Asia Pacific Automated Container Terminal Market

Market Size in USD Billion

CAGR :

%

USD

4.86 Billion

USD

8.88 Billion

2025

2033

USD

4.86 Billion

USD

8.88 Billion

2025

2033

| 2026 –2033 | |

| USD 4.86 Billion | |

| USD 8.88 Billion | |

|

|

|

|

Asia-Pacific Automated Container Terminal Market Size

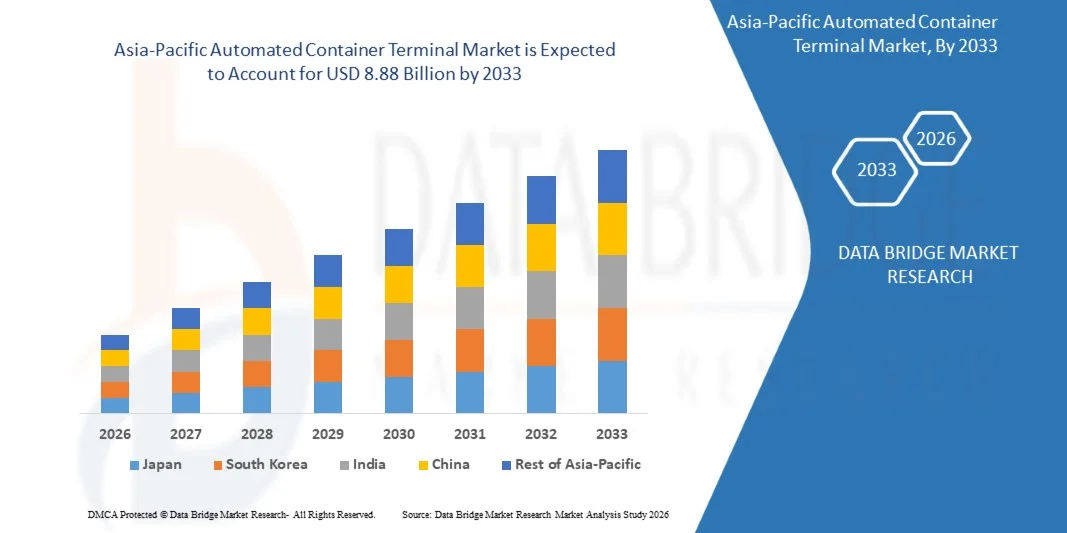

- The Asia-Pacific Automated Container Terminal Market was valued at USD 4.86 billion in 2025 and is expected to reach USD 8.88 billion by 2033, at a CAGR of 7.9% during the forecast period

- The market is primarily driven by the rising cancer prevalence, increasing healthcare expenditure, and growing awareness of advanced treatment options. Rapid improvements in healthcare infrastructure, expansion of specialized cancer treatment centres

- This growth is driven by factors such as government initiatives promoting early diagnosis and innovative therapies, large patient pool and increasing investments by international and local companies in photodynamic therapy technologies

Asia-Pacific Automated Container Terminal Market Analysis

- The Asia-Pacific Automated Container Terminal Market is experiencing steady growth, driven by the surge in international trade has led to higher container throughput, proliferation of automation, robotics, and AI in port operations, sustainability initiatives promoting energy-efficient and low-emission terminals, and rising government investments and incentives for smart port initiatives.

- However, high upfront investment and installation costs, compliance with stringent regional regulations and safety standard, and operational Disruptions during Transition & complexity associated with automation systems remain key restraints, while expansion of automated terminals in emerging markets, integration with smart logistics solutions and port community systems, growing adoption of electric and hybrid automated equipment for sustainability present significant growth opportunities

- China is expected to dominate the Asia-Pacific Automated Container Terminal Market with the largest revenue share of 22.77% in 2026, supported by strong government initiatives for port modernization, large-scale investments in smart port infrastructure, and rapid adoption of advanced automation technologies. The presence of leading domestic equipment manufacturers such as Shanghai Zhenhua Heavy Industries (ZPMC) and Huawei Technologies, along with the growing implementation of automated guided vehicles (AGVs), automated stacking cranes (ASCs), and digital twin solutions across major ports including Shanghai, Ningbo-Zhoushan, and Qingdao, further reinforces China’s leading position in the global market.

- China is expected to be the fastest-growing region in the Asia-Pacific Automated Container Terminal Market during the forecast period with a CAGR of 8.9%, fueled by large-scale investments in port automation, rapid expansion of trade volumes, and strong government support for developing smart and sustainable port infrastructure. Rising adoption of advanced digital technologies, including AI, IoT, and digital twin systems, along with the growing preference for energy-efficient and low-emission automated equipment, is further driving market growth. The increasing participation of domestic technology providers and collaborations with global automation companies are also accelerating the deployment of next-generation automated terminals across the country.

- The semi-automated terminals segment is expected to dominate the Asia-Pacific Automated Container Terminal Market with a market share of 53.23% in 2026, driven by their cost-effectiveness and operational flexibility. These terminals enable ports to integrate automation gradually while maintaining manual oversight, reducing both risks and transition costs. Increasing adoption of automated stacking cranes (ASCs) and remote-controlled yard equipment, along with rising focus on efficiency and worker safety, is further fueling segment growth across major global ports.

Report Scope and Asia-Pacific Automated Container Terminal Market Segmentation

|

Attributes |

Asia-Pacific Automated Container Terminal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include industry analysis & futuristic scenario, penetration and growth prospect mapping, competitor key pricing strategies (prominent players), technology analysis, company profiling, competitive analysis. |

Asia-Pacific Automated Container Terminal Market Trends

“Expansion of automated terminals in emerging markets”

- The rapid growth in trade volumes and the increasing demand for efficient port operations in emerging markets are creating a significant opportunity for ACT market players. By developing greenfield and brownfield automated container terminals, these regions can enhance port efficiency, accommodate larger vessels, and strengthen their integration into global supply chains.

- Expansion into emerging markets enables equipment manufacturers, software vendors, and service integrators to leverage first-mover advantages, deploy modern automation technologies, and achieve greater operational scalability. Investments in advanced cranes, Automated Guided Vehicles (AGVs), Terminal Operating Systems (TOS), and digital logistics platforms are transforming ports into modern, efficient hubs capable of handling surging container traffic while reducing costs and dwell times.

- In July 2025, according to the Times of India, Vizhinjam International Seaport (India) commenced operations using AI-based port operations and automated cranes, trained India’s first female automated crane operators, and handled over 830,000 containers in its first year

- In September 2025, Reuters reported that the Colombo West International Terminal (Sri Lanka), operated by a consortium led by Adani Group, expanded its fully automated terminal capacity to handle up to 3.2 million containers annually, ahead of schedule, strengthening regional logistics capabilities

- Thus, the expansion of automated terminals in emerging markets is establishing these regions as key growth drivers for the ACT market. By implementing advanced automation technologies, emerging-market ports are modernizing infrastructure, reducing operational bottlenecks, and improving global competitiveness, paving the way for sustained industry growth.

Asia-Pacific Automated Container Terminal Market Dynamics

Driver

“The surge in international trade has led to higher container throughput”

- The continuous expansion of global trade has significantly increased the volume of containerized cargo moving across international borders, thereby driving demand for efficient, automated container-handling solutions. As seaborne trade remains the backbone of global commerce, ports worldwide are under growing pressure to enhance throughput capacity, reduce vessel turnaround time, and improve overall terminal efficiency. Automated Container Terminals (ACTs) have emerged as a vital solution to address these operational demands by leveraging robotics, AI, and advanced logistics technologies.

- Rising globalization, coupled with the growth of e-commerce and cross-border supply chains, is further accelerating the need for automation in port operations. Automated cranes, driverless vehicles, and digital port management systems are increasingly being deployed to handle large container volumes with precision and minimal human intervention.

- In October 2024, according to the United Nations Conference on Trade and Development (UNCTAD, 2024), global maritime trade volumes grew by 2.4% in 2023, with containerized trade accounting for over 60% of seaborne cargo, emphasizing the critical need for automated port infrastructure

- In November 2024, A report by Hamburg Port Consulting highlights that automation and digitalisation are becoming essential to modern port operations, as rising cargo volumes demand higher efficiency

- In addition, the increasing complexity of global logistics networks and the expansion of free trade zones are compelling ports to adopt next-generation automated systems to remain competitive. Automation not only supports higher container throughput but also ensures greater operational accuracy, sustainability, and adaptability to fluctuating trade demands. As international maritime trade continues to surge, automation technologies such as AGVs, automated stacking cranes, and digital twin-based monitoring systems are becoming indispensable for optimizing performance and reducing operational bottlenecks.

- Thus, the surge in international trade volumes and the growing need for efficient container handling are propelling the adoption of automated container terminals globally, solidifying automation as a key pillar for future-ready, resilient, and high-performing port operations.

Restraint/Challenge

“High upfront investment and installation costs”

- Despite the growing adoption of automation technologies across global ports, the high upfront investment and installation costs remain a significant restraining factor in the Asia-Pacific Automated Container Terminal Market. Developing fully or semi-automated terminals requires substantial capital for advanced machinery, such as Automated Guided Vehicles (AGVs), Automated Stacking Cranes (ASCs), and sophisticated Terminal Operating Systems (TOS), as well as for integrating supporting digital infrastructure and energy systems. These expenses often exceed hundreds of millions of dollars, posing a major restraint, particularly for medium- and small-scale ports with limited budgets or uncertain cargo throughput.

- Moreover, automation projects typically involve complex retrofitting and long installation timelines, which can disrupt ongoing operations and extend Return-On-Investment (ROI) periods. While automation promises long-term operational efficiency and labor savings, the high initial Capital Expenditure (CAPEX) and integration risks often deter terminal operators from adopting full-scale automation solutions. Consequently, many ports opt for phased or hybrid automation models instead of complete overhauls.

- In January 2024, Port Technology International reported that 62% of terminal professionals identified high initial investment requirements as the primary barrier to automation deployment in container terminals

- In June 2023, PortEconomics highlighted that automation retrofits in existing terminals often face complex integration issues, further increasing project costs and limiting flexibility post-installation.

- Thus, while terminal automation promises long-term benefits such as enhanced productivity, labor optimization, and sustainability, the significant upfront financial burden and complex installation processes remain key restraints for market growth. Overcoming these challenges will depend on adopting innovative financing mechanisms, phased automation models, and increased public–private collaboration to make automation financially viable for ports of all sizes in the coming years.

Asia-Pacific Automated Container Terminal Market Scope

The market is segmented on the basis of degree of automation, project type, offering, end user, and distribution channel.

- By Degree of Automation

On the basis of degree of automation, the Asia-Pacific Automated Container Terminal Market is segmented into Semi-Automated Terminals and Fully Automated Terminals. In 2026, the Semi-Automated Terminals segment is expected to dominate the market with a 53.23% market share, driven by their cost-effectiveness, operational flexibility, and compatibility with existing port infrastructure. Key factors supporting this dominance include ease of integration, gradual automation upgrades, high productivity, and improved safety, which together make semi-automated solutions the preferred choice over fully automated terminals across the region.

- By Project Type

On the basis of project type, the Asia-Pacific Automated Container Terminal Market is segmented into brownfield and greenfield. In 2026, the brownfield segment is expected to dominate with a 65.77% market share, driven by the modernization of existing ports, established infrastructure, and cost-effective automation upgrades. Growing investments in advanced equipment, safety enhancements, and operational efficiency further reinforce its market leadership over Greenfield projects.

The greenfield segment is the fastest-growing segment in the Asia-Pacific Automated Container Terminal Market, with a CAGR of 8.4%, driven by the development of new ports, increasing trade volumes, and rising demand for state-of-the-art automated infrastructure. Greenfield projects allow designing terminals with fully integrated automation systems, advanced equipment, and smart port technologies from the ground up. Additionally, investments in AI-based terminal management, IoT-enabled monitoring, and sustainable operations are accelerating adoption and driving rapid growth in this segment.

- By Offering

On the basis of offering, the Asia-Pacific Automated Container Terminal Market is segmented into equipment, software, services. In 2026, the equipment segment is expected to dominate the market with 53.96% market share, driven by the high demand for automated cranes, guided vehicles, and essential terminal machinery. Strong port infrastructure, government support, and rising trade volumes in the region, along with investments in smart and sustainable port technologies, reinforce the segment’s leading position.

Software is the fastest-growing segment with a CAGR of 8.7% in the Asia-Pacific Automated Container Terminal Market driven by its ease of integration, cost-effectiveness, and ability to optimize terminal operations. automation software enables real-time monitoring, predictive maintenance, and efficient resource allocation without the need for extensive physical upgrades, improving overall terminal productivity. Increasing adoption of digital terminal management systems, growing awareness of smart port benefits, and advancements in AI and IoT technologies are further driving the rapid growth of this segment.

- By End User

On the basis of end user, the Asia-Pacific Automated Container Terminal Market is segmented into public and private. In 2026, the public segment is expected to dominate the market with 59.75% market share, driven by the government-led port authorities, large-scale infrastructure investments, national trade facilitation initiatives, modernization of strategic ports, adoption of automation to improve efficiency and safety, long-term funding stability, and policy support aimed at enhancing global connectivity and economic growth.

Private is the fastest-growing segment with CAGR of 8.3% in the market driven by rising private terminal concessions, public–private partnerships, demand for operational efficiency, faster decision-making, return-on-investment focus, adoption of advanced automation technologies, competitive pressure to reduce costs, improve throughput, and deliver higher service reliability.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific Automated Container Terminal Market is segmented into direct channel and indirect channel. In 2026, the direct channel segment is expected to dominate the market with 68.21% market share, driven by the strong relationships between terminal operators and automation solution providers, customized system integration requirements, reduced procurement costs, direct technical support, long-term service contracts, and the need for seamless implementation of complex, high-value automation solutions.

Asia-Pacific Automated Container Terminal Market Regional Analysis

- China is expected to dominate the Asia-Pacific Automated Container Terminal Market with the largest revenue share of 22.77% in 2026, supported by large-scale investments in port automation, increasing cargo throughput, and strong government initiatives promoting smart and sustainable port infrastructure. Growing adoption of advanced technologies and presence of key domestic automation equipment manufacturers further reinforce its market leadership.

- China is expected to be the fastest-growing region in the Asia-Pacific Automated Container Terminal Market during the forecast period with a CAGR of 8.9%, fueled by rapid digital transformation, expansion of automated terminals, and strong government support for smart port development. Increasing adoption of AI-driven terminal management systems and energy-efficient automated equipment is accelerating market growth

- Additionally, continuous modernization of major ports, rising international trade volumes, and strategic investments in eco-friendly and high-efficiency port operations are driving the sustained growth of China’s automated container terminal sector.

Singapore Asia-Pacific Automated Container Terminal Market Insight

The Singapore Asia-Pacific Automated Container Terminal Market plays a significant role in the Asia-Pacific region, driven by the country’s status as a major global transshipment hub and its commitment to fully automated, high-efficiency port operations. Key terminals like PSA Singapore Terminals have implemented automated guided vehicles (AGVs), automated stacking cranes (ASCs), and remote-controlled yard equipment, enhancing productivity and reducing turnaround times. Strong government support for smart port initiatives, digitalization, and sustainable operations, along with continuous technology upgrades, further reinforce Singapore’s leadership in the Asia-Pacific Automated Container Terminal Market.

South Korea Asia-Pacific Automated Container Terminal Market Insight

The South Korea Asia-Pacific Automated Container Terminal Market is projected to grow steadily, supported by its focus on smart port development, high automation readiness, and government-industry collaboration. The country’s major ports, such as Busan, are implementing AI-powered terminal management systems, IoT-enabled tracking, and digital twin solutions to enhance operational efficiency. Additionally, rising adoption of electric and hybrid automated equipment for sustainable operations further strengthens market growth and positions South Korea as a regional leader in advanced container terminal automation.

The Major Players Operating in the Market Are:

- TOTAL SOFT BANK LTD. (South Korea)

- INFORM SOFTWARE (Germany)

- Logstar ERP. (India)

- infyz.com (India)

- Tideworks (U.S.)

- Loginno Logistic Innovation ltd. (Israel)

- World Crane Services FZE (U.A.E.)

- STARCOMM SYSTEMS (U.K.)

- Kalmar Corporation (Finland)

- Cargotec Corporation (Finland)

- Konecranes Plc (Finland)

- Shanghai Zhenhua Heavy Industries Co., Ltd. (China)

- LIEBHERR Group (Switzerland)

- ABB Ltd. (Switzerland)

- HAPAG LLOYD (Germany)

- APM Terminals (Netherlands)

- BECKHOFF AUTOMATION GMBH & CO. KG (Germany)

- Künz GmbH (Austria)

- CyberLogitec Co., Ltd. (Korea)

- Camco Technologies NV (Belgium)

- IDENTEC SOLUTIONS AG (Austria)

- ORBCOMM Inc. (U.S.)

- ORBITA PORTS & TERMINALS acquired by TMEIC PORT TECHNOLOGIES, S.L. (Japan)

- PACECO Corp. (U.S.)

Latest Developments in Asia-Pacific Automated Container Terminal Market

- In October 2025, Hapag-Lloyd and DP World renewed their long-term partnership at the Port of Santos in Brazil. This extension secures collaboration for the next decade and includes a major expansion of the terminal, increasing quay length and annual handling capacity, which will allow Hapag-Lloyd to handle larger vessels and deliver new services for customers.

- In September 2025, Hiab Corporation signed a partnership with Forterra to accelerate the development of autonomous trucking and load handling solutions. This aims to elevate autonomous capabilities, enhancing sustainability and safety in logistics workflows.

- In September 2025, Liebherr and TPT entered into a 10-year strategic partnership agreement aimed at modernizing and enhancing efficiency across South Africa’s port operations. The agreement includes the supply of four large STS cranes for the Port of Durban and 48 rubber-tyred gantry (RTG) cranes for the Durban and Cape Town terminals, along with a 20-year asset management program to ensure long-term reliability of the equipment.

- In November 2024, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) entered into a strategic cooperation agreement with Cavotec SA, marking a significant step toward advancing sustainability and innovation in port and terminal infrastructure globally. This partnership combines ZPMC’s expertise in manufacturing heavy-duty port equipment with Cavotec’s specialized technologies in automation and electrification. Together, they aim to develop cutting-edge solutions that improve the efficiency and environmental performance of ports, such as reducing emissions through electrified equipment and enhancing operational automation. By leveraging the strengths of both companies, the collaboration seeks to support the global maritime industry’s transition toward greener, smarter, and more sustainable port operations.

- In December 2024, Konecranes completed the acquisition of Rotterdam-based Peinemann Port Services BV and Peinemann Container Handling BV after receiving approval from the Dutch competition authority. The acquisition, valued at an undisclosed amount, added approximately 100 employees and strengthened Konecranes' position in the Netherlands, particularly in the Rotterdam area.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 COMPETITOR KEY PRICING STRATEGIES (PROMINENT PLAYERS)

4.4 TECHNOLOGY ANALYSIS – ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

4.5 COMPANY PROFILING

4.5.1 HAPAG-LLOYD AG

4.5.1.1 LIST OF ACQUISITION

4.5.1.2 SHAREHOLDING PATTERN

4.5.1.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.1.4 BUSINESS MODEL

4.5.1.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.1.5.1 COMPANY CUSTOMER SEGMENTS

4.5.1.5.2 COMPANY VALUE PROPOSITIONS

4.5.1.5.3 COMPANY CHANNELS

4.5.1.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.1.5.5 COMPANY REVENUE STREAMS

4.5.1.5.6 COMPANY KEY RESOURCES

4.5.1.5.7 COMPANY KEY ACTIVITIES

4.5.1.5.8 COMPANY KEY PARTNERS

4.5.1.5.9 COMPANY A COST STRUCTURE

4.5.1.5.10 COMPANY SWOT ANALYSIS

4.5.2 KONECRANES

4.5.2.1 LIST OF ACQUISITION

4.5.2.2 SHAREHOLDING PATTERN

4.5.2.3 COMPANY’S COMPETITORS AND ALTERNATIVES

4.5.2.4 BUSINESS MODEL

4.5.2.5 HOW THE COMPANY MAKES MONEY CANVAS

4.5.2.5.1 COMPANY CUSTOMER SEGMENTS

4.5.2.5.2 COMPANY VALUE PROPOSITIONS

4.5.2.5.3 COMPANY CHANNELS

4.5.2.5.4 COMPANY CUSTOMER RELATIONSHIPS

4.5.2.5.5 COMPANY REVENUE STREAMS

4.5.2.5.6 COMPANY KEY RESOURCES

4.5.2.5.7 COMPANY KEY ACTIVITIES

4.5.2.5.8 COMPANY KEY PARTNERS

4.5.2.5.9 COMPANY A COST STRUCTURE

4.5.2.5.10 COMPANY SWOT ANALYSIS

4.6 COMPETITIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT

5.1.2 PROLIFERATION OF AUTOMATION, ROBOTICS, AND AI IN PORT OPERATIONS

5.1.3 SUSTAINABILITY INITIATIVES PROMOTING ENERGY-EFFICIENT AND LOW-EMISSION TERMINALS

5.1.4 RISING GOVERNMENT INVESTMENTS AND INCENTIVES FOR SMART PORT INITIATIVES

5.2 RESTRAINTS

5.2.1 HIGH UPFRONT INVESTMENT AND INSTALLATION COSTS

5.2.2 COMPLIANCE WITH STRINGENT REGIONAL REGULATIONS AND SAFETY STANDARDS

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF AUTOMATED TERMINALS IN EMERGING MARKETS

5.3.2 INTEGRATION WITH SMART LOGISTICS SOLUTIONS AND PORT COMMUNITY SYSTEMS

5.3.3 GROWING ADOPTION OF ELECTRIC AND HYBRID AUTOMATED EQUIPMENT FOR SUSTAINABILITY

5.4 CHALLENGES

5.4.1 CYBERSECURITY RISKS ASSOCIATED WITH DIGITAL PORT INFRASTRUCTURE

5.4.2 SYSTEM INTEROPERABILITY WITH LEGACY EQUIPMENT AND MULTI-VENDOR SOLUTIONS

6 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION

6.1 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

6.1.1 SEMI-AUTOMATED TERMINALS

6.1.2 FULLY AUTOMATED TERMINALS

7 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

7.1 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

7.1.1 BROWNFIELD PROJECTS

7.1.1.1 BROWNFIELD PROJECTS, BY TYPE

7.1.1.1.1 END-TO-END BROWNFIELD PROJECTS TERMINAL AUTOMATION

7.1.1.1.2 YARD-ONLY AUTOMATION RETROFITS

7.1.1.1.3 LANDSIDE / GATE AUTOMATION UPGRADES

7.1.1.1.4 QUAY CRANE AUTOMATION RETROFITS

7.1.2 GREENFIELD PROJECTS

7.1.2.1 GREENFIELD PROJECTS, BY TYPE

7.1.2.1.1 FULLY AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.2 SEMI-AUTOMATED GREENFIELD PROJECTS TERMINALS

7.1.2.1.3 PHASED GREENFIELD PROJECTS AUTOMATION

8 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING

8.1 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

8.1.1 EQUIPMENT

8.1.1.1 EQUIPMENT, BY TYPE

8.1.1.1.1 AUTOMATED & REMOTE-CONTROLLED CRANES

8.1.1.1.2 AUTOMATED HORIZONTAL TRANSPORT

8.1.1.1.3 GATE & LANDSIDE AUTOMATION EQUIPMENT

8.1.1.1.4 OTHERS

8.1.2 SOFTWARE

8.1.2.1 SOFTWARE, BY TYPE

8.1.2.1.1 EQUIPMENT CONTROL SYSTEMS (ECS) & FLEET MANAGEMENT

8.1.2.1.2 TERMINAL OPERATING SYSTEMS (TOS)

8.1.2.1.3 AUTOMATION & ORCHESTRATION PLATFORMS

8.1.2.1.4 DIGITAL TWIN & SIMULATION TOOLS

8.1.2.1.5 GATE & COMMUNITY PLATFORMS

8.1.2.1.6 OTHERS

8.1.3 SERVICES

8.1.3.1 SERVICE, BY TYPE

8.1.3.1.1 PROFESSIONAL SERVICES

8.1.3.1.2 MANAGED SERVICES

9 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER

9.1 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

9.1.1 PUBLIC

9.1.1.1 PUBLIC, BY APPLICATION

9.1.1.1.1 PORT INFRASTRUCTURE MODERNIZATION

9.1.1.1.2 TRADE FACILITATION & CUSTOMS AUTOMATION

9.1.1.1.3 SAFETY & COMPLIANCE AUTOMATION

9.1.1.1.4 SMART NATIONAL LOGISTICS CORRIDORS

9.1.1.1.5 PUBLIC–PRIVATE PARTNERSHIP (PPP) CO-MANAGED TERMINALS

9.1.1.1.6 OTHERS

9.1.2 PRIVATE

9.1.2.1 PRIVATE, BY APPLICATION

9.1.2.1.1 HIGH-VOLUME AUTOMATED CONTAINER HANDLING

9.1.2.1.2 AUTOMATED LOGISTICS & INTERMODAL HUBS

9.1.2.1.3 CARRIER-OWNED SMART TERMINALS

9.1.2.1.4 SUBSCRIPTION & MANAGED TERMINAL AUTOMATION SERVICES

10 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL

10.1 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

10.1.1 DIRECT CHANNEL

10.1.2 INDIRECT CHANNEL

10.1.2.1 INDIRECT CHANNEL, BY TYPE

10.1.2.1.1 SYSTEM INTEGRATORS

10.1.2.1.2 VALUE-ADDED RESELLERS (VAR)

10.1.2.1.3 OTHERS

11 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 SINGAPORE

11.1.3 SOUTH KOREA

11.1.4 JAPAN

11.1.5 INDIA

11.1.6 AUSTRALIA

11.1.7 MALAYSIA (

11.1.8 INDONESIA

11.1.9 THAILAND

11.1.10 PHILIPPINES (

11.1.11 REST OF ASIA PACIFIC

12 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIEBHERR

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 BECKHOFF AUTOMATION

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 SHANGHAI ZHENHUA HEAVY INDUSTRIES CO., LTD.

14.3.1 COMPANY SNAPSHOTS

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 KONECRANES

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 KALMAR CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 APM TERMINALS

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CAMCO TECHNOLOGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 CLT

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HIAB CORPORATION (SUBSIDIARY OF CARGOTEC)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 HAPAG-LLOYD AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 INFYZ.COM.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 INFORM SOFTWARE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 IDENTEC SOLUTIONS AG

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 KÜNZ GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 LOGSTAR ERP.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 LOGINNO LOGISTIC INNOVATION LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 ORBCOMM

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 PACECO CORP.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 STARCOM GPS ASIA-PACIFIC SOLUTIONS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 ECENT DEVELOPMENT

14.21 TMEIC

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 TIDEWORKS.

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 TOTAL SOFT BANK LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.24 WCS CONSULTANCY

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 INDUSTRY ANALYSIS AND FUTURISTIC SCENARIO OF THE ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET

TABLE 2 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC SEMI-AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC FULLY AUTOMATED TERMINALS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC DIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 CHINA (USD THOUSAND)

TABLE 43 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 44 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 CHINA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 CHINA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 48 CHINA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 CHINA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 CHINA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 CHINA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 53 CHINA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 54 CHINA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 55 CHINA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 56 CHINA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 SINGAPORE (USD THOUSAND)

TABLE 58 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 59 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 SINGAPORE BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 SINGAPORE GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 63 SINGAPORE EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 SINGAPORE SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SINGAPORE SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 66 SINGAPORE PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 68 SINGAPORE PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 69 SINGAPORE PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 70 SINGAPORE AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 71 SINGAPORE INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 SOUTH KOREA (USD THOUSAND)

TABLE 73 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 74 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 SOUTH KOREA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 SOUTH KOREA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 78 SOUTH KOREA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 SOUTH KOREA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 SOUTH KOREA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 SOUTH KOREA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 82 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 83 SOUTH KOREA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 84 SOUTH KOREA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 85 SOUTH KOREA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 86 SOUTH KOREA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 JAPAN (USD THOUSAND)

TABLE 88 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 89 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 JAPAN BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 JAPAN GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 93 JAPAN EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 JAPAN SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 JAPAN SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 JAPAN PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 98 JAPAN PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 99 JAPAN PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 100 JAPAN AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 101 JAPAN INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 INDIA (USD THOUSAND)

TABLE 103 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 104 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 INDIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 INDIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 108 INDIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 INDIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 INDIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 INDIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 113 INDIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 114 INDIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 115 INDIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 INDIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 AUSTRALIA (USD THOUSAND)

TABLE 118 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 119 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 AUSTRALIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 AUSTRALIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 123 AUSTRALIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 AUSTRALIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 AUSTRALIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 AUSTRALIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 128 AUSTRALIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 129 AUSTRALIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 130 AUSTRALIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 131 AUSTRALIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 MALAYSIA (USD THOUSAND)

TABLE 133 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 134 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 MALAYSIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 MALAYSIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 138 MALAYSIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 MALAYSIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 MALAYSIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 MALAYSIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 143 MALAYSIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 144 MALAYSIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 145 MALAYSIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 146 MALAYSIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 INDONESIA (USD THOUSAND)

TABLE 148 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 149 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 INDONESIA BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 INDONESIA GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 153 INDONESIA EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 INDONESIA SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 INDONESIA SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 INDONESIA PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 158 INDONESIA PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 159 INDONESIA PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 160 INDONESIA AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 161 INDONESIA INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 THAILAND (USD THOUSAND)

TABLE 163 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 164 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 THAILAND BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 THAILAND GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 168 THAILAND EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 THAILAND SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 THAILAND SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 THAILAND PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 173 THAILAND PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 174 THAILAND PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 175 THAILAND AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 176 THAILAND INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 PHILIPPINES (USD THOUSAND)

TABLE 178 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 179 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 PHILIPPINES BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 PHILIPPINES GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 183 PHILIPPINES EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 PHILIPPINES SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 PHILIPPINES SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 PHILIPPINES PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 188 PHILIPPINES PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 189 PHILIPPINES PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 190 PHILIPPINES AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 191 PHILIPPINES INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 REST OF ASIA PACIFIC (USD THOUSAND)

TABLE 193 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DEGREE OF AUTOMATION, 2018-2033 (USD THOUSAND)

TABLE 194 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 REST OF ASIA-PACIFIC BROWNFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 REST OF ASIA-PACIFIC GREENFIELD PROJECTS IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 198 REST OF ASIA-PACIFIC EQUIPMENT IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 REST OF ASIA-PACIFIC SOFTWARE IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 REST OF ASIA-PACIFIC SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 REST OF ASIA-PACIFIC PROFESSIONAL SERVICES IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 203 REST OF ASIA-PACIFIC PUBLIC IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 204 REST OF ASIA-PACIFIC PRIVATE IN AUTOMATED CONTAINER TERMINAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 205 REST OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 206 REST OF ASIA-PACIFIC INDIRECT CHANNEL IN AUTOMATED CONTAINER TERMINAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET

FIGURE 2 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: MULTIVARIATE MODELLING

FIGURE 7 SWOT ANALYSIS

FIGURE 8 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET, BY PROJECT TYPE

FIGURE 15 THE SURGE IN INTERNATIONAL TRADE HAS LED TO HIGHER CONTAINER THROUGHPUT. IT IS EXPECTED TO DRIVE THE ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 SEMI-AUTOMATED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET IN 2025 AND 2033

FIGURE 17 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR THE AUTOMATED CONTAINER TERMINAL MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET

FIGURE 19 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: BY DEGREE OF AUTOMATION, 2025

FIGURE 20 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: BY PROJECT TYPE, 2025

FIGURE 21 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: BY OFFERING, 2025

FIGURE 22 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: BY END USER, 2025

FIGURE 23 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 24 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: SNAPSHOT (2025)

FIGURE 25 ASIA-PACIFIC AUTOMATED CONTAINER TERMINAL MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.