Asia Pacific Capillary Blood Collection And Sampling Devices Market

Market Size in USD Million

CAGR :

%

USD

633.09 Million

USD

1,171.81 Million

2024

2032

USD

633.09 Million

USD

1,171.81 Million

2024

2032

| 2025 –2032 | |

| USD 633.09 Million | |

| USD 1,171.81 Million | |

|

|

|

|

Capillary Blood Collection and Sampling Devices Treatment Market Size

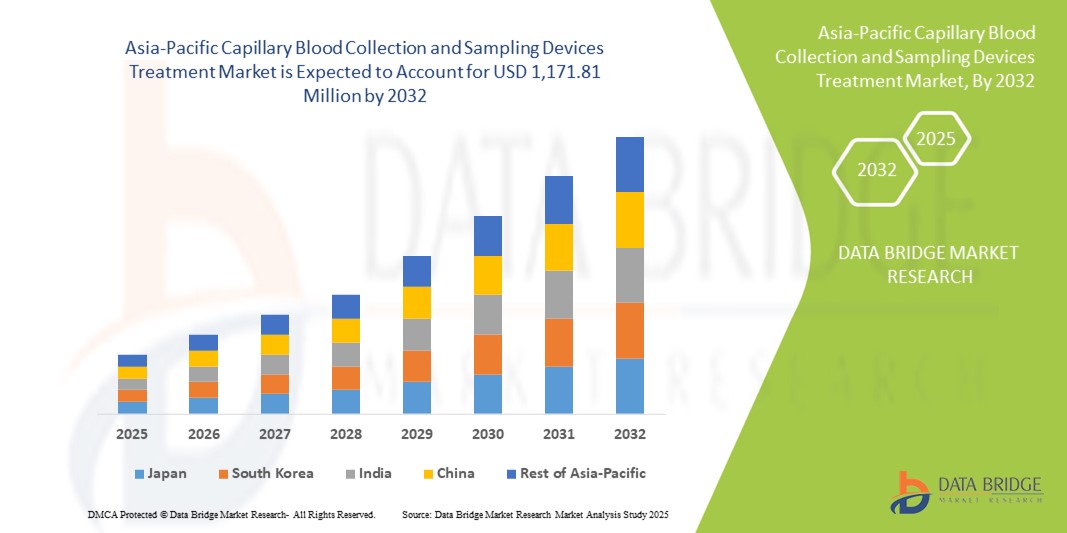

- The Asia-Pacific capillary blood collection and sampling devices treatment market size was valued at USD 633.09 million in 2024 and is expected to reach USD 1,171.81 million by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced healthcare technologies and innovations in blood collection and diagnostic procedures, leading to improved efficiency and accuracy in clinical testing

- Furthermore, rising demand for minimally invasive, patient-friendly, and rapid diagnostic solutions is driving the adoption of capillary blood collection and sampling devices, thereby significantly boosting the growth of the market across hospitals, clinics, and diagnostic laboratories

Capillary Blood Collection and Sampling Devices Treatment Market Analysis

- Capillary blood collection and sampling devices treatment systems, enabling minimally invasive and accurate blood sampling, are increasingly critical in modern healthcare for diagnostics, patient monitoring, and research applications due to their convenience, safety, and rapid results

- The escalating demand for capillary blood collection and sampling devices treatment is primarily fueled by rising healthcare awareness, growing prevalence of chronic and lifestyle-related diseases, and the increasing adoption of home-based and point-of-care diagnostic solutions

- China dominated the capillary blood collection and sampling devices treatment market in Asia-Pacific with the largest revenue share of 37.8% in 2024, characterized by rapidly expanding healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong government support for healthcare modernization. The presence of leading domestic manufacturers and collaborations with global healthcare companies is further strengthening China’s market leadership

- India is expected to be the fastest-growing country in the capillary blood collection and sampling devices treatment market from 2025 to 2032, driven by increasing healthcare awareness, expansion of private healthcare facilities, growing demand for affordable blood sampling solutions, and government initiatives such as the National Digital Health Mission. Rising home healthcare adoption and collaborations between domestic and international manufacturers are accelerating market growth

- The Puncture segment dominated the capillary blood collection and sampling devices treatment market with a revenue share of 62.4% in 2024, as lancets and needle-based devices are widely used for capillary blood collection

Report Scope and Capillary Blood Collection and Sampling Devices Treatment Market Segmentation

|

Attributes |

Capillary Blood Collection and Sampling Devices Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Capillary Blood Collection and Sampling Devices Treatment Market Trends

Enhanced Convenience and Automation in Healthcare

- A significant and accelerating trend in the Asia-Pacific capillary blood collection and sampling devices treatment market is the growing adoption of automated and easy-to-use systems that enhance accuracy, speed, and patient comfort. These devices allow healthcare providers to collect blood samples with minimal invasiveness, reducing errors and improving workflow efficiency

- Modern sampling devices are designed for both clinical and home use, enabling quick and safe collection, storage, and transportation of capillary blood. This reduces the risk of contamination and enhances reliability for diagnostics, therapeutic monitoring, and research applications

- Integration with digital monitoring platforms and healthcare IT systems is improving data management, enabling laboratories and hospitals to track patient samples efficiently, maintain accurate records, and reduce manual errors. Such systems streamline processes in hospitals, clinics, and diagnostic center

- User-friendly design and ergonomics are increasingly emphasized, with devices that allow safe collection even for neonates, elderly patients, and patients with limited mobility. Disposable and single-use components further improve hygiene and reduce cross-contamination risks

- The market is witnessing innovation in portable, point-of-care capillary blood collection devices, which allow faster diagnostic testing outside traditional laboratory settings, enhancing accessibility and patient convenience

- Manufacturers are focusing on developing devices that are compact, lightweight, and easy to operate, meeting the rising demand for home-based monitoring and decentralized healthcare solutions across Asia-Pacific

- The trend towards automated, accurate, and convenient blood collection solutions is reshaping healthcare workflows, reducing manual workload for medical staff, and improving patient experiences. Consequently, companies are continuously innovating to enhance safety, speed, and usability in their capillary blood sampling products

Capillary Blood Collection and Sampling Devices Treatment Market Dynamics

Driver

Growing Need Due to Rising Demand for Efficient and Accurate Sample Collection

- The increasing prevalence of chronic diseases, growing healthcare awareness, and rising demand for precise diagnostics are significant drivers for the heightened adoption of capillary blood collection and sampling devices. These devices allow for minimally invasive, reliable, and rapid sample collection across hospitals, clinics, and home care settings

- For instance, In March 2023, Becton, Dickinson and Company (BD) launched the BD MiniDraw Capillary Blood Collection System, which enables healthcare professionals to collect laboratory-quality blood samples from a patient’s fingertip. This device is designed to support patients with chronic diseases such as diabetes and cardiovascular conditions who require frequent monitoring. By offering a minimally invasive and convenient sampling method, it reduces patient discomfort and increases compliance, especially in home-care and outpatient settings

- As healthcare providers increasingly emphasize patient safety and operational efficiency, advanced sampling devices provide standardized collection methods, reducing human error, contamination risks, and variability in test results. This ensures more reliable diagnostic outcomes and supports better clinical decision-making

- Furthermore, the rising trend of point-of-care testing, home diagnostics, and remote patient monitoring is driving the adoption of user-friendly, portable, and automated capillary blood collection devices. These solutions enable convenient and timely testing outside traditional laboratory environments

- The convenience of rapid sample collection, integration with laboratory information systems, and improved workflow efficiency for clinicians are key factors fueling the demand for these devices. The ability to process multiple samples quickly and accurately is particularly beneficial in high-volume healthcare facilities

- Manufacturers are focusing on designing ergonomic, safe, and disposable sampling kits that cater to neonatal, pediatric, and geriatric populations, addressing diverse clinical requirements while minimizing risks of contamination

- The overall trend towards automation, precision, and patient-centric solutions is reshaping the market landscape. Consequently, companies are developing more reliable, scalable, and cost-effective Capillary Blood Collection and Sampling Devices Treatment solutions to meet growing regional demand

Restraint/Challenge

Concerns Regarding Cost and Adoption in Developing Regions

- The relatively high initial cost of some advanced capillary blood collection and sampling devices can be a barrier to adoption for budget-conscious healthcare providers, particularly in developing regions with limited healthcare infrastructure

- Smaller clinics and rural hospitals may face challenges in acquiring automated or high-end devices due to financial constraints, impacting widespread market penetration

- Addressing these cost-related challenges through affordable, modular, and easy-to-maintain devices is crucial to expanding adoption across varied healthcare settings. Companies are increasingly focusing on producing cost-effective kits and instruments while maintaining high standards of accuracy and reliability

- Limited awareness about the benefits of advanced capillary blood collection solutions in some regions also hinders rapid adoption. Healthcare provider education and demonstration of clinical efficacy are essential to overcoming this barrier

- While prices are gradually decreasing and portable devices are becoming more accessible, the perceived premium for automated or high-precision devices may still restrict adoption in price-sensitive markets

- Overcoming these challenges through cost optimization, enhanced training for healthcare staff, and the development of adaptable, scalable solutions will be vital for sustained growth of the capillary blood collection and sampling devices treatment market in Asia-Pacific

Capillary Blood Collection and Sampling Devices Treatment Market Scope

The market is segmented on the basis of product, modality, material, puncture type, procedure, age group, test type, application, technology, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into blood sampling devices and capillary blood devices. The blood sampling devices segment dominated the largest market revenue share of 45.1% in 2024, driven by its versatility in clinical, hospital, and home healthcare settings. These devices are highly preferred for their ability to provide accurate blood samples with minimal patient discomfort, supporting a wide range of diagnostic applications. Hospitals, clinics, and research labs favor blood sampling devices due to their reliability and ease of integration with laboratory workflows. Growing awareness about preventive healthcare and routine diagnostic testing in Asia-Pacific countries further strengthens demand. In addition, favorable reimbursement policies in several countries encourage adoption in both public and private healthcare facilities. The segment benefits from continuous innovation in lancet designs, automated sample handling, and disposable solutions that enhance efficiency and reduce contamination risk.

The capillary blood devices segment is expected to witness the fastest CAGR of 11.8% from 2025 to 2032, driven by rising adoption in automated and minimally invasive point-of-care testing. These devices are increasingly used in research and clinical studies for accurate capillary blood collection in pediatric, geriatric, and adult patients. The growing trend of home healthcare monitoring and remote diagnostics is encouraging the use of compact, easy-to-use capillary blood devices. Manufacturers are focusing on improving ergonomics, safety features, and compatibility with downstream diagnostic assays. Technological advancements, such as integration with volumetric microsampling and automation, are further accelerating adoption. Rising awareness among healthcare professionals and patients about safer and faster blood collection techniques is contributing to market growth. The segment is also benefiting from cost-effective manufacturing and increased availability across emerging markets.

- By Modality

On the basis of modality, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into manual sampling and automated/autoinjection sampling. The manual sampling segment held the largest market revenue share of 51.2% in 2024, attributed to its simplicity, affordability, and widespread usage in clinics, hospitals, and diagnostic labs. Manual devices are often preferred for routine procedures due to their reliability, minimal maintenance, and ability to handle a wide variety of patient age groups. They are especially useful in low-resource settings where automation infrastructure may be limited. The segment also benefits from healthcare personnel being extensively trained in manual blood collection techniques, ensuring high-quality samples. Cost-effectiveness and easy disposal are additional factors supporting demand. With rising volumes of diagnostic tests and ongoing clinical trials, manual sampling continues to be a trusted choice for healthcare providers.

Automated/autoinjection sampling is projected to register the fastest CAGR of 10.9% from 2025 to 2032, driven by the growing need for precision, reproducibility, and safety in blood collection. Automation reduces human error, improves sample consistency, and minimizes the risk of needlestick injuries, making these systems highly suitable for hospitals and research laboratories. Rising adoption of telemedicine and remote patient monitoring is further fueling demand. These devices are increasingly integrated with point-of-care testing systems, allowing faster processing of samples. Technological innovations such as user-friendly interfaces, safety-enhancing features, and compatibility with multiple test types are driving rapid uptake. Market players are investing in R&D to expand automated solutions that cater to pediatric, geriatric, and adult populations.

- By Material

On the basis of material, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into plastic, glass, stainless steel, ceramic, and others. The plastic segment dominated with a market revenue share of 47.5% in 2024, attributed to its lightweight nature, cost-effectiveness, and disposability. Plastic devices are widely used in hospitals, pathology labs, and home care settings due to their ease of handling and reduced contamination risk. The material is compatible with a variety of diagnostic tests, including serum, plasma, and dried blood spot testing. Manufacturers also prefer plastic for scalable production and sterile packaging. Rising demand for single-use, safe, and environmentally friendly devices is reinforcing dominance. The segment benefits from strong distribution networks, including direct tenders and retail channels, enhancing accessibility across Asia-Pacific.

Stainless steel is anticipated to witness the fastest CAGR of 9.7% from 2025 to 2032, driven by its durability, reusability, and suitability for high-precision laboratory procedures. Stainless steel devices are particularly preferred in research laboratories and advanced clinical settings where repeated sampling is required. The material supports sterilization processes without compromising device integrity, which is critical for regulatory compliance. Rising adoption of sophisticated analytical and clinical procedures is pushing demand. Continuous innovations in ergonomic design and safety features are making stainless steel devices more user-friendly. Growth is also supported by increased investment in research labs, biotechnology firms, and high-throughput diagnostic centers.

- By Puncture Type

On the basis of puncture type, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into puncture and incision. The puncture segment held the largest revenue share of 62.4% in 2024, as lancets and needle-based devices are widely used for capillary blood collection. Their minimal invasiveness, ease of use, and suitability across different age groups contribute to dominance. Puncture devices allow rapid sample collection, enabling quick diagnostic turnaround, especially in hospital and point-of-care settings. The availability of single-use disposable lancets improves safety and reduces cross-contamination risk. Rising awareness of preventive health check-ups and chronic disease monitoring further reinforces demand. Training programs for healthcare personnel and established regulatory standards also support market growth. Puncture devices are compatible with a variety of sample types, enhancing their utility in multiple diagnostic applications.

The incision segment is expected to grow at the fastest CAGR of 8.5% during 2025–2032, driven by increasing applications in specialized procedures requiring larger sample volumes. Incision-based devices are increasingly used in research and advanced clinical testing where capillary puncture is insufficient. Technological advancements, such as minimally invasive incision techniques and integrated safety features, are accelerating adoption. The segment benefits from rising awareness among healthcare providers of precise sample collection requirements. Demand is further fueled by pediatric and neonatal testing applications. Continuous development of ergonomic and safer incision devices is supporting market growth.

- By Procedure

On the basis of procedure, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into conventional and point of care testing. The conventional segment dominated with a 54.8% revenue share in 2024, due to its well-established protocols and widespread use in hospitals and clinical laboratories. Conventional procedures offer reliability, reproducibility, and adherence to regulatory standards, making them suitable for routine testing. Healthcare personnel are extensively trained in conventional blood collection methods, which reinforces continued adoption. The segment benefits from strong supply chains and availability of consumables. Growing clinical research activities and diagnostic testing volumes in Asia-Pacific further strengthen dominance.

Point of care testing is projected to witness the fastest CAGR of 12.3% from 2025 to 2032, fueled by the rising demand for rapid, on-site diagnostic results. Point-of-care devices allow decentralized testing, home monitoring, and quicker clinical decision-making. Increasing prevalence of chronic and infectious diseases drives adoption, along with technological innovations in minimally invasive sampling and automated testing. Rising awareness among patients and healthcare providers about convenient testing solutions is contributing to market growth. Integration with digital health platforms and remote monitoring systems further accelerates adoption in Asia-Pacific.

- By Age Group

On the basis of age group, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into geriatrics, infant, paediatric, and adult. The adult segment held the largest market revenue share of 48.6% in 2024, driven by the widespread need for routine diagnostics, preventive healthcare programs, and the higher prevalence of chronic and lifestyle-related diseases in adult populations. Adults frequently undergo metabolic, cardiovascular, and chronic disease testing, which sustains steady demand for capillary blood collection devices. Hospitals, diagnostic centers, and clinical laboratories prioritize adult-focused devices due to their reliability, standardized protocols, and compatibility with multiple test types. Government health initiatives, insurance coverage policies, and wellness programs further encourage the adoption of adult blood sampling devices. The segment also benefits from increasing patient awareness of preventive health monitoring. In addition, established healthcare infrastructure in urban and semi-urban areas ensures easy access to these devices, supporting strong market growth.

The infant segment is expected to witness the fastest CAGR of 13.1% from 2025 to 2032, driven by rising demand for neonatal screening, early disease detection, and pediatric diagnostic testing. Advances in minimally invasive devices specifically designed for infants and children have made blood collection safer and more comfortable, encouraging rapid adoption. Growing awareness among parents, caregivers, and healthcare providers about early-stage disease identification and routine pediatric testing contributes to market expansion. Government programs supporting child health monitoring, immunization campaigns, and neonatal care further stimulate demand. Manufacturers are innovating compact, safe, and ergonomically designed devices tailored for neonatal and pediatric applications. Technological improvements, such as automated microsampling and integration with point-of-care testing systems, are also supporting growth. Increasing use of home-based pediatric testing and research studies targeting early-life biomarkers enhances adoption.

- By Test Type

On the basis of test type, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into dried blood spot tests, plasma/serum protein tests, comprehensive metabolic panel (CMP) Tests, liver panel / liver profile/ liver function tests, whole blood test, and others. The comprehensive metabolic panel (CMP) tests segment dominated the market with a revenue share of 42.7% in 2024, attributed to its wide clinical applicability across metabolic, renal, and hepatic disorder detection. CMP tests are extensively used in hospitals and diagnostic laboratories for routine health assessments and preventive screenings. Strong patient demand for holistic health evaluations and early disease detection drives market adoption. Healthcare professionals favor CMP tests due to their reliability, reproducibility, and ability to generate multiple analyte readings from a single sample. Growing awareness about chronic disease monitoring and increased physician recommendation rates further reinforce dominance. Established supply chains and availability of compatible sampling devices across Asia-Pacific strengthen accessibility and adoption.

Dried blood spot tests are expected to witness the fastest CAGR of 14.2% during 2025–2032, fueled by their convenience in remote monitoring, neonatal screening, and large-scale epidemiological studies. These tests require only a small volume of blood, are easy to transport, and are ideal for decentralized or home-based testing. The growing popularity of telehealth and point-of-care diagnostic models accelerates demand. Integration with volumetric absorptive microsampling technologies enhances accuracy and reliability, boosting adoption. Manufacturers are focusing on portable, user-friendly kits suitable for self-collection, further driving market expansion. Increasing prevalence of chronic diseases and public health monitoring programs also supports uptake. The ability to safely collect and store samples for delayed testing makes these tests highly attractive for both clinical and research applications.

- By Application

On the basis of application, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into cardiovascular disease, infectious diseases, respiratory diseases, metabolic disorders, and others. The cardiovascular disease segment held the largest market revenue share of 40.5% in 2024, owing to the high prevalence of heart conditions and the critical need for regular biomarker monitoring. Hospitals and clinics routinely utilize capillary blood collection devices for cardiovascular diagnostics, ensuring timely assessment and disease management. Rising incidence of lifestyle-related disorders, such as hypertension, atherosclerosis, and heart failure, further drives sustained demand. Healthcare providers value the segment for its reliability, minimal invasiveness, and compatibility with routine laboratory tests. Government health programs and preventive care initiatives targeting heart health support continued growth. Patient awareness campaigns and early diagnosis requirements also enhance adoption.

The infectious diseases segment is projected to grow at the fastest CAGR of 11.5% during the forecast period, driven by rising outbreaks and the growing need for rapid diagnostic testing. Point-of-care blood sampling plays a critical role in monitoring infectious diseases, enabling timely interventions and supporting epidemiological research. Government surveillance programs, public health initiatives, and global efforts to control disease spread further encourage adoption. Portable and minimally invasive devices for infectious disease testing are increasingly preferred in hospitals, clinics, and community health centers. Technological innovations in automated sampling, rapid assays, and decentralized testing models are accelerating market uptake. Increasing awareness among healthcare professionals and patients about early detection and outbreak prevention also fuels segment growth.

- By Technology

On the basis of technology, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into volumetric absorptive microsampling, capillary electrophoresis-based chemical analysis, and others. The volumetric absorptive microsampling segment dominated with a market revenue share of 46.3% in 2024, owing to its high accuracy, minimal invasiveness, and ease of sample storage and transport. This technology allows for precise blood volume collection, reducing errors and improving reliability across diverse test types. Its versatility makes it widely adopted in hospitals, pathology laboratories, and research institutions. The simplicity of operation, along with compatibility with various analytical procedures, supports its widespread utilization. Increasing focus on patient comfort and minimally invasive techniques further reinforces its market dominance. In addition, advancements in device design and sample preservation methods enhance its efficiency and applicability. The availability of standardized kits for routine clinical and research applications strengthens its adoption.

Capillary electrophoresis-based chemical analysis is expected to witness the fastest CAGR of 12.0% from 2025 to 2032, driven by increasing demand for precision analytics and complex biomarker studies in research and clinical laboratories. Technological improvements in capillary electrophoresis instrumentation, automation, and integration with advanced software workflows are fueling growth. Its high-resolution separation capability enables accurate detection of multiple analytes from small blood volumes, making it attractive for proteomics, metabolomics, and molecular diagnostics. Rising investment in pharmaceutical research, contract research organizations, and academic institutions further supports adoption. Continuous innovation in sample throughput, sensitivity, and reliability enhances its appeal. Regulatory approval of newer devices and compatibility with diverse testing protocols also drive market penetration. The method’s suitability for high-precision applications and complex analyses positions it for rapid adoption in specialized laboratories.

- By End User

On the basis of end user, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into hospitals, pathology laboratories, clinics, home care setting, blood banks, research & academic laboratories, and others. Hospitals dominated the market with a revenue share of 49.2% in 2024, owing to high patient volumes, established clinical workflows, and preference for standardized, validated sampling methods. Hospitals benefit from bulk procurement, long-term supplier contracts, and integration with laboratory information systems, ensuring consistent availability. High demand for routine testing, preventive health programs, and diagnostic monitoring drives widespread adoption. The presence of well-trained staff and established protocols facilitates reliable and efficient sample collection. Government healthcare programs and public hospital initiatives further reinforce market dominance. Hospitals also serve as primary testing centers for both inpatient and outpatient services, contributing to sustained demand. Technological compatibility with multiple testing platforms enhances workflow efficiency and reduces operational costs.

Home care settings are expected to register the fastest CAGR of 13.4% during 2025–2032, driven by the rising popularity of home diagnostics, telehealth services, and remote patient monitoring. Easy-to-use devices suitable for self-collection are increasingly adopted by patients, particularly those with chronic conditions or limited mobility. The convenience of conducting tests at home reduces hospital visits, improving patient compliance and engagement. Rising awareness about preventive healthcare and early disease detection further supports growth. Integration with mobile apps and telemedicine platforms enables seamless data transmission to healthcare providers. Manufacturers are designing compact, user-friendly, and safe devices tailored for home use. Government programs promoting remote healthcare solutions and insurance coverage for home diagnostics also stimulate adoption. The combination of convenience, accessibility, and technological support drives rapid expansion in this segment.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific capillary blood collection and sampling devices treatment market is segmented into direct tender, retail sales, and others. The direct tender segment held the largest market revenue share of 52.1% in 2024, owing to bulk procurement by hospitals, government programs, and large diagnostic chains. Strong supplier relationships, long-term contracts, and efficient logistics networks facilitate widespread availability and adoption. Direct tenders enable standardized supply of devices across multiple healthcare facilities, ensuring consistent quality and reliability. High-volume orders reduce per-unit costs, further reinforcing market preference. Government healthcare initiatives and public health programs contribute significantly to segment dominance. Hospitals and large diagnostic laboratories rely on direct tender procurement for predictable supply and operational efficiency. The segment also benefits from regulatory approvals and compliance support, ensuring smooth market operations.

Retail sales are projected to witness the fastest CAGR of 10.8% from 2025 to 2032, fueled by the growing adoption of e-commerce, expanding pharmacy networks, and increasing demand for home-based testing solutions. Consumers prefer retail channels for convenience, accessibility, and immediate product availability. Rising awareness of preventive healthcare and self-monitoring practices drives retail sales growth. Manufacturers are increasingly offering consumer-friendly kits optimized for easy use, contributing to adoption. The expansion of online marketplaces, pharmacy chains, and point-of-sale outlets further facilitates market penetration. Retail channels enable rapid product rollout, catering to individual users and smaller healthcare facilities. Marketing campaigns and awareness programs support consumer confidence in home testing solutions. The segment’s flexibility, accessibility, and focus on patient convenience are key factors driving accelerated growth.

Capillary Blood Collection and Sampling Devices Treatment Market Regional Analysis

- The Asia-Pacific capillary blood collection and sampling devices treatment market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising healthcare awareness, technological advancements, and government initiatives promoting digital healthcare solutions

- The region’s expanding healthcare infrastructure, rising demand for efficient and accurate blood sampling, and increasing adoption of point-of-care and home healthcare services are major factors contributing to market growth

- Furthermore, Asia-Pacific is emerging as a key manufacturing hub for capillary blood collection and sampling devices, enhancing affordability and accessibility across hospitals, clinics, and home care settings

Japan Capillary Blood Collection and Sampling Devices Treatment Market Insight

The Japan capillary blood collection and sampling devices treatment market is gaining momentum due to rapid urbanization, a technologically advanced healthcare ecosystem, and a strong focus on patient-centric care. Increasing demand for convenient, safe, and reliable blood sampling solutions is driving adoption in hospitals, clinics, and diagnostic centers. Japan’s aging population is expected to significantly boost demand for user-friendly devices suitable for both clinical and home healthcare settings. Moreover, collaborations between domestic healthcare providers and international manufacturers are enabling the introduction of advanced, automated sampling technologies. The Japanese market also emphasizes stringent quality standards and regulatory compliance, ensuring safe and accurate diagnostic outcomes.

China Capillary Blood Collection and Sampling Devices Treatment Market Insight

The China capillary blood collection and sampling devices treatment market dominated the Asia-Pacific market with the largest revenue share of 37.8% in 2024, driven by rapidly expanding healthcare infrastructure, widespread adoption of advanced diagnostic technologies, and strong government support for healthcare modernization. Leading domestic manufacturers and partnerships with global healthcare companies have strengthened China’s market leadership. The country’s expanding middle class, high demand for efficient clinical workflows, and rapid urbanization are fueling the adoption of capillary blood collection and sampling devices across hospitals, diagnostic centers, and home healthcare settings. Government initiatives promoting digital health and point-of-care testing further support market expansion.

India Capillary Blood Collection and Sampling Devices Treatment Market Insight

The India capillary blood collection and sampling devices treatment market is expected to be the fastest-growing country in the region from 2025 to 2032, driven by increasing healthcare awareness, expansion of private healthcare facilities, and growing demand for affordable blood sampling solutions. Government initiatives, such as the National Digital Health Mission, are encouraging the adoption of digital and automated diagnostic tools. Rising home healthcare services, collaborations between domestic and international manufacturers, and the availability of cost-effective devices are further accelerating market growth. Increasing investments in rural healthcare infrastructure and diagnostic capabilities also contribute to India’s rapid adoption of capillary blood collection and sampling technologies.

Capillary Blood Collection and Sampling Devices Treatment Market Share

The capillary blood collection and sampling devices treatment industry is primarily led by well-established companies, including:

- BD (U.S.)

- TERUMO Corporation (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Cardinal Health (U.S.)

- Owen Mumford Ltd (U.K.)

- Abbott Laboratories (U.S.)

- Nipro Corporation (Japan)

- Greiner Bio-One International GmbH (Austria)

- SARSTEDT AG & Co. KG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- CML Biotech (India)

- Narang Medical Limited (India)

- Hindustan Syringes & Medical Devices Ltd (India)

- Sparsh Mediplus (India)

- B. Braun SE (Germany)

Latest Developments in Asia-Pacific Capillary Blood Collection and Sampling Devices Treatment Market

- In March 2023, Greiner Bio-One introduced an innovative capillary blood collection device designed to enhance patient comfort and improve sample quality. This launch aimed to address the growing demand for safer and more efficient blood collection methods in the Asia-Pacific region

- In June 2023, Terumo Corporation expanded its product portfolio by launching a new line of capillary blood collection devices tailored for pediatric and geriatric patients. This development was part of Terumo's strategy to cater to the specific needs of these patient demographics in the Asia-Pacific market

- In September 2023, SARSTEDT AG & Co. announced the expansion of its manufacturing facility in Singapore to meet the increasing demand for capillary blood collection devices in the Asia-Pacific region. This move was expected to enhance the company's production capacity and distribution efficiency

- In December 2023, Nipro Corporation unveiled a next-generation capillary blood collection device featuring advanced safety mechanisms. The product was designed to minimize the risk of needlestick injuries, aligning with the company's commitment to improving healthcare safety standards

- In February 2024, BD (Becton, Dickinson and Company) launched a new capillary blood collection device equipped with an integrated safety feature to prevent accidental needle sticks. This innovation aimed to enhance safety protocols in clinical settings across the Asia-Pacific region

- In May 2024, Greiner Bio-One announced a strategic partnership with a leading healthcare provider in India to distribute its capillary blood collection devices. This collaboration was expected to strengthen Greiner Bio-One's presence in the Indian market and improve access to advanced diagnostic tools

- In August 2024, Terumo Corporation received regulatory approval for its new capillary blood collection device in Australia. The approval marked a significant milestone in Terumo's efforts to expand its product offerings in the Asia-Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.