Asia Pacific Bullet Proof Glass Market

Market Size in USD Billion

CAGR :

%

USD

2.87 Billion

USD

6.09 Billion

2024

2032

USD

2.87 Billion

USD

6.09 Billion

2024

2032

| 2025 –2032 | |

| USD 2.87 Billion | |

| USD 6.09 Billion | |

|

|

|

|

Bullet Proof Glass Market Size

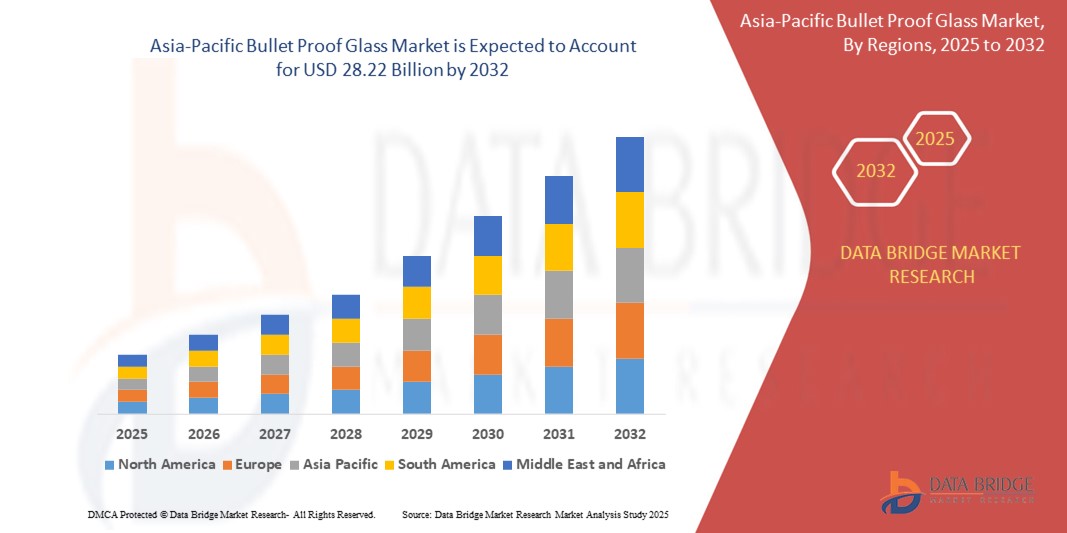

- The Asia-Pacific bullet proof glass market size was valued at USD 2.87 billion in 2024 and is expected to reach USD 6.09 billion by 2032, at a CAGR of 9.87% during the forecast period

- The market growth is primarily driven by increasing security concerns, rapid urbanization, and growing demand for advanced safety solutions in automotive, banking, and construction sectors

- Rising investments in infrastructure development and the adoption of advanced materials for enhanced protection are further accelerating the demand for bullet proof glass across the region

Bullet Proof Glass Market Analysis

- Bullet proof glass, designed to resist penetration from bullets and other ballistic threats, is a critical component in high-security applications across automotive, military, banking, and construction sectors due to its durability, transparency, and protective capabilities

- The growing demand for bullet proof glass is fueled by rising security threats, increasing adoption in luxury and armored vehicles, and stringent safety regulations in financial and government institutions

- China dominated the Asia-Pacific bullet proof glass market with the largest revenue share of 38.5% in 2024, driven by its robust manufacturing base, significant infrastructure projects, and increasing defense spending

- Japan is expected to be the fastest-growing market in the region during the forecast period, propelled by advancements in automotive safety technologies and rising demand for high-security solutions in urban centers

- The acrylic segment dominated the market with a revenue share of 47.7% in 2024, driven by its high optical clarity, lightweight nature, cost-effectiveness, and ease of fabrication, making it ideal for applications such as ATM enclosures, display cases, and certain vehicle windows where moderate ballistic protection is required

Report Scope and Bullet Proof Glass Market Segmentation

|

Attributes |

Bullet Proof Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bullet Proof Glass Market Trends

“Increasing Adoption of Advanced Materials and Lightweight Solutions”

- The Asia-Pacific bullet proof glass market is experiencing a notable trend toward the adoption of advanced materials such as polycarbonate and glass-clad polycarbonate, which offer enhanced ballistic protection while reducing weight

- These lightweight solutions are particularly appealing in the automotive sector, where manufacturers aim to balance security with fuel efficiency and vehicle performance

- Innovations in material science are enabling the development of thinner, more transparent, and cost-effective bullet proof glass without compromising strength, making it suitable for a wider range of applications

- For instances, companies are leveraging acrylic and ballistic insulated glass to provide high optical clarity and thermal insulation, catering to both commercial and residential building demands.

- This trend is driven by the need for aesthetically pleasing and functional security solutions, particularly in rapidly urbanizing countries such as China and Japan

- Advanced manufacturing techniques are also improving the durability and customization of bullet proof glass, enhancing its appeal across end-user segments such as automotive, military, and banking

Bullet Proof Glass Market Dynamics

Driver

“Growing Security Concerns and Rapid Urbanization”

- The rising prevalence of security threats, including terrorism, violent crime, and geopolitical tensions, is a key driver for the Asia-Pacific bullet proof glass market

- Rapid urbanization in countries such as China, which dominates the market, and Japan, the fastest-growing region, is increasing the demand for bullet proof glass in commercial and residential buildings, government facilities, and financial institutions

- The automotive sector is witnessing heightened demand for bullet proof glass in luxury vehicles, SUVs, and sedans, driven by consumer preference for enhanced safety features and the growing production of armored vehicles

- Government regulations and initiatives in countries such as China, mandating stringent safety standards for public infrastructure and high-risk facilities, are further propelling market growth

- The expansion of the military sector, particularly in China and Japan, is boosting the adoption of bullet proof glass in defense vehicles and bases, supported by increasing defense budgets

- The proliferation of smart city projects and infrastructure development in the region is also creating opportunities for bullet proof glass in building and construction applications

Restraint/Challenge

“High Production Costs and Regulatory Complexities”

- The high cost of manufacturing bullet proof glass, driven by the use of specialized materials such as polycarbonate and glass-clad polycarbonate, as well as advanced production processes, poses a significant barrier to market adoption, particularly in cost-sensitive markets within the Asia-Pacific region

- The integration of bullet proof glass into vehicles and buildings requires substantial investment in customization and installation, which can deter small businesses and residential consumers

- Data security and privacy concerns related to smart bullet proof glass systems, which may incorporate IoT or sensors-based technologies, are emerging as challenges, particularly in regions with stringent data protection laws such as Japan

- The fragmented regulatory landscape across Asia-Pacific countries regarding safety standards, material certifications, and environmental compliance complicates operations for manufacturers and increases costs

- These factors can limit market penetration, especially in emerging economies where affordability and regulatory awareness are critical concerns

- In addition, the heavy weight of traditional laminated glass can pose challenges in automotive applications, prompting the need for cost-effective lightweight alternatives

Bullet Proof Glass market Scope

The market is segmented on the basis of type, security level, car make, and end-user.

- By Type

On the basis of type, the Asia-Pacific bullet proof glass market is segmented into acrylic, traditional laminated glass, polycarbonate, glass-clad polycarbonate, ballistic insulated glass, and others. The acrylic segment dominated the market with a revenue share of 47.7% in 2024, driven by its high optical clarity, lightweight nature, cost-effectiveness, and ease of fabrication, making it ideal for applications such as ATM enclosures, display cases, and certain vehicle windows where moderate ballistic protection is required.

The glass-clad polycarbonate segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior ballistic protection (UL levels 1-8) and ability to withstand forced entry, explosive blasts, and hurricane winds. Its robust construction, combining the hardness of glass with the toughness of polycarbonate, makes it increasingly popular for high-security applications in military and automotive sectors.

- By Security Level

On the basis of security level, the market is segmented into VIP security level and standard security level. The VIP security level segment held the largest market revenue share of 60.2% in 2024, driven by the rising need for enhanced security in military operations, political environments, and among high-profile individuals due to growing geopolitical tensions and targeted attack threats.

The standard security level segment is anticipated to experience significant growth from 2025 to 2032, fueled by increasing demand in commercial and civilian sectors such as banking, retail, and residential applications, where cost-effective yet reliable ballistic protection is required.

- By Car Make

On the basis of car make, the market is segmented into luxury, SUV, sedan, truck, minivan, convertible, coupe, hatchback, and others. The luxury segment dominated the market with a revenue share of 38.4% in 2024, driven by the rising demand for armored luxury vehicles among high-net-worth individuals, corporate executives, and government officials seeking enhanced personal security while maintaining aesthetic and functional vehicle designs.

The SUV segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, fueled by the increasing adoption of bullet proof glass in SUVs for both personal and commercial use, particularly in regions with high crime rates and security concerns, such as China and India.

- By End-User

On the basis of end-user, the market is segmented into building and construction, banking and finance, automotive, military, and others. The military segment held the largest market revenue share of 38.6% in 2024, driven by rising defense budgets, increasing threats from terrorism, and cross-border conflicts in the Asia-Pacific region, particularly in China, which necessitates robust ballistic protection for military vehicles and installations.

The automotive segment is anticipated to witness rapid growth from 2025 to 2032, driven by the expanding automotive industry in Japan, where manufacturers such as Toyota and Nissan are integrating bullet proof glass in premium and armored vehicles to meet growing security demands and comply with safety regulations.

Bullet Proof Glass Market Regional Analysis

- China dominated the Asia-Pacific bullet proof glass market with the largest revenue share of 38.5% in 2024, driven by its robust manufacturing base, significant infrastructure projects, and increasing defense spending

- Japan is expected to be the fastest-growing market in the region during the forecast period, propelled by advancements in automotive safety technologies and rising demand for high-security solutions in urban centers

Asia-Pacific Bullet Proof Glass Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the bullet proof glass market, driven by expanding automotive production, rising disposable incomes, and heightened security needs in countries such as China, India, and Japan. Increasing awareness of ballistic protection, coupled with demand for lightweight and durable materials such as polycarbonate and glass-clad polycarbonate, boosts market growth. Government initiatives promoting infrastructure security and military modernization further encourage the adoption of advanced bullet proof glass across automotive, construction, banking, and military sectors.

Japan Bullet Proof Glass Market Insight

Japan’s bullet proof glass market is expected to witness the fastest growth rate, driven by strong consumer preference for high-quality, technologically advanced bullet proof glass that enhances safety and security. The presence of major automotive manufacturers and integration of bullet proof glass in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization and increasing defense budgets further contribute to growth.

China Bullet Proof Glass Market Insight

The China dominates the Asia-Pacific bullet proof glass market with the highest revenue share in 2023, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for security solutions in high-risk environments. The growing middle class and focus on secure infrastructure support the adoption of advanced bullet proof glass. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, particularly in the automotive and construction sectors.

Bullet Proof Glass Market Share

The bullet proof glass industry is primarily led by well-established companies, including:

- Saint-Gobain (France)

- PPG Industries, Inc. (U.S.)

- AGC Inc. (Japan)

- Schott AG (Germany)

- Taiwan Glass Industry Corporation (Taiwan)

- Nippon Sheet Glass Co., Ltd. (Japan)

- Armortex (U.S.)

- Total Security Solutions (U.S.)

- Apogee Enterprises, Inc. (U.S.)

- Binswanger Glass (U.S.)

- Centigon (U.S.)

- Armassglass (Turkey)

- Stec Armour Glass (Malaysia)

- Total Security Solution (U.S.)

- D.W. Price Security (U.K.)

- Smartglass International (Ireland)

What are the Recent Developments in Asia-Pacific Bullet Proof Glass Market?

- In April 2024, Nippon Sheet Glass Co., Ltd., a global leader in glass manufacturing, introduced a new range of advanced bulletproof glass products for the Asia-Pacific market. This innovative product line features enhanced lightweight polycarbonate laminates, catering to the rising demand for high-security solutions in commercial and automotive applications, particularly in China and India. The launch underscores Nippon Sheet Glass’s commitment to advancing ballistic protection technologies, ensuring greater safety and durability

- In March 2024, Saint-Gobain, a global leader in glass manufacturing, announced a strategic partnership with a leading Indian security solutions provider to develop and distribute next-generation bullet-resistant glass for government and military applications. This collaboration leverages Saint-Gobain’s expertise in advanced materials, addressing the specific security needs of the Indian market while reinforcing its position in the Asia-Pacific region. The initiative aims to enhance ballistic protection technologies, ensuring greater safety and durability

- In February 2024, Asahi India Glass Limited (AIS) partnered with Enormous Brands to develop marketing campaigns highlighting its AIS Windows bulletproof glass solutions. This initiative aims to promote the adoption of bullet-resistant glass in high-rise commercial and residential buildings across the Asia-Pacific, leveraging the region’s rapid urbanization and growing security concerns. The collaboration underscores AIS’s commitment to providing advanced safety solutions while expanding its presence in the architectural glass market

- In January 2024, Taiwan Glass Industry Corp. acquired a majority stake in a Southeast Asian glass fabrication company to expand its bulletproof glass production capabilities. This strategic acquisition strengthens Taiwan Glass’s supply chain in the Asia-Pacific, enabling it to meet the growing demand for ballistic glass in Malaysia, Thailand, and Vietnam. The surge in infrastructure development and security needs across the region has driven the demand for high-performance protective glass solutions

- In November 2023, Vetrotech Saint-Gobain introduced an upgraded version of its Vetrogard bullet-resistant glass, specifically certified for the Asia-Pacific market. This 65mm-thick ballistic glass, tested to withstand AK-47 rifle rounds, is engineered for high-security applications, including banks and government buildings in India and Southeast Asia. The launch underscores Vetrotech’s commitment to region-specific ballistic solutions, ensuring enhanced safety and durability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Bullet Proof Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Bullet Proof Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Bullet Proof Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.