Asia Pacific Biotechnology Market

Market Size in USD Billion

CAGR :

%

USD

372.23 Billion

USD

2,665.48 Billion

2025

2033

USD

372.23 Billion

USD

2,665.48 Billion

2025

2033

| 2026 –2033 | |

| USD 372.23 Billion | |

| USD 2,665.48 Billion | |

|

|

|

|

Asia-Pacific Biotechnology Market Size

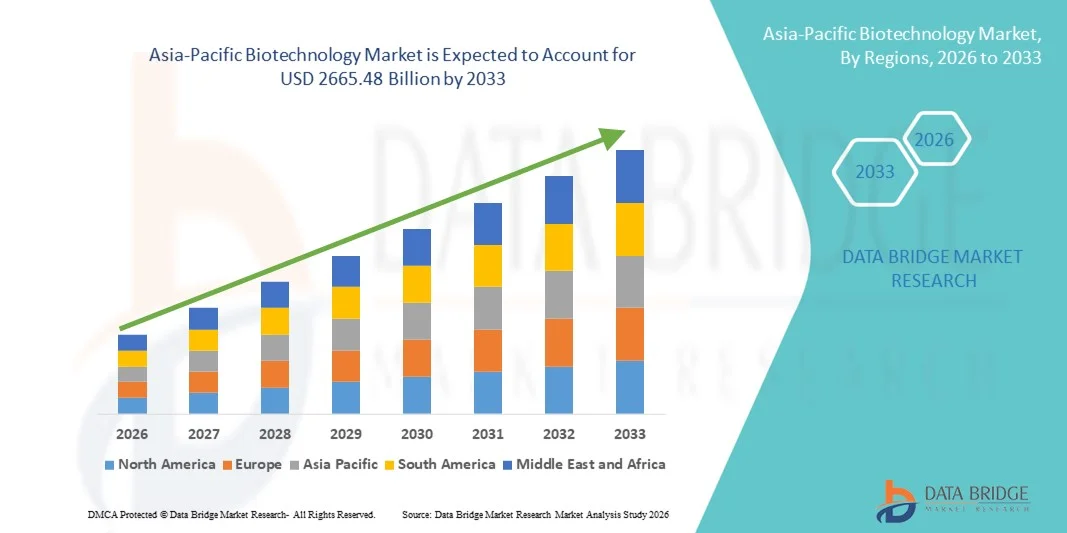

- The Asia-Pacific biotechnology market size was valued at USD 372.23 billion in 2025 and is expected to reach USD 2665.48 billion by 2033, at a CAGR of 27.90% during the forecast period

- The market growth is largely fueled by increasing investments in advanced research, rising adoption of innovative biologics and biopharmaceuticals, and technological progress in genetic engineering and molecular biology, leading to enhanced capabilities across healthcare, agriculture, and industrial biotechnology

- Furthermore, growing consumer demand for personalized medicine, sustainable bio-based products, and advanced therapeutics is establishing biotechnology solutions as a critical driver of innovation across multiple sectors. These converging factors are accelerating the uptake of Biotechnology solutions, thereby significantly boosting the industry's growth

Asia-Pacific Biotechnology Market Analysis

- Biotechnology solutions, including advanced biologics, gene therapies, and bio-manufacturing platforms, are increasingly vital across healthcare, agriculture, and industrial applications due to their potential to improve outcomes, efficiency, and sustainability

- The escalating demand for biotechnology is primarily fueled by rising investments in R&D, increasing adoption of personalized medicine, growing awareness of sustainable bio-based products, and government initiatives supporting innovation in biotech sectors

- China dominated the Biotechnology market with the largest revenue share of 38.7% in 2025, characterized by significant government support, expanding biopharmaceutical manufacturing infrastructure, and a growing number of biotech startups and research centers driving innovation and adoption

- India is expected to be the fastest-growing region in the Biotechnology market during the forecast period, registering a CAGR of 11.2%, driven by rapid expansion of contract research organizations, increasing investments in biosimilars and vaccines, and rising government support for biotechnology and life sciences initiatives

- The Bio-pharmacy segment dominated with a revenue share of 47.6% in 2025, driven by increasing biologics, vaccines, and therapeutic protein production

Report Scope and Biotechnology Market Segmentation

|

Attributes |

Biotechnology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Biotechnology Market Trends

Enhanced Focus on Advanced Biotechnological Research and Innovation

- A significant and accelerating trend in the global biotechnology market is the increasing investment in advanced research and development of novel therapies, including gene editing, regenerative medicine, and precision medicine. This emphasis on innovation is enabling companies to create more targeted and effective solutions for complex diseases

- For instance, leading biotechnology firms such as CRISPR Therapeutics and Moderna are expanding their R&D pipelines to develop advanced gene therapies and mRNA-based treatments, which address previously untreatable conditions and improve patient outcomes

- There is also a growing focus on leveraging bioinformatics and high-throughput screening technologies to accelerate the discovery of new drugs and therapeutic targets. These approaches allow researchers to identify potential candidates faster, optimize clinical trials, and enhance overall efficiency in biopharmaceutical development

- Collaborative initiatives between academic institutions, hospitals, and biotechnology companies are further promoting innovation and knowledge sharing, which is enhancing the overall capability of the biotechnology ecosystem to respond to emerging health challenges

- The trend towards increased biotechnological research and innovation is fundamentally reshaping the industry landscape, driving competition, and setting higher standards for the development of advanced therapies. Consequently, companies are prioritizing strategic partnerships, technology adoption, and talent acquisition to maintain a competitive edge

- The rising demand for cutting-edge treatments and the ability to address unmet medical needs is fostering a dynamic market environment, accelerating the adoption of biotechnological solutions across healthcare, agriculture, and environmental applications

Asia-Pacific Biotechnology Market Dynamics

Driver

Rising Disease Burden and Innovation Drive Growth in the Global Biotechnology Market

- The increasing global incidence of chronic and rare diseases is driving demand for advanced biotechnological solutions that provide more effective and personalized treatments

- For instance, the rapid growth of cancer and autoimmune disorders in Asia-Pacific has prompted leading biotechnology companies like Moderna and BioNTech to accelerate the development of mRNA-based therapies and targeted immunotherapies

- In addition, the aging population in Europe and North America is creating a higher demand for regenerative medicine and gene therapies to treat degenerative diseases, pushing companies to innovate faster

- Growing government support and funding for biotechnology research, such as grants from the NIH in the U.S. and Horizon Europe, are enabling faster clinical trials and development of cutting-edge therapies, further fueling market growth

Restraint/Challenge

High Development Costs and Stringent Regulatory Requirements

- The high cost of research, development, and clinical trials for advanced therapies, combined with strict regulatory requirements, poses a major challenge to market growth

- For instance, a mid-sized biotech firm developing a novel cell therapy faced delays and additional costs due to compliance with FDA and EMA safety and efficacy guidelines, highlighting the financial and procedural hurdles

- Complex intellectual property (IP) regulations and patent disputes can further slowdown product commercialization, as seen in several CRISPR-related therapies, where licensing disputes delayed market entry

- Moreover, the scalability of advanced biotechnologies for mass production remains a challenge, particularly for therapies like personalized gene editing, which require specialized equipment and skilled personnel, adding to operational costs and limiting accessibility

Asia-Pacific Biotechnology Market Scope

The market is segmented on the basis of product type, technology, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Biotechnology market is segmented into Instruments, Reagents, and Services & Software. The Instruments segment dominated the market with a revenue share of 45.3% in 2025, driven by high demand for laboratory automation, analytical testing, and diagnostics. Instruments such as PCR machines, chromatography systems, and cell-based assay tools are essential in research and production across pharmaceutical, bio-pharma, and agricultural applications. Increasing adoption of high-throughput instruments in genomics and proteomics research is a key growth driver. Advanced lab facilities, coupled with regulatory requirements for validated equipment, reinforce adoption. The rising prevalence of biologics, vaccines, and personalized medicine necessitates precise instrumentation. Academic and research institutes also contribute to growing demand. Instruments enable real-time monitoring, improved reproducibility, and enhanced efficiency. The expansion of biotechnology startups globally fuels instrument sales. Continuous innovation and integration with software platforms enhance productivity. Emerging markets are increasingly investing in lab equipment to support biotech R&D. High-capacity instruments facilitate large-scale studies, further solidifying revenue dominance.

The Reagents segment is anticipated to witness the fastest CAGR of 10.5% from 2026 to 2033, driven by increased consumption of consumables in molecular biology, cell culture, and genomics research. Rising demand for PCR reagents, enzymes, culture media, and antibodies supports this growth. Pharmaceutical R&D and contract research organizations require consistent reagent supplies for ongoing studies. Reagents are critical for bio-manufacturing, vaccine production, and diagnostics. Growth in personalized medicine, including gene and cell therapies, fuels reagent consumption. Academic research and clinical trials also boost usage. Expansion of high-throughput sequencing and omics technologies increases reagent demand. Cost-effective reagent kits enable adoption in emerging markets. Partnerships between biotech companies and suppliers enhance availability. Rapid technological advancements drive the need for specialized reagents. Regulatory approvals and quality compliance ensure high standards, supporting market confidence. Online distribution channels and third-party supply agreements further expand reach.

- By Technology

On the basis of technology, the Biotechnology market is segmented into Nano Biotechnology, PCR Technology, DNA Sequencing, Chromatography, Tissue Engineering and Regeneration, Cell-Based Assays, Fermentation, and Others. The PCR Technology segment dominated with a revenue share of 41.8% in 2025, due to widespread applications in diagnostics, infectious disease testing, and genomics research. PCR systems are critical in pandemic response, pathogen detection, and molecular diagnostics. Adoption is accelerated by government initiatives and emergency response programs. Academic and clinical labs rely on PCR for rapid, precise detection of genetic material. High-throughput PCR instruments streamline research workflows. PCR enables accurate quantification of DNA/RNA, supporting vaccine and therapeutic development. Rising awareness of molecular testing in healthcare drives laboratory investment. Continuous innovation in real-time PCR enhances sensitivity and throughput. Integration with software for data analysis strengthens market adoption. Collaboration between reagent and instrument suppliers improves usability. Regulatory approvals in clinical diagnostics further drive utilization. Expansion in emerging markets increases PCR adoption for healthcare and research.

The DNA Sequencing segment is projected to grow at the fastest CAGR of 11.2% from 2026 to 2033, driven by the rising demand for genomics, precision medicine, and gene therapy applications. Next-generation sequencing technologies enable large-scale genomic analysis. Pharmaceutical and biotechnology companies are investing heavily in sequencing for drug discovery and personalized therapeutics. Clinical genomics and oncology diagnostics are major application areas. Decreasing sequencing costs improve accessibility in emerging markets. Academic research programs contribute to increasing adoption. High-throughput DNA sequencing platforms accelerate study timelines. Demand for bioinformatics integration supports growth. Government initiatives in genomics research and population sequencing programs fuel expansion. Advancements in automation enhance workflow efficiency. Partnerships between sequencing providers and biotech firms promote adoption. Rapid technological innovation ensures continuous upgrades and increased deployment.

- By Application

On the basis of application, the Biotechnology market is segmented into Bio-pharmacy, Bio-industrial, Bio-services, Bioinformatics, and Bio-agriculture. The Bio-pharmacy segment dominated with a revenue share of 47.6% in 2025, driven by increasing biologics, vaccines, and therapeutic protein production. Growing demand for monoclonal antibodies, recombinant proteins, and gene therapies underpins market expansion. Pharmaceutical and biotechnology companies invest heavily in bio-pharmaceutical R&D. Clinical trials, regulatory compliance, and GMP standards drive adoption of biotechnology solutions. Contract manufacturing organizations expand bio-pharma production capacity globally. Automation in drug discovery and production enhances efficiency and consistency. Rising global prevalence of chronic and infectious diseases supports innovation. Academic research also fuels adoption of biotechnology applications. Biopharma-focused instruments, reagents, and software are essential for quality control. Integration with digital lab management systems optimizes productivity. Governments and funding agencies promote bio-pharma innovation. Increasing outsourcing to specialized biotech firms further supports growth.

The Bio-agriculture segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, fueled by demand for genetically modified crops, biofertilizers, and sustainable agriculture solutions. Adoption of biotechnology in crop improvement enhances yields, pest resistance, and stress tolerance. Regulatory approvals for GM crops expand market opportunities. Contract research for bio-agriculture solutions increases demand for instruments and reagents. Rising global population and food security concerns drive innovation. Government initiatives for sustainable farming and crop protection promote growth. Bio-agriculture startups and precision farming adoption boost market expansion. Technological advancements in plant genomics accelerate product development. Integration with bioinformatics platforms optimizes breeding programs. Smallholder and commercial farms increasingly adopt biotech solutions. Climate change adaptation encourages resilient crop technologies. Global trade in biotech seeds supports market growth. Expansion of research institutes for agricultural biotechnology reinforces adoption.

- By End User

On the basis of end user, the market is segmented into Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Academic & Research Institutes, and Others. The Pharmaceutical & Biotechnology Companies segment dominated with a revenue share of 44.5% in 2025, driven by heavy investment in drug discovery, biologics, and personalized medicine. R&D pipelines, clinical trials, and high compliance standards necessitate advanced biotechnology solutions. Contract manufacturing for biologics supports instrumentation and reagent demand. Integration with lab automation platforms enhances productivity. High adoption in North America and Europe drives revenue. Expansion of biopharmaceutical production globally further reinforces market dominance. Regulatory standards for quality assurance require continuous monitoring. Collaborations between pharma and biotech companies improve adoption of cutting-edge technology. Continuous innovation in molecular diagnostics supports instrument deployment. Government incentives promote biotech R&D initiatives. Large-scale bio-manufacturing operations rely on validated tools.

The Academic & Research Institutes segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, fueled by increasing research programs in genomics, proteomics, and cell-based assays. Expansion of university laboratories and government-funded research centers supports adoption. Student training programs require versatile and affordable instruments. Collaborative projects with pharma and biotech companies enhance market access. Growth in academic biotech startups and translational research promotes demand. Integration with bioinformatics software and digital lab tools supports research efficiency. Increasing grants and funding for life sciences research accelerates growth. Focus on innovation in regenerative medicine and synthetic biology drives adoption. Multi-disciplinary projects across biology, chemistry, and engineering further expand market reach. Academic publishing and patenting activity encourage high-quality instrumentation. Emerging markets are investing in academic research infrastructure. Global initiatives for disease genomics research enhance utilization of biotechnology tools.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Third-Party Distributors, and Others. The Direct Tender segment dominated with a revenue share of 46.2% in 2025, due to strong relationships between manufacturers and end users, particularly large pharmaceutical and biotech companies. Direct sales provide customization, service, and support for complex instruments and integrated solutions. High-value equipment is often procured directly to ensure compliance and validation. Manufacturers offer training and maintenance packages to optimize performance. Expansion of multinational biotech companies encourages direct procurement. Integration with corporate procurement policies facilitates large orders. Direct sales strengthen brand presence and technical support. Long-term service contracts increase adoption and customer loyalty. Government and academic tenders also contribute to direct sales revenue. Strategic collaborations and partnerships with research institutions support growth. Expansion in emerging markets encourages direct engagement.

The Third-Party Distributors segment is projected to grow at the fastest CAGR of 9.2% from 2026 to 2033, fueled by the need for wider market reach in emerging regions and smaller end users. Distributors provide cost-effective access to instruments, reagents, and software for startups, SMEs, and academic labs. Rapid growth in biotechnology hubs in Asia-Pacific, Latin America, and Eastern Europe drives distributor adoption. Distributors facilitate logistics, spare parts availability, and local technical support. Online and e-commerce channels expand reach to remote markets. Third-party distributors help overcome procurement barriers in regions with limited manufacturer presence. Partnerships with multiple suppliers increase product diversity and availability. Local regulatory compliance is supported by distributor networks. Distribution agreements enhance scalability for global biotechnology companies. Emerging markets increasingly rely on distributor networks for supply chain efficiency. Flexibility and convenience of third-party sourcing make it attractive for small-to-medium end users.

Asia-Pacific Biotechnology Market Regional Analysis

- The Asia-Pacific biotechnology market is poised to grow at the fastest CAGR of 11.2% during the forecast period of 2026 to 2033

- Growth is driven by rapid expansion of biopharmaceutical manufacturing, increasing investments in biosimilars and vaccines, and strong government support for biotechnology initiatives across countries such as China, India, and Japan

- In addition, rising healthcare expenditure, technological advancements, and the emergence of APAC as a hub for biotechnology research and manufacturing are enhancing accessibility and adoption of advanced biotech solutions

China Biotechnology Market Insight

China biotechnology market dominated the biotechnology market with the largest revenue share of 38.7% in 2025, characterized by substantial government support, a rapidly expanding biopharmaceutical manufacturing infrastructure, and a growing number of biotech startups and research centers driving innovation. The country is witnessing accelerated adoption of advanced therapies, supported by investments in vaccine production, gene therapy development, and large-scale biomanufacturing projects. Strong regulatory reforms and incentives for research and development are further strengthening China’s position as the regional leader.

India Biotechnology Market Insight

India biotechnology market is expected to be the fastest-growing market in the Asia-Pacific Biotechnology sector during the forecast period, registering a CAGR of 11.2%. The growth is fueled by the rapid expansion of contract research organizations (CROs), increasing investments in biosimilars and vaccines, and rising government support for biotechnology and life sciences initiatives. In addition, India’s growing healthcare infrastructure, availability of skilled talent, and cost-competitive manufacturing capabilities are making the country a preferred destination for biotechnology research, development, and production.

Asia-Pacific Biotechnology Market Share

The Biotechnology industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- Danaher Corporation (U.S.)

- Agilent Technologies (U.S.)

- Illumina (U.S.)

- Qiagen (Germany)

- Bio-Rad Laboratories (U.S.)

- PerkinElmer (U.S.)

- GE Healthcare Life Sciences (U.K.)

- Sartorius AG (Germany)

- Lonza Group (Switzerland)

- Takara Bio Inc. (Japan)

- Charles River Laboratories (U.S.)

- Becton, Dickinson and Company (U.S.)

- New England Biolabs (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Shimadzu Corporation (Japan)

- WuXi AppTec (China)

- Beijing Genomics Institute (China)

- Samsung Biologics (South Korea)

Latest Developments in Asia-Pacific Biotechnology Market

- In July 2025, China’s WuXi AppTec announced plans to raise approximately HK$7.70 billion (about USD 980.9 million) through new share placement to boost its global expansion, facility investments, and customer‑service infrastructure, underscoring its strategic growth ambitions in biopharma, biologics, and biotech services across Asia‑Pacific and globally. This capital raise will support new and existing facilities, enabling broader service offerings and support for biotech R&D and manufacturing in the region

- In December 2025, China’s Sichuan Kelun‑Biotech Biopharmaceutical entered into a licensing deal with U.S. firm Crescent Biopharma for the experimental cancer drug SKB105, receiving USD 80 million upfront and up to USD 1.25 billion in milestone payments, reflecting strong Asia‑Pacific biotech innovation and global partnerships for oncology treatments. This agreement accelerates clinical development of a solid‑tumor treatment and exemplifies increasing cross‑border collaboration in biotech research

- In March 2025, AstraZeneca announced a committed USD 2.5 billion investment in China to build a new research and development center in Beijing focused on early‑stage research, clinical development, AI, and data science, reinforcing multinational biopharma investment and Asia‑Pacific capability building. The facility will strengthen partnerships with local biotech firms and enhance the regional biotech research ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.