Asia Pacific Contrast And Imaging Agents In Interventional X Ray Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.60 Billion

2024

2032

USD

1.60 Billion

USD

2.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 2.60 Billion | |

|

|

|

|

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Size

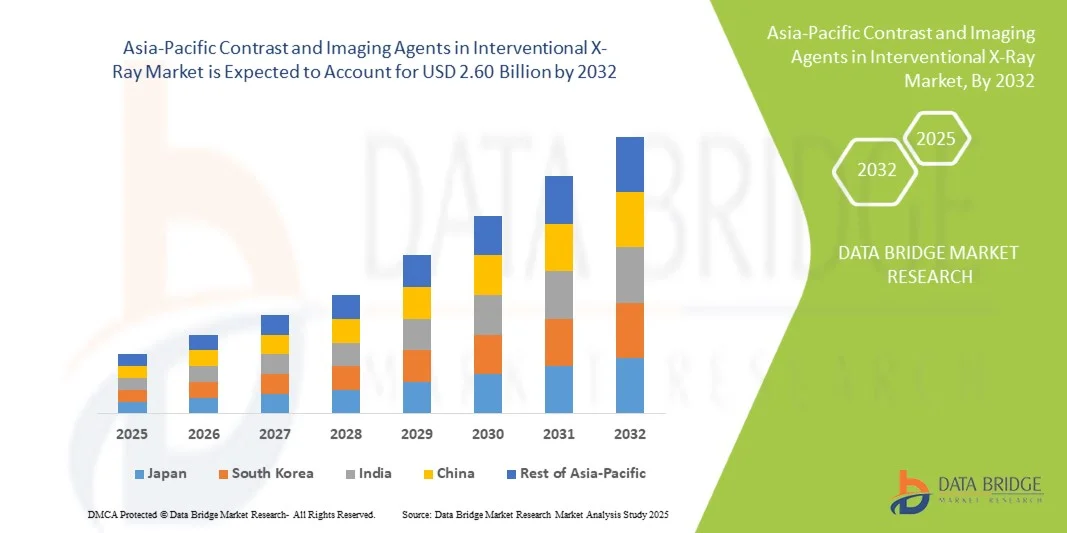

- The Asia-Pacific contrast and imaging agents in interventional x-ray market size was valued at USD 1.60 billion in 2024 and is expected to reach USD 2.60 billion by 2032, at a CAGR of 6.3% during the forecast period

- The market growth is largely driven by increasing prevalence of cardiovascular and neurological disorders, expansion of interventional procedures, and rising adoption of advanced imaging techniques in hospitals and diagnostic centers across the region

- Furthermore, growing investment in healthcare infrastructure and the increasing demand for accurate, minimally invasive diagnostic solutions are establishing contrast and imaging agents as essential components in interventional radiology. These converging factors are accelerating market adoption, thereby significantly boosting the industry's growth

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Analysis

- Contrast and imaging agents, used to enhance visibility during interventional X-ray procedures, are increasingly vital in modern diagnostic and interventional radiology due to their ability to improve imaging accuracy, support minimally invasive procedures, and reduce patient risk

- The rising demand for these agents is primarily fueled by the increasing prevalence of cardiovascular and neurological disorders, expansion of interventional procedures, and growing adoption of advanced imaging technologies in hospitals and diagnostic centers

- Japan dominated the market with the largest revenue share of 29% in 2024, characterized by well-established healthcare infrastructure, high investment in medical technology, and strong presence of key industry players

- China is expected to be the fastest-growing country in the market during the forecast period due to increasing healthcare expenditure, rising awareness about minimally invasive procedures, and expansion of hospital and diagnostic networks

- Iodinated contrast agents segment dominated the market with a significant share of 62.8% in 2024, driven by their widespread use in angiography, cardiology, and neurovascular imaging, along with their proven efficacy and safety profile

Report Scope and Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Segmentation

|

Attributes |

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Trends

“Advancements in Imaging Accuracy and Minimally Invasive Procedures”

- A significant and accelerating trend in the Asia-Pacific market is the adoption of advanced contrast and imaging agents that enhance visualization during interventional X-ray procedures, improving procedural accuracy and patient safety

- For instance, iodinated contrast agents combined with digital subtraction angiography (DSA) enable highly detailed vascular imaging, allowing clinicians to precisely navigate catheters and guidewires during complex interventions

- Integration of these agents with AI-enabled imaging systems allows features such as automatic vessel segmentation, real-time anomaly detection, and optimized contrast dosage, enhancing procedural efficiency. For instance, some Philips and Siemens imaging solutions use AI-assisted visualization to reduce contrast volume while maintaining image quality

- The seamless combination of advanced imaging agents with digital imaging platforms facilitates improved diagnosis, workflow efficiency, and patient outcomes, allowing clinicians to monitor multiple parameters in real-time

- This trend towards more accurate, intelligent, and patient-centric imaging solutions is reshaping clinical expectations in interventional radiology. For instance, companies such as Guerbet are developing novel contrast formulations optimized for low-dose, high-precision imaging

- The demand for advanced imaging agents that integrate with AI and minimally invasive technologies is growing rapidly across hospitals and diagnostic centers, as clinicians prioritize precision, safety, and operational efficiency

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Dynamics

Driver

“Increasing Prevalence of Cardiovascular and Neurovascular Disorders”

- The rising incidence of cardiovascular and neurovascular diseases, combined with the expansion of interventional procedures, is a key driver for increased demand for contrast and imaging agents

- For instance, in March 2024, Bracco launched a next-generation iodinated contrast media optimized for neurovascular interventions, designed to improve image clarity while reducing patient exposure to contrast

- As hospitals and diagnostic centers seek enhanced imaging accuracy and minimally invasive procedural support, contrast agents enable real-time visualization, improving clinical decision-making and patient outcomes

- Furthermore, the growing focus on precision medicine and interventional radiology is making advanced imaging agents integral to procedure planning, risk reduction, and improved therapeutic success

- The combination of rising procedure volumes, technological advancements, and clinician preference for optimized contrast solutions is propelling market adoption across both large hospitals and specialized imaging centers

Restraint/Challenge

“Adverse Reactions and Regulatory Compliance Hurdles”

- Safety concerns such as contrast-induced nephropathy or allergic reactions pose a challenge to broader adoption of contrast and imaging agents in interventional procedures

- For instance, reports of iodine-based contrast causing mild to severe renal complications have made some hospitals cautious in agent selection, particularly for high-risk patients

- Addressing these safety concerns through low-osmolar formulations, pre-procedure screening protocols, and clinician education is critical for adoption. Companies such as GE Healthcare and Bayer emphasize optimized dosing and safety monitoring in their product guidelines

- In addition, stringent regulatory requirements and approvals across multiple Asia-Pacific countries can delay product launches, increasing compliance costs and market entry time

- While advanced agents are improving safety profiles, perceived risks and regulatory complexity may still hinder widespread adoption, especially in smaller clinics and cost-sensitive markets

- Overcoming these challenges through enhanced safety measures, regulatory alignment, and clinician training will be essential for sustained market growth

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Scope

The market is segmented on the basis of agent type, application, and end user.

- By Agent Type

On the basis of agent type, the market is segmented into iodinated contrast media, barium-based contrast media, microbubble contrast media, gold nanoparticle contrast agents, and others. The iodinated contrast media segment dominated the market with the largest revenue share of 62.8% in 2024, driven by its extensive use in angiography, cardiology, and neurovascular interventions. These agents are preferred for their high radiopacity, rapid renal clearance, and proven safety profile, making them the first choice for hospitals and diagnostic centers. Clinicians often prioritize iodinated media for complex interventional procedures due to their reliable imaging quality. In addition, their compatibility with both conventional and advanced digital X-ray imaging systems enhances their adoption across Asia-Pacific healthcare facilities. Companies such as Bracco and Bayer are investing in low-osmolar formulations, further boosting market preference. The widespread familiarity and long-standing clinical trust associated with iodinated agents also reinforce their dominant position.

The microbubble contrast media segment is anticipated to witness the fastest growth rate during the forecast period, fueled by rising adoption in echocardiography and minimally invasive diagnostic procedures. Microbubbles enhance ultrasound imaging quality, allowing for real-time assessment of blood flow and organ perfusion, which is increasingly valued in cardiac and liver diagnostics. Their non-ionizing nature and safety profile make them particularly attractive for patients with kidney dysfunction or iodine sensitivity. The expansion of imaging centers and technological advancements in ultrasound devices across countries such as China, India, and Japan is accelerating microbubble usage. In addition, ongoing R&D in targeted microbubble agents for tumor detection and therapy monitoring is driving growth. Rising clinician awareness of non-invasive alternatives to traditional X-ray contrast media also contributes to adoption.

- By Application

On the basis of application, the market is segmented into cardiology, gastroenterology, neurology, oncology, urology, and general surgery. The cardiology segment dominated the market in 2024, accounting for the largest share due to the high prevalence of cardiovascular diseases and the frequent requirement of angiography and interventional procedures. Hospitals and cardiac centers prefer advanced contrast agents to improve imaging clarity for coronary vessels, enabling accurate stent placements and catheter navigation. Countries such as Japan, South Korea, and India are witnessing a surge in interventional cardiology procedures, further supporting demand. Clinicians rely on iodinated and microbubble agents to minimize procedural risks and enhance diagnostic precision. Increasing government initiatives to improve cardiac care infrastructure across Asia-Pacific also support the segment. Moreover, the growing number of catheterization labs and rising patient awareness of minimally invasive treatments continue to reinforce the dominance of cardiology applications.

The oncology segment is expected to witness the fastest growth rate during the forecast period, driven by the rising incidence of cancers and increasing use of contrast agents for tumor detection, staging, and treatment monitoring. Advanced agents enable precise visualization of tumor boundaries, vascularity, and perfusion, facilitating targeted interventions and therapy planning. Countries such as China and India are experiencing rapid expansion of oncology imaging centers, contributing to adoption. Furthermore, integration with AI-assisted imaging platforms enhances diagnostic accuracy and reduces the need for invasive biopsies. Research into nanoparticle-based and microbubble agents for oncology imaging is accelerating, further fueling growth. Rising patient preference for early detection and minimally invasive monitoring is also a key growth factor.

- By End User

On the basis of end user, the market is segmented into imaging centers, hospitals, clinics, diagnostic centers, ambulatory surgical centers, and private practices. The hospitals segment dominated the market with the largest revenue share in 2024, owing to the high volume of interventional procedures, advanced imaging infrastructure, and preference for comprehensive contrast agent portfolios. Hospitals often conduct complex cardiology, neurology, and oncology interventions, which require high-quality imaging support, driving demand for iodinated and advanced contrast media. Countries such as Japan, South Korea, and Australia have large hospital networks with state-of-the-art imaging facilities, contributing to dominance. The presence of experienced radiologists and interventional specialists further reinforces hospital preference. In addition, hospitals benefit from long-term supplier contracts and bulk procurement agreements, ensuring steady demand. Hospitals also lead adoption of innovative agents and AI-integrated imaging solutions, strengthening their market position.

The diagnostic centers segment is expected to witness the fastest growth rate during the forecast period, driven by the rising number of outpatient imaging facilities and specialized centers offering affordable interventional diagnostics. Diagnostic centers in China, India, and Southeast Asia are expanding rapidly to cater to increasing patient demand for convenient and cost-effective imaging services. These centers often adopt portable and advanced imaging systems that are compatible with a wide range of contrast agents. Growth is further supported by rising awareness of minimally invasive procedures and early disease detection among urban populations. For instance, centers offering cardiac and oncology imaging increasingly utilize microbubble and nanoparticle-based agents. The growing number of partnerships between diagnostic centers and contrast media manufacturers also facilitates faster adoption.

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Regional Analysis

- Japan dominated the market with the largest revenue share of 29% in 2024, characterized by well-established healthcare infrastructure, high investment in medical technology, and strong presence of key industry players

- Hospitals and diagnostic centers in the region highly value the accuracy, efficiency, and safety offered by advanced contrast agents, which enable precise visualization for cardiology, neurology, and oncology interventions

- This widespread adoption is further supported by government initiatives to improve healthcare delivery, rising healthcare expenditure, and increasing investments by leading manufacturers in AI-integrated imaging solutions, establishing contrast agents as an essential component in interventional radiology across Asia-Pacific

The Japan Contrast and Imaging Agents in Interventional X-Ray Market Insight

The Japan market is gaining momentum due to the country’s well-established healthcare system, high adoption of advanced imaging technologies, and demand for precision diagnostics. Hospitals and interventional centers prioritize iodinated and microbubble contrast agents for cardiology, neurology, and oncology procedures. The integration of AI-assisted imaging platforms and low-dose contrast solutions is further fueling growth. Japan’s aging population and the increasing focus on early diagnosis and minimally invasive treatments are expected to sustain demand in both public and private healthcare sectors.

China Contrast and Imaging Agents in Interventional X-Ray Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding healthcare infrastructure, and rising patient awareness regarding minimally invasive diagnostics. The country has seen a surge in interventional cardiology and oncology procedures, driving demand for high-quality contrast agents. Government initiatives supporting hospital expansions and investment in advanced imaging technologies further boost the market. In addition, domestic manufacturing of contrast media and imaging equipment is improving accessibility and affordability for a wide range of healthcare facilities.

India Contrast and Imaging Agents in Interventional X-Ray Market Insight

The India market is witnessing strong growth due to the country’s increasing prevalence of cardiovascular and neurovascular disorders, growing number of hospitals and diagnostic centers, and high adoption of advanced imaging technologies. Contrast agents are increasingly used in cardiology, oncology, and neurology interventions, especially in urban healthcare hubs. Government programs promoting health infrastructure expansion and initiatives to encourage minimally invasive procedures are accelerating market adoption. Furthermore, rising awareness among patients and physicians regarding safe and effective imaging solutions is contributing to the sustained growth of contrast agent usage.

South Korea Contrast and Imaging Agents in Interventional X-Ray Market Insight

The South Korea market is expanding steadily, supported by advanced hospital networks, high investment in imaging technology, and growing demand for interventional radiology procedures. Hospitals and diagnostic centers are increasingly adopting iodinated and microbubble contrast agents for cardiology and neurovascular interventions. The country’s strong emphasis on research and development, coupled with adoption of AI-assisted imaging platforms, is enhancing procedural efficiency and patient safety. South Korea’s proactive healthcare policies and rising awareness of minimally invasive diagnostics are expected to drive continued growth.

Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market Share

The Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray industry is primarily led by well-established companies, including:

- Bracco. (Italy)

- GE HealthCare (U.S.)

- Guerbet (U.S.)

- Bayer AG (Germany)

- Lantheus (U.S.)

- Beilu Pharmaceutical Co., Ltd. (China)

- Iso-Tex Diagnostics, Inc. (U.S.)

- Novartis AG (Switzerland)

- FUJIFILM Corporation (Japan)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- JB Chemicals and Pharmaceuticals Ltd. (India)

- Unijules Life Sciences Ltd. (India)

- Mallinckrodt (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Amgen Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Samsung (South Korea)

What are the Recent Developments in Asia-Pacific Contrast and Imaging Agents in Interventional X-Ray Market?

- In November 2023, Fujifilm unveiled several new medical imaging systems, including digital radiography suites and fluoroscopy systems, at the Radiological Society of North America (RSNA) conference. These systems incorporate advanced technologies aimed at improving diagnostic accuracy and patient outcomes in interventional procedures

- In November 2022, GE Healthcare introduced the CT Motion syringeless injector, designed to deliver iodinated contrast media for computed tomography (CT) imaging. This innovative system aims to enhance patient safety and streamline imaging procedures by eliminating the need for syringes, thereby reducing the risk of contamination and improving workflow efficiency

- In November 2022, GE Healthcare and Ulrich Medical announced a collaboration to develop a multi-dose contrast media injector system. This partnership focuses on enhancing the delivery of contrast agents in interventional imaging, aiming to improve efficiency and patient care in clinical settings

- In September 2022, Guerbet announced that the U.S. Food and Drug Administration (FDA) had approved Elucirem™ (gadopiclenol) injection for use in contrast-enhanced MRI. This approval marked a significant advancement in MRI imaging, offering improved image quality at a lower dose compared to traditional contrast agents

- In September 2022, Bracco announced that the FDA had approved Gadopiclenol Injection, a new, highly stable macrocyclic gadolinium-based contrast agent. This agent, commercialized as VUEWAY (gadopiclenol) injection, is noted for its high relaxivity, providing enhanced imaging capabilities for various diagnostic procedures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.