Asia Pacific Automotive Sensor And Camera Technologies Market

Market Size in USD Billion

CAGR :

%

USD

3.86 Billion

USD

8.85 Billion

2024

2032

USD

3.86 Billion

USD

8.85 Billion

2024

2032

| 2025 –2032 | |

| USD 3.86 Billion | |

| USD 8.85 Billion | |

|

|

|

|

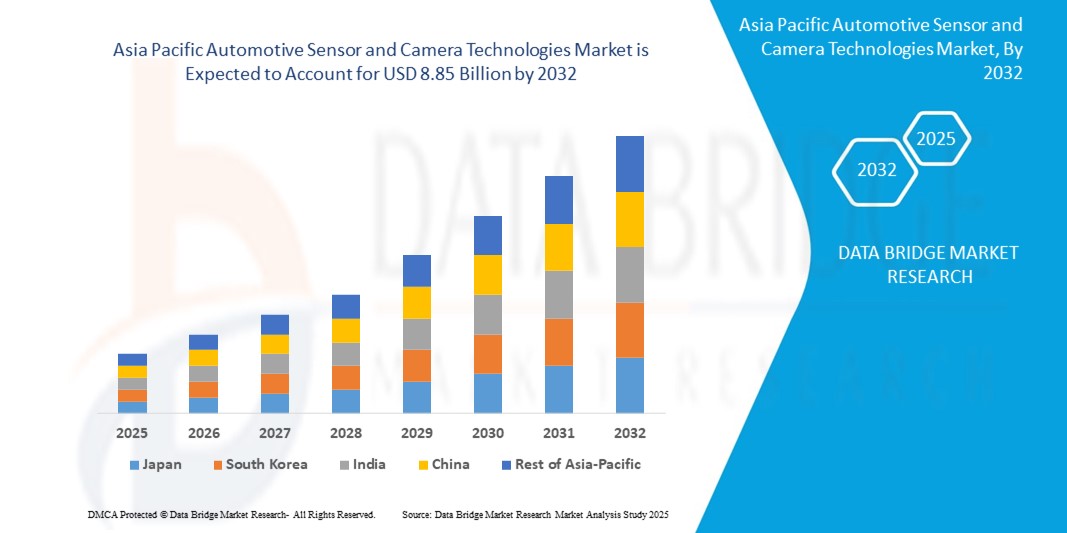

Asia Pacific Automotive Sensor and Camera Technologies Market Size

- The Asia Pacific Automotive Sensor and Camera Technologies Market size was valued at USD 3.86 billion in 2024 and is expected to reach USD 8.85 billion by 2032, at a CAGR of 1.6% during the forecast period.

- This growth is driven by EU cities like Paris and Stockholm are investing in smart mobility, encouraging the use of vehicle-to-infrastructure (V2X) camera systems, often developed by ZF Friedrichshafen and Continental AG.

Asia Pacific Automotive Sensor and Camera Technologies Market Analysis

- The Asia Pacific Union’s General Safety Regulation (GSR), enforced since July 2022, mandates advanced safety features like emergency lane-keeping and automatic braking. This boosts demand for vision and radar sensors from companies like Bosch and Valeo.

- Asia Pacific automakers like Volkswagen and Stellantis are expanding EV production, increasing the need for high-efficiency, lightweight camera and sensor systems to support semi-autonomous features.

- China holds a significant market share due to Demand for Autonomous Driving.

- China is expected to register the fastest growth, fuelled by Urban Traffic Safety Initiatives.

- The Sensor Type segment is projected to account for a significant market share of approximately 68.1% in 2025, driven by Rise of Electrification.

Report Scope and Asia Pacific Automotive Sensor and Camera Technologies Market Segmentation

|

Attributes |

Asia Pacific Automotive Sensor and Camera Technologies Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia Pacific Automotive Sensor and Camera Technologies Market Trends

“Innovative Sensor Technologies”

- Companies are developing advanced sensor technologies to meet the growing demand for high-resolution imaging and real-time data processing. For instance, in 2024, Sony Semiconductor Solutions introduced the ISX038, the industry's first CMOS image sensor for automotive cameras capable of simultaneously processing and outputting RAW and YUV images.

- The adoption of cloud technologies facilitates scalable and flexible deployment of automotive sensor and camera systems. Cloud-based platforms allow for efficient data storage, processing, and analysis, supporting features like over-the-air updates and remote diagnostics.

- In January 2025, China’s NCAP and India’s Bharat NCAP have implemented stricter safety scoring since 2022, compelling OEMs like Tata Motors and Geely to include forward collision warning and lane detection cameras.

- The growing complexity of sensor fusion makes calibration difficult during vehicle servicing. Valeo noted this issue in their 2024 ADAS system diagnostics update.

Asia Pacific Automotive Sensor and Camera Technologies Market Dynamics

Driver

“Stringent Safety Regulations”

- Asia Pacific regulatory bodies are enforcing strict safety standards, compelling automotive manufacturers to integrate advanced sensor and camera systems to comply with regulations and enhance vehicle safety.

- The increasing popularity of electric and autonomous vehicles is driving the need for sophisticated sensor and camera technologies to support functionalities like Advanced Driver Assistance Systems (ADAS) and autonomous driving capabilities.

- For instance, In January 2025, Robert Bosch GmbH introduced the AI-based MPC3 multifunctional camera at CES 2025, combining traditional image processing with AI to enhance object and pedestrian recognition for autonomous driving applications.

- The General Data Protection Regulation (GDPR) limits in-cabin camera usage and facial recognition features. This has delayed deployment for companies like Tesla, whose cabin monitoring features faced scrutiny in Germany.

Opportunity

“Technological Advancement”

- Continuous innovation in sensor and camera technologies, such as the development of wide-angle cameras, high-resolution imaging, and night-vision capabilities, opens new avenues for market growth and application diversification.

- Emerging markets in Asia Pacific present significant growth opportunities for automotive sensor and camera technologies, driven by urbanization, increasing vehicle ownership, and the adoption of smart transportation solution.

- For instance, As of April 2023, Smart Eye's DMS technology has been deployed in over 1 billion vehicles globally. The company has secured 217 design wins from more than 19 global car manufacturers, including BMW, Polestar, and Geely.

- The EU’s planned 2025 rollout of pan-Asia Pacific AV corridors will require sophisticated sensors and cameras from firms like Mobileye and Valeo.

Restraint/Challenge

“Supply Chain Disruptions”

- The initial investment required for advanced sensor and camera systems can be substantial, posing a barrier for small and medium-sized enterprises (SMEs) and limiting widespread adoption.

- The automotive industry faces challenges related to supply chain disruptions and shortages of critical components, such as semiconductors and sensors, which can impede the production and integration of sensor and camera systems.

- For instance, Continental AG launched the ProViu Mirror, a digital camera monitor system replacing traditional wing mirrors in commercial vehicles, aiming to improve aerodynamics and safety.

- Advanced sensor suites including LiDAR and thermal imaging remain expensive, limiting use to high-end models. For example, BMW’s 7 Series (2023) incorporates costly sensor arrays, out of reach for mass-market buyers.

Asia Pacific Automotive Sensor and Camera Technologies Market Scope

The market is segmented based on Type, Vehicle Type, End User, and Application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Vehicle Type |

|

|

By Application |

|

|

By End User |

|

In 2025, Car’s segment is projected to dominate the End User segment

The Cars segment is expected to hold a market share of approximately 39.3% in 2025, driven by Technological Advancements.

The Sensor segment is expected to account for the largest share during the forecast period in the Road Type market

In 2025, the Sensor segment is projected to account for a market share of 59.8%, driven by Growth in Smart City Development.

“China Holds the Largest Share in the Asia Pacific Automotive Sensor and Camera Technologies Market”

- China dominates the market due to Asia Pacific automakers like Volkswagen and Stellantis are expanding EV production, increasing the need for high-efficiency, lightweight camera and sensor systems to support semi-autonomous features.

- The China holds a significant share, driven by Demand for Autonomous Driving.

- In April 2024, Companies such as Mercedes-Benz (with Drive Pilot Level 3, launched in Germany in 2024) are accelerating adoption of cameras, LiDAR, and radar for autonomous driving capabilities.

“China is Projected to Register the Highest CAGR in the Asia Pacific Automotive Sensor and Camera Technologies Market”

- China growth is driven by Growth The increasing popularity of electric and autonomous vehicles is driving the need for sophisticated sensor and camera technologies to support functionalities like Advanced Driver Assistance Systems (ADAS) and autonomous driving capabilities.

- China is projected to exhibit the highest CAGR due to Growth of Semiconductor Industry.

- Asia Pacific’s strong premium vehicle market—led by BMW, Audi, and Volvo—has driven advanced sensor and surround-view camera installations as standard across multiple 2023 models.

Asia Pacific Automotive Sensor and Camera Technologies Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Robert Bosch Gmbh,

- BorgWarner Inc.,

- Aptiv, Continental Ag,

- Valeo,

- Autoliv Inc,

- Garmin Ltd.,

- Sensata Technologies Inc,

- Omnivision Technologies Inc,

- Panasonic corporation,

- HELLA GmbH & Co.

- KGaA, Magna International Inc,

- Mobileye,

- Zf Friedrichshafen Ag,

- GENTEX CORPORATION,

- Stadt Friedrichshafen,

- Te Connectivity,

- STMicroelectronics,

- Nxp Semiconductors,

- Autoliv Inc,

- STONKAM CO., LTD.

Latest Developments in Asia Pacific Automotive Sensor and Camera Technologies Market

- In May 2025, Ouster reported strong Q1 results, highlighting increased demand for lidar in smart infrastructure to enhance traffic systems and reduce congestion.

- Smart Eye AB (Sweden): As of April 2023, Smart Eye's DMS technology has been deployed in over 1 billion vehicles globally. The company has secured 217 design wins from more than 19 global car manufacturers, including BMW, Polestar, and Geely.

- In January 2025, Robert Bosch GmbH introduced the AI-based MPC3 multifunctional camera at CES 2025, combining traditional image processing with AI to enhance object and pedestrian recognition for autonomous driving applications.

- As of May 2025, Bosch introduced the AI-based MPC3 multifunctional camera at CES 2025. This camera combines traditional image processing algorithms with AI technologies to recognize objects and people, as well as differentiate between the road and its edges, aiding in lane-keeping.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Automotive Sensor And Camera Technologies Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Automotive Sensor And Camera Technologies Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Automotive Sensor And Camera Technologies Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.