Asia Pacific Corneal Transplant Market

Market Size in USD Million

CAGR :

%

USD

76.39 Million

USD

133.22 Million

2024

2032

USD

76.39 Million

USD

133.22 Million

2024

2032

| 2025 –2032 | |

| USD 76.39 Million | |

| USD 133.22 Million | |

|

|

|

|

Asia-Pacific Corneal Transplant Market Size

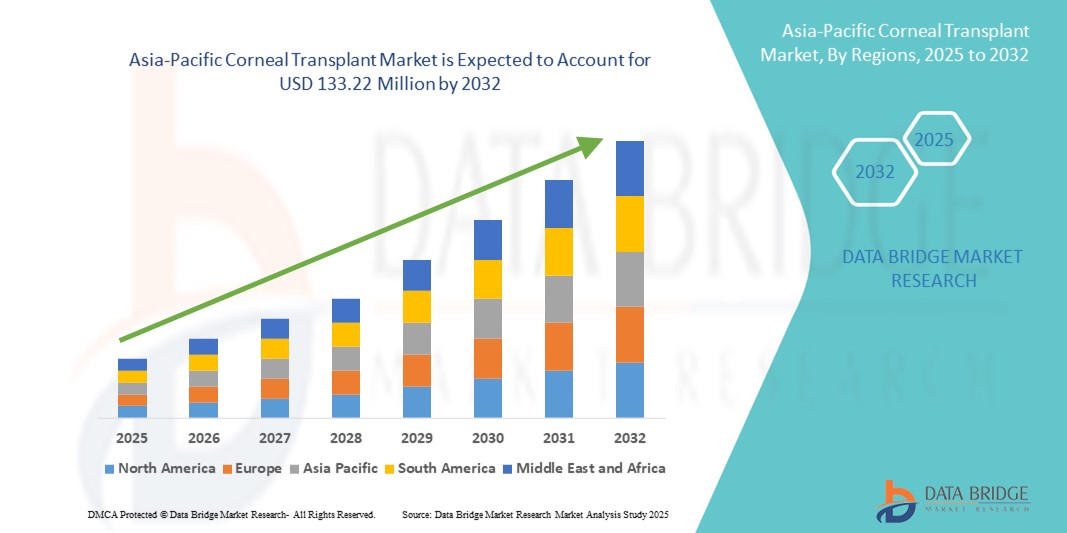

- The Asia-Pacific corneal transplant market size was valued at USD 76.39 million in 2024 and is expected to reach USD 133.22 million by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of corneal blindness, a rising number of eye banks, and improvements in corneal storage and transplant techniques across the region

- Furthermore, growing awareness about eye health, government initiatives to support vision restoration, and the expanding availability of advanced ophthalmic equipment in emerging economies are driving the demand for corneal transplantation procedures

Asia-Pacific Corneal Transplant Market Analysis

- Corneal transplantation, a surgical procedure to replace damaged or diseased corneal tissue, is becoming increasingly essential in restoring vision across Asia-Pacific, supported by advancements in techniques such as endothelial and penetrating keratoplasty

- The escalating demand for corneal transplants is primarily fueled by a growing prevalence of corneal blindness, increased incidence of eye injuries and infections, and improving access to ophthalmic care across developing countries

- China dominated the Asia-Pacific corneal transplant market with the largest revenue share of 35.5% in 2024, driven by a high burden of corneal diseases, expanding healthcare infrastructure, and strong government support for organ donation and vision restoration programs

- India is expected to be the fastest-growing country in the Asia-Pacific corneal transplant market during the forecast period due to rising awareness of corneal donation, growing number of eye banks, and increased adoption of advanced surgical techniques in both public and private eye care centers

- The penetrating keratoplasty segment dominated the Asia-Pacific corneal transplant market with a market share of 49.2% in 2024, attributed to its broad clinical applicability in full-thickness corneal damage and its well-established surgical outcomes

Report Scope and Asia-Pacific Corneal Transplant Market Segmentation

|

Attributes |

Asia-Pacific Corneal Transplant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Corneal Transplant Market Trends

“Rising Technological Advancements and Tissue Availability”

- A significant and accelerating trend in the Asia-Pacific corneal transplant market is the growing adoption of advanced surgical techniques such as Descemet Membrane Endothelial Keratoplasty (DMEK) and Descemet Stripping Automated Endothelial Keratoplasty (DSAEK), which offer faster recovery and better visual outcomes compared to traditional procedures

- For instance, ophthalmic centers in India and China have increasingly shifted toward endothelial keratoplasty procedures, especially for patients with endothelial dysfunction, due to lower rejection rates and faster healing

- Moreover, the use of femtosecond lasers in corneal surgery has enhanced precision in graft preparation and placement, improving the success rate of transplants and reducing complications. Countries such as Japan and South Korea are at the forefront of implementing such advanced technologies in ophthalmic surgery

- The establishment and expansion of structured eye bank networks in countries such as India, Australia, and Singapore have led to improved availability of quality donor tissues. For instance, India's Eye Bank Association has launched awareness campaigns and tissue distribution programs to meet increasing transplant needs

- Public-private partnerships, international collaborations, and regional medical tourism for eye surgeries are further contributing to access and affordability, especially in Southeast Asian countries

- These ongoing advancements in surgical methods, technology integration, and tissue accessibility are elevating the standard of care and driving a robust increase in corneal transplant procedures across the region

Asia-Pacific Corneal Transplant Market Dynamics

Driver

“Increasing Prevalence of Corneal Blindness and Government-Led Eye Health Initiatives”

- The growing incidence of corneal blindness and other degenerative eye conditions across Asia-Pacific is a primary driver for the region's rising demand for corneal transplantation

- For instance, India alone accounts for over 1.2 million people with corneal blindness, with an estimated 25,000–30,000 new cases annually, spurring urgent demand for effective treatment solutions

- Several countries in the region, including China and Indonesia, have initiated nationwide eye health programs and corneal donation awareness campaigns to address the growing burden of visual impairment

- Advancements in surgical techniques, increasing training opportunities for ophthalmologists, and government-supported infrastructure development such as establishing more transplant centers and improving rural outreach are further fueling market growth

- The rise in medical tourism for ophthalmic care, particularly in Thailand and India, coupled with expanding insurance coverage for vision-related procedures, is also boosting the number of surgeries performed across borders

- These factors are collectively enhancing access, awareness, and the clinical success of corneal transplant surgeries in Asia-Pacific

Restraint/Challenge

“Donor Tissue Shortage and Procedural Accessibility Gap”

- A persistent challenge in the Asia-Pacific corneal transplant market is the insufficient availability of high-quality donor corneal tissue, particularly in rural and underdeveloped regions

- For instance, despite India's growing awareness campaigns, the demand for donor corneas continues to significantly outpace supply, leading to long wait times and reduced access in lower-tier cities

- Many countries in the region face infrastructural and logistical hurdles in collecting, preserving, and distributing donor tissues effectively, which limits the reach of transplant services

- In addition, while advanced surgical methods are gaining traction, access remains limited in less urbanized areas due to a shortage of trained ophthalmic surgeons and lack of advanced ophthalmic equipment

- Cultural hesitations around eye donation and a lack of consistent policy frameworks on tissue procurement and transplant regulation in certain countries further hinder market expansion

- Bridging these gaps through expanded eye banking networks, public education campaigns, and investment in mobile eye care units will be crucial for ensuring equitable and sustainable growth of corneal transplant procedures across Asia-Pacific

Asia-Pacific Corneal Transplant Market Scope

The market is segmented on the basis of procedure type, type, donor type, graft type, surgery type, indication, gender, age group, and end user.

- By Procedure Type

On the basis of procedure type, the Asia-Pacific corneal transplant market is segmented into endothelial keratoplasty, penetrating keratoplasty, anterior lamellar keratoplasty (ALK), corneal limbal stem cell transplant, artificial cornea transplant, and others. The penetrating keratoplasty segment dominated the market with the largest revenue share of 49.2% in 2024, driven by its long-standing use in treating full-thickness corneal disorders. Its versatility in managing conditions such as keratoconus, corneal scarring, and bullous keratopathy contributes to its widespread adoption across hospitals and clinics in countries such as China and India.

The endothelial keratoplasty segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising preference for less invasive procedures, faster recovery times, and reduced post-operative complications. Techniques such as DSAEK and DMEK are gaining traction in developed healthcare systems such as Japan and South Korea.

- By Type

On the basis of type, the Asia-Pacific corneal transplant market is segmented into human cornea and synthetic. The human cornea segment held the largest market share in 2024, primarily due to the increasing number of cornea donations and the expanding network of eye banks, particularly in India and Australia. Government initiatives and public awareness campaigns have played a key role in encouraging tissue donation.

The synthetic segment is expected to register the fastest CAGR during the forecast period, supported by advancements in bioengineered corneas and their growing use in patients unsuitable for human tissue transplantation.

- By Donor Type

On the basis of donor type, the Asia-Pacific corneal transplant market is segmented into autograft and allograft. The allograft segment dominated the market in 2024, driven by the high availability of donor tissues through organized eye banks and international donation programs. Allografts are the standard practice for corneal transplantation in most Asia-Pacific countries.

The autograft segment is expected to witness fastest growth during forecast period, due to its applicability, mainly used in limbal stem cell transplant procedures or where immune compatibility is a major concern.

- By Graft Type

On the basis of graft type, the Asia-Pacific corneal transplant market is segmented into partial thickness grafts (lamellar) and full thickness grafts (penetrating). The full thickness grafts (penetrating) segment held the largest revenue share in 2024, attributed to its wide use in severe and complex corneal conditions requiring total tissue replacement.

The partial thickness grafts (lamellar) segment is projected to grow at the highest rate during the forecast period, owing to improved patient outcomes, faster healing, and lower risk of rejection. The adoption of lamellar grafting techniques is steadily rising in tertiary eye hospitals across Singapore, South Korea, and Malaysia.

- By Surgery Type

On the basis of surgery type, the Asia-Pacific corneal transplant market is segmented into conventional surgery and laser-assisted surgery. The conventional surgery segment dominated the market in 2024 due to its accessibility, lower cost, and widespread availability across government hospitals and mid-tier healthcare centers in countries such as India and the Philippines.

The laser-assisted surgery segment is expected to witness the fastest growth rate during the forecast period, driven by improved surgical accuracy, reduced invasiveness, and expanding adoption of femtosecond laser technologies in countries such as Japan and China.

- By Indication

On the basis of indication, the Asia-Pacific corneal transplant market is segmented into Fuch's endothelial dystrophy, infectious keratitis, bullous keratopathy, keratoconus, regraft procedures, corneal scarring, corneal ulcers, and others. The keratoconus segment held the largest share of the market in 2024, supported by high disease prevalence among young adults in India, Australia, and Southeast Asia. The condition’s progressive nature and the lack of early diagnosis often necessitate corneal transplant as a final treatment.

The Fuch’s endothelial dystrophy segment is projected to witness strong growth through 2032, particularly among elderly populations in Japan and China, as diagnosis and surgical interventions become more accessible and effective.

- By Gender

On the basis of gender, the Asia-Pacific corneal transplant market is segmented into female and male. The male segment dominated the market in 2024, reflecting higher prevalence of corneal trauma and occupational exposure to eye injuries in the male population across developing economies.

The female segment is expected to grow steadily during forecast period, due to increasing healthcare access, public awareness programs, and a rising number of eye health initiatives targeted at underserved female populations in rural regions.

- By Age Group

On the basis of age group, the Asia-Pacific corneal transplant market is segmented into geriatric, adult, and pediatric. The adult segment held the largest market share in 2024, primarily due to a higher burden of infectious keratitis and keratoconus in this age group. Adults between 20–60 years represent the majority of corneal transplant candidates in both urban and semi-urban settings.

The geriatric segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by age-related corneal diseases such as Fuch’s dystrophy and bullous keratopathy, particularly in aging populations across East Asia.

- By End User

On the basis of end user, the Asia-Pacific corneal transplant market is segmented into hospitals, eye clinics, ambulatory surgical centers, academic & research institutes, and others. The hospitals segment dominated the market in 2024, owing to the availability of skilled surgeons, advanced infrastructure, and higher surgical volumes in tertiary and government hospitals throughout Asia-Pacific.

The eye clinics segment is expected to grow at the fastest pace over the forecast period due to the rise in private specialty practices and increasing preference for outpatient corneal surgeries in metro cities across India, Indonesia, and Thailand.

Asia-Pacific Corneal Transplant Market Regional Analysis

- China dominated the Asia-Pacific corneal transplant market with the largest revenue share of 35.5% in 2024, driven by a high burden of corneal diseases, expanding healthcare infrastructure, and strong government support for organ donation and vision restoration programs

- The country’s leadership in the region is further supported by the growing number of eye banks, increasing availability of donor tissue, and adoption of advanced surgical techniques in major urban hospitals

- China's focus on public awareness campaigns, investment in ophthalmic training programs, and collaborations between public institutions and private eye care providers are accelerating the accessibility and success of corneal transplant procedures, positioning it as the key growth engine within the Asia-Pacific market

The China Corneal Transplant Market Insight

China dominated the Asia-Pacific corneal transplant market with the largest revenue share in 2024, supported by a large patient base, expanding healthcare infrastructure, and proactive government initiatives promoting organ and tissue donation. The country has significantly advanced in corneal transplant technology, with high adoption of both traditional and modern procedures in urban hospitals. In addition, rising investment in ophthalmic equipment and increasing public-private partnerships are enhancing surgical success rates and access to treatment.

India Corneal Transplant Market Insight

India is the fastest-growing market in the Asia-Pacific region for corneal transplants, attributed to the expanding middle class, strong government support for vision care, and a growing number of cornea donation drives. India performed the highest number of transplant surgeries in the region in 2024, driven by its extensive eye bank network and rising demand from both rural and urban populations. National initiatives such as the National Programme for Control of Blindness (NPCB) and increasing involvement of private eye care providers are propelling India’s rapid market growth.

Japan Corneal Transplant Market Insight

The Japan corneal transplant market is witnessing steady growth driven by a rapidly aging population and high incidence of corneal diseases such as Fuch’s endothelial dystrophy. Japan’s focus on minimally invasive procedures and adoption of cutting-edge surgical technologies such as DMEK and femtosecond laser-assisted keratoplasty is enhancing clinical outcomes. Government-supported healthcare reimbursement systems and strong public health infrastructure also support the expansion of corneal transplant services across the country.

South Korea Corneal Transplant Market Insight

The South Korea corneal transplant market is gaining momentum due to the country’s strong healthcare system, increased awareness of corneal diseases, and adoption of advanced eye care technologies. The government’s support for organ and tissue donation programs and the rise of premium eye hospitals in Seoul and other major cities are enhancing access to transplant procedures. In addition, the integration of precision surgical tools and favorable insurance coverage are contributing to steady market growth.

Asia-Pacific Corneal Transplant Market Share

The Asia-Pacific Corneal Transplant industry is primarily led by well-established companies, including:

- CorneaGen, Inc. (U.S.)

- KeraLink International (U.S.)

- Aurolab (India)

- AJL Ophthalmic S.A. (Spain)

- DIOPTEX GmbH (Austria)

- SightLife (U.S.)

- Tissue Bank International (U.S.)

- Eversight (U.S.)

- The Eye-Bank for Sight Restoration (U.S.)

- Lions Eye Institute (Australia)

- Narayana Nethralaya Eye Bank (India)

- LV Prasad Eye Institute (India)

- Chennai Vision Charitable Trust Eye Bank (India)

- Shandong Eye Institute (China)

- Keio University Hospital (Japan)

- Singapore National Eye Centre (Singapore)

- CSL Limited (Australia)

- CERA (Australia)

- HOYA Corporation (Japan)

- Ziemer Ophthalmic Systems AG (Switzerland)

What are the Recent Developments in Asia-Pacific Corneal Transplant Market?

- In June 2024, the All-India Institute of Medical Sciences (AIIMS), New Delhi, launched an AI-powered donor cornea tracking system to enhance the efficiency and transparency of cornea allocation and distribution. This initiative aims to reduce waiting times and improve transplant outcomes by streamlining the logistics of donor-recipient matching, reinforcing India's leadership in technological innovation in ophthalmology. The system is expected to be rolled out across other major Indian eye institutes in the coming years

- In April 2024, the Chinese National Health Commission introduced a new nationwide cornea donation registry platform to improve donor engagement and tracking. This digital platform enables citizens to register as cornea donors easily and ensures real-time monitoring of cornea availability across provinces. The move reflects China’s commitment to addressing regional disparities in corneal tissue access and strengthening its eye banking infrastructure for higher transplant success rates

- In March 2024, Japan’s Keio University Hospital successfully completed a series of clinical trials using lab-grown corneal tissue derived from induced pluripotent stem cells (iPSCs). This breakthrough represents a major advancement in regenerative medicine, potentially addressing the chronic shortage of donor corneas in the country. The development underscores Japan’s ongoing investment in cutting-edge biomedical research and its contribution to the global corneal transplant field

- In February 2024, the Centre for Eye Research Australia (CERA) announced a strategic partnership with Melbourne-based biotech firm CSL Limited to co-develop synthetic corneal implants for high-risk transplant patients. The collaboration seeks to provide alternative treatment options for patients with repeated graft failures and limited donor tissue access, marking a significant milestone in Australia’s pursuit of next-generation corneal therapies

- In January 2024, South Korea’s Ministry of Health and Welfare expanded funding for national eye health programs, including corneal transplant subsidies and advanced surgical training for ophthalmologists. This policy initiative supports greater access to high-quality corneal transplants, particularly in underserved regions, and reflects the government’s broader commitment to reducing preventable blindness across the population

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.