Asia Pacific Aseptic Sampling Market

Market Size in USD Million

CAGR :

%

USD

143.60 Million

USD

343.05 Million

2024

2032

USD

143.60 Million

USD

343.05 Million

2024

2032

| 2025 –2032 | |

| USD 143.60 Million | |

| USD 343.05 Million | |

|

|

|

|

Asia-Pacific Aseptic Sampling Market Size

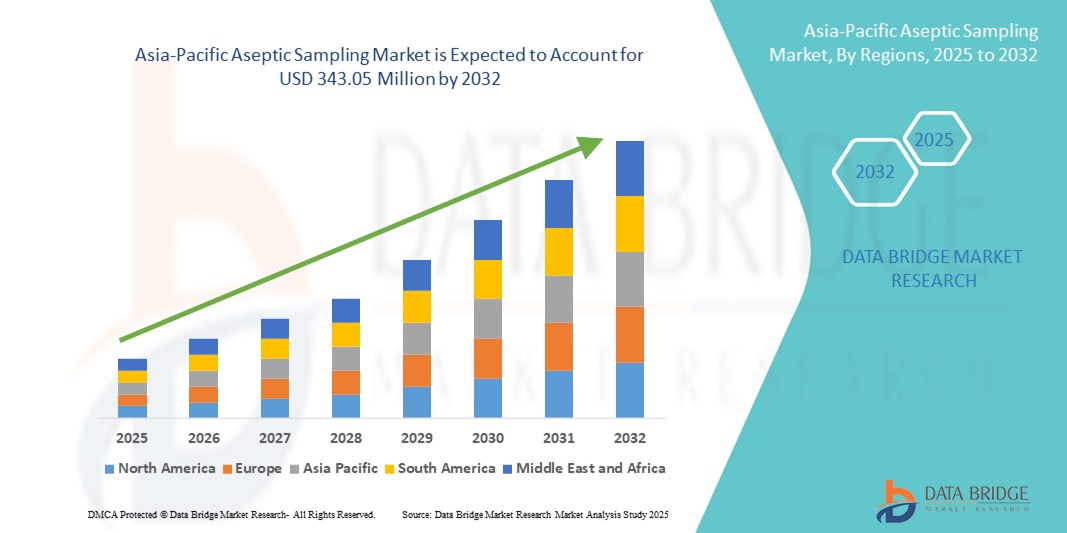

- The Asia-Pacific aseptic sampling market size was valued at USD 143.60 million in 2024 and is expected to reach USD 343.05 million by 2032, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by increasing awareness of contamination control, rising biopharmaceutical manufacturing activities, and advancements in aseptic processing technologies across Asia-Pacific, enabling efficient and sterile sampling in production environments. The region is experiencing a surge in biologics, vaccines, and advanced therapy manufacturing—particularly in rapidly industrializing countries such as India, China, and South Korea—contributing to the growing adoption of aseptic sampling solutions

- Furthermore, escalating investments in pharmaceutical and biotechnology infrastructure, expansion of manufacturing facilities in rural and semi-urban areas, and increasing public-private partnerships are driving innovation and the availability of advanced aseptic sampling systems. Government initiatives promoting quality compliance, coupled with the growing presence of international life science companies and local manufacturing capabilities, are significantly boosting the growth of the Asia-Pacific aseptic sampling market

Asia-Pacific Aseptic Sampling Market Analysis

- Aseptic sampling solutions, which ensure contamination-free collection of samples in pharmaceutical, biotechnology, and food & beverage manufacturing, are witnessing rising adoption across the Asia-Pacific region, driven by the expansion of biologics production, stricter regulatory requirements, and increasing investments in cleanroom infrastructure. Countries such as China, India, Japan, and South Korea are significantly strengthening their aseptic processing capabilities to meet both domestic and export market demand.

- The growing shift toward single-use aseptic sampling systems over traditional reusable methods is supported by their lower contamination risk, operational efficiency, and cost-effectiveness in high-compliance environments. In addition, the region’s growing biopharmaceutical manufacturing base—particularly in vaccine and monoclonal antibody production—is accelerating demand for innovative and pre-validated aseptic sampling solutions

- China dominated the Asia-Pacific aseptic sampling market, accounting for the largest revenue share of 38.5% in 2024, driven by large-scale pharmaceutical manufacturing capacity, rapid expansion of biologics and vaccine facilities, and government-led initiatives to enhance GMP compliance. Strong presence of domestic equipment manufacturers and technology collaborations with Western companies are further boosting adoption

- India is projected to register the fastest CAGR of 12.85% from 2025 to 2032 in the Asia-Pacific aseptic sampling market, fueled by rapid growth in biopharmaceutical exports, government incentives under the Production Linked Incentive (PLI) scheme, and increasing investments in cleanroom and sterile processing infrastructure. The country’s expanding contract manufacturing and research services sector is also creating new opportunities for advanced aseptic sampling systems

- The upstream processes segment dominated the Asia-Pacific aseptic sampling market with a share of 62.5% in 2024, as aseptic sampling is critical during cell culture and fermentation stages to ensure early detection of contamination and maintain product quality. This segment benefits from growing investments in biopharmaceutical R&D and the rising production of biologics in China, India, and South Korea

Report Scope and Asia-Pacific Aseptic Sampling Market Segmentation

|

Attributes |

Asia-Pacific Aseptic Sampling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Aseptic Sampling Market Trends

Growing Technological Advancements and Expanding Biopharmaceutical Research

- A major and accelerating trend in the Asia-Pacific Aseptic Sampling market is the rapid adoption of advanced sterile sampling technologies to support the region’s expanding biopharmaceutical manufacturing and clinical research activities. The shift toward high-value biologics, vaccines, and cell and gene therapies is driving demand for precise, contamination-free sampling methods that meet stringent regulatory requirements

- For instance, leading pharmaceutical manufacturers and research institutes across the region are investing in closed-system aseptic sampling solutions, including single-use assemblies, automated sampling devices, and integrated monitoring systems, to enhance process reliability and reduce the risk of microbial ingress

- The increasing adoption of process analytical technology (PAT) frameworks in manufacturing facilities is enabling real-time quality monitoring, improving production efficiency, and ensuring compliance with Good Manufacturing Practices (GMP). These advancements are particularly vital for high-containment environments such as biosafety level (BSL) laboratories and vaccine production units

- Collaborations between equipment manufacturers, biotechnology companies, and academic research centers are accelerating the deployment of innovative sampling solutions. Government-backed initiatives and favorable regulatory reforms in countries such as China, India, Japan, and South Korea are also improving market access and supporting technology transfer for advanced aseptic processes

- As Asia-Pacific continues to emerge as a global hub for biopharmaceutical production, the Aseptic Sampling market is expected to see sustained growth—driven by technological innovation, enhanced manufacturing capabilities, and the region’s increasing role in global clinical trial activity

Asia-Pacific Aseptic Sampling Market Dynamics

Driver

Growing Need Due to Rising Biopharmaceutical Production and Advancements in Bioprocess Monitoring

- The increasing adoption of biologics and biosimilars manufacturing across Asia-Pacific, supported by growing investments in pharmaceutical infrastructure and improved quality control measures, is significantly driving market growth. Countries such as China, India, South Korea, and Singapore are enhancing their bioprocessing capabilities and regulatory frameworks, enabling higher sterility standards and reliable product quality for large-scale production

- For instance, in March 2024, Sartorius AG (Germany) announced the expansion of its bioprocessing solutions portfolio in Asia-Pacific, including advanced aseptic sampling systems to meet rising demand in biotechnology manufacturing. Such innovations are expected to catalyze the adoption of high-performance sampling methods, thereby accelerating the Asia-Pacific Aseptic Sampling Market over the forecast period

- Rising interest in continuous bioprocessing and the availability of next-generation aseptic sampling technologies—such as automated, single-use systems—is prompting a shift from conventional manual sampling to more precise, contamination-free, and real-time monitoring solutions

- Regulatory bodies across Asia-Pacific, such as the Therapeutic Goods Administration (TGA) in Australia and the National Medical Products Administration (NMPA) in China, are increasingly supporting aseptic manufacturing innovation through streamlined approvals, Good Manufacturing Practice (GMP) compliance incentives, and training programs for process operators

- Collaborations among regional biotech firms, contract manufacturing organizations (CMOs), and academic research centers are strengthening the innovation ecosystem in Asia-Pacific. These partnerships are instrumental in expanding access to advanced sampling systems, scaling process optimization initiatives, and enhancing awareness of sterile manufacturing practices across diverse production facilities

Restraint/Challenge

Limited Infrastructure and Variability in Technology Adoption

- The high cost associated with advanced aseptic sampling systems—including automated units, single-use consumables, and integrated process monitoring devices—poses a substantial barrier to widespread adoption, especially in Southeast Asia and rural manufacturing zones with limited capital budgets

- Even when regulatory frameworks promote GMP compliance, the implementation of cutting-edge aseptic systems typically requires sophisticated facility upgrades, operator training, and validation processes, making them less feasible for small-scale manufacturers

- Moreover, specialized process engineers and validation experts are often concentrated in urban industrial hubs. This geographic disparity forces smaller production units to either outsource aseptic sampling or operate with suboptimal manual methods

- Another challenge is the lack of standardized protocols for aseptic sampling in biologics and cell/gene therapy production. Due to limited field data and operator familiarity—especially in facilities new to single-use technology—the adoption of innovative sampling systems remains inconsistent

- To overcome these challenges, policy reforms, enhanced government subsidies, industry-wide training programs, and the establishment of regional bioprocessing centers of excellence will be essential in expanding access and achieving sustainable growth in the Asia-Pacific aseptic sampling market

Asia-Pacific Aseptic Sampling Market Scope

The market is segmented on the basis of type, technique, application, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into manual aseptic sampling and automated aseptic sampling/ instruments. The manual aseptic sampling type accounted for the largest market share of 57.8% in 2024, driven by its extensive application in traditional pharmaceutical and biotechnology production lines. Its appeal lies in the low upfront investment, operational flexibility, and ease of deployment, making it the preferred choice for smaller biopharmaceutical players, academic laboratories, and research institutions across the Asia-Pacific region. This segment continues to be a cost-effective solution, particularly in countries where biopharma industries are in the growth phase and infrastructure for advanced automation remains limited.

The automated aseptic sampling/ instruments type is forecasted to achieve the highest CAGR of 10.3% between 2025 and 2032, as manufacturers shift toward automation and digital biomanufacturing to enhance reproducibility, efficiency, and sterility in production workflows. Automated sampling supports continuous monitoring, high-throughput processes, and real-time quality control, minimizing human error while aligning with global regulatory expectations. Rising investments in next-generation biologics, biosimilars, and advanced therapies are further propelling demand, especially in leading APAC biopharma hubs such as Singapore, India, and Australia, where large-scale facilities are embracing Industry 4.0 and smart factory models.

- By Technique

On the basis of technique, the market is segmented into off-line sampling technique, at-line sampling technique, and on-line aseptic sampling. The off-line sampling technique segment accounted for the largest share of 46.8% in 2024, as it is widely utilized in routine quality control processes where samples are physically removed and analyzed separately in laboratories. This method offers flexibility in testing parameters and is commonly used in smaller facilities across India, China, and Southeast Asia.

The on-line aseptic sampling segment is expected to witness the fastest CAGR of 9.8%, supported by the push toward continuous bioprocess monitoring, automation, and reduced risk of contamination. Its uptake is significant in high-value biologics and sterile injectable manufacturing across advanced APAC markets.

- By Application

On the basis of application, the market is categorized into upstream processes and downstream processes. The upstream processes segment led the market with a share of 62.5% in 2024, as aseptic sampling is critical during cell culture and fermentation stages to ensure early detection of contamination and maintain product quality. This segment benefits from growing investments in biopharmaceutical R&D and the rising production of biologics in China, India, and South Korea.

The downstream processes segment is forecasted to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by the increasing complexity of purification, filtration, and formulation processes that demand frequent quality checks under sterile conditions. The expansion of biosimilar production across Asia-Pacific is also boosting demand in this segment.

- By End User

On the basis of end user, the market is segmented into biotechnology and pharmaceutical manufacturers, contract manufacturing organizations (CMOs), contract research organizations (CROs), academic and R&D Departments, and others. The biotechnology and pharmaceutical manufacturers segment held the largest share of 51.3% in 2024, owing to the extensive use of aseptic sampling in large-scale biologics, vaccines, and sterile drug production facilities. Increasing investments in biologics manufacturing plants in India, China, and Singapore are expected to maintain segment dominance.

The contract manufacturing organizations (CMOs) segment is projected to grow at the fastest CAGR of 9.5% from 2025 to 2032, supported by the outsourcing trend in biopharmaceutical manufacturing, where contract partners must comply with rigorous aseptic processing standards.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third party distributor, and others. The direct tender segment dominated with 47.1% market share in 2024, as bulk procurement by large pharmaceutical companies, CMOs, and government research institutions is a common practice in the Asia-Pacific region. This channel ensures cost efficiency and compliance with institutional procurement policies.

The third party distributor segment is expected to grow at the fastest CAGR of 10.1% from 2025 to 2032, driven by the rise of specialized life sciences distributors offering localized technical support, faster delivery timelines, and tailored inventory management solutions.

Asia-Pacific Aseptic Sampling Market Regional Analysis

- Asia-Pacific held a market share of 22.6% the global aseptic sampling market in 2024, driven by the region's rapid expansion of biopharmaceutical manufacturing, growing adoption of advanced process monitoring systems, and increasing focus on maintaining sterility in large-scale biologics production

- Strong regulatory frameworks, such as GMP and PIC/S compliance mandates, along with rising investments in vaccine and biosimilar facilities, are fostering growth across both domestic and multinational pharmaceutical companies. Public–private partnerships and government incentives for biotech capacity expansion are further accelerating adoption of aseptic sampling technologies in the region

- Furthermore, Asia-Pacific hosts several leading aseptic processing equipment manufacturers and R&D centers, facilitating continuous product innovation, process validation improvements, and enhanced operator training programs

China Asia-Pacific Aseptic Sampling Market Insight

The China aseptic sampling market dominated the Asia-Pacific market, accounting for the largest revenue share of 38.5% in 2024, driven by large-scale pharmaceutical manufacturing capacity, rapid expansion of biologics and vaccine production facilities, and government-led initiatives to enhance GMP compliance. The strong presence of domestic aseptic equipment manufacturers and increasing technology collaborations with Western companies are further boosting adoption rates. In addition, China's push for self-reliance in high-value bioprocessing equipment is spurring local innovation in automated and single-use aseptic sampling systems.

Japan Asia-Pacific Aseptic Sampling Market Insight

The Japan aseptic sampling market held 19.2% of the Asia-Pacific market share in 2024, supported by its highly advanced pharmaceutical sector, robust bioprocess validation standards, and early adoption of automated sampling systems in cell and gene therapy production. The country’s strong focus on quality assurance, high R&D investment in biologics, and strategic government funding for regenerative medicine are further strengthening its market position.

India Asia-Pacific Aseptic Sampling Market Insight

The India aseptic sampling market is projected to register the fastest CAGR of 12.85% from 2025 to 2032 in the Asia-Pacific market, fueled by rapid growth in biopharmaceutical exports, government incentives under the Production Linked Incentive (PLI) scheme, and increasing investments in cleanroom and sterile processing infrastructure. The country’s expanding contract manufacturing and contract research organization (CRO) sectors are also creating new opportunities for the deployment of advanced aseptic sampling systems, particularly single-use and automated platforms that support large-scale biologics production.

Asia-Pacific Aseptic Sampling Market Share

The Asia-Pacific Aseptic Sampling industry is primarily led by well-established companies, including:

- Sartorius AG (Germany)

- KEOFITT A/S (Denmark)

- KIESELMANN GmbH (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- GEMU Group (Germany)

- Flownamics (U.S.)

- Merck KGaA (Germany)

- Advanced Microdevices Pvt. Ltd. (MDI) (India)

- Saint-Gobain (France)

- GEA Group Aktiengesellschaft (Germany)

- Avantor, Inc. (U.S.)

- ALFA LAVAL (Sweden)

- W. L. Gore & Associates, Inc. (U.S.)

- QualiTru Sampling Systems (U.S.)

- Aerre Inox S.r.l. (Italy)

- Shanghai LePure Biotech Co., Ltd. (China)

- Joneng Valves Co., Limited (China)

- Burkle GmbH (Germany)

- Dietrich Engineering Consultants (Switzerland)

Latest Developments in Asia-Pacific Aseptic Sampling market

- In March 2023, Sartorius AG announced a strategic expansion of its bioprocessing production and customer service capabilities in South Korea and across Asia-Pacific, aiming to support growing demand in biopharma and aseptic sampling

- In June 2022, Merck kGaA announced a collaboration with Agilent Technologies to fill the industry gap in process analytical technologies for downstream processing. The collaboration will help in a further increase in revenue

- In November 2021, Sartorius AG, a leading international partner of life science research and the biopharmaceutical industry, announced that it had been awarded the "Overall Best Bioprocessing Supplier" winner at the Europe Bioprocessing Excellence Awards 2021. This award has helped the company in making getting recognition for its work

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.