Asia Pacific Blood Collection And Sampling Devices Market

Market Size in USD Million

CAGR :

%

USD

985.91 Million

USD

1,825.06 Million

2024

2032

USD

985.91 Million

USD

1,825.06 Million

2024

2032

| 2025 –2032 | |

| USD 985.91 Million | |

| USD 1,825.06 Million | |

|

|

|

Blood Collection And Sampling Devices Market Analysis

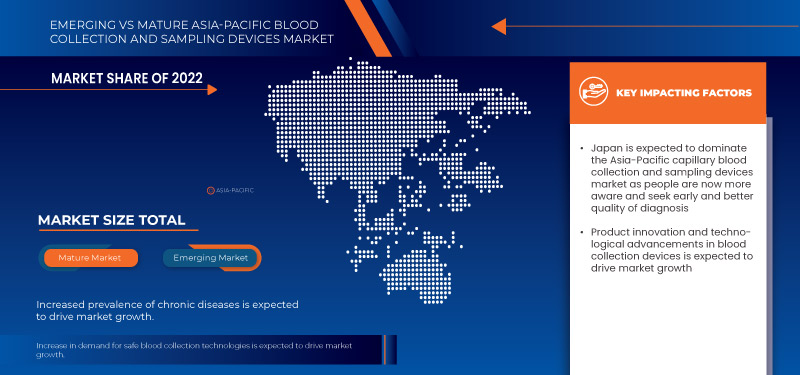

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disordersIn May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Blood Collection And Sampling Devices Market Size

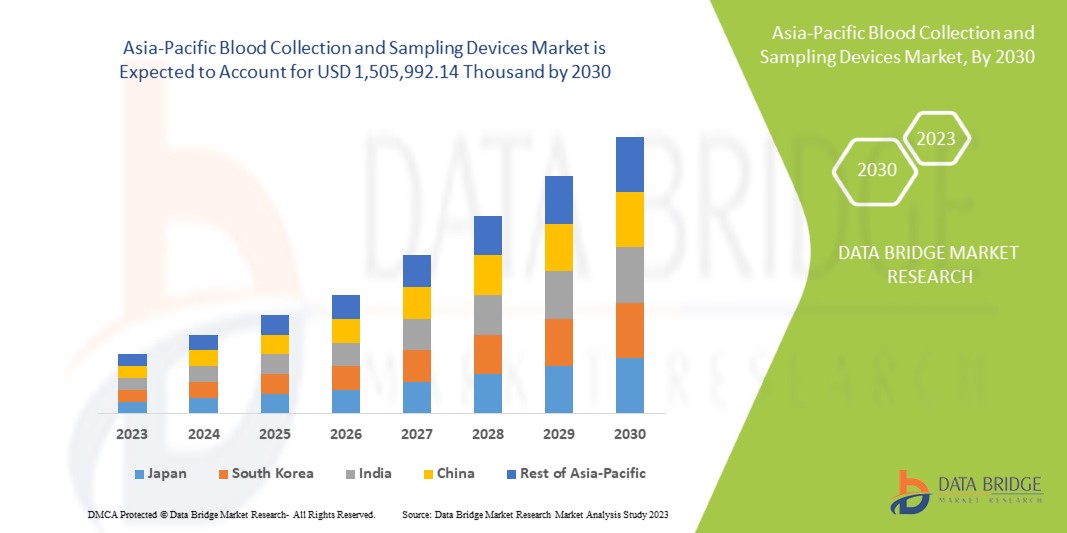

Asia-Pacific blood collection and sampling devices market size was valued at USD 985.91 million in 2024 and is projected to reach USD 1,825.06 million by 2032, with a CAGR of 8.3% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Blood Collection And Sampling Devices Market Trends

“Increased Prevalence Of Chronic Diseases”

Increased Prevalence of Chronic Diseases is a significant driver in the growth of the Blood Collection and Sampling Devices market, particularly in Japan and other countries in the Asia-Pacific region. The trend of rising chronic conditions, such as diabetes, cardiovascular diseases, and hypertension, is contributing to the growing demand for regular diagnostic testing. As more individuals suffer from these long-term health issues, healthcare providers are increasingly relying on blood collection and sampling devices to monitor and manage these conditions. As the burden of chronic diseases increases, healthcare systems are becoming more reliant on accurate, consistent, and frequent testing, which requires advanced blood collection and sampling devices. These devices are essential for early detection, disease management, and ongoing monitoring of chronic conditions, as regular blood tests help in tracking the progression of diseases, adjusting treatments, and improving patient outcomes.

In response to this trend, medical device manufacturers are focusing on developing innovative blood collection technologies that ensure better patient comfort, higher accuracy, and quicker results. Additionally, the trend towards preventive healthcare further amplifies the need for blood tests as individuals seek early diagnosis and monitoring, thus propelling the demand for blood collection devices in both hospitals and home-care settings.

Overall, the rising prevalence of chronic diseases and the shift towards more frequent and advanced diagnostic testing are key factors driving the rapid expansion of the blood collection and sampling devices market. This trend emphasizes the need for accurate, efficient, and minimally invasive devices to collect blood samples for diagnostic testing and ongoing health management, driving market growth.

Report Scope and Blood Collection And Sampling Devices Market Segmentation

|

Attributes |

Blood Collection And Sampling Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and Rest of Asia-Pacific |

|

Key Market Players |

BD (U.S.), TERUMO BCT, INC. (Japan), Thermo Fisher Scientific Inc. (U.S.), Cardinal Health (U.S.), Owen Mumford Ltd (United Kingdom), Abbott (U.S.), Nipro Europe Group Companies (Japan), Greiner Bio-One International GmbH (Austria), SARSTEDT AG & Co. KG (Germany), Bio-Rad Laboratories, Inc. (U.S.), ICU Medical, Inc. (U.S.), CML Biotech (India), Narang Medical Limited (India), Hindustan Syringes & Medical Devices Ltd (India), Sparsh Mediplus (India), and B. Braun Medical Ltd (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blood Collection And Sampling Devices Market Definition

Capillary blood collection devices are defined as devices that are used for capillary blood withdrawal. Capillary blood can be obtained by puncturing in finger, earlobe, or heel. It can also be performed by giving an incision on the skin. Its procedure gained wide attention as it withdraws an accurate amount of blood and reduces the chances of anemia. There are various kinds of needles, lancets, and syringes offered by market players for capillary blood collection. The need for blood tests is increasing as the prevalence of chronic disease increases. Moreover, the rising geriatric population and neonates have put a challenge for invasive blood-collecting procedures. This is why minimal invasive capillary blood collection procedure has gained wide attention. Nowadays volumetric micro sampling technique has gained attention for capillary blood collection. Moreover, new technological advancements are taking place to fulfill the needs of physicians and consumers.

Blood Collection And Sampling Devices Market Dynamics

Drivers

- Increased Prevalence Of Chronic Diseases

The increased prevalence of chronic diseases is a significant health concern. Chronic diseases are long-term conditions that progress slowly and require ongoing medical attention and management. These diseases can significantly impact the quality of life of individuals and place a substantial burden on healthcare systems.

Capillary and venous blood collection is a common method to obtain small blood samples for various diagnostic tests, such as blood glucose monitoring for diabetes management or any other blood test.

For instance,

In 2019, According to data from the Global Burden of Disease, the leading causes of death and disability in India are Non-Communicable Diseases (NCDs) or chronic diseases. These include cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders

In May 2021, according to the World Health Organization (WHO), the prevalence of chronic diseases, including cardiovascular diseases, diabetes, chronic respiratory diseases, cancer, and mental health disorders, has been increasing in China with National Health Systems Resource Centre (NHSRC), the burden of non-communicable diseases is 53%

Lower middle-income countries are the worst affected by chronic diseases therefore, the disease also becomes a financial burden for the underprivileged countries. The disease must be diagnosed accurately for the early detection and timely treatment of the disease. For this, efficient blood collection and sampling are necessary, creating a demand for technologically advanced capillary and venous blood testing devices. Thus, the increased prevalence of infectious and chronic diseases is expected to drive market growth.

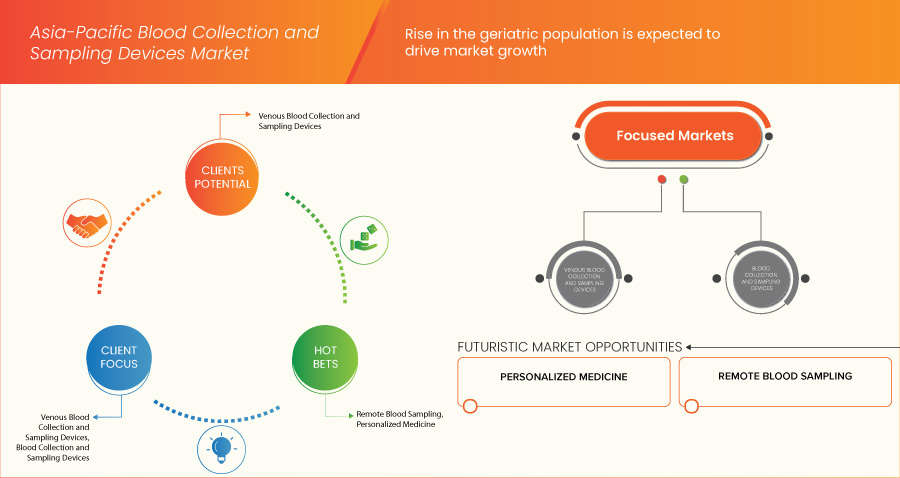

- Rise In The Geriatric Population

The population is experiencing a significant demographic shift characterized by an increasing number of older adults. The rising geriatric population in the Asia-Pacific is primarily attributed to several factors, such as increased life expectancy, advancements in healthcare, improved living conditions, and better access to medical services, which have contributed to increased life expectancy in China. This means that people are living longer, leading to a more significant proportion of older adults in the population.

The older generation is prone to more chronic disease that requires regular blood tests and diagnostics tests.

For instance,

In March 2019, according to Japan's Internal Affairs and Communications Ministry, the population of people aged 65 years and above was 35.88 million in 2019, up by 3,20,000 from the previous year by 2050, the population of people who are 60

In July 2021, According to WHO, 69% of adults have two or more chronic conditions. These diseases can lower the quality of life of adults and can be a leading cause of death in this population and adults who are 65 years and above experience a higher risk of chronic diseases than the younger generation

In June 2019, According to the Census of India, the population aged 60 years and above accounted for approximately 8.6% of the total population at that time India's geriatric population will reach around 319 million, accounting for nearly 20% of the country's total population

It is essential to diagnose the disease at an early stage to treat adults with chronic disease. Regular, proper, and accurate blood tests must be done. The capillary and venous blood testing technique is preferred for them. Hence, the rising geriatric population is expected to drive market growth.

- Rising Availability Of Point-Of-Care Diagnostics

Point-of-care testing is a type of diagnostic testing that can be performed at home or anywhere at any time. Therefore, it is commonly known as bedside testing. Earlier, testing was only limited to laboratories and hospitals, where the specimen was sent and then it took hours to days to obtain the sample.

For instance,

According to various reports, the total worth of the market was USD 40.00 billion to USD 45.00 billion, out of which the contribution of POC diagnostics is USD 12.00 billion to USD 13.00 billion

According to a review from investment bank Morgan Stanley, 37% of the USD 3 billion POC market is dedicated to infectious disease testing

With the rise in health awareness and incidence of infectious diseases, there has been a rise in the demand for POC testing. Conventional blood collection methods are painful and invasive and have a higher risk of needlestick injuries and contamination if not performed by skilled people.

The POC devices are minimally invasive, cause less pain, and have significantly fewer side effects. Also, they do not require skilled professionals to carry out the blood sampling and collection procedure. With the rise in POC testing, there has also been advancement in capillary and venous collection devices.

For instance,

Neoteryx, LLC developed a Mitra cartridge device used for capillary blood sampling anywhere, anytime, and by anyone

Elabscience, Inc. is manufacturing and distributing COVID-19 IgG/IgM Rapid Test for testing COVID-19 symptoms

Less time consumption and enhanced efficiency improve healthcare performance, resulting in more significant economic advantages for healthcare providers and patients. Thus, techniques such as capillary blood sampling, which can be used at the POC are preferred. Therefore, the rising availability of POC diagnostics is expected to drive market growth.

Opportunities

- Favorable Medical Device Regulations

The U.S. Food and Drug Administration regulates all medical devices in the U.S. Any medical device manufactured, relabeled, imported, or repackaged by any company to sell in India has to meet Central Drugs Standard Control Organization (CDSCO) regulations.

Capillary and Venous blood collection devices used for diagnostics are regulated in India by the CDSCO, which operates under the purview of the Ministry of Health and Family Welfare. The regulatory framework for medical devices in India has been evolving and recent changes have been introduced to strengthen the regulation and ensure the safety and efficacy of medical devices, including capillary and venous blood collection devices.

In India, medical devices are classified into different categories based on risk level, and the regulatory requirements vary accordingly. Capillary and venous blood collection devices typically fall under the category of In vitro Diagnostic Devices (IVDs).

The Medical Device Rules is the primary regulation governing medical devices in India. Under these rules, manufacturers, importers, and distributors of medical devices, including Capillary and Venous blood collection devices, are required to comply with the registration and licensing requirements as per the risk classification of the device. The regulatory process includes submitting technical documentation, clinical data (if applicable), and compliance with quality management system requirements. However, such regulations do not apply to self-administered personal tests by employees or residents of an establishment. Therefore, people who take regular blood- glucose using lancets are not covered under this law.

It is important to note that regulatory frameworks can change over time. It is recommended to refer to the most recent guidelines and regulations published by the CDSCO and other relevant regulatory authorities for the most up-to-date information on the favorable regulations for Capillary and Venous blood collection devices in India, which provide a better opportunity for manufacturers to launch their products in the market.

- Product Innovation And Technological Advancements In Blood Collection Devices

Blood collection is a step of utmost importance for healthcare delivery. 70-80% of the clinical decisions made are on the analysis of blood samples. With the growing trend in innovation in blood collection, many companies are using safe, easy, and more efficient ways to collect blood samples.

Capillary and venous blood collection is an ideal technique for pharmacy clinics. This method is preferred over venipuncture due to its ease of use and safety. Moreover, it eliminates the need for skilled technicians. However, one of the disadvantages of fingersticks is that there are variations between the droplets of blood. This can be overcome by the launch of novel and innovative products.

For instance,

In December 2024, according to article of IMetropolis Healthcare Limited, one of India’s leading diagnostic service providers, has launched the innovative UltraTouch Push Button Blood Collection Set (PBBCS), a first-of-its-kind technology in the country. This cutting-edge device features a thinner needle designed to significantly reduce insertion pain, making blood collection more comfortable, particularly for first-time patients, children, and senior citizens. The introduction of UltraTouch aligns with Metropolis Healthcare’s mission to improve patient care through innovation and technology

In January 2023, according to article of National Library Medicine, minimally invasive sampling techniques, such as capillary blood sampling, are routinely used for point of care testing in the home healthcare setting and clinical settings such as the Intensive Care Unit with less pain and wounding than conventional venepuncture

Capillary and venous blood collection involves utilizing modern technology and innovative collection methods for better and more efficient results. Thus, product innovation and technological advancements in blood collection devices are expected to provide opportunities for market growth.

Restraints/Challenges

- High Risk Associated With Blood Assortment Technologies

Innovations in remote sampling and POC testing have led to the popularity of fingerprick blood withdrawal. It has several advantages over traditional blood collection practices in clinic labs, hospital labs, and places requiring on-site sampling. Though they are safer and easier to use than conventional devices, they have their side effects. As the number of fingerstick procedures is rising, the cases of accidental injuries and transmission of pathogens from infected blood are also increasing.

Lancing patients' fingers and handling their used test strips exposes the clinician to blood-borne infectious agents, which can lead transmission of diseases such as hepatitis B.

These risks arise from multiple factors, including contamination concerns, improper handling, and the potential for errors during sample collection, storage, and transportation, all of which can compromise the integrity of the blood samples and lead to inaccurate diagnostic results. Such inaccuracies are particularly problematic in critical scenarios, such as diagnosing chronic diseases, monitoring therapeutic interventions, or conducting genetic testing, where precise and reliable results are paramount. Additionally, the invasive nature of traditional blood sampling methods often leads to patient discomfort, fear, and anxiety, further discouraging individuals from undergoing regular diagnostic procedures.

For healthcare systems in the Asia-Pacific region, the varying levels of infrastructure and expertise across countries exacerbate these issues, as underdeveloped healthcare settings may lack access to advanced technologies or adequate training programs, resulting in inconsistent practices and heightened risks. These challenges collectively contribute to skepticism among end-users, including hospitals, diagnostic labs, and patients, which ultimately affects the pace of adoption and the overall growth trajectory of the blood sampling device market in this region. Addressing these risks requires a concerted effort from stakeholders across the spectrum, including healthcare providers, device manufacturers, regulatory bodies, and policymakers, to implement robust safety measures, invest in research and development of minimally invasive or non-invasive technologies, and ensure widespread education on proper blood sampling practices.

- Increasing Product Recalls

Blood collection devices are instrumental to the healthcare industry. If these products are unsafe or defective, they can have harmful effects. Thus, the FDA gives out strict regulations regarding the use of these products. Despite the strict laws, there are some cases where the product has been launched in the market and is recalled later for the safety of people from its hazardous effects.

For instance,

In July 2021, Acording to the article Published by CDC's Laboratory Outreach Communication System (LOCS), Magellan Diagnostics expanded a recall of their LeadCare blood lead test kits after identifying a significant risk of falsely low results. This defect potentially delayed the identification and treatment of lead exposure in vulnerable populations, particularly children

In March 2019, According to the article Published by Becton Dickinson (BD) , company recalled certain lots of their Vacutainer® blood collection tubes due to reports of false elevations in carboxyhemoglobin (COHb) levels when samples were analyzed using specific instruments. This issue posed risks of misdiagnosis and inappropriate treatment for patients

Product recalls pose an obstacle to medical device manufacturers as these recalls cost too much to the manufacturers. Moreover, the manufacturers also have to provide some compensation which again costs a lot. Thus, the high costs and the defamation of the company name in the market are expected to pose a challenge to market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Blood Collection And Sampling Devices Market Scope

The market is segmented on the basis of product. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Venous Blood Collection And Sampling Devices

- By Type

- Poc

- By Age Group

- Infants

- Pediatrics

- Geriatrics

- Adults

- By Application

- Cardiovascular Diseases

- Respiratory Disease

- Infectious Disease

- Metabolic Disorders

- Others

- Coventional

- By Age Group

- Infants

- Pediatrics

- Geriatrics

- Adults

- By Application

- Cardiovascular Diseases

- Respiratory Disease

- Infectious Disease

- Metabolic Disorders

- Others

- By End User

- Hospitals

- Pathology Laboratories

- Clinics

- Blood Banks

- Home Care Settings

- Research & Academic Institutes

- Others

- Capillary Blood Collection And Sampling Devices

- By Type

- Poc

- By Age Group

- Infants

- Pediatrics

- Geriatrics

- Adults

- By Application

- Cardiovascular Diseases

- Respiratory Disease

- Infectious Disease

- Metabolic Disorders

- Others

- By Puncture Type

- Incision

- Puncture

- Finger Puncture

- Heel Puncture

- Coventional

- By Age Group

- Infants

- Pediatrics

- Geriatrics

- Adults

- By Application

- Cardiovascular Diseases

- Respiratory Disease

- Infectious Disease

- Metabolic Disorders

- Others

- By Puncture Type

- Incision

- Puncture

- Finger Puncture

- Heel Puncture

- By End User

- Hospitals

- Pathology Laboratories

- Clinics

- Blood Banks

- Home Care Settings

- Research & Academic Institutes

- Others

Blood Collection And Sampling Devices Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country and product as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, and rest of Asia-Pacific.

China is expected to dominate the market due to its large aging population, high prevalence of cardiovascular diseases, and increased government investments in healthcare infrastructure and technology.

Japan is expected to be the fastest growing due to the rising health awareness, and strong government support for healthcare advancements.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Blood Collection And Sampling Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Blood Collection And Sampling Devices Market Leaders Operating in the Market Are:

- BD (U.S.)

- Terumo BCT, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health (U.S.)

- Owen Mumford Ltd (United Kingdom)

- Abbott (U.S.)

- Nipro Europe Group Companies (Japan)

- Greiner Bio-One International GmbH (Austria)

- SARSTEDT AG & Co. KG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- CML Biotech (India)

- Narang Medical Limited (India)

- Hindustan Syringes & Medical Devices Ltd (India)

- Sparsh Mediplus (India)

- B. Braun Medical Ltd (Germany)

Latest Developments in Blood Collection And Sampling Devices Market

- In September 2024, Abbott and Seed Global Health are partnering to enhance maternal and child healthcare in Malawi. Their initiative includes establishing a Maternal Health Center of Excellence at Queen Elizabeth Central Hospital, focusing on training health workers to improve care quality and sustainability

- In September 2024, BD completed its acquisition of Edwards Lifesciences' Critical Care product group, renaming it BD Advanced Patient Monitoring. This move expanded BD's portfolio with advanced monitoring technologies and AI-enabled clinical tools, enhancing its smart connected care solutions and supporting future innovations in patient care

- In March 2024, Medtronic has received FDA approval for its latest Evolut FX+ TAVR system, designed to treat symptomatic severe aortic stenosis. This new generation features a modified diamond-shaped frame that offers larger coronary access windows, enhancing catheter maneuverability while maintaining the exceptional valve performance and strength associated with the Evolut platform

- In March 2024, Abbott has extended its partnership with Real Madrid and the Real Madrid Foundation through the 2026-27 season, focusing on combating childhood malnutrition and promoting healthy habits. The collaboration has provided extensive nutrition education and screening for millions of children worldwide

- In November 2023, Boston Scientific Corporation concluded its acquisition of Relievant Medsystems on November 17, 2023, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In November 2023, BD and Bio Farma signed a memorandum of understanding to combat tuberculosis in Indonesia by providing access to BD's TB diagnostics. This collaboration aimed to optimize the supply chain and enhance TB diagnosis, aligning with Indonesia’s goal to eliminate the disease by 2030

- In September 2023, Boston Scientific Corporation announced it had entered into an agreement to acquire Relievant Medsystems, Inc.for USD 850 million upfront, plus contingent payments. The acquisition, expected to close in early 2024, aimed to enhance Boston Scientific's chronic low back pain treatment portfolio with the Intracept system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATORY

5.1 JAPAN –

5.2 CHINA –

5.3 INDIA –

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC DISEASES

6.1.2 RISE IN THE GERIATRIC POPULATION

6.1.3 RISING AVAILABILITY OF POINT-OF-CARE DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH RISK ASSOCIATED WITH BLOOD ASSORTMENT TECHNOLOGIES

6.2.2 DISADVANTAGES OF MICRO-COLLECTION OF BLOOD

6.3 OPPORTUNITIES

6.3.1 FAVORABLE MEDICAL DEVICE REGULATIONS

6.3.2 PRODUCT INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN BLOOD COLLECTION DEVICES

6.4 CHALLENGE

6.4.1 INCREASING PRODUCT RECALLS

7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 VENOUS BLOOD COLLECTION AND SAMPLING DEVICES

7.2.1 CONVENTIONAL

7.2.2 GERIATRICS

7.2.3 INFANTS

7.2.4 PEDIATRICS

7.2.5 ADULT

7.2.6 INFECTIOUS DISEASES

7.2.7 METABOLIC DISORDERS

7.2.8 CARDIOVASCULAR DISEASE

7.2.9 RESPIRATORY DISEASES

7.2.10 OTHERS

7.2.11 POC

7.2.12 GERIATRICS

7.2.13 INFANTS

7.2.14 PEDIATRICS

7.2.15 ADULT

7.2.16 INFECTIOUS DISEASES

7.2.17 METABOLIC DISORDERS

7.2.18 CARDIOVASCULAR DISEASE

7.2.19 RESPIRATORY DISEASES

7.2.20 OTHERS

7.2.21 HOSPITALS

7.2.22 PATHOLOGY LABORATORIES

7.2.23 CLINICS

7.2.24 BLOOD BANKS

7.2.25 HOME CARE SETTINGS

7.2.26 RESEARCH & ACADEMIC LABORATORIES

7.2.27 OTHERS

7.3 CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES

7.3.1 POC

7.3.2 GERIATRICS

7.3.3 INFANTS

7.3.4 PEDIATRICS

7.3.5 ADULT

7.3.6 INFECTIOUS DISEASES

7.3.7 METABOLIC DISORDERS

7.3.8 CARDIOVASCULAR DISEASE

7.3.9 RESPIRATORY DISEASES

7.3.10 OTHERS

7.3.11 PUNCTURE

7.3.12 INCISION

7.3.13 FINGER PUNCTURE

7.3.14 HEEL PUNCTURE

7.3.15 CONVENTIONAL

7.3.16 GERIATRICS

7.3.17 INFANTS

7.3.18 PEDIATRICS

7.3.19 ADULT

7.3.20 INFECTIOUS DISEASES

7.3.21 METABOLIC DISORDERS

7.3.22 CARDIOVASCULAR DISEASE

7.3.23 RESPIRATORY DISEASES

7.3.24 OTHERS

7.3.25 PUNCTURE

7.3.26 INCISION

7.3.27 FINGER PUNCTURE

7.3.28 HEEL PUNCTURE

7.3.29 HOSPITALS

7.3.30 PATHOLOGY LABORATORIES

7.3.31 CLINICS

7.3.32 BLOOD BANKS

7.3.33 HOME CARE SETTINGS

7.3.34 RESEARCH & ACADEMIC LABORATORIES

7.3.35 OTHERS

8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET BY COUNTRIES

8.1 ASIA-PACIFIC

8.1.1 JAPAN

8.1.2 AUSTRALIA

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 MALAYSIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 INDONESIA

8.1.9 PHILIPPINES

8.1.10 REST OF ASIA

9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 BD

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 CARDINAL HEALTH

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENTS

11.3 THERMO FISHER SCIENTIFIC INC.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 TERUMO MEDICAL CORPORATION

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENTS

11.5 ABBOTT

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 BIO-RAD LABORATORIES INC

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 B. BRAUN SE

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 CML BIOTECH

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 GREINER BIO-ONE INTERNATIONAL GMBH

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT DEVELOPMENTS

11.1 HINDUSTAN SYRINGES & MEDICAL DEVICES LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT DEVELOPMENT

11.11 ICUMEDICAL INC

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT DEVELOPMENT

11.12 NARANG MEDICAL LIMITED

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT DEVELOPMENT

11.13 NIPRO

11.13.1 COMPANY SNAPSHOT

11.13.2 REVENUE ANALYSIS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT DEVELOPMENT

11.14 OWEN MUMFORD LTD

11.14.1 COMPANY SNAPSHOT

11.14.2 PRODUCT PORTFOLIO

11.14.3 RECENT DEVELOPMENTS

11.15 SARSTEDT AG & CO. KG

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT DEVELOPMENT

11.16 SPARSH MEDIPLUS

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

List of Table

TABLE 1 CLINICAL LAB TESTS THAT ARE INFLUENCED BY HEMOLYSIS

TABLE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 20 JAPAN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 23 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 JAPAN VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 33 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 JAPAN CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 37 AUSTRALIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 AUSTRALIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 AUSTRALIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 AUSTRALIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH KOREA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH KOREA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH KOREA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 INDIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 88 MALAYSIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 89 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 91 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 93 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 MALAYSIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 97 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 MALAYSIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MALAYSIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 101 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 MALAYSIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 MALAYSIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 105 SINGAPORE BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 108 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 110 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 SINGAPORE VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 112 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 114 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 SINGAPORE POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SINGAPORE PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 118 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SINGAPORE CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SINGAPORE CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 122 THAILAND BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 123 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 125 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 142 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 143 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 144 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 INDONESIA VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 146 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 148 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 INDONESIA POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 INDONESIA PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 152 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 INDONESIA CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 INDONESIA CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 PHILIPPINES BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 157 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 159 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 160 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 161 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 PHILIPPINES VENOUS BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 163 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 165 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 PHILIPPINES POC IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 PHILIPPINES PUNCTURE IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 169 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 PHILIPPINES CONVENTIONAL IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PUNCTURE TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 PHILIPPINES CAPILLARY BLOOD COLLECTION AND SAMPLING DEVICES IN BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 173 REST OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SEGMENTATION

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 INCREASED PREVALENCE OF CHRONIC DISEASES AND RISE IN THE GERIATRIC POPULATION ARE FACTORS EXPECTED TO DRIVE THE GROWTH OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 13 THE BLOOD SAMPLING DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET IN 2025 AND 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET

FIGURE 15 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2024

FIGURE 16 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: SNAPSHOT

FIGURE 20 ASIA-PACIFIC BLOOD COLLECTION AND SAMPLING DEVICES MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.