Asia Pacific Aws Managed Services Market

Market Size in USD Million

CAGR :

%

USD

203.52 Million

USD

653.54 Million

2024

2032

USD

203.52 Million

USD

653.54 Million

2024

2032

| 2025 –2032 | |

| USD 203.52 Million | |

| USD 653.54 Million | |

|

|

|

|

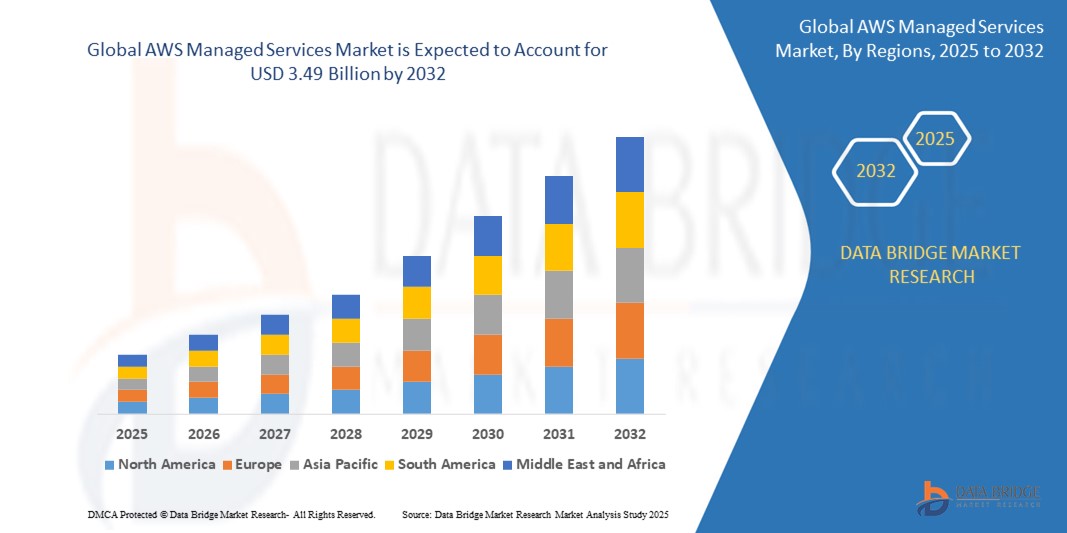

AWS Managed Services Market Size

- The Asia-Pacific AWS Managed Services market size was valued at USD 206.43 million in 2024 and is expected to reach USD 824.57 million by 2032, at a CAGR of 21.9% during the forecast period

- This growth is driven by factors such as the rapid digital transformation, increasing cloud adoption by enterprises, and expanding IT infrastructure across emerging economies.

AWS Managed Services Market Analysis

- AWS managed services are the set of services and tools that assists in providing AWS cloud managing services to the customers that automate infrastructure management for the Amazon web services deployments. The services are focused at large enterprises that want a basic way to major for migrating the on premise server or workloads to the cloud specifically to public cloud but also use private or hybrid clouds. AWS managed services are considered due to various reasons such as low cost of the services, data protection, accessibility, upgradation, data storage, continuous monitoring of the cloud and others.

- China is expected to dominate the AWS Managed Servicess market due to its large-scale cloud adoption, strong government support for digitalization, and rapid growth of tech-driven industries

- India is expected to be the fastest growing region in the AWS Managed Services market during the forecast period due to rising cloud adoption and strong demand from startups and enterprises

- Operations Services segment is expected to dominate the market with a market share of 56.22% due to its critical role in managing, monitoring, and optimizing cloud infrastructure efficiently.

Report Scope and AWS Managed Services Market Segmentation

|

Attributes |

AWS Managed Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

AWS Managed Services Market Trends

“Integration of AI and Automation in Cloud Services”

- Organizations in Asia-Pacific are increasingly integrating Artificial Intelligence (AI) and automation into their cloud strategies to enhance service delivery, optimize operations, and drive innovation. This trend is fostering the adoption of AWS Managed Services that offer AI-driven solutions and automated workflows

- Asia-Pacific enterprises are rapidly embracing cloud technologies to modernize their IT infrastructures, enhance operational efficiency, and support digital transformation initiatives. This shift is propelling the demand for AWS Managed Services, as organizations seek specialized expertise to navigate complex cloud environments

- For instance, In April 2024, AWS introduced Deadline Cloud, a fully managed service designed to scale compute instances for complex rendering tasks, simplifying render management and enabling production-ready generative AI applications

AWS Managed Services Market Dynamics

Driver

“Rising Focus on Data Security and Compliance”

- As organizations in the Asia-Pacific region digitize operations, their need for secure and compliant cloud solutions has increased significantly. Managed services help companies meet both local and international data protection laws while ensuring high performance. AWS Managed Services provide structured frameworks for governance, risk management, and data security, which are essential in highly regulated sectors like healthcare, finance, and government. With laws such as India’s Digital Personal Data Protection Act and similar regulations across Asia, enterprises are seeking expert guidance to remain compliant.

- AWS partners with local firms to offer data residency options and localized support, enhancing customer trust. Cloud security threats are also evolving, prompting firms to invest in proactive management services that can detect and mitigate vulnerabilities

- Enterprises see managed services as a cost-effective way to stay secure without having to build large in-house cybersecurity teams. As digital transactions increase, so does the pressure to secure personal and financial data. The assurance of real-time monitoring and automatic updates from AWS partners adds value to clients

For instance,

- In December 2023, Amazon Web Services (AWS) renewed its certification under the Korea Information Security Management System (K-ISMS) for its Asia Pacific (Seoul) Region. This certification proves AWS meets strict security and compliance standards set by the Korea Internet & Security Agency (KISA). It’s especially important for South Korean businesses operating in sectors like healthcare and finance, where regulatory compliance is mandatory. The renewal reassures customers that AWS services in the country remain aligned with national data protection laws and security best practices. This step further boosts AWS’s trust and credibility among organizations prioritizing secure cloud usage

- Overall, concerns around data privacy and compliance have become powerful drivers for adopting AWS Managed Services

Opportunity

“Advancing Ophthalmology with Artificial Intelligence Integration”

- The Asia-Pacific region is experiencing significant growth in cloud infrastructure, driven by substantial investments from global tech companies. These investments are enhancing the availability and scalability of cloud services, thereby increasing the demand for AWS Managed Services

- Asia-Pacific region to meet the increasing demand for cloud and AI expertise. Initiatives by governments and organizations are creating a skilled talent pool, thereby driving the adoption of AWS Managed Services

For instance,

- In May 2024, Amazon announced plans to invest approximately $9 billion to expand its cloud infrastructure in Singapore by 2028. This move aims to support the increasing demand for cloud and AI services in the region. The investment underscores Singapore's role as a strategic hub for AWS in Southeast Asia

Restraint/Challenge

“High Cost of Advanced AWS Managed Services for SMEs”

- Another barrier to growth in the Asia-Pacific AWS Managed Services market is the high cost of advanced services, especially for small and medium-sized enterprises (SMEs). While large corporations can afford fully managed cloud solutions, many smaller businesses find the costs too steep. Services like continuous monitoring, AI integration, and custom cloud optimization often come with premium pricing.

- For SMEs working with tight budgets, these expenses can outweigh the benefits, discouraging them from adopting AWS managed solutions altogether. This results in slower cloud adoption among a significant portion of the business community. Moreover, billing complexity and unpredictable costs make budgeting a challenge, especially for businesses unfamiliar with cloud usage patterns. Even when SMEs want to scale, they may hesitate due to fears of hidden charges or vendor lock-in. This pricing issue limits the accessibility and reach of AWS managed offerings in the broader market. Unless pricing models become more flexible or tailored to smaller businesses, this challenge will continue to hinder growth in the region.

For instance,

- In December 2023, an analysis revealed that businesses in Southeast Asia are paying 20 to 40 percent more for cloud services compared to their counterparts in the United States. This price disparity is attributed to factors such as opaque pricing structures, lack of local competition, and higher data transfer costs. For instance, Indonesian SMEs face challenges in managing IT budgets due to these inflated costs, which can divert funds away from other critical business investments

AWS Managed Services Market Scope

The market is segmented on the basis services type, deployment mode, organization size and industry vertical

|

Segmentation |

Sub-Segmentation |

|

Services type |

|

|

Deployment mode |

|

|

Organization size |

|

|

Industry vertical |

|

In 2025, the Operations Services is projected to dominate the market with a largest share in segment

In 2025, the Operations Services segment is expected to lead the Asia-Pacific AWS Managed Services market with the largest share of 56.22%. This dominance is driven by growing demand for continuous monitoring, system optimization, and routine cloud management. As businesses scale their cloud environments, they increasingly rely on managed service providers to ensure stability and performance. Operations services also help reduce downtime and improve cost-efficiency. Their ability to provide real-time support and automation makes them essential for modern cloud strategies

The Cloud Migration Services is expected to account for the largest share during the forecast period in market

The Cloud Migration Services segment is anticipated to hold the largest share of 52.14% in the AWS Managed Services market during the forecast period. This growth is mainly driven by enterprises shifting from legacy systems to cloud platforms for better scalability and efficiency. As digital transformation accelerates across industries, the need for seamless and secure migration solutions is increasing. Companies seek expert support to reduce risks and downtime during migration. This trend positions cloud migration services as a critical component of long-term IT strategies

AWS Managed Services Market Regional Analysis

“China Holds the Largest Share in the AWS Managed Services Market”

- China holds the largest share in the AWS Managed Services market across the Asia-Pacific region, driven by rapid digital transformation and strong government support for cloud adoption. The country’s booming e-commerce, manufacturing, and fintech sectors are increasingly relying on cloud infrastructure to scale operations efficiently

- AWS and its partners are investing in local data centers and compliance solutions to meet China's strict data sovereignty laws. Chinese enterprises are also embracing AI, big data, and IoT—technologies that thrive in a managed cloud environment. With growing demand for operational efficiency and business continuity, managed services have become a go-to solution

- Additionally, China's focus on building a self-reliant tech ecosystem encourages the use of scalable, secure cloud services. As cloud-native startups and traditional enterprises alike modernize, the need for expert AWS management continues to grow. These factors collectively contribute to China's dominance in the regional AWS Managed Services market

“India is Projected to Register the Highest CAGR in the AWS Managed Services Market”

- India is projected to register the highest compound annual growth rate (CAGR) in the AWS Managed Services market due to rapid digital transformation and increased cloud adoption. The country's growing tech ecosystem, coupled with a shift toward infrastructure modernization, fuels demand for AWS cloud services. Businesses in India are leveraging AWS to scale operations, enhance security, and improve cost efficiency

- The increasing focus on automation, AI, and machine learning also drives AWS service adoption. Additionally, government initiatives like "Digital India" contribute to cloud growth. Key industries such as e-commerce, finance, and manufacturing are expected to lead this expansion. The rise of start-ups and SMEs in India further boosts the market. India's robust IT talent pool supports the accelerated growth of AWS managed services

AWS Managed Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market

The Major Market Leaders Operating in the Market Are:

- RACKSPACE US INC,

- Smartronix Inc.,

- Mission Cloud Services, Inc,

- Claranet limited,

- Capgemini,

- DXC Technology Company,

- Onica,

- Accenture,

- Slalom, LLC,

- 8K Miles Software Services Ltd.,

- e-Zest Solutions,

- Great Software Laboratory,

- Cloudnexa,

- Logicworks,

- CLOUDREACH,

- AllCloud

Latest Developments in Asia-Pacific AWS Managed Services Market

- In October 2024, Rackspace Technology signed a multi-year Strategic Collaboration Agreement (SCA) with AWS to accelerate digital transformation. This partnership includes the launch of the Rackspace Rapid Migration Offer (RRMO), which provides end-to-end services such as migration planning, landing zone setup, and 24/7 cloud operations support. The RRMO is designed to expedite data center migrations to AWS, leveraging Rackspace's expertise and AWS's infrastructure

- In December 2024, Mission Cloud Services was acquired by CDW, a leading IT solutions provider. This acquisition enhances CDW's cloud and AI technology services, integrating Mission's AWS expertise into CDW's offerings. Mission Cloud continues to operate as CDW's dedicated AWS practice, focusing on delivering customized solutions and strategic guidance for AWS customers

- In June 2024, Claranet Group and AWS announced a bold new initiative to accelerate cloud transformation for companies. The five-year strategic collaboration agreement involves the establishment of a APAC AWS Managed Services and the certification of over 1,200 cloud experts. This initiative aims to support Claranet's customers in their innovation and cloud migration projects worldwide, leveraging AWS's cloud services

- In January 2024, Capgemini and AWS expanded their strategic collaboration to enable broad enterprise generative AI adoption. The multi-year agreement focuses on helping clients realize the business value of adopting generative AI, addressing challenges such as cost, scale, and trust. The collaboration includes the development of industry-specific solutions and accelerators using Amazon Bedrock to access a range of secure, high-performing foundational models

- In November 2023, DXC Technology and AWS expanded their strategic partnership to accelerate cloud adoption and digital transformation for nearly 1,000 customers. The collaboration includes upskilling 15,000 DXC professionals with role-based AWS certifications over the next five years. This initiative aims to create an industry-leading talent pool for cloud transformation capabilities and transform DXC's service delivery into a cloud-centric and asset-light model

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.