Asia Pacific Cardiac Computed Tomography Cct Market

Market Size in USD Million

CAGR :

%

USD

582.17 Million

USD

978.05 Million

2025

2033

USD

582.17 Million

USD

978.05 Million

2025

2033

| 2026 –2033 | |

| USD 582.17 Million | |

| USD 978.05 Million | |

|

|

|

|

Asia-Pacific Cardiac Computed Tomography (CCT) Market Size

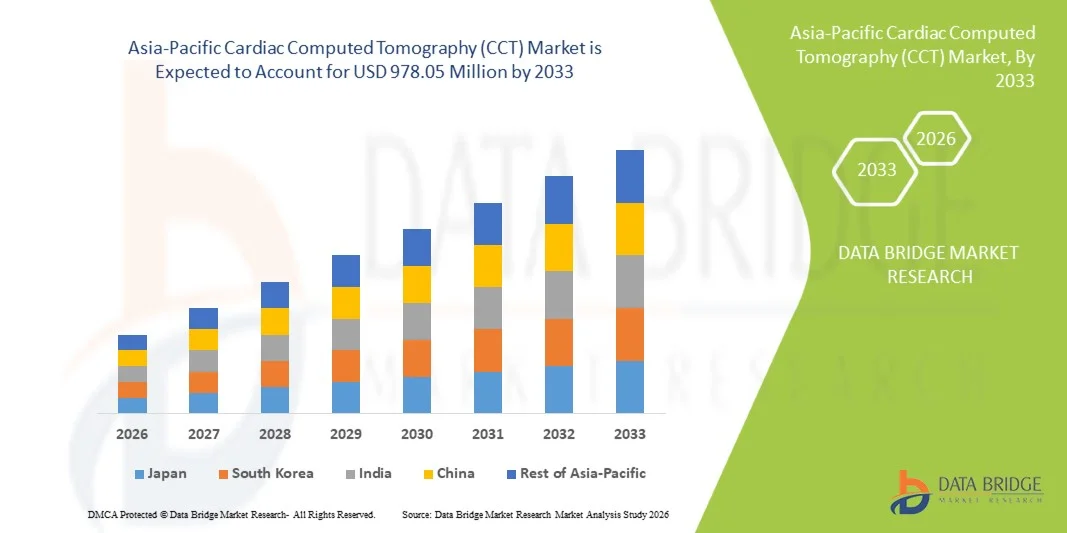

- The Asia-Pacific Cardiac Computed Tomography (CCT) market size was valued at USD 582.17 million in 2025 and is expected to reach USD 978.05 million by 2033, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases, expanding aging population, and rapid adoption of advanced diagnostic imaging technologies across hospitals and diagnostic centers in the region

- Furthermore, increasing awareness about early and non-invasive cardiac diagnostics, along with growing healthcare investments and improvements in medical infrastructure, is positioning CCT as a preferred modality for accurate cardiac assessment. These converging factors are accelerating the uptake of cardiac CT solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Cardiac Computed Tomography (CCT) Market Analysis

- Cardiac computed tomography (CCT), providing non-invasive and high-resolution imaging for detailed evaluation of coronary arteries and cardiac anatomy, is increasingly adopted across major Asia-Pacific countries as a critical diagnostic modality for cardiovascular disease management

- The escalating demand for CCT is primarily driven by the rising incidence of cardiovascular diseases, expanding elderly population, growing preference for non-invasive cardiac diagnostics, and continuous technological advancements in CT imaging systems across key national healthcare markets

- China dominated the Asia-Pacific CCT market with an estimated revenue share of 34.2% in 2025, supported by large patient volumes, rapid expansion of hospital infrastructure, and strong government investments in advanced diagnostic imaging, with widespread deployment of cardiac CT systems in tertiary and urban hospitals

- India is expected to be the fastest growing country in the Asia-Pacific cardiac computed tomography market during the forecast period driven by improving access to advanced cardiac care, increasing adoption of preventive cardiac screening, and rising investments in private diagnostic and multi-specialty hospital chains

- System segment dominated the cardiac computed tomography market across Asia-Pacific countries with a market share of 60.5% in 2025, driven by high capital investments in advanced CT scanners and growing demand for accurate, high-throughput cardiac imaging solutions at the country level

Report Scope and Asia-Pacific Cardiac Computed Tomography (CCT) Market Segmentation

|

Attributes |

Asia-Pacific Cardiac Computed Tomography (CCT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Cardiac Computed Tomography (CCT) Market Trends

“Rising Integration of AI and Advanced Imaging Software”

- A significant and accelerating trend in the Asia-Pacific cardiac computed tomography (CCT) market is the increasing integration of artificial intelligence (AI) and advanced post-processing software to enhance diagnostic accuracy, workflow efficiency, and clinical decision-making in cardiac imaging

- For instance, leading imaging vendors are embedding AI-driven algorithms into cardiac CT systems to enable automated coronary artery segmentation, plaque characterization, and faster image reconstruction, supporting high patient throughput in busy hospitals

- AI integration in CCT enables features such as improved motion correction, automated calcium scoring, and rapid detection of coronary artery disease, reducing interpretation time and inter-observer variability. For instance, AI-powered software solutions are increasingly used to assist clinicians in identifying complex cardiac anomalies and generating standardized diagnostic reports

- The seamless integration of CCT systems with hospital information systems and advanced visualization platforms allows centralized data access, enabling cardiologists and radiologists to efficiently manage imaging workflows alongside other diagnostic modalities

- This trend toward more intelligent, precise, and interconnected cardiac imaging solutions is reshaping clinical expectations for non-invasive cardiac diagnostics. Consequently, manufacturers are focusing on developing AI-enabled cardiac CT platforms tailored to the growing diagnostic demands of Asia-Pacific healthcare systems

- The demand for CCT systems offering advanced AI-driven imaging and analysis capabilities is growing rapidly across hospitals and diagnostic centers, as healthcare providers increasingly prioritize accuracy, speed, and scalability in cardiac care delivery

- Increasing collaboration between imaging vendors and healthcare providers to localize software solutions for regional clinical needs is further strengthening technology adoption across Asia-Pacific

Asia-Pacific Cardiac Computed Tomography (CCT) Market Dynamics

Driver

“Growing Burden of Cardiovascular Diseases and Demand for Non-Invasive Diagnostics”

- The increasing prevalence of cardiovascular diseases across Asia-Pacific countries, coupled with the rising need for early and accurate diagnosis, is a major driver fueling demand for cardiac computed tomography systems

- For instance, national healthcare initiatives in countries such as China and India are emphasizing early detection of coronary artery disease, encouraging hospitals to invest in advanced non-invasive imaging technologies including CCT

- As clinicians and patients increasingly prefer non-invasive diagnostic procedures over conventional invasive angiography, CCT offers high diagnostic accuracy, reduced patient risk, and faster turnaround times, making it a compelling choice for cardiac assessment

- Furthermore, expanding healthcare infrastructure and rising healthcare expenditure across emerging Asia-Pacific economies are supporting the adoption of advanced cardiac imaging equipment in tertiary and secondary care facilities

- The ability of CCT to support applications such as coronary CT angiography, calcium scoring, and pre-procedural planning is significantly enhancing its clinical value, driving adoption across both public and private healthcare settings

- Rising awareness of preventive cardiology and routine cardiac screening among urban populations is further accelerating utilization of cardiac CT scans

- The increasing number of private multi-specialty hospitals and diagnostic chains across Asia-Pacific is also contributing to higher demand for advanced CCT systems

Restraint/Challenge

“High Capital Costs and Limited Access in Developing Healthcare Systems”

- The high capital investment required for acquiring and maintaining advanced cardiac CT systems poses a significant challenge to market expansion, particularly in developing Asia-Pacific countries with constrained healthcare budgets

- For instance, smaller hospitals and diagnostic centers in emerging markets often face financial limitations that restrict their ability to adopt high-end CCT systems despite growing clinical demand

- In addition, the requirement for specialized infrastructure, skilled radiologists, and trained technologists to operate and interpret cardiac CT scans further limits widespread adoption, especially in rural and semi-urban regions

- Regulatory approval processes and varying reimbursement policies across Asia-Pacific countries can also slow system deployment and reduce return on investment for healthcare providers

- Overcoming these challenges through cost-effective system offerings, expanded training programs, and supportive government policies will be essential to ensure sustained growth of the Asia-Pacific cardiac computed tomography market

- Limited availability of standardized cardiac CT training programs across several Asia-Pacific countries continues to impact optimal utilization of installed systems

- Uneven distribution of advanced imaging facilities between urban and rural areas further restricts equitable access to cardiac CT diagnostics

Asia-Pacific Cardiac Computed Tomography (CCT) Market Scope

The market is segmented on the basis of offerings, product type, application, end user, and distribution channel.

- By Offerings

On the basis of offerings, the Asia-Pacific CCT market is segmented into system, service, and software. The system segment dominated the market in 2025 with a market share of 60.5%, driven by high demand for advanced cardiac CT scanners in tertiary hospitals and large diagnostic centers. Hospitals are prioritizing capital investment in high-performance imaging systems to handle rising patient volumes and complex cardiac diagnostics. Replacement of legacy CT equipment with cardiac-optimized systems is further strengthening the system segment. Government healthcare infrastructure programs and modernization initiatives also contribute significantly to system adoption. Hospitals are increasingly integrating CCT systems into their broader imaging workflows for improved efficiency and patient management.

The software segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by growing adoption of AI-driven image analysis, automated reporting, and workflow optimization tools. These software solutions improve diagnostic accuracy, reduce radiologist workload, and enable faster clinical decision-making. Increasing focus on precision diagnostics and digital healthcare transformation is further driving software adoption across Asia-Pacific hospitals and diagnostic centers.

- By Product Type

On the basis of product type, the Asia-Pacific CCT market is segmented into single source CT, dual source cardiac CT, and spectral CT. The dual source cardiac CT segment held the largest market share in 2025, owing to its superior temporal resolution and ability to capture high-quality images in patients with irregular or high heart rates. These systems are widely used for coronary CT angiography and complex cardiac assessments. Their proven clinical reliability and strong vendor support across hospitals reinforce market leadership. Dual source CT systems also support advanced applications such as pre-procedural planning and device implantation. Widespread adoption in tertiary hospitals and teaching institutions continues to strengthen dominance.

The spectral CT segment is expected to grow at the fastest rate during the forecast period, driven by its ability to provide enhanced tissue characterization, improved plaque differentiation, and reduced image artifacts. Spectral CT adoption is rising in technologically advanced hospitals and research centers due to the growing need for functional cardiac imaging. Increasing clinical interest in advanced diagnostic applications and personalized treatment planning is further accelerating growth.

- By Application

On the basis of application, the Asia-Pacific CCT market is segmented into calcium scoring, coronary CT angiography, device implantation, pulmonary vein isolation, and left atrial appendage occlusion. The coronary CT angiography segment dominated the market in 2025, as it is the most widely used non-invasive diagnostic method for coronary artery disease. Its high diagnostic accuracy, reduced procedural risk, and faster scan times compared to invasive angiography drive adoption. Increasing guideline support and clinician confidence further strengthen this segment. Rising patient awareness of early cardiac disease detection is boosting utilization. Coronary CT angiography is widely integrated into hospital workflows for cardiac risk assessment and interventional planning.

The calcium scoring segment is projected to witness the fastest growth from 2026 to 2033, driven by growing preventive cardiology initiatives and routine cardiac screening programs. Increasing awareness of cardiovascular risk factors among urban populations is encouraging early adoption. Expanding inclusion in health check-up packages and government-sponsored screening programs supports rapid growth. Calcium scoring is also being integrated with AI-based risk assessment tools, enhancing its clinical value.

- By End User

On the basis of end user, the Asia-Pacific CCT market is segmented into hospitals, specialty centers, diagnostic & imaging centers, and others. The hospitals segment accounted for the largest market share in 2025, supported by high patient volumes, advanced cardiac care infrastructure, and availability of skilled cardiologists and radiologists. Tertiary and multi-specialty hospitals are primary adopters of advanced CCT systems. Integration of cardiac CT into clinical workflows and treatment planning strengthens hospital dominance. Public and private hospital expansions across Asia-Pacific continue to drive system installations. Hospitals also benefit from vendor-supported service contracts and financing options for high-end systems.

The diagnostic & imaging centers segment is expected to grow at the fastest rate during the forecast period, driven by rising demand for cost-effective outpatient cardiac imaging services. Private diagnostic chains and imaging centers are expanding rapidly across urban regions. Shorter turnaround times and accessibility for preventive check-ups make these centers attractive. Increasing referrals from cardiologists and healthcare providers support faster adoption. Expansion into tier-2 and tier-3 cities is further boosting growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific CCT market is segmented into direct tender and third-party distributor. The direct tender segment dominated the market in 2025, due to large-scale procurement by government hospitals and public healthcare institutions. Centralized tendering ensures standardized pricing, long-term service agreements, and consistent system deployment across hospital networks. Public healthcare expansion projects heavily rely on direct tenders for bulk equipment procurement. Government-supported funding for advanced diagnostic imaging reinforces dominance. Direct tendering also facilitates easier maintenance contracts and system upgrades.

The third-party distributor segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing penetration into smaller hospitals, private clinics, and diagnostic centers. Distributors provide localized sales, technical support, and after-sales service, enabling faster adoption of CCT systems. Their reach is particularly important in emerging markets with fragmented healthcare infrastructure. Rising partnerships between vendors and distributors enhance accessibility and adoption in semi-urban and rural regions.

Asia-Pacific Cardiac Computed Tomography (CCT) Market Regional Analysis

- China dominated the Asia-Pacific CCT market with an estimated revenue share of 34.2% in 2025, supported by large patient volumes, rapid expansion of hospital infrastructure, and strong government investments in advanced diagnostic imaging, with widespread deployment of cardiac CT systems in tertiary and urban hospitals

- Hospitals and diagnostic centers across major urban regions are heavily investing in dual source and spectral CT systems to improve diagnostic accuracy and patient throughput

- Widespread adoption is supported by government initiatives promoting preventive healthcare, large-scale cardiac screening programs, and rising awareness of early detection of coronary artery disease. The availability of skilled cardiologists and radiologists, combined with collaborations between imaging vendors and healthcare providers, further strengthens China’s dominance in the market

The China Cardiac Computed Tomography (CCT) Market Insight

The China Cardiac Computed Tomography (CCT) market captured the largest revenue share of 34.2% in 2025 within Asia-Pacific, fueled by rapid expansion of healthcare infrastructure and rising prevalence of cardiovascular diseases. Hospitals and diagnostic centers are investing heavily in dual source and spectral CT systems to enhance diagnostic accuracy and patient throughput. The growing adoption of AI-enabled imaging software and integration with hospital workflows is driving efficiency in cardiac care. Government initiatives promoting preventive cardiology and early cardiac screening programs further support market growth. Urbanization and rising healthcare spending are encouraging both public and private hospitals to procure advanced CCT systems. China’s position as a manufacturing hub for imaging equipment also improves affordability and accessibility, reinforcing market dominance.

Japan Cardiac Computed Tomography (CCT) Market Insight

The Japan Cardiac Computed Tomography (CCT) market is projected to grow at a substantial CAGR during the forecast period, driven by the country’s advanced healthcare system and increasing focus on preventive cardiology. High adoption of dual source and spectral CT systems in tertiary hospitals and specialty centers supports accurate coronary artery disease assessment. AI-enabled CCT software for automated image reconstruction and workflow optimization is increasingly being integrated into hospital operations. Rising awareness of cardiovascular risk and aging population are fueling demand for non-invasive cardiac imaging. Government healthcare initiatives and reimbursement policies promote early diagnosis and treatment planning. Japan’s technologically advanced hospital networks continue to adopt cutting-edge cardiac CT solutions for complex cardiac procedures.

India Cardiac Computed Tomography (CCT) Market Insight

The India Cardiac Computed Tomography (CCT) accounted for the largest revenue share in South Asia in 2025, attributed to rapid urbanization, increasing incidence of cardiovascular diseases, and high adoption of advanced imaging technologies. Private hospitals and diagnostic chains are expanding cardiac imaging infrastructure to meet growing patient demand. Government initiatives promoting smart hospitals and digital healthcare adoption are boosting the procurement of dual source and spectral CT systems. Rising health awareness and preventive cardiac check-ups are driving non-invasive coronary CT angiography and calcium scoring. Affordability of cardiac CT systems and availability of vendor support are encouraging adoption in tier-2 and tier-3 cities. India’s growing healthcare investment, combined with expanding private diagnostic networks, positions it as a key contributor to the regional market.

Australia Cardiac Computed Tomography (CCT) Market Insight

The Australia Cardiac Computed Tomography (CCT) market is expected to grow at a steady CAGR during the forecast period, driven by increasing cardiovascular disease prevalence and high adoption of advanced imaging technologies in hospitals. Tertiary hospitals and diagnostic centers are investing in dual source and spectral CT systems to improve patient outcomes and workflow efficiency. Government healthcare programs and reimbursement policies promote early cardiac diagnostics and preventive care. Integration of AI-enabled CCT software for automated reporting is enhancing diagnostic accuracy and radiologist productivity. Urban hospitals and private diagnostic centers are expanding cardiac imaging services to cater to growing patient volumes. Strong clinical infrastructure and technological readiness support sustained adoption of advanced cardiac CT solutions.

Asia-Pacific Cardiac Computed Tomography (CCT) Market Share

The Asia-Pacific Cardiac Computed Tomography (CCT) industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Neusoft Medical Systems Co., Ltd. (China)

- United Imaging Healthcare (China)

- Shimadzu Corporation (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- FUJIFILM Healthcare Corporation (Japan)

- Hitachi High-Tech Corporation (Japan)

- Mindray Medical International Limited (China)

- Shenzhen Anke High-Tech Co., Ltd. (China)

- Carestream Health (U.S.)

- Analogic Corporation (U.S.)

- NeuroLogica Corp. (U.S.)

- Agfa HealthCare (Belgium)

- Planmed Oy (Finland)

- Cybermed Inc. (South Korea)

- Unison Healthcare Group (Taiwan)

- Shanghai United Imaging Healthcare Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Cardiac Computed Tomography (CCT) Market?

- In September 2025, Medscan Merrylands in Australia began clinical use of the NAEOTOM Alpha.Pro photon‑counting CT scanner, a breakthrough CT technology offering high‑resolution cardiac imaging at lower radiation doses, particularly beneficial for patients with heavy arterial calcification or irregular heart rhythms

- In August 2025, Samsung India, together with its subsidiary NeuroLogica, launched a portfolio of next‑generation mobile CT systems (including models such as OmniTom Elite PCD) in India designed to deliver advanced imaging capabilities expanding accessibility to CT‑based cardiac and other diagnostics in diverse healthcare settings without extensive infrastructure

- In May 2025, Singapore’s major cardiac imaging institutions National Heart Centre Singapore (NHCS), National University Hospital, and Tan Tock Seng Hospital progressed to deploy SENSE, an AI‑driven cardiac imaging interpretation system that can process large cardiac CT datasets in minutes, significantly improving early coronary artery disease detection and workflow efficiency

- In April 2025, Gleneagles Hospital Penang in Malaysia introduced the SOMATOM Pro.Pulse Dual Source CT scanner, marking the first deployment of this dual‑source CT technology in Southeast Asia to deliver faster, more accurate diagnostics with AI‑powered personalization for patients with irregular heart rhythms or difficulty remaining still

- In January 2025, Royal Philips launched its AI‑enabled CT 5300 system at the 23rd Asian Oceanian Congress of Radiology (AOCR) 2025 — a next‑generation CT scanner equipped with advanced AI reconstruction, cardiac motion correction, and smart workflows designed to improve diagnostic confidence and efficiency across cardiac and other clinical imaging applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.