Asia Pacific Antibody Drug Conjugates Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

7.10 Billion

2024

2032

USD

2.06 Billion

USD

7.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 7.10 Billion | |

|

|

|

|

Asia-Pacific Antibody Drug Conjugates (ADC) Market Size

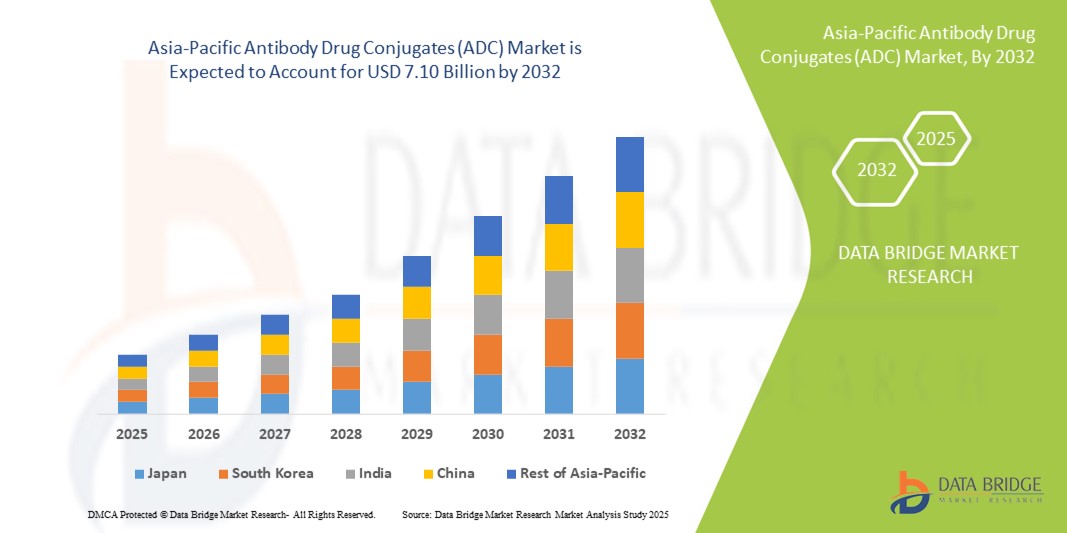

- The Asia-Pacific antibody drug conjugates (ADC) market size was valued at USD 2.06 billion in 2024 and is expected to reach USD 7.10 billion by 2032, at a CAGR of 16.70% during the forecast period

- The market growth is largely fueled by the rising cancer burden, increasing investments in oncology research, and greater availability of targeted therapeutics in countries such as China, Japan, and South Korea

- Furthermore, the growing adoption of precision medicine, along with favorable government initiatives to enhance biopharmaceutical innovation, is positioning ADCs as a preferred modality in cancer treatment. These converging factors are driving robust demand for ADC therapies, thereby significantly propelling the region's market expansion

Asia-Pacific Antibody Drug Conjugates (ADC) Market Analysis

- Antibody drug conjugates (ADCs), which combine the targeting capabilities of monoclonal antibodies with the potent cell-killing effect of cytotoxic drugs, are becoming a critical class of therapeutics in oncology across the Asia-Pacific region due to their enhanced efficacy, targeted delivery, and reduced systemic toxicity

- The rising demand for ADCs is primarily driven by the increasing cancer prevalence, improving healthcare infrastructure, and growing access to advanced biopharmaceuticals across emerging economies such as China and India

- China dominated the Asia-Pacific antibody drug conjugates (ADC) market with the largest revenue share of 48.1% in 2024, supported by accelerated regulatory approvals, extensive clinical research activities, and strategic partnerships between domestic firms and global biotech players focusing on novel ADC pipelines

- Japan is expected to witnessing fastest growth in antibody drug conjugates (ADC) market, propelled by high healthcare expenditure, well-established pharmaceutical industries, and rising patient awareness regarding targeted cancer therapies

- Breast cancer segment dominated the Asia-Pacific antibody drug conjugates (ADC) market, with a market share of 40.2% in the Asia-Pacific antibody drug conjugates (ADC) market in 2024, owing to the high incidence rate, increasing diagnosis rates, and the presence of several approved ADC therapies targeting HER2-positive breast cancer

Report Scope and Asia-Pacific Antibody Drug Conjugates (ADC) Market Segmentation

|

Attributes |

Asia-Pacific Antibody Drug Conjugates (ADC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Antibody Drug Conjugates (ADC) Market Trends

“Surge in Clinical Trials and Local Biotech Collaborations”

- A significant and accelerating trend in the Asia-Pacific ADC market is the surge in region-specific clinical trials and strategic collaborations between local biotech firms and global pharmaceutical companies, aimed at accelerating the development and commercialization of novel ADC therapies

- For instance, in 2024, China-based Biokin Pharmaceuticals entered a co-development agreement with a U.S. biotech firm to advance a pipeline of HER2-targeted ADCs, reflecting a growing pattern of international partnerships driven by the region's rising R&D capabilities and regulatory reforms

- Increasing investment in oncology pipelines and improvements in regulatory frameworks—particularly in China and South Korea—are enabling faster approvals and streamlined pathways for innovative therapeutics such as ADCs. These advancements are encouraging both local and multinational companies to expand their clinical trial operations and establish localized manufacturing facilities

- Moreover, governments across the region, especially in China and Japan, are actively funding cancer research and precision medicine programs, fostering a conducive environment for ADC innovation. Notable initiatives include expanded funding under China’s “Healthy China 2030” plan and Japan’s “Cancer Control Promotion Act,” both aimed at improving oncology outcomes through advanced therapeutics

- The integration of advanced linker technologies and site-specific conjugation techniques is also gaining traction in regional development efforts, allowing ADCs to achieve higher therapeutic indices with improved safety profiles. This is reshaping the standard of care and positioning ADCs as frontline options in targeted cancer therapy

- As a result, the Asia-Pacific region is becoming an attractive hub for ADC research, bolstered by strong scientific expertise, increasing patient pools for oncology trials, and a favorable regulatory environment that supports fast-tracked innovation and approvals

Asia-Pacific Antibody Drug Conjugates (ADC) Market Dynamics

Driver

“Growing Cancer Burden and Rising Demand for Targeted Therapy”

- The rising incidence of various cancers across Asia-Pacific, coupled with growing awareness of precision oncology, is a major driver fueling the demand for ADCs in the region

- For instance, in 2024, the World Health Organization estimated over 9 million new cancer cases in Asia, with breast, lung, and gastric cancers among the most prevalent. This alarming rise is leading to increased demand for innovative treatment options such as ADCs that offer improved specificity and reduced toxicity compared to traditional chemotherapies

- In addition, the increasing affordability of biologics and growing insurance coverage in key markets such as China and Japan are supporting broader access to ADC therapies. Favorable reimbursement policies and national healthcare programs are also encouraging the adoption of high-cost treatments by reducing financial burdens on patients

- Biopharma investments are also surging in the region, with companies such as Seagen and Daiichi Sankyo expanding their ADC footprints through local partnerships and expanded clinical programs. These strategic moves are enabling faster development cycles and improved availability of ADCs across the region

- Furthermore, the increasing capabilities of regional CROs and CDMOs are supporting end-to-end ADC development, from early-stage research to commercial-scale production, further enhancing local market readiness

Restraint/Challenge

“High Manufacturing Complexity and Regulatory Variability”

- Despite the growth potential, the ADC market in Asia-Pacific faces notable challenges, including the high manufacturing complexity and cost associated with producing ADCs, which limits accessibility and scalability in some parts of the region

- ADCs require precision in conjugation chemistry, high containment manufacturing, and strict quality control, all of which drive up production costs. These technical hurdles can restrict market entry for smaller biotech companies lacking the infrastructure or capital to invest in ADC development and production

- In addition, regulatory inconsistency across Asia-Pacific countries presents barriers to seamless regional commercialization. While China and Japan have streamlined pathways for biologics, other countries still face lengthy approval processes or lack clear ADC-specific guidelines

- These hurdles can delay market entry and limit cross-border collaborations, particularly for newer players. Moreover, the lack of experienced workforce and technical expertise in some emerging markets can further slow ADC adoption and innovation

- Overcoming these barriers through harmonized regulatory frameworks, increased public-private investment in biomanufacturing capabilities, and training programs for ADC production will be crucial to ensure sustained growth and equitable access across the Asia-Pacific region

Asia-Pacific Antibody Drug Conjugates (ADC) Market Scope

The market is segmented on the basis of product, antigen component, antibody component, linker component, cytotoxic payloads, linker technology, conjugation technology, indication, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak, and Others. The Enhertu segment dominated the market with the largest market revenue share in 2024, driven by its broad clinical application in HER2-positive cancers and strong uptake across key Asia-Pacific countries such as Japan, China, and South Korea. Enhertu’s robust efficacy data and regulatory approvals in multiple solid tumor indications have solidified its leadership in the regional ADC landscape.

The Polivy segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its increasing adoption in treating diffuse large B-cell lymphoma (DLBCL) and inclusion in regional treatment guidelines. Strategic expansion by Roche and growing reimbursement coverage across oncology centers are further supporting its rapid growth in this market.

- By Antigen Component

On the basis of antigen component, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into HER2 Receptor, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, Tissue Factors, and Others. The HER2 Receptor segment held the largest revenue share in 2024, attributed to the high prevalence of HER2-positive cancers and the availability of advanced ADCs targeting this antigen, including Kadcyla and Enhertu.

The Trop-2 segment is expected to register the fastest growth rate during the forecast period, supported by increasing use of Trodelvy and rising clinical interest in Trop-2 targeting agents for aggressive breast and urothelial cancers in the region.

- By Antibody Component

On the basis of antibody generation, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into First Generation ADCs, Second Generation ADCs, Third Generation ADCs, and Fourth Generation ADCs. The Second Generation ADCs segment dominated the market with the largest share in 2024, owing to the clinical success and commercial availability of ADCs such as Kadcyla and Adcetris, which offer enhanced stability and efficacy.

The Third Generation ADCs segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by technological advancements in site-specific conjugation and improved safety profiles that are being adopted by regional developers and global pharma collaborators asuch as.

- By Linker Component

On the basis of linker component, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Cleavable Linkers and Non-Cleavable Linkers. The Cleavable Linkers segment held the majority market revenue share in 2024, driven by their ability to release cytotoxic agents selectively within tumor environments, thereby reducing systemic toxicity and improving therapeutic outcomes.

The Non-Cleavable Linkers segment is expected to grow at the fastest rate during forecast period, particularly in hematological malignancies, where intracellular degradation mechanisms facilitate effective drug release even without linker cleavage.

- By Cytotoxic Payloads or Warheads Component

On the basis of cytotoxic payloads, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into DNA Damaging Agents and Microtubule Disrupting Agents. The Microtubule Disrupting Agents segment dominated the market in 2024, driven by their successful use in established ADCs such as Kadcyla and Adcetris. These agents exhibit potent antitumor activity and have demonstrated favorable outcomes in both solid and blood cancers.

The DNA Damaging Agents segment is expected to grow at the fastest pace from 2025 to 2032, owing to their unique mechanisms and rising adoption in next-generation ADCs, including those under development for solid tumors with high mutation burdens.

- By Linker Technology

On the basis of linker technology, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Peptide Linkers, Thioether Linkers, Hydrazone Linkers, and Disulfide Linkers. The Peptide Linkers segment accounted for the largest revenue share in 2024, driven by their selective cleavage in tumor tissues and compatibility with modern ADC designs.

The Thioether Linkers segment is expected to grow at the fastest rate during forecast period, as they offer chemical stability and are commonly used in approved ADCs such as Kadcyla, supporting safe and effective drug delivery in systemic circulation.

- By Conjugation Technology

On the basis of conjugation method, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Site-Specific Conjugation and Chemical Conjugation. The Chemical Conjugation segment held the highest market share in 2024, as it has been the conventional method used in most first- and second-generation ADCs.

The Site-Specific Conjugation segment is expected to grow at the fastest rate during forecast period, due to its ability to enhance payload delivery precision, improve therapeutic index, and support the development of advanced-generation ADCs across various indications.

- By Indication

On the basis of indication, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Breast Cancer, Blood Cancer (Leukemia, Lymphoma), Lung Cancer, Gynecological Cancer, Gastrointestinal Cancer, Genitourinary Cancer, and Others. The Breast Cancer segment dominated the market with the largest market share of 40.2% in 2024, driven by the high burden of HER2-positive cases and the widespread use of approved ADCs such as Enhertu and Kadcyla.

The Lung Cancer segment is anticipated to experience the fastest growth rate from 2025 to 2032, due to rising incidence rates, emerging ADC clinical trials for NSCLC, and increasing adoption of precision medicine strategies in China and Japan.

- By End User

On the basis of end user, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Hospitals, Specialty Centers, Clinics, Ambulatory Centers, Home Healthcare, and Others. The Hospitals segment accounted for the largest market share in 2024, as they are primary locations for cancer treatment and ADC administration requiring controlled environments.

The Specialty Centers segment is projected to grow at the highest CAGR during forecast period , supported by increasing investments in oncology-focused facilities and patient demand for specialized, high-quality care in dedicated cancer treatment centers.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific antibody drug conjugates (ADC) market is segmented into Direct Tenders, Retail Sales, and Others. The Direct Tenders segment dominated the market in 2024, driven by centralized procurement by government and private hospital networks, especially for expensive oncology therapies requiring bulk purchase agreements.

The Retail Sales segment is expected to grow at the fastest rate during forecast period, due to the gradual shift toward outpatient cancer care models, expanding pharmacy networks, and rising patient access to targeted therapies through private healthcare systems in countries such as Japan and South Korea.

Asia-Pacific Antibody Drug Conjugates (ADC) Market Regional Analysis

- China dominated the Asia-Pacific antibody drug conjugates (ADC) market with the largest revenue share of 48.1% in 2024, supported by accelerated regulatory approvals, extensive clinical research activities, and strategic partnerships between domestic firms and global biotech players focusing on novel ADC pipelines

- The region’s growth is further propelled by increasing investments in oncology R&D, robust clinical trial activity, and expanding domestic manufacturing capabilities. China’s biopharmaceutical sector is rapidly maturing, making it a key hub for ADC development and commercialization

- Favorable reimbursement policies, increasing healthcare expenditure, and growing awareness of precision oncology across countries such as Japan, South Korea, and Australia are also contributing to regional expansion, positioning Asia-Pacific as a major contributor to the global ADC market in the coming years

The China Antibody Drug Conjugates (ADC) Market Insight

The China antibody drug conjugates (ADC) market captured the largest revenue share in Asia Pacific in 2024, fueled by supportive government policies, a rapidly growing oncology pipeline, and a strong domestic pharmaceutical manufacturing base. Regulatory reforms such as the “MAH” (Marketing Authorization Holder) system and fast-track drug approvals have made China a hub for ADC development. Increasing awareness of targeted therapies and strategic alliances between Chinese firms and global biotech leaders are further propelling market expansion, particularly in HER2-positive and hematologic cancer treatments.

Japan Antibody Drug Conjugates (ADC) Market Insight

The Japan antibody drug conjugates (ADC) market is gaining momentum due to its advanced healthcare infrastructure, significant investment in oncology R&D, and early adoption of innovative therapeutics. Japan’s mature pharmaceutical industry and established reimbursement systems support the introduction of high-cost biologics such as ADCs. The rising incidence of breast and lung cancer, combined with the Japanese population’s trust in targeted treatments, is fostering strong growth, particularly for second and third-generation ADCs with proven safety and efficacy profiles.

India Antibody Drug Conjugates (ADC) Market Insight

The India antibody drug conjugates (ADC) market is poised for rapid growth, driven by increasing cancer prevalence, improving access to specialty care, and growing participation in global clinical trials. India’s expanding middle class and focus on healthcare infrastructure development have made advanced treatments more accessible. The emergence of local biotech companies investing in ADC research, coupled with supportive policies under initiatives such as “Make in India” and “Pharma Vision 2020,” is expected to significantly enhance domestic manufacturing and development capabilities, boosting the country’s position in the Asia-Pacific ADC market.

South Korea Antibody Drug Conjugates (ADC) Market Insight

The South Korea antibody drug conjugates (ADC) market is expanding steadily due to the country’s strong emphasis on biotech innovation, government funding for oncology research, and increasing prevalence of lifestyle-related cancers. South Korea’s leading pharmaceutical firms are actively collaborating with international biotech companies to co-develop and commercialize new ADC therapies. The country’s streamlined regulatory framework and high healthcare spending further support the integration of ADCs into oncology treatment protocols across major hospitals and specialty cancer centers.

Asia-Pacific Antibody Drug Conjugates (ADC) Market Share

The Asia-Pacific antibody drug conjugates (ADC) industry is primarily led by well-established companies, including:

- Daiichi Sankyo Co., Ltd. (Japan)

- Seagen Inc. (U.S.)

- AstraZeneca (U.K.)

- RemeGen Co., Ltd. (China)

- Mycenax Biotech Inc. (Taiwan)

- Mabwell (Shanghai) Bioscience Co., Ltd. (China)

- Mersana Therapeutics, Inc. (U.S.)

- Biocon Biologics Ltd. (India)

- WuXi Biologics (Cayman) Inc. (China)

- Samsung Biologics Co., Ltd. (South Korea)

- Bio-Thera Solutions, Ltd. (China)

- Zymeworks Inc. (Canada)

- Prestige Biopharma Ltd. (Singapore)

- SinoMab BioScience Limited (Hong Kong)

- Kyowa Kirin Co., Ltd. (Japan)

- AbbVie Inc. (U.S.)

- Innovent Biologics, Inc. (China)

- Nanjing Leads Biolabs Co., Ltd. (China)

- Tot Biopharm Co., Ltd. (China)

- Amgen Inc. (U.S.)

What are the Recent Developments in Global Asia-Pacific Antibody Drug Conjugates (ADC) Market?

- In April 2024, RemeGen Co., Ltd., a China-based biopharmaceutical company, announced the expansion of its global clinical trials for disitamab vedotin, an HER2-targeted ADC, into Southeast Asia and Australia. This move aims to accelerate regulatory approvals across Asia-Pacific and reflects the company’s strategic focus on expanding access to next-generation cancer therapeutics. RemeGen’s initiative highlights the region’s rising involvement in global oncology development and its growing importance in the ADC innovation ecosystem

- In March 2024, Japan’s Daiichi Sankyo entered into a research and licensing agreement with Singapore-based A*STAR’s Genome Institute to explore novel ADC payloads and linker technologies. The collaboration focuses on enhancing the therapeutic window of existing ADCs and creating more targeted therapies for solid tumors. This development underscores the increasing trend of cross-border collaborations in the Asia-Pacific region aimed at advancing oncology research and drug development

- In February 2024, South Korea’s Samsung Biologics announced its expansion into contract development and manufacturing of ADCs, positioning itself as a key regional player in ADC production. With growing demand for outsourced biopharmaceutical manufacturing in Asia-Pacific, this expansion enhances the scalability of ADC supply chains and supports regional biotech firms in bringing novel therapies to market faster and more cost-effectively

- In February 2024, India's Biocon Biologics signed an exclusive partnership agreement with a U.S.-based biotech firm to co-develop and commercialize a pipeline of ADCs targeting gynecological and gastrointestinal cancers. The partnership is aligned with Biocon’s strategic goal to expand its oncology portfolio and leverage India’s growing clinical and manufacturing infrastructure for advanced biologics

- In January 2024, Australia’s Garvan Institute of Medical Research initiated a Phase I clinical trial evaluating a new Trop-2 targeting ADC developed in partnership with a local biotech startup. The trial represents one of the first early-stage ADC studies launched within Australia and reflects the increasing role of local research institutes in advancing targeted cancer therapies tailored to regional patient populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PESTEL ANALYSIS

5 COST STRUCTURE ANALYSIS OF ANTIBODY-DRUG CONJUGATE (ADC) MANUFACTURING

5.1 ANTIBODIES

5.1.1 OVERVIEW OF ANTIBODY PRODUCTION

5.1.1.1 In-house vs. Outsourced:

5.1.2 ANTIBODY PRICING FACTORS

5.2 LINKERS

5.2.1 ROLE AND TYPES OF LINKERS

5.2.1.1 Cost Impact by Linker Type:

5.3 CYTOTOXIC AGENTS

5.3.1 COST CONSIDERATIONS:

5.3.2 BUFFERS AND SOLVENTS

5.4 COST BREAKDOWN BY MANUFACTURING STAGE

5.4.1 PRE-PRODUCTION COSTS

5.4.2 CONJUGATION PROCESS

5.4.3 PURIFICATION AND FILTRATION

5.4.4 QUALITY CONTROL

5.5 COST PROJECTIONS AND PRICING TRENDS (2024–2030)

5.5.1 PROJECTED COST FLUCTUATIONS

5.5.2 COST IMPACT OF SCALABILITY

5.6 SUPPLIER AND GEOGRAPHIC PRICING TRENDS

5.6.1 GEOGRAPHIC COST VARIATIONS

5.6.2 SUPPLIER ANALYSIS

5.6.3 CONCLUSION

6 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 ADVANCES IN ANTIBODY-DRUG CONJUGATE (ADC) TECHNOLOGY

7.1.3 INCREASING DEMAND FOR TARGETED THERAPIES

7.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS RESEARCH

7.2 RESTRAINTS

7.2.1 HIGH DEVELOPMENT COST & MANUFACTURING COMPLEXITIES

7.2.2 SAFETY AND TOXICITY ISSUES OF ANTIBODY DRUG CONJUGATES

7.3 OPPORTUNITIES

7.3.1 GROWING ONCOLOGY PIPELINE FOR ANTIBODY DRUG CONJUGATES (ADCS)

7.3.2 INCREASING INVESTMENT IN CANCER RESEARCH

7.3.3 INCREASING COLLABORATION WITH RESEARCH INSTITUTIONS FOR ANTIBODY DRUG CONJUGATES

7.4 CHALLENGES

7.4.1 CLINICAL TRIAL FAILURES FOR ANTIBODY DRUG CONJUGATES DEVELOPMENT

7.4.2 LENGTHY CLINICAL TRIALS AND DEVELOPMENT PHASES

8 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ENHERTU

8.3 KADCYLA

8.4 TRODELVY

8.5 POLIVY

8.6 ADCETRIS

8.7 PADCEV

8.8 BESPONSA

8.9 ELAHERE

8.1 ZYLONTA

8.11 MYLOTARG

8.12 TIVDAK

8.13 OTHERS

9 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT

9.1 OVERVIEW

9.2 HER2 RECEPTOR

9.3 TROP-2

9.4 CD79B

9.5 CD30

9.6 NECTIN 4

9.7 CD22

9.8 CD19

9.9 CD33

9.1 TISSUE FACTORS

9.11 OTHERS

10 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT

10.1 OVERVIEW

10.2 THIRD GENERATION ADCS

10.3 SECOND GENERATION ADCS

10.4 FOURTH GENERATION ADCS

10.5 FIRST GENERATION ADCS

11 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT

11.1 OVERVIEW

11.2 CLEAVABLE LINKERS

11.2.1 PEPTIDE BASED

11.2.2 ACID SENSITIVE OR ACID LABILE

11.2.3 GLUTATHIONE SENSITIVE DISULFIDE

11.3 NON CLEAVABLE LINKERS

12 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT

12.1 OVERVIEW

12.2 DNA DAMAGING AGENTS

12.2.1 CAMPTOTHECIN

12.2.2 CALICHEAMICIN

12.2.3 PYRROLOBENZODIAZEPINES

12.3 MICROTUBULE DISRUPTING AGENTS

12.3.1 AURISTATIN

12.3.2 MAYTANSINOIDS

13 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY

13.1 OVERVIEW

13.2 PEPTIDE LINKERS

13.3 THIOETHER LINKERS

13.4 HYDRAZONE LINKERS

13.5 DISULFIDE LINKERS

14 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY

14.1 OVERVIEW

14.2 SITE-SPECIFIC CONJUGATION

14.3 CHEMICAL CONJUGATION

15 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION

15.1 OVERVIEW

15.2 BREAST CANCER

15.3 BLOOD CANCER (LEUKEMIA, LYMPHOMA)

15.4 LUNG CANCER

15.5 GYNECOLOGICAL CANCER

15.6 GASTROINTESTINAL CANCER

15.7 GENITOURINARY CANCER

15.8 OTHERS

16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 SPECIALTY CENTER

16.4 CLINICS

16.5 AMBULATORY CENTERS

16.6 HOME HEALTHCARE

16.7 OTHERS

17 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDERS

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACY

17.3.2 RETAIL PHARMACY

17.3.3 ONLINE PHARMACY

17.4 OTHERS

18 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION

18.1 ASIA-PACIFIC

18.1.1 JAPAN

18.1.2 CHINA

18.1.3 INDIA

18.1.4 AUSTRALIA

18.1.5 SINGAPORE

18.1.6 REST OF ASIA-PACIFIC

19 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC): COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 DAIICHI SANKYO, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 F. HOFFMANN-LA ROCHE LTD

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENT

21.3 GILEAD SCIENCES, INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 ASTELLAS PHARMA INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENT

21.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 ABBVIE INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENT

21.7 ADC THERAPEUTICS SA

21.7.1 6.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENT

21.8 AMGEN, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 ASTRAZENECA

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENT

21.1 BAYER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENT

21.11 BYONDIS

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 EISAI INC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

21.13 GSK PLC

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENT

21.14 JOHNSON & JOHNSON SERVICES, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENT

21.15 OXFORD BIOTHERAPEUTICS

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 PFIZER INC.

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 REMEGEN

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SANOFI

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENT

21.19 SUTRO BIOPHARMA, INC.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

22 QUESTIONNAIRE

23 RELATED REPORTS

List of Table

TABLE 1 PROJECTED PRICE CHANGE (2024–2030)

TABLE 2 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 4 ASIA-PACIFIC ENHERTU IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 ASIA-PACIFIC KADCYLA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 ASIA-PACIFIC TRODELVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 ASIA-PACIFIC POLIVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 ASIA-PACIFIC ADCETRIS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 ASIA-PACIFIC PADCEV IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 ASIA-PACIFIC BESPONSA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 ASIA-PACIFIC ELAHERE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 ASIA-PACIFIC ZYLONTA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 ASIA-PACIFIC MYLOTARG IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 ASIA-PACIFIC TIVDAK IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 17 ASIA-PACIFIC HER2 RECEPTOR IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 ASIA-PACIFIC TROP-2 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 ASIA-PACIFIC CD79B IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 ASIA-PACIFIC CD30 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 ASIA-PACIFIC NECTIN 4 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 ASIA-PACIFIC CD22 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 23 ASIA-PACIFIC CD19 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 ASIA-PACIFIC CD33 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 ASIA-PACIFIC TISSUE FACTORS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC THIRD GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC SECOND GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC FOURTH GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC FIRST GENERATION ADCS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC NON CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 36 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 37 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 38 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 39 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 40 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 41 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 42 ASIA-PACIFIC PEPTIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 43 ASIA-PACIFIC THIOETHER LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 44 ASIA-PACIFIC HYDRAZONE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 45 ASIA-PACIFIC DISULFIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 46 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 47 ASIA-PACIFIC SITE-SPECIFIC CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 48 ASIA-PACIFIC CHEMICAL CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 49 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 50 ASIA-PACIFIC BREAST CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 51 ASIA-PACIFIC BLOOD CANCER (LEUKEMIA, LYMPHOMA) IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 52 ASIA-PACIFIC LUNG CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 53 ASIA-PACIFIC GYNECOLOGICAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 54 ASIA-PACIFIC GASTROINTESTINAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 55 ASIA-PACIFIC GENITOURINARY CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 56 ASIA-PACIFIC OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 57 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 58 ASIA-PACIFIC HOSPITALS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 59 ASIA-PACIFIC SPECIALTY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 60 ASIA-PACIFIC CLINICS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 61 ASIA-PACIFIC AMBULATORY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 62 ASIA-PACIFIC HOME HEALTHCARE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 63 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 64 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 65 ASIA-PACIFIC DIRECT TENDERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 66 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 67 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 68 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 69 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 70 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 71 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 72 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 73 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 74 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 75 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 76 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 77 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 78 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 79 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 80 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 81 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 82 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 83 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 84 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 85 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 86 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 87 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 88 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 89 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 90 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 91 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 92 JAPAN CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 93 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 94 JAPAN DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 95 JAPAN MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 96 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 97 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 98 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 99 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 100 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 JAPAN RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 103 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 104 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 105 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 106 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 107 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 108 CHINA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 109 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 110 CHINA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 111 CHINA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 112 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 113 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 114 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 115 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 116 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 117 CHINA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 118 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 119 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 120 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 121 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 122 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 123 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 124 INDIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 125 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 126 INDIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 127 INDIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 128 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 129 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 130 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 131 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 132 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 133 INDIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 134 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 135 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 136 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 137 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 138 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 139 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 140 AUSTRALIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 141 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 142 AUSTRALIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 143 AUSTRALIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 144 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 145 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 146 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 147 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 148 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 149 AUSTRALIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 151 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 152 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 153 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 154 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 155 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 156 SINGAPORE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 157 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 158 SINGAPORE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 159 SINGAPORE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 160 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 161 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 162 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 163 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 164 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 165 SINGAPORE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 166 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 167 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 168 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

List of Figure

FIGURE 1 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING INCIDENCE OF CANCER IS DRIVING THE GROWTH OF THE ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET FROM 2024 TO 2031

FIGURE 14 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET IN 2024 AND 2031

FIGURE 15 DROC

FIGURE 16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2023

FIGURE 17 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 18 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 19 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2023

FIGURE 21 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2024-2031 (USD MILLION)

FIGURE 22 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, CAGR (2024-2031)

FIGURE 23 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2023

FIGURE 25 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 26 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, CAGR (2024-2031)

FIGURE 27 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2023

FIGURE 29 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 30 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, CAGR (2024-2031)

FIGURE 31 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2023

FIGURE 33 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 34 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, CAGR (2024-2031)

FIGURE 35 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2023

FIGURE 37 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 38 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, CAGR (2024-2031)

FIGURE 39 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, LIFELINE CURVE

FIGURE 40 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2023

FIGURE 41 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 42 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, CAGR (2024-2031)

FIGURE 43 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2023

FIGURE 45 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2024-2031 (USD MILLION)

FIGURE 46 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, CAGR (2024-2031)

FIGURE 47 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 48 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2023

FIGURE 49 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 50 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 51 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, LIFELINE CURVE

FIGURE 52 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 53 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 54 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 55 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 56 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SNAPSHOT (2023)

FIGURE 57 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC): COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.