Asia Pacific Barrier Films Market

Market Size in USD Billion

CAGR :

%

USD

9.67 Billion

USD

16.45 Billion

2024

2032

USD

9.67 Billion

USD

16.45 Billion

2024

2032

| 2025 –2032 | |

| USD 9.67 Billion | |

| USD 16.45 Billion | |

|

|

|

|

Barrier Films Market Size

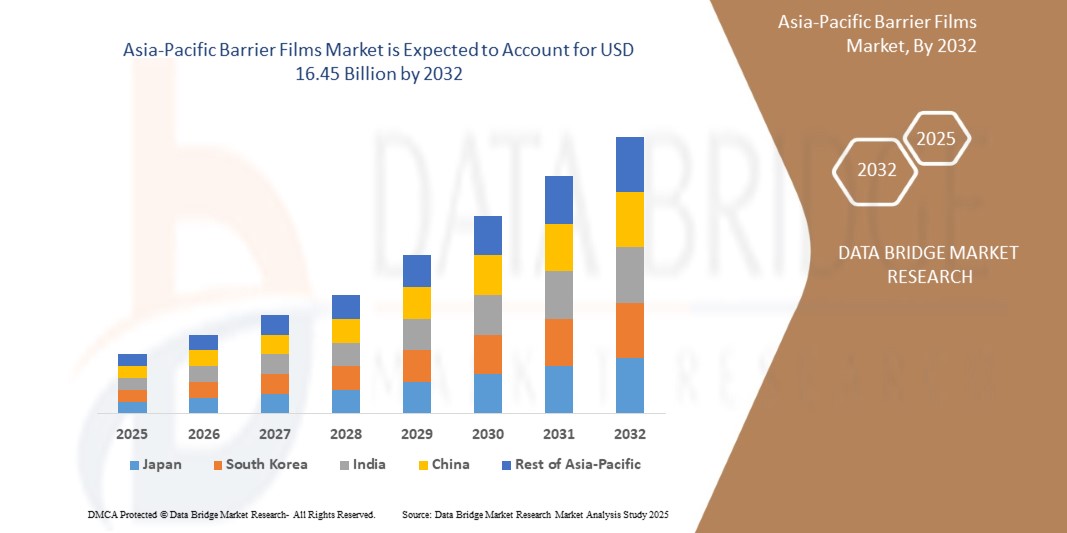

- The Asia-Pacific Barrier Films Market was valued at USD 9.67 billion in 2024 and is expected to reach USD 16.45 billion by 2032, growth at a CAGR of 6.9% of 2025 to 2032

- Positive outlook towards food processing and pharmaceuticals industry in emerging economies including China and India is expected to expand the market size

- This growth is driven by factors such as the rising demand for extended shelf-life packaging in food & pharmaceuticals and growing pharmaceutical industry and the need for moisture- and oxygen-resistant packaging are fuelling demand for high-performance barrier films

Barrier Films Market Analysis

- The Barrier Films Market is driven by increasing demand for extended shelf life, food safety, and product integrity across packaged food, pharmaceuticals, and industrial applications. Consumers and brands alike are seeking lightweight, durable, and high-barrier packaging solutions to minimize spoilage and waste

- While biodegradable and recyclable materials are gaining attention for sustainability, metalized barrier films remain dominant due to their excellent oxygen, moisture, and light barrier properties, particularly in snack foods, dairy packaging, and pharmaceuticals

- The metalized barrier films segment is expected to dominate the market by type, accounting for approximately 43.8% of share in 2025, as metalized barrier films are specially designed to preserve various types of products to provide a high barrier against oxygen as well as humidity in terms of ensuring extent shelf life for sensitive products, which helps to boost its demand in the forecast year

Report Scope and Barrier Films Market Segmentation

|

Attributes |

Barrier films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Barrier Films Market Trends

“Shift Towards Sustainable and Recyclable Barrier Films in Response to Environmental Concerns”

- A significant trend in the Asia-Pacific Barrier Films Market is the increasing demand for sustainable and recyclable packaging solutions. This shift is driven by growing environmental awareness among consumers and stringent regulations aimed at reducing plastic waste

- Manufacturers are innovating by developing barrier films that incorporate biodegradable materials and are designed for recyclability, aligning with the principles of a circular economy

- The adoption of high-barrier films made from sustainable resources is gaining traction, particularly in the food and beverage industry, where preserving product freshness while minimizing environmental impact is crucial

- For instance, a report by Smithers highlights that the packaging industry is increasingly focusing on sustainable multilayer films, which can be designed to incorporate recycled content and be more easily recyclable

Barrier Films Market Dynamics

Driver

“Rising Demand for Extended Shelf-Life Packaging in Food & Pharmaceuticals”

- A key driver for the Asia-Pacific Barrier Films Market is the growing need for packaging that ensures extended shelf life, especially in the food and pharmaceutical industries. Barrier films help protect contents from moisture, oxygen, light, and other external factors that compromise product quality

- Increasing consumer preference for ready-to-eat meals, processed foods, and single-serve packaging formats is pushing manufacturers to adopt high-barrier materials that prevent contamination and spoilage

- In the pharmaceutical sector, strict regulatory requirements for product safety and stability are prompting widespread use of barrier films in blister packs, sachets, and flexible pouches

For instance,

- Amcor introduced its "AmLite Ultra Recyclable" high-barrier film for pharmaceuticals and food packaging in 2023, offering both product protection and recyclability to meet sustainability and safety demands

- As demand for longer shelf-life, product protection, and sustainable packaging intensifies across industries, the Barrier Films Market is poised for robust growth, especially in food, pharmaceuticals, and personal care sectors

Opportunity

“Development of Recyclable and Bio-Based Barrier Films to Meet Circular Economy Goals”

- The shift toward circular economy models is prompting packaging manufacturers to develop recyclable, biodegradable, and compostable barrier films that maintain high performance while reducing environmental impact

- Brands are seeking sustainable alternatives to traditional multilayer plastic structures that are difficult to recycle due to mixed polymer compositions

- Advancements in mono-material barrier films (e.g., recyclable polyethylene or polypropylene with barrier coatings) are creating new opportunities in food and pharmaceutical packaging

For instance,

- UFlex launched PCR-grade high-barrier packaging films made with 90% post-consumer recycled content under its "FlexGreen" range. These films offer barrier properties comparable to virgin plastic and are targeted at food and personal care packaging

- As demand for eco-friendly and recyclable packaging surges, the Barrier Films Market is poised to benefit from rapid material innovation and regulatory support, especially in food, pharma, and e-commerce sectors

Restraint/Challenge

“Complex Recycling and High Cost of Multilayer Barrier Structures Restrain Market Scalability”

- Barrier films are often made from multilayer laminates combining polymers like PET, PE, EVOH, and aluminum—making recycling extremely difficult with current infrastructure

- The incompatibility of multilayer films with standard recycling streams limits their circularity, drawing regulatory scrutiny and increasing compliance costs for packaging companies

- High production costs and the need for specialized machinery to manufacture high-barrier films also hinder widespread adoption, particularly among small and medium-sized manufacturers

- As recyclability challenges and cost barriers persist, manufacturers in the Barrier Films Market face mounting pressure to innovate or shift toward simpler, mono-material alternatives to align with evolving sustainability goals

Barrier Films Market Scope

The market is segmented on the basis of type, material type, layer, and application,

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material Type |

|

|

By Layer |

|

|

By Application |

|

In 2025, the Food & Beverage segment is projected to dominate the market with the largest share in the application segment

The Food & Beverage segment is expected to dominate the Asia-Pacific Barrier Films Market with the largest share of approximately 49.2% in 2025. This growth is driven by the increasing demand for packaged and processed food with extended shelf life, as well as the need for moisture, oxygen, and aroma protection in snack foods, dairy products, and ready-to-eat meals.

In 2025, the Metalized Barrier Films segment is expected to account for the largest share during the forecast period in the type segment.

In 2025, the Metalized Barrier Films segment is expected to dominate the market by type, accounting for approximately 43.8% of revenue share. This is due to its superior barrier performance against light, gas, and moisture, along with cost-effectiveness and widespread adoption in flexible packaging for food, pharmaceuticals, and consumer goods.

Barrier Films Market Regional Analysis

“China is the Dominant Country in the Barrier films Market”

- China dominates the Asia-Pacific barrier films market, accounting for approximately 35% of the regional market share in 2025. This leadership is driven by China’s massive food processing industry, rapid industrialization, and booming e-commerce sector, which fuels demand for advanced flexible packaging

- The country's growing middle class and urban population have led to increased consumption of packaged foods, ready meals, and pharmaceuticals, significantly boosting the need for high-barrier films

- China is also a global manufacturing hub, hosting numerous local and international film producers who are investing in cost-effective multilayer and metalized barrier technologies to meet both domestic and export packaging demands

- The government’s initiatives promoting food safety, waste reduction, and circular economy practices are pushing companies to adopt innovative, recyclable, and biodegradable barrier film solutions

“ China is Projected to Register the Highest Growth Rate”

- China is expected to record the highest growth rate in the Asia-Pacific barrier films market, driven by expanding cold chain logistics, growing exports of perishable goods, and the increasing adoption of sustainable packaging practices

- Rising awareness of environmental concerns and stringent packaging regulations are accelerating the shift toward mono-material films and compostable barrier solutions

- Chinese packaging firms are rapidly adopting advanced extrusion and coating technologies to produce high-performance films that ensure product freshness, reduce food spoilage, and minimize material waste

- With strong domestic demand and supportive government policies, China is emerging as both the leading consumer and global supplier of innovative barrier film materials

Barrier Films Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell International Inc (U.S.)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Amcor plc (Switzerland)

- TOPPAN PRINTING CO., LTD. (Japan)

- Berry Asia-Pacific Inc. (U.S.)

- CLONDALKIN GROUP (Netherlands)

- Sonoco Products Company (U.S.)

- Huhtamaki (Finland)

- Dupont Teijin Films U.S. Limited Partnership (U.S.)

- Mondi (UK)

- Fraunhofer –Gesellschaft (Germany)

- Klöckner Pentaplast (Germany)

- ProAmpac (U.S.)

- Glenroy, Inc. (U.S.)

- Constantia Flexibles (Austria)

- UFlex Limited (India)

- WINPAK LTD (Canada)

Latest Developments in Asia-Pacific Barrier films Market

- In September 2024, Amcor introduced recyclable high-barrier paper-based packaging solutions designed to replace traditional multi-material films. The innovation supports sustainability by simplifying material structures and incorporating renewable and recycled content

- In May 2023, Amcor signed a definitive agreement to acquire Moda Systems, a prominent manufacturer of advanced automated protein packaging machines

- In April 2023, Sealed Air and Koenig & Bauer AG signed a non-binding letter of intent to expand their strategic partnership, aiming to enhance packaging design through the development of cutting-edge digital printing technology, equipment, and services

- In July 2021, Toppan acquired InterFlex Group, a flexible packaging converter with five production facilities across the United States and the United Kingdom, offering a broad portfolio that includes printed shrink films, stand-up pouches, pre-formed bags, wax-coated papers, surface print and laminate roll stocks, and both barrier and non-barrier film laminations tailored for various consumer goods markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Barrier Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Barrier Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Barrier Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.