Asia Pacific Compression Therapy Market

Market Size in USD Million

CAGR :

%

USD

718.30 Million

USD

1,463.00 Million

2024

2032

USD

718.30 Million

USD

1,463.00 Million

2024

2032

| 2025 –2032 | |

| USD 718.30 Million | |

| USD 1,463.00 Million | |

|

|

|

|

Compression Therapy Market Size

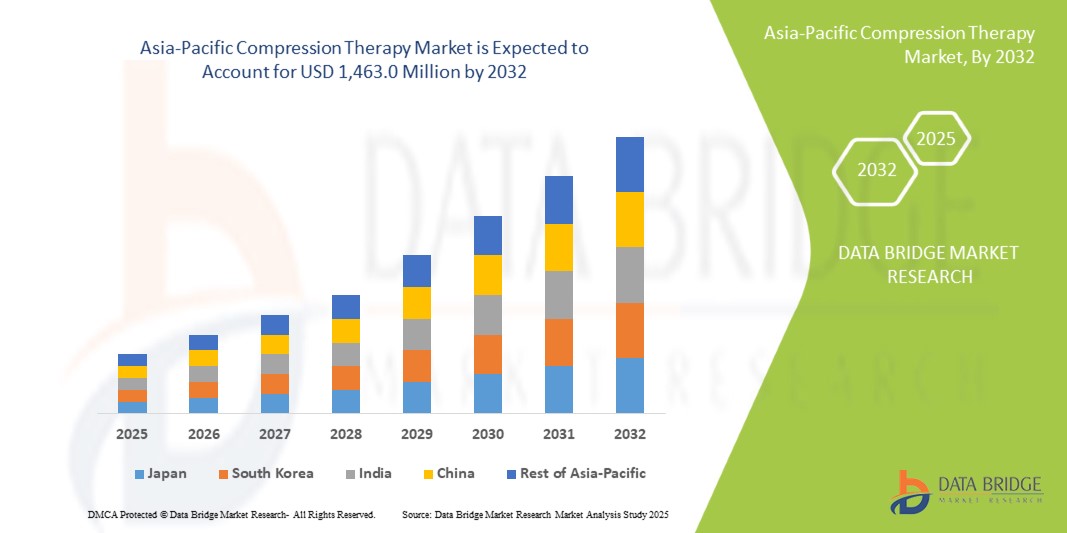

The Asia-Pacific Compression Therapy Market was valued at USD 718.3 million in 2024 and is expected to reach USD 1,463.0 Million by 2032, at a CAGR of 9.3% During the forecast period

- The increasing prevalence of chronic venous disorders, such as chronic venous insufficiency (CVI), varicose veins, and deep vein thrombosis (DVT), which are fueling the demand for effective compression therapy solutions.

Asia-Pacific Compression Therapy Market Analysis

- Compression therapy plays a critical role in the management of various venous and lymphatic conditions, including chronic venous insufficiency (CVI), deep vein thrombosis (DVT), lymphedema, and varicose veins. Compression products—such as bandages, stockings, pneumatic compression devices, and wraps—aid in improving blood circulation, reducing swelling, and preventing the progression of venous disorders. These solutions are widely used across hospitals, rehabilitation centers, home care settings, and specialty clinics.

- The demand for compression therapy in Asia-Pacific is primarily driven by a rising incidence of chronic venous diseases, a growing geriatric population more susceptible to vascular conditions, and increasing awareness about the benefits of early intervention and non-invasive treatment. Additionally, the growing prevalence of obesity and diabetes—both major risk factors for venous insufficiencies—is further fueling market expansion.

- China is a leading region in the compression therapy market with a share of 26.4%, supported by a well-established healthcare infrastructure, early adoption of advanced medical technologies, and favorable reimbursement policies. The China holds a dominant share, driven by a large base of vascular disease patients, increasing outpatient procedures, and strong investments in home healthcare and wearable medical devices.

- India is projected to be the fastest-growing region in the compression therapy market during the forecast period. This growth is driven by several factors, including the rapid expansion of healthcare infrastructure, increasing prevalence of chronic venous disorders and lymphedema, and rising awareness about the benefits of compression therapy. Moreover, the region is witnessing a surge in the geriatric population and lifestyle-related conditions such as obesity and diabetes, which further fuel the demand for effective vascular health management solutions.

- The compression garments segment is expected to dominate the Asia-Pacific compression therapy market with a market share of 38.7%, driven by its widespread usage, affordability, and high patient compliance. Compression garments—including stockings, sleeves, and wraps—are commonly used for the prevention and treatment of venous disorders, lymphedema, and post-surgical swelling. Their non-invasive nature and ease of availability in both hospital and homecare settings make them a preferred choice across diverse patient populations. Additionally, the increasing elderly population, rising awareness of vascular health, and expanded retail and e-commerce distribution channels are further propelling the growth of this segment in key markets such as China, India, and Japan.

Report Scope Compression Therapy Market Segmentation

|

Attributes |

Compression Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Compression Therapy Market Trends

“Smart Fabrics and Digital Health Integration”

- Advancements in compression therapy technologies—such as smart compression garments, wearable sensors, and digitally controlled pneumatic compression devices—are transforming patient care by enabling real-time monitoring of pressure levels, compliance, and treatment outcomes. These innovations are especially impactful in managing chronic conditions like lymphedema and venous leg ulcers with greater precision and comfort.

- For instance, the China has seen a notable increase in the adoption of intermittent pneumatic compression (IPC) devices and gradient compression garments, bolstered by clinical guidelines recommending their use for DVT prevention in both hospital and at-home care settings

- AI-powered solutions and mobile health apps are increasingly being integrated with compression therapy systems to personalize treatment regimens, track patient adherence, and alert clinicians to early signs of complications. These digital tools are streamlining care coordination, enhancing patient engagement, and driving better long-term outcomes across both clinical and home care settings.

Compression Therapy Market Dynamics

Driver

“Rising Prevalence of Venous Disorders and Technological Advancements in Compression Devices”

- The Asia-Pacific Compression Therapy Market is experiencing significant growth driven by the increasing incidence of chronic venous insufficiency (CVI), varicose veins, lymphedema, and deep vein thrombosis (DVT), particularly among the aging and diabetic populations.

- Technological innovations—such as intermittent pneumatic compression (IPC) devices, gradient compression garments, and smart textiles with integrated sensors—are improving therapeutic outcomes through enhanced comfort, real-time monitoring, and personalized pressure control.

- Government health initiatives in the China and India promoting preventive care, early diagnosis of venous diseases, and home-based management of chronic conditions are fueling demand for advanced compression therapy products across healthcare settings.

- The integration of compression therapy devices with digital health platforms and electronic health records (EHRs) is improving treatment compliance, remote monitoring, and patient engagement—thereby accelerating adoption.

For instance,

- According to the Venous Forum (2024), over 40% of adults are affected by chronic venous disorders, underscoring a critical need for accessible and effective compression therapies.

- In March 2024, 3M Health Care launched a next-generation compression wrap featuring adjustable tension indicators and antimicrobial layers to enhance ease of use and infection control in both clinical and home environments.

- The ongoing focus on non-invasive, cost-effective treatment options and the growing preference for wearable health solutions are further boosting the uptake of advanced compression therapy products across Asia-Pacific.

Opportunity

“Digital Health Integration and Expansion of Home-Based Compression Therapies”

- The shift toward digital healthcare delivery and decentralized patient management is opening new opportunities for the adoption of portable and connected compression therapy solutions in Asia-Pacific.

- Demand is rising for smart compression garments and mobile compression pumps that can be used in home care settings, long-term care facilities, and remote monitoring programs—extending care access to rural and underserved populations.

- The growth of telehealth platforms is driving the development of compression devices that sync with mobile apps, allowing clinicians to remotely monitor therapy adherence, pressure levels, and treatment progress.

For instance,

- In February 2024, the CADTH highlighted the growing implementation of smart compression therapy tools in community-based lymphedema management programs.

- Companies such as Bio Compression Systems and Tactile Medical have introduced app-enabled IPC devices tailored for home use, offering remote tracking and clinician feedback features.

- Healthcare providers’ focus on reducing hospital readmissions and improving chronic care outcomes is accelerating the adoption of home-based therapy models.

- Additionally, the increasing availability of cloud-based platforms and AI-powered analytics is enabling more precise and personalized compression therapy planning across multi-site healthcare networks.

Restraint/Challenge

“High Product Costs and Limited Reimbursement Coverage”

- A major challenge in the Asia-Pacific Compression Therapy Market is the high cost associated with premium compression products, particularly advanced pneumatic compression devices and smart wearable systems. These require substantial upfront investment, making them less accessible for low-income patients and smaller healthcare providers.

- Reimbursement policies for compression therapy vary significantly across payers and provinces, with limited coverage for certain devices, especially when used in home settings—creating disparities in access and adoption.

For instance,

- According to a 2024 report by the American College of Phlebology, many private insurers in the do not fully cover smart compression garments or home-use IPC devices unless patients meet strict clinical criteria, delaying early intervention.

- In China, provincial variation in lymphedema coverage programs results in inconsistent patient access to therapeutic-grade compression solutions.

- Regulatory compliance with safety and performance standards from bodies like the FDA and Health China also adds complexity and time to market entry for new products.

Compression Therapy Market Scope

The market is segmented into four notable segments based on Technique, Product, Application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technique |

|

|

By Product

|

|

|

By Application

|

|

|

By End User |

|

In 2025, the Static Compression Therapy is projected to dominate the market with a largest share in technique segment

The Static Compression Therapy segment is expected to dominate the Compression Therapy Market with the largest share of 37.82% in 2025 due to its high prevalence and demand for precision. This dominance is driven by increasing preference for easy-to-use, cost-effective, and reliable compression solutions for managing conditions such as varicose veins, lymphedema, and chronic venous insufficiency.

The Varicose Vein Treatment is expected to account for the largest share during the forecast period in application market

In 2025, the Varicose Vein Treatment segment is expected to dominate the market with the largest market share of 31.11% due to its high prevalence and demand for precision. This is attributed to to the rising prevalence of varicose veins, especially among the aging and obese population. Increased demand for non-invasive, cost-effective treatment options like compression stockings and wraps is further driving segment growth.

Compression Therapy Market Regional Analysis

“China is the Dominant Country in the Compression Therapy Market”

- The China dominates the Asia-Pacific Compression Therapy Market, accounting for the largest share due to its well-established healthcare infrastructure, early adoption of innovative medical technologies, and strong presence of key market players specializing in vascular and lymphedema care.

- The high prevalence of venous disorders such as chronic venous insufficiency, varicose veins, and lymphedema—coupled with a growing elderly and diabetic population—is driving increased utilization of both static and dynamic compression therapy solutions across clinical and homecare settings.

- Major companies like 3M Health Care, Tactile Medical, and Bio Compression Systems are offering a wide range of FDA-approved, technologically advanced compression devices designed to improve therapeutic outcomes and patient adherence.

- Government-led initiatives promoting preventive care, chronic disease management, and home-based treatment—along with favorable reimbursement policies for compression garments and devices—further reinforce the China leadership in the Asia-Pacific Compression Therapy Market.

“India is Projected to Register the Highest Growth Rate”

- India is expected to register the fastest growth in the Asia-Pacific Compression Therapy Market. The country’s publicly funded healthcare system, combined with an increasing emphasis on chronic disease prevention and community-based care, is driving the uptake of compression therapy solutions.

- Strategic investments by provincial health authorities in managing conditions such as lymphedema, venous ulcers, and deep vein thrombosis are accelerating the adoption of both static and dynamic compression therapies. Growing awareness of early intervention and non-invasive treatment options is further supporting demand.

- The expansion of multidisciplinary clinics, rehabilitation centers, and home healthcare services across India is creating a robust demand for user-friendly, cost-effective compression products suited for both clinical and at-home use. Collaborations between health ministries, patient advocacy groups, and academic institutions are also fostering research and innovation in compression therapy technologies.

Compression Therapy Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M Health Care (U.S.)

- Tactile Medical (U.S.)

- Bio Compression Systems, Inc. (U.S.)

- Medi USA (U.S.)

- Sigvaris Group (U.S.)

- KOB Medical Textiles Co., Ltd. (China)

- Tokushu Textile Co., Ltd. (Japan)

- Daoseal Co., Ltd. (South Korea)

- Medi-Tech Devices Pvt. Ltd. (India)

Latest Developments in Asia-Pacific Compression Therapy Market

- In October 2023, Medi GmbH & Co. launched Medi Rehab, a compression stocking available in thigh stocking and calf stocking versions with either open or closed toe. Particularly in the conservative or postoperative treatment of ankle joint injuries or Achilles tendon ruptures, the calf stocking with an open toe makes it easy and comfortable to put on and take off.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC COMPRESSION THERAPY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 COST ANALYSIS BREAKDOWN

4.4 HEALTHCARE ECONOMY

4.4.1 HEALTHCARE EXPENDITURE

4.4.2 CAPITAL EXPENDITURE

4.4.3 CAPEX TRENDS

4.4.4 CAPEX ALLOCATION

4.4.5 FUNDING SOURCES

4.4.6 INDUSTRY BENCHMARKS

4.4.7 GDP RATIO IN OVERALL GDP

4.4.8 HEALTHCARE SYSTEM STRUCTURE

4.4.9 GOVERNMENT POLICIES

4.4.10 ECONOMIC DEVELOPMENT

4.5 INDUSTRY INSIGHTS

4.5.1 MICRO AND MACRO ECONOMIC FACTORS

4.5.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.5.3 KEY PRICING STRATEGIES

4.6 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.6.1.1 JOINT VENTURES

4.6.1.2 MERGERS AND ACQUISITIONS

4.6.1.3 LICENSING AND PARTNERSHIP

4.6.1.4 TECHNOLOGY COLLABORATIONS

4.6.1.5 STRATEGIC DIVESTMENTS

4.6.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.6.3 STAGE OF DEVELOPMENT

4.6.4 TIMELINES AND MILESTONES

4.6.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.6.6 RISK ASSESSMENT AND MITIGATION

4.6.7 FUTURE OUTLOOK

4.7 OPPORTUNITY MAP ANALYSIS

4.8 PATENT ANALYSIS –

4.8.1 PATENT QUALITY AND STRENGTH

4.8.2 PATENT FAMILIES

4.8.3 LICENSING AND COLLABORATIONS

4.8.4 COMPETITIVE LANDSCAPE

4.8.5 IP STRATEGY AND MANAGEMENT

4.8.6 OTHER OBSERVATIONS

4.9 REIMBURSEMENT FRAMEWORK

4.1 SUPPLY CHAIN ECOSYSTEM

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM SIZE COMPANIES

4.10.3 END USERS

4.11 TECHNOLOGY ROADMAP

4.12 TARIFFS & IMPACT ON THE MARKET

4.12.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

4.13 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.14 VENDOR SELECTION CRITERIA DYNAMICS

4.15 IMPACT ON SUPPLY CHAIN

4.15.1 RAW MATERIAL PROCUREMENT

4.15.2 MANUFACTURING AND PRODUCTION

4.15.3 LOGISTICS AND DISTRIBUTION

4.15.4 PRICE PITCHING AND POSITION OF MARKET

4.16 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.16.1 SUPPLY CHAIN OPTIMIZATION

4.16.2 JOINT VENTURE ESTABLISHMENTS

4.17 IMPACT ON PRICES

4.18 REGULATORY INCLINATION

4.18.1 GEOPOLITICAL SITUATION

4.18.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.18.2.1 FREE TRADE AGREEMENTS:

4.18.2.2 ALLIANCES ESTABLISHMENTS:

4.18.3 STATUS ACCREDITATION (INCLUDING MFTN)

4.18.4 DOMESTIC COURSE OF CORRECTION

4.18.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS:

4.18.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS:

4.19 PRICE INDEX

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC VENOUS DISORDERS ASIA-PACIFIC LY

6.1.2 TECHNOLOGICAL ADVANCEMENTS AND PRODUCT INNOVATION

6.1.3 INCREASING SPORTS INJURIES & ACCIDENTS

6.1.4 INCREASING AWARENESS OF THERAPY BENEFITS

6.2 RESTRAINTS

6.2.1 LIMITED REIMBURSEMENT AND INSURANCE COVERAGE

6.2.2 AVAILABILITY OF ALTERNATIVE TREATMENT

6.3 OPPORTUNITIES

6.3.1 GROWTH IN HOME BASED THERAPY

6.3.2 POST-SURGICAL CARE & REHABILITATION

6.3.3 RISING LIFESTYLE-RELATED DISEASES

6.4 CHALLENGES

6.4.1 LACK OF STANDARDIZED THERAPY PROTOCOLS

6.4.2 ENSURING ACCURATE PRODUCT FIT AND CORRECT APPLICATION

7 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE

7.1 OVERVIEW

7.2 STATIC COMPRESSION THERAPY

7.2.1 COMPRESSION STOCKINGS

7.2.2 COMPRESSION BANDAGES

7.2.3 COMPRESSION SLEEVES

7.2.4 COMPRESSION WRAPS

7.2.5 COMPRESSION GLOVES/GAUNTLETS

7.3 DYNAMIC COMPRESSION THERAPY

7.3.1 PNEUMATIC COMPRESSION DEVICES

7.3.2 ADAPTIVE COMPRESSION THERAPY DEVICES

8 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 COMPRESSION BANDAGES

8.2.1 SHORT STRETCH BANDAGES

8.2.2 LONG STRETCH BANDAGES

8.2.3 MULTILAYER COMPRESSION BANDAGES

8.3 COMPRESSION GARMENTS FOR LYMPHEDEMA

8.3.1 LEG GARMENTS

8.3.2 ARM SLEEVES

8.3.3 HAND GLOVES

8.3.4 TORSO/TRUNK GARMENTS

8.3.5 FACE/HEAD GARMENTS

8.4 COMPRESSION STOCKINGS FOR VENOUS DISEASES

8.4.1 BELOW KNEE STOCKINGS

8.4.2 THIGH HIGH STOCKINGS

8.4.3 PANTYHOSE/FULL LEG STOCKINGS

8.4.4 MATERNITY STOCKINGS

8.5 COMPRESSION WRAPS

8.6 PNEUMATIC COMPRESSION DEVICES

8.7 COMPRESSION HOSIERY & GAUNTLETS

9 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 VARICOSE VEINS

9.3 LYMPHEDEMA

9.4 CHRONIC VENOUS INSUFFICIENCY (CVI)

9.5 DEEP VEIN THROMBOSIS (DVT)

9.6 VENOUS LEG ULCERS

9.7 WOUND CARE

9.8 SPORTS INJURY MANAGEMENT

10 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PATIENT GROUP

10.1 OVERVIEW

10.2 ADULT

10.3 GERIATRIC

10.4 PEDIATRIC

11 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL

11.1 OVERVIEW

11.2 MODERATE COMPRESSION

11.3 STRONG COMPRESSION

11.4 MILD COMPRESSION

11.5 VERY STRONG COMPRESSION

12 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 BANDAGES

12.2.2 POST-OPERATIVE COMPRESSION STOCKINGS

12.2.3 PNEUMATIC COMPRESSION DEVICES

12.3 RETAIL PHARMACIES

12.3.1 MILD TO MODERATE COMPRESSION STOCKINGS

12.3.2 COMPRESSION BANDAGES

12.3.3 SLEEVES AND GAUNTLETS

12.4 ECOMMERCE PLATFORMS

12.4.1 COMPRESSION STOCKINGS & GARMENTS

12.4.2 COMPRESSION WRAPS

12.4.3 SLEEVES, GLOVES, AND SOCKS

12.4.4 PORTABLE PNEUMATIC DEVICES

12.5 SPECIALTY CLINICS

12.5.1 HIGH-PRESSURE COMPRESSION GARMENTS

12.5.2 PNEUMATIC COMPRESSION PUMPS

12.5.3 CUSTOM WRAPS

12.6 MEDICAL DEVICE STORES

12.6.1 COMPRESSION STOCKINGS

12.6.2 COMPRESSION BANDAGES

12.6.3 COMPRESSION WRAPS

12.6.4 PNEUMATIC COMPRESSION DEVICES

12.6.5 ADAPTIVE COMPRESSION SYSTEMS

12.7 HOME HEALTHCARE PROVIDERS

12.7.1 COMPRESSION WRAPS

12.7.2 SLEEVES & GARMENTS

12.7.3 BANDAGES

12.7.4 PNEUMATIC PUMPS (PORTABLE)

12.8 NURSING HOMES/LONG-TERM CARE FACILITIES

12.8.1 COMPRESSION WRAPS

12.8.2 SLEEVES AND GAUNTLETS

12.8.3 ADAPTIVE GARMENTS

13 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 INDONESIA

13.1.7 SINGAPORE

13.1.8 THAILAND

13.1.9 MALAYSIA

13.1.10 PHILIPPINES

13.1.11 VIETNAM

13.1.12 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC COMPRESSION THERAPY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMAPANY PROFILES

16.1 SOLVENTUM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 CARDINAL HEALTH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 SMITH+NEPHEW

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 ESSITY AKTIEBOLAG (PUBL)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 PAUL HARTMANN AG

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADIDAS AG

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AIROS MEDICAL, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 ARJO

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 BAUERFEIND

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BIOCOMPRESSION SYSTEMS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CALZE G.T.S.R.L

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 CONVATEC GROUP PLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 ENOVIS CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 BRAND PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 GETINGE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HUNTLEIGH HEALTHCARE LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 JUZO

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 LOHMANN & RAUSCHER GMBH & CO. KG

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 MCKESSON MEDICAL-SURGICAL INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 MEDLINE INDUSTRIES, LP

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MEDI GMBH & CO. KG

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 MEGO AFEK LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 MÖLNLYCKE AB

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 NIKE, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

16.24 OFA BAMBERG GMBH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 ÖSSUR

16.25.1 COMPANY SNAPSHOT

16.25.2 RECENT FINANCIALS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENT

16.26 SIGVARIS GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 TACTILE MEDICAL

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENT

16.28 THERMOTEK

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 THUASNE, SAS

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 ZIMMER BIOMET

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 PRODUCT PORTFOLIO

16.30.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC COMPRESSION WRAPS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PNEUMATIC COMPRESSION DEVICES IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC COMPRESSION HOSIERY & GAUNTLETS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC VARICOSE VEINS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC CHRONIC VENOUS INSUFFICIENCY (CVI) IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC DEEP VEIN THROMBOSIS (DVT) IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC VENOUS LEG ULCERS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC WOUND CARE IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC SPORTS INJURY MANAGEMENT IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC ADULT IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC GERIATRIC IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC PEDIATRIC IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC MODERATE COMPRESSION IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC STRONG COMPRESSION IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC MILD COMPRESSION IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC VERY STRONG COMPRESSION IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC HOSPITALS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 68 CHINA STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CHINA COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 CHINA COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 CHINA COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 JAPAN COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 JAPAN COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 93 JAPAN COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 INDIA COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 104 INDIA STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDIA DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 INDIA COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 INDIA COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 INDIA COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 INDIA COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 INDIA COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 INDIA COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 112 INDIA COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 113 INDIA COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH KOREA COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 122 SOUTH KOREA STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SOUTH KOREA COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SOUTH KOREA COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH KOREA COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH KOREA COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 AUSTRALIA COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 140 AUSTRALIA STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 AUSTRALIA DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 AUSTRALIA COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 AUSTRALIA COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 148 AUSTRALIA COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 149 AUSTRALIA COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 150 AUSTRALIA HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 INDONESIA COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 158 INDONESIA STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 INDONESIA DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 INDONESIA COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 INDONESIA COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 INDONESIA COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 INDONESIA COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 INDONESIA COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 165 INDONESIA COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 166 INDONESIA COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 167 INDONESIA COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 168 INDONESIA HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 INDONESIA RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 INDONESIA ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 INDONESIA SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 INDONESIA MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 INDONESIA HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 INDONESIA NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SINGAPORE COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 176 SINGAPORE STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SINGAPORE DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SINGAPORE COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SINGAPORE COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 SINGAPORE COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 184 SINGAPORE COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 186 SINGAPORE HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 SINGAPORE ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SINGAPORE HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SINGAPORE NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 THAILAND COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 194 THAILAND STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 THAILAND DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 THAILAND COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 THAILAND COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 THAILAND COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 THAILAND COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 THAILAND COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 THAILAND COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 202 THAILAND COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 203 THAILAND COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 204 THAILAND HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 THAILAND RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 THAILAND ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 THAILAND SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 MALAYSIA COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 212 MALAYSIA STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 MALAYSIA DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 MALAYSIA COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MALAYSIA COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MALAYSIA COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 MALAYSIA COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 220 MALAYSIA COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 222 MALAYSIA HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MALAYSIA ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MALAYSIA MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 PHILIPPINES COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 230 PHILIPPINES STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 PHILIPPINES DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 PHILIPPINES COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 PHILIPPINES COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 PHILIPPINES COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 PHILIPPINES COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 PHILIPPINES COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 239 PHILIPPINES COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 240 PHILIPPINES HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 PHILIPPINES RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 PHILIPPINES ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 PHILIPPINES SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 PHILIPPINES MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 PHILIPPINES HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 PHILIPPINES NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 VIETNAM COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 248 VIETNAM STATIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 VIETNAM DYNAMIC COMPRESSION THERAPY IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 VIETNAM COMPRESSION THERAPY MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 VIETNAM COMPRESSION BANDAGES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 VIETNAM COMPRESSION GARMENTS FOR LYMPHEDEMA IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 VIETNAM COMPRESSION STOCKINGS FOR VENOUS DISEASES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 VIETNAM COMPRESSION THERAPY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 255 VIETNAM COMPRESSION THERAPY MARKET, BY PATIENT GROUP, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM COMPRESSION THERAPY MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM COMPRESSION THERAPY MARKET, BY DISTRIBUTION CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 258 VIETNAM HOSPITALS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM RETAIL PHARMACIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 VIETNAM ECOMMERCE PLATFORMS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM SPECIALTY CLINICS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 VIETNAM MEDICAL DEVICE STORES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 VIETNAM HOME HEALTHCARE PROVIDERS IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 VIETNAM NURSING HOMES/LONG-TERM CARE FACILITIES IN COMPRESSION THERAPY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 REST OF ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC COMPRESSION THERAPY MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC COMPRESSION THERAPY MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC COMPRESSION THERAPY MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC COMPRESSION THERAPY MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC COMPRESSION THERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC COMPRESSION THERAPY MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC COMPRESSION THERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC COMPRESSION THERAPY MARKET: MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC COMPRESSION THERAPY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC COMPRESSION THERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC COMPRESSION THERAPY MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC COMPRESSION THERAPY MARKET: EXECUTIVE SUMMARY

FIGURE 13 ASIA-PACIFIC COMPRESSION THERAPY MARKET: STRATEGIC DECISIONS

FIGURE 14 RISING PREVALENCE OF CHRONIC VENOUS DISORDERS GLOBALLY IS EXPECTED TO DRIVE THE ASIA-PACIFIC COMPRESSION THERAPY MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 STATIC COMPRESSION THERAPY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC COMPRESSION THERAPY MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 16 TWO SEGMENT COMPRISE THE ASIA-PACIFIC COMPRESSION THERAPY MARKET, BY PRODUCT TECHNIQUE (2024)

FIGURE 17 DISTRIBUTION OF PATENTS BY IPC CODE

FIGURE 18 REGION-WISE DISTRIBUTION OF PATENTS

FIGURE 19 NUMBER OF PATENTS BY APPLICANT

FIGURE 20 ANNUAL PATENT PUBLICATIONS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC COMPRESSION THERAPY MARKET

FIGURE 22 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TECHNIQUE, 2024

FIGURE 23 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TECHNIQUE, 2025 TO 2032 (USD THOUSAND)

FIGURE 24 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TECHNIQUE, CAGR (2025-2032)

FIGURE 25 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TECHNIQUE, LIFELINE CURVE

FIGURE 26 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TYPE, 2024

FIGURE 27 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 28 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 29 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY APPLICATION, 2024

FIGURE 31 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 32 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 33 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PATIENT GROUP, 2024

FIGURE 35 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PATIENT GROUP, 2025 TO 2032 (USD THOUSAND)

FIGURE 36 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PATIENT GROUP, CAGR (2025-2032)

FIGURE 37 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY PATIENT GROUP, LIFELINE CURVE

FIGURE 38 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY COMPRESSION LEVEL, 2024

FIGURE 39 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY COMPRESSION LEVEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 40 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY COMPRESSION LEVEL, CAGR (2025-2032)

FIGURE 41 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY COMPRESSION LEVEL, LIFELINE CURVE

FIGURE 42 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY DISTRIBUTION CHANNELS, 2024

FIGURE 43 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY DISTRIBUTION CHANNELS, 2025 TO 2032 (USD THOUSAND)

FIGURE 44 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY DISTRIBUTION CHANNELS, CAGR (2025-2032)

FIGURE 45 ASIA-PACIFIC COMPRESSION THERAPY MARKET: BY DISTRIBUTION CHANNELS, LIFELINE CURVE

FIGURE 46 ASIA-PACIFIC COMPRESSION THERAPY MARKET: SNAPSHOT (2024)

FIGURE 47 ASIA-PACIFIC COMPRESSION THERAPY MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.