Asia Pacific Cyro Electron Microscopy Market

Market Size in USD Million

CAGR :

%

USD

140.65 Million

USD

252.71 Million

2024

2032

USD

140.65 Million

USD

252.71 Million

2024

2032

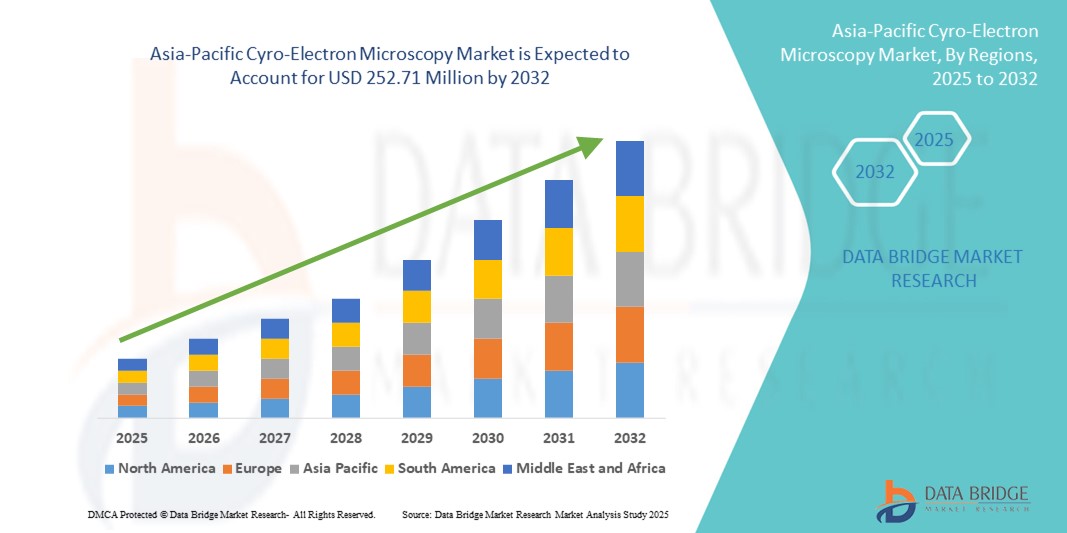

| 2025 –2032 | |

| USD 140.65 Million | |

| USD 252.71 Million | |

|

|

|

|

Asia-Pacific Cyro-Electron Microscopy Market Size

- The Asia-Pacific cyro-electron microscopy market size was valued at USD 140.65 million in 2024 and is expected to reach USD 252.71 million by 2032, at a CAGR of 7.6% during the forecast period

- The market growth is largely fueled by the rising adoption of advanced imaging technologies in structural biology, drug discovery, and life sciences research, supported by increasing investments in biotechnology and healthcare infrastructure across the region

- Furthermore, growing collaborations between academic institutions, research centers, and pharmaceutical companies, coupled with advancements in cryo-EM resolution and automation, are establishing it as a critical tool for molecular and cellular analysis. These converging factors are accelerating the uptake of cryo-electron microscopy systems, thereby significantly boosting the industry’s growth

Asia-Pacific Cyro-Electron Microscopy Market Analysis

- Cryo-electron microscopy (cryo-EM), enabling high-resolution visualization of biomolecules in their near-native state without crystallization, is becoming a critical technology in structural biology, drug discovery, and advanced medical research across the Asia-Pacific region due to its precision, speed, and ability to accelerate R&D in pharmaceuticals and life sciences

- The escalating demand for cryo-EM is primarily fueled by the rapid growth of biotechnology and academic research, rising government and private investments in life sciences infrastructure, and a growing emphasis on precision medicine and targeted drug development

- China dominated the Asia-Pacific cryo-electron microscopy market with the largest revenue share of 42% in 2024, driven by strong funding for research facilities, rapid expansion of structural biology programs, and the adoption of next-generation cryo-EM platforms in top universities and pharmaceutical labs

- India is expected to be the fastest-growing country in the Asia-Pacific cryo-electron microscopy market in the region during the forecast period, supported by increased academic–industry collaborations, expanding pharmaceutical manufacturing capabilities, and the adoption of advanced imaging technologies in molecular and protein research

- The transmission electron microscopy (TEM) segment dominated the Asia-Pacific cryo-electron microscopy market with a 46.3% share in 2024, owing to its unmatched resolution, growing use in protein structure analysis, and expanding role in disease-related research

Report Scope and Asia-Pacific Cyro-Electron Microscopy Market Segmentation

|

Attributes |

Asia-Pacific Cyro-Electron Microscopy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Cyro-Electron Microscopy Market Trends

Rising Automation and AI Integration for Structural Analysis

- A significant and accelerating trend in the Asia-Pacific cryo-electron microscopy market is the incorporation of automation, artificial intelligence (AI), and advanced image-processing algorithms into cryo-EM workflows, enabling faster and more accurate molecular structure determination

- For instance, Thermo Fisher Scientific’s EPU Multigrid software and JEOL’s AI-assisted imaging features allow automated sample screening and optimal image capture, reducing the time from sample preparation to final analysis

- AI integration enables automated particle picking, 3D reconstruction, and noise reduction, significantly improving data quality while reducing operator workload. For instance, AI-powered cryo-EM analysis platforms can process terabytes of imaging data and identify structural patterns that may be missed by manual review

- Automation in sample handling such as robotic grid loading and cryo-transfer systems reduces contamination risk and increases throughput for pharmaceutical and academic laboratories

- The integration of cryo-EM with cloud-based data platforms allows collaborative analysis across multiple institutions in different countries, supporting regional research networks in China, Japan, and India

- This trend toward higher efficiency, reproducibility, and collaborative research is reshaping the role of cryo-EM in drug discovery and structural biology, making it an indispensable part of advanced life sciences infrastructure

Asia-Pacific Cyro-Electron Microscopy Market Dynamics

Driver

Growing Demand from Drug Discovery and Life Sciences Research

- The rapid growth of pharmaceutical R&D and academic structural biology in the Asia-Pacific region is a key driver for cryo-EM adoption

- For instance, in March 2024, Hitachi High-Tech Corporation launched a next-generation cryo-EM system in Japan, designed for high-throughput molecular imaging in drug target validation, supporting both academic and industry needs

- Cryo-EM’s ability to visualize proteins, viruses, and large biomolecular complexes at near-atomic resolution makes it critical for vaccine development, enzyme engineering, and disease mechanism studies

- Growing government investments in research infrastructure such as China’s National Protein Science Facility and Japan’s RIKEN structural biology programs are accelerating regional adoption

- The technology’s applications in emerging areas such as gene therapy, antibody engineering, and precision oncology are further expanding its market potential

- Continuous improvements in detector sensitivity, automation, and cryo-sample handling have made cryo-EM more efficient and capable of producing atomic-resolution images faster

- New direct electron detectors, such as Gatan’s K3 and Thermo Fisher’s Falcon 4, enable researchers to capture high-quality datasets in significantly less time, boosting productivity and reducing operational costs

Restraint/Challenge

High Capital Costs and Technical Expertise Gap

- The high purchase and maintenance costs of cryo-EM systems often exceeding USD 5 million pose a significant barrier for smaller institutions and labs in developing Asia-Pacific markets

- For instance, the need for specialized facilities with vibration isolation, controlled temperature, and cryogenic storage adds substantial infrastructure expenses

- In addition, a shortage of trained operators and data analysts limits the ability of institutions to fully leverage cryo-EM’s capabilities. While leading centers in China, Japan, and Singapore have invested heavily in training, other countries in the region face talent gaps

- Complex workflows from sample preparation to image processing require multidisciplinary expertise in biology, physics, and computational sciences, which can hinder adoption

- Overcoming these challenges through regional training programs, shared facility models, and strategic partnerships between equipment manufacturers and academic institutions will be crucial for sustained market growth

- Cryo-EM generates massive datasets that require advanced data storage solutions and high-performance computing for processing

- The absence of sufficient computing resources and secure cloud-based solutions in some institutions can slow down analysis and collaboration, reducing overall research efficiency

Asia-Pacific Cyro-Electron Microscopy Market Scope

The market is segmented on the basis of product type, method type, nano formulations, technology, mounting technique, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Asia-Pacific cryo-electron microscopy market is segmented into hardware and software. The hardware segment dominated the market with the largest revenue share in 2024, driven by the high cost and demand for advanced microscopes, detectors, and cryo-sample preparation systems. Hardware remains the core investment area for research institutions and pharmaceutical companies aiming to enhance imaging resolution and throughput.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by advancements in AI-powered image processing, automation of particle picking, and 3D reconstruction tools. Increasing collaborations between software developers and microscope manufacturers are enhancing usability, reducing data processing time, and making cryo-EM more accessible to less-experienced operators.

- By Method Type

On the basis of method type, the Asia-Pacific cryo-electron microscopy market is segmented into electron crystallography, single particle analysis, cryo-electron tomography, and others. The single particle analysis segment dominated the market in 2024 due to its ability to determine high-resolution structures of proteins and macromolecular complexes without crystallization, making it the most widely used method in structural biology.

The cryo-electron tomography segment is expected to register the fastest CAGR during the forecast period, driven by its growing use in studying cellular architecture in situ, offering three-dimensional insights into native biological environments for disease research.

- By Nano Formulations

On the basis of nano formulations, the Asia-Pacific cryo-electron microscopy market is segmented into lipid nanoparticle formulations (LNFs), metal oxide formulations, metal formulations, and others. The lipid nanoparticle formulations segment held the largest share in 2024, supported by their critical role in mRNA vaccine development and drug delivery research, which increasingly relies on cryo-EM for structural validation.

The metal oxide formulations segment is projected to witness rapid growth during forecast period, particularly in nanotechnology and materials science applications, where cryo-EM enables precise visualization of particle morphology and structure at the nanoscale.

- By Technology

On the basis of technology, the Asia-Pacific cryo-electron microscopy market is segmented into transmission electron microscopy (TEM), scanning electron microscopy (SEM), and nuclear magnetic resonance (NMR) microscopy. The transmission electron microscopy (TEM) segment dominated the market with the largest share of 46.3% in 2024, driven by its superior resolution capabilities and extensive use in single particle analysis for drug discovery and structural biology.

The scanning electron microscopy (SEM) segment is anticipated to grow steadily during forecast period, supported by its applications in nanomaterials characterization, semiconductor inspection, and cross-disciplinary research in the region.

- By Mounting Technique

On the basis of mounting technique, the Asia-Pacific cryo-electron microscopy market is segmented into surface mounting, edge mounting, film emulsion mounting, rivet mounting, and others. The surface mounting segment accounted for the largest revenue share in 2024 due to its versatility and efficiency in preparing biological and material samples for high-resolution imaging.

The film emulsion mounting segment is expected to see strong growth during forecast period, particularly in advanced structural studies requiring optimal electron transparency and reduced imaging artifacts.

- By Application

On the basis of application, the Asia-Pacific cryo-electron microscopy market is segmented into biological science, material science, nanotechnology, life sciences, medical, semiconductors, and others. The biological science segment dominated the market in 2024, driven by the widespread use of cryo-EM in protein structure analysis, virus imaging, and drug target validation.

The nanotechnology segment is projected to experience the fastest growth during forecast period, owing to increasing research into nanoscale materials and their applications in electronics, energy, and biomedical devices.

- By End User

On the basis of end user, the Asia-Pacific cryo-electron microscopy market is segmented into research laboratories and institutes, forensic and diagnostic laboratories, pharmaceutical and biotechnology companies, contract research organizations (CROs), and others. The research laboratories and institutes segment held the largest share in 2024, supported by the growing number of dedicated cryo-EM facilities in China, Japan, and India.

The pharmaceutical and biotechnology companies segment is expected to witness strong growth during forecast period, as drug developers increasingly incorporate cryo-EM into early-stage R&D workflows to shorten development timelines.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific cryo-electron microscopy market is segmented into direct tenders, third party distribution, and others. The direct tenders segment dominated the market in 2024, reflecting the preference of large research institutions and universities for direct procurement from manufacturers to ensure technical support and training.

The third party distribution segment is forecasted to grow steadily during forecast period, particularly in emerging economies where distributors facilitate market access for smaller institutions and private labs.

Asia-Pacific Cyro-Electron Microscopy Market Regional Analysis

- China dominated the Asia-Pacific cryo-electron microscopy market with the largest revenue share of 42% in 2024, driven by strong funding for research facilities, rapid expansion of structural biology programs, and the adoption of next-generation cryo-EM platforms in top universities and pharmaceutical labs

- China’s growing pool of highly trained scientists and active participation in global research collaborations are accelerating the development of novel therapeutics and vaccines using cryo-EM technology

- With strong domestic manufacturing capabilities and an increasing emphasis on nanotechnology and precision medicine, China is well-positioned to maintain its dominance in the regional market over the forecast period

The China Cryo-Electron Microscopy Market Insight

The China cryo-electron microscopy market captured the largest market share in Asia Pacific in 2024, fueled by extensive government funding for structural biology, rapid infrastructure expansion in research institutes, and a strong biopharmaceutical sector. Significant investments in high-resolution Cryo-EM facilities within universities and life science parks are enabling breakthroughs in vaccine and drug discovery. With domestic manufacturing capabilities and active global research participation, China is set to maintain its leadership in the region.

Japan Cryo-Electron Microscopy Market Insight

The Japan cryo-electron microscopy market is expanding steadily, driven by the nation’s strong technological foundation, long-standing expertise in electron microscopy, and commitment to pharmaceutical innovation. The growing integration of Cryo-EM in academic research and industrial drug development, along with collaborations between universities and biotech companies, is boosting demand. Government-supported programs to advance structural biology are further catalyzing market growth.

India Cryo-Electron Microscopy Market Insight

India’s cryo-electron microscopy market is experiencing rapid growth due to the expansion of biomedical research infrastructure, the rising focus on indigenous vaccine development, and collaborations with international research bodies. Increasing investments in biotechnology parks, along with the government’s “Make in India” initiative for scientific equipment, are improving access to Cryo-EM technologies. Academic institutes are adopting the technology for advanced protein and virus structure analysis, enhancing drug design capabilities.

South Korea Cryo-Electron Microscopy Market Insight

The South Korea cryo-electron microscopy market is witnessing notable growth, supported by strong R&D in life sciences, government-backed funding programs, and the country’s leadership in semiconductor and imaging technologies. Major universities and research institutes are investing in Cryo-EM systems for structural studies in neuroscience, oncology, and infectious diseases. The country’s strong focus on translational research is expected to drive sustained adoption.

Australia Cryo-Electron Microscopy Market Insight

The Australia cryo-electron microscopy market is expanding as the country invests heavily in national research facilities and collaborative scientific programs. The government’s support for precision medicine and advanced imaging technologies is encouraging adoption across biomedical and pharmaceutical sectors. Australia’s strategic position as a hub for Asia-Pacific research collaboration is fostering partnerships that enhance access to Cryo-EM infrastructure and expertise.

Asia-Pacific Cyro-Electron Microscopy Market Share

The Asia-Pacific cyro-electron microscopy industry is primarily led by well-established companies, including:

- JEOL Ltd. (Japan)

- Hitachi High-Tech Corporation (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Delong Instruments a.s. (Czech Republic)

- Rigaku Corporation (Japan)

- CryoSol-World (Netherlands)

- Protochips Inc. (U.S.)

- Gatan, Inc. (U.S.)

- Leica Microsystems GmbH (Germany)

- FEI Company (U.S.)

- Nanion Technologies GmbH (Germany)

- Technai Cryo (Netherlands)

- Vision BioSystems (Australia)

- Delmic B.V. (Netherlands)

- KRI, Inc. (Japan)

- Nippon Denshi Kogyo Co., Ltd. (Japan)

- Park Systems Corp. (South Korea)

- Opensprings Biotechnology (China)

- Beijing Zhongke Electron Microscopy Technology Co., Ltd. (China)

- Sino-Instruments Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Cyro-Electron Microscopy Market?

- In March 2025, Thermo Fisher Scientific entered into a Technology Alliance with the Chan Zuckerberg Institute for Advanced Biological Imaging to develop laser phase plate technology for cryo-EM, aiming to enhance contrast and resolution for cellular imaging

- In August 2024, the Indian Institute of Technology Kanpur (IIT-K) inaugurated India’s National Cryogenic-Electron Microscopy (Cryo-EM) facility equipped with a powerful 300 kV cryo-EM microscope, advanced sample preparation systems, and computational infrastructure. This marks a major leap in India’s structural biology research capabilities

- In June 2023, researchers from RIKEN and Tohoku University successfully visualized hydrogen atoms and chemical bond information in proteins using JEOL’s CRYO ARM 300 cryo-EM through single-particle analysis. This breakthrough enables near-physiological insights into protein chemistry deepening understanding of molecular function in life science and drug discovery research

- In July 2022, Tohoku University unveiled an AI-based cryo-electron microscope at its Institute of Multidisciplinary Research for Advanced Materials (IMRAM). The system employs deep-learning (YoneoLocr) to automate sample identification and high-quality data collection—reducing manual intervention from hours or days to just 10–30 minutes. It supports both hard and soft material imaging and is now available for shared use both within and outside the university

- January 2021, JEOL Ltd. announced the release of the CRYO ARM 300 II (JEM-3300), a cold field-emission cryo-electron microscope designed to improve throughput, image quality and operability for single-particle cryo-EM workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.