Asia Pacific Anti Money Laundering Market

Market Size in USD Million

CAGR :

%

USD

919.25 Million

USD

2,696.76 Million

2024

2032

USD

919.25 Million

USD

2,696.76 Million

2024

2032

| 2025 –2032 | |

| USD 919.25 Million | |

| USD 2,696.76 Million | |

|

|

|

|

Anti-Money Laundering Market Size

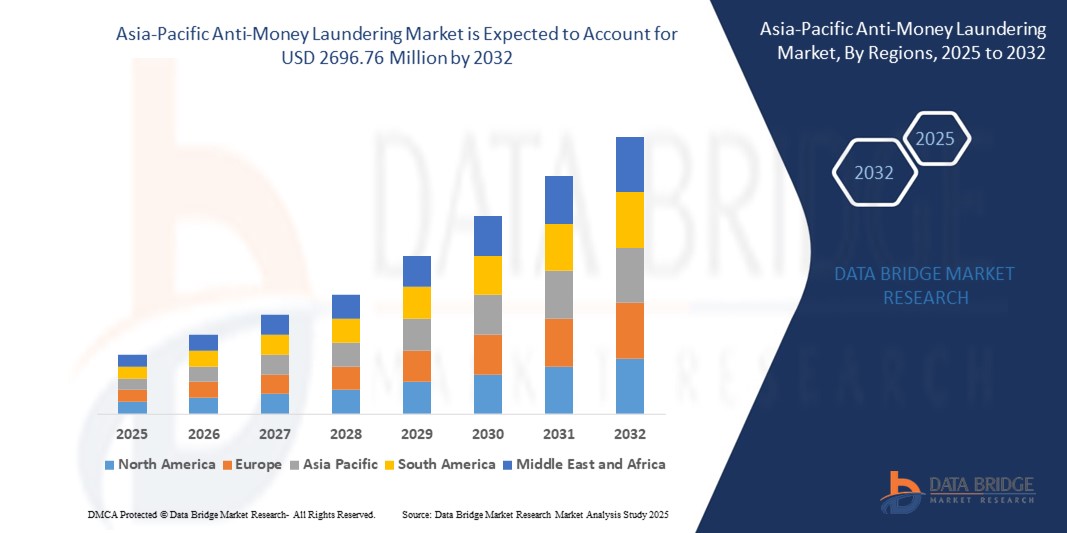

- The Asia-Pacific anti-money laundering market size was valued at USD 919.25 million in 2024 and is expected to reach USD 2696.76 million by 2032, at a CAGR of 14.4% during the forecast period

- The market growth is primarily driven by increasing regulatory scrutiny, the rise of digital banking, and the growing adoption of advanced technologies such as artificial intelligence and machine learning to combat financial crimes

- In addition, heightened awareness of financial fraud, coupled with the need for robust compliance solutions across industries, is positioning anti-money laundering (AML) systems as critical tools for financial security and regulatory adherence

Anti-Money Laundering Market Analysis

- Anti-money laundering solutions, encompassing software and services to detect and prevent illicit financial activities, are increasingly vital for financial institutions, governments, and other sectors due to their ability to ensure compliance, enhance security, and integrate with digital ecosystems

- The demand for AML solutions is fueled by stricter regulatory frameworks, the proliferation of digital transactions, and growing concerns over money laundering and terrorist financing activities

- China dominated the Asia-Pacific anti-money laundering market with the largest revenue share of 38.5% in 2024, driven by its large financial sector, stringent government regulations, and significant investments in AML technologies by major banks and fintech companies

- Japan is expected to be the fastest-growing country in the Asia-Pacific AML market during the forecast period, attributed to rapid digital transformation, increasing adoption of cloud-based solutions, and proactive government initiatives to combat financial crimes

- The solutions segment held the largest market revenue share of 60.2% in 2024, driven by the increasing demand for advanced anti-money laundering software that enables real-time transaction monitoring, compliance management, and customer identity verification

Report Scope and Anti-Money Laundering Market Segmentation

|

Attributes |

Anti-Money Laundering Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Anti-Money Laundering Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Asia-Pacific Anti-Money Laundering (AML) market is experiencing a significant trend of integrating Artificial Intelligence (AI) and Big Data analytics to enhance compliance and detection capabilities

- These technologies enable advanced data processing and analysis, providing deeper insights into transaction patterns, customer behavior, and potential financial crime risks

- AI-powered anti-money laundering solutions facilitate proactive identification of suspicious activities, such as money laundering, terrorist financing, and fraud, before they escalate into significant threats

- For instance, companies are developing AI-driven platforms that analyze transactional data to detect anomalies, streamline Know Your Customer (KYC) processes, and optimize compliance workflows, particularly in high-growth markets such as Japan

- This trend enhances the efficiency and accuracy of AML systems, making them more appealing to financial institutions, insurance providers, and gaming operators across the Asia-Pacific region

- AI algorithms can analyze vast datasets, including unusual transaction patterns, high-risk customer profiles, and cross-border activities, improving detection of financial crimes

Anti-Money Laundering Market Dynamics

Driver

“Rising Demand for Robust Compliance Systems and Regulatory Enforcement”

- Increasing regulatory scrutiny and stringent anti-money laundering compliance requirements, particularly in countries such as China, are major drivers for the Asia-Pacific AML market

- Anti-money laundering systems enhance financial security by providing features such as real-time transaction monitoring, customer identity verification, and automated reporting of suspicious activities

- Government mandates, such as India’s Prevention of Money Laundering Act (PMLA) and regulations from the Financial Action Task Force (FATF), are driving widespread adoption of AML solutions across the region

- The proliferation of digital banking, cross-border transactions, and cryptocurrency platforms, especially in Japan, is fueling the need for advanced anti-money laundering technologies with faster data processing and lower latency

- Financial institutions and other sectors, such as gaming and gambling, are increasingly adopting anti-money laundering systems as standard solutions to meet regulatory expectations and safeguard their operations

Restraint/Challenge

“High Implementation Costs and Data Privacy Concerns”

- The high initial investment required for anti-money laundering hardware, software, and system integration poses a significant barrier to adoption, particularly for small and medium enterprises (SMEs) in emerging markets within the Asia-Pacific region

- Integrating anti-money laundering solutions into existing financial systems can be complex and costly, especially for institutions with legacy infrastructure

- Data security and privacy concerns are a major challenge, as anti-money laundering systems collect and transmit sensitive customer and transactional data, raising risks of breaches and non-compliance with data protection regulations such as GDPR or local privacy laws

- The fragmented regulatory landscape across Asia-Pacific countries, such as varying compliance requirements in China, Japan, and India, complicates operations for multinational organizations and service providers

- These factors can deter adoption, particularly in regions with high cost sensitivity or where awareness of data privacy issues is growing

Anti-Money Laundering market Scope

The market is segmented on the basis of offering, function, deployment, enterprise size, and end use.

- By Offering

On the basis of offering, the Asia-Pacific anti-money laundering market is segmented into solutions and services. The solutions segment held the largest market revenue share of 60.2% in 2024, driven by the increasing demand for advanced anti-money laundering software that enables real-time transaction monitoring, compliance management, and customer identity verification. These solutions leverage AI and machine learning to enhance detection of financial crimes such as money laundering and terrorist financing.

The services segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, driven by the rising need for expert guidance and managed services to navigate complex anti-money laundering regulations. Financial institutions are increasingly outsourcing compliance tasks to ensure cost-effective regulatory adherence and reduce operational risks.

- By Function

On the basis of function, the Asia-Pacific anti-money laundering market is segmented into compliance management, customer identity management, transaction monitoring, currency transaction reporting, and others. The compliance management segment dominated the market with a 32.6% revenue share in 2024, owing to stringent regulations and the need for financial institutions to strengthen their AML frameworks to avoid penalties and ensure regulatory compliance.

The transaction monitoring segment is anticipated to experience the fastest growth rate of 16.4% from 2025 to 2032, driven by the increasing adoption of AI-driven systems that enhance the detection of suspicious transactions and reduce false positives, improving efficiency in combating financial crimes.

- By Deployment

On the basis of deployment, the Asia-Pacific anti-money laundering market is segmented into cloud and on-premise. The cloud segment held the largest market revenue share of 54.4% in 2024, attributed to its flexibility, scalability, and cost-effectiveness, enabling financial institutions to integrate advanced technologies such as AI and real-time analytics without significant infrastructure investments.

The on-premise segment is expected to witness significant growth from 2025 to 2032, driven by organizations prioritizing control and security over their compliance systems. On-premise solutions offer customization and integration with existing IT infrastructure, which is crucial for large enterprises with complex regulatory needs.

- By Enterprise Size

On the basis of enterprise size, the Asia-Pacific anti-money laundering market is segmented into large enterprises and small & medium enterprises (SMEs). The large enterprises segment dominated the market with a 56.8% revenue share in 2024, driven by their focus on digital payment systems and the need for robust anti-money laundering solutions to address transaction monitoring and compliance requirements in high-volume financial operations.

The SMEs segment is anticipated to grow rapidly at a CAGR of 17.2% from 2025 to 2032, fueled by increasing awareness of anti-money laundering regulations and the adoption of cost-effective cloud-based solutions that cater to smaller organizations with limited resources.

- By End Use

On the basis of end use, the Asia-Pacific anti-money laundering market is segmented into banks & financial institutions, insurance providers, government, gaming & gambling, and others. The banks & financial institutions segment held the largest market revenue share of 45.3% in 2024, driven by the critical need for anti-money laundering solutions to combat financial crimes such as fraud, terrorist financing, and money laundering in the banking sector.

The gaming & gambling segment is expected to witness the fastest growth rate of 18.1% from 2025 to 2032, fueled by the rising adoption of anti-money laundering solutions to monitor high-risk transactions and ensure compliance with regulations, particularly in online gambling platforms where illicit financial flows are a concern.

Anti-Money Laundering Market Regional Analysis

- China dominated the Asia-Pacific anti-money laundering market with the largest revenue share of 38.5% in 2024, driven by its large financial sector, stringent government regulations, and significant investments in AML technologies by major banks and fintech companies

- The increasing volume of digital transactions and rising awareness of AML compliance drive demand for advanced solutions. Strong domestic technology development and competitive pricing enhance market accessibility, with banks and financial institutions leading adoption

- The integration of AI and machine learning in transaction monitoring and customer identity management further supports market growth

Japan Anti-Money Laundering Market Insight

Japan is expected to witness the fastest growth rate in the Asia-Pacific AML market, driven by strong regulatory frameworks and a high focus on technological innovation. Japanese financial institutions prioritize advanced AML solutions to enhance compliance and combat sophisticated financial crimes. The adoption of cloud-based AML systems and the integration of these solutions in large enterprises and SMEs accelerate market penetration. Rising interest in compliance management and transaction monitoring, particularly in the banking and insurance sectors, also contributes to sustained growth.

Anti-Money Laundering Market Share

The anti-money laundering industry is primarily led by well-established companies, including:

- NICE (Israel)

- IBM (U.S.)

- sanctions.io (U.S.)

- Intel Corporation (U.S.)

- Oracle (U.S.)

- SAP SE (Germany)

- Accenture (U.S.)

- Experian Information Solution

- Inc. (Ireland)

- Open Text Corporation (Canada)

- BAE Systems (U.K.)

- SAS Institute Inc (U.S.)

- ACI Worldwide (U.S.)

- Cognizant (U.S.)

- Trulioo (Canada)

- Temenos Headquarters SA (Switzerland)

- WorkFusion, Inc, (U.S.)

- Vixio Regulatory Intelligence (England)

What are the Recent Developments in Asia-Pacific Anti-Money Laundering Market?

- In February 2025, Mastercard officially launched TRACE (Trace Financial Crime) in the Asia Pacific region, introducing a network-level anti-money laundering (AML) solution powered by artificial intelligence. TRACE analyzes large-scale payments data across multiple financial institutions to detect and prevent financial crime, offering a holistic view beyond siloed systems. The Philippines became the first market in Asia Pacific to implement TRACE, integrating it into its Real-Time Payment (RTP) network via a partnership with BancNet, which onboarded 36 domestic banks. This rollout supports compliance with the country’s Anti-Financial Account Scamming Act (AFASA) and marks a transformative step in regional AML efforts

- In July 2024, the Asian Development Bank (ADB), in partnership with the Global Forum on Transparency and Exchange of Information for Tax Purposes and regional bodies of the Financial Action Task Force (FATF), hosted a three-day workshop on beneficial ownership transparency. Held from 3–5 July, the event brought together over 60 tax and AML officials from across Asia and the Pacific, alongside civil society and international experts. The training focused on aligning tax transparency standards with FATF’s updated recommendations, fostering a whole-of-government approach to combat illicit financial flows, money laundering, and tax evasion

- In April 2024, Oracle Financial Services launched the Compliance Agent, an AI-powered cloud service designed to help banks proactively manage anti-money laundering (AML) risks. The platform enables hypothetical scenario testing to fine-tune transaction monitoring systems (TMS), assess risk profiles of new products, and optimize controls for high-risk typologies such as human trafficking. By automating model risk analysis and supporting evidence-based decisions, Compliance Agent reduces compliance costs and enhances regulatory readiness. This innovation reflects the growing trend of AI and cloud adoption in financial crime prevention across Asia and beyond

- In October 2023, WorkFusion launched Isaac, an AI-powered Digital Worker designed to automate first-level (L1) alert reviews in AML transaction monitoring. Isaac integrates with existing surveillance systems to evaluate alerts, auto-escalate suspicious activity, and auto-close non-suspicious alerts with a supporting dossier. By reducing manual review burdens and false positives—often comprising 90–95% of alerts—Isaac enables analysts to focus on high-risk investigations. The solution enhances consistency, transparency, and compliance efficiency, reflecting a broader industry shift toward AI-driven financial crime management

- In November 2023, the Financial Action Task Force (FATF) and the Asia/Pacific Group on Money Laundering (APG) jointly hosted an Assessor Training Workshop in Ottawa, Canada, with a strong focus on Asia-Pacific jurisdictions. The event welcomed 40 delegates from countries including Chinese Taipei, Indonesia, Mongolia, Thailand, and the UAE, and was supported by Canada’s Department of Finance. Participants engaged in mock evaluations of a fictional country, covering legislation review, interviews, and report drafting. The training aimed to prepare assessors for upcoming mutual evaluations, reinforcing regional efforts to improve AML/CFT compliance and implement FATF’s evolving methodology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.