Africa Rolling Stock Market

Market Size in USD Billion

CAGR :

%

USD

2.51 Billion

USD

3.11 Billion

2024

2032

USD

2.51 Billion

USD

3.11 Billion

2024

2032

| 2025 –2032 | |

| USD 2.51 Billion | |

| USD 3.11 Billion | |

|

|

|

|

Africa Rolling Stock Market Analysis

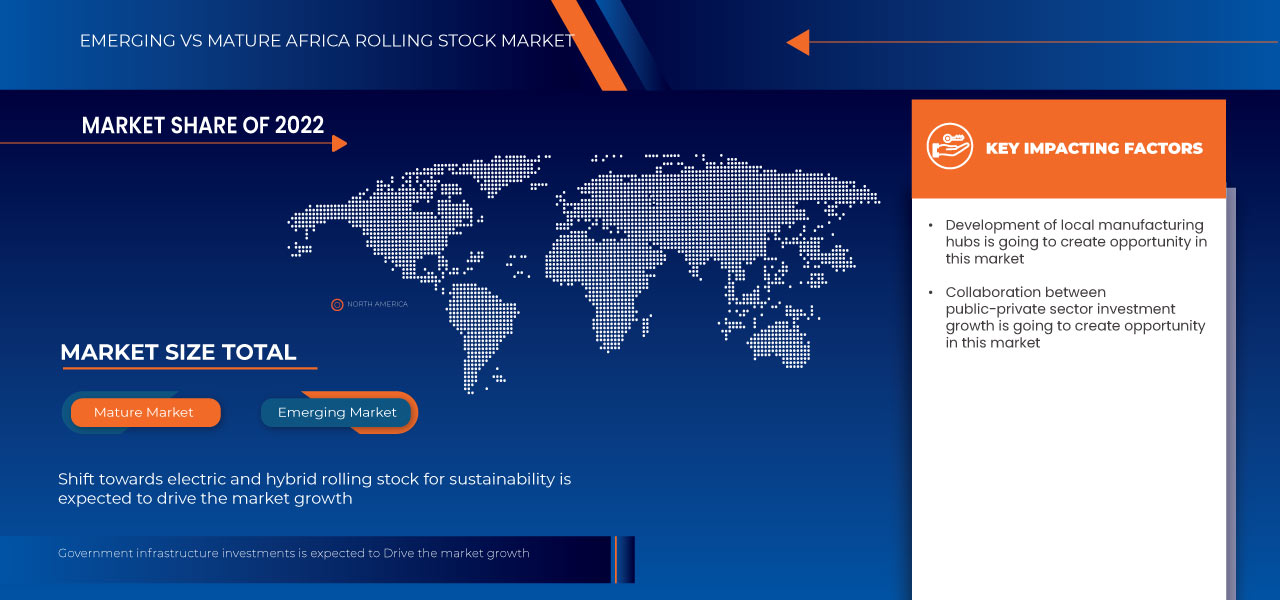

The Africa rolling stock market is witnessing steady growth, driven by increasing urbanization, infrastructure investments, and the need for efficient rail transportation. Governments and private players are focusing on expanding and modernizing rail networks to enhance connectivity and reduce congestion. The market includes locomotives, coaches, wagons, and rapid transit vehicles, catering to both passenger and freight applications. Advancements in technology, such as electrification, automation, and digital train control systems, are shaping the market’s evolution. Despite challenges like funding constraints and aging rail infrastructure, initiatives for rail modernization and cross-border connectivity are expected to drive future growth

Africa Rolling Stock Market Size

Data Bridge Market Research analyses that the Africa rolling stock market is expected to reach USD 3.11 billion by 2032 from USD 2.51 billion in 2024, growing with a CAGR of 2.8% in the forecast period of 2025 to 2032.

Africa Rolling Stock Market Trends

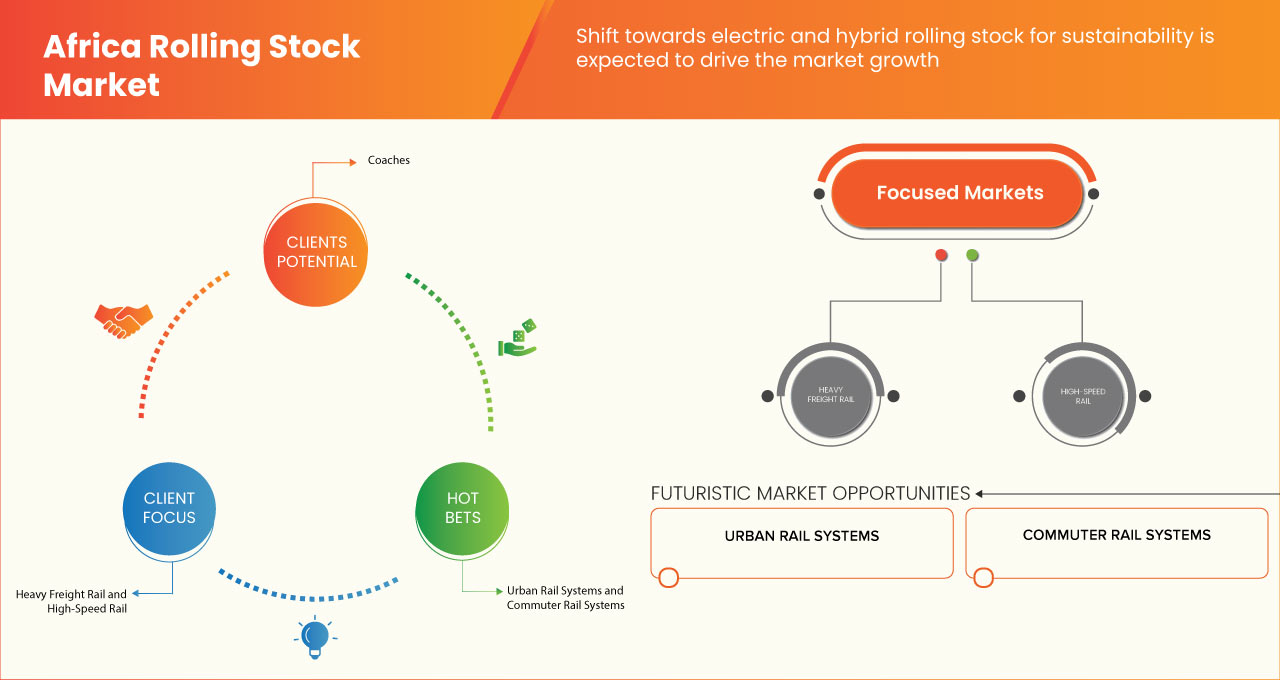

“Expansion of High-Speed Rail (HSR) Projects"

The growing demand for faster and more efficient transportation across Africa created significant opportunities for the rolling stock market, driven by the push for modernized rail infrastructure. Several countries invested in to enhance regional connectivity, reduce travel times, and support economic integration. Governments and private investors increasingly prioritized electrified and high-speed rail systems, leading to increased demand for advanced locomotives, passenger coaches, and freight wagons. With ongoing urbanization and trade expansion, the adoption of HSR projects played a crucial role in transforming Africa’s rail sector, opening new avenues for rolling stock manufacturers and suppliers.

Report Scope and Africa Rolling Stock Market Segmentation

|

Report Metric |

Africa Rolling Stock Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Gibela Rail Transport Consortium (South Africa), Bombela Operating Company (South Africa), Lucchini South Africa (Pty) Ltd (South Africa), Voestalpine Railway Systems Gmbh (Austria), Wabtec Corporation (U.S.), Talgo (Spain), Alstom SA (France), Atlas Copco AB (U.S.), Hitachi Rail Limited (U.K.), Mitsubishi Heavy Industries Ltd. (Japan), Hyundai Corporation (Japan), Siemens AG (Germany), Toshiba Infrastructure Systems & Solutions Corporation (Japan) and ABB (Switzerland) among others. |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Africa Rolling Stock Market Definition

The Africa rolling stock market encompasses the manufacturing, procurement, maintenance, and modernization of railway vehicles, including locomotives, wagons, coaches, and rapid transit systems. It covers both passenger and freight applications across various rail systems such as heavy freight, commuter, urban, and high-speed rail. The market is driven by increasing investments in rail infrastructure, urbanization, and the need for efficient transportation solutions. Key components include traction motors, braking systems, gearboxes, train control systems, and auxiliary power units, with a focus on both new builds and replacements to enhance rail network efficiency and sustainability

Africa Rolling Stock Market Dynamics

Drivers

- Increasing Urbanization & Population Growth

Increasing urbanization and population growth in Africa are driving demand for rolling stock as cities expand and transportation needs rise. Rapid urban migration is straining existing rail infrastructure, necessitating investments in modern rail solutions, including metro systems, light rail, and high-capacity trains. Governments and private players are focusing on enhancing rail networks to improve mobility, reduce congestion, and support economic growth. As a result, rolling stock demand is set to increase, driven by the need for efficient, sustainable, and cost-effective transportation solutions.

For instance,

- As per data shared by Worldometers.info, Africa's population is projected to grow significantly from approximately 1.52 billion in 2024 to 2.47 billion by 2050. This rapid increase, coupled with ongoing urbanization, is intensifying pressure on existing transportation infrastructure. With cities expanding and urban populations rising, demand for efficient and high-capacity rail transport solutions is becoming critical. Investments in modern rolling stock, including metro, light rail, and intercity trains, will be essential to support mobility and economic development. As a result, the African rolling stock market is set for substantial growth to meet evolving transportation needs

Government Infrastructure Investments

Government infrastructure investments are a key driver of the rolling stock market, as nations prioritize expanding and modernizing rail networks to support economic growth and urban mobility. Large-scale projects, backed by public funding and international partnerships, aim to enhance connectivity, improve freight and passenger transport efficiency, and reduce road congestion. Investments in high-speed rail, metro systems, and intercity trains are gaining momentum, driven by the need for sustainable and cost-effective transportation solutions. As governments continue to allocate resources to rail infrastructure, the demand for advanced rolling stock is set to rise, creating opportunities for manufacturers and service providers across the continent.

For instance,

- In January 2025, data shared by Verdict Media Limited reveals that South African coal and iron ore exporters are set to invest billions in rail infrastructure improvements in partnership with state-owned Transnet. Poor maintenance and theft have severely impacted freight rail efficiency, causing coal exports to hit a 30-year low in 2023. To address this, the government has allowed private operators to run trains on key routes starting in April, unlocking private capital and expertise. With an estimated R12.9 billion (USD 700 million) needed for coal rail repairs and R9 billion for iron ore lines, these investments aim to restore rail capacity and boost export volumes. This renewed focus on infrastructure underscores the growing demand for rolling stock, as upgraded rail networks will require modern locomotives and wagons to optimize efficiency and capacity

Opportunities

- Collaboration Between Public-Private Sector Investment Growth

The growth of public-private investments in Africa’s rail sector created significant opportunities for the rolling stock market. Governments partnered with private entities to fund and develop modern railway infrastructure, driving demand for advanced locomotives, passenger coaches, and freight wagons. These collaborations accelerated the expansion of high-speed and conventional rail networks, ensuring steady procurement of rolling stock to meet rising transportation needs. Additionally, private sector involvement introduced cutting-edge technologies, enhancing efficiency, sustainability, and reliability in rail operations. As investment momentum continued, the rolling stock market benefited from increased production, maintenance contracts, and long-term growth prospects.

For instance,

- In September 2024, Africa Finance Corporation (AFC) signed concession agreements with the governments of Angola and Zambia to advance the Zambia Lobito Rail Project. The project, backed by the U.S. Government, European Union, and African Development Bank, aimed to construct an 800km rail line connecting Angola’s Benguela rail line to Zambia’s railway network. AFC secured a USD 2 million grant from the U.S. Trade and Development Agency for environmental and social impact assessments. The initiative was expected to generate USD 3 billion in economic benefits, create over 1,250 jobs, and reduce emissions by 300,000 tons annually. The project demonstrated the increasing role of public-private investments in Africa’s rolling stock market, fostering trade, industrialization, and regional connectivity

Development Of Local Manufacturing Hubs

The establishment of local manufacturing hubs presents a major opportunity for Africa’s rolling stock market by reducing dependence on imports, lowering costs, and fostering industrial growth. Governments and private investors are increasingly supporting domestic production of locomotives, wagons, and rail components through policy incentives and joint ventures with global manufacturers. These hubs create jobs, enhance skill development, and strengthen supply chains, making rail projects more sustainable and cost-effective. As demand for rolling stock rises, localized production will improve delivery timelines, boost regional economies, and position Africa as a key player in the global railway industry.

For instance,

- In July 2022, data shared by China Daily Information Co (CDIC) revealed that South Africa unveiled its first 100 locally manufactured electric trains, marking a shift from reliance on imports. The Gibela Rail Transport Consortium, backed by a USD 3.2 billion government investment, was contracted to produce 600 trains for the Passenger Rail Agency of South Africa (PRASA) by 2028. The project created over 8,209 jobs and trained local workers abroad. Officials emphasized modernizing railway infrastructure and urged protection of public assets. This initiative positioned South Africa as a potential supplier of rolling stock to other African nations, supporting local industry growth

Restraints/Challenges

- Political & Economic Instability

Unlike radio frequency communication, FSOC relies on direct, unobstructed pathways between transmitters and receivers, making it vulnerable to obstacles such as buildings, mountains, and atmospheric disturbances. This constraint limits its scalability, particularly for large-scale terrestrial networks, where maintaining clear optical links over long distances remains a significant problem.

For instance,

- In January 2023, data shared by Chatham House revealed that Africa's economic recovery from the COVID-19 pandemic faced severe setbacks due to multiple internal and external shocks, including adverse weather, a locust invasion, and the Russia-Ukraine war. While Africa had limited direct trade and financial ties with Russia and Ukraine, the conflict triggered soaring commodity prices, food and fuel inflation, and rising borrowing costs, increasing the risk of civil unrest. Key economies like South Africa and Nigeria struggled with low growth, while countries such as Ethiopia and Ghana saw their debt reach distressed levels. With Africa’s public sector debt-to-GDP ratio exceeding 60% in 2022, many governments faced mounting financial pressure. The decline of large Chinese state-backed loans further reduced funding for major infrastructure projects, including rail development. Additionally, geopolitical competition among global powers intensified, causing uncertainties that disrupted planned investments. This economic and political instability acted as a major restraint on the rolling stock market, limiting funding, delaying projects, and increasing operational risks across the continent

Strong Presence of Road-Based Logistics Slowing Railway Adoption

The predominance of road-based logistics in Africa presents a significant challenge to the adoption and expansion of railway systems across the continent. Roads currently handle approximately 80% of goods and 90% of passenger traffic in Africa, underscoring their dominant role in the transportation sector. This heavy reliance on road transport often leads to increased transaction costs and contributes to a low level of intra-African trade, which stands at just 18% of total goods traded within the continent. The existing infrastructure deficit hampers the competitiveness of railways, making it challenging for them to attract investment and gain a larger share of the freight and passenger markets. Consequently, efforts to promote railway adoption must address these entrenched preferences for road transport and the associated infrastructure advantages.

For instance,

- As per BRICKSTONE AFRICA, road transport remained the dominant mode of transportation in Africa, driving economic development and trade. Since the 1960s, African leaders recognized infrastructure as crucial for regional integration, but the continent continued to lag in road and rail development. Studies showed that Africa had only 31 km of paved roads per 100 square km, compared to 134 km in other low-income countries. Poor road conditions increased transport costs, with logistics expenses reaching up to 60% for landlocked nations. While the African Continental Free Trade Area (AfCFTA) aimed to boost trade, inadequate road infrastructure posed a challenge, further reinforcing reliance on road-based logistics over rail. Climate change and insufficient maintenance further deteriorated roads, limiting accessibility for rural populations. With only USD 5 billion invested annually against the required USD 18-25 billion for infrastructure, the lack of funding and dependence on roads slowed railway adoption and expansion across Africa

Africa Rolling Stock Market Scope

Africa rolling stock market is segmented into six notable segments based on the product type, component, type, locomotive technology, service network type, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product Type

- Coaches

- Fuel Type

- Diesel

- Electric

- Natural Gas

- Wagons

- Type

- Hopper Wagons

- Covered wagons

- Flat WAGONS

- Tank Wagons

- Locomotives

- Type

- Electro-Diesel Locomotives

- Diesel Locomotives

- Electric Locomotives

- Type

- Direct and Altering Current

- Power Transmission

- Driving The Wheels

- Wheel Arrangement

- Battery Locomotive

- Rapid Transit

- Type

- Subway/Metro

- EMU

- Type

- Motor Cars

- Trailers Cars

- Power Cars

- Driving Cars

- Type

- DMU

- Monorail

- Light Rail/Tram

By Component

- Traction Motor

- Auxiliary Power System

- Wheelset

- Brakes

- AXLE

- Type

- Sealed-Clean Rotating End CAP Tapered Roller Bearings (RCT)

- Spherical Roller Bearings

- Cylindrical Roller Bearings With RIBS

- Tapered Roller Bearings

- Cylindrical Roller Bearings Combined With Ball Bearings

- Sealed-Clean Rotating End Cap Cylindrical Roller Bearings (RCC)

- Type

- Train Control System

- Gearboxes

- Air Conditioning System

- Pantograph

- Position Train Control

- Passenger Information System

- Others

By Type

- Replacement

- New Build

By Locomotive Technology

- Turbocharged Locomotives

- Conventional Locomotives

- Maglev

By Service Network Type

- Heavy Freight Rail

- Commuter Rail SYSTEMS

- Urban Rail systems

- High-Speed Rail

- Others

By Application

- Passenger Application

- Type

- Coaches

- Locomotives

- Rapid Transit

- Wagon

- Freight Application

- Type

- Wagon

- locomotives

- Rapid Transit

- Coaches

- Type

Africa Rolling Stock Market Regional Analysis

Africa rolling stock market is segmented into six notable segments based on the product type, component, type, locomotive technology, service network type, and application.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Africa Rolling Stock Market Share

Africa rolling stock market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Africa rolling stock market.

Africa Rolling Stock Market Leaders Operating in the Market are:

- Gibela Rail Transport Consortium (South Africa)

- Bombela Operating Company (South Africa)

- Lucchini South Africa (Pty) Ltd (South Africa)

- Voestalpine Railway Systems Gmbh (Austria)

- Wabtec Corporation (U.S.)

- Talgo (Spain)

- Alstom SA (France)

- Atlas Copco AB (U.S.)

- Hitachi Rail Limited (U.K.)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Hyundai Corporation (Japan)

- Siemens AG (Germany)

Latest Developments in Africa Rolling Stock Market

- In February 2025, Hitachi Rail secured a contract to implement its advanced CBTC digital signaling technology on Paris Metro Line 12, operated by RATP. As part of the OCTYS 2030 program, Hitachi Rail will design and deploy wayside CBTC technology following RATP’s specifications. This project builds on Hitachi Rail’s ongoing collaboration with RATP, following upgrades on Metro Lines 3 and 6

- In December 2024, Alstom, a global leader in smart and sustainable mobility, announced the official entry into commercial service of the RER NG on the RER D Line of the Île-de-France Mobilités network. Following its phased deployment on the RER E Line over the past year, RER NG began operating on the RER D Line on December 16, 2024. Additionally, since December 15, 2024, RER NG has been running full service across the entire RER E Line

- In November 2024, the Gjøvik Line North became the first railway line in Norway to operate with the latest ERTMS technology. Siemens Mobility and Bane NOR successfully launched this modern system on November 16, setting a new benchmark for railway operations in Europe. This milestone positions Norway at the forefront of rail innovation, enhancing efficiency, safety, and interoperability in the European railway network

- In June 2024, Gibela hosted the prestigious Gibela Excellence Award 2024, recognizing outstanding achievements across various sectors of the rail manufacturing industry. The awards celebrated excellence in innovation, quality, and sustainability, honoring employees, suppliers, and stakeholders who have contributed significantly to the company’s success and the advancement of South Africa’s rail sector

- In April 2024, Hyundai Rotem, headquartered in South Korea, was honored as a Category Award Winner in the Railway Technology Excellence Awards. This recognition underscores the company's innovation and leadership in the railway sector, showcasing its commitment to cutting-edge rail solutions and technological advancements worldwide, and a live audio webcast of the event will be available on the CACI investor relations website. A replay will be posted for 90 days following the event

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AFRICA ROLLING STOCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET APPLICATION COVERAGE GRID

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SERVICE LIFE

4.2 TECHNOLOGICAL ADVANCEMENTS

4.3 REGIONAL GROWTH OPPORTUNITIES

4.4 SUSTAINABILITY INITIATIVES

4.5 ROLLING STOCK R&D MARKET

4.6 TECHNOLOGICAL TRENDS

4.7 SUPPLY CHAIN ANALYSIS

4.8 CASE STUDY

4.9 TRADE ANALYSIS: IMPORT & EXPORT SCENARIOEXPORT SCENARIO

4.1 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.11 PRICING ANALYSIS

4.12 CONSUMER BUYING BEHAVIOUR

4.13 COUNTRY WISE LOCOMOTIVE PRODUCTION

4.14 KEY STRATEGIC INITIATIVES - AFRICA ROLLING STOCK MARKET

4.15 CONSUMER PURCHASE DECISION PROCESS - AFRICA ROLLING STOCK MARKET

4.16 DEMAND FOR CARS

4.17 ROLLING STOCK DOMINANCE IN THE MARKET (EXISTING PRODUCTS)

4.18 NEW LAUNCHES OF ROLLING STOCK

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING URBANIZATION & POPULATION GROWTH

6.1.2 GOVERNMENT INFRASTRUCTURE INVESTMENTS

6.1.3 BELT & ROAD INITIATIVE SUPPORTING RAILWAY GROWTH

6.1.4 SHIFT TOWARDS ELECTRIC AND HYBRID ROLLING STOCK FOR SUSTAINABILITY

6.2 RESTRAINTS

6.2.1 POLITICAL & ECONOMIC INSTABILITY

6.2.2 LIMITED RAIL CONNECTIVITY & POOR MAINTENANCE

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF HIGH-SPEED RAIL (HSR) PROJECTS

6.3.2 COLLABORATION BETWEEN PUBLIC-PRIVATE SECTOR INVESTMENT GROWTH

6.3.3 DEVELOPMENT OF LOCAL MANUFACTURING HUBS

6.4 CHALLENGES

6.4.1 CROSS-BORDER REGULATORY ISSUES

6.4.2 STRONG PRESENCE OF ROAD-BASED LOGISTICS SLOWING RAILWAY ADOPTION

7 AFRICA ROLLING STOCK MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COACHES

7.2.1 COACHES, BY FUEL TYPE

7.2.1.1 DIESEL

7.2.1.2 ELECTRIC

7.2.1.3 NATURAL GAS

7.3 WAGONS

7.3.1 WAGONS, BY TYPE

7.3.1.1 HOPPER WAGONS

7.3.1.2 COVERED WAGONS

7.3.1.3 FLAT WAGONS

7.3.1.4 TANK WAGONS

7.4 LOCOMOTIVES

7.4.1 LOCOMOTIVES, BY TYPE

7.4.1.1 ELECTRO-DIESEL LOCOMOTIVES

7.4.1.2 DIESEL LOCOMOTIVES

7.4.1.3 ELECTRIC LOCOMOTIVES

7.4.1.3.1 ELECTRIC LOCOMOTIVES, BY TYPE

7.4.1.3.1.1 DIRECT AND ALTERING CURRENT

7.4.1.3.1.2 POWER TRANSMISSION

7.4.1.3.1.3 DRIVING THE WHEELS

7.4.1.3.1.4 WHEEL ARRANGEMENT

7.4.1.3.1.5 BATTERY LOCOMOTIVE

7.5 RAPID TRANSIT

7.5.1 RAPID TRANSIT, BY TYPE

7.5.1.1 SUBWAY/METRO

7.5.1.2 EMU

7.5.1.2.1 EMU, BY TYPE

7.5.1.2.1.1 MOTOR CARS

7.5.1.2.1.2 TRAILERS CARS

7.5.1.2.1.3 POWER CARS

7.5.1.2.1.4 DRIVING CARS

7.5.1.3 DMU

7.5.1.4 MONORAIL

7.5.1.5 LIGHT RAIL/TRAM

8 AFRICA ROLLING STOCK MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 TRACTION MOTOR

8.3 AUXILIARY POWER SYSTEM

8.4 WHEELSET

8.5 BRAKES

8.6 AXLE

8.6.1 AXLE, BY TYPE

8.6.1.1 SEALED-CLEAN ROTATING END CAP TAPERED ROLLER BEARINGS (RCT)

8.6.1.2 SPHERICAL ROLLER BEARINGS

8.6.1.3 CYLINDRICAL ROLLER BEARINGS WITH RIBS

8.6.1.4 TAPERED ROLLER BEARINGS

8.6.1.5 CYLINDRICAL ROLLER BEARINGS COMBINED WITH BALL BEARINGS

8.6.1.6 SEALED-CLEAN ROTATING END CAP CYLINDRICAL ROLLER BEARINGS (RCC)

8.7 TRAIN CONTROL SYSTEM

8.8 GEARBOXES

8.9 AIR CONDITIONING SYSTEM

8.1 PANTOGRAPH

8.11 POSITION TRAIN CONTROL

8.12 PASSENGER INFORMATION SYSTEM

8.13 OTHERS

9 AFRICA ROLLING STOCK MARKET, BY TYPE

9.1 OVERVIEW

9.2 REPLACEMENT

9.3 NEW BUILD

10 AFRICA ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY

10.1 OVERVIEW

10.2 TURBOCHARGED LOCOMOTIVES

10.3 CONVENTIONAL LOCOMOTIVES

10.4 MAGLEV

11 AFRICA ROLLING STOCK MARKET, BY SERVICE NETWORK TYPE

11.1 OVERVIEW

11.2 HEAVY FREIGHT RAIL

11.3 COMMUTER RAIL SYSTEMS

11.4 URBAN RAIL SYSTEMS

11.5 HIGH-SPEED RAIL

11.6 OTHERS

12 AFRICA ROLLING STOCK MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 PASSENGER APPLICATION

12.2.1 PASSENGER APPLICATION, BY TYPE

12.2.1.1 COACHES

12.2.1.2 LOCOMOTIVES

12.2.1.3 RAPID TRANSIT

12.2.1.4 WAGON

12.3 FREIGHT APPLICATION

12.3.1 FREIGHT APPLICATION, BY TYPE

12.3.1.1 WAGON

12.3.1.2 LOCOMOTIVES

12.3.1.3 RAPID TRANSIT

12.3.1.4 COACHES

13 AFRICA ROLLING STOCK MARKET

13.1 COMPANY SHARE ANALYSIS: AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 HITACHI RAIL LIMITED

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ALSTOM SA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 SOLUTION PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 SIEMENS MOBILITY

15.3.1 COMPANY SNAPSHOT

15.3.2 SOLUTION PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 GIBELA RAIL TRANSPORT CONSORTIUM

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT/NEWS TYPE

15.5 HYUNDAI ROTEM COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 SOLUTION CATEGORY

15.5.4 RECENT DEVELOPMENT

15.5.4.1 RECENT NEWS

15.6 ABB

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ATLAS COPCO AB

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 BOMBELA OPERATING COMPANY

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 LUCCHINI SOUTH AFRICA (PTY) LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 MITSUBISHI HEAVY INDUSTRIES, LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 TALGO

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 DEVELOPMENT/NEWS TYPE

15.13 VOESTALPINE RAILWAY SYSTEMS GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT/ NEWS TYPE

15.14 WABTEC CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 TECHNOLOGICAL DEVELOPMENT

TABLE 2 PRICES

TABLE 3 CONSUMER BUYING BEHAVIOUR PATTERN

TABLE 4 TABULATED DATA REPRESENTATION

TABLE 5 PERCENTAGE OF COUNTRY WISE SHARE OF ROLLING STOCK FROM TOTAL ROLLING STOCK SALES

TABLE 6 AFRICA ROLLING STOCK MARKET

TABLE 7 AFRICA ROLLING STOCK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 AFRICA ROLLING STOCK MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 9 AFRICA COACHES IN ROLLING STOCK MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 AFRICA WAGONS IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AFRICA LOCOMOTIVES IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 AFRICA ELECTRIC LOCOMOTIVES IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA RAPID TRANSIT IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA EMU IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA ROLLING STOCK MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA AXLE IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA ROLLING STOCK MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 19 AFRICA ROLLING STOCK MARKET, BY LOCOMOTIVE TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA ROLLING STOCK MARKET, BY SERVICE NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AFRICA ROLLING STOCK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA PASSENGER APPLICATION IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 AFRICA FREIGHT APPLICATION IN ROLLING STOCK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 AFRICA ROLLING STOCK MARKET: SEGMENTATION

FIGURE 2 AFRICA ROLLING STOCK MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA ROLLING STOCK MARKET: DROC ANALYSIS

FIGURE 4 AFRICA ROLLING STOCK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 AFRICA ROLLING STOCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA ROLLING STOCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 AFRICA ROLLING STOCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 AFRICA ROLLING STOCK MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 AFRICA ROLLING STOCK MARKET: SEGMENTATION

FIGURE 10 AFRICA EXECUTIVE SUMMARY

FIGURE 11 FOUR SEGMENTS COMPRISE THE AFRICA ROLLING STOCK MARKET, BY PRODUCT TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASING URBANIZATION & POPULATION GROWTH IS EXPECTED TO DRIVE THE AFRICA ROLLING STOCK MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA ROLLING STOCK MARKET IN 2025 & 2032

FIGURE 15 KEY COMPONENTS OF THE ROLLING STOCK SUPPLY CHAIN IN AFRICA

FIGURE 16 LOCOMOTIVE PRODUCTIVITY (AVERAGE, FOR TOTAL FLEET)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF AFRICA ROLLING STOCK MARKET

FIGURE 18 AFRICA POPULATION FORECAST

FIGURE 19 AFRICA ROLLING STOCK MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 AFRICA ROLLING STOCK MARKET: BY COMPONENT, 2024

FIGURE 21 AFRICA ROLLING STOCK MARKET: BY TYPE, 2024

FIGURE 22 AFRICA ROLLING STOCK MARKET: BY LOCOMOTIVE TECHNOLOGY, 2024

FIGURE 23 AFRICA ROLLING STOCK MARKET: BY SERVICE NETWORK TYPE, 2024

FIGURE 24 AFRICA ROLLING STOCK MARKET: BY APPLICATION, 2024

FIGURE 25 AFRICA ROLLING STOCK MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.