDE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 AFRICA TELMISARTAN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 AFRICA PITAVASTATIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 43 AFRICA VALSARTAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 44 AFRICA EPLERENONE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 45 AFRICA ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 AFRICA ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 47 AFRICA ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 48 AFRICA ABIRATERONE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 AFRICA TAMOXIFEN IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 AFRICA BICALUTAMIDE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 AFRICA TERIFLUNOMIDE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 AFRICA LEFLUNOMIDE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 AFRICA ALIMENTARY TRACT & METABOLISM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 AFRICA ALIMENTARY TRACT & METABOLISM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 55 AFRICA ALIMENTARY TRACT & METABOLISM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 56 AFRICA SITAGLIPTIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 AFRICA EMPAGLIFLOZIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 AFRICA EMPAGLIFLOZIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 AFRICA DAPAGLIFLOZIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 60 AFRICA PIOGLITAZONE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 AFRICA CANAGLIFLOZIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 AFRICA CANAGLIFLOZIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 AFRICA ACARBOSE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 AFRICA MUSCULO-SKELETAL SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 65 AFRICA MUSCULO-SKELETAL SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032(MILLION UNITS)

TABLE 66 AFRICA MUSCULO-SKELETAL SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032(USD/UNITS)

TABLE 67 AFRICA CELECOXIB CAPSULES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 SOUTH AFRICA FEBUXOSTAT FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE. 2018-2032 (USD MILLION)

TABLE 69 AFRICA IBANDRONIC ACID FILM-COATED TABLETS 150 MG IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 AFRICA GENITO-URINARY SYSTEM AND SEX HORMONES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 AFRICA GENITO-URINARY SYSTEM AND SEX HORMONES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 72 SOUTH AFRICA GENITO-URINARY SYSTEM AND SEX HORMONES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE. 2018-2032(USD/UNITS)

TABLE 73 AFRICA SILODOSIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 AFRICA SOLIFENACIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 AFRICA MIRABEGRON PROLONGED-RELEASE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 AFRICA RESPIRATORY SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 AFRICA RESPIRATORY SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 78 AFRICA RESPIRATORY SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032(USD/UNITS)

TABLE 79 AFRICA BLOOD AND BLOOD FORMING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 AFRICA BLOOD AND BLOOD FORMING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, (MILLION UNITS)

TABLE 81 AFRICA BLOOD AND BLOOD FORMING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE,(USD/UNITS)

TABLE 82 AFRICA CLOPIDOGREL FILM-COATED TABLETS 75 MG IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 AFRICA APIXABAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 AFRICA RIVAROXABAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 AFRICA TICAGRELOR FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 AFRICA PRASUGREL FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 87 AFRICA VACCINES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 88 AFRICA VACCINES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 89 AFRICA VACCINES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 90 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY POTENCY, 2018-2032 (USD MILLION)

TABLE 91 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY MANUFACTURING METHOD, 2018-2032 (USD MILLION)

TABLE 92 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM, 2018-2032 (USD MILLION)

TABLE 93 AFRICA ORAL IN PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM, 2018-2032 (USD MILLION)

TABLE 94 AFRICA INJECTABLES IN PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM, 2018-2032 (USD MILLION)

TABLE 95 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 96 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 97 AFRICA RETAIL SALES IN PHARMACEUTICAL MOLECULES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 AFRICA PHARMACEUTICAL MOLECULES MARKET: SEGMENTATION

FIGURE 2 AFRICA PHARMACEUTICAL MOLECULES MARKET: GEOGRAPHICAL SCOPE

FIGURE 3 AFRICA PHARMACEUTICAL MOLECULES MARKET: YEARS CONSIDERED FOR THE STUDY

FIGURE 4 AFRICA PHARMACEUTICAL MOLECULES MARKET: DATA TRIANGULATION

FIGURE 5 AFRICA PHARMACEUTICAL MOLECULES MARKET: DROC ANALYSIS

FIGURE 6 AFRICA PHARMACEUTICAL MOLECULES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 7 AFRICA PHARMACEUTICAL MOLECULES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 AFRICA PHARMACEUTICAL MOLECULES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AFRICA PHARMACEUTICAL MOLECULES MARKET: MULTIVARIATE MODELLING

FIGURE 10 AFRICA PHARMACEUTICAL MOLECULES MARKET: DBMR MARKET POSITION GRID

FIGURE 11 AFRICA PHARMACEUTICAL MOLECULES MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 AFRICA PHARMACEUTICAL MOLECULES MARKET: SEGMENTATION

FIGURE 13 AFRICA PHARMACEUTICAL MOLECULES MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 EXPANSION OF DENTAL INSURANCE COVERAGE FOR PERIODONTAL CARE IS DRIVING THE GROWTH OF THE AFRICA PHARMACEUTICAL MOLECULES MARKET FROM 2025 TO 2032

FIGURE 16 THE NERVOUS SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA PHARMACEUTICAL MOLECULES MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 MARKET OVERVIEW

FIGURE 19 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, 2024

FIGURE 20 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 21 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 22 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, 2024

FIGURE 24 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, 2025-2032 (USD MILLION)

FIGURE 25 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, CAGR (2025-2032)

FIGURE 26 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, LIFELINE CURVE

FIGURE 27 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, 2024

FIGURE 28 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

FIGURE 29 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, CAGR (2025-2032)

FIGURE 30 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, LIFELINE CURVE

FIGURE 31 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, 2024

FIGURE 32 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, 2025-2032 (USD MILLION)

FIGURE 33 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, CAGR (2025-2032)

FIGURE 34 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 35 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, 2024

FIGURE 36 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, 2025-2032 (USD MILLION)

FIGURE 37 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, CAGR (2025-2032)

FIGURE 38 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, LIFELINE CURVE

FIGURE 39 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 41 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 42 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.