Apac Medical Aesthetics Market

Market Size in USD Billion

CAGR :

%

USD

4.50 Billion

USD

12.64 Billion

2024

2032

USD

4.50 Billion

USD

12.64 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 12.64 Billion | |

|

|

|

Asia-Pacific Medical Aesthetic Market Analysis

Medical aesthetic has a rich history that dates backs in ancient civilizations, where beauty treatments were practiced using natural remedies and early forms of cosmetic procedures. In the early 20th century, medical aesthetics began to merge with advancements in medical technology, with innovations such as the first injectable collagen for wrinkle treatment in the 1970s. The development of Botox in the 1980s marked a major milestone, introducing non-surgical facial rejuvenation. Over the decades, the field expanded with the advent of laser technologies, dermal fillers, and non-invasive body contouring treatments. Today, medical aesthetics combines advanced technology with the growing desire for non-invasive cosmetic procedures, making it a rapidly growing industry in Asia Pacific healthcare.

Asia Pacific Medical Aesthetic Market Size

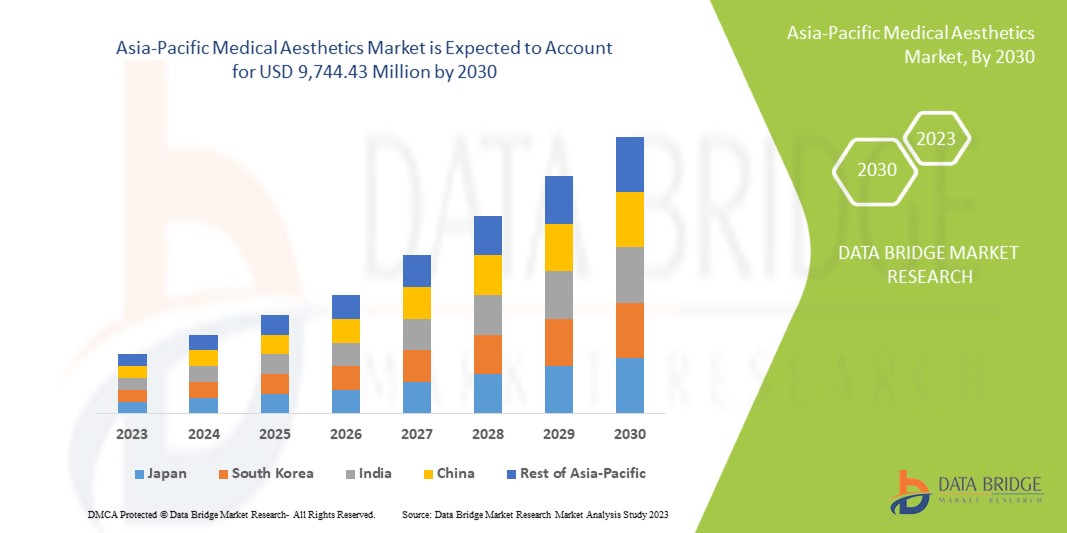

Asia-Pacific medical aesthetic market is expected to reach USD 12.64 billion by 2032 from USD 4.50 billion in 2024, growing with a CAGR of 13.8% in the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Asia Pacific Medical Aesthetic Market Trends

“Increasing Demand for Non-Surgical Procedures”

The Asia Pacific medical aesthetic market is witnessing a significant trend toward non-surgical cosmetic procedures, driven by advancements in technology, minimal recovery times, and increasing consumer preference for less invasive treatments. Procedures such as Botox injections, dermal fillers, laser treatments, and non-surgical body contouring are becoming increasingly popular as individuals seek to enhance their appearance without the risks and downtime associated with traditional surgeries. The growing awareness about aesthetic treatments, coupled with social media's influence on beauty standards, has contributed to this surge in demand. Additionally, the rise in disposable income, coupled with aging populations in developed markets, is fueling the market's expansion. The increasing availability of innovative, personalized treatments and the growing acceptance of medical aesthetics in mainstream society further accelerate this trend, positioning non-surgical options as the preferred choice for many consumers.

Report Scope and Asia Pacific Medical Aesthetic Market Segmentation

|

Attributes |

Asia Pacific Medical Aesthetic Market Insights |

|

Segments Covered |

|

|

Region Covered |

China, India, Japan, South Korea, Australia, Indonesia, Thailand, Malaysia, Philippines, Singapore, and Rest of Asia-Pacific |

|

Key Market Players |

Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.), Allergan (A Subsidiary of AbbVie Inc.) (Ireland), GALDERMA (Switzerland), Cutera, Inc. (U.S.), Lumenis Be Ltd. (Israel), Densply Sirona (U.S.), Institut Straumann AG (U.S.), Candela Corporation (U.S.), Medytrox (South Korea), BioHorizons(U.S.), BTL (India), Nobel Biocare Services AG (Switzerland), Merz Pharma (Germany), Cynosure, LLC (U.S.), Sharplight Technologies Inc. (Israel), Alma Lasers (U.S.), MEGA'GEN IMPLANT CO., LTD. (India), 3M (U.S), Quanta System (Italy), Sciton (California) and among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia Pacific Medical Aesthetic Market Definition

Medical aesthetics includes all medical treatments that are focused on improving the cosmetic appearance of patients. Medical aesthetics sits in a beautiful little niche in between the beauty industry and plastic surgery. Qualified doctors, nurses, or dentists can provide a multitude of stunning treatments to improve your appearance. These treatments require a high degree of skill, training, and knowledge of your anatomy and physiology. This is what separates medical aesthetic treatments from beauty treatments such as eyebrow threading, waxing, or eyelash extensions. On the other hand, medical aesthetic treatments are not as aggressive as surgical interventions (aesthetic medical treatments are sometimes referred to as non-surgical cosmetic treatments), which includes procedures like facelifts, breast augmentations, or liposuction.

Asia Pacific Medical Aesthetic Market Definition Dynamics

Drivers

- Increase in the Ageing Population

The increase in the aging population significantly drives the aesthetic services market due to the growing desire among older adults to maintain a youthful appearance and enhance their quality of life. As people age, they often experience a decline in skin elasticity, the emergence of wrinkles, and other signs of aging that can impact self-esteem and overall well-being. This demographic shift has led to a higher demand for various aesthetic treatments, including non-invasive procedures such as botox, dermal fillers, and skin rejuvenation therapies. The increasing awareness of these aesthetic options, coupled with a cultural emphasis on beauty and appearance, prompts older adults to seek out solutions that allow them to look as vibrant as they feel, thus fueling the market growth.

For instance,

- In September 2022, according to an article published by The Nation, Thailand's health & aesthetics industry has been driven by the ageing population in the country. Moreover, according to the same source, as of December 31 last year, 12.24 million or 18.5% of Thailand’s population were aged 60 or above

- In January 2024, according to the news published by PRB, a significant increase in the aging population in the United States, with the number of Americans aged 65 and older projected to rise from 17% to 23% by 2060. This demographic shift drives the Asia Pacific medical aesthetics market as older adults seek treatments to address age-related concerns like wrinkles, sagging skin, and volume loss. The growing demand for anti-aging procedures, such as Botox, dermal fillers, and skin rejuvenation treatments, fuels market growth and innovation in aesthetic products and services

- In May 2023, according to the news published in The U.S. Census Bureau, the report highlights a 38.6% increase in the U.S. population aged 65 and over from 2010 to 2020, driving demand for anti-aging treatments such as Botox and dermal fillers, thus fueling growth in the Asia Pacific medical aesthetics market

Moreover, the rise in disposable income among the aging population further contributes to the expansion of the aesthetic services market. As the older adults seek to invest in their personal appearance and wellness, they are more willing to spend on enhancement treatments.

In conclusion, advancements in technology have made aesthetic procedures safer, minimally invasive, and more accessible, attracting a broader segment of older adults who may have previously been hesitant about such interventions. This convergence of demographic trends, increasing disposable incomes, and enhanced service offerings presents significant growth for the aesthetic services sector, driving innovation and competition among providers.

- Changing Beauty Standards and Social Media Influence

Evolving beauty standards and the influence of social media platforms significantly drive the demand for medical aesthetics treatments. Social media platforms such as Instagram and TikTok showcase idealized beauty standards, encouraging individuals to seek aesthetic enhancements to achieve similar looks. Influencers and celebrities often promote aesthetic treatments, making them more mainstream and desirable. This trend leads to increased awareness and acceptance of medical aesthetics, driving market growth.

For instance,

- In June 2023, according to an article published in The National Library of Medicine, the increasing demand for medical aesthetics driven by the aging population and advancements in technology. As people age, they seek treatments to address signs of aging, such as wrinkles and sagging skin. Technological advancements have made these treatments more effective and accessible, further driving market growth. In addition, the growing awareness and acceptance of aesthetic procedures contribute to the expanding market

- In July 2024, according to an article published in ResearchGate, social media had a significant influence on body image and cosmetic surgery considerations. Social media platforms often portray idealized beauty standards, leading individuals to seek aesthetic enhancements to achieve similar looks. This trend drives the demand for medical aesthetics treatments, as people are increasingly influenced by the images and lifestyles they see online. The review underscores the role of social media in shaping perceptions of beauty and the growing acceptance of cosmetic procedures, thereby fueling market growth

The Asia Pacific medical aesthetics market is propelled by changing beauty standards and the pervasive influence of social media. As individuals strive to meet these evolving ideals, the demand for aesthetic treatments continues to rise, fostering innovation and expansion within the industry.

Opportunities

- Development of New Innovative Treatments

The introduction of new and innovative treatments presents a significant opportunity for the medical aesthetic market. With advancements in medical technology, aesthetic treatments have evolved to include non-invasive, highly effective options that cater to the growing demand for improved results with minimal downtime. Treatments such as stem cell therapies, advanced laser techniques, and non-surgical face lifts are reshaping the market by providing consumers with a wider array of choices that meet their diverse needs and preferences. These innovations not only enhance the effectiveness and safety of treatments but also reduce the risks associated with more traditional surgical procedures. As consumers increasingly seek cutting-edge solutions to maintain their youthfulness and enhance their appearance, the demand for these advanced aesthetic services continues to rise. This shift towards newer, more effective treatments acts as a key opportunity, driving growth in the market and positioning it for long-term expansion as technology continues to transform the industry.

For instance,

- In February 2022, according to the article published by Science Direct, Stem cells, originally used for chronic degenerative diseases, are now emerging as a promising, minimally invasive treatment in aesthetics. This shift towards stem cell therapies offers effective solutions for skin rejuvenation and anti-aging, attracting growing consumer interest. As this innovative treatment gains traction, it presents a significant opportunity for the Southeast Asia aesthetic services market to expand and evolve

- In August 2021, according to the article published by NCBI, Stem cells, particularly adipose-derived ones, are gaining popularity in cosmetic dermatology due to their ability to self-renew and differentiate into various cell types. Their ease of collection and abundance make them an attractive option for aesthetic treatments, such as skin rejuvenation. This innovation presents a valuable opportunity for the Southeast Asia aesthetic services market to grow and diversify its offerings

- In January 2023, according to the article published in MedEsthetics Magazine, significant technological innovations driving growth in the medical aesthetic market. These advancements include new-age painless procedures, advanced devices, fractional resurfacing, third-generation ultrasound-assisted lipoplasty, and advanced skin imaging. The integration of VR, AR, AI, CAD, telemedicine, and IoT enhances the accuracy and efficiency of procedures, making them more precise and less invasive

- In February 2024, according to the article published in MDPI, the advancements in regenerative medicine for aesthetic dermatology focusing on innovative, minimally invasive treatments for facial rejuvenation and regeneration. The close correlation between tissue repair, regeneration, and aging has paved the way for applying regenerative medicine principles in cosmetic dermatology

The introduction of new and advanced treatments offers a valuable opportunity for the medical aesthetic market. Innovations such as stem cell therapies, improved laser treatments, and non-surgical face lifts provide consumers with safer, more effective options that require less recovery time. These advancements cater to the growing demand for non-invasive procedures and appeal to those seeking better, longer-lasting results. As these treatments gain popularity, they create strong demand, acting as a key driver for market growth and positioning it for continued expansion.

- Medical Partnerships and Innovations

Medical partnerships and innovations present a significant opportunity for the medical aesthetic market by enhancing the credibility and quality of services offered. Collaborations between aesthetic service providers and qualified medical professionals, such as dermatologists and plastic surgeons, ensure that treatments are not only effective but also safe for consumers. These partnerships also allow for the integration of advanced medical technologies and techniques into aesthetic procedures, making services more reliable and attractive to a broader customer base. With trusted medical professionals involved, consumers feel more confident in the procedures, leading to increased demand for aesthetic services. Moreover, such collaborations open doors to developing new, cutting-edge treatments that address emerging consumer needs. This alliance between aesthetics and medicine drives growth in the market by positioning it as a trusted, innovative, and high-quality sector.

For instance,

- In November 2024, according to the article published by The Nation, MASTER’s partnership with Indonesia’s "Lumeo Health" positions it as Southeast Asia’s leading cosmetic surgery provider. This collaboration fosters innovation and enhances medical partnerships, offering advanced aesthetic services to a growing market. By combining expertise and resources, this alliance opens new opportunities for expanded access, cutting-edge treatments, and improved patient outcomes, fueling growth in aesthetic sector

- In October 2023, according to the article published by Health365, they partnership with Bangkok Hospital marks a significant step in enhancing aesthetic services in Southeast Asia. By combining Health365’s expertise with Bangkok Hospital's medical innovation, this collaboration promotes access to world-class treatments and advanced technologies. This strategic alliance presents a valuable opportunity to elevate the region’s aesthetic services market, driving growth and improving patient care

Medical partnerships present a valuable opportunity for the medical aesthetic services market by enhancing service credibility and quality. Collaborations between aesthetic providers and qualified medical professionals ensure treatments are safe and effective, building consumer trust. These partnerships also facilitate the introduction of advanced techniques and technologies, attracting a wider customer base. By combining medical expertise with aesthetic innovation, the market experiences growth and increased demand.

Restraints/Challenges

- Lack of Trained Professionals

The lack of trained professionals in the aesthetic services market significantly hampers the growth and proliferation of these services. Aesthetic procedures, which often require specialized skills and knowledge, necessitate a workforce well-versed in the latest technologies, techniques, and safety protocols. The shortage of certified practitioners limits the availability of services and poses risks to patient safety, leading to potential complications and dissatisfaction with results. This creates a cycle where consumers become hesitant to engage with aesthetic offerings, further stagnating market growth.

For instance,

- In August 2023, according to an article published by The Malaysian Reserve, ignorance or lack of awareness regarding risky aesthetic procedures performed by beauticians or unlicensed practitioners in Malaysia poses a serious threat to consumers. The use of substandard products or unsanitary practices can result in serious health issues, infections, or irreversible damage. Furthermore, the absence of regulatory oversight leaves consumers vulnerable to deceptive practices, making it difficult for them to seek recourse in case of malpractice or adverse effects

- In July 2019, according to an article, ‘Association promotes qualified aestheticians in Malaysia’, It was stated that the local estimates suggest that there are 20,000 uncertified aestheticians in comparison to only 200 certified holders of professional qualifications. This challenges the industry to maintain its standards of providing aesthetic services

- In October 2024, according to the article published in The Evaluation Company, the significant shortage of medical staff in the U.S., which poses a restraint for the Asia Pacific medical aesthetic market. The shortage affects not only doctors but also nurses and other healthcare professionals, leading longer to wait times and reduced availability of aesthetic treatments. This scarcity of skilled professionals can limit the growth and expansion of the medical aesthetics market, as the demand for qualified practitioners exceeds the supply

Moreover, this talent gap can hinder clinics and service providers from scaling their operations or expanding their offerings. As the demand for aesthetic services continues to rise, particularly among younger demographics seeking non-invasive treatments, the ability to meet this demand is obstructed by a limited pool of qualified professionals. This challenge impacts brand reputation and trust, as clients are more likely to choose establishments known for their skilled and experienced staff. Consequently, without targeted training programs and supportive initiatives to nurture healthcare professionals in aesthetics, the potential of the Asia Pacific medical aesthetic market remains underutilized.

- Risk of Side Effects Associated with These Procedures

The risk of side effects associated with aesthetic procedures acts as a significant restraint for the medical aesthetic market by creating apprehension among potential clients. Many cosmetic procedures, whether surgical or non-surgical, carry the inherent risk of complications such as infections, scarring, or unsatisfactory results. This fear of adverse effects can deter individuals from seeking these services, as consumers are increasingly informed through social media and online platforms about the experiences of others, including negative outcomes. Consequently, the potential for side effects can create a perception that these procedures are not worth the risk, leading to reduced demand and participation in the market.

For instance,

- In October 2024, according to an article, ‘Dangers of Cosmetic Surgery in Thailand by Dr. Ehsan Jadoon’, the dangers involved with the cosmetic surgeries include swelling, bruising, infection, allergic reaction, asymmetrical results, vascular injury, nerve trauma, visual disturbances, psychological trauma and grievous body harm

- In October 2024, according to article published in Journal of Cutaneous and Aesthetic Surgery, many adverse events go unreported due to a lack of regulation and poor enforcement, as procedures are often performed in non-medical settings such as spas and beauty parlors. This lack of oversight can lead to complications such as fat necrosis, infections, and other side effects, particularly when inexperienced practitioners perform procedures. The fear of adverse media publicity and low reporting rates further exacerbate these issues, making it crucial for the industry to implement stringent risk assessment and prevention measures to ensure patient safety and maintain market growth

- In August 2020, according to the news published in The PMFA Journal, Complications can arise from various factors, including patient selection, injection techniques, and the inherent risks of the procedures themselves. These complications can range from minor issues such as bruising and swelling to more severe problems such as infections, vascular occlusions, and allergic reactions. The fear of these potential complications can deter individuals from seeking aesthetic treatments, thereby limiting market growth

Moreover, the influence of local healthcare systems and regulatory environments further amplifies concerns about side effects in the region. If individuals perceive that clinic may not prioritize safety or adhere to rigorous health regulations, they may be less likely to pursue aesthetic treatments altogether. This skepticism can be compounded by media coverage of botched procedures and unsafe practices, making potential clients wary of the associated risks. As a result, the fear of experiencing side effects not only curbs individual interest but also poses challenges for market growth as businesses strive to build consumer trust and confidence in their services.

Asia Pacific Medical Aesthetic Market Scope

The market is segmented on the basis of products, application, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Aesthetic Laser Devices

- Ablative Skin Resurfacing Devices

- CO2 Laser

- Erbium Laser

- Others

- Non-Ablative fractional Laser Resurfacing Devices

- Radiofrequency

- Intense Pulsed Light

- Fractional Laser

- The Q-switched ND:YAG Laser

- Others

- Energy Devices

- Laser Surgery Devices

- Electrocautery devices

- Electrosurgery Devices

- Cryosurgery Devices

- Harmonic Scalpel

- Microwave Devices

- Body Contouring Devices

- Liposuction

- Nonsurgical Skin Tightening

- Cellulite Treatment

- Facial Aesthetic Devices

- Botox Injection

- Dermal Filler

- Natural Dermal Fillers

- Synthetic Dermal Fillers

- Collagen injections

- Chemical peel

- Facial Toning

- Fraxel

- Cosmetic Acupuncture

- Electrotherapy

- Microdermabrasion

- Permanent Makeup

- Aesthetic Implants

- Breast Augmentation

- Saline Implants

- Silicon Implants

- Buttock Augmentation

- Aesthetic Dental Implants

- Dental Titanium Implants

- Dental Zerconium Implants

- Facial Implants

- Soft Tissue Implants

- Transdermal Implant

- Others

- Skin Aesthetic Devices

- Laser Skin Resurfacing Devices

- Non Surgical Skin Tightening Devices

- Light Therapy Devices

- Tattoo Removal Devices

- Micro-Needling Products

- Thread Lift Products

- Nail Treatment Laser Devices

- Others

Application

- Anti-Aging and Wrinkles

- Facial and Skin Rejuvenation

- Breast Enhancement

- Body Shaping and Cellulite

- Tattoo Removal

- Vascular Lesions

- Sears, Pigment Lesions, Reconstructive

- Psoriasis and Vitiligo

- Others

End User

- Cosmetic Centers

- Dermatology Clinics

- Hospitals

- Medical Spas and Beauty Centers

Distribution Channel

- Direct Tender

- Retail

Asia Pacific Medical Aesthetic Market Regional Analysis

The market is analyzed and market size insights and trends are provided By Products, Application, End User, Distribution Channel as referenced above.

The region covered in the market are China, India, Japan, South Korea, Australia, Indonesia, Thailand, Malaysia, Philippines, Singapore, and rest of Asia-Pacific.

Japan is expected to dominate the market due to its advanced healthcare infrastructure, high consumer demand for non-surgical beauty treatments, and a strong emphasis on anti-aging solutions. In addition, Japan’s aging population and cultural focus on beauty and wellness drive continuous market growth and innovation in aesthetic procedures.

India is expected to be the fastest growing due to rising disposable incomes, increased awareness of beauty treatments, and a large, youthful population. Additionally, the growing acceptance of non-surgical procedures and advancements in technology are driving rapid demand for aesthetic services across the country.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia Pacific Medical Aesthetic Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Asia Pacific Medical Aesthetic Market Leaders Operating in the Market Are:

- Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.)

- Allergan (A Subsidiary of AbbVie Inc.) (Ireland)

- GALDERMA (Switzerland)

- Cutera, Inc. (U.S.)

- Lumenis Be Ltd. (Israel)

- Densply Sirona (U.S.)

- Institut Straumann AG (U.S.)

- Candela Corporation (U.S.)

- Medytrox (South Korea)

- BioHorizons(U.S.)

- BTL (India)

- Nobel Biocare Services AG (Switzerland)

- Merz Pharma (Germany)

- Cynosure, LLC (U.S.)

- Sharplight Technologies Inc. (Israel)

- Alma Lasers (U.S.)

- MEGA'GEN IMPLANT CO., LTD. (India)

- 3M (U.S)

- Quanta System (Italy)

- Sciton (California)

Latest Developments in Asia Pacific Medical Aesthetic Market

- In January 2023, Galderma announced the launch of FACE by Galderma, an innovative augmented reality application. The ground-breaking solution enables aesthetic practitioners and patients to visualize treatment results at the planning stage. The technology will be presented to the aesthetic scientific community at the International Master Course on Aging Science (IMCAS) World Congress 2023

- In February 2022, Allergan (a subsidiary of AbbVie Inc.) has announced the FDA approval of JUVÉDERM VOLBELLA XC for improvement of infraorbital hollows in adult’s age above 21. This helped the company to expand the product portfolio of aesthetics in the U.S. market

- In January 2022, Mentor Worldwide LLC (a subsidiary of the Johnson & Johnson Medical Devices Companies) announced that the FDA has approved the MENTOR MemoryGel BOOST breast implant for breast augmentation and breast reconstruction. This product has helped the company to expand the product portfolio of aesthetics in the U.S. market

- In January 2021, Cutera, Inc. announced that the company has launched a truSculpt Flex+, optimized to deliver targeted, repeatable, and uniform sculpting of problem areas. This helps the company to enhance its product portfolio within the market

- In November 2019, Lumenis Be Ltd. has announced its acquisition with the Baring Private Equity Asia (BPEA), a leading provider of specialty energy-based medical-based devices across the field of aesthetics. This shows the company is held by strong support within the aesthetics market for the product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 JAPAN

10.1.2 INDIA

10.1.3 CHINA

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA

10.1.6 THAILAND

10.1.7 SINGAPORE

10.1.8 MALAYSIA

10.1.9 INDONESIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 JAPAN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 JAPAN AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 JAPAN ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 JAPAN NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 JAPAN ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 JAPAN BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 JAPAN FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 JAPAN DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 JAPAN AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 JAPAN BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 JAPAN AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 JAPAN SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 JAPAN MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 JAPAN MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 JAPAN MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 INDIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CHINA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 CHINA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 96 CHINA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH KOREA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH KOREA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH KOREA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH KOREA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH KOREA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH KOREA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH KOREA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH KOREA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH KOREA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH KOREA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH KOREA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 AUSTRALIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 AUSTRALIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 AUSTRALIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 AUSTRALIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 AUSTRALIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 AUSTRALIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 AUSTRALIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 AUSTRALIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 AUSTRALIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 AUSTRALIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 AUSTRALIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRALIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRALIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 AUSTRALIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 AUSTRALIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 THAILAND MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 THAILAND MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 141 THAILAND MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 SINGAPORE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SINGAPORE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SINGAPORE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SINGAPORE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SINGAPORE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SINGAPORE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SINGAPORE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SINGAPORE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SINGAPORE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SINGAPORE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SINGAPORE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SINGAPORE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SINGAPORE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 SINGAPORE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 SINGAPORE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 157 MALAYSIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MALAYSIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MALAYSIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MALAYSIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MALAYSIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MALAYSIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MALAYSIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MALAYSIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MALAYSIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MALAYSIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MALAYSIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MALAYSIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 MALAYSIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 INDONESIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 INDONESIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 INDONESIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 INDONESIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 INDONESIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 INDONESIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 INDONESIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 INDONESIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 INDONESIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 INDONESIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 INDONESIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 INDONESIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 INDONESIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 INDONESIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 186 INDONESIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 187 PHILIPPINES MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 PHILIPPINES AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 PHILIPPINES ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 PHILIPPINES NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 PHILIPPINES ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 PHILIPPINES BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 PHILIPPINES FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 PHILIPPINES DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 PHILIPPINES AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 PHILIPPINES BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 PHILIPPINES AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 PHILIPPINES SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 PHILIPPINES MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 PHILIPPINES MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 201 PHILIPPINES MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SIX SEGMENTS COMPRISE THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES IS DRIVING THE GROWTH OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET FROM 2025 TO 2032

FIGURE 14 THE AESTHETIC LASER DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET IN 2025 AND 2032

FIGURE 15 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2024

FIGURE 16 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: PRODUCT TYPE, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, 2024

FIGURE 20 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 21 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, 2024

FIGURE 24 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 25 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, CAGR (2025-2032)

FIGURE 26 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 29 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 30 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SNAPSHOT (2024)

FIGURE 32 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.