Asia Pacific Active Wound Care Market

Market Size in USD Billion

CAGR :

%

USD

261.20 Billion

USD

406.98 Billion

2024

2032

USD

261.20 Billion

USD

406.98 Billion

2024

2032

| 2025 –2032 | |

| USD 261.20 Billion | |

| USD 406.98 Billion | |

|

|

|

|

Active Wound Care Market Size

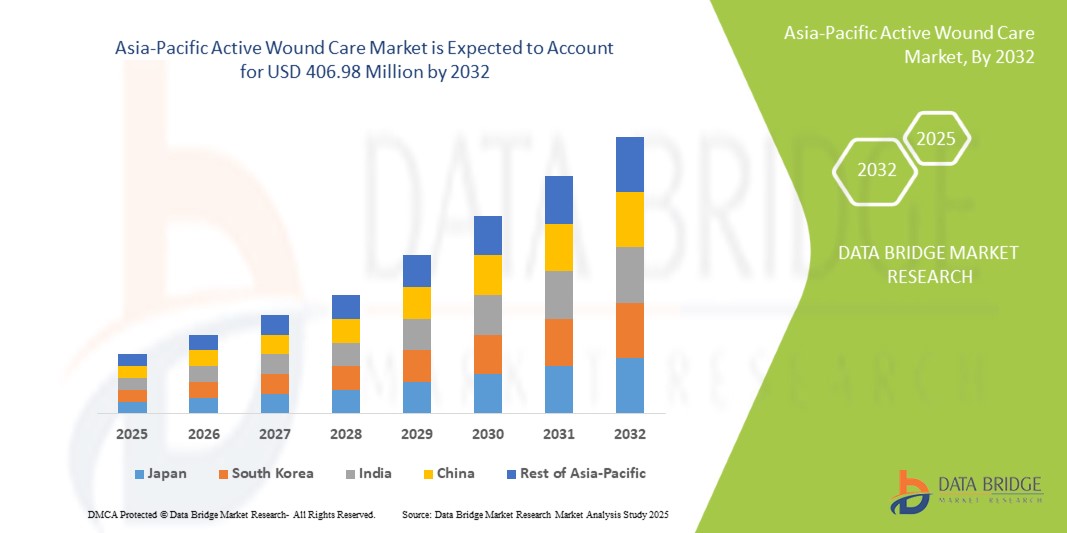

- The Asia-Pacific Active Wound Care Market was valued at USD 261.2 Million in 2024 and is expected to reach USD 406.98 Million by 2032, at a CAGR of 5.7% during the forecast period.

- The growth of the Asia-Pacific Active Wound Care Market is driven by several key factors. A major driver is the increasing prevalence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which are contributing to higher demand for advanced wound care solutions.

Asia-Pacific Active Wound Care Market Analysis

- Active Wound Care plays a crucial role in treating and managing chronic wounds by promoting tissue regeneration and accelerating healing processes. It includes advanced therapies such as growth factor-based treatments, biologic dressings, and cellular therapies, all of which are vital for improving patient outcomes. The increasing focus on personalized medicine and patient-centric care in Asia-Pacific has further boosted the demand for these advanced wound care solutions.

- The Asia Pacific market for Active Wound Care is primarily driven by the rising incidence of chronic conditions, including diabetes and cardiovascular diseases, which lead to complications such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers. As the elderly population grows, the prevalence of these chronic wounds is expected to rise, increasing the need for advanced wound care products.

- Japan holds a dominant position in the Asia-Pacific active Wound Care market, driven by its strong healthcare infrastructure, high healthcare spending, and an emphasis on advanced wound care technologies. Countries such as Japan, and China are at the forefront, supported by their well-established healthcare systems, advanced medical research facilities, and the high adoption of cutting-edge wound care therapies

- Synthetic Skin Grafts segment is expected to dominate the market with a market share of 32.22%, due to the increasing prevalence of burn injuries, chronic wounds, and skin loss conditions worldwide. Advances in bioengineering and the development of innovative synthetic materials that promote faster healing, reduce infection risk, and improve patient outcomes have further fueled its adoption. Additionally, the ability of synthetic skin grafts to provide a readily available, sterile, and customizable alternative to traditional grafts makes them highly preferred in clinical settings.

Report Scope Active Wound Care Market Segmentation

|

Attributes |

Active Wound Care Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Active Wound Care Market Trends

“Innovations in Wound Healing Technologies and Growing Focus on Chronic Wound Management”

- The Asia-Pacific Active Wound Care market is witnessing strong growth due to increasing demand for advanced wound healing therapies, particularly in the treatment of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers. These conditions are becoming more prevalent with the rise in aging populations and lifestyle-related diseases.

- Ongoing innovation in biologic dressings, stem cell-based therapies, and growth factor-infused wound care products is transforming the wound management landscape by enhancing tissue regeneration and reducing healing time.

- For instance, research institutions and biotech companies in China and Japan are actively developing bioengineered skin substitutes and growth factor-based gels aimed at improving outcomes in chronic wound care.

- The growing shift toward outpatient care and home-based wound treatment is further driving adoption of advanced wound care solutions, which offer better ease of use, longer wear times, and enhanced patient comfort.

- Regulatory support for product approvals and streamlined reimbursement pathways in countries like Japan and China are encouraging broader market access and adoption. These regulations ensure that products meet stringent quality, safety, and efficacy standards while supporting innovation in the field.

- While emerging alternatives such as smart dressings and 3D-bioprinted skin substitutes are gaining interest, traditional active wound care modalities continue to dominate, especially where proven clinical efficacy and physician familiarity are key decision drivers.

Active Wound Care Market Dynamics

Driver

“Increasing Prevalence of Chronic Wounds and Advancements in Regenerative Therapies”

- The Asia-Pacific Active Wound Care market is largely driven by the rising incidence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, linked to aging populations and growing rates of diabetes and obesity across the region.

- Increased adoption of regenerative therapies, including bioengineered skin substitutes and growth factor-based dressings, is expanding the scope of Active Wound Care in both hospital and outpatient settings.

- Advancements in stem cell therapy and tissue engineering are further supporting the use of active wound care products that promote tissue regeneration and accelerate healing.

- The growing integration of advanced wound care into national healthcare protocols across countries like Japan, China is boosting product accessibility and physician awareness.

For instance,

- In 2024, Smith+Nephew introduced a next-generation collagen dressing in the Asia Pacific market, specifically designed to support tissue regeneration in non-healing wounds.

- Supportive reimbursement policies, increased healthcare funding, and greater awareness of chronic wound complications are fueling sustained market growth throughout Asia Pacific.

Opportunity

“Expanding Use of Biologic Dressings and Smart Technologies in Outpatient Settings”

- The shift toward outpatient and home-based care is driving demand for user-friendly, high-efficacy active wound care products, particularly among elderly and mobility-limited patient groups.

- Biologic dressings, cellular therapies, and growth factor-based formulations are gaining traction for their ability to accelerate healing and reduce the need for invasive procedures.

- Emerging technologies such as smart dressings with real-time monitoring capabilities offer new opportunities for manufacturers to innovate and differentiate their product offerings.

For instance,

- In February 2024, Mölnlycke Health Care launched a smart wound dressing in select Asia Pacific markets, incorporating sensors that monitor moisture levels and healing progression to support remote patient management.

- Increasing public-private research collaborations, along with China-funded innovation initiatives, are also supporting the development and commercial rollout of next-generation wound care technologies.

Restraint/Challenge

“High Cost and Regulatory Complexity Limiting Widespread Adoption”

- One of the key restraints in the Active Wound Care market is the high cost of advanced wound care products, which limits their accessibility in cost-sensitive healthcare systems and among uninsured or underinsured populations.

- Complex and evolving regulatory requirements for biologic and cell-based wound therapies can extend development timelines and increase compliance costs for manufacturers.

- Limited awareness among general practitioners and inconsistent wound care training across Asian regions can result in underutilization of advanced wound care options, particularly in rural and under-resourced areas.

For instance,

- In 2023, several regional hospitals in Eastern Asia-Pacific reported delays in adopting advanced wound care products due to budget constraints and lack of clinical training in regenerative technologies.

- These challenges are further compounded by supply chain disruptions, particularly for biologic components and advanced materials, which can affect timely product availability and pricing stability.

Active Wound Care Market Scope

The market is segmented on the basis, product, wound type, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Wound Type |

|

|

By End User |

|

In 2025, Synthetic Skin Grafts is projected to dominate the market with a largest share in product segment

The Synthetic Skin Grafts segment is expected to dominate the Active Wound Care Market with the largest share of 32.22% in 2025 due to their increasing adoption in the treatment of complex and chronic wounds, such as burns, diabetic foot ulcers, and surgical wounds. These grafts offer several advantages, including consistent quality, reduced risk of disease transmission, and ease of availability compared to biologic alternatives. Moreover, ongoing advancements in biomaterials and tissue engineering have led to the development of next-generation synthetic grafts that closely mimic natural skin properties, enhancing their efficacy in wound healing. The rising demand for cost-effective, scalable, and ready-to-use wound care solutions, especially in high-volume clinical settings across Asia Pacific Region, is further driving the dominance of this segment.

The Surgical Wounds is expected to account for the largest share during the forecast period in wound type market

In 2025, the Surgical Wounds segment is projected to dominate the Asia-Pacific Active Wound Care (FBS) market with the largest share, accounting for 61.34%. This dominance is driven by the rising volume of surgical procedures across the region, particularly in orthopedics, cardiovascular interventions, and oncology-related surgeries. The growing elderly population and increasing prevalence of lifestyle-related diseases are contributing to a higher rate of surgeries, thereby amplifying the need for effective wound care solutions to support post-operative healing and reduce complications such as infections and delayed recovery. FBS, known for its rich concentration of growth factors and nutrients, plays a crucial role in enhancing cell proliferation and tissue regeneration, making it a preferred supplement in surgical wound management and post-operative care protocols. Additionally, heightened awareness around advanced wound care options and improved hospital infrastructure are further supporting the segment’s sustained growth.

Active Wound Care Market Regional Analysis

“Japan is the Dominant Country in the Active Wound Care Market”

- Japan holds the leading position in the Asia-Pacific Active Wound Care market, accounting for the largest market share due to its advanced healthcare infrastructure, strong presence of medical device manufacturers, and widespread adoption of innovative wound care technologies.

- The country’s high incidence of chronic conditions such as diabetes and vascular diseases, combined with an aging population, is driving the demand for advanced wound management solutions, including synthetic skin grafts, biologics, and growth factor-based products.

- Japan's emphasis on clinical research and its strong hospital network support the early adoption and integration of next-generation wound care therapies in both inpatient and outpatient settings.

- The presence of key industry players in Japan, further contributes to product innovation, domestic availability, and market dominance.

- In addition, the country’s robust reimbursement framework and strict adherence to regulatory standards—such as those set by the national health authorities—enhance product accessibility and clinical trust.

- Japan’s continued focus on patient-centric care, digital health integration, and personalized wound treatment plans ensures sustained leadership in the Asia Pacific Active Wound Care market.

“China is Projected to Register the Highest Growth Rate”

- China is poised to register the fastest growth in the Asia-Pacific Active Wound Care market, driven by increasing adoption of advanced wound care products in both hospital and community care settings.

- A growing burden of chronic wounds, supported by the rise in diabetes, obesity, and an aging demographic, is fueling the need for more effective, active wound healing solutions.

- China government’s strategic investments in NHS modernization and community wound care programs are encouraging the adoption of innovative wound care therapies such as negative pressure wound therapy (NPWT), smart dressings, and regenerative biologics.

- The country is also witnessing a rise in research and development activity, with leading universities and medical institutions focusing on regenerative medicine and tissue engineering—further driving demand for advanced wound care solutions.

- Collaborations between biotech startups and major medical technology firms are fostering innovation and accelerating product launches, contributing to the market's rapid expansion.

- The Japan’s focus on enhancing clinical outcomes, reducing hospitalization rates, and improving home-based wound care—combined with a favorable regulatory and reimbursement environment—positions it as the fastest-growing market within Asia Pacific.

Active Wound Care Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Smith+Nephew plc

- Mölnlycke Health Care AB

- Paul Hartmann AG

- Coloplast A/S

- B. Braun Melsungen AG

- ConvaTec Group Plc

- Lohmann & Rauscher GmbH & Co. KG

- Urgo Medical

- Essity AB

- 3M Health Care

Latest Developments in Asia-Pacific Active Wound Care Market

- In April 2024, Smith+Nephew shared results from its ALLEVYN LIFE Foam Dressing study in the International Wound Journal, revealing a novel mechanism of action for pressure injury prevention (PIP), which supports the growing emphasis on advanced wound care technologies in the Asia-Pacific region.

- In July 2024, Sonoma Pharmaceuticals, Inc. strengthened its distribution presence by partnering with Smart Healthcare Company (SHC) s.r.o., enabling broader access to its Microdacyn60 wound care products in Eastern Asia Pacific, with similar expansion strategies anticipated in Asia-Pacific markets.

- In May 2024, Convatec, based in London, released findings from a multinational randomized controlled trial (RCT), demonstrating that its AQUACEL Ag+ Extra dressing significantly improves healing outcomes in venous leg ulcers—findings that are driving increased adoption across hospitals and clinics in Asia-Pacific.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.