Asia Pacific Adme Toxicology Testing Market

Market Size in USD Million

CAGR :

%

USD

788.68 Million

USD

1,857.22 Million

2024

2032

USD

788.68 Million

USD

1,857.22 Million

2024

2032

| 2025 –2032 | |

| USD 788.68 Million | |

| USD 1,857.22 Million | |

|

|

|

|

Asia-Pacific ADME Toxicology Testing Market Size

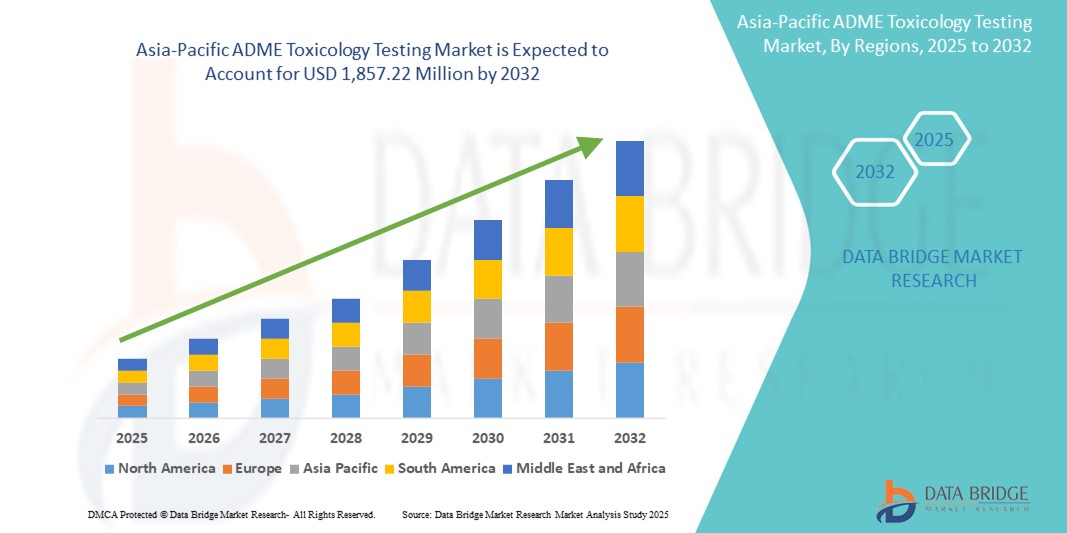

- The Asia-Pacific ADME toxicology testing market size was valued at USD 788.68 Million in 2024 and is expected to reach USD 1,857.22 Million by 2032, at a CAGR of 11.3% during the forecast period

- The market growth is largely fueled by the growing adoption of high-throughput screening technologies and advancements in in-silico modeling across pharmaceutical and biotech sectors, leading to enhanced efficiency in drug discovery and development in the Asia-Pacific region

- Furthermore, rising demand for early toxicity detection and predictive safety profiling is establishing ADME toxicology testing as a critical component of preclinical drug evaluation. These converging factors are accelerating the uptake of Asia-Pacific ADME toxicology testing solutions, thereby significantly boosting the industry's growth

Asia-Pacific ADME Toxicology Testing Market Analysis

- ADME toxicology testing, which includes evaluating a drug’s absorption, distribution, metabolism, and excretion properties along with potential toxicity, is becoming increasingly vital across pharmaceutical and biotechnology research in the Asia-Pacific region due to rising drug development activities and regulatory emphasis on early safety profiling

- The escalating demand for ADME toxicology solutions is fueled by the growing prevalence of chronic diseases, increased clinical trial activity, and heightened focus on reducing late-stage drug failures in countries such as China, India, Japan, and South Korea

- China dominated the Asia-Pacific ADME toxicology testing market, with the largest share within Asia-Pacific at 37.8% in 2024. This dominance is attributed to the rapid expansion of China’s pharmaceutical sector, strong government support through initiatives such as “Made in China 2025,” and an increasing number of drug approvals requiring safety evaluations

- India is expected to be the fastest growing region in the Asia-Pacific ADME toxicology testing market with a CAGR of 28.7% from 2025 to 2032. The country’s rapidly growing pharmaceutical manufacturing base, cost-effective R&D ecosystem, and rise in government and private investment in life sciences are key factors driving growth

- In-vitro testing segment dominated the Asia-Pacific ADME toxicology testing market with a market share of 61.4% in 2024, driven by strong regulatory support and reduced ethical concerns compared to animal-based testing. Its growing acceptance as a reliable alternative for toxicity screening and pharmacokinetic studies has positioned it as a preferred method among pharmaceutical and research organizations across the region

Report Scope and Asia-Pacific ADME Toxicology Testing Market Segmentation

|

Attributes |

Asia-Pacific ADME Toxicology Testing Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific ADME Toxicology Testing Market Trends

“Advancing Asia-Pacific ADME Toxicology Testing Market with AI and Voice-Enabled Technologies”

- A significant and accelerating trend in the Asia-Pacific ADME toxicology testing market is the deeper integration of artificial intelligence (AI), machine learning (ML), and automation technologies into preclinical drug assessment platforms. This convergence is significantly enhancing data analysis speed, decision-making accuracy, and throughput across ADME and toxicity studies

- For instance, companies such as Thermo Fisher Scientific and Agilent Technologies are leveraging AI-powered platforms that can predict drug metabolism pathways, simulate toxicity profiles, and optimize lead candidate selection with minimal manual intervention. These platforms enable faster go/no-go decisions, thereby improving pipeline efficiency

- AI integration also enables adaptive testing algorithms that can adjust study parameters in real-time based on intermediate results—leading to more personalized and precise assessments of absorption, distribution, metabolism, and excretion characteristics

- Moreover, automation technologies—such as liquid handling robots, lab-on-chip systems, and high-content screening platforms—are increasingly being deployed across laboratories in China, India, and South Korea. These technologies reduce human error, standardize testing workflows, and significantly boost productivity in toxicology research

- This growing demand for AI-enabled and automation-based ADME toxicology testing solutions is driving a paradigm shift in drug discovery, particularly as pharmaceutical companies across Asia-Pacific seek to reduce development timelines and costs while maintaining regulatory compliance

- Consequently, key players such as Charles River Laboratories, Merck KGaA, and Takara Bio Inc. are investing heavily in smart, automated platforms and cloud-based data integration tools to meet the evolving expectations of precision, speed, and scalability in ADME/Tox testing across the region

Asia-Pacific ADME Toxicology Testing Market Dynamics

Driver

“Growing Need Due to Rising Drug Development Activities and Technological Advancements”

- The increasing burden of chronic diseases and the rising number of drug discovery initiatives in countries such as China, India, and Japan are significantly driving the demand for ADME toxicology testing in the Asia-Pacific region. The growing pharmaceutical and biopharmaceutical sectors are highly dependent on accurate toxicological assessments to ensure drug safety and efficacy before clinical trials

- For instance, multiple regional governments have increased funding for biotech R&D, leading to enhanced adoption of in-vitro and in-silico ADME testing platforms. These efforts are reducing the reliance on animal testing while improving efficiency and compliance with global regulatory standards

- Technological advancements, such as high-throughput screening, omics-based testing, and AI-integrated platforms, are streamlining ADME testing processes, allowing faster, more predictive toxicology results

- The adoption of ADME toxicology tools is also propelled by increased outsourcing to CROs in Asia-Pacific due to cost advantages and skilled research personnel. As more international pharmaceutical companies establish research bases in this region, the demand for robust and compliant toxicological testing solutions continues to surge

Restraint/Challenge

“High Cost of Advanced Platforms and Lack of Skilled Workforce”

- Despite significant growth prospects, the Asia-Pacific ADME toxicology testing market faces key challenges including high costs associated with advanced technologies such as high-content screening, in-silico modeling tools, and molecular imaging systems. Small and mid-sized firms often find these costs prohibitive, limiting market penetration

- Moreover, the adoption of advanced platforms is constrained by the shortage of trained professionals proficient in bioinformatics, omics data interpretation, and machine learning tools for toxicology modeling. This skills gap leads to suboptimal use of the available technologies and delays in testing timelines

- Infrastructural inconsistencies across developing countries further impact uniform implementation of ADME toxicology testing standards

- To overcome these hurdles, investment in training programs, public-private collaborations, and strategic support from governments for technological upgradation will be vital. Affordable innovation, localized software solutions, and simplified interfaces can also help increase accessibility for small labs and emerging CROs in the region

Asia-Pacific ADME Toxicology Testing Market Scope

The market is segmented on the basis of technology, product type, test, method, application, end user, and distribution channel.

- By Technology

On the basis of technology, The Asia-Pacific ADME toxicology testing market is segmented into cell culture, high throughput, molecular imaging, and omics technology. Cell culture dominated the market with a 34.5% revenue share in 2024, attributed to its widespread use in predicting drug toxicity and absorption.

Omics technology is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, driven by advancements in genomics, proteomics, and metabolomics supporting detailed molecular toxicology studies.

- By Product Type

On the basis of product type, the Asia-Pacific ADME toxicology testing market is segmented into instruments, assays and reagents, accessories, and software solutions. Assays and reagents held the largest share of 41.2% in 2024, due to their recurring demand in testing workflows.

Software solutions are expected to grow at a CAGR of 12.5% from 2025 to 2032, supported by rising adoption of in-silico modeling and digital data analytics in ADME testing.

- By Test

On the basis of test, the Asia-Pacific ADME toxicology testing market is segmented into in-vivo and in-vitro tests. In-vitro testing dominated the market, with a revenue share of 61.4% of the market in 2024, driven by regulatory support and reduced ethical concerns compared to animal testing.

In-vivo testing is expected to witness fastest CAGR of 7.1% during the forecast period, maintaining relevance for complex physiological studies.

- By Method

On the basis of method, the Asia-Pacific ADME toxicology testing market is segmented into cellular assay, biochemical assay, in-silico, and ex-vivo. Cellular assays led the market with a 38.3% share in 2024, being integral in evaluating cell-level responses to drug compounds.

In-silico methods are expected to grow fastest at CAGR of 13.2% during the forecast period, due to their computational speed and cost efficiency.

- By Application

On the basis of application, the Asia-Pacific ADME toxicology testing market is segmented into systemic toxicity, renal toxicity, hepatotoxicity, neurotoxicity, and others. Systemic toxicity dominated with a 29.7% share in 2024, as it's essential for understanding whole-body responses during drug trials.

Neurotoxicity is projected to grow at the highest CAGR of 10.4% during the forecast period, reflecting increasing CNS drug development activities.

- By End User

On the basis of end user, the Asia-Pacific ADME toxicology testing market is segmented into biopharmaceutical companies, contract research organizations (CROs), academic and research institutes, and others. Biopharmaceutical companies accounted for the largest share at 46.8% in 2024, due to high R&D investment in drug discovery and safety screening.

CROs are expected to grow at a fastest CAGR of 11.1% during the forecast period, as outsourcing ADME services becomes more prevalent among pharma firms for cost and speed advantages.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific ADME toxicology testing market is divided into direct tender and others. Direct tender captured a 62.3% share in 2024, supported by bulk procurement by major institutions and companies.

The others segment, including third-party and online platforms, is growing at a CAGR of 8.7%, catering to smaller labs and emerging players.

Asia-Pacific ADME Toxicology Testing Market Regional Analysis

- Asia-Pacific accounted for the largest share of 40.5% in the global ADME toxicology testing market in 2024, owing to the region’s expanding pharmaceutical and biotechnology industries, growing R&D expenditures, and an increasing focus on early-stage drug development

- The market is further driven by the surge in contract research outsourcing, supportive government policies promoting innovation, and growing adoption of predictive toxicology tools

- Countries such as China, India, and Japan are at the forefront due to their significant clinical trial activity and increasing awareness of drug safety

China ADME Toxicology Testing Market Insight

The China ADME toxicology testing market held the largest share within Asia-Pacific at 37.8% in 2024, making it the regional leader in ADME toxicology testing. This dominance is attributed to the rapid expansion of China’s pharmaceutical sector, strong government support through initiatives such as “Made in China 2025,” and an increasing number of drug approvals requiring safety evaluations. China’s robust CRO landscape, alongside favorable regulatory reforms by the NMPA (formerly CFDA), is accelerating the adoption of in vitro and high-throughput toxicology methods.

Japan ADME Toxicology Testing Market Insight

The Japan ADME toxicology testing market accounted for 24.6% of the Asia-Pacific market in 2024, supported by its well-established pharmaceutical infrastructure, advanced laboratory technologies, and stringent regulatory requirements for preclinical testing. Japanese pharmaceutical companies are increasingly leveraging AI-driven platforms and automation in ADME analysis to enhance drug discovery efficiency and reduce development timelines. The aging population and high healthcare expenditure further fuel the demand for safe, effective therapeutic innovations.

India ADME Toxicology Testing Market Insight

The India ADME toxicology testing market captured a 21.5% share of the Asia-Pacific market in 2024 and is projected to register the fastest CAGR of 28.7% from 2025 to 2032. The country’s rapidly growing pharmaceutical manufacturing base, cost-effective R&D ecosystem, and rise in government and private investment in life sciences are key factors driving growth. India's emergence as a global outsourcing hub for clinical trials and toxicological assessments, combined with the rising focus on biosimilars and generic drugs, is expected to further strengthen its market position.

Asia-Pacific ADME Toxicology Testing Market Share

The Asia-Pacific ADME toxicology testing industry is primarily led by well-established companies, including:

- Promega Corporation (U.S.)

- Lonza (Switzerland)

- AAT Bioquest, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Corning Incorporated (U.S.)

- Charles River Laboratories (U.S.)

- LABCYTE INC. (U.S.)

- BioIVT (U.S.)

- Takara Bio Inc. (Japan)

- Agilent Technologies, Inc. (U.S.)

- PromoCell GmbH (Germany)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

Latest Developments in Asia-Pacific ADME toxicology testing Market

- In May 2021, Merck KGaA, a leading science and technology company, announced the extension of its ongoing collaboration with BioMed X, Heidelberg, Germany. As a result of this successful collaboration, multiple innovative discovery projects in new research areas have been started at Merck

- In April 2021, Agilent Technologies Inc. announced that it has acquired Resolution Bioscience, which is a leader in the development and commercialization of Next Generation Sequencing based precision oncology solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.