Asia Pacific Colorectal Cancer Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

629.69 Million

USD

1,254.70 Million

2024

2032

USD

629.69 Million

USD

1,254.70 Million

2024

2032

| 2025 –2032 | |

| USD 629.69 Million | |

| USD 1,254.70 Million | |

|

|

|

|

Asia-Pacific Colorectal Cancer Diagnostics Market Size

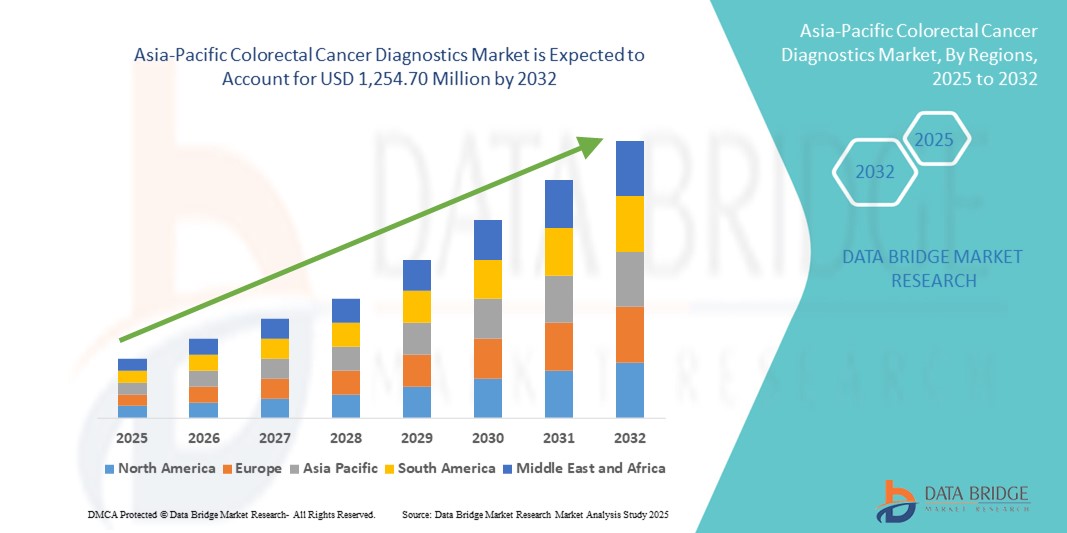

- The Asia-Pacific colorectal cancer diagnostics market size was valued at USD 629.69 million in 2024 and is expected to reach USD 1,254.70 million by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by increasing awareness of colorectal cancer, expanding access to preventive healthcare, and advancements in diagnostic technologies across Asia-Pacific, enabling early detection and intervention. The region is witnessing a sharp rise in colorectal cancer incidence, particularly in rapidly urbanizing countries such as China, Japan, and South Korea, which is driving demand for advanced screening tools, including fecal immunochemical tests (FIT), colonoscopy, and molecular diagnostics

- Furthermore, escalating investments in oncology infrastructure, expansion of cancer screening programs in rural and underserved areas, and growing public-private collaborations are enhancing the availability and adoption of advanced colorectal cancer diagnostics. Government-led awareness campaigns, coupled with the increasing presence of international diagnostic companies and the strengthening of local manufacturing capabilities, are significantly boosting the growth of the Asia-Pacific colorectal cancer diagnostics market

Asia-Pacific Colorectal Cancer Diagnostics Market Analysis

- Colorectal cancer diagnostics, which encompass screening, detection, and monitoring solutions such as fecal occult blood tests (FOBT), fecal immunochemical tests (FIT), colonoscopy, and advanced molecular assays, are witnessing increasing adoption across the Asia-Pacific region. This growth is driven by a rising incidence of colorectal cancer, aging populations, and the expansion of organized cancer screening programs. Countries such as China, Japan, South Korea, and Australia are investing heavily in national screening initiatives, which is boosting demand for both traditional and next-generation diagnostic tools

- The rising preference for molecular and non-invasive diagnostics over conventional procedures in the region is supported by growing patient awareness, government-led early detection programs, and improvements in laboratory infrastructure. In addition, the increasing role of medical tourism in countries such as India and Thailand, combined with the availability of cost-effective yet advanced diagnostic technologies, is further driving uptake of colorectal cancer diagnostics

- China dominated the Asia-Pacific colorectal cancer diagnostics market, accounting for the largest revenue share of 30.3% in 2024, driven by its large aging population, significant healthcare investments, and widespread integration of advanced molecular testing platforms in tertiary hospitals

- India is projected to register the fastest CAGR of 14.8% in the Asia-Pacific colorectal cancer diagnostics market during the forecast period, fueled by expanding access to screening programs, rising public health awareness, and the emergence of indigenous diagnostic kit manufacturing. National health schemes, coupled with private sector investments, are enabling increased access to affordable and timely colorectal cancer screening in both metropolitan and rural areas

- Adenocarcinoma dominated the Asia-Pacific colorectal cancer diagnostics market in 2024 with a 64.1% share, as it remains the most prevalent histological subtype of colorectal cancer across the Asia-Pacific region. Screening guidelines and public awareness campaigns largely target this subtype, enhancing detection rates

Report Scope and Asia-Pacific Colorectal Cancer Diagnostics Market Segmentation

|

Attributes |

Asia-Pacific Colorectal Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Colorectal Cancer Diagnostics Market Trends

Advancements in Diagnostic Technologies and Expansion of Clinical Research Initiatives

- A significant and accelerating trend in the Asia-Pacific colorectal cancer diagnostics market is the increasing focus on diagnostic innovations and clinical research—particularly targeting early detection, accurate staging, and real-time disease monitoring through advanced molecular and imaging technologies

- For instance, various diagnostic companies and research institutes across Asia-Pacific are investing in next-generation colorectal cancer testing solutions, including liquid biopsies, circulating tumor DNA (ctDNA) assays, high-sensitivity fecal immunochemical tests (FIT), and AI-assisted colonoscopy platforms. These developments aim to enhance diagnostic accuracy, reduce false positives/negatives, and enable detection at earlier, more treatable stages

- The increasing adoption of personalized oncology diagnostics across specialized cancer centers and hospitals is enabling more targeted treatment planning. These models integrate genetic profiling, biomarker analysis, and precision screening protocols to identify high-risk populations and tailor follow-up strategies based on individual risk profiles

- Partnerships between diagnostic technology firms, university hospitals, and government-backed cancer screening programs are also helping to expand access to advanced colorectal cancer diagnostics. This includes improving reimbursement policies, scaling up laboratory infrastructure, and providing clinician training for advanced testing methodologies

- As Asia-Pacific continues to prioritize precision oncology and value-based healthcare, the Colorectal Cancer Diagnostics market is poised for sustained growth—driven by innovation, enhanced screening coverage, and a growing demand for early intervention to improve survival rates among aging populations

Asia-Pacific Colorectal Cancer Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Diagnosis Rates and Advancements in Genetic Research

- The increasing incidence of colorectal cancer (CRC) across Asia-Pacific, driven by lifestyle changes, aging populations, and improved screening rates, is significantly accelerating demand for advanced diagnostic solutions. Countries such as China, Japan, South Korea, and Australia are expanding national screening programs, enabling earlier detection and intervention, which in turn is boosting market growth

- For instance, in March 2024, Guardant Health announced the launch of its blood-based CRC screening test, Shield, in Japan following successful clinical validation. Such innovations in minimally invasive diagnostics are expected to transform early detection strategies and enhance patient compliance across the region

- Rising adoption of next-generation sequencing (NGS) for mutation profiling, along with advancements in biomarker discovery, is shifting the market from conventional colonoscopy toward more personalized and precision-based diagnostic approaches

- Regulatory authorities, including Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) and China’s National Medical Products Administration (NMPA), are increasingly providing fast-track approvals for innovative cancer diagnostic technologies, improving market access timelines

- Collaborations between regional biotech firms, cancer research institutes, and diagnostic companies are strengthening the innovation ecosystem, enabling large-scale clinical validation studies and expanding access to cutting-edge CRC diagnostic tools, especially in underserved regions

Restraint/Challenge

Limited Infrastructure and Variability in Clinical Adoption

- High costs associated with advanced CRC diagnostic technologies—such as liquid biopsies, AI-assisted imaging, and multiplex molecular assays—pose a significant barrier to adoption in low- and middle-income Asia-Pacific countries

- Despite increasing governmental support, many advanced diagnostic solutions require sophisticated laboratory infrastructure and skilled personnel, which are often concentrated in metropolitan hospitals, leaving rural and remote areas underserved

- Variations in national CRC screening guidelines and a lack of standardized protocols for genetic and molecular testing result in inconsistent adoption of best practices across the region

- Furthermore, limited awareness among primary care physicians and the general population in certain countries delays early diagnosis, reducing the effectiveness of treatment interventions

- To address these challenges, coordinated policy reforms, increased public funding, workforce training programs, and the establishment of regional cancer diagnostic hubs will be essential for ensuring equitable access and sustainable growth in the Asia-Pacific colorectal cancer diagnostics market

Asia-Pacific Colorectal Cancer Diagnostics Market Scope

The market is segmented on the basis of test type, product type, cancer stage, cancer type, age group, end user and distribution

- By Test Type

On the basis of test type, the Asia-Pacific colorectal cancer diagnostics market is segmented into stool examination, imaging test, biopsy, blood test, and others. The stool examination segment accounted for the largest market share of 34.7% in 2024, driven by the widespread adoption of fecal occult blood tests (FOBT) and fecal immunochemical tests (FIT) as primary tools for early and non-invasive colorectal cancer screening. National and regional screening programs in countries such as Japan, Australia, and South Korea have further accelerated uptake due to their cost-effectiveness and high population coverage.

The biopsy segment is projected to register the fastest CAGR of 9.8% from 2025 to 2032, owing to its critical role in providing definitive histopathological confirmation, tumor grading, and molecular profiling. Advances in minimally invasive biopsy techniques, such as endoscopic ultrasound-guided fine-needle aspiration (EUS-FNA) and image-guided core needle biopsy, are also improving diagnostic precision and patient comfort.

- By Product Type

On the basis of product type, the Asia-Pacific colorectal cancer diagnostics market is segmented into instruments and kits & reagents. Among these, the kits & reagents segment dominated the market with a 58.3% share in 2024, largely due to their recurring demand in routine diagnostic and screening procedures. Their ease of use in both centralized laboratories and decentralized point-of-care settings has made them indispensable in clinical practice. In addition, the increasing adoption of kits & reagents in national-level screening programs has further reinforced their market presence. Government initiatives, including subsidies and bulk procurement policies, have also played a crucial role in boosting accessibility, particularly across middle-income countries in the region.

The instruments segment is projected to expand at the fastest CAGR of 8.9% from 2025 to 2032. This growth is supported by rising investments in next-generation diagnostic platforms such as high-resolution colonoscopy systems, AI-assisted imaging tools, and next-generation sequencing (NGS) analyzers for molecular subtyping. These advancements are significantly enhancing diagnostic precision and enabling personalized treatment planning.

- By Cancer Stage

On the basis of cancer stage, the Asia-Pacific colorectal cancer diagnostics market is segmented into stage 0, stage I, stage II, stage III, and stage IV. The stage II colorectal cancer diagnostics segment accounted for the largest share of 28.5% in 2024, reflecting higher detection rates driven by strong early intervention initiatives and well-established treatment protocols. Public health programs across Asia-Pacific are emphasizing early detection, which has contributed to higher diagnosis at stage II compared to other stages.

Meanwhile, the stage IV diagnostics segment is anticipated to register the fastest CAGR of 10.2% during 2025–2032. This trend is fueled by the rising demand for advanced imaging modalities, liquid biopsy assays for real-time monitoring, and precision diagnostics tailored specifically for metastatic disease management. The increasing clinical adoption of these technologies is expected to transform outcomes for patients with advanced colorectal cancer.

- By Cancer Type

On the basis of cancer type, the Asia-Pacific colorectal cancer diagnostics market is segmented into adenocarcinoma, colorectal lymphoma, gastrointestinal stromal tumors, carcinoid tumors, leiomyosarcomas, melanomas, and others. The adenocarcinoma segment led the market in 2024 with a 64.1% share, as this histological subtype represents the majority of colorectal cancer cases across the Asia-Pacific region. Public awareness campaigns, government-led screening programs, and clinical guidelines primarily target adenocarcinoma, further strengthening its dominance in the diagnostics market.

The carcinoid tumors segment is projected to grow at the fastest CAGR of 9.5% throughout the forecast period. Growth is being driven by advancements in imaging technologies, particularly PET-CT with Ga-68 DOTATATE, as well as more refined histopathological classification techniques that allow earlier and more accurate detection of carcinoid tumors.

- By Age Group

On the basis of age group, the Asia-Pacific colorectal cancer diagnostics market is segmented into geriatric, adults, and pediatric populations. The geriatric segment captured the largest share of 55.6% in 2024, reflecting the sharp increase in colorectal cancer incidence among individuals aged 60 years and above. The segment’s dominance is also linked to higher screening participation rates within this age group, supported by strong public health outreach programs and growing awareness of age-related cancer risks.

The adult segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2032. This is largely attributed to the shifting epidemiology of colorectal cancer, with lifestyle-related risk factors such as obesity, poor diet, and sedentary habits contributing to rising incidence in younger populations. In addition, several countries in the Asia-Pacific region have lowered the recommended age for routine screening to 45 years, further accelerating diagnostic uptake in the adult population.

- By End User

On the basis of end user, the Asia-Pacific colorectal cancer diagnostics market is segmented into hospitals, diagnostic centers, cancer research centers, ambulatory surgical centers, academic institutes, and others. The hospital segment accounted for the largest market share of 47.8% in 2024, driven by their access to advanced diagnostic infrastructure, multidisciplinary oncology teams, and integrated care pathways that include both screening and treatment services. Hospitals serve as major referral hubs across the region, further strengthening their role in the market.

In contrast, the diagnostic centers segment is expected to post the fastest CAGR of 9.1% during 2025–2032. Expansion of standalone diagnostic centers and chain-based labs into semi-urban and rural areas, combined with faster turnaround times and competitive pricing models, is expected to drive strong growth in this category.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific colorectal cancer diagnostics market is segmented into direct tender, retail sales, and online sales. The direct tender segment held the dominant share of 51.4% in 2024, owing to centralized procurement processes for government-backed screening programs and public healthcare facilities. This model ensures cost efficiency and widespread accessibility, particularly in large-scale population screening initiatives.

The online sales segment is projected to witness the fastest CAGR of 10.5% during 2025–2032. Growth in this channel is fueled by the expansion of telemedicine services, increasing demand for home sample collection, and the rising availability of diagnostic kits through e-commerce platforms. These trends are reshaping patient access to colorectal cancer diagnostics, especially in urban and tech-driven healthcare environments.

Asia-Pacific Colorectal Cancer Diagnostics Market Regional Analysis

- Asia-Pacific held a market share of 21.6% in the global colorectal cancer diagnostics market in 2024, supported by rapid advancements in molecular testing technologies, rising incidence of colorectal cancer, and expanding national screening initiatives

- Strong regulatory frameworks, government-backed public health campaigns, and growing adoption of minimally invasive diagnostic methods—such as liquid biopsy and stool DNA tests—are fostering market growth across both public and private healthcare systems

- Furthermore, Asia-Pacific is home to several leading diagnostic technology providers, cancer research institutes, and clinical trial networks, enabling continuous innovation, early adoption of new testing platforms, and large-scale validation studies

China Colorectal Cancer Diagnostics Market Insight

The China colorectal cancer diagnostics market dominated the Asia-Pacific colorectal cancer diagnostics market, accounting for the largest revenue share of 30.3% in 2024, driven by its large aging population, significant healthcare investments, and widespread integration of advanced molecular testing platforms in tertiary hospitals. The Chinese government’s expansion of cancer prevention and control programs, along with favorable reimbursement for diagnostic procedures, is accelerating adoption. Local biotechnology companies are also increasing R&D spending to develop cost-effective, high-sensitivity CRC diagnostic kits tailored for the domestic market.

Japan Colorectal Cancer Diagnostics Market Insight

The Japan colorectal cancer diagnostics market accounted for 20.3% of the Asia-Pacific market share in 2024, supported by a highly developed healthcare infrastructure, universal health insurance, and strong emphasis on early cancer detection. Japan’s national screening programs, combined with advanced imaging modalities such as AI-assisted colonoscopy and PET-CT, are enabling earlier diagnosis and improved patient outcomes. Ongoing collaborations between research institutions and diagnostic companies are further strengthening Japan’s position as a leader in precision oncology diagnostics.

India Colorectal Cancer Diagnostics Market Insight

The India colorectal cancer diagnostics market is projected to register the fastest CAGR of 14.8% in the Asia-Pacific colorectal cancer diagnostics market during the forecast period, fueled by expanding access to screening programs, rising public health awareness, and the emergence of indigenous diagnostic kit manufacturing. National health schemes such as Ayushman Bharat, along with increasing private sector investments, are enabling affordable and timely colorectal cancer screening in both metropolitan and rural areas. Growing adoption of rapid immunochemical fecal occult blood test (iFOBT) kits and mobile diagnostic units is also improving outreach in underserved regions.

Asia-Pacific Colorectal Cancer Diagnostics Market Share

The Asia-Pacific colorectal cancer diagnostics industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Illumina, Inc. (U.S.)

- QIAGEN (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Quest Diagnostics Incorporated, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Myriad Genetics, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- FUJIFILM Corporation (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Bio-Rad Laboratories, Inc. (U.S.)

- Neusoft Corporation (China)

- Exact Sciences Corporation (U.S.)

- BIOMÉRIEUX (France)

- Sysmex Asia Pacific Pte Ltd (Singapore)

- GE HealthCare (U.S.)

- Medtronic (Ireland)

- Agilent Technologies, Inc. (U.S.)

Latest Developments in Asia-Pacific Colorectal Cancer Diagnostics market

- In August 2022, F. Hoffmann-La Roche Ltd, announced the launch of the Digital LightCycler System, Roche’s first digital polymerase chain reaction (PCR) system. This next-generation system detects disease and is designed to accurately quantify trace amounts of specific DNA and RNA targets not typically detectable by conventional PCR methods. This has helped the company to increase its Asia-Pacific presence in the market

- In July 2024, Australia lowered the National Bowel Cancer Screening Program eligibility age from 50 to 45, enabling people aged 45–49 to request free FIT kits—an expansion aimed at earlier colorectal-cancer detection

- In May 2025, Japan’s PMDA updated its official list of approved companion diagnostics for colorectal cancer (e.g., MSI testing and other CDx assays linked to therapies such as nivolumab), reflecting continued regulatory support for advanced molecular diagnostics.

- In May 2025, Australian public health guidance reiterated that 45–49-year-olds can request early bowel screening tests (with free at-home kits), reinforcing the July 2024 policy change and broadening access to population-level diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.