Asia Pacific Analytical Laboratory Services Market

Market Size in USD Million

CAGR :

%

USD

407.57 Million

USD

905.96 Million

2024

2032

USD

407.57 Million

USD

905.96 Million

2024

2032

| 2025 –2032 | |

| USD 407.57 Million | |

| USD 905.96 Million | |

|

|

|

|

Asia-Pacific Analytical Laboratory Services Market Size

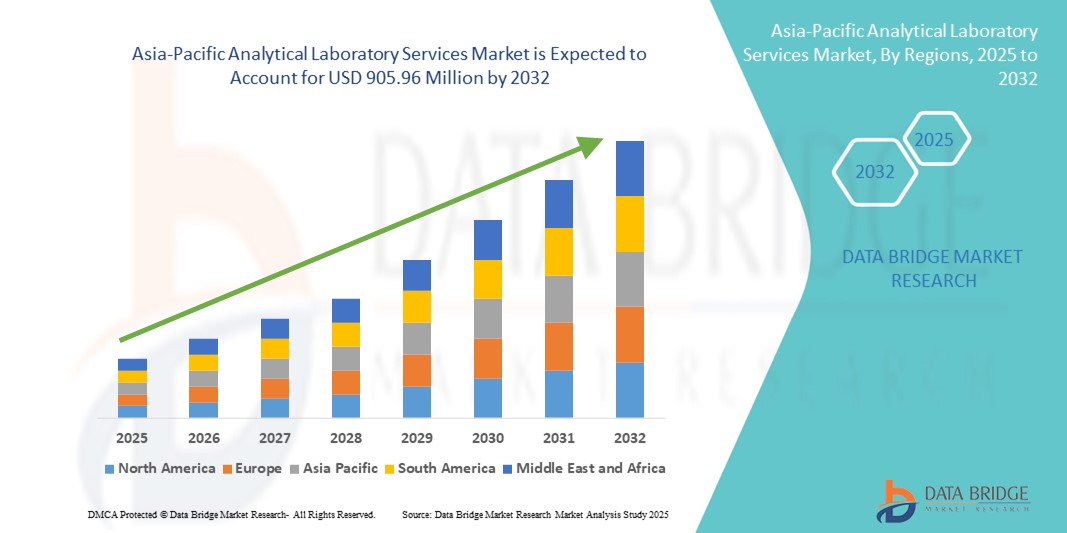

- The Asia-Pacific analytical laboratory services market size was valued at USD 407.57 million in 2024 and is expected to reach USD 905.96 million by 2032, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by increasing demand for reliable testing, rising healthcare access, and advancements in laboratory technologies across Asia-Pacific, enabling accurate and timely analysis for various industries including pharmaceuticals, food & beverages, and environmental testing. The region is witnessing a surge in outsourcing analytical services, particularly in rapidly developing countries such as India, China, and Indonesia, contributing to the growing adoption of analytical laboratory services

- Furthermore, escalating investments in laboratory infrastructure, expansion of testing facilities in rural and semi-urban areas, and increasing public-private collaborations are driving innovation and the availability of specialized analytical services. Government quality-control initiatives, coupled with the growing presence of international analytical service providers and local laboratory capabilities, are significantly boosting the growth of the Asia-Pacific Analytical Laboratory Services market

Asia-Pacific Analytical Laboratory Services Market Analysis

- The Asia-Pacific analytical laboratory services market is experiencing robust growth, driven by the rapid expansion of the pharmaceutical, biotechnology, and food & beverage industries across countries such as China, India, Japan, South Korea, Australia, Thailand, Indonesia, and Vietnam

- Increasing R&D investments, a surge in clinical trials, stricter regulatory requirements, and growing demand for quality testing in export-oriented industries are fueling market expansion across the region

- China dominated the Asia-Pacific analytical laboratory services market, accounting for the largest revenue share of 45.0% in 2024, supported by its strong pharmaceutical manufacturing base, high volume of drug approvals, expanding testing infrastructure, and government initiatives to enhance quality standards across industries

- India is projected to register the fastest CAGR of 18.8% in the Asia-Pacific analytical laboratory services market during the forecast period, driven by a growing pharmaceutical and biotechnology sector, increasing outsourcing of analytical testing, rising awareness of global compliance standards, and the expansion of domestic laboratory networks into semi-urban and rural regions

- The Hospital-Based Laboratories segment dominated the Asia-Pacific analytical laboratory services market with a market share of 41.5% in 2024, supported by their advanced infrastructure, integrated patient care, and the ability to handle high test volumes

Report Scope and Asia-Pacific Analytical Laboratory Services Market Segmentation

|

Attributes |

Asia-Pacific Analytical Laboratory Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Analytical Laboratory Services Market Trends

Growing Demand for Advanced Testing and Regulatory Compliance Support

- A significant and accelerating trend in the Asia-Pacific analytical laboratory services market is the increasing focus on high-precision testing, method development, and regulatory compliance support. This includes efforts to improve analytical accuracy, turnaround times, and compliance with evolving international quality standards

- Major service providers across the region are collaborating with pharmaceutical, biotechnology, and food & beverage companies to deliver next-generation analytical solutions such as high-resolution mass spectrometry, stability testing, and advanced microbiological analysis. These innovations cater to the growing demand for validated, reliable, and audit-ready testing data

- Increasing adoption of analytical services in sectors such as pharmaceuticals, healthcare, environmental monitoring, and nutraceuticals is further accelerating market growth. These services are being recognized for their ability to ensure product safety, efficacy, and compliance with strict regulatory guidelines

- Academic institutions, research centers, and government laboratories in countries such as Japan, India, and Australia are conducting studies on new analytical methodologies, validation techniques, and automation in laboratory workflows—leading to service enhancements backed by scientific evidence and tailored to industry-specific needs

- As the Asia-Pacific region continues to emphasize quality assurance, innovation, and export competitiveness, the Analytical Laboratory Services market is poised for sustained expansion—driven by regulatory stringency, technological advancements, and the increasing integration of R&D with laboratory expertise

Asia-Pacific Analytical Laboratory Services Market Dynamics

Driver

Growing Demand Driven by Advancements in Healthcare, Pharmaceuticals, and Biotechnology

- The Asia-Pacific analytical laboratory services market is experiencing accelerated growth fueled by the expansion of pharmaceutical manufacturing, biotechnology research, and advanced healthcare infrastructure across key countries such as China, India, Japan, South Korea, and Australia. Increasing investments in drug discovery, biosimilar development, and personalized medicine are boosting the demand for high-quality analytical testing services that meet international regulatory standards

- For instance, in March 2024, WuXi AppTec expanded its analytical testing facilities in China, enhancing capabilities in bioanalytical services, stability testing, and microbiological analysis to support both domestic and global clients in achieving faster regulatory approvals

- The rising prevalence of chronic diseases, coupled with a strong focus on ensuring product quality and safety, is driving pharmaceutical and biotech companies to outsource analytical laboratory services to specialized providers with advanced instrumentation and GMP-compliant facilities

- Government initiatives promoting local R&D capabilities, alongside incentives for clinical trial activities, are further supporting market growth. Countries such as Singapore and South Korea are positioning themselves as regional hubs for analytical excellence, attracting global clients through strong IP protection and competitive service costs

- The expansion of digital platforms and integrated laboratory information management systems (LIMS) is enabling service providers to handle large volumes of analytical data efficiently, thereby improving accuracy, turnaround times, and regulatory compliance for clients across multiple industries

Restraint/Challenge

Limited Penetration in Small-Scale Enterprises and Rural Regions

- Despite rapid urban and industrial development, the Asia-Pacific analytical laboratory services market faces barriers in penetrating small-scale manufacturing units and rural-based industries, particularly in Southeast Asia and parts of South Asia. High service costs, limited awareness of the benefits of advanced analytical testing, and budget constraints often prevent smaller companies from adopting these services

- Infrastructure challenges, including inadequate cold chain systems, underdeveloped transport networks, and limited laboratory coverage in non-metropolitan regions, further hinder the timely execution of sample collection, testing, and reporting

- Many rural and semi-urban businesses still rely on basic in-house quality checks, which do not meet international standards, resulting in a gap between product quality requirements and testing capabilities

- In addition, the uneven distribution of accredited laboratories across the region forces companies in remote areas to rely on long-distance sample transportation, increasing turnaround times and operational costs

- To overcome these hurdles, leading market players are exploring decentralized testing models, mobile laboratory setups, and partnerships with local industry bodies to enhance accessibility. They are also introducing cost-effective service packages tailored for SMEs to improve adoption in price-sensitive markets while ensuring compliance with regulatory norms

Asia-Pacific Analytical Laboratory Services Market Scope

The market is segmented on the basis of test type, service type, method type, application, technology, and end user channel.

- By Test Type

On the basis of test type, the Asia-Pacific analytical laboratory services market is segmented into bioanalytical testing, batch release testing, stability testing, raw material testing, physical characterization, method validation, microbial testing, and environmental monitoring. The bioanalytical testing segment dominated the market with the largest revenue share of 28.7% in 2024, owing to its critical role in drug development, pharmacokinetics, and bioequivalence studies for regulatory compliance.

The environmental monitoring segment is projected to grow at the fastest CAGR of 10.8% from 2025 to 2032, driven by increasing environmental safety regulations, stringent quality control standards, and growing awareness of contamination prevention in pharmaceutical manufacturing.

- By Service Type

On the basis of service type, the Asia-Pacific analytical laboratory services market is segmented into hospital-based laboratories, stand-alone laboratories, and clinics-based laboratories. The hospital-based laboratories segment accounted for the largest share of 41.5% in 2024, supported by their advanced infrastructure, integrated patient care, and the ability to handle high test volumes.

The stand-alone laboratories segment is anticipated to register the fastest CAGR of 9.6% from 2025 to 2032, due to the rising number of independent diagnostic centers and increased outsourcing by small- and medium-sized healthcare facilities.

- By Method Type

On the basis of method type, the Asia-Pacific analytical laboratory services market is segmented into cell-based assays, virology testing, biomarker testing, pharmacokinetic testing, immunogenicity, and serology. Among these, the biomarker testing segment led the market with a share of 24.9% in 2024, driven by the rising adoption of precision medicine, companion diagnostics, and targeted therapies in oncology and chronic disease management. Biomarker testing is increasingly being leveraged to guide personalized treatment plans, monitor disease progression, and evaluate therapeutic response, making it a critical component of modern analytical laboratory workflows.

The cell-based assays segment is projected to grow at the fastest CAGR of 9.8% from 2025 to 2032, supported by their expanding applications in immunology, high-throughput drug screening, biologics development, and evaluation of cellular responses to novel therapies. The growing focus on functional assays and cell-based models is further accelerating demand in both research and clinical settings.

- By Application

On the basis of application, the Asia-Pacific analytical laboratory services market is segmented into oncology, neurology, infectious disease, gastroenterology, cardiology, and other applications. The oncology segment dominated with a market share of 34.6% in 2024, fueled by the high prevalence of cancer, increasing demand for molecular diagnostics, and substantial investments in cancer research and clinical trials across the region. Analytical laboratory services in oncology are critical for early detection, biomarker profiling, and personalized treatment planning, which are key drivers of patient outcomes.

The infectious disease segment is anticipated to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by the ongoing need for advanced testing solutions to detect emerging and re-emerging pathogens. The COVID-19 pandemic has underscored the importance of rapid and accurate diagnostics, leading to increased investment in infectious disease testing infrastructure and preparedness for future outbreaks.

- By Technology

On the basis of technology, the Asia-Pacific analytical laboratory services market is segmented into Mass Spectroscopy (LC-MS/MS), Immunochemistry, UPLC Technology, Turbulent Flow Technology, and Others. The Mass Spectroscopy (LC-MS/MS) segment accounted for the largest share of 38.1% in 2024, owing to its high accuracy, sensitivity, and versatility in bioanalysis, toxicology, pharmacokinetics, and metabolite profiling. LC-MS/MS is widely regarded as the gold standard for quantitative and qualitative analysis in both pharmaceutical and clinical research applications.

The UPLC Technology segment is projected to grow at the fastest CAGR of 9.9% from 2025 to 2032, driven by its ability to deliver rapid and high-resolution analysis, enhance laboratory throughput, and support complex drug development workflows. Its growing adoption is also fueled by the increasing demand for precise quantification and efficient separation of complex biological samples in analytical laboratories.

- By End User Channel

On the basis of end user channel, the Asia-Pacific analytical laboratory services market is segmented into pharmaceutical and biopharmaceutical companies, contract development and manufacturing organizations (CDMOs), contract research organizations (CROs), and others. The pharmaceutical and biopharmaceutical companies segment dominated with a revenue share of 44.2% in 2024, driven by the substantial volume of in-house and outsourced analytical testing required during the drug discovery, development, and regulatory approval stages. These companies rely heavily on advanced laboratory services for quality control, formulation analysis, stability testing, and bioanalytical support, ensuring the efficacy and safety of their therapeutic products.

The contract development and manufacturing organizations (CDMOs) segment is projected to record the fastest CAGR of 9.7% from 2025 to 2032, fueled by the increasing trend of outsourcing analytical testing to specialized service providers. This allows pharmaceutical firms to reduce operational costs, streamline development processes, and accelerate time-to-market for new drugs. CDMOs are increasingly investing in state-of-the-art analytical capabilities, including high-throughput screening, bioanalysis, and method development, positioning themselves as critical partners in the regional pharmaceutical ecosystem.

Asia-Pacific Analytical Laboratory Services Market Regional Analysis

- Asia-Pacific held a revenue share of 23.5% in the global analytical laboratory services market, in 2024. This leadership position is driven by the region’s vast population base, the rapid expansion of its healthcare, pharmaceutical, and biotechnology sectors, and the increasing outsourcing of testing and analytical functions to specialized laboratories

- A rising focus on product quality, regulatory compliance, and safety testing across multiple industries—including food & beverages, environmental monitoring, and medical research—is also contributing to market growth. The strong presence of advanced analytical facilities, coupled with a skilled workforce, is enabling the region to cater to both domestic and international clients. Furthermore, the expansion of contract research organizations (CROs), growth in clinical trial activities, and adoption of digital laboratory solutions are reinforcing Asia-Pacific’s dominant position in the market

- The demand for analytical laboratory services is further supported by significant investments from both public and private sectors to enhance laboratory infrastructure and technology capabilities. Key growth contributors include the increasing prevalence of chronic diseases, a surge in personalized medicine development, and the expansion of environmental testing mandates across several countries in the region. In addition, rapid industrialization, a growing middle-class population with higher awareness of product quality, and government-led initiatives for R&D advancement have collectively fueled market growth. Strategic partnerships between regional laboratories and global players, along with a rise in cross-border testing collaborations, are accelerating Asia-Pacific’s influence in the global market

China Asia-Pacific Analytical Laboratory Services Market Insight

The China analytical laboratory services market held the largest market share in the Asia-Pacific region at 45.0% in 2024, solidifying its leadership through a combination of advanced technological capabilities, cost-competitive service offerings, and a robust domestic industrial base. The country’s analytical laboratory sector benefits from substantial government funding for life sciences research, pharmaceutical innovation, and environmental protection programs. Rapid urbanization, industrial growth, and stricter regulatory frameworks have driven demand for chemical, biological, and environmental testing. In addition, China’s expanding role as a global manufacturing hub has increased the need for quality control and compliance testing, both for exports and domestic consumption. The strong presence of well-established local laboratories, as well as foreign-invested analytical service providers, has created a competitive and innovation-driven market environment.

India Asia-Pacific Analytical Laboratory Services Market Insight

The India analytical laboratory services market is projected to register the fastest CAGR of 18.8% from 2025 to 2032, driven by growing awareness of product safety, the rapid expansion of the pharmaceutical and biotechnology sectors, and the increasing adoption of third-party testing services. Government initiatives such as “Make in India” and investments in R&D infrastructure have significantly boosted domestic laboratory capabilities. Rising healthcare expenditure, increased foreign investment, and the proliferation of diagnostic centers across tier 2 and tier 3 cities are fueling service demand. Furthermore, the adoption of advanced technologies such as high-performance liquid chromatography (HPLC), mass spectrometry, and genomics-based testing is elevating the quality and scope of services offered in the country. Strategic collaborations between Indian laboratories and global CROs, coupled with the expansion of export-oriented manufacturing in pharmaceuticals, chemicals, and food products, are positioning India as one of the fastest-growing analytical laboratory service markets in Asia-Pacific.

Asia-Pacific Analytical Laboratory Services Market Share

The Asia-Pacific analytical laboratory services industry is primarily led by well-established companies, including:

- WuXiAppTec (China)

- Eurofins Scientific (U.S.)

- SGS SA (Switzerland)

- Covance (U.S.)

- Intertek Group plc (U.K.)

- Charles River Laboratories (U.S.)

- ICON plc (Ireland)

- Medpace (U.S.)

- Q2 Solutions (a subsidiary of IQVIA) (U.S.)

- Syneos Health (U.S.)

- Frontage Labs (U.S.)

- TOXIKON (U.S.)

- ALS Limited (Australia)

- Evotec SE (Germany)

- Shanghai Medicilon Inc. (China)

- PPD Inc. (U.S.)

Latest Developments in Asia-Pacific Analytical Laboratory Services market

- In February 2021, Eurofins Scientific announced that they had acquired Beacon Discovery, preeminent drug discovery and contract research organization (CRO). This will increase the company's access to contract research and will increase its revenue for the company

- In March 2024, SGS opened a new bioanalysis center in Shanghai, featuring high-end instrumentation such as triple-quad LC-MS/MS, MSD platforms, bio-Plex, and LIMS software. The center offers sample design, pharmacokinetic testing, and comprehensive data analysis for clinical research

- In August 2025, Agilent Technologies inaugurated a new biopharma experience center in Hyderabad, India. Equipped with advanced chromatography, mass spectrometry, cell analysis, and lab informatics, the facility is designed to accelerate life-saving drug development and strengthen academia-industry collaborations within India's life sciences ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.