Asia Pacific Advanced Composite Market

Market Size in USD Billion

CAGR :

%

USD

5.26 Billion

USD

9.89 Billion

2025

2033

USD

5.26 Billion

USD

9.89 Billion

2025

2033

| 2026 –2033 | |

| USD 5.26 Billion | |

| USD 9.89 Billion | |

|

|

|

|

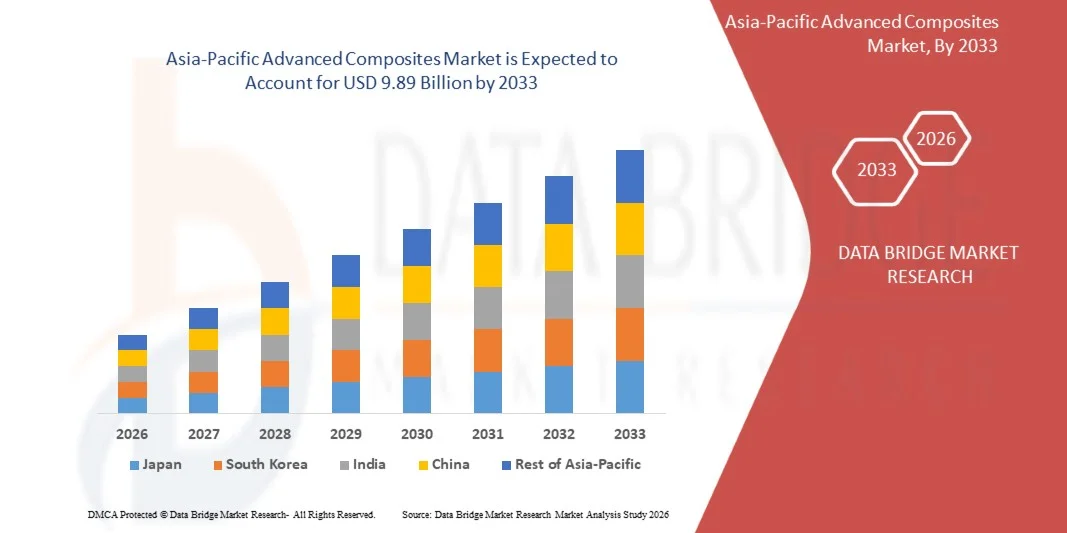

Asia-Pacific Advanced Composites Market Size

- The Asia-Pacific Advanced Composites Market size was valued at USD 5.26 billion in 2025 and is expected to reach USD 9.89 billion by 2033, at a CAGR of 8.2% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight, high-strength materials across aerospace, automotive, energy, and defense industries, driving the adoption of advanced composites for structural and high-performance applications

- Furthermore, rising emphasis on fuel efficiency, emission reduction, and sustainability in automotive and aerospace sectors is establishing advanced composites as the preferred material for lightweight and durable components. These converging factors are accelerating the uptake of composite solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Advanced Composites Market Analysis

- Advanced composites, offering superior strength-to-weight ratios, corrosion resistance, and design flexibility, are increasingly vital in aerospace, automotive, energy, and industrial applications due to their ability to enhance performance, reduce maintenance costs, and improve operational efficiency

- The escalating demand for advanced composites is primarily fueled by stringent regulatory standards for fuel efficiency and emissions, growing adoption of electric vehicles, and increasing investments in high-performance infrastructure, reflecting a rising preference for lightweight, durable, and sustainable materials

- China dominated the Asia-Pacific Advanced Composites Market in 2025, due to its expansive manufacturing ecosystem, strong aerospace and automotive production capabilities, and rising demand for lightweight, high-strength materials

- India is expected to be the fastest growing country in the Asia-Pacific Advanced Composites Market during the forecast period due to rapid industrial growth, expanding automotive and renewable energy sectors, and rising adoption of lightweight materials across manufacturing

- Carbon fiber composites segment dominated the market with a market share of 66.73% in 2025, due to its superior strength-to-weight ratio, exceptional stiffness, and extensive adoption in aerospace, automotive, and high-performance sporting applications. Its widespread use in aircraft structural components, automotive body panels, and wind turbine blades fuels steady demand, and ongoing innovations in carbon fiber production techniques have further enhanced affordability and performance. Manufacturers and end-users prefer carbon fiber composites for their durability, fatigue resistance, and ability to withstand harsh environmental conditions, making it the preferred choice for critical applications requiring lightweight yet high-strength materials

Report Scope and Asia-Pacific Advanced Composites Market Segmentation

|

Attributes |

Advanced Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Advanced Composites Market Trends

“Adoption of Lightweight Composites in Aerospace and Automotive”

- The Asia-Pacific Advanced Composites Market is witnessing an accelerated adoption of lightweight and high-strength composite materials across aerospace and automotive industries. A focus on reducing fuel consumption, improving efficiency, and minimizing emissions is leading manufacturers to incorporate carbon fiber and glass fiber composites into aircraft structures, electric vehicle bodies, and high-performance components

- For instance, Hexcel Corporation and Toray Industries have invested in automated carbon composite manufacturing for aircraft wings, automotive chassis, and next-generation electric vehicles. Their developments in nanotechnology and automated fabrication enhance weight reduction, stiffness, and fatigue resistance, addressing stringent regulatory and sustainability targets worldwide

- Rising adoption of composites in wind energy, construction, and high-speed rail sectors is further expanding market potential. Companies are pioneering innovations such as self-healing composites, bio-based resins, and advanced recycling, which improve lifespan, minimize maintenance, and support green building initiatives

- Investment in smart manufacturing processes—such as robotic layup, additive manufacturing, and real-time quality control—facilitates scalability and cost reduction. Such automation enables mass-production of complex components, broadening composite applications in mass-market vehicles and infrastructure

- In addition, increasing collaboration among research centers, OEMs, and material suppliers accelerates the development and commercialization of sustainable composite solutions. Policy incentives and international standards supporting low-carbon, recyclable materials propel composite usage as an essential strategy for cleaner mobility and energy

- These trends reflect a market transformation focused on efficiency, sustainability, and innovation. As regulatory environments evolve and technology matures, advanced composites are set to become foundational in global transportation and industrial ecosystems

Asia-Pacific Advanced Composites Market Dynamics

Driver

“Demand for Fuel-Efficient and Sustainable Materials”

- The demand for fuel-efficient and sustainable materials drives the growth of the Asia-Pacific Advanced Composites Market, fueled by the need to reduce operational costs and environmental footprint across transportation, energy, and infrastructure sectors. Composites provide superior strength-to-weight ratios, corrosion resistance, and design flexibility, making them ideal for sustainable design initiatives

- For instance, Boeing and BMW have expanded the utilization of carbon fiber composites to produce lighter, stronger components. These materials help aircraft and automotive manufacturers achieve improved fuel efficiency, lower emissions, and higher structural integrity, supporting ambitious regulatory compliance and corporate sustainability programs

- Fuel savings in aerospace and automotive industries attributable to composites are significant, with a 10% reduction in weight enabling up to 8% improvement in aircraft fuel economy. Growth in electric vehicles, wind energy, and green construction sectors further amplifies the need for advanced composites, given their impact on efficiency and lifecycle emissions

- Initiatives focusing on green building, renewable energy, and sustainable mobility boost composite adoption in structural, rotor, and modular construction applications. Emerging bio-based composites and closed-loop recycling contribute to circular economy goals, enhancing the reputation and viability of advanced materials

- Business and policy collaboration is accelerating innovation and market penetration, as manufacturers align product portfolios to meet fuel, emissions, and recycling targets. The shift towards sustainable materials is expected to be a core driver shaping future composite market expansion

Restraint/Challenge

“High Production and Raw Material Costs”

- High production and raw material costs present a significant challenge for Asia-Pacific Advanced Composites Market expansion. Manufacturing composites, particularly carbon fiber varieties, involves energy-intensive processes, demanding high-purity inputs and specialized equipment that elevate operational expenses

- For instance, companies such as SGL Carbon and Mitsubishi Chemical Group contend with premium costs for carbon fiber precursors, complex processing steps, and rigorous quality control. These expenses frequently result in price premiums that limit composites’ viability for cost-sensitive product categories

- Customization, certification, and compliance increase costs, particularly in aerospace and defense applications, as every component must meet stringent regulatory and performance standards. Although technological advancements in automation and recycling offer cost-saving potential, upfront investments remain a barrier for many entrants and small manufacturers

- Limited recycling options, particularly for thermoset-based composites, pose additional environmental and disposal challenges, amplifying total lifecycle costs. As regulations tighten and sustainability standards evolve, the need to advance cost-effective, recyclable composite solutions is becoming more urgent

- Addressing these barriers will require scaling up innovation in bio-based feedstocks, automated manufacturing, and next-generation recycling. Strategic industry partnerships, policy support, and investment in mass-production technology will be essential to achieving sustainable, affordable growth for advanced composites worldwide

Asia-Pacific Advanced Composites Market Scope

The market is segmented on the basis of type, resin, manufacturing process, and end-user.

• By Type

On the basis of type, the Asia-Pacific Advanced Composites Market is segmented into Carbon Fiber Composites, S-Glass Composites, Aramid Fiber Composites, and Others. The carbon fiber composites segment dominated the market with the largest revenue share of 66.73% in 2025, driven by its superior strength-to-weight ratio, exceptional stiffness, and extensive adoption in aerospace, automotive, and high-performance sporting applications. Its widespread use in aircraft structural components, automotive body panels, and wind turbine blades fuels steady demand, and ongoing innovations in carbon fiber production techniques have further enhanced affordability and performance. Manufacturers and end-users prefer carbon fiber composites for their durability, fatigue resistance, and ability to withstand harsh environmental conditions, making it the preferred choice for critical applications requiring lightweight yet high-strength materials.

The aramid fiber composites segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing use in ballistic protection, aerospace, and defense applications. For instance, companies such as DuPont are innovating with aramid-based composites for helmets, body armor, and aerospace panels, capitalizing on its high impact resistance and thermal stability. Growing awareness regarding protective gear in defense and safety-conscious industries, combined with expanding use in automotive and industrial sectors, drives strong demand. The lightweight nature, high tensile strength, and resistance to abrasion and chemical degradation make aramid composites an increasingly attractive choice across multiple high-performance applications.

• By Resin

On the basis of resin, the market is segmented into Advanced Thermoplastic and Advanced Thermosetting. The advanced thermosetting resin segment dominated the market with the largest revenue share in 2025, driven by its ability to deliver excellent thermal and chemical resistance, structural stability, and mechanical strength under extreme conditions. Aerospace, automotive, and wind energy industries extensively use thermosetting composites in high-load-bearing and high-temperature applications, providing long-term reliability. For instance, Hexcel and Cytec manufacture thermosetting prepregs and laminates for aircraft structures and industrial machinery, underscoring the resin’s pivotal role in high-performance composite applications.

The advanced thermoplastic resin segment is projected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in automotive, medical, and consumer goods sectors for lightweight, recyclable, and high-performance components. Thermoplastic composites offer faster manufacturing cycles and improved toughness compared to thermosets, making them ideal for mass production. Companies such as Solvay are innovating with thermoplastic composites for automotive structural parts and lightweight aerospace components, driving market momentum. The ability to reprocess and thermoform thermoplastic composites enhances sustainability and cost-efficiency, appealing to environmentally conscious manufacturers.

• By Manufacturing Process

On the basis of manufacturing process, the market is segmented into Automated Tape Laying (ATL) and Automated Fiber Placement (AFP), Hand Layup/Spray Layup, Compression Molding, Resin Transfer Molding (RTM), Injection Molding, Filament Winding, Pultrusion, and Others. The Automated Fiber Placement (AFP) segment dominated the market with the largest revenue share in 2025, driven by its precision, automation, and efficiency in producing large-scale, high-performance composite structures for aerospace and defense applications. AFP allows consistent fiber placement, optimized material utilization, and reduced labor costs, supporting adoption in aircraft fuselage, wing components, and spacecraft. For instance, Boeing and Lockheed Martin implement AFP extensively for carbon fiber-reinforced panels, highlighting its critical role in advanced manufacturing.

The resin transfer molding (RTM) segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its cost-effectiveness, repeatability, and suitability for medium-to-large components in automotive, energy, and industrial sectors. RTM offers excellent surface finish, high fiber volume fraction, and design flexibility, making it attractive for mass-produced composite parts. Companies such as Gurit are innovating RTM processes for wind turbine blades and automotive structural components, driving adoption. The balance of production efficiency, structural performance, and scalability contributes to RTM’s rapid growth.

• By End-User

On the basis of end-user, the Asia-Pacific Advanced Composites Market is segmented into Aerospace and Defense, Energy and Power, Automotive, Sports Equipment, Civil Engineering, Electrical and Electronics, Healthcare, and Others. The aerospace and defense segment dominated the market with the largest revenue share in 2025, driven by the critical demand for lightweight, high-strength, and fatigue-resistant materials in aircraft, spacecraft, and defense equipment. Stringent safety standards, fuel efficiency targets, and the need for high-performance components in military aircraft and satellites reinforce market dominance. For instance, Airbus extensively uses carbon fiber composites for fuselage panels and wing structures, highlighting the segment’s strategic importance.

The automotive segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the global shift toward lightweight, fuel-efficient, and electric vehicles. Composites offer significant weight reduction, improved energy efficiency, and enhanced crashworthiness, meeting regulatory and consumer demands. Companies such as BMW and Tesla are integrating advanced composites into EV chassis and structural components, accelerating adoption. Expanding applications in commercial vehicles, sports cars, and urban mobility solutions contribute to the automotive sector’s rapid growth trajectory.

Asia-Pacific Advanced Composites Market Regional Analysis

- China dominated the Asia-Pacific Advanced Composites Market with the largest revenue share in 2025, driven by its expansive manufacturing ecosystem, strong aerospace and automotive production capabilities, and rising demand for lightweight, high-strength materials

- Robust government initiatives supporting advanced material adoption, in addition to rapid industrialization and increased focus on carbon-fiber integration across transportation and electronics, reinforce China’s leadership in the regional market

- The presence of leading domestic composite manufacturers, strategic collaborations with global material suppliers, and continuous investments in high-performance thermoset and thermoplastic composites continue to strengthen China’s dominant position during the forecast period. Expanding export capacity and accelerated innovation in industrial applications further boost market penetration across major industries

Japan Asia-Pacific Advanced Composites Market Insight

Japan is anticipated to grow steadily from 2026 to 2033, supported by its advanced automotive, electronics, and aerospace sectors coupled with a strong emphasis on high-precision and high-durability materials. Japanese manufacturers are increasingly adopting premium composite solutions that offer superior strength-to-weight ratios and long-term reliability. The demand for compact, high-performance, and energy-efficient composite components is rising due to Japan’s technological preferences and engineering-driven production standards. Continuous R&D investments and collaborations between Japanese composite producers and global aerospace and automotive companies reinforce the market’s stable expansion. Japan’s commitment to innovation, precision engineering, and sustainable material development underpins its strong regional positioning.

India Asia-Pacific Advanced Composites Market Insight

India is projected to register the fastest CAGR in the Asia Pacific Asia-Pacific Advanced Composites Market during 2026–2033, fueled by rapid industrial growth, expanding automotive and renewable energy sectors, and rising adoption of lightweight materials across manufacturing. Growing investments in wind energy, electric vehicles, and infrastructure modernization are accelerating composite consumption. The demand for cost-effective, durable, and easy-to-process composite solutions is particularly strong among emerging domestic manufacturers. Expanding industrial corridors, supportive government policies promoting advanced material adoption, and partnerships with global composite technology companies are improving production capabilities and accessibility. India’s strategic focus on industrial expansion, sustainability, and material innovation ensures its position as the fastest-growing market in the region.

Asia-Pacific Advanced Composites Market Share

The advanced composites industry is primarily led by well-established companies, including:

- TORAY INDUSTRIES, INC.(Japan)

- Teijin Aramid B.V. (Netherlands)

- Mitsubishi Chemical Group Corporation (Japan)

- Huntsman International LLC. (U.S.)

- BASF SE (Germany)

- Solvay (Belgium)

- Akzo Nobel N.V. (Netherlands)

- DuPont (U.S.)

- Hexion (U.S.)

- Honeywell International Inc. (U.S.)

- Owens Corning (U.S.)

- Formosa Plastics Corporation (Taiwan)

- Henkel AG & Co. KgaA (Germany)

- Lyondellbasell Industries Holdings B.V. (Netherlands)

- Hanwha Solutions (South Korea)

- SGL Carbon (Germany)

- Kemira (Finland)

- H.B. Fuller (U.S.)

- Evonik Industries AG (Germany)

Latest Developments in Asia-Pacific Advanced Composites Market

- In May 2025, Solvay unveiled a fully recyclable thermoplastic composite resin specifically designed for electric-vehicle battery housings. This innovation significantly reduces the overall weight of vehicles while maintaining strict fire-safety and structural standards. The development enhances the adoption of composites in the rapidly growing EV sector, addressing manufacturers’ needs for lightweight, durable, and environmentally sustainable materials. By combining performance with recyclability, Solvay is driving a shift toward greener, high-performance solutions in automotive and energy-intensive applications

- In January 2025, Mallinda launched its Vitrimax VHM (Versatile Hot Melt) resin, a vitrimer-based system that merges the high mechanical performance of thermosets with the recyclability of thermoplastics. This breakthrough enables the economic recycling and reuse of composite scrap, reducing waste and supporting circular manufacturing practices. The introduction of Vitrimax VHM strengthens the sustainability aspect of advanced composites, appealing to manufacturers in automotive, aerospace, and industrial sectors seeking eco-friendly and high-performance materials

- In June 2022, Hexcel Corporation announced that Sikorsky, a Lockheed Martin Company, awarded a long-term contract to deliver advanced composite structures for the CH-53K King Stallion heavy-lift helicopter program. This contract underscores the increasing reliance on lightweight, high-strength composites in critical aerospace applications, where performance and durability are paramount. The collaboration also highlights the strategic importance of advanced composites in defense programs and their role in enhancing aircraft efficiency, payload capacity, and operational reliability

- In March 2022, Hexcel Corporation expanded its engineered core manufacturing operation in Morocco to meet the growing demand for lightweight advanced composites from aerospace clients. The expansion strengthens Hexcel’s global supply chain, enabling faster delivery and better support for large-scale aerospace projects. This move also reflects the broader industry trend of increasing investments in production capacity to cater to rising demand for materials that reduce weight, improve fuel efficiency, and maintain structural integrity in aircraft and spacecraft

- In February 2022, Teijin Automotive Technologies, the primary entity for the Teijin Group’s automotive composites sector, inaugurated a new 39,000-square-meter production facility in Changzhou, Jiangsu province, China, within the Wujin National Hi-Tech Industrial Zone. The company also announced a third 13,000-square-meter facility under construction, expected to be completed in the summer of 2023. These expansions strengthen Teijin’s production capabilities, support the growing automotive composites market in China, and enable the company to supply lightweight, high-strength materials for vehicle structural components, improving performance and fuel efficiency in the automotive sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Advanced Composite Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Advanced Composite Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Advanced Composite Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.