Asia Pacific Cold Sore Treatment Market

Market Size in USD Million

CAGR :

%

USD

154.13 Million

USD

268.81 Million

2024

2032

USD

154.13 Million

USD

268.81 Million

2024

2032

| 2025 –2032 | |

| USD 154.13 Million | |

| USD 268.81 Million | |

|

|

|

|

Asia-Pacific Cold Sore Treatment Market Size

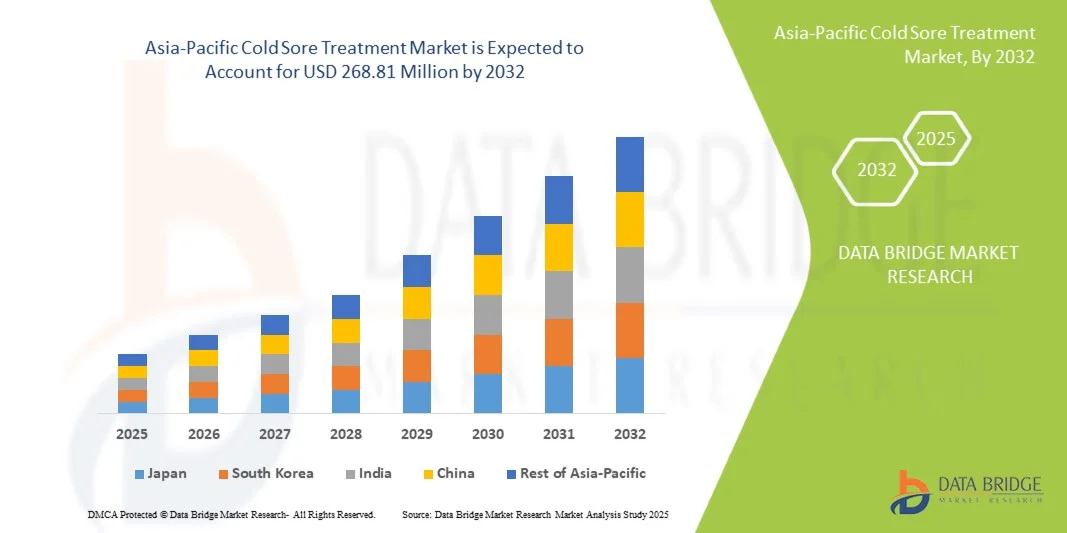

- The Asia-Pacific Cold Sore Treatment Market size was valued at USD 154.13 Million in 2024 and is expected to reach USD 268.81 Million by 2032, at a CAGR of7.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of herpes simplex virus infections and the rising demand for effective antiviral therapies to manage cold sores

- Furthermore, growing awareness of early treatment, availability of over-the-counter and prescription antiviral medications, and innovations in topical and systemic therapies are accelerating the uptake of cold sore treatment solutions, thereby significantly boosting the industry's growth

Asia-Pacific Cold Sore Treatment Market Analysis

- The Asia-Pacific Cold Sore Treatment Market is witnessing significant growth, driven by increasing prevalence of herpes simplex virus infections, rising awareness of early intervention, and demand for effective antiviral therapies in both clinical and at-home settings

- The escalating demand for cold sore treatments is primarily fueled by growing healthcare awareness, adoption of over-the-counter and prescription therapies, and preference for faster healing options

- China dominated the Asia-Pacific Cold Sore Treatment Market with the largest revenue share of 41.5% in 2024, driven by widespread access to advanced healthcare facilities, strong presence of leading pharmaceutical companies, and high patient awareness about effective cold sore therapies. The country also benefits from large-scale distribution networks and rapid adoption of clinically approved antiviral treatments, particularly in urban centers, contributing to substantial market growth

- India is expected to be the fastest growing region in the Asia-Pacific Cold Sore Treatment Market during the forecast period, with a CAGR fueled by increasing urbanization, rising disposable incomes, expansion of healthcare infrastructure, and growing access to both branded and generic antiviral treatments. The rising awareness about cold sore management and the penetration of online pharmacies further accelerate growth in the country

- The Herpes Simplex Type-1 Virus segment dominated the largest market revenue share of 61.5% in 2024, driven by its higher prevalence worldwide and frequent recurrence leading to consistent treatment demand

Report Scope and Asia-Pacific Cold Sore Treatment Market Segmentation

|

Attributes |

Asia-Pacific Cold Sore Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Cold Sore Treatment Market Trends

“Increased Focus on Advanced Therapeutics and Preventive Care”

- A notable trend in the Asia-Pacific Cold Sore Treatment Market is the growing emphasis on advanced therapeutics, including targeted antiviral formulations, as well as preventive and combination therapies that reduce recurrence and severity of outbreaks

- For instance, in March 2023, BioLine Rx announced the expansion of its clinical program for BL-5010, a novel topical antiviral therapy aimed at accelerating cold sore healing and minimizing scarring. Similarly, Dermik Laboratories introduced a combination cream containing antiviral and skin-repair agents to improve efficacy and patient comfort

- Innovations in formulation technologies, such as nanoparticle delivery systems and sustained-release topical gels, are enhancing the bioavailability of antiviral agents, improving treatment outcomes, and reducing dosing frequency. These advancements are fostering higher patient adherence and satisfaction

- The focus on preventive care, including prophylactic topical agents and long-acting antivirals, is transforming treatment paradigms, allowing patients to manage recurrences more effectively and minimizing disruption to daily activities

- The trend toward evidence-based, combination, and patient-friendly formulations is reshaping expectations for cold sore therapies, prompting manufacturers to develop products that offer both rapid relief and long-term protection

- As a result, companies such as Dermik Laboratories and BioLine Rx are investing in R&D to create innovative cold sore treatment solutions with enhanced efficacy, improved safety profiles, and convenience in application, addressing unmet patient needs

- Demand for advanced, effective, and convenient cold sore treatments is steadily increasing across both over-the-counter and prescription segments, reflecting a patient-driven shift toward proactive and high-efficacy care

Asia-Pacific Cold Sore Treatment Market Dynamics

Driver

“Increasing Prevalence of HSV Infections and Patient Awareness”

- The rising global incidence of herpes simplex virus (HSV) infections, coupled with growing patient awareness regarding early treatment and preventive care, is a major driver of the Asia-Pacific Cold Sore Treatment Market

- For instance, in January 2024, Pfizer expanded its antiviral portfolio by launching a new topical acyclovir formulation designed for faster lesion healing and reduced recurrence, enhancing treatment accessibility and effectiveness

- Increasing knowledge of viral triggers, improved diagnostics, and patient education campaigns are encouraging early intervention, which in turn boosts demand for topical and systemic antiviral therapies

- Furthermore, the increasing burden of HSV infections in both developed and emerging economies is prompting healthcare providers to recommend effective cold sore management solutions, thereby expanding market uptake

- The growing preference for convenient, clinically proven, and minimally invasive treatments is driving the adoption of newer antivirals and combination therapies

- Enhanced patient awareness regarding the psychosocial impact of cold sores is also motivating individuals to seek rapid-acting and preventive solutions, further propelling market growth

Restraint/Challenge

“Concerns Regarding Drug Resistance and Treatment Costs”

- The potential for antiviral resistance in HSV strains presents a challenge to long-term efficacy of existing cold sore treatments, which can hinder adoption of certain therapies

- For instance, reports of acyclovir-resistant HSV strains in immunocompromised patients have prompted healthcare providers to consider alternative or combination therapies, increasing complexity in treatment choices

- High treatment costs, especially for advanced formulations or prescription-only combination therapies, can be a barrier for price-sensitive patients in both developed and emerging markets

- While generic antivirals are more accessible, premium products with faster action, improved tolerability, or preventive benefits often carry a higher price point, limiting widespread use

- Addressing drug resistance through continuous R&D, developing cost-effective formulations, and educating patients on appropriate use will be critical to ensure sustained growth and trust in cold sore treatment options

- Overcoming these challenges with innovative therapeutics, better clinical outcomes, and patient-centric approaches is essential for continued expansion of the Asia-Pacific Cold Sore Treatment Market

Asia-Pacific Cold Sore Treatment Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Strain Type

On the basis of strain type, the Asia-Pacific Cold Sore Treatment Market is segmented into Herpes Simplex Type-1 Virus and Herpes Simplex Type-2 Virus. The Herpes Simplex Type-1 Virus segment dominated the largest market revenue share of 61.5% in 2024, driven by its higher prevalence worldwide and frequent recurrence leading to consistent treatment demand. The segment benefits from strong clinical awareness, preventive care strategies, and established antiviral therapies. OTC availability enhances patient accessibility, while prescription treatments maintain physician trust. Government health programs and patient education campaigns further reinforce Type-1 dominance. Research advancements in rapid-acting formulations and improved delivery methods boost adoption. Patient preference for proven, reliable therapies keeps the revenue stable. Public awareness initiatives for hygiene and prevention indirectly support continuous treatment consumption. Type-1 remains a priority for pharmaceutical R&D due to higher market volumes and predictable usage patterns. Strong insurance coverage and reimbursement policies in developed regions also contribute to dominance.

The Herpes Simplex Type-2 Virus segment is expected to witness the fastest CAGR of 9.6% from 2025 to 2032, driven by increasing genital herpes awareness, expanding treatment access, and growing demand for targeted antiviral agents. Rising sexual health education and early screening programs further support growth. Telemedicine adoption improves patient consultation rates, while OTC and prescription integration enhances accessibility. Innovations in combination therapies and long-acting formulations stimulate patient preference. Emerging markets with growing sexual health initiatives contribute to the rapid expansion of this segment. Increased social awareness reduces stigma, encouraging more patients to seek treatment.

• By Therapeutics

On the basis of therapeutics, the market is segmented into Antiviral Agents, Analgesic Agents, and Others. The Antiviral Agents segment dominated with a market share of 57.8% in 2024, driven by superior efficacy in reducing lesion duration, recurrence prevention, and widespread clinical acceptance. Leading agents such as acyclovir, valacyclovir, and famciclovir maintain strong market presence. OTC and prescription formulations increase accessibility and convenience. R&D in rapid-release topical creams and combination products further strengthen market dominance. Physician recommendation and guideline inclusion ensure steady adoption. Continuous patient awareness campaigns increase treatment initiation rates. Insurance coverage and reimbursement policies support higher consumption. Antiviral agents remain preferred for both acute outbreaks and preventive therapy. Clinical data supports long-term safety and efficacy, reinforcing patient trust. Market penetration in developed regions is strong due to well-established distribution networks. Strategic collaborations between pharma companies expand product availability and patient outreach.

The Analgesic Agents segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, supported by rising demand for symptom-relief therapies alongside antivirals. Growing patient preference for combination therapies and OTC options enhances market penetration. Product innovations in cooling gels and topical pain relievers drive adoption. Rising awareness of faster symptom management encourages usage. E-commerce platforms and retail pharmacy availability improve accessibility for patients. Expansion of healthcare programs promoting pain management also supports growth. Increasing collaborations between pharmaceutical companies and healthcare providers further enhance distribution and adoption.

• By Drug Type

On the basis of drug type, the market is segmented into Branded and Generic. The Branded segment held the largest market revenue share of 52.4% in 2024, benefiting from established physician trust, clinical efficacy, and strong marketing presence. Branded products maintain premium pricing and patient loyalty due to proven safety profiles. Continuous product innovation, patient education, and guideline recommendations further reinforce dominance. Wide distribution in hospitals and pharmacies ensures high accessibility. Long-term clinical data supporting efficacy enhances physician confidence. Strategic marketing campaigns and patient awareness programs strengthen brand recall. Branded antivirals also benefit from combination therapy approvals. Premium packaging and patient support programs add value. Branded drugs often enjoy insurance coverage advantages. Physician prescribing behavior favors branded formulations. Global presence of leading brands ensures high penetration in key markets.

The Generic segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by cost-effectiveness, rising insurance coverage, and expanding penetration in emerging markets. Patient preference for affordable treatments encourages adoption. Availability in retail and online pharmacies boosts convenience. Regulatory approvals and patent expirations stimulate generic market growth. Telemedicine integration and e-commerce support faster access. Increasing awareness programs and patient education on generic efficacy further drive adoption. Growing competition among manufacturers also leads to wider availability and competitive pricing, supporting rapid market expansion.

• By Dosage Type

On the basis of dosage type, the market is segmented into Oral, Topical, and Others. The Topical segment dominated with a market share of 48.7% in 2024, due to ease of application, rapid symptom relief, and OTC availability. Patient preference for home-based treatment ensures strong adoption. Dermatology clinics frequently recommend topical antivirals for localized outbreaks. Innovation in fast-acting gels, creams, and patches enhances effectiveness. Marketing campaigns emphasizing convenience and rapid relief strengthen dominance. High patient compliance and low systemic side effects contribute to stable growth. OTC distribution through retail pharmacies ensures wide availability. Formulation improvements in soothing ingredients increase consumer satisfaction. Clinical efficacy reinforces physician trust. Preventive care and early treatment guidelines further boost market share. Consumer awareness about recurring outbreaks supports repeat purchase behavior.

The Oral segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, due to growing usage in recurrent or severe outbreaks. Oral antivirals provide systemic efficacy, improved patient compliance, and compatibility with combination therapies. Extended-release formulations and novel delivery methods contribute to growth. Increasing telemedicine consultations facilitate prescription-based oral treatments. Patient awareness campaigns highlight oral therapy effectiveness. Insurance coverage and reimbursement support faster adoption. Emerging market penetration drives incremental growth.

• By End User

On the basis of end user, the market is segmented into Hospitals, Homecare, Specialty Clinics, and Others. The Hospitals segment held the largest market revenue share of 49.3% in 2024, driven by high patient influx, prescription availability, and integration into clinical protocols. Hospital pharmacies ensure consistent supply, proper monitoring, and adherence to treatment guidelines. Physician recommendations and inpatient care support stable market dominance. Hospitals act as primary distribution hubs in both urban and semi-urban areas. Large-scale treatment adoption is facilitated by insurance coverage. Educational initiatives increase patient compliance. Hospitals also provide outpatient consultation services, extending market penetration. Pharmaceutical partnerships ensure availability of branded and generic options. Recurrent patient treatment plans boost hospital segment revenue. Clinical trials and research collaborations enhance treatment innovation. Hospitals remain central to awareness and early intervention programs.

The Homecare segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, fueled by growing self-medication trends, telemedicine adoption, and home-based management convenience. Rising awareness of cold sore management protocols promotes patient independence. Online pharmacies and home delivery services enhance accessibility. Mobile health apps support adherence to treatment schedules. Awareness campaigns educate patients on early intervention. Chronic and recurrent outbreak management drives growth. Cost-effective at-home therapies appeal to patients. Evolving telehealth regulations expand patient reach. Patient preference for privacy encourages homecare adoption. OTC availability and generic options support segment growth.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Others. The Retail Pharmacy segment dominated with a market share of 45.8% in 2024, due to widespread availability, OTC access, and consumer familiarity. Retail chains improve visibility, convenience, and brand recognition. Pharmacist guidance reinforces safe usage. Marketing initiatives and promotions strengthen sales. Strategic partnerships with pharma companies ensure consistent supply. Urban and semi-urban penetration supports volume growth. Consumer trust and habitual purchases increase repeat sales. Retail distribution allows rapid response to seasonal outbreak trends. Pricing strategies enhance competitive advantage. Accessibility boosts adherence and brand preference. Retail pharmacies act as primary points of care for minor outbreaks. Community awareness programs further encourage adoption.

The Online Pharmacy segment is expected to witness the fastest CAGR of 11.3% from 2025 to 2032, driven by rising e-commerce adoption, home delivery convenience, telehealth integration, and regulatory approvals. Digital channels improve accessibility for semi-urban and rural patients. Online platforms facilitate prescription compliance and chronic care management. Mobile apps, teleconsultations, and delivery tracking enhance patient experience. Competitive pricing and discounts attract wider adoption. Awareness campaigns via digital channels support market penetration. E-prescription acceptance accelerates adoption rates. Patient privacy, convenience, and 24/7 access contribute to growth. Online channels enable combination therapy availability. Emerging markets increasingly rely on digital pharmacies. Homecare integration further supports rapid expansion.

Asia-Pacific Cold Sore Treatment Market Regional Analysis

- The Asia-Pacific Cold Sore Treatment Market is poised to grow at the fastest CAGR of 11.2% during the forecast period of 2025 to 2032

- Driven by increasing urbanization, rising disposable incomes, and expansion of healthcare infrastructure in countries such as China and India. The region’s growing patient awareness and accessibility to both branded and generic antiviral treatments are supporting market growth

- Furthermore, government initiatives and the rapid adoption of clinically approved therapies are enhancing treatment accessibility across urban and semi-urban areas

China Asia-Pacific Cold Sore Treatment Market Insight

The China Asia-Pacific Cold Sore Treatment Market dominated the Asia-Pacific region with the largest revenue share of 41.5% in 2024, attributed to widespread access to advanced healthcare facilities, the strong presence of leading pharmaceutical companies, and high patient awareness about effective cold sore therapies. The country also benefits from large-scale distribution networks and rapid adoption of clinically approved antiviral treatments, particularly in urban centers, contributing to substantial market growth.

India Asia-Pacific Cold Sore Treatment Market Insight

The India Asia-Pacific Cold Sore Treatment Market is expected to be the fastest-growing in the Asia-Pacific region during the forecast period, registering a CAGR .Market growth is fueled by increasing urbanization, rising disposable incomes, expansion of healthcare infrastructure, and growing access to both branded and generic antiviral treatments. In addition, increasing awareness about cold sore management and the penetration of online pharmacies are accelerating adoption across residential and clinical settings.

Asia-Pacific Cold Sore Treatment Market Share

The Cold Sore Treatment industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Johnson & Johnson and its affiliates (U.S.)

- Mundipharma International Ltd. (U.K.)

- Merck & Co., Inc. (U.S.)

- Bayer AG (Germany)

- Dr. Reddy’s Laboratories Ltd. (India)

- Cipla Limited (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

Latest Developments in Asia-Pacific Cold Sore Treatment Market

- In August 2024, Linpharma announced the launch of Lyranda, a novel cold sore treatment in the U.S. market. Lyranda is a convenient, pleasant-tasting lozenge designed to reduce healing time compared to other popular remedies

- In April 2024, Merix Pharmaceutical Corp introduced RELEEV 1 Day Cold Sore Treatment at the NACS Show. This clinically proven topical treatment claims to heal cold sores in as little as one day, easing pain within minutes and alleviating all symptoms within 24 hours

- In April 2024, a team from Southern Illinois University Edwardsville launched Helocaine, an over-the-counter treatment for cold sores, minor cuts, minor burns, and insect bites. Helocaine provides effective pain relief for various skin irritations

- In November 2024, Julie, a healthcare brand, introduced a cold sore treatment aimed at reducing the stigma associated with the condition. This product targets Gen Z and Millennial women, offering a shame-free solution to cold sore management

- In January 2025, ClevorX Nanomedicine Laboratories launched Clevorx, a new over-the-counter cold sore treatment cream offering relief from discomfort and inconvenience of cold sores, providing consumers with an alternative to existing treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.