Asia Pacific Consumer Electronics Packaging Market

Market Size in USD Billion

CAGR :

%

USD

12.55 Billion

USD

36.05 Billion

2024

2032

USD

12.55 Billion

USD

36.05 Billion

2024

2032

| 2025 –2032 | |

| USD 12.55 Billion | |

| USD 36.05 Billion | |

|

|

|

|

Asia-Pacific Consumer Electronics Packaging Market Size

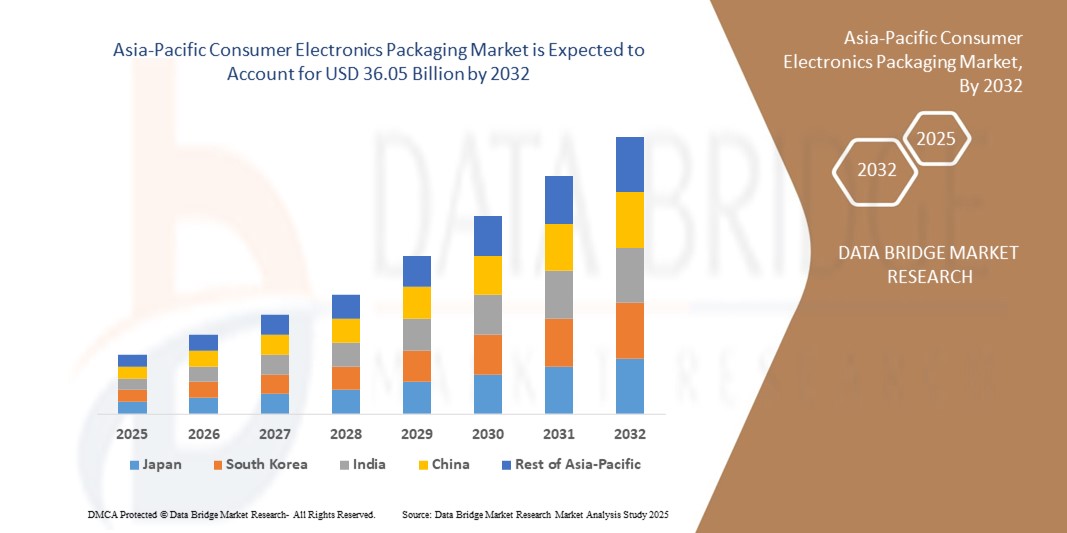

- The Asia-Pacific consumer electronics packaging market size was valued at USD 12.55 billion in 2024 and is expected to reach USD 36.05 billion by 2032, at a CAGR of 14.1% during the forecast period

- The market growth is largely fueled by the rising demand for safe, durable, and sustainable packaging solutions to protect delicate consumer electronics during transportation, storage, and retail display. Increasing sales of smartphones, laptops, wearables, and home appliances are driving the need for innovative packaging that ensures product safety and enhances consumer experience

- Furthermore, the growing adoption of eco-friendly materials such as paperboard, molded pulp, and fiber-based packaging is reshaping the industry as manufacturers respond to regulatory pressures and shifting consumer preferences. These converging factors are accelerating the uptake of advanced and sustainable packaging formats, thereby significantly boosting the industry’s growth

Asia-Pacific Consumer Electronics Packaging Market Analysis

- Consumer electronics packaging comprises a range of materials and formats, including corrugated boxes, blister packs, clamshells, thermoformed trays, protective packaging, and flexible solutions, designed to safeguard products from damage, dust, and moisture. It also plays a vital role in branding and consumer engagement through visually appealing and functional designs

- The escalating demand for consumer electronics packaging is primarily driven by the rapid expansion of e-commerce, increasing electronics production, and heightened focus on recyclability and sustainability. Continuous innovation in lightweight, cost-effective, and premium packaging formats reinforces the market’s strong growth outlook across both developed and emerging economies

- China dominated the consumer electronics packaging market in 2024, due to its strong electronics manufacturing base, large-scale exports, and rapid adoption of innovative packaging technologies

- India is expected to be the fastest growing country in the consumer electronics packaging market during the forecast period due to rapid urbanization, expanding middle-class population, and surging demand for smartphones and other consumer devices

- Plastic segment dominated the market with a market share of 44.1% in 2024, due to its flexibility, lightweight properties, and strong protective capabilities against dust, moisture, and shocks. Plastic formats such as thermoformed trays, films, and blister packs are widely adopted for mobile devices and accessories due to their versatility and cost-effectiveness. The material’s adaptability for both primary and secondary packaging formats also makes it the preferred choice for electronics manufacturers

Report Scope and Consumer Electronics Packaging Market Segmentation

|

Attributes |

Consumer Electronics Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Consumer Electronics Packaging Market Trends

Growth in Consumer Electronics Industry

- The steady growth of the consumer electronics industry is directly driving demand for innovative, protective, and visually appealing packaging solutions. With rising sales of smartphones, laptops, and wearables, brands are increasingly investing in packaging that safeguards sensitive devices while enhancing brand value and consumer unboxing experiences

- For instance, Samsung and Apple have both redesigned packaging for their smartphones, significantly reducing the use of plastic and adopting fiber-based designs. These changes reflect how leading companies are aligning packaging innovation with sustainability goals while increasingly catering to consumer demand for premium unboxing experiences

- The miniaturization of electronic devices has created demand for compact, lightweight, and protective packaging formats. Shock-absorbent inserts, molded pulp trays, and recycled paper-based solutions are emerging as alternatives to polystyrene or foam, ensuring safety during transportation and storage without adding bulk

- Sustainability is becoming a critical trend, with companies shifting to recyclable and minimalist packaging. This aligns with global sustainability commitments and consumer preference for eco-friendly solutions, pushing packaging manufacturers to optimize material use and reduce waste generation in supply chains

- Technological advances are enabling smarter packaging solutions, such as tamper-evident seals, QR-enabled packaging, and tracking systems, all of which enhance transparency and product authenticity. Such innovations improve consumer confidence in the authenticity of electronics while allowing companies to streamline inventory management

- Overall, the growth of the consumer electronics industry is transforming packaging into a strategic differentiator. The combination of safety, sustainability, and branding needs is compelling brands to adopt innovative designs, making packaging an essential enabler of competitive positioning in this expanding market

Asia-Pacific Consumer Electronics Packaging Market Dynamics

Driver

Expansion of E-Commerce Sector

- The rapid expansion of e-commerce platforms has emerged as a crucial driver for consumer electronics packaging. With more consumers purchasing devices online, demand for strong, tamper-proof, and protective packaging has intensified to ensure safe delivery from warehouses to customers' homes

- For instance, Amazon has introduced its “Frustration-Free Packaging” program to minimize material use while maintaining high levels of product safety for electronics shipped through its platform. This initiative highlights how packaging innovations in e-commerce are reshaping industry expectations globally

- The rise of e-commerce has increased the importance of packaging formats that reduce returns and damage rates. Rigid corrugated boxes, cushioned inserts, and waterproof external wraps are increasingly utilized to secure fragile electronic devices during cross-border transportation and long-distance deliveries

- In addition, the shift toward online-exclusive electronics launches and festive season sales has put higher demand on scalable, lightweight, and functional packaging solutions. Meeting this demand ensures timely delivery while optimizing logistics and cost-efficiency for manufacturers and retailers alike

- In conclusion, the expansion of e-commerce is amplifying the role of packaging in providing safety, branding, and efficient handling for electronics. This trend ensures that packaging remains integral to successful online retail strategies and long-term customer retention

Restraint/Challenge

Product Variability and Standardization

- One of the major challenges in consumer electronics packaging is addressing the wide variability of product sizes, shapes, and fragility levels. The diversity of devices, ranging from wearables to large appliances, complicates the process of designing standardized yet protective packaging solutions

- For instance, Dell has faced challenges balancing sustainability goals with the protective needs of packaging across its diverse product portfolio, from lightweight laptops to bulky monitors. This reflects the industry-wide struggle of ensuring standardization while catering to multiple device categories

- The constant evolution of electronic devices, which often bring new form factors and fragile components, requires frequent redesigning of packaging formats. This raises costs for manufacturers and slows down the ability to scale packaging solutions efficiently across product ranges

- Lack of universal standards in packaging materials and protective benchmarks leads to inconsistency in performance, with some solutions failing to adequately protect devices during shipment. This risk can result in higher return rates, increased logistics costs, and customer dissatisfaction

- Addressing product variability while working toward standardization is increasingly critical for the industry. Achieving this balance will require investment in modular designs, sustainable materials adaptable to multiple product categories, and industry-level collaboration on protective benchmarks to ensure packaging innovation remains effective and scalable

Asia-Pacific Consumer Electronics Packaging Market Scope

The market is segmented on the basis of type, packaging material, layer, technology, printing technology, distribution channel, and application.

- By Type

On the basis of type, the consumer electronics packaging market is segmented into corrugated boxes, paperboard boxes, thermoformed trays, blister packs and clamshell, protective packaging, bags, sacks, pouches, films, foam packaging, air bubble pouches, and others. The corrugated boxes segment dominated the largest market revenue share in 2024, driven by their superior strength, recyclability, and wide use for shipping bulky electronics such as televisions, desktops, and household appliances. Their ability to withstand stacking pressure and safeguard fragile goods during long-distance transportation makes them a preferred choice for manufacturers. Growing focus on sustainable and lightweight packaging further reinforces their dominance, as corrugated boxes balance cost-efficiency with durability.

The blister packs and clamshell segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption for mobile phones, wearables, and accessories packaging. These solutions provide excellent product visibility, tamper resistance, and compactness, making them ideal for retail display. Their transparent design enhances consumer appeal while reducing theft, and their compatibility with automated packaging processes supports efficiency. With increasing demand for premium presentation in consumer electronics, blister packs and clamshells are expected to see rapid expansion.

- By Packaging Material

On the basis of packaging material, the market is segmented into plastic, paper, aluminium foil, cellulose, and others. The plastic segment held the largest market revenue share of 44.1% in 2024, attributed to its flexibility, lightweight properties, and strong protective capabilities against dust, moisture, and shocks. Plastic formats such as thermoformed trays, films, and blister packs are widely adopted for mobile devices and accessories due to their versatility and cost-effectiveness. The material’s adaptability for both primary and secondary packaging formats also makes it the preferred choice for electronics manufacturers.

The paper segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for eco-friendly and recyclable packaging alternatives. Increasing restrictions on single-use plastics are accelerating the shift toward paperboard and molded pulp solutions in consumer electronics packaging. Paper-based formats are gaining traction for smaller electronics and accessories due to their sustainability and biodegradability. With continuous innovations in coated and engineered paperboard offering enhanced durability and moisture resistance, the segment is set for significant growth.

- By Layer

On the basis of layer, the market is segmented into primary packaging, secondary packaging, and tertiary packaging. The primary packaging segment dominated the largest revenue share in 2024, owing to its direct role in protecting electronics such as smartphones, cameras, and wearables from damage, dust, and electrostatic discharge. Primary packaging also enhances consumer experience through attractive unboxing designs that serve as a key branding element. Manufacturers are heavily investing in sleek, compact, and protective designs, strengthening the segment’s position in the market.

The secondary packaging segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by its importance in bulk handling, logistics, and retail display. Corrugated cartons and multipacks used in this layer provide efficient stacking, safe transportation, and enhanced shelf presence in retail. With the growth of e-commerce and international shipments, demand for strong yet lightweight secondary packaging has surged. Rising adoption of recyclable and sustainable secondary materials further accelerates this segment’s growth trajectory.

- By Technology

On the basis of technology, the market is segmented into active packaging, intelligent packaging, modified atmospheric packaging, anti-microbial packaging, aseptic packaging, and others. The modified atmospheric packaging segment dominated the largest revenue share in 2024, due to its effectiveness in protecting sensitive electronics from oxidation, moisture, and microbial risks. This technology is particularly valuable for semiconductors and precision components, ensuring extended shelf life and product stability. Its integration with anti-static features further strengthens adoption in the consumer electronics industry.

The intelligent packaging segment is expected to record the fastest growth rate from 2025 to 2032, driven by the rising adoption of smart tags, sensors, QR codes, and NFC features. These technologies help combat counterfeiting and enable real-time tracking and authentication, which are increasingly critical in electronics supply chains. Intelligent packaging also enhances consumer engagement by providing product details and usage instructions. The trend toward connected and traceable packaging solutions is fueling the rapid uptake of this segment.

- By Printing Technology

On the basis of printing technology, the market is segmented into flexographic, gravure, and others. The flexographic printing segment dominated the largest market share in 2024, owing to its cost-effectiveness, adaptability across multiple substrates, and ability to deliver high-quality graphics at scale. Widely used in corrugated boxes and flexible packaging, it enables quick turnaround and supports branding efforts in consumer electronics. The growing importance of visually appealing packaging continues to drive demand for flexographic solutions.

The gravure printing segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to its capability of producing premium-quality prints with fine detailing, metallic effects, and high-resolution graphics. It is particularly favored in high-end consumer electronics packaging where luxury presentation matters. Despite higher costs, gravure’s consistent quality in long production runs makes it attractive for premium packaging applications. Rising demand for luxury and aesthetic packaging solutions in electronics is expected to drive segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into e-commerce, supermarkets/hypermarkets, specialty stores, and others. The e-commerce segment dominated the largest revenue share in 2024, supported by the growing popularity of online shopping for smartphones, laptops, and accessories. Packaging in this channel focuses on product safety during transit, lightweight materials, and consumer-friendly unboxing experiences. The rapid penetration of digital retail platforms and convenience of home delivery continue to strengthen the segment’s dominance.

The supermarkets and hypermarkets segment is expected to post the fastest growth rate from 2025 to 2032, as consumers increasingly prefer in-store evaluation of electronics before purchase. Shelf-ready packaging, tamper-evident formats, and premium displays are driving demand in this segment. The expansion of organized retail infrastructure in emerging economies is providing significant growth opportunities for this channel. Packaging innovation to enhance shelf visibility is further accelerating its adoption.

- By Application

On the basis of application, the market is segmented into mobile phones, computers, TVs, DTH and set-top boxes, music systems, printer, scanner and photocopy machines, game console and toys, camcorders and camera, electronic wearables, digital media adapters, and others. The mobile phones segment dominated the largest revenue share in 2024, driven by high shipment volumes and frequent product launches. Packaging for smartphones emphasizes compactness, premium finishes, and protective features to enhance brand image and consumer experience. The continuous innovation cycle in the smartphone industry keeps demand strong for packaging in this segment.

The electronic wearables segment is projected to grow at the fastest rate from 2025 to 2032, fueled by rising adoption of fitness trackers, smartwatches, and health-monitoring devices. Wearable electronics require compact, lightweight, and sustainable packaging that also highlights product design and aesthetics. Increasing consumer focus on health and lifestyle products, along with rapid innovation in wearable technology, is driving demand for specialized packaging solutions. The segment benefits from strong growth in both premium and mid-range wearable categories.

Asia-Pacific Consumer Electronics Packaging Market Regional Analysis

- China dominated the consumer electronics packaging market with the largest revenue share in 2024, driven by its strong electronics manufacturing base, large-scale exports, and rapid adoption of innovative packaging technologies

- The country’s dominance is reinforced by the presence of major consumer electronics brands and contract manufacturers that demand high volumes of protective, sustainable, and cost-effective packaging

- Growing domestic consumption of smartphones, laptops, and wearables further drives demand for diverse packaging formats. Strong investment in smart packaging and eco-friendly materials consolidates China’s leadership in the regional market, while robust e-commerce growth continues to strengthen its position

Japan Consumer Electronics Packaging Market Insight

The Japan market is anticipated to grow steadily from 2025 to 2032, driven by its advanced electronics sector and emphasis on high-quality, precision-based packaging solutions. Japanese manufacturers are increasingly adopting premium, compact, and sustainable packaging for products such as wearables, cameras, and gaming consoles. The market benefits from strong consumer demand for innovative packaging that enhances product appeal and brand trust. With rising focus on recyclable and biodegradable materials, Japan is leading in eco-friendly packaging adoption. Collaborations between local packaging companies and global electronics brands further reinforce steady growth in the Japanese market.

India Consumer Electronics Packaging Market Insight

India is projected to register the fastest CAGR in the Asia Pacific consumer electronics packaging market during 2025–2032, fueled by rapid urbanization, expanding middle-class population, and surging demand for smartphones and other consumer devices. The growth of domestic electronics manufacturing under initiatives such as “Make in India” has significantly boosted the need for cost-effective and protective packaging. Rising e-commerce penetration is further accelerating adoption of durable and lightweight packaging formats. Increasing focus on sustainability and rising investments in paper-based and recyclable materials are shaping market development. Expanding retail networks and collaborations with global packaging firms position India as the fastest-growing market in the region.

Asia-Pacific Consumer Electronics Packaging Market Share

The consumer electronics packaging industry is primarily led by well-established companies, including:

- Smurfit Kappa Group (Ireland)

- Mondi Group (Austria)

- DS Smith (U.K.)

- WestRock (U.S.)

- Huhtamäki Oyj (Finland)

- Amcor plc (Switzerland)

- Coveris Holdings S.A. (Luxembourg)

- Saica Group (Spain)

- Seda Group (Italy)

- LGR Packaging (France)

Latest Developments in Asia-Pacific Consumer Electronics Packaging Market

- In February 2025, Siemens Digital Industries Software introduced an automated workflow certified for TSMC’s InFO packaging technology, integrating Innovator3D IC, Xpedition Package Designer, HyperLynx DRC, and Calibre nmDRC software. This advancement strengthens Siemens’ position in the semiconductor packaging design market by enabling more efficient and accurate chip-scale integration. The launch reflects the growing demand for automated, high-precision electronic packaging solutions, improving time-to-market for semiconductor manufacturers and reinforcing Siemens’ competitive edge in advanced IC packaging workflows

- In September 2024, Scrona AG partnered with Electroninks to advance materials and processes for next-generation semiconductor packaging, focusing on applications such as RDL repair, fine-line metallization, via filling, and 3D interconnects. This collaboration, with joint R&D in Zurich and Taiwan, marks a significant step toward miniaturization and performance enhancement in chip packaging. By combining Scrona’s EHD printhead technology with Electroninks’ advanced materials, the partnership accelerates innovation in semiconductor manufacturing, addressing the industry’s need for finer precision and higher density interconnections

- In July 2024, Google announced in its 2024 Green Report that its Pixel phone packaging is now 99% plastic-free, reducing both packaging weight and volume by over 50%. This initiative significantly impacts the consumer electronics packaging market, as Google leads the transition toward fiber-based, sustainable alternatives. The move aligns with the company’s pledge to eliminate all plastic packaging by 2025, setting new sustainability benchmarks for the smartphone industry and influencing competitors to adopt eco-friendly practices in premium device packaging

- In November 2023, DS Smith unveiled redesigned paper-based packaging for Versuni’s Philips home appliance line, covering products such as air fryers and vacuum cleaners. The new design replaces traditional protective materials with fiber buffers and incorporates QR-code instructions, minimizing ink usage while boosting recyclability. This development strengthens DS Smith’s role in the sustainable packaging market by delivering eco-friendly, consumer-engaging solutions. It highlights how innovation in fiber-based packaging addresses both regulatory pressures and consumer demand for greener alternatives in home appliance packaging

- In February 2020, Mondi collaborated with Cartro, a Mexican corrugated packaging company, to produce sustainable corrugated packaging solutions. This strategic partnership enhanced Mondi’s footprint in the Latin American packaging market by leveraging Cartro’s regional expertise. The initiative supports the growing demand for recyclable corrugated packaging in consumer goods and electronics, ultimately contributing to Mondi’s long-term revenue growth while reinforcing its commitment to circular economy-driven packaging innovations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Consumer Electronics Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Consumer Electronics Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Consumer Electronics Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.