Asia Pacific Cell And Gene Therapy Thawing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

3.41 Billion

2025

2033

USD

1.18 Billion

USD

3.41 Billion

2025

2033

| 2026 –2033 | |

| USD 1.18 Billion | |

| USD 3.41 Billion | |

|

|

|

|

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Size

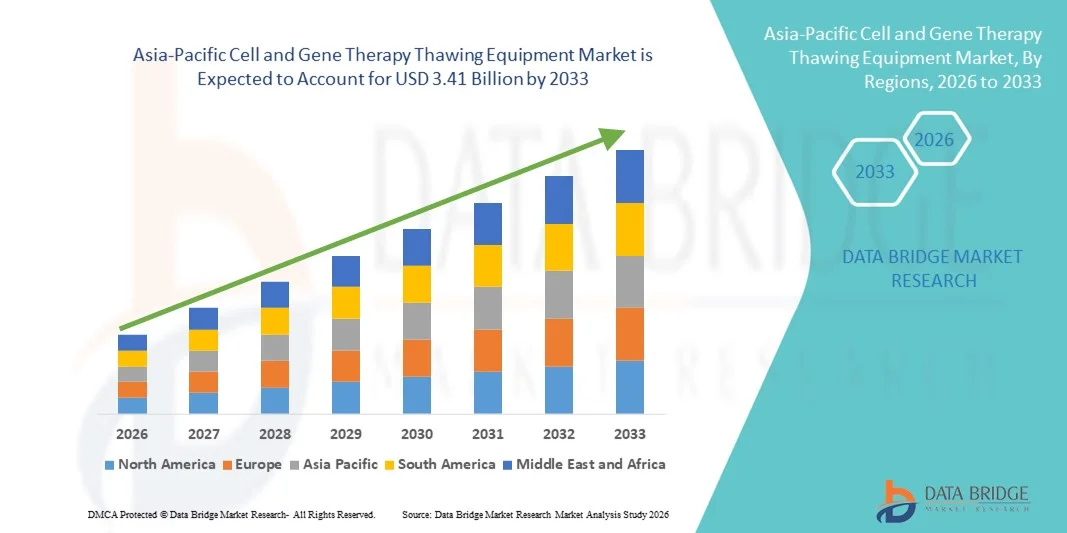

- The Asia-Pacific cell and gene therapy thawing equipment market size was valued at USD 1.18 billion in 2025 and is expected to reach USD 3.41 billion by 2033, at a CAGR of 14.20% during the forecast period

- The market growth is largely fueled by the rapid expansion of cell and gene therapy research and commercialization, along with continuous technological advancements in controlled thawing systems, leading to improved temperature precision, reduced cell damage, and enhanced process standardization across clinical and commercial manufacturing settings

- Furthermore, rising demand for safe, reliable, and GMP-compliant thawing solutions in biopharmaceutical manufacturing and clinical laboratories is positioning cell and gene therapy thawing equipment as a critical component of modern regenerative medicine workflows, thereby significantly boosting the overall growth of the Cell and Gene Therapy Thawing Equipment market

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Analysis

- Cell and gene therapy thawing equipment, designed to ensure controlled, uniform, and contamination-free thawing of cryopreserved biological materials, is becoming an essential component across clinical, research, and commercial cell therapy workflows due to its role in maintaining cell viability and product integrity

- The escalating demand for cell and gene therapy thawing equipment is primarily driven by the rapid expansion of cell and gene therapy pipelines, increasing clinical trial activity, and growing adoption of automated, GMP-compliant bioprocessing solutions to support scalable and reproducible manufacturing

- China dominated the cell and gene therapy thawing equipment market with the largest revenue share of approximately 38.6% in 2025, supported by strong government funding for regenerative medicine, rapid expansion of biopharmaceutical manufacturing capacity, increasing domestic cell therapy approvals, and the presence of a growing number of local and international therapy developers

- India is expected to be the fastest-growing country in the cell and gene therapy thawing Equipment market during the forecast period, driven by rising investments in biopharma R&D, expanding clinical trial activity, growth of contract development and manufacturing organizations (CDMOs), and increasing adoption of advanced cell therapy technologies across academic and private healthcare institutions

- The cell therapies segment accounted for the largest market revenue share of 61.7% in 2025, driven by the growing number of approved cell-based therapies

Report Scope and Cell and Gene Therapy Thawing Equipment Market Segmentation

|

Attributes |

Cell and Gene Therapy Thawing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Trends

Advancements in Controlled and Automated Thawing Technologies

- A prominent and accelerating trend in the global gene therapy thawing equipment market is the growing adoption of automated and precisely controlled thawing systems designed to maintain cell and vector viability during post-cryopreservation handling. As gene therapies rely heavily on temperature-sensitive viral vectors and modified cells, consistent and reproducible thawing has become a critical requirement in both clinical and commercial settings

- Manufacturers are increasingly focusing on closed-system and water-free dry thawing technologies, which minimize contamination risks and ensure uniform heat transfer

- For instance, Sartorius has promoted dry thawing solutions for cell and gene therapy workflows to replace conventional water baths, while Cytiva’s TheraCube and related controlled thawing platforms are increasingly used by CDMOs to support GMP-compliant viral vector and cell handling processes, reducing cross-contamination risks and operator-dependent variability

- The integration of real-time temperature monitoring, programmable thawing profiles, and data logging capabilities is further enhancing process control and traceability. These features allow laboratories and biopharmaceutical companies to standardize thawing protocols across multiple sites, ensuring consistent product quality during clinical trials and commercial-scale production

- In addition, the increasing shift toward point-of-care and decentralized manufacturing models is driving demand for compact, portable, and easy-to-operate thawing equipment. Such systems are particularly valuable in hospital pharmacies and clinical centers where gene therapies are prepared immediately prior to patient administration

- This trend toward safer, faster, and more reproducible thawing solutions is reshaping operational standards across the gene therapy workflow, encouraging continuous innovation by equipment manufacturers to meet the evolving needs of advanced biologics production

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Dynamics

Driver

Rising Demand Driven by Rapid Growth of Gene Therapy Development and Commercialization

- The rapid expansion of gene therapy research, clinical trials, and regulatory approvals is a major driver of the gene therapy thawing equipment market. As an increasing number of gene therapies progress from early-stage development to late-stage trials and commercial launch, the need for reliable and standardized thawing solutions is intensifying

- For instance, the commercialization of FDA-approved gene therapies such as Zolgensma and Luxturna has increased demand for tightly controlled cold-chain handling and thawing systems across hospitals and specialty treatment centers, prompting manufacturers and CDMOs to adopt validated thawing equipment to protect high-value therapies prior to patient administration

- Gene therapies often involve high-value, temperature-sensitive materials such as viral vectors and genetically modified cells, making precise thawing essential to preserve therapeutic efficacy and patient safety. This has led biopharmaceutical companies and contract development and manufacturing organizations (CDMOs) to invest in specialized thawing equipment that supports consistent and validated workflows

- The growing prevalence of genetic disorders, oncology indications, and rare diseases is further accelerating demand for gene therapies, indirectly boosting the adoption of advanced thawing systems across research institutes, manufacturing facilities, and clinical centers

- In addition, increasing funding from governments and private investors to support advanced therapy medicinal products (ATMPs) is strengthening infrastructure development, thereby driving procurement of dedicated gene therapy processing equipment, including thawing systems

Restraint/Challenge

High Equipment Costs and Limited Standardization Across Facilities

- The relatively high cost of specialized gene therapy thawing equipment remains a key challenge, particularly for small biotechnology firms, academic research laboratories, and emerging market players. Compared to conventional thawing methods, advanced automated systems require higher upfront investment, which can limit adoption among cost-sensitive users

- For instance, small biotech startups and early-stage academic spin-offs often continue using manual or semi-automated thawing approaches due to the high capital cost of GMP-compliant dry thawing systems, which can be difficult to justify before therapies advance into late-stage clinical trials or commercialization

- In addition, the lack of universal standardization in thawing protocols across different gene therapy products and manufacturing platforms complicates equipment selection and implementation. Variability in container formats, volumes, and temperature requirements often necessitates customized solutions, increasing operational complexity

- Training requirements and integration challenges within existing manufacturing workflows can also act as barriers, especially for facilities transitioning from traditional cryogenic handling methods to fully automated systems

- To overcome these challenges, manufacturers are focusing on developing scalable, versatile, and cost-efficient thawing platforms, along with enhanced user training and validation support. Addressing affordability and interoperability will be critical for enabling broader adoption and sustaining long-term market growth

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Scope

The market is segmented on the basis of modality, sample, type, application, end user, and distribution channel.

- By Modality

On the basis of modality, the Cell and Gene Therapy Thawing Equipment market is segmented into benchtop and portable systems. The benchtop segment dominated the market with a revenue share of 58.4% in 2025, driven by its widespread use in controlled laboratory and clinical environments. Benchtop systems offer high precision, temperature uniformity, and reproducibility, which are critical for maintaining cell viability during thawing. These systems are extensively adopted in hospitals, blood banks, and pharmaceutical manufacturing facilities. Their compatibility with GMP-compliant workflows further strengthens demand. Benchtop units support high-volume processing, making them suitable for large-scale clinical trials. Integration with automated cell processing systems enhances operational efficiency. Strong regulatory acceptance also supports dominance. High accuracy reduces contamination risks. Continuous technological upgrades improve reliability. Skilled personnel preference further boosts adoption. Established infrastructure in developed regions reinforces leadership. Overall, reliability and scalability drive dominance.

The portable segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by increasing demand for point-of-care and decentralized therapies. Portable systems offer flexibility for bedside and field applications. Growing adoption of personalized cell therapies fuels demand. These systems enable rapid thawing in emergency and remote settings. Rising use in clinical trials increases uptake. Compact design improves mobility and ease of use. Technological advancements enhance temperature accuracy. Expansion of outpatient treatment centers supports growth. Increased adoption in emerging markets boosts demand. Cost-effectiveness compared to benchtop systems supports penetration. Rising investment in mobile healthcare infrastructure accelerates adoption. Overall, portability and convenience drive strong CAGR growth.

- By Sample

On the basis of sample, the market is segmented into cell therapies and gene therapies. The cell therapies segment accounted for the largest market revenue share of 61.7% in 2025, driven by the growing number of approved cell-based therapies. High demand for CAR-T and stem cell therapies significantly contributes to dominance. Cell therapies require precise thawing to preserve viability and functionality. Increased clinical applications in oncology and regenerative medicine support growth. Rising adoption in hospitals and research centers boosts demand. Strong pipeline of cell therapy products strengthens market share. Frequent use in blood banks further supports dominance. Advanced thawing protocols improve clinical outcomes. Regulatory approvals enhance confidence. Expansion of cell therapy manufacturing facilities increases equipment demand. Investment in automation supports scalability. Collectively, these factors sustain leadership.

The gene therapies segment is projected to grow at the fastest CAGR of 10.1% from 2026 to 2033, driven by rapid advancements in genetic engineering. Increasing approvals for gene-based treatments support demand. Gene therapies require controlled thawing to maintain vector stability. Expanding clinical trial activity fuels adoption. Rising investments in rare disease treatment accelerate growth. Improved thawing solutions enhance safety and efficacy. Growing awareness among clinicians supports uptake. Expansion of gene banks increases equipment use. Partnerships between biotech firms drive innovation. Regulatory support for gene therapy accelerates commercialization. Improved cold-chain logistics further support growth. These trends collectively drive high CAGR.

- By Type

On the basis of type, the market is segmented into manual thawing systems and automatic thawing systems. he automatic thawing systems segment dominated the market with a revenue share of 54.9% in 2025, driven by superior consistency and reduced human error. Automated systems ensure precise temperature control and standardized thawing protocols. High adoption in GMP-compliant facilities supports dominance. These systems reduce contamination risks significantly. Increasing preference for automation in biopharma manufacturing boosts demand. Integration with closed-system processing enhances safety. Reduced labor dependency improves efficiency. High throughput capability supports large-scale production. Strong demand from pharmaceutical companies reinforces leadership. Regulatory bodies favor automated processes. Continuous innovation improves system performance. Overall, automation drives dominance.

The manual thawing systems segment is expected to grow at the fastest CAGR of 8.6% from 2026 to 2033, driven by affordability and simplicity. Manual systems are widely used in small laboratories and academic institutes. Low capital investment supports adoption. Growing research activities in emerging economies boost demand. Flexibility in handling different sample types supports growth. Increasing training programs improve usage accuracy. Adoption in early-stage clinical research supports expansion. Rising number of small biotech startups fuels demand. Easy maintenance supports preference. Portability advantages further enhance use. Growing decentralization of therapy processing supports growth. Collectively, these factors drive CAGR expansion.

- By Application

On the basis of application, the market is segmented into upstream processing and downstream processing. The downstream processing segment held the largest market revenue share of 57.3% in 2025, driven by its critical role in final therapy preparation. Accurate thawing during downstream processing ensures product integrity. Increasing commercialization of cell and gene therapies boosts demand. High dependency on controlled thawing supports dominance. Adoption in manufacturing facilities strengthens revenue share. Stringent quality control requirements enhance equipment use. Advanced downstream workflows require precise temperature management. Rising production volumes increase usage frequency. Regulatory emphasis on consistency supports adoption. Integration with fill-finish operations enhances demand. Strong pharmaceutical investment supports growth. These factors sustain leadership.

The upstream processing segment is anticipated to grow at the fastest CAGR of 9.0% from 2026 to 2033, driven by expanding research activities. Early-stage cell expansion requires reliable thawing. Increasing R&D investment boosts adoption. Growth in academic research supports demand. Technological innovation improves upstream efficiency. Rising number of clinical trials fuels growth. Automation integration enhances scalability. Increased focus on process optimization supports expansion. Growing biotech startup activity boosts demand. Adoption in pilot-scale manufacturing increases usage. Improved reproducibility supports preference. Overall, upstream expansion drives CAGR growth.

- By End User

On the basis of end user, the market is segmented into blood banks and transfusion centers, hospitals and diagnostic laboratories, research laboratories and academic institutes, biotechnology and pharmaceutical industry, cord blood and stem cell banks, gene banks, and others. The biotechnology and pharmaceutical industry segment dominated the market with a revenue share of 36.8% in 2025, driven by large-scale therapy manufacturing. High-volume production requires advanced thawing equipment. Increasing commercial approvals support dominance. Investment in automation enhances efficiency. Strong R&D pipelines drive demand. Global expansion of manufacturing facilities boosts adoption. Regulatory compliance requires precise thawing. High capital availability supports equipment upgrades. Strategic partnerships enhance market position. Increasing outsourcing activities support usage. Continuous process optimization sustains leadership. These factors maintain dominance.

The cord blood and stem cell banks segment is expected to grow at the fastest CAGR of 9.4% from 2026 to 2033, driven by rising awareness of stem cell preservation. Increasing birth rates in emerging regions boost storage demand. Growing use in regenerative medicine supports adoption. Improved thawing technologies enhance cell viability. Government initiatives promote stem cell banking. Expanding private banking facilities fuel growth. Rising medical tourism supports demand. Technological advancements improve operational efficiency. Increasing clinical applications drive usage. Expansion of storage infrastructure supports CAGR. Growing consumer awareness boosts enrollment. These trends drive strong growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third-party distributor, and others. The direct tender segment dominated the market with a revenue share of 48.6% in 2025, driven by bulk procurement by hospitals and pharmaceutical companies. Direct sourcing ensures cost efficiency and quality assurance. Government-funded institutions prefer tender-based procurement. Long-term supply contracts ensure stability. Standardization of equipment supports operational efficiency. Strong supplier-buyer relationships reinforce dominance. Large-scale manufacturing facilities rely on direct procurement. Tender processes support regulatory compliance. Inclusion of service agreements enhances value. Reduced intermediary costs support preference. High-volume purchasing drives dominance. These factors sustain leadership.

The third-party distributor segment is projected to grow at the fastest CAGR of 8.9% from 2026 to 2033, driven by expanding reach in emerging markets. Distributors facilitate access for small and mid-sized facilities. Local presence improves service delivery. Growing private healthcare infrastructure boosts demand. Flexible purchasing options support adoption. Improved logistics enhance availability. Manufacturers benefit from reduced operational burden. Rising healthcare spending supports distributor networks. Increasing number of biotech startups rely on distributors. After-sales support enhances customer retention. Market expansion in remote regions fuels growth. These factors drive strong CAGR expansion.

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Regional Analysis

- The Asia-Pacific cell and gene therapy thawing equipment market is poised to grow at a robust and fastest CAGR during the forecast period, driven by rapid expansion of the biopharmaceutical sector, increasing investments in regenerative medicine, and rising clinical adoption of cell- and gene-based therapies across the region. Countries such as China, India, Japan, and South Korea are witnessing significant growth in advanced therapy research, supported by government funding, improving healthcare infrastructure, and expanding manufacturing capabilities

- The growing number of clinical trials and commercialization of cell and gene therapies is increasing demand for reliable, precise, and contamination-free thawing equipment to ensure product integrity and therapeutic efficacy

- In addition, the emergence of Asia-Pacific as a global hub for biopharmaceutical manufacturing and contract development services is accelerating the adoption of standardized and GMP-compliant thawing solutions across research laboratories, CDMOs, and hospital-based treatment centers

China Cell and Gene Therapy Thawing Equipment Market Insight

China cell and gene therapy thawing equipment market dominated the cell and gene therapy thawing equipment market in the Asia-Pacific region with the largest revenue share of approximately 38.6% in 2025, supported by strong government funding for regenerative medicine and the rapid expansion of biopharmaceutical manufacturing capacity. National initiatives promoting innovation in advanced therapies, along with favorable regulatory reforms, have significantly increased domestic cell and gene therapy approvals, driving higher demand for specialized thawing equipment across manufacturing and clinical settings. The presence of a growing number of local and international therapy developers has further strengthened market growth, as companies seek reliable thawing systems to support viral vector handling, cell processing, and last-mile preparation prior to patient administration. In addition, China’s expanding network of GMP-certified facilities and large patient population with unmet medical needs continues to fuel investments in advanced cell and gene therapy infrastructure, reinforcing the country’s leadership position in the regional market.

India Cell and Gene Therapy Thawing Equipment Market Insight

India cell and gene therapy thawing equipment market is expected to be the fastest-growing country in the cell and gene therapy thawing equipment market during the forecast period, driven by rising investments in biopharmaceutical research and development and a steady increase in clinical trial activity for advanced therapies. The rapid growth of contract development and manufacturing organizations (CDMOs) is playing a crucial role in accelerating demand for standardized and scalable thawing equipment to support both domestic and international therapy developers. Increasing adoption of advanced cell therapy technologies across academic research institutes, private hospitals, and specialty treatment centers is further contributing to market expansion. In addition, supportive government initiatives aimed at strengthening healthcare infrastructure and promoting innovation in biologics manufacturing are improving access to modern processing equipment, including automated and controlled thawing systems. As India continues to position itself as a cost-effective and high-quality destination for cell and gene therapy development, demand for reliable thawing equipment is expected to rise steadily.

Asia-Pacific Cell and Gene Therapy Thawing Equipment Market Share

The Cell and Gene Therapy Thawing Equipment industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- GE HealthCare (U.S.)

- Cytiva (U.S.)

- BioLife Solutions (U.S.)

- Sartorius (Germany)

- Merck KGaA (Germany)

- PHC Holdings Corporation (Japan)

- Panasonic Healthcare (Japan)

- Eppendorf (Germany)

- Helmer Scientific (U.S.)

- B Medical Systems (Luxembourg)

- Brooks Automation (U.S.)

- Asymptote (U.K.)

- MedCision (China)

- Haier Biomedical (China)

Latest Developments in Asia-Pacific Cell and Gene Therapy Thawing Equipment Market

- In March 2023, BioLife Solutions, Inc. introduced an upgraded version of its evo® Smart Thawing System equipped with wireless connectivity and an improved user interface, allowing for remote monitoring and traceability in thawing cryopreserved cell therapies — a key improvement for quality control and compliance in clinical and manufacturing workflows

- In February 2023, Sartorius AG announced a strategic collaboration with a leading European biopharmaceutical company to co-develop a fully closed, automated thawing solution tailored for stem cell-derived therapies, aimed at minimizing contamination risk and improving thaw consistency in advanced therapy manufacturing

- In January 2023, Thermo Fisher Scientific Inc. launched its CryoMed Controlled-Rate Thawing System, designed to ensure consistent thawing of critical biological samples with high reproducibility and support regulatory compliance in clinical research and biopharma thawing workflows

- In April 2025, Thermo Fisher Scientific announced a strategic collaboration with Miltenyi Biotec to integrate automated thawing with cell processing workflows for clinical cell therapies, helping to reduce overall processing time and improve cell viability in advanced therapy production

- In May 2025, Stylus Medicine, a biotech startup focused on advanced therapy manufacturing technologies, raised US USD 85 million in funding — backing initiatives that include innovations around thawing and production workflows that address challenges in cell and gene therapy delivery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.