Asia Pacific Autonomous Forklifts Market

Market Size in USD million

CAGR :

%

USD

5.63 million

USD

15.84 million

2024

2032

USD

5.63 million

USD

15.84 million

2024

2032

| 2025 –2032 | |

| USD 5.63 million | |

| USD 15.84 million | |

|

|

|

|

Asia-Pacific Autonomous Forklifts Market Size

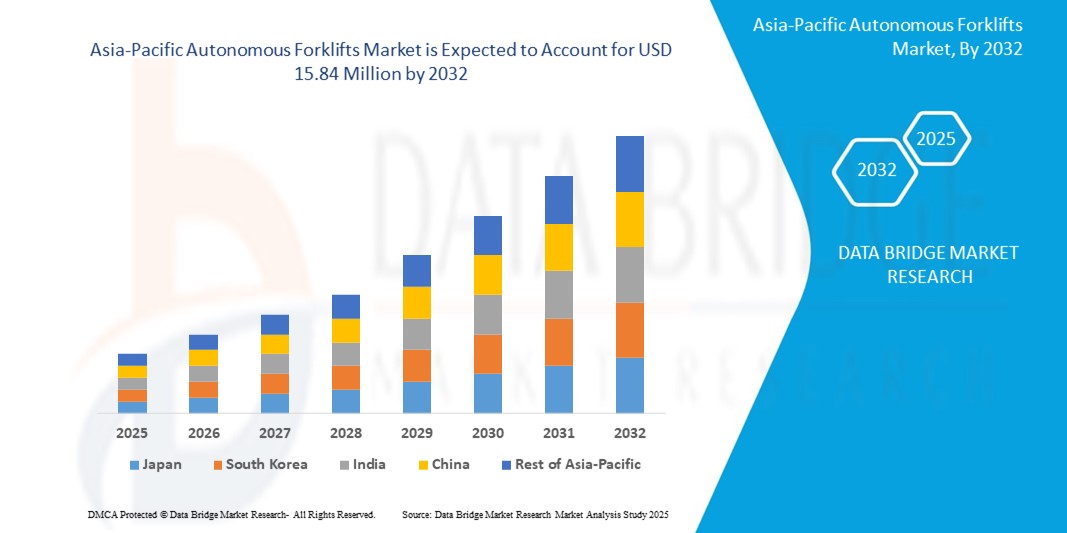

- The Asia-Pacific autonomous forklifts market size was valued at USD 5.63 million in 2024 and is expected to reach USD 15.84 million by 2032, at a CAGR of 13.80% during the forecast period

- The market growth is largely fuelled by the increasing adoption of automation technologies in warehouses and manufacturing plants to improve efficiency and reduce labor costs

- Rising demand for smart logistics solutions and the integration of advanced sensors and artificial intelligence in material handling equipment are also driving the market growth

Asia-Pacific Autonomous Forklifts Market Analysis

- The market is expanding as industries increasingly adopt autonomous forklifts to streamline material handling processes and enhance operational efficiency

- Companies are investing in integrating artificial intelligence and sensor technologies to improve the accuracy and safety of autonomous forklift operations

- China autonomous forklifts market accounted for the largest market revenue share of 45% in Asia Pacific in 2024, driven by the country's advanced manufacturing capabilities, strong logistics infrastructure, and rapid industrial automation

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific autonomous forklifts market due to increasing labor shortages, rising demand for precision automation, and the nation’s strong focus on integrating advanced robotics in industrial operations

- The electric motor rider forklifts segment dominated the market with the largest revenue share in 2024, attributed to their versatility in indoor applications and lower operational noise. Their widespread use in warehousing and manufacturing enhances workflow efficiency and safety

Report Scope and Asia-Pacific Autonomous Forklifts Market Segmentation

|

Attributes |

Asia-Pacific Autonomous Forklifts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asia-Pacific Autonomous Forklifts Market Trends

“Rise of Collaborative Autonomous Forklifts in Warehousing”

- A noticeable trend in the Asia-Pacific autonomous forklifts market is the growing adoption of collaborative autonomous forklifts that work alongside human operators

- These forklifts are designed to enhance safety and efficiency by using advanced sensors and AI to navigate dynamic warehouse environments without disrupting human activities

- For instance, companies such as Toyota Industries Corporation and Hangcha Group are developing forklifts equipped with obstacle detection and adaptive path planning to support mixed human-robot workflows

- Collaborative autonomous forklifts help reduce labor costs while improving productivity by handling repetitive tasks and allowing humans to focus on complex operations

- The increasing integration of these forklifts into warehouse management systems enables real-time monitoring and coordination, further optimizing supply chain processes and reducing downtime

Asia-Pacific Autonomous Forklifts Market Dynamics

Driver

“Increasing Demand for Automation to Enhance Warehouse Efficiency”

- The Asia-Pacific autonomous forklifts market is driven by rising demand for automation in logistics, manufacturing, and warehousing to handle increasing supply chain complexity and faster delivery expectations

- Autonomous forklifts automate repetitive tasks such as loading, unloading, and transporting goods, boosting operational efficiency and reducing dependence on manual labor

- These forklifts help address workforce shortages and lower labor costs by performing programmed routes accurately, reducing human errors

- Advanced technologies such as artificial intelligence, machine learning, and sensors improve navigation and safety, enabling forklifts to operate smoothly in dynamic warehouse environments

- For instance, Toyota Industries Corporation has integrated AI-driven autonomous forklifts in smart warehouses to enhance productivity and safety, reflecting the shift towards Industry 4.0 and digital transformation in the region

Restraint/Challenge

“High Initial Investment and Integration Complexity”

- Adoption of autonomous forklifts in Asia-Pacific faces challenges due to high initial investment costs in hardware, software, and infrastructure, which can be a barrier for small and medium enterprises

- Integrating autonomous forklifts into existing warehouse systems requires workflow redesign, compatibility checks, and extensive employee training to ensure smooth operations

- Deploying autonomous vehicles safely demands advanced sensors, real-time data processing, and strong cybersecurity to avoid operational failures and data breaches

- Ongoing software updates and maintenance increase total ownership costs, making it harder for some companies to justify investment

- Varying regulations and standards across Asia-Pacific countries complicate market entry and slow down adoption, especially in cost-sensitive regions

- For instance, smaller warehouse operators in India and Southeast Asia often face budget constraints and lack the technical infrastructure to smoothly integrate autonomous forklifts, which slows market adoption in those areas

Asia-Pacific Autonomous Forklifts Market Scope

The market is segmented on the basis of type, level of automation, tonnage, components, sales channel, function, and end-users.

- By Type

On the basis of type, the Asia-Pacific autonomous forklifts market is segmented into electric motor rider forklifts, electric motor narrow aisle forklifts, electric pallet jacks, stackers and tow tractors, internal combustion cushion tire forklifts, internal combustion pneumatic tire forklifts, electric/ic engine tow tractors, and rough terrain forklift trucks. The Electric Motor Rider Forklifts segment dominated the market with the largest revenue share in 2024, attributed to their versatility in indoor applications and lower operational noise. Their widespread use in warehousing and manufacturing enhances workflow efficiency and safety.

The Stackers and Tow Tractors segment is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, driven by increasing adoption in last-mile logistics and compact industrial settings. Their compact footprint, energy efficiency, and ease of integration with automation platforms make them increasingly popular for e-commerce warehousing and retail logistics.

- By Level of Automation

On the basis of level of automation, the market is segmented into level 1, level 2, level 3, level 4, and level 5. The Level 2 segment held the largest revenue share in 2024 due to its ability to combine manual and semi-autonomous operations, offering cost-effective upgrades for traditional forklifts. It enables improved productivity while allowing human oversight when necessary.

Level 4 is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, fuelled by advancements in AI and sensor technologies. Level 4 forklifts support fully autonomous operations in controlled environments, which aligns well with smart warehouse trends and increasing labor cost concerns.

- By Tonnage

On the basis of tonnage, the market is segmented into below 5 tons, 5–10 tons, and more than 10 tons. The Below 5 Tons segment accounted for the highest market share in 2024, driven by their widespread use in retail, manufacturing, and distribution centers where light-duty material movement is common.

The 5–10 Tons segment is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, due to its rising adoption in industrial and automotive applications where mid-load operations are essential, supported by enhanced performance and autonomous control features.

- By Components

On the basis of components, the market is segmented into hardware, software, and service. The Hardware segment led the market in 2024 due to high demand for LiDAR sensors, cameras, GPS, and robotic control systems essential for autonomous navigation and safety.

The Software segment is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, driven by innovations in AI algorithms, fleet management systems, and real-time data analytics that optimize forklift efficiency and reduce operational costs.

- By Sales Channel

On the basis of sales channel, the market is segmented into in-house purchase and leasing. The In-House Purchase segment held the dominant share in 2024, supported by large enterprises investing in long-term automation infrastructure.

Leasing is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, owing to its cost-effective, flexible approach for small to medium-sized businesses looking to implement automation without large capital expenditures.

- By Function

On the basis of function, the market is segmented into manufacturing, warehousing, material handling, logistics & freight, and others. The Warehousing segment secured the largest market share in 2024, attributed to the surge in e-commerce and the need for high-efficiency, automated storage and retrieval systems.

Logistics & Freight is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, due to increasing reliance on autonomous solutions for streamlined goods movement, error reduction, and 24/7 operational capability in transportation hubs.

- By End-Users

On the basis of end-users, the market is segmented into transportation & logistics, manufacturing, paper industry, wood industry, construction, automotive, food and beverages, retail, and others. The Manufacturing segment dominated the market in 2024, as autonomous forklifts improve plant safety, reduce labor dependency, and enhance throughput.

The Retail segment is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, due to increased demand for rapid inventory turnover, real-time stock handling, and integration with automated supply chain systems.

Asia-Pacific Autonomous Forklifts Market Regional Analysis

- The China autonomous forklifts market accounted for the largest market revenue share of 45% in Asia Pacific in 2024, driven by the country's advanced manufacturing capabilities, strong logistics infrastructure, and rapid industrial automation

- With China’s leadership in smart factory initiatives and increased demand for warehouse efficiency, autonomous forklifts are widely adopted in sectors such as e-commerce, automotive, and electronics

- In addition, the presence of major robotics and automation firms, coupled with favorable government policies promoting intelligent logistics, continues to boost market growth

- The scalability and affordability of domestic solutions also contribute to China's market dominance

Japan Autonomous Forklifts Market Insight

The Japan autonomous forklifts market is expected to grow at the fastest growth rate during the forecast period of 2025 to 2032, fuelled by the nation’s focus on precision automation, labor shortages, and a strong inclination toward robotics adoption. Japan’s industrial sector increasingly relies on autonomous forklifts to improve efficiency and reduce dependency on manual labor, especially in manufacturing and logistics. The integration of advanced technologies such as artificial intelligence and computer vision into material handling solutions is driving adoption. In addition, Japan’s emphasis on high-quality automation aligns with the growing need for safe and reliable warehouse operations.

Asia-Pacific Autonomous Forklifts Market Share

The Asia-Pacific Autonomous Forklifts industry is primarily led by well-established companies, including:

- Toyota Industries Corporation (Japan)

- Mitsubishi Logisnext Co., Ltd. (Japan)

- Doosan Corporation (South Korea)

- Hyundai Construction Equipment Co., Ltd. (South Korea)

- Hangcha Group Co., Ltd. (China)

- Anhui Heli Co., Ltd. (China)

- BYD Company Limited (China)

- Godrej & Boyce Manufacturing Co. Ltd. (India)

- Komatsu Ltd. (Japan)

- Tailift Co., Ltd. (Taiwan)

Latest Developments in Asia-Pacific Autonomous Forklifts Market

- In November 2022, Linde Material Handling Equipment launched the R-Matic autonomous reach truck. This hybrid solution allows operators to take control and switch to manual mode when needed, providing flexibility. The trucks are equipped with fast-charging batteries that enable them to travel independently to charging stations, reducing downtime. This innovation enhances warehouse efficiency and supports continuous operations. It is expected to positively impact the adoption of autonomous forklifts in material handling industries.

- In September 2022, Toyota Industries Corporation developed an autonomous lift truck featuring the world’s first artificial intelligence-based system. The system automatically recognizes the position of trucks and loads and generates dynamic travel routes. This enables automation of loading tasks beyond fixed positions, allowing greater flexibility in warehouse operations. The advancement significantly boosts productivity and operational accuracy. It also strengthens Toyota’s position in the autonomous forklift market.

- In March 2022, Linde Material Handling Equipment, a subsidiary of KION Group AG, introduced the C-Matic autonomous mobile robots. These robots are small, fast, and highly adaptable, designed to assist in various logistics tasks. The launch broadens Linde’s automated solutions portfolio, catering to diverse warehouse environments. The innovation improves material handling efficiency and supports the growing demand for smart logistics. It marks a key step in expanding autonomous technology adoption.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Autonomous Forklifts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Autonomous Forklifts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Autonomous Forklifts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.